John Vachon Billie Holiday at the Newport Jazz Festival Jul 1954

“We don’t see anything scary in the forecast ..”

• Natural Gas Drops Below $3 for First Time Since 2012 (Bloomberg)

Natural gas slumped below $3 per million British thermal units in New York for the first time since 2012 on speculation that record production will overwhelm demand for the heating fuel. Futures settled at the lowest in 27 months and have plunged 26% in December, heading for the biggest one-month drop since July 2008, as mild weather and record production erased a surplus to year-ago levels for the first time in two years. Temperatures will be mostly above average in the eastern half of the U.S. through Dec. 30, according to Commodity Weather Group LLC. “We don’t see anything scary in the forecast,” said Stephen Schork, president of Schork Group Inc., a consulting group in Villanova, Pennsylvania.

“You had this psyche where people were worried about a polar vortex; we had a cold October and a cold early November, and boom, if you were long you are wrong.” Natural gas for January delivery fell 2.3 cents, or 0.8%, to settle at $3.007 per million Btu on the New York Mercantile Exchange. Futures touched $2.973, the lowest intraday price since Sept. 26, 2012. Volume was 54% below the 100-day average for the time of day at 2:32 p.m. Gas dropped 13% this week, a fifth straight weekly decline. Prices broke below several technical support levels, including $3.046 and then $3, and may be headed toward $2.80 or lower, said Schork. “I am playing this market short,” he said. “Anyone who is selling now is trying to trigger a panic selloff.”

Why insist on talking about “OPEC’s refusal to cut production”, and not America’s?

• Oil Caps Fifth Weekly Loss on Global Supply Glut Concern (Bloomberg)

Oil fell, capping a fifth weekly loss on concern that OPEC’s refusal to cut production will worsen a global supply glut. Brent and West Texas Intermediate extended their annual declines of more than 40%, the biggest since 2008, as the Organization of Petroleum Exporting Countries resisted supply cuts to defend market share while the highest U.S. production in three decades exacerbated a global glut. Trading volume headed for the lowest this year. “The market is still reeling from oversupply,” said Phil Flynn, senior market analyst at the Price Futures Group in Chicago. “It’s really hard to muster a substantial rally until we figure out how we are going to use all this oil.”

Brent for February settlement slipped 79 cents, or 1.3%, to $59.45 a barrel on the London-based ICE Futures Europe exchange, down 3.1% this week. The volume of all futures was 84% below the 100-day average as of 3:10 p.m., with much of Europe on holiday after Christmas. West Texas Intermediate crude for February delivery fell $1.11, or 2%, to $54.73 on the New York Mercantile Exchange with volume 68% below average. Prices were down 3.2% this week. Trading reached 174,562 contracts at 2:49 p.m. The previous lowest volume this year was 244,240 on Aug. 25. Brent traded at a premium of $4.72 to WTI on the ICE.

They have zero choice.

• Saudi Arabia Maintains Spending Plans in 2015 Despite Oil Slide (WSJ)

The Saudi government unveiled a 2015 budget on Thursday that signaled a continuation of a high level of spending despite pressures from a steep fall in oil prices in recent months. The kingdom, the world’s top oil exporter, depends on oil revenue to fund social spending, helping head off the kind of unrest that has roiled Middle Eastern countries since 2011. A prolonged oil-price slump could threaten such policies here and in other Gulf monarchies. Saudi King Abdullah struck a note of caution in the budget announcement, instructing officials to consider the developments that led to oil’s decline by “rationalizing the expenditure.” Riyadh has chosen not to cut output in an effort to push up prices, despite its dependence on oil exports.

The Saudi oil minister, Ali al-Naimi—secretary-general of OPEC – on Sunday blamed a lack of coordination among non-OPEC producers, along with speculators and misleading information, for the fall in the oil price. In an indication of the government’s confidence that it can weather the market volatility, Mr. al-Naimi described the slump as “a temporary situation.” The kingdom didn’t say on what price of oil it based its 2015 budget. The International Monetary Fund and others estimate a Saudi Arabia’s fiscal break-even price for oil at well above $90 a barrel—it has been trading recently under $60 – underlining the country’s vulnerability to changes in the energy market.

“It is worrying when the expanding government expenditure begins to erode the financial surpluses built over the last few years,” Saudi economist Fadhil Albuainain said. Saudi Arabia said on Thursday that it projects total expenditure in 2015 to reach 860 billion Saudi riyals ($229.3 billion), an increase of nearly 1% from the last budget, a record. It will likely use cash from its reserves to spend ondevelopment projects in sectors such as health care and education. The kingdom expects to run a wider deficit of 145 billion riyals to continue with its spending plans, as projected revenue falls by nearly a third to 715 billion riyals, according to a finance ministry statement.

