DPC Cuyahoga River, Lift Bridge and Superior Avenue viaduct, Cleveland, Ohio 1912

A Papal Encyclical is a big deal.

• Pope Francis Climate Change Encyclical To Anger Deniers, US Churches (Observer)

He has been called the “superman pope”, and it would be hard to deny that Pope Francis has had a good December. Cited by President Barack Obama as a key player in the thawing relations between the US and Cuba, the Argentinian pontiff followed that by lecturing his cardinals on the need to clean up Vatican politics. But can Francis achieve a feat that has so far eluded secular powers and inspire decisive action on climate change? It looks as if he will give it a go. In 2015, the pope will issue a lengthy message on the subject to the world’s 1.2 billion Catholics, give an address to the UN general assembly and call a summit of the world’s main religions. The reason for such frenetic activity, says Bishop Marcelo Sorondo, chancellor of the Vatican’s Pontifical Academy of Sciences, is the pope’s wish to directly influence next year’s crucial UN climate meeting in Paris, when countries will try to conclude 20 years of fraught negotiations with a universal commitment to reduce emissions.

“Our academics supported the pope’s initiative to influence next year’s crucial decisions,” Sorondo told Cafod, the Catholic development agency, at a meeting in London. “The idea is to convene a meeting with leaders of the main religions to make all people aware of the state of our climate and the tragedy of social exclusion.” Following a visit in March to Tacloban, the Philippine city devastated in 2012 by typhoon Haiyan, the pope will publish a rare encyclical on climate change and human ecology. Urging all Catholics to take action on moral and scientific grounds, the document will be sent to the world’s 5,000 Catholic bishops and 400,000 priests, who will distribute it to parishioners. According to Vatican insiders, Francis will meet other faith leaders and lobby politicians at the general assembly in New York in September, when countries will sign up to new anti-poverty and environmental goals.

In recent months, the pope has argued for a radical new financial and economic system to avoid human inequality and ecological devastation. In October he told a meeting of Latin American and Asian landless peasants and other social movements: “An economic system centred on the god of money needs to plunder nature to sustain the frenetic rhythm of consumption that is inherent to it. “The system continues unchanged, since what dominates are the dynamics of an economy and a finance that are lacking in ethics. It is no longer man who commands, but money. Cash commands. “The monopolising of lands, deforestation, the appropriation of water, inadequate agro-toxics are some of the evils that tear man from the land of his birth. Climate change, the loss of biodiversity and deforestation are already showing their devastating effects in the great cataclysms we witness,” he said.

Dickens never died.

• Hungry Britain: Millions Struggle To Feed Themselves, Face Malnourishment (Ind.)

Millions of the poorest people in Britain are struggling to get enough food to maintain their body weight, according to official figures published this month. The Government’s Family Food report reveals that the poorest 10% of the population – some 6.4 million people – ate an average of 1,997 calories a day last year, compared with the average guideline figure of about 2,080 calories. This data covers all age groups. One expert said the figures were a “powerful marker” that there is a problem with food poverty in Britain and it was clear there were “substantial numbers of people who are going hungry and eating a pretty miserable diet”. The use of food banks in the UK has surged in recent years. The Trussell Trust, a charity which runs more than 400 food banks, said it had given three days worth of food, and support, to more than 492,600 people between April and September this year, up 38% on the same period in 2013.

Based on an annual survey of 6,000 UK households, the Family Food report said the population as a whole was consuming 5% more calories than required. Tables of figures attached to the report reveal the average calorie consumption for the poorest 10%, but the report itself did not highlight this. Chris Goodall, an award-winning author who writes about energy, discovered the figures while investigating human use of food resources. “The data absolutely shocked me. What it shows is for the first time since the Second World War, if you are poor you cannot afford to eat sufficient calories,” he said. He also highlights a widening consumption gap between rich and poor. In 2001/2, there was little difference, with the richest 10th consuming a total of 2,420 calories daily, about 4% more than the poorest. But in 2013, the richest group consumed 2,294 calories, about 15% more than the poorest. The report, published by the Department for Environment, Food & Rural Affairs, also found that the poorest people spent 22% more on food in 2013 than in 2007 but received 6.7% less.

