Pablo Picasso Glass � 1914

Interest rates.

• Bondholders Lost Nearly $1 Trillion Since September 26 (CR)

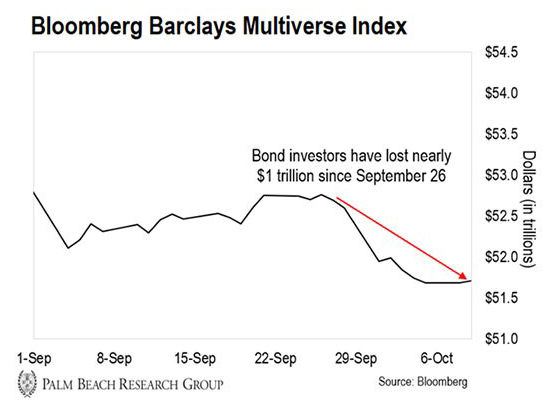

At the Daily, we’ve been warning readers for months that rising interest rates will lead to an exodus of investors from the bond markets. Income Exodus (or Income Extermination) is when bond investors get “exterminated” by rising interest rates. As interest rates rise, bond prices drop. So when interest rates rise rapidly (like they are now), bond prices drop a lot. Now, we’re seeing this exodus play out in real time. Since September 26, bondholders lost nearly $1 trillion according to the Bloomberg Barclays Multiverse Index… This index tracks the market value of publicly traded bonds around the world. The reason it’s down is simple: The rate on the benchmark 10-year U.S. Treasury has risen from 2.8% to 3.2% since August 24.

Bloomberg says the bond rout could spark an even worse sell-off than in 1976, the worst year for bond returns over the last four decades. And there’s good reason for fear… The Federal Reserve has already hiked rates three times in 2018… with plans for one more rate hike before the end of the year. And Fed chair Jerome Powell has indicated at least three more rate hikes in 2019 and one more in 2020. We’ve warned you that higher rates were coming for more than a year now. Hopefully, you’ve followed our steps and prepared for Income Exodus… because it’s here.

On debt.

• The US Housing Recovery Is Built On Quicksand (MW)

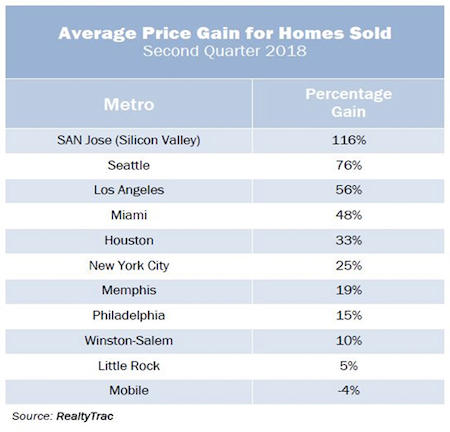

Home price gains since 2013 have been much less impressive than you think. While reports show that home prices have recovered nationwide, the increase has been uneven and not as strong as you have been led to believe. Consider RealtyTrac’s latest report on 148 major U.S. metropolitan areas. The average gain on the sale of property was 30%. Not bad, except the average holding period was just over eight years. That comes to an annual price increase of 3.75%. High-yield corporate bonds would have earned you considerably more. Taken together, the average gain for all metros is deceptive. While the average price gain in booming Silicon Valley was a remarkable 116%, it was a pitiful 2% in El Paso, Texas, 10% in Cleveland, and 15% in Chicago. Even the price rise in the New York City metro area was just 25%. The table below shows the great disparity:

At the same time, I am greatly troubled by the consistently weak volume of home sales. During the insane bubble years, sales volume rocketed along with prices. In the hottest metros, desperate buyers dove into the market in record numbers. This has not happened since 2013. Statistics from brokerage Trulia.com show that sales volume has declined substantially in all major metros from the torrid pace of 2005-2006. Most analysts have attributed the weak sales, as well as rising prices, to a lack of available inventory. The number of homes listed for sale has indeed fallen dramatically over the past five years, but look closer: Trulia’s Inventory and Price Watch, first published in March 2016, divides homes for sale into three segments: (1) starter homes — the least-expensive homes for first-time buyers; (2) trade-up homes, and (3) premium homes.

