Marc Chagall The Smolensk newspaper 1914

To think that until recently this was not considered possible at all.

• Yield Curve Screams “Recession” as Trade War Picks Up Steam (Mish)

Futures pick up where they left off Friday with equity prices and bond yields lower. Sunday Evening Futures: • Equities Down • Gold Up • Treasury Yields Down As of 1:36 AM Central on Monday morning, the 30-year long bond is a record low 1.942%. It’s now inverted 17.8 basis points with the Fed Funds rate. The 5-year note is a whopping 78.4 basis points inverted. Few seem to believe it, but the yield curve is now screaming recession.

“The impact of the new tariffs on China’s economic growth will be sizeable..”

• China’s Yuan Slumps To 11-Year Low, Stocks Fall As Trade War Escalates (R.)

China’s yuan slumped to a fresh 11-year low against the dollar on Monday and stocks fell as the Sino-U.S. trade war sharply escalated, threatening to inflict more damage on the world’s largest economies and weigh further on global growth. In Hong Kong, a weekend flare-up in violence during anti-government protests added to pressure on share prices. The onshore yuan fell 0.6% in early trade to 7.15 per dollar, its weakest since February 2008 and its second biggest one-day drop of the month. The offshore yuan fell to a record low of 7.1850, before regaining some ground to around 7.1595.

The Chinese authorities have allowed the tightly-managed yuan to fall some 3.6% so far this month as trade tensions between Beijing and Washington worsened, sparking fears of a global currency war. It was trading around 7.1419 by 0330 GMT. On Friday, U.S. President Donald Trump announced an additional duty on some $550 billion of targeted Chinese goods, hours after China unveiled retaliatory tariffs on $75 billion worth of U.S. goods. “This tit-for-tat escalation shows how unlikely a trade deal and de-escalation have become,” Louis Kuijs, of Oxford Economics, wrote in a note late on Sunday. “The impact of the new tariffs on China’s economic growth will be sizeable,” he said.

China denies.

• Trump Says China Called Twice To Restart Trade Talks (MW)

In a comment that moved financial markets, President Donald Trump on Monday said serious negotiations with China will begin after the U.S. received two “very good calls” from Beijing. “China called last night our top trade people and said let’s get back to the table,” the president said after meeting Egyptian President Abdel-Fattah el-Sissi. “I have great respect for it.” Trump said “we are going to start talking very seriously.” He says the Chinese want to make a deal and he thinks one will finally be reached. Trump says he’ll say more about China later Monday.

China’s foreign ministry meanwhile said it wasn’t aware of any such calls and that a U.S.-China decoupling will lead to market chaos, according to wire reports. After the Dow Jones Industrial Average DJIA, -2.37% dropped 623 points on Friday, U.S. stock futures were higher in the early hours of Monday morning. The dollar rose against the Japanese yen. Europe stocks were a bit weaker, with trading light with the U.K. market closed for a holiday.

All has to be said in a way that avoids losing face.

• China Willing To Resolve Trade Dispute With US Via Dialogue (R.)

Chinese Vice Premier Liu He said on Monday that China is willing to resolve its trade dispute with the United States through calm negotiations and resolutely opposes the escalation of the conflict, a state-backed newspaper reported. Liu, China’s top trade negotiator, was speaking at a tech conference in Chongqing in southwest China, the Chongqing Morning Post reported. The comments come after U.S. President Donald Trump last week announced an extra 5% duty on some $550 billion of Chinese goods, the latest tit-for-tat move announced hours after China unveiled its retaliatory tariffs on $75 billion worth of U.S. products.

“They have free entrance into our markets, our investments, our companies and we do not have the same thing there. That’s the only reason why we are in this situation..”

• Mnuchin: If China Agreed To Fair Relationship, We’d Sign ‘In A Second’ (CNBC)

American Treasury Secretary Steven Mnuchin doubled down on the White House’s latest punch in the U.S.-China trade war by calling out Beijing for unfair trade practices. “We do not have free trade with them,” Mnuchin said Sunday on the sidelines of the G-7 meeting in France. “It’s a one way street: They have free entrance into our markets, our investments, our companies and we do not have the same thing there. That’s the only reason why we are in this situation with China. If China would agree to a fair and balanced relationship, we would sign that deal in a second,” he added.

“Sometimes you’ve got to take stern measures,” White House economic advisor Larry Kudlow said alongside Mnuchin, adding that American companies should heed the president’s call to leave China. “Come home to America, we’ve got the best tax system, we’ve got the best regulatory system, it’s an easy place to make money, the best technology in the world. Come home. That’s what the president is saying,” Kudlow said. Before leaving for the G-7, U.S. President Donald Trump said he would raise existing duties on $250 billion in Chinese products to 30% from 25% on Oct. 1. Additionally, he said, tariffs on another $300 billion of Chinese goods, which start to take effect on Sept. 1, will now be 15% instead of 10%.

Protesters are escalating because their demands are ignored.

• Hong Kong Police Arrest 36 After Running Battles With Protesters (R.)