Really?

• Saudis To Hit ‘Panic Button’ At $40 Oil: Energy CEO (CNBC)

Saudi Arabia has insisted that OPEC will keep oil production at 30 million barrels per day no matter the cost of crude, but even the world’s biggest oil exporter has a limit, the CEO of Breitling Energy told CNBC on Friday. “I think the panic button is at $40,” Chris Faulkner said in a “Squawk Box” interview. “They can say whatever they want, but at the end of the day, they can’t just bleed out money forever.” With the Saudis’ deficit for 2015 projected to reach $50 billion—the official figure is $39 billion—the country’s leaders will face challenges in maintaining its subsidies, he said. Young people will not stand for planned wage cuts, either, he added.

That said, Faulkner expects oil prices to rebound to the low $70s by the end of 2015, after initially sliding further into the low $50s and possibly recovering in the second quarter. With oil prices at current levels, Venezuela will likely default on its debt payments due in March and October, Faulkner said. Brent crude for February delivery traded below $61 in morning trade on Friday. Faulkner sees natural gas remaining below $5 until 2020, as the supply and demand fundamentals are unlikely to change significantly. Natural gas dipped below $3 on Friday for the first time since Sept. 24, 2012.

A bit of hurt for Halliburton is always welcome.

• Drilling Cutbacks Mean Service Companies Forced to Scrap Rigs (Oilprice.com)

Offshore oil contractors such as Halliburton or Transocean have seen their share prices tank worse than exploration companies because their revenue comes from being paid to drill, not necessarily from oil production after wells are completed. That means that when drilling slumps, their profits take an immediate hit. Even worse, exploration companies may see rising profits from existing production as oil prices rebound, but drilling service companies don’t benefit if their drilling contracts had been put on hold or cancelled. The problem is compounded by the fact that a slew of new offshore oil rigs are set to come into operation – an estimated 200 over the next six years. As Bloomberg reports, these new rigs will mean there could be a surplus of about 140 rigs, meaning offshore oil contractors will have to scrap that many to bring new ones online.

If oil prices stay where they are now – in the neighborhood of $60 per barrel – a deep contraction in shipping rig supply will be inevitable. In 2015, spending on offshore exploration may be slashed by 15%, which will mean taking a deep knife to companies providing rigs and contracting. Transocean has already announced that it is idling seven deepwater rigs, along with several other drillships. However the shakeout may take some time because offshore contractors can resort to using older rigs in order to bring down the rates they are charging, essential to maintaining market share. In order to entice exploration companies to keep up the drilling frenzy, older ships can keep costs lower. But that may not be a tenable prospect since offshore contractors will feel compelled to put the new and more state-of-the-art rigs into operation. That will force companies with older fleets to start discarding the most dated drilling rigs.

Transocean already took a $2.6 billion impairment charge in the third quarter of this year, due to a “decline in the market valuation of the company’s contract drilling services business.” By scrapping more ships, it expects to write down at least $240 million in the fourth quarter. More may be in the offing – Transocean released an update on the status of its fleet in mid-December, confirming its plans to scrap 11 ships. The statement also added that “additional rigs may be identified as candidates for scrapping.” Perhaps it is Seadrill, another offshore drilling services company, that has taking the worst of the oil price downturn. The company decided to cancel its dividend in November amid falling oil prices, a move that sent its share price tumbling downwards. Seadrill has seen its shares lose almost 75% of their value since July.

Lots of ’em if the price doesn’t start rising soon.

• Gartman: Get Ready For Oil Bankruptcies (CNBC)

Shale oil firms in the U.S. will suffer in the next two years due to the dramatic fall in the price of the commodity, according to Dennis Gartman, the founder and editor of the Gartman Letter, who expects a further fall in prices in the near term. The commodities investor has turned slightly more bearish on oil since last week, telling CNBC Tuesday that “crude oil prices haven’t seen their lows yet.” “I’m afraid we’re going to see demonstrably lower prices still,” he said. “Demand is weak and that price is going to continue to go down more.” The U.S. has seen a revolution in gas and oil production in the U.S. with new technology unlocking new shale resources.

This oil and gas boom has spurred economic activity and giving industry a competitive edge with less expensive fuel prices. However, the recent drop in prices – with Brent crude and WTI crude both down around 47% since mid-June – is set to impact the blossoming sector over the next two years, Gartman fears. “There will clearly be bankruptcies,” Gartman said, name checking oil production sites like the Permian Basin and the Marcellus Shale. U.S. oil production is a private-sector venture and differs wildly from the state-run companies in the Gulf states and South America.

