Russell Lee Sign Along the Road Near Capulin New Mexico 1939

Let’s be a bit contrarian this Sunday, shall we?

• Zero Covid Is A Mirage – The Virus Is Here To Stay (Jonathan Sumption)

Coronavirus has divided society. A chasm of mutual misunderstanding and resentment has opened up. On one side are people who want to be allowed to make their own judgments about risk, in the light of their own vulnerabilities and those of the people around them. On the other side are people who think their safety depends on coercing their fellow citizens into accepting the judgment of Government Ministers. Despite the optimism created by the vaccines, powerful voices are still exploiting public fears to keep us locked up for longer and impose distancing rules indefinitely in pursuit of the mirage of zero Covid. There is concern that medical scientists are moving the goalposts, changing their objectives in a way that would keep us locked up for longer, perhaps indefinitely.

Those of us who point to the staggering collateral cost of such policies are drowned out by outbursts of emotion and abuse from people who behave as if nothing matters except reducing the Covid death toll. As a society, we have been urged to suppress the most basic instinct of the human spirit – our interaction with each other. In the process, we turned a public health crisis into something much worse: a public health crisis AND an economic, social and educational crisis. Our economy is being laid waste, with small businesses snuffed out and job prospects destroyed for a generation of young people. Yet no society ever reduced deaths by making itself poorer. We have shut down our cities and crippled a once-flourishing musical, artistic and sporting culture.

We have created an acute crisis of mental health among the young. We are depriving children of their education, perhaps the most important benefit that the state can give them, at untold cost for their future. We are locking the elderly into islands of loneliness and wretchedness, depriving them of the stimulus of human contact. Dementia – a bigger killer than Covid-19 – is hitting unprecedented levels. None of this is the result of the disease. It is all due to the lockdown. To escape this situation, we need to understand how we got into it. Covid-19 is serious, but it is no worse than the scenario for which governments have planned for years. A pandemic caused by a new respiratory disease has topped the National Risk Register since 2008. In 2017, it assumed that a new pathogen might cause 750,000 deaths.

The principles of any response were set out in a 2011 Department of Health strategy. They were designed to ensure the minimum of disruption. The aim was to shield the sick and the vulnerable, not isolate the healthy and economically active. It was to ‘encourage those who are well to carry on with their normal lives for as long and as far as that is possible’. The Government would not close borders or stop mass gatherings. Lockdown was not even an option. Minutes of the Scientific Advisory Group for Emergencies (Sage) show that the same policies were the basis of its advice to Ministers right up to the moment last March when the first lockdown was decided.

One of many problems with reliance on hasty vaccines.

• Oxford Covid Jab Less Effective Against South African Variant (R.)

British drugmaker AstraZeneca said on Saturday that its vaccine developed with the University of Oxford appeared to offer only limited protection against mild disease caused by the South African variant of Covid-19, based on early data from a trial. The study from South Africa’s University of the Witwatersrand and Oxford University showed the vaccine had significantly reduced efficacy against the South African variant, according to a Financial Times report published earlier in the day. Among coronavirus variants now most concerning for scientists and public health experts are the so-called British, South African and Brazilian variants, which appear to spread more swiftly than others.

“In this small phase I/II trial, early data has shown limited efficacy against mild disease primarily due to the B.1.351 South African variant,” an AstraZeneca spokesperson said in response to the FT report. The newspaper said none of the more than 2,000 trial participants had been hospitalised or died. “However, we have not been able to properly ascertain its effect against severe disease and hospitalisation given that subjects were predominantly young healthy adults,” the AstraZeneca spokesperson said. The company said it believed its vaccine could protect against severe disease, given that the neutralising antibody activity was equivalent to that of other Covid-19 vaccines that have demonstrated protection against severe disease.

A splintered court.

• Supreme Court Lifts California Worship Bans Prompted By Coronavirus (Pol.)