Hong Kong police said on Monday they arrested 36 people, the youngest aged 12, after violence during anti-government demonstrations escalated as protesters hurled Molotov cocktails at security forces who responded with water cannon and tear gas. Sunday’s protests saw some of the fiercest clashes yet between police and demonstrators since protests escalated in mid-June over a now-suspended extradition bill that would have allowed Hong Kong people to be sent to mainland China for trial. Police fired water cannon and volleys of tear gas in running battles with brick-throwing protesters on Sunday, the second day of violent clashes in the Chinese-ruled city.

Six officers drew their pistols and one officer fired a warning shot into the air, police said in a statement. “The escalating illegal and violent acts of radical protesters are not only outrageous, they also push Hong Kong to the verge of a very dangerous situation,” the government said in a statement.

More demonstrations are planned in the days and weeks ahead, including a rally at Hong Kong’s Cathay Pacific Airways headquarters on Wednesday to protest against perceived “white terror”, a common expression to describe anonymous acts that create a climate of fear. Cathay has emerged as the biggest corporate casualty of the protests after China demanded it suspend staff involved in, or who support, the anti-government demonstrations that have plunged the former British colony into a political crisis. The protests also pose the gravest popular challenge to Chinese President Xi Jinping since he took power in 2012, with Beijing eager to quell the unrest ahead of the 70th anniversary of the founding of the People’s Republic of China on Oct 1.

Bubbling below the surface.

• Australia’s Big Banks Gear Up For Capital Raising Rush (R.)

Australia’s biggest banks are expected to cut dividend payments and tap bond markets for more funding to cope with tougher capital requirements as regulators look to safeguard the sector from future market volatility, according to analysts and bankers. This week, Commonwealth Bank of Australia Chief Executive Matt Comyn and Chief Financial Officer Alan Docherty will finalise a roadshow with Australian equity investors before holding similar meetings in New York next month as well as London and Hong Kong. The bank traditionally meets with investors following its full-year results and the presentations have often preceded CBA tapping the bond markets. However, the meetings this year come as Australia’s banks are under increasing pressure to boost their capital.

Last week, the Australian Prudential Regulation Authority (APRA) said local banks would only be allowed to have 25% of their tier one capital – core funds held to help absorb losses – exposed to international operations or related parties from January 2021, down from the current 50%. That means banks such as Australia and New Zealand Banking Group face higher costs because they will have to fund each unit separately. The news came on top of another decision by APRA last month ruling that Australian banks would need to raise an extra A$50 billion ($33.8 billion) of so-called “tier two” bonds – riskier instruments that suffer losses before tier one capital is touched – by 2024 as part of its new total loss absorbing capital rules.

“..all this happens amidst an unprecedented chained stimulus.”

• Why The Next ECB Stimulus Plan May Fail (Lacalle)

When many analysts tell us that Europe “is not so bad” or that “it is only a slowdown,” they ignore that all this happens amidst an unprecedented chained stimulus. The results are not only extremely poor, but they are also deeply worrying. According to Morgan Stanley, the European Central Bank could be preparing a new repurchase program of between 2.2 and 3.3 billion euros. Not only buying back bonds from governments, but also from banks and companies. What for? Even Italy – in the midst of a political crisis – has negative real sovereign bond yields. The sovereign debt of all the eurozone countries shows negative yields in two-year maturity and negative as well going up to seven years. Germany has just launched a 30-year bond at -0.11%.

Is it really necessary to artificially depress yields even more? In the eurozone there are already fourteen junk bonds listed with negative yields and high-risk bonds of banks and companies are listed with ridiculous returns of 3-4%. The problem of the eurozone is not lack of liquidity, when excessive liquidity reaches 1.8 trillion euros, or low rates when they are already negative,. The eurozone problem is precisely the constant practice of using monetary policy as a perverse incentive to maintain structural imbalances. Monetary policy works as a huge transfer of wealth from savers and productive sectors of the eurozone to inefficient governments and unproductive sectors that are constantly refinanced, zombifying the economy, putting obstacles to productivity and technological change.

The stimulus chain described above can be summed up in the phrase: a huge subsidy to low productivity. Here is the debate. Why has it worked in the US and not in Europe? First, because it is not true that the United States owes its improvement to quantitative easing. In a report by Stephen Williamson for the Federal Reserve, he already warned that “there is no relationship between greater economic activity and quantitative easing.” The US economy is the most dynamic, open and least dependent on bank financing of the world’s leading countries. The Federal Reserve never accounted for 100% of the demand for government bonds, it always kept an eye on the secondary market. The ECB became seven times the bond supply, according to Deutsche Bank.

Blaming the EU will not work.

• Britain Can ‘Easily Cope’ With No-Deal Brexit, Claims Boris Johnson (G.)

Britain could “easily cope” with a no-deal Brexit, which would be the fault of EU leaders’ “obduracy”, Boris Johnson claimed at the summit of G7 countries in France, as he continued to resist mounting pressure to spell out his own plans for breaking the deadlock. “I think we can get through this, this is a great, great country, the UK, we can easily cope with a no-deal scenario,” Johnson insisted in Biarritz, as he made his debut on the international stage as prime minister with a series of bilateral meetings with world leaders including Donald Trump, the EU council president Donald Tusk and Indian prime minister Narendra Modi. Johnson said preparations for no deal were being ramped up to help secure an agreement, but also “so that if and when we are forced by the obduracy by our European friends to come out on 31 October without a deal that things are as smooth as they can possibly be”.