These countries are able to extract oil from the ground at a cheaper cost than U.S. shale firms and there has been speculation that the two different industries could be playing a “game of chicken” over the price of oil before cutting back to ease the oversupply. A brief rally for oil on Monday was cut short with Saudi Arabian Oil Minister Ali al-Naimi stating that Organization of the Petroleum Exporting Countries would not cut production at any price, according to Reuters. Oil majors in Europe also received a stark warning this week with credit ratings agency Standard & Poor’s (S&P) placing BP, Total and Shell all on a negative watch. The change now means that the three firms are more likely to have their debt rating downgraded in the next three months.

The “major unexpected headwinds” keep on coming.

• China November Industrial Profits Suffer Sharpest Fall In 27 Months (Reuters)

Chinese industrial profits dropped 4.2% in November to 676.12 billion yuan ($108.85 billion), official data showed on Saturday, the biggest annual decline since August 2012 as the economy hit major unexpected headwinds in the second half. Despite last month’s drop, profits for January-November were 5.3% higher than in the first 11 months of 2013, according to the National Bureau of Statistics (NBS) data. The NBS attributed November’s profit drop to declining sales and a long-running slide in producer pricing power. “Increasing price falls shrank the space for profit,” the agency said. It said the impact of prices for coal, oil and basic materials falling to their lowest levels in years “was extremely clear”. As the NBS analysis suggested, the net slide in industrial profits was driven primarily by weakness in coal mining, and oil and gas industries, where November profits tumbled from a year earlier by 44.4% and 13.2% respectively.

Oil, coking coal and nuclear fuel processing industries saw their profits slide by 34.2%, according to the data. On the upside, Chinese technology industries saw profits grow sharply last month. Telecommunications firms saw a 20.7% increase, electronics and machinery grew 15.1% and automobile manufacturers enjoyed a 16.7% gain. “This suggests that on the one hand, in the context of weak investment demand, stable consumption demand provided a certain degree of support; on the other hand, promoting industry restructuring is having a positive effect on efficiency,” the NBS analysis said. However, the unbalanced nature of the performance highlights a quandary regulators face. They want to restructure the Chinese economy away from credit- and energy-intensive heavy industries toward lightweight technology products and services, yet they must also avoid causing a crisis in the financial system.

Dangerous political games.

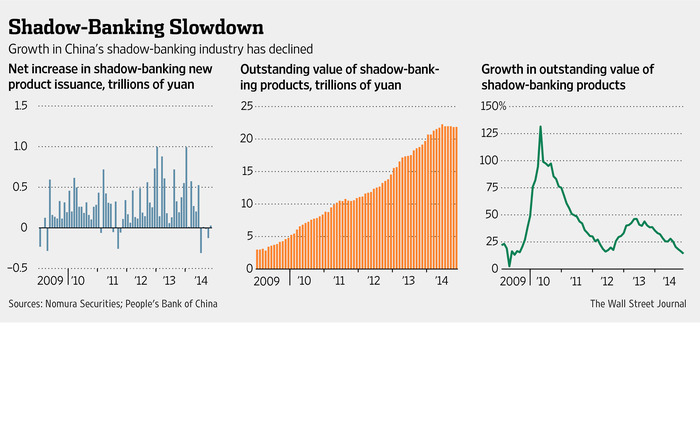

• China’s Shadow-Banking Boom Is Over (WSJ)

Following years of explosive growth, China’s shadow-banking industry is experiencing a sharp slowdown after Beijing tightened its grip on the sector, which has been a key source of funding for the economy but also has added to rising debt levels and other risks in the financial system. The industry, a mélange of informal lenders such as trust companies and leasing firms, takes in money from investors and lends it to often risky projects for which traditional bank lending is unavailable. Investors have flocked to the so-called wealth-management and trust products sold by shadow lenders in recent years because they typically promise returns ranging from 4% to more than 10%, much higher than a bank account. But the sector has been hit especially hard in the second half of this year. Investors have shifted their cash into the rallying stock market.

The slowdown may become even more pronounced next year, with authorities set to increase efforts to rein in financial risks as the economy slows. “The government has realized that shadow banking has fallen off its radar screen and it carries enormous risks. The days of laissez-faire are over,” said Shen Meng, executive director of Chanson Capital, a boutique investment bank. A decline in interest rates in China and diminishing returns on property and infrastructure projects may also reduce the promised investment gains on the products issued by shadow banks. The outstanding value of shadow-banking products stood at 21.87 trillion yuan ($3.52 trillion) at the end of November, up 14.2% from the level a year earlier, according to estimates by Nomura Securities based on central-bank data. That growth is significantly slower than the 35.5% rise it registered for the whole of last year and the 33.1% gain in 2012.