A splintered U.S. Supreme Court blocked California from enforcing coronavirus-related bans on indoor worship services, but declined to upset other state rules banning singing and chanting and limiting the number of worshipers. The ruling issued just before 11 p.m. ET Friday produced four separate statements by the justices, as well as a convoluted description of what relief various justices would have granted to churches objecting to the limits. However, a majority of the court was only willing to lift the ban California has applied on all indoor worship in Tier 1 counties — those most challenged by Covid-19. The other restrictions remain undisturbed, for now.

Perhaps the most surprising aspect of the Friday night ruling: new Justice Amy Coney Barrett, whose conservative Catholic views drew suspicion from many liberals in advance of her confirmation last year, declined to grant the churches the most sweeping relief favored by her most conservative colleagues. Justices Neil Gorsuch and Clarence Thomas would have granted all the churches’ requests, lifting the singing and chanting bans and barred California from enforcing a 25 percent capacity limit that applies to many indoor facilities. Justice Samuel Alito would have had such a ban kick in 30 days from now if the state didn’t make certain showings in court.

“Even if a full congregation singing hymns is too risky, California does not explain why even a single masked cantor cannot lead worship behind a mask and a plexiglass shield. Or why even a lone muezzin may not sing the call to prayer from a remote location inside a mosque as worshippers file in,” Gorsuch wrote. Barrett opted for a middle-ground position with Justice Brett Kavanaugh that did not go as far as Gorsuch, Thomas or Alito. “The applicants bore the burden of establishing their entitlement to relief from the singing ban. In my view, they did not carry that burden—at least not on this record,” she wrote in a brief opinion.

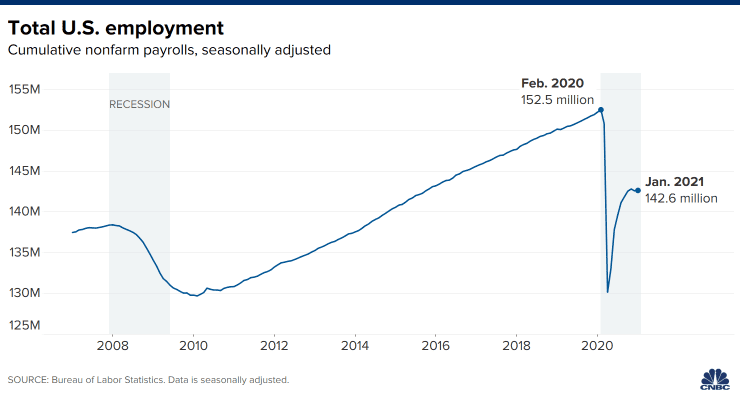

“It would take approximately 29 years to get back to get back to pre-recession levels at the current pace of job growth..”

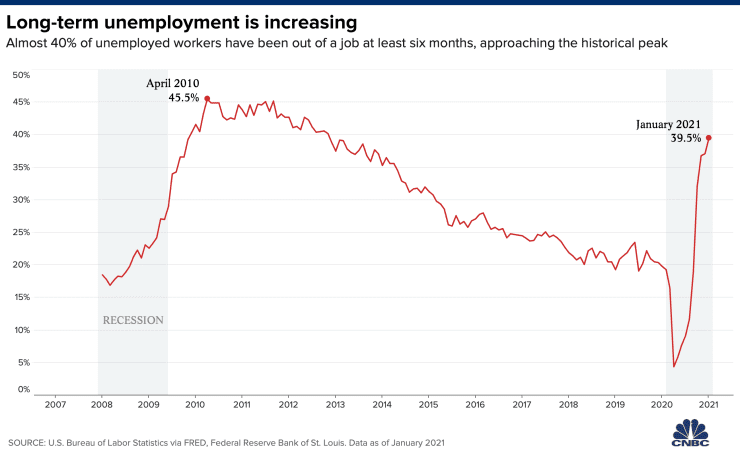

• Long-Term Unemployment Is Close To A Great Recession Record (CNBC)

Long-term unemployment is edging toward a historical peak, almost a year into the pandemic-fueled downturn. Workers are deemed to be “long-term unemployed” when their jobless spell is longer than six months. It’s an especially dangerous period of unemployment, according to labor economists. For one, household income may drop significantly. But the dynamic also makes finding a new job more difficult, scars workers’ long-term earnings potential and raises the odds of losing a job (if they find one) down the road, economists said. Almost 40% of jobless workers in January were long-term unemployed, the Bureau of Labor Statistics reported Friday.