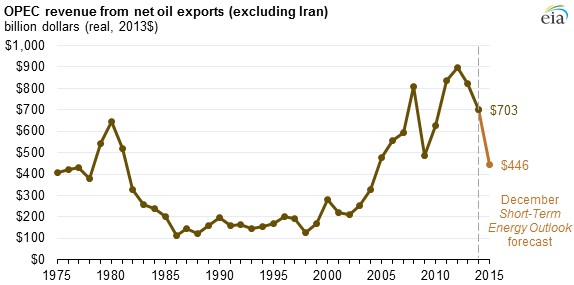

2012 revenues: $900 billion. 2015: $446 billion.

• Decline in Oil Could Cost OPEC $257 Billion in 2015 (Daily Finance)

Falling oil prices are giving a huge boost to the U.S. economy just in time for the holidays, and the reprieve from high gas prices doesn’t look like it will stop anytime soon. But elsewhere around the world, the drop in oil might not be looked upon so kindly. Most of OPEC’s 12 member countries rely on oil as a major source of revenue, not only supporting their domestic economies but also balancing national budgets. The amount of potential revenue they’ve lost as crude oil prices have fallen is staggering. If you’re a country like Saudi Arabia, Kuwait or Iraq, which rely on oil as a major revenue source, the drop in oil prices can impact your country dramatically. The U.S. Energy Information Administration just estimated that next year’s OPEC oil export revenue (excluding Iran) will drop an incredible $257 billion to $446 billion. That’s off its peak of nearly $900 billion in 2012.

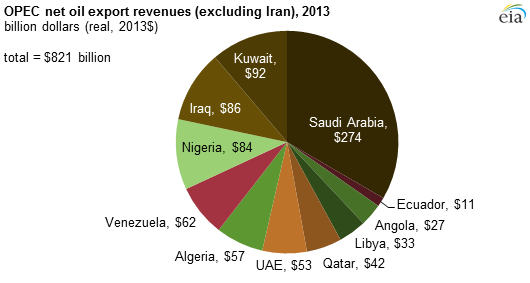

The chart above shows the scale of OPEC’s potential revenue drop and the chart below shows who has the most at stake. Interestingly, Saudi Arabia is leading the charge against cutting OPEC’s production, which is keeping oil prices low, despite having the most money at stake. The reason may be a long-term need for greater market share in the oil market.

“Nothing is off the table at this point.”

• US Oil-Producing States See Budgets, Jobs at Risk as Price Falls (NY Times)

States dependent on oil and gas revenue are bracing for layoffs, slashing agency budgets and growing increasingly anxious about the ripple effect that falling oil prices may have on their local economies. The concerns are cutting across traditional oil states like Texas, Louisiana, Oklahoma and Alaska as well as those like North Dakota that are benefiting from the nation’s latest energy boom. “The crunch is coming,” said Gunnar Knapp, a professor of economics and the director of the Institute of Social and Economic Research at the University of Alaska Anchorage. Experts and elected officials say an extended downturn in oil prices seems unlikely to create the economic disasters that accompanied the 1980s oil bust, because energy-producing states that were left reeling for years have diversified their economies. The effects on the states are nothing like the crises facing big oil-exporting nations like Russia, Iran and Venezuela.

But here in Houston, which proudly bills itself as the energy capital of the world, Hercules Offshore announced it would lay off about 300 employees who work on the company’s rigs in the Gulf of Mexico at the end of the month. Texas already lost 2,300 oil and gas jobs in October and November, according to preliminary data released last week by the federal Bureau of Labor Statistics. On the same day, Fitch Ratings warned that home prices in Texas “may be unsustainable” as the price of oil continues to plummet. The American benchmark for crude oil, known as West Texas Intermediate, was $54.73 per barrel on Friday, having fallen from more than $100 a barrel in June. In Louisiana, the drop in oil prices had a hand in increasing the state’s projected 2015-16 budget shortfall to $1.4 billion and prompting cuts that eliminated 162 vacant positions in state government, reduced contracts across the state and froze expenses for items like travel and supplies at all state agencies. Another round of reductions is expected as soon as January.