The growth rate was as high as 75% in 2010, when Beijing encouraged shadow lenders to complement overstretched traditional banks and help extend a lending binge to keep the economy humming following the global financial crisis. The slowdown in the industry this year has primarily been caused by a series of tighter regulations that made it less profitable for shadow lenders to issue new products, or forced them to enhance risk controls. Shadow-lending products are usually sold through traditional banks. In July, China’s banking regulator asked banks to separate their wealth-management-product business from their retail-lending business, a move that incurred extra costs. Banks also were ordered to set up independent departments to oversee wealth-management products, and to better explain in sales documents that these products aren’t deposits and carry risks.

The result was immediate: New issuance of shadow-banking products fell by 309.6 billion yuan in July from a month earlier. That followed a month-on-month increase of 526.2 billion yuan in June and a rise of 993.2 billion yuan in January, according to estimates by Nomura Securities. There was a mild rebound in August, but issuance shrank in September and October before seeing a modest rise of 28.4 billion yuan in November. The slowdown since July coincided with a surge in China’s long-depressed stock market. Compared with the 43% gain of the Shanghai market this year, the yields on trust and wealth-management products, which have declined, no longer look as attractive.

How much longer for Abe?

• Game Over Japan: Real Wages Crash, Savings Rate Turns Negative (Zero Hedge)

When about a month ago it was revealed that Japan’s shadow economic advisor is none other than Paul Krugman, we said it was only a matter of time before the Japanese economy implodes. Terminally. We didn’t have long to wait and last night the barrage of Japanese economic data pretty much assured Japan’s transition into failed Keynesian state status. In fact, after last night’s abysmal Japanese eco data, we doubt even the most lobotomized Keynesian voodoo priests have anything favorable left to say about Abenomics: not only did core inflation miss expectations and is now clearly in slowdown mode despite Japan openly monetizing all gross Treasury issuance.

Not only did industrial production decline 0.6% missing expectations of an increase and record its first decline in 3 months with durable goods shipments crashing, not only did consumer spending plunge for the 8th straight month dropping 2.5% in November (with real spending on housing in 20% freefall), but – the punchline – both nominal and real wages imploded, when total cash wages and overtime pay declined for the first time in 9 months and 20 months, respectively. And the reason why any poll that shows a recently “re-elected” Abe has even a 1% approval rating has clearly been Diebolded beyond recognition, is that real wages cratered 4.3% compared to a year ago. This was the largest decline since the 4.8% recorded in December 1998. In other words, Abenomics has now resulted in the worst economy, if only for consumers, in the 21st century.

The Petrobras scandal is yet to reach its climax. Brazil as a whole will be severely shaken.

• Brazilian Oil Company Petrobras Sued By US City In Corruption Scandal (BBC)

The US city of Providence, Rhode Island is suing the Brazilian state-run oil company Petrobras over investor losses due to a corruption scandal. Unlike other class actions, some of the company’s senior executives have also been named as defendants. Providence alleges that Petrobras made false statements to investors that inflated the company’s value. Its lawyers say that when the corruption scandal broke, the city’s investments plummeted. So far, 39 people in Brazil have been indicted on charges that include corruption, money laundering and racketeering. They have been accused of forming a cartel to drive up the prices of major Petrobras infrastructure projects and of channelling money into a kickback scheme at Petrobras to pay politicians. The executives could face sentences of more than 20 years in jail.

The case has shaken the government of President Dilma Rousseff, who served as chair of the Petrobras board for seven years until 2010. She has denied any knowledge of the scheme. According to the Brazilian Federal Police the group under investigation moved more than $3.9bn (£2.5bn) in what police describe as “atypical” financial transactions. Brazilian courts have blocked around $270m in assets belonging to various suspects. Federal agents revealed contracts worth $22bn are regarded as suspicious. Former Petrobras director Paulo Roberto Costa, who worked at the company from 2004 to 2012, has told investigators that politicians received a 3% commission on contracts signed during this period.

Crazy plan.

• Nicaragua Canal A Potential Threat To The US And Western Powers (RT)

The Nicaragua Canal can become an alternative route through Central America for China and Russia, as well as an alternative route for potential military use right in America’s backyard, international consultant and author Adrian Salbuchi told RT. Nicaragua has begun the most ambitious construction project in Latin America – a waterway connecting the Atlantic and the Pacific oceans that is supposed to become an alternative to the Panama Canal. It is 278 km long, will cost around $50 billion and provide jobs for 50,000 people. The construction is being run by a Hong Kong company and should be completed by 2020. The project is supposed to boost Nicaragua’s GDP. Meanwhile, ecologists fear the giant ship canal will endanger Lake Nicaragua – Central America’s largest lake and Nicaragua’s largest main water source – which the waterway will run through. Locals are concerned their homes and farm lands are under threat. According to some estimates, around 30,000 people may be displaced by the waterway. RT discussed the project and protests it sparked in Nicaragua with international consultant and author Adrian Salbuchi.