What will a normal economy look like?

• Fed Indicates It’s Staying The Course On Rate Hikes (CNBC)

Federal Reserve officials remain convinced that continuing to gradually increase interest rates is the best formula to preserve a steady economy, according to minutes released Wednesday of the central bank’s most recent policy meeting. That may not please President Donald Trump, who has been vocal in his criticism of the central bank’s actions. A summary of the Sept. 25-26 Federal Open Market Committee session reflected both confidence in the rate of economic growth and some hesitancy over the impact that tariffs might have on the future path.

Ultimately, the committee unanimously voted to approve a quarter-point hike to its benchmark rate target, with members indicating that more increases are on the way. The increase took the Fed’s overnight target to a range of 2 percent to 2.25 percent. “With regard to the outlook for monetary policy beyond this meeting, participants generally anticipated that further gradual increases in the target range for the federal funds rate would most likely be consistent with a sustained economic expansion, strong labor market conditions, and inflation near 2 percent over the medium term,” the minutes read.

“There is no means of avoiding the final collapse of a boom brought about by credit expansion.”

• Trump Is Completely Misguided On Interest Rates (Colombo)

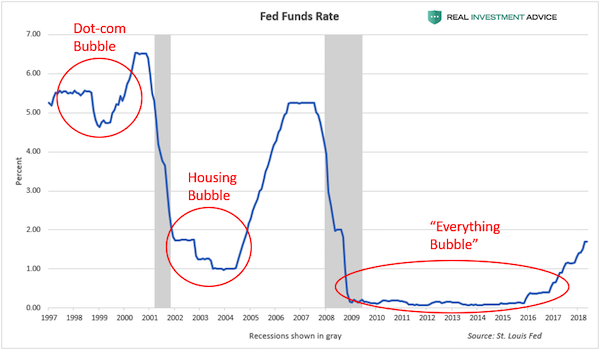

President Donald Trump has been making a big stink about the Federal Reserve’s rate hikes lately. Last week, after the Dow plunged nearly 2,000 points, he blamed the Fed for it, saying “I think the Fed is making a mistake. They’re so tight. I think the Fed has gone crazy…” On Tuesday, Trump said that the Federal Reserve is “my biggest threat.” Since he became president, Trump has been praising the soaring stock market (something I said was very dangerous to do), viewing it as evidence of the success of his administration’s policies. Trump is worried that rising interest rates will put an end to the stock market boom, which will make him look bad.

Unfortunately, the president is extremely misguided about how interest rates work and the role they play in creating booms in the stock market and economy. As I’ve explained in great detail, the U.S. stock market has been booming because the Fed held interest rates at record low levels for a record length of time after the Great Recession. This Fed-driven stock market boom is an unsustainable bubble instead of a genuine, organic boom. The fact that the Fed held rates at record low levels and inflated a credit and asset bubble meant that a crisis was already “baked into the cake” whether the Fed raised interest rates or not. Once a credit expansion or bubble is already in motion, the actions of the central bank from that point on can only determine what type of crisis occurs when the credit expansion ends – not whether a crisis will occur or not.

The Austrian School economist Ludwig von Mises said it best in his book Human Action: “There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

Negotiating.

• China Not Manipulating Currency But Lacks Transparency – Mnuchin (AFP)

Beijing is not a currency manipulator but China’s exchange rate practices and the yuan’s recent decline are of “particular concern,” US Treasury Steven Mnuchin said Wednesday. In putting Beijing and five other US trading partners on notice, the Treasury again refrained from escalating a fight over China’s currency as US President Donald Trump had once pledged to do on the campaign trail. “Of particular concern are China’s lack of currency transparency and the recent weakness in its currency,” Mnuchin said in releasing a twice-yearly report to Congress on how country’s manage exchange rates and trade.

“These pose major challenges to achieving fairer and more balanced trade and we will continue to monitor and review China’s currency practices, including through ongoing discussions with the People’s Bank of China.” Washington has long argued that China keeps its currency artificially low to make its exports more competitive but in recent years the yuan or renminbi (RMB) has strengthened and is viewed by economists as more in line with economic fundamentals. Still, as US interest rates have risen, the US dollar has strengthened further, which makes American exports more expensive.