And in Alaska – where about 90% of state government is funded by oil, allowing residents to pay no state sales or income taxes – the drop in oil prices has worsened the budget deficit and could force a 50% cut in capital spending for bridges and roads. Moody’s, the credit rating service, recently lowered Alaska’s credit outlook from stable to negative. States that have become accustomed to the benefits of energy production — budgets fattened by oil and gas taxes, ample jobs and healthy rainy-day funds — are now nervously eyeing the changed landscape and wondering how much they will lose from falling prices that have been an unexpected present to drivers across the country this holiday season. The price of natural gas is falling, too. “Our approach to the 2016 budget includes a full review of every activity in every agency’s budget and the cost associated with them,” said Kristy Nichols, the chief budget adviser to Gov. Bobby Jindal of Louisiana. “Nothing is off the table at this point.”

“.. according to a report on the Ministry of Commerce’s website that was subsequently revised to remove the numbers.”

• China’s 3.5% Trade Growth in 2014 Falling Far Short Of 7.5% Target (Reuters)

China’s trade will grow 3.5% in 2014, implying the country will fall short of a current 7.5% official growth target, according to a report on the Ministry of Commerce’s website that was subsequently revised to remove the numbers. The initial version of the report published on the website on Saturday, which quoted Minister of Commerce Gao Hucheng, was replaced with a new version that had identical wording but with all the numbers and percentages removed. The Commerce Ministry did not answer calls requesting comment on the reason for the change. China’s trade figures have repeatedly fallen short of expectations in the second half of this year, providing more evidence that China’s economy may be facing a sharper slowdown. Foreign direct investment will amount to $120 billion for the year, the earlier version of Ministry of Commerce report said, in line with official forecasts.

The earlier version of the report also said outward non-financial investment from China could also come in around the same level. That would mark the first time outward flows have pulled even with inward investment flows in China, and would imply a major surge in outward investment in December given that the current accumulated level stands slightly below $90 billion. The earlier version of the report also predicted that retail sales growth would come in at 12% for 2014, in line with the current average growth rate. In a separate report, the Chinese Academy of Social Sciences predicted that real estate prices in Chinese cities would continue to slide in 2015, with third- and fourth-tier cities hit hardest. But it said the market would have a soft landing as local governments take action to provide further policy support to the market.

“.. the government will avoid fresh debt issuance and fund the package with unspent money from previous budgets and tax revenues that have exceeded budget forecasts due to economic recovery ..”

• Japan Approves $29 Billion Stimulus Plan, Impact In Doubt (Reuters)

Japan’s government approved on Saturday stimulus spending worth $29 billion aimed at helping the country’s lagging regions and households with subsidies, merchandise vouchers and other steps, but analysts are skeptical about how much it can spur growth. The package, worth 3.5 trillion yen ($29.12 billion) was unveiled two weeks after a massive election victory by Prime Minister Shinzo Abe’s ruling coalition gave him a fresh mandate to push through his “Abenomics” stimulus policies. The government said it expects the stimulus plan to boost Japan’s GDP by 0.7%. Given Japan’s dire public finances, the government will avoid fresh debt issuance and fund the package with unspent money from previous budgets and tax revenues that have exceeded budget forecasts due to economic recovery.

With nationwide local elections planned in April which Abe’s ruling bloc must win to cement his grip on power, the package centers on subsidies to regional governments to carry out steps to stimulate private consumption and support small firms. Of the total, 1.8 trillion yen will be spent on measures such as distributing coupons to buy merchandise, providing low-income households with subsidies for fuel purchases, supporting funding at small firms and reviving regional economies. The remaining 1.7 trillion yen will be used for disaster-prevention and rebuilding disaster-hit areas including those affected by the March 2011 tsunami. Tokyo will also seek to bolster the housing market by lowering the mortgage rates offered by a governmental home-loan agency. “It’s better than doing nothing, but I don’t think this stimulus will have a big impact on boosting the economy,” said Masaki Kuwahara, a senior economist at Nomura Securities.