RT: The residents are promised compensation. Why are they protesting? Were they misinformed about the project?

Adrian Salbuchi: It’s understandable because we are talking about a mega project that will displace many people; some estimates say as many as 30,000 farmers will be displaced. There will be an ecological impact, no doubt about it. However, I think we have to be very careful to distinguish between what is this spontaneous reaction of many of these farmers which is probably genuine, and what may also be some engineering of social convulsion from foreign powers, not only the US that had been doing that in the so-called Arab Spring and that had been doing that throughout Latin America for many decades. So I wouldn’t be surprised if some of the exaggeration or some of the future problems do come from some American agitators or Western agitators. Don’t forget this is the country which is governed by President Daniel Ortega of the Sandinista Liberation Front, who are enemies of the US for many decades.RT: Just to push you a bit on this, do you think there may be a foreign state involved?

AS: Absolutely. And we should even take it together with what just happened with Cuba because if America is trying to bring Cuba into the fold, it might try to play a similar card with Nicaragua to try to range them away as in the case of Cuba from Russia, in the case of Nicaragua from China. We have to see not just the trade implications that are huge, and the economic implications that are also huge, as well as social and ecological, but much more so the geopolitical implications. This is a Chinese private company, but we all know that very likely behind the Chinese investment there are geopolitical factors being handled and being driven by the Chinese government quite rightly, who have an increasing interest throughout Latin America.

People vs power.

• The Cradle of Democracy Should Defy the Autocrats & Kleptocrats (Landevoisin)

On the old continent, this December 29th, a succinct political showdown is scheduled to take place which may well become a defining moment for our entirely unsettled new millenium. What is at stake is none other than the prosperity of the common man pitted against the privilege of concentrated power. Lamentably, this deliberate dogmatic divide has relentlessly defined human civilization for the ages. What is at hand isn’t so much about lofty ideals. It’s not about Socialism. It’s not about Capitalism. It’s not about Communism. It’s not about being a progressive, or a conservative or a liberal. It’s not about left vs right. Forget all those dumbed down dichotomies. It’s much more fundamental than all of that. Quite simply, it’s about People vs. Power, that’s it, nothing more. Those that have and wield institutional power, and those that do not. It’s as elementary and base as that I’m afraid.

Take a good look around, I defy you to point to a single socioeconomic construct in our supposedly enlightened and advanced society of today which is not essentially determined by that crude polarizing characterization. Whether it be our bought and paid for Political Class, our rapacious Banking Sector, our entitled Multinational Corporations, our entrenched Governmental Agencies, our marauding Military Industrial Complex, our fleecing Healthcare Providers, our muzzled Free Press, our hijacked Justice System, or our grossly overpaid CEOs, Athletes, and Entertainers, they all have one thing in common, and I assure you that it’s not the common good that they share. What they seek above all else is to expand the existing institutional dominion and their own privileges within it.

Sad to say, but at the end of the day, perhaps dog eat dog is what we humans are really best at, and the only state of being we’re actually capable of. Maybe all those exalted ideals of enlightened forms of governance are just a load of crap to make us feel better about ourselves. Judging by the overt self seeking avarice that dictates the pace of just about everything these days, it sure seems that way.

“Menacing figures arrive at your door uninvited, demand your property, and threaten to perform an unspecified “trick” if you don’t fork over.”

• A Capitalist Christmas (Mises Inst.)

Halloween has a socialist tenor. Menacing figures arrive at your door uninvited, demand your property, and threaten to perform an unspecified “trick” if you don’t fork over. That’s the way the government works in a nutshell. Thanksgiving has been reinterpreted as the white man, after burning, raping, and pillaging the noble Indian, trying to make amends with a cheap turkey dinner. New Year’s can be ruined as the beginning of a new tax year, and the knowledge that the next five or six months will be spent working for the government. That’s why I love Christmas. To this day it remains a celebration of liberty and private life, as well as a much-needed break from the incessant politicization of modern life. It’s the most pro-capitalist of all holidays because its temporal joys are based on private property, voluntary exchange, and mutual benefit.

In Christmas shopping, we find persistent reminders of charity programs that work and little sign of those (welfare bureaucracies) that don’t. The Salvation Army, Goodwill dispensers in parking lots, and boxes filled with canned goods and toys are all elements of true charity. This giving is based on volition rather than coercion, which is the key to its success. People complain about “commercialism,” but all the buying and selling is directed toward meeting the needs of others. Even if the recipient doesn’t give gifts in return, the giver still receives satisfaction. Absent entirely is the zero or negative-sum political process that tilts property in favor of one group or another. Santa, unlike Halloween figures, comes to your home to bring gifts and goodwill, and never takes anything except milk and cookies.