The share has grown steadily since the spring and is approaching the record set in April 2010, in the aftermath of the Great Recession. At that time, nearly 46% of the unemployed were out of work at least six months. “I think that is one of the many concerning things we see in this report,” Nick Bunker, economic research director at job site Indeed, said of January’s uptick in long-term unemployment. “I think it’s even more concerning when you see job gains continue to slow down.” The U.S. economy added 49,000 jobs last month, according to the Bureau of Labor Statistics. The economy shed 227,000 jobs in December, the first drop since the rebound began in the spring. Meanwhile, there are about 10 million fewer jobs than before the pandemic.

It would take approximately 29 years to get back to get back to pre-recession levels at the current pace of job growth, according to Heidi Shierholz, director of Policy at the Economic Policy Institute, a left-leaning think tank. (Her analysis uses the average growth over the past three months.) “There’s a massive hole to fill,” said Shierholz, a former chief economist at the Department of Labor.

That’s a lot.

• UK Exports To EU Slashed By 68% Since Brexit (G.)

The volume of exports going through British ports to the EU fell by a staggering 68% last month compared with January last year, mostly as a result of problems caused by Brexit, the Observer can reveal. The dramatic drop in the volume of traffic carried on ferries and through the Channel tunnel has been reported to Cabinet Office minister Michael Gove by the Road Haulage Association after a survey of its international members. In a letter to Gove dated 1 February, the RHA’s chief executive, Richard Burnett, also told the minister he and his officials had repeatedly warned over several months of problems and called for measures to lessen difficulties – but had been largely ignored.

In particular he had made clear throughout last year there was an urgent need to increase the number of customs agents to help firms with mountains of extra paperwork. The number now, around 10,000, is still about a fifth of what the RHA says is required to handle the massive increase in paperwork facing exporters. Burnett told the Observer that in addition to the 68% fall-off in exports, about 65%-75% of vehicles that had come over from the EU were going back empty because there were no goods for them to return with, due to hold-ups on the UK side, and because some UK companies had either temporarily or permanently halted exports to the EU. “I find it deeply frustrating and annoying that ministers have chosen not to listen to the industry and experts,” he said.

Contact with Gove had been limited and had achieved little over recent months. “Michael Gove is the master of extracting information from you and giving nothing back,” he said. “He responds on WhatsApp and says he got the letter but no written response comes. Pretty much every time we have written over the last six months he has not responded in writing. He tends to get officials to start working on things. But the responses are a complete waste of time because they don’t listen to what the issues were that we raised in the first place.” According to the House of Commons library, UK exports to the EU were £294bn in 2019 (43% of all UK exports) while UK imports from the EU were £374bn (52% of the total). The overwhelming majority of exports to the EU from the UK go through ports rather than by air.

And now go global.

• Google Reverses Course, Opens Paid Platform For (Some) Australian News (ZH)

The Australian government has possibly obtained a rare, partial victory in its standoff with Google. The US-based tech giant has appeared to reverse course as Australia holds hearings aimed at enacting legislation that would effectively force Google to pay local sources for news it links to and features in its search engine. Google last month threatened to pull its search engine off the continent altogether, with Canberra counter-threatening that they won’t budge. But on Thursday Google made the following official announcement: “To meet growing reader and publisher needs, last year we increased our investment in news partnerships and launched Google News Showcase.”