Shopping vouchers?

• Japan Approves $29 Billion Spending Package to Boost Economy

Japan’s government approved a 3.5 trillion yen ($29 billion) fiscal stimulus package to boost the economy after April’s sales tax hike caused consumption to slump. The measures include shopping vouchers, subsidized heating fuel for the poor and low interest loans for small businesses hurt by rising input costs, and will boost gross domestic product by 0.7%, the government estimates. The spending will be paid for with tax revenue and unspent funds and won’t need new bond issuance, Economy Minister Akira Amari said today in Tokyo. Unexpected falls in output and retail sales in November underscore the continued weakness in the economy. With little sign of a rebound in domestic demand, getting growth back on a recovery track is a priority for Prime Minister Shinzo Abe.

“This will support private consumption and boost regional economies, so that the virtuous economic cycle spreads to all corners of the nation,” Abe said in Tokyo after the decision. About 1.7 trillion yen will be spent on public works in areas damaged by natural disasters and to improve disaster preparedness, with 600 billion yen for revitalizing regional economies and 1.2 trillion yen to support people and small businesses hurt by the current economic situation, according to documents released by the Cabinet Office. The package is part of an extra budget for the fiscal year through March which will be adopted by the cabinet on Jan. 9, Finance Minister Taro Aso said in Tokyo today. The budget then needs to be approved by parliament, which is controlled by the ruling coalition.

Abe last month delayed the planned further hike in the sales tax by 18 months after data showed the economy fell into recession. GDP shrank an annualized 1.9% last quarter, more than initially estimated, after a 6.7% contraction in the three months from April, when the levy was raised for the first time since 1997. The postponement fueled concern about the government’s effort to rein in the world’s heaviest debt and prompted Moody’s Investors Service to cut its credit rating on Japan.

“Japan’s work force of 80 million will drop to 40 million by 2060.”

• The Keynesian End Game Crystalizes In Japan’s Monetary Madness (Stockman)

If the BOJ’s mad money printers were treated as monetary pariahs by the rest of the world, it would at least imply that a modicum of sanity remains on the planet. But just the opposite is the case. Establishment institutions like the IMF, the US treasury and the other major central banks urge them on, while the Keynesian arson squad led by Professor Krugman actually faults Japan for being too tepid with its “stimulus”. Now comes several new data points that absolutely confirm Japan is a financial mad house – even as its policy model is embraced by mainstream officials and analysts peering from a distance. Front and center is the newly reported fact from the Cabinet Office that Japan’s household savings rate plunged to minus 1.3% in the most recent fiscal year, thereby entering negative territory for the first time since records were started in 1955.

Indeed, Japan had been heralded as a nation of savers only a generation ago. During the era before it’s plunge into bubble finance in the late 1980s, households routinely saved 15-25% of income. But after nearly three decades of Keynesian policies, Japan has now stumbled into an insuperable demographic/financial trap; and one that is unusually transparent and rigidly delineated, to boot. Since Japan famously and doggedly refuses to accept immigrants, its long-term demographics are rigidly baked into the cake. Accordingly, anyone who will make a difference over the next several decades has already been born, counted, factored and attrited into the projections.

Japan’s work force of 80 million will thus drop to 40 million by 2060. At the same time, its current 30 million retirees will continue to rise, meaning that its retiree rolls will ultimately exceed the number of workers. Given those daunting facts, it follows that on the eve of its demographic bust Japan needs high savings and generous interest rates to augment retirement nest eggs; a strong exchange rate to attract foreign capital to help absorb its staggering $12 trillion of public debt, which already stands at a world leading 230% of GDP; and rising real incomes in order to shoulder the heavy taxation that is unavoidably necessary to close its fiscal gap and contain its mushrooming public debt.