You wouldn’t think of hiding your silver from him. Unlike government bureaucrats, Santa and his workers are entirely trustworthy, and even work overtime by creating goods that are desired by millions of people. If the Labor Department or OSHA ever get around to investigating the North Pole, they’ll probably find all sorts of labor violations: safety and health (too cold), unemployment insurance (does he pay it?), minimum wage (is there exploitation here?), overtime (Heaven knows they work long hours), civil rights (any non-elves employed?), and disability (is Santa accommodating these tiny men?). But the point is that everyone is there voluntarily, and no doubt considers it an honor and privilege.

What I said yesterday, in different words: “We appeal to the media, to more scrupulously adhere to their obligation to provide unbiased reporting.”

• 60 Prominent Germans Appeal Against Another War In Europe (Zero Hedge)

Two weeks ago, as the S&P was preparing to surge on the latest round of all time high market-goosing algo trickery by the FOMC, 60 prominent German personalities from the realms of politics, economics, culture and the media were less concerned with blinking red and green stock quotes and were focused on something far more serious to the future of the world: the threat of war with Russia. In a letter published by Germany’s Die Zeit, numerous famous and respected Germans including a former president and former prime minister write “Wieder Krieg in Europa? Nicht in unserem Namen!”, or, roughly translated, “War in Europe Again? Not in Our Names!”

The open letter to the German government, parliament, and media, excerpted here, was signed by more than 60 prominent German personalities and published in the weekly Die Zeit on Dec. 5. The initiators were Horst Teltschik (CDU), advisor to then-Chancellor Helmut Kohl at the time German of reunification; Walther Stützle (SPD), former Secretary of State for the Ministry of Defense; and Antje Vollmer (Greens), former Bundestag Vice President. Teltschik said, in motivating the appeal, “We are giving a political signal that the justified criticism of Russia’s Ukraine policy should not wipe out all the progress that we have made in the past 25 years in relations with Russia.” Below is an excerpted translation (source) of the original letter:

“Nobody wants war. But North America, the European Union, and Russia are inevitably driving towards war if they do not finally halt the disastrous spiral of threats and counter-threats. All Europeans, including Russia, are jointly responsible for peace and security. Only those who do not lose sight of this goal can avoid fatal actions. The Ukraine conflict shows that the quest for power and domination has not been overcome. In 1990, at the end of the Cold War, we all hoped that it would be. But the success of the détente policy and the peaceful revolutions allowed people to become lethargic and careless. In both East and West. The Americans, Europeans, and Russians all lost, as their guiding principle, the idea of permanently banishing war from their relationship.

Otherwise it is impossible to explain either the West’s eastward expansion without simultaneously deepening cooperation with Moscow—a policy which Russia sees as a threat—or Putin’s annexation of Crimea in violation of international law. At this moment of great danger for the continent, Germany has a special responsibility for the maintenance of peace. Without the will for reconciliation of the people of Russia, without the foresight of Mikhail Gorbachov, without the support of our Western allies, and without the prudent action by the then-Federal government, the division of Europe would not have been overcome. To allow German unification to evolve peacefully was a great gesture, shaped by the wisdom of the victorious powers. It was a decision of historic proportions. [..]

We call upon the members of the German Bundestag, delegated by the people as their political representatives, to deal appropriately with the seriousness of the situation. . . . Whoever is constructing a bogeyman, putting the blame on only one side, is exacerbating tensions, when the signals should be for de-escalation. We appeal to the media, to more scrupulously adhere to their obligation to provide unbiased reporting.than they have hitherto done. Editorialists and leading commentators are demonizing entire nations, without fully taking their histories into account. Any journalist experienced in foreign affairs would understand the Russians’ fear, since members of NATO in 2008 invited Georgia and Ukraine to join the Alliance. It is not about Putin. Heads of state come and go. What is at stake is Europe.“

And so he did. But not everybody likes that.

• Gorbachev: Putin Saved Russia From Disintegration (RT)

Russian President Vladimir Putin saved the country from falling apart, former Soviet leader Mikhail Gorbachev said during the presentation of his new book ‘After the Kremlin.’ Gorbachev also commented on the situation in Ukraine and NATO expansion. “I think all of us – Russian citizens – must remember that [Putin] saved Russia from the beginning of a collapse. A lot of the regions did not recognize our constitution. There were over a hundred local constitutional variations from that of the Russian constitution,” RIA Novosti quoted Gorbachev as saying on Friday. He added that saving Russia during that crucial period was a “historical deed.” Gorbachev remarked that he knew the Russian president before Putin took office, describing him as having good judgment and discipline.