Yield.

• Bank of England Raises Alarm Over Surge In High-Risk Lending (G.)

The Bank of England has issued a stark warning over the rapid growth in lending to indebted companies around the world, drawing parallels with the US sub-prime mortgage market that triggered the 2008 financial crisis. Threadneedle Street said Britain was not immune from a global boom in risky lending that had alarmed financial regulators around the world this year, with the US market for such loans more than doubling since 2010 to surpass $1tn (£763bn). “The global leveraged loan market was larger than – and was growing as quickly as – the US sub-prime mortgage market had been in 2006,” the central bank said of the rapid growth in leveraged loans, which are defined as loans to firms that already have debts worth more than four times their earnings.

The Bank’s financial policy committee (FPC), set up after the crisis to assess the risks to UK financial stability, noted that lending standards were falling and that it would more closely monitor the risks to Britain. Though far from the scale of the US market, which is the largest in the world, gross issuance of leveraged loans by UK companies reached a record £38bn in 2017, while a further £30bn has been issued so far this year. Taken together with high-yield bonds, which are debts of firms with weaker credit ratings, the Bank estimates the total stock of debt to riskier firms in Britain was worth about a fifth of all lending to UK companies.

Which of course the Brexiteers don’t want. Ministers will leave her government.

• Theresa May Opens Door To Longer Brexit Transition Period (Ind.)

Theresa May has opened the door to an even longer Brexit transition period, setting herself on yet another collision course with Tory Eurosceptics and potentially growing the EU divorce bill by billions. The prime minister brought up the possibility of an extension during meetings with EU leaders in Brussels on Wednesday as she sought to find a way to break the deadlock in negotiations. The period – during which the UK would stay completely tied to EU rules without any say on them – is hugely unpopular with Brexiteers, who believe it would make Britain a “vassal state” of the bloc. European Parliament president Antonio Tajani, who was in the room while Ms May spoke with leaders, said the prime minister had listed a longer transition as a possible solution to the current impasse.

“It was mentioned – both sides mentioned the idea of an extension of a transition period as one possibility that is on the table and would be looked into,” Mr Tajani told reporters after Ms May’s address. “Theresa May during her speech said it’s possible to achieve an agreement also on a transition period, but not with a clear position on the timing.” With a smile, he added: “This Council is the transition Council.” The prime minister is also understood to have brought up an extension to the period in a private bilateral meeting with Council president Donald Tusk earlier in the afternoon. One Brussels official told The Independent that the UK’s negotiators had been sounding out a possible extension to the transition “for months” in talks.

“Britons would be “obliged to present a visa to enter French territory and to hold a residence permit to remain there..”

• Germany And France Start To Draw Up No-Deal Brexit Contingency Plans (G.)

Germany and France are starting to step up their preparations for a no-deal Brexit even though both publicly insist an agreement with the UK over the terms of its departure from the EU can still be achieved. Angela Merkel revealed for the first time on Wednesday that Germany was drawing up contingency plans, saying the government had started making “suitable preparations” for the possibility of Britain leaving with no accord. While there was there was still a chance for a deal, it was “only fitting as a responsible and forward-thinking government leadership that we prepare for every scenario”, the German chancellor told MPs in Berlin. “That includes the possibility of Britain leaving the EU without an agreement.”

France has published a draft bill that would allow the government to introduce new legal measures to avoid or mitigate the consequences of a hard Brexit by emergency decree, as opposed to parliamentary vote, within 12 months of the law being passed. It said those consequences would include include Britons needing visas to visit and UK nationals resident in the country being in an “irregular” legal situation. Without emergency measures, British citizens living in France would become third-country nationals, the draft bill states, which would prevent them from holding jobs restricted to EU nationals and limit their access to healthcare and welfare.

Britons would be “obliged to present a visa to enter French territory and to hold a residence permit to remain there”, the bill’s preamble says. A no-deal Brexit would also mean “British citizens with a work contract under French law with a French employer could be asked for a document authorising them to work in France”.

But Rand Paul still wants him to testify.