With its debilitating Keynesian fiscal and monetary policies now re-upped on steroids under Abenomics, however, it goes without saying that nearly the opposite conditions prevail. Most notably, no household or institution anywhere in Japan can earn anything on liquid savings. The money market rate which determines deposit money yields was driven from a “high” of 100 basis points (as ridiculous as that sounds) at the time of the financial crisis to 10 basis points today, which is to say, nothing. But what is even more astounding is that the yield on the 10-year JGB dipped to an all-time low of 0.31% in recent trading. Given the militant insistence of the BOJ that it will hit its 2% inflation target come hell or high water, it is accurate to say that the official policy of Abenomics is to cause holders of the government’s long-term debt to loose their shirts.

“Escape velocity”. Hadn’t heard that in while.

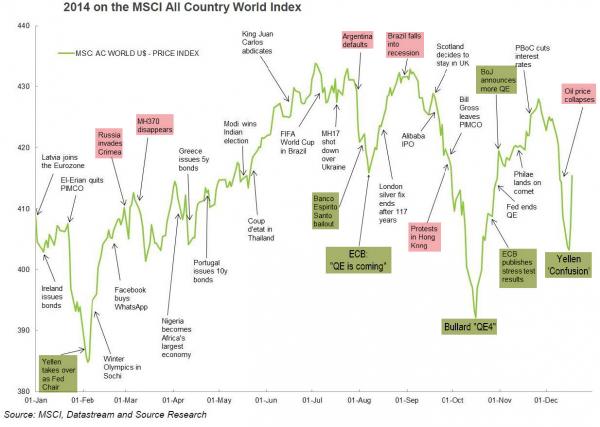

• How Central Banks Saved The World (Stocks) In 2014 (Zero Hedge)

2014 was awash with potentially status quo destabilizing ‘realities’ to the “we’re back on track and world economic growth is about to reach escape velocity” meme… but time after time, the well-conditioned ‘investor’ was rescued… here’s how… Because – fun-durr-mentals.

Love the picture.

• Now Whitehall’s Crazy Eco Zealots Want To Ban Your Gas Cooker (Daily Mail)

As many as 14 million households slid their turkey into a gas oven yesterday, then waited for a succulent, browned and delicious meal to emerge. But such a familiar festive scene will be a thing of the past just a few years down the line, if the Government has its way. As for turning up the thermostat to ensure our gas boiler keeps our home snug and warm on a chilly festive morning – that simple action too, is under threat, even though some 90% of all homes in Britain are heated by gas. Householders across the country will be horrified to learn that, over the next decade or two, the Government plans to phase out all our gas-fired cookers and heating systems – forcing us to replace them at a cost of untold billions. Official documents reveal the Government is seriously contemplating that, within 25 years or so, gas will be all but banned — along with petrol and diesel.

The intention is that not only our cooking and heating but much else, including our cars and most of the vehicles on Britain’s roads, will have to be powered by electricity. The Government admits this astonishingly ambitious plan will be the most far-reaching energy revolution since electricity itself was discovered. But it is not being planned because our gas and oil supplies will have run out – or even because of any looming shortage. On the contrary, the world is now facing a glut of gas and oil, thanks in part to the ‘shale gas revolution’ led by the U.S., a country which almost overnight, has become the world’s largest natural gas producer as a result of a process called fracking – where water and sand are fired at high pressure into shale rock to release the oil and gas inside. This has led to plummeting prices, and prompted many industries to switch to gas.

Yet our own rulers want to abandon it. Astonishingly, the plan to change the way we cook our food and heat our homes is being instigated by the Government as the only way by which we can meet a statutory requirement under the Climate Change Act. This particular piece of legislative folly was pushed through Parliament six years ago by Ed Miliband, as our first ever Secretary of State for Energy and Climate Change, and decreed that Britain must cut its emissions of carbon dioxide from fossil fuels by a staggering 80% within 35 years. When this Act passed almost unanimously through Parliament in 2008, not a single MP, let alone Mr Miliband, had the faintest idea how we could actually meet such an improbable target.