Commenting on the situation in Ukraine, the ex-Soviet president said the armed stand-off must be immediately stopped and both sides need to come to the negotiating table. “All of us are concerned by what is happening in Ukraine – politicians and the public. And the fact that our government is supporting the people who are in trouble there, no matter how hard things are at home, it is what always distinguished us,” Gorbachev said, stressing that the conflict cannot be solved through violence. Gorbachev also noted that influential American and European politicians need to speak out against the worsening of international ties, adding that many of his old colleagues are seeing the first signs of a new Cold War and understand how crucial it is to calm things down.

He said he has received comments which include concerns on how not to miss the escalating situation, and stopping it before it “acquires an explosive nature.” In terms of Russia’s worries over NATO’s expansion, Gorbachev agrees that the US is playing a key role in the process. “[NATO] began to establish bases around the world…I think the president is mostly right when drawing the attention to the special responsibility the US has,” Gorbachev said. Meanwhile, when speaking about the domestic situation in the country, the former president of the USSR expressed confidence that Russia will get out of the crisis, adding that the only questions are “when and at what price.” “Now we need to be very careful in politics – what policy is implemented, by who, and who stands to benefit?”

Not smart enough for my tastes.

• Putin: It Is Time to Play Your Ace in the Hole (Daily Bell)

The entire world is watching Putin play poker with the Western politicians lead by Obama and followed by Washington quislings in London, Brussels and Berlin. America’s goal since the end of the Cold War has been to weaken by financial, economic and, if necessary, military means any real competition to its global financial and resource domination through the petrodollar and dollar world reserve currency status. The current trade and economic sanctions against Russia and Iran follow this time-tested action that is never successful on its own, as we know from the 50-plus-year blockade of Cuba. But this strategy can lead to opposition nations retaliating by military means, often their only alternative to end blockades etc., which are an act of war and allow the US and other democracies to bring their ultimate superior military power to bare against the offending sovereign state.

This worked for Lincoln against the Confederate States of America, by Woodrow Wilson against the Central Powers before World War One, against the Japanese Empire before World War Two, Iraq, Libya – the list is endless. Recently the US has created the oil price collapse, working closely with its client state Saudi Arabia, in order to weaken the economic power of both Iran and Russia, the two main nations opposing US hegemony, foreign policy and petrodollar policy. Yes, this will play havoc with the US shale oil industry as well as London’s North Sea oil industry but oil profits pale in comparison to the importance of maintaining Western power over Russia and China. I hope Putin realizes the US is not playing games here, as this is a financial and strategic game to the death for Washington and it’s Western allies that have foolishly followed the Goldman Sachs/central banking cartel’s deadly sovereign debt recipe and for growth and prosperity.

The time is up; the debts can never be repaid and sooner or later must be repudiated one way or the other. China is waiting in the wings as the new world economic power and while it is too big to challenge, US strategy is to take out its top two allies, Iran and Russia, to buy time for Wall Street and Washington. The strategy might be a competitive economic course of action but the risk of military consequences and even a third world war loom on the horizon and no country has ever defeated Russia in a land attack. This is risky brinkmanship just to protect our banking and Wall Street elites and their profits at the expense of the American people, I might add, but the US has done this before.

Nice takedown.

• Google Further Crapifies Search, Exploiting Both Users and Advertisers (NC)

Google is a case study of why we need antitrust enforcement. With Google at 97% market share in search, Yahoo and Bing don’t have enough of a foothold for it to be worth the gamble of trying to beat Google at search, even with Google having degraded its service so badly that there are now obvious ways that a challenger could best them. I had assumed that the ongoing crapification of Google was for a commercial purpose, namely to optimize the browser for shopping and the hell with everything else. But as we will discuss in more detail below, my experience in poking around to see about buying a new laptop demonstrates that Google has gotten worse at that too. Lambert, who I enlisted to confirm my experience, was appalled and said, “What have they been doing with all that money?”

But as we’ll see, there is an evil purpose here, just not the evil purpose we’d first assumed. It isn’t as if the degradation of Google is a new phenomenon. I used Google heavily while researching ECONNED, which was written on an insanely tight time schedule. It worked really well then. But even a mere year later, by late 2010, the search algo had been restructured in some mysterious way to make the results much less targeted, and it’s been downhill since then. The most recent appalling change came in the last few months: eliminating the ability to do date range searches. But all of this ruination was so Google could make more money by optimizing for shopping right? Apparently not. I’ve idly and actively looked for stuff on the Internet over the years.