• Congress Members Pen Letter Demanding Ecuador Hand Over Julian Assange (GWP)

Representatives Eliot L. Engel (D-NY), Ranking Member of the House Committee on Foreign Affairs, and Ileana Ros-Lehtinen (R-FL), Chair Emeritus of the Committee, have sent a letter to Ecuadorian President Lenín Moreno demanding that Julian Assange be handed over to authorities. The firm stance against press freedom comes as Ecuador is preparing to restore Assange’s communications — with strict limitations that will not allow him to properly continue his work as a publisher. The letter threatens that the United States will be unwilling to provide economic cooperation with Ecuador unless the WikiLeaks founder and political refugee is handed over.

“Many of us in the United States Congress are eager to move forward in collaborating with your government on a wide array of issues, from economic cooperation to counternarcotics assistance to the possible return of a United States Agency for International Development mission to Ecuador. However, in order to advance on these crucial matters, we must first resolve a significant challenge created by your predecessor, Rafael Correa – the status of Julian Assange,” the members wrote in their letter.

“Most recently, we were particularly disturbed to learn that your government restored Mr. Assange’s access to the Internet. On numerous occasions, Mr. Assange has compromised the national security of the United States. He has done so by publicly releasing classified government documents along with confidential materials from individuals connected to our country’s 2016 presidential election. As you yourself have noted, he has repeatedly used his standing in the international media to meddle in the affairs of foreign governments such as Spain and the United Kingdom. This has frayed Ecuador’s relations with like-minded governments. Mr. Assange also remains wanted by British authorities for a bail violation. It is clear that Mr. Assange remains a dangerous criminal and a threat to global security, and he should be brought to justice,” the letter states.

“These laws may or may not have been decreed by God, but he cannot intervene to break the laws or they would not be laws.”

• Stephen Hawking: Time Travel More Likely Than The Existence Of God (F.)

In Stephen Hawking’s universe there was no room for God, because the famous cosmologist came to believe that the entirety of existence was created out of, well… nothing. As he explains in his final book, “Brief Answers to the Big Questions,” before the Big Bang there was nothing, not even a God to create the universe. “I think the universe was spontaneously created out of nothing according to the laws of science,” Hawking writes. “There is no time for a creator to have existed in.” He goes on to explain that the only God who could be consistent with the laws of physics would be a deity who never directly influences the workings of the universe. “These laws may or may not have been decreed by God, but he cannot intervene to break the laws or they would not be laws.”

While the existence of God makes little sense to Hawking, he’s more open to the possibility of something that most people might consider much more far-fetched: time travel. Hawking famously held a party for time travelers but did not send out the invitations until after the party. No one showed up for the festivities. But the scientist writes that there is still some hope that traveling back in time could be possible according to the laws of the universe. He pegs this notion on the promise of something called “M theory” that suggests the universe may contain seven hidden dimensions in addition to the familiar four dimensions of space-time. “Rapid space travel and travel back in time can’t be ruled out according to our present understanding,” he writes. “Science fiction fans need not lose heart: there’s hope in M theory.”

40,000 tree clones.

• Largest, Oldest ‘Living Thing’ On Earth Is Dying (Ind.)

Scientists have warned that an ancient forest widely considered the largest single living thing in the world is dying, despite efforts to preserve it. The Pando aspen is an enormous expanse of 40,000 trees, all of which are clones with identical genetic compositions, meaning they are classified together as one individual. Thought to be up to 80,000 years old, the colony known as the “trembling giant” is a contender for the oldest organism as well as the heaviest and largest. In total the trees, which originate from a single underground parent clone, cover 43 hectares of Utah’s Fishlake National Forest. But in recent years a tragedy has been quietly unfurling. Despite their best efforts, scientists think this natural wonder that has lasted millennia may not survive a few decades of human interference.

“While Pando has likely existed for thousands of years – we have no method of firmly fixing its age – it is now collapsing on our watch,” said Professor Paul Rogers, an ecologist at Utah State University. After analysing Pando’s condition comprehensively, Professor Rogers and his colleague Professor Darren McAvoy examined a 72-year aerial photo sequence that revealed its steady decline. [..] As it has often proved difficult to measure the true extent of such enormous organisms, Pando has some contenders for the largest living thing – including massive fungi growing in Oregon and clonal colonies of underwater Neptune grass.

Home › Forums › Debt Rattle October 18 2018