Got to admire the spin: “.. to “make management of public-sector finances more efficient ..”

• Mexico Withdraws $3.4 Billion From Pemex as Oil Revenue Shrinks (Bloomberg)

Mexico’s Finance Ministry took out 50 billion pesos ($3.4 billion) from the state oil company Petroleos Mexicanos, according to a statement sent to the Mexican Stock Exchange. The payment this month was meant to “make management of public-sector finances more efficient,” according to the filing from the oil company, known as Pemex. The withdrawal marks a departure from the government’s usual methods of obtaining revenue from Pemex, which include taxes and royalties.

Pemex typically provides about a third of the federal budget, and its contributions dropped this year as the oil company faced production declines and falling crude prices. During the first 11 months of 2014, taxes paid by Mexico City-based Pemex declined by about 260 billion pesos, or 22%, from the same period of 2013, according to records. The withdrawal shows “a near addiction to Pemex’s revenue by the ministry,” Fluvio Ruiz, a board member of the oil company’s petrochemical unit, said in a phone interview. He said he had no prior knowledge of the disclosure through his role at the company.

I don’t think he still believes in it.

• Greece Faces New ‘Catastrophe’ As PM Battles To Avert Snap Elections (Observer)

Greece’s embattled prime minister, Antonis Samaras, issued an eleventh-hour appeal to parliamentarians on Saturday in an attempt to avert snap elections that would almost certainly plunge the eurozone into renewed crisis. In an impassioned plea, he urged MPs to rid the country of “menacing clouds” gathering over it by supporting the government’s presidential candidate when they gather for the final round of a three-stage vote on Monday. Failure would automatically trigger elections that radical leftists would be likely to win. The ballot has therefore electrified Greece, rattled markets and unnerved Europe. “I am once again appealing to all MPs, of all parties, to vote for the president of the republic,” Samaras told state television. “If we don’t elect a president the responsibility will hang heavily over those who don’t vote for [him]. They will be remembered by everyone, especially history.”

Samaras’s high-stakes gamble of calling the poll two months early has brought him face-to-face with the spectre of losing power if he fails to convince 12 MPs to back Stavros Dimas, his choice for the presidential post. A former European commissioner, Dimas received 168 ballots in a second round of voting last week – well short of the 200 required. On Monday he must amass 180 to be elected. Following a Christmas of frantic behind-the-scenes politicking, the prime minister warned of the perils of taking the debt-stricken country down the road of “absurd adventure” if deputies failed to endorse Dimas. “People do not want early elections… We gave sweat and blood in recent years to keep Greece standing upright.”

Understatement of the day/week/month/year: “With so much cheap money sloshing around the global markets, a second financial crisis cannot be ruled out.”

• Challenging UK Party Games Ahead As Greece Threatens 2nd Debt Crisis (Observer)

Europe. Emerging markets. Earnings. Equality. And the election. Look out, because 2015 is going to be the year of the five Es. In the UK, it will be the election that dominates the economic and business scene, particularly in the first half of the year and for much longer if the result is inconclusive. The prospect of a minority government living from hand to mouth would certainly unsettle the markets. But the election result will be influenced by the four other Es, starting with Europe, where the first crunch moment comes tomorrow in Greece with the third and final chance for the government of Antonis Samaras to get its choice of a new president through parliament. If he fails to secure 180 votes, there will be a snap election that the anti-austerity Syriza party is currently favourite to win. That would prompt fears of a fresh leg to Europe’s debt crisis, which began in Greece more than six years ago. This is something Europe can ill afford. The eurozone economy is barely growing; the German locomotive is slowing; and falling oil prices bring with them the threat of deflation.