A reliable way to do that was to type in a rough or better yet precise description of the product/product name plus the word “price”. That would usually get you a nice list of vendors selling what you wanted so you could comparison shop, and often you’d get links to sites like Nextag which would provide a list of vendors with all-in prices as well as vendro ratings. Over the last two months, I’ve been looking for an easy-to-install monochrome laser printer (I have NO time to deal with anything more demanding than plug and play, and sadly, dealing with printers on a Mac is not plug and play). I didn’t get any good answers from all my searching and would up buying a used version of my current out-of-production printer. In retrospect, it appears some of my search hassles may have been due to Google, not to having atypical requirements.

Biggest company on the planet because they buy their own stock?

• Apple Spent $56 Billion On Buybacks In 2014 (MarketWatch)

If Apple’s year had a theme, it was the year the company finally started to chip away at that colossal hoard of cash. After a little nudging by activist investor Carl Icahn, Apple boosted its share-buyback program in April to $90 billion and increased the pace of capital returns. New data from FactSet show that Apple has been the biggest buyback spender of 2014 among the S&P 500, pouring more than $56 billion into the program on a trailing 12-month basis as of the end of the third quarter. That’s nearly three times the outlay of runner-up IBM, which spent $19.2 billion. Apple bought back $17 billion in shares last quarter, a 240% year-over-year increase that marks the second-highest dollar amount spent on buybacks during a quarter by any individual company in the S&P 500 since 2005, when FactSet began tracking the data. It’s second only to Apple’s own record of $18.6 billion set in the first quarter as part of the same buyback program.

Morningstar analyst Brian Colello said that while it’s not all surprising the world’s most valuable company would top a list such as this given its enormous cash cushion, he said the buybacks have undoubtedly been a “big contributor” to the stock’s strong performance in 2014. Adjusted for a 7-for-1 stock split earlier this year, shares of Apple have climbed more than 43% over the last 12 months. Since hitting a 52-week low back on Jan. 30, they have been on the march higher — flirting with all-time highs since September. “It showed that management was confident in its upcoming product launches and helped to put a floor into the company’s valuation during times of skepticism,” said Colello. Apple is the world’s most valuable company, with a $641.7 billion market cap, almost double the market valuations of the next companies on that list, Microsoft and Exxon Mobil, both valued around $377 billion.

Curious.

• Strange Predictions For The Future From 1930 (BBC)

Shortly before he died in 1930, former cabinet minister and leading lawyer FE Smith, a friend of Winston Churchill and one of the more outspoken British politicians of his age, wrote a book predicting how the world would look in 100 years’ time. They covered science, lifestyles, politics and war. So what did he say?

Health/lifespan Smith, a former Lord Chancellor who became the Earl of Birkenhead a few years before his death, was writing in a period when tuberculosis was a major killer in the UK and around the world. He was optimistic enough to suggest the eradication of this and other epidemic diseases was “fairly certain” by 2030, as was “the discovery of cures for such scourges as cancer”. Death from old age could also be delayed, Smith thought. Scientists would create injections containing an unspecified substance bringing “rejuvenations”, which would be used to prolong the average lifespan to as much as 150 years. Smith acknowledged this would present “grave problems” from an “immense increase in population”. He also foresaw extreme inter-generational inequality, wondering “how will youths of 20 be able to compete in the professions or business against vigorous men still in their prime at 120, with a century of experience on which to draw”?

Work and leisure

Mechanisation would mean a “gradual contraction” of hours worked, Smith believed. By 2030 it was likely the “average week of the factory hand will consist of 16 or perhaps 24 hours”, which no worker could possibly “grudge”. But, with factories largely automated, work would provide little scope for self-fulfilment, becoming “supremely easy and supremely dull”, consisting largely of supervising machines. It didn’t occur to Smith, in an age before widespread use of computers, that the machines might become self-monitoring. The cut in hours hasn’t happened yet. According to figures from the OECD group of industrialised nations, the lowest average weekly hours worked in a main job in 2013 were 30, in the Netherlands. The highest figure was 47.9, in Turkey. In the UK it was 36.5, with the US among the countries for which information was not provided.Smith believed that, despite the shortening of hours, everyone would earn enough by 2030 to afford to play football, cricket or tennis in their spare time. But one of the big winners in this more leisure-rich world would be fox-hunting, one of his own hobbies. “As wealth increases, we shall all be able to ride to hounds,” he said. Men would free up even more time with changes to sartorial rules. By 2030 they would be expected to own only two outfits, one for leisure and the other for more formal occasions. John Logie-Baird had demonstrated television in the late 1920s and Smith was excited by the idea. He said that by 2030 full “stereoscopic television in full natural colours” would be available in people’s homes, with proper loudspeaker-quality sound. This meant exiled US citizens would be able to watch any baseball match and, in cricket, “the MCC selection committee, in conclave at Lord’s, will be able to follow the fortunes of an English eleven through the days (or weeks) of an Australian Test match”.

Home › Forums › Debt Rattle December 27 2014