The ‘Showcase’ app is the result of the company negotiating to pay some Australian news producers who sign up for the program. It’s an attempt to undercut legislation being proposed to require the company to pay for all such content. It’s not likely to stop the new legislation, however, but Google is offering it as an ‘alternative’. The move shows that the tech giant is arguably feeling the pressure and is looking to compromise. The Google announcement continued, “Today we are happy to announce we are rolling out an initial version of the product to benefit users and publishers in Australia, with a keen focus on leading regional and independent publishers given the importance of local information and the role it plays in people’s everyday lives.”

“News Showcase is designed to bring value to both publishers and readers by providing a licensing program that pays publishers to curate content for story panels across Google services, and gives readers more insights into the stories that matter,” it said. While the details have yet to be revealed, for example just which publishers will eventually be enabled to join the platform, it’s being reported as a significant compromise which is likely to first reward major national Australian outlets, as Reuters details: With the legislation now before a parliamentary inquiry, Friday’s launch of News Showcase in Australia will see it pay seven domestic outlets, including the Canberra Times, to use their content.

About the Time article.

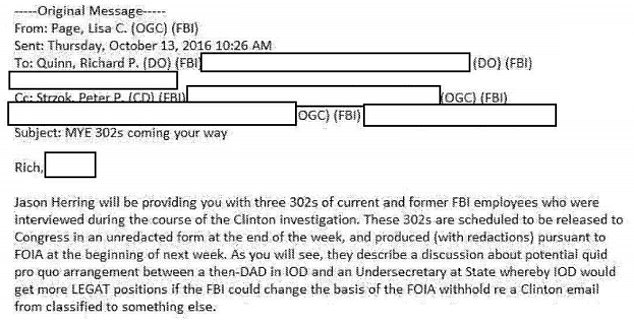

• There Was A Color Revolution In The US After All (Malic)

The 2020 US presidential elections wasn’t “rigged,” oh no, but “fortified” by a conspiracy of activists united in saving “Our Democracy” from the Bad Orange Man, now proud to share their story in a friendly tell-all piece in TIME.“There was a conspiracy unfolding behind the scenes,” writes Molly Ball – a biographer of House Speaker Nancy Pelosi, by the way – in TIME magazine this week, describing it as a “vast, cross-partisan campaign to protect the election – an extraordinary shadow effort.” Ball’s article reveals a lot, from why there were no street riots by Democrats either on November 4 or on January 6 – the organizers of this “conspiracy” stopped them – to who was behind the push to alter election rules in key states and set up mail-in voting, who organized “information” campaigns about the results of the election, and who even threatened election officials into making the “right” decision to certify the vote.

While everyone – myself included – was focused on the summer riots as a possible “color revolution,” they turned out to be misdirection. According to TIME, the real action was taking place behind the scenes, as Democrat activists and unions joined forces with NeverTrump Republicans, Chamber of Commerce, corporations, and Big Tech to make sure the 2020 election turns out the way they wanted. They call this a victory of democracy and the will of the people, of course, for no one is ever a villain in their own story. “Their work touched every aspect of the election,” Ball writes, from getting states to “change voting system laws” and fending off “voter-suppression lawsuits,” to recruiting “armies” of poll workers and pressuring social media companies to “take a harder line against disinformation.”

Then, after Election Day, “they monitored every pressure point to ensure that Trump could not overturn the result.” Alarmed yet? Maybe you should be. So who are these shadowy saviors of Our Democracy? One of them is union organizer Mike Podhorzer of AFL-CIO, a traditional Democrat powerhouse. Another is Ian Bassin, associate White House counsel in Barack Obama’s first administration. The roster of his “nonpartisan, rule-of-law” outfit called Protect Democracy includes a lot of Obama lawyers, a John McCain campaign aide, an editor from the defunct neocon Weekly Standard, and someone from SPLC, while among their advisers is the NeverTrump failed presidential candidate and ex-CIA spy Evan McMullin.

Bear that in mind when you read Bassin’s quote that “Every attempt to interfere with the proper outcome of the election was defeated,” but “it’s massively important for the country to understand that it didn’t happen accidentally. The system didn’t work magically. Democracy is not self-executing.” Chilling words.

Trojan horse.

• How Ecuador’s US-backed ‘Ecosocialist’ Candidate Aids The Right-Wing (GZ)

Ecuador’s historic February 7 election could bring a popular revolutionary movement back from the dead and help fuel a new wave of socialist governments in Latin America. The contrast between the two main presidential candidates could hardly be more stark: On one side is a conservative banker backed by Ecuadorian elites and the United States, Guillermo Lasso; and on the other is a youthful left-wing economist, Andrés Arauz, who follows in the footsteps of socialist former President Rafael Correa and wants to return to his Citizens’ Revolution. But a third candidate who has stayed in the race until the end, despite all polls showing him significantly behind, has helped to divide Ecuador’s left-wing vote by running what has been marketed as a progressive environmentalist campaign.

Yaku Pérez Guartambel, an Indigenous leader from Ecuador’s party Pachakutik, purports to be the true left-wing option in the election. But his political record suggests he is a Trojan Horse for the left’s most bitter enemies. Pérez supported right-wing US-backed coups targeting Bolivia, Brazil, Venezuela, and Nicaragua, demonizing the countries’ socialist governments as “racist.” His political views fuse ultra-leftist, anarchistic critiques of existing left-wing states with an objectively right-wing political agenda. And his opposition to state power is deeply opportunistic. While Pérez harshly criticizes China, he has simultaneously pronounced he “would not think twice” about signing a trade deal with the United States. Pérez’s ostensibly progressive ideology is filled with contradictions. While the Correista candidate Arauz has proposed giving $1000 checks to one million working-class Ecuadorian families, Pérez has attacked the plan on the grounds that poor citizens would spend all the money on beer in one day.

The party of Pérez, Pachakutik, identifies as “ecosocialist” and claims to represent Ecuador’s Indigenous communities. But like the candidate that leads it, it employs left-wing rhetoric to paper over regressive goals. Pachakutik is closely linked to NGOs funded by Washington and EU member states. The party’s leaders have been trained by the US government-funded National Democratic Institute (NDI), a CIA cutout that operates under the auspices of the National Endowment for Democracy. In the past, Pérez and Pachakutik helped lead protests against Ecuador’s former President Correa, forming an unspoken alliance with the country’s right-wing oligarchs in a bid to destabilize and overthrow the socialist president. In fact, Pachakutik played a significant role in a US-backed 2010 coup attempt that came close to undemocratically removing Correa from power.

Pachakutik’s ties to Washington are extensive. One of its most prominent former members is Fernando Villavicencio, an Ecuadorian journalist who spearheaded a disinformation campaign targeting journalist Julian Assange, peddling discredited but deeply damaging claims about the Wikileaks publisher through the neoliberal British newspaper The Guardian. Villavicencio’s anti-Correa activism also appears to have been funded by the US government’s National Endowment for Democracy.

“Indeed, what’s denounced as extremism “back home” is very likely to be praised as bravery “over there.”

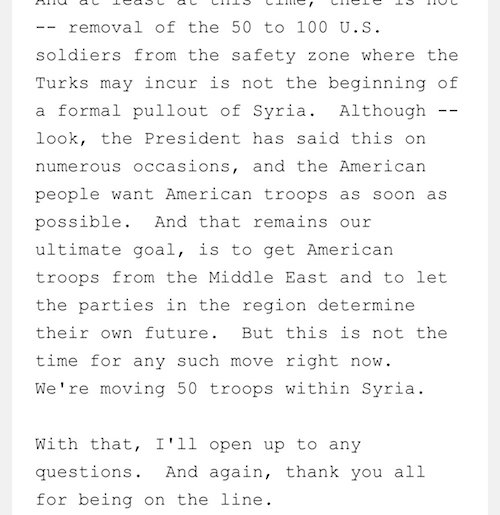

• Pentagon Goes Rooting For ‘Extremists’ Among Its 3.6mn Trained Killers (RT)

The US military is making a big show of cleansing its ranks of ‘extremism’ – because nothing says tolerance like raining fiery death on innocent strangers at the command of a guy who just stepped down from Raytheon’s board. With “domestic extremists” now officially the enemy du jour in Washington, the top order of business has become finding some. On Wednesday, newly-anointed secretary of defense (and former Raytheon board member) Lloyd Austin ordered a two-month stand-down so that commanders could engage in “needed discussions” with their subordinates on the issue. Did we mention they have a lot of subordinates? There are 3.6 million service members in the most expensive military in the world, and evaluating every single one of them for a characteristic that lacks even a universally-agreed-upon definition is certain to be both time-consuming and frustrating.

It’s also quite likely to backfire. Being spuriously accused of “domestic extremism” is the sort of thing that might turn an ‘ordinary’ soldier into an anti-government ‘extremist.’ After all, what sort of gratitude is rewarding a person who just signed up to die for their country with the ideological equivalent of a prostate exam? The FBI, DHS and other security agencies have, at various times, declared almost every American to be some sort of anti-government extremist or other, from “conspiracy theorists” to, well, veterans, depending on that season’s trend in fear. But even the most ambitious diversity consultant can’t just lock up millions of Americans for thoughtcrime – yet.

It takes extreme conditioning indeed to abandon one’s humanity and learn to kill on command – “Thou shalt not kill” isn’t just a religious commandment. Former military personnel describing the process through which they were transformed from “normal” people into killing machines talk about a radicalization process quite unlike anything ever posted to 4chan or wherever 21st-century “radicals” are supposed to be born from. Yet anti-extremism nonprofits wring their hands when confronted with the seemingly disproportionate number of Three Percenters, Oath Keepers, Boogaloo Bois, and other militia and quasi-militia groups that have served in the military. Do they expect veterans to simply forget their entire training upon returning to civilian life?

Indeed, what’s denounced as extremism “back home” is very likely to be praised as bravery “over there.” Such doublethink makes it difficult for many returning veterans to readjust to civilian life – and the government – and it doesn’t help that Washington basically washes its hands of them once they remove their uniforms. What good is all that college money they dangle in front of young recruits’ faces if all that “life experience” leaves you a dysfunctional PTSD-stricken shell of a person, incapable of forming meaningful relationships or even sleeping through the night? Not every service member sees conflict, of course, but those who do are irrevocably changed by it.

“a personal book about his own personal journey..”

• Hunter Biden Memoir #1 In ‘Chinese Biography Bestsellers’ On Amazon (RT)

President Joe Biden’s son Hunter briefly hit bestseller status in Amazon’s ‘Chinese biography’ section for a new memoir, for which he was reportedly paid $2 million by the same publisher who scrapped GOP Sen. Josh Hawley’s book. The ‘Chinese biography’ listing was first reported on Friday by the New York Post, the same newspaper censored on social media in the run-up to the 2020 US presidential election over a story about Hunter’s business dealings in Ukraine and China. After a few hours at the top of the section, however, Amazon scrubbed the ranking, relocating Biden’s memoir to the number-one spot in its ‘Lawyer & Judge biographies’ category. Biden was reportedly paid a $2 million advance for the book, titled ‘Beautiful Things’ and said to contain an account of his struggle with drug abuse, among other things.

News of the contract – reportedly signed secretly in late 2019 – was only announced on Thursday. The memoir is scheduled to be published in early April by Gallery Books, an imprint of Simon & Schuster – the very same publisher who canceled Hawley’s ‘Tyranny of Big Tech’ after the January 6 unrest at the US Capitol. Asked about the memoir on Thursday, White House press secretary Jen Psaki called it “a personal book about his own personal journey.” Psaki also quoted a statement “in their personal capacity as parents” from Joe and Jill Biden, who said they “admire our son Hunter’s strength and courage to talk openly about his addiction so that others might see themselves in his journey and find hope.”

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

“Think of how stupid the average person is, and then realize half of them are stupider than that.”

– George Carlin

Support the Automatic Earth in 2021. Click at the top of the sidebars to donate with Paypal and Patreon.