The issue for the European Central Bank in 2015 is whether to take the plunge with a quantitative easing programme, something the Germans have resisted up until now. Berlin’s hardline stance has, however, softened in recent months as the situation in Russia – the key emerging market to watch – has deteriorated. Europe’s trade links with Russia are not all that important, but there are two big concerns. The first is of heightened geopolitical risk. Russia is being squeezed by western sanctions and now faces the inevitability of a deep recession in 2015. This might make Vladimir Putin more willing to come to terms over Ukraine, but it might not. The second risk is that the collapse of the rouble puts intolerable strain on Russian companies and Russian banks, with corporate losses ricocheting through the entire global financial system through the sort of highly leveraged derivatives trades that caused the 2007 meltdown. With so much cheap money sloshing around the global markets, a second financial crisis cannot be ruled out.

The third E is equality, brought to prominence in the past year not just by the bestselling book Capital by the French economist Thomas Piketty, but by evidence from the IMF and the Organisation for Economic Co-operation and Development that inequality is bad for growth. Standing trickle-down economics on its head, the OECD said recently that UK growth in the two decades from 1990 to 2010 would have been nine percentage points higher had it not been for widening inequality. Given that the trend towards greater inequality has been evident for the past three decades, it is worth asking why it has become a political issue now. The answer is simple. In the years leading up to the financial crisis, incomes were rising across the board. People on low and middle incomes didn’t mind all that much that the bankers and hedge fund owners were earning stratospheric sums when their own pay packets were going up.

Think it’ll take that long?

• You Can Put The Next Crash On Your 2016 Calendar Now (Paul B. Farrell)

With the recent budget bill, the too-big-to-fail banks were handed even more of what they’ve wanted: a further delay of the Volcker Rule, which could effectively kill it, and, worse, a rollback of Dodd-Frank provisions that protected taxpayers against abusive gambling in the shadowy global derivatives casino using Main Street depositors’ money. It’s as if we’re back to 1999, when the banks got Congress to erase the Glass-Steagall Act, which for 80 years protected Main Street by separating retail banks and investment banking. Now the banks are back to their speculation and gambling, exposing the economy to great risk, just as they were before the 1929 crash. As MarketWatch’s David Weidner put it, Yellen’s Fed looks to have forgotten that banks caused the Great Recession: that hellish era that was set off by the Bear Stearns, Lehman, Countrywide, AIG, Merrill, Freddie, Sallie and the other disasters.

Now Yellen’s Fed and our too-big-to-fail banks and their mainly Republican co-conspirators have set another big trap. A huge trap. As Stephen Roach, former chairman of Morgan Stanley Asia, wrote for Project Syndicate, Yellen’s Federal Reserve “is headed down a familiar — and highly dangerous — path.” “Steeped in denial of its past mistakes, the Fed is pursuing the same incremental approach that helped set the stage for the financial crisis of 2008-2009. The consequences,” writes Roach, “could be similarly catastrophic.” The next crash is due in 2016, around the presidential election. Why? Yellen’s brain is trapped in the same myopic capitalist dogma that blinded Greenspan for 18 years, forcing him to confess he “really didn’t get it till very late,” long after the $10 trillion market loss was a reality.

Same with Yellen. It will happen again. Losses bigger than 2000 and 2008 combined. Think I’m kidding? Bet against this at your peril. Jeremy Grantham’s already on record predicting that “around the presidential election or soon after, the market bubble will burst, as bubbles always do, and will revert to its trend value, around half of its peak or worse.” That could translate to the DJIA crashing – which on Friday posted the week’s (and history’s) second close above the 18,000 level – to around 10,000. The Dow crashing all the way back down to 10,000? Wow. Unimaginable. No wonder our brains tune out. Instead, we prefer the happy talk that will just keep coming out of Wall Street and Washington till 2016. We’ll keep denying reality … till it’s too late, and another $10 trillion loss is in the books.

So the question is: did the internet facilitate the rise in propaganda?

• 2014: The Year The Internet Came Of Age (Guardian)

The best we can say about 2014 is that it was the year when we finally began to have