Johnson claimed food shortages – one of the risks outlined in the leaked Operation Yellowhammer documents on no-deal planning – were “highly unlikely”, and offered a “guarantee” that patients would be able to access medicines unhindered. The prime minister said that in the event of no deal the UK would withhold much of the £39bn financial settlement agreed by Theresa May – and insisted it was up to the EU27 to avert that eventuality. “If we come out without an agreement it is certainly true that the £39bn is no longer, strictly speaking, owed,” he said “There will be very substantial sums available to our country to spend on our priorities. It’s not a threat. It’s a simple fact of reality.”

Robert Peston was once a serious journalist. What is this, the elites are closing ranks?

• Has Anyone Loved Being Prime Minister As Much As Boris Johnson? (Peston)

I’ve learned only one thing at the G7 summit of big rich countries here in Biarritz: Boris Johnson absolutely loves being Prime Minister. There’s little of the conspicuous sense of duty that weighed on the shoulders of Theresa May, Gordon Brown and Sir John Major. Nor is there that unnerving claim to embody the spirit of a nation that Tony Blair and Margaret Thatcher perhaps made too often and believed too much. There’s a touch of David Cameron’s Old Etonian entitlement, the idea that it would be odd if he weren’t PM. But mostly Johnson simply seems to be having fun – whether by pointing a joshing finger at the imperious president of France or telling an incredulous President of the EU that they agree on absolutely everything.

Johnson’s bonhomie is all the more odd because the UK – as his advisers remind him continuously – is in the grips of the most acute peacetime crisis for generations, over how and even whether to leave the EU, and Johnson’s grip on power is almost non-existent, with no majority in Parliament and fratricide in his own Tory party as unremarkable as shaking hands. But in Johnson we have the clown prince of prime ministers, who – for the first time in years, or perhaps ever – plainly thinks he is home. His interlocutors – Emmanuel Macron, Donald Tusk, Justin Trudeau – all laugh. With him or at him? I am not sure that matters, in that he seems to cheer them up.

Feel-good Boris.

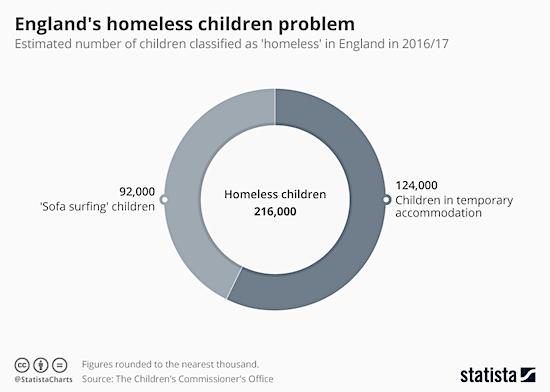

• England’s Homeless Children Problem (ZH)

New estimates from the Children’s Commissioner’s Office for England have revealed that, in addition to the official figure for child homelessness of 124 thousand, there are thought to be around 92 thousand children ‘sofa surfing’ in the country. Statista’s Martin Armstrong notes that the report, ‘Bleak Houses’ also found that the temporary accommodation of families and children is often not fit for human habitation with shipping containers, office blocks and B&Bs being re-purposed to house them.

Commenting on the findings, Children’s Commissioner Anne Longfield said: “It is a scandal that a country as prosperous as ours is leaving tens of thousands of families in temporary accommodation for long periods of time, or to sofa surf.” On the reasons for the current situation, Polly Neate, chief executive of charity Shelter blamed “a cocktail of punitive welfare policies, a woeful lack of social homes and wildly expensive private rents mean this is frighteningly commonplace.”

Oh no.

• English Police Could Patrol Northern Ireland Border After No-Deal Brexit (RT)

Despite a wealth of history suggesting that it’s a very bad idea, UK politicians have reportedly devised detailed plans to deploy English police officers in Northern Ireland in the event of a no-deal Brexit. According to a report in The Sunday Times, the plans would first see approximately 300 Scottish police drafted in to support the Police Service of Northern Ireland (PSNI) as a preliminary step. However, if tensions between the unionist and nationalist communities boil over or civil unrest erupts, officers from English forces will be deployed in the province.

A source at London’s City Hall told the newspaper: “All the police forces have agreed to give support to Northern Ireland. It is a concern. Thankfully it wouldn’t affect too many London officers, but we would be there. Imagine it: officers from the mainland in Northern Ireland. Bloody hell.” Unsurprisingly the report has triggered alarm bells in Northern Ireland and Ireland with many people worrying that it could incite anger among Irish nationalists and endanger the fragile peace in the region. “English police on the Irish border. What could go wrong? Don’t remember this on the referendum ballot paper or being debated in 2016? In the week we have remembered Mo Mowlam I despair at such a reckless attitude to hard-won peace,” Labour MP Anna Turley said.

Home › Forums › Debt Rattle August 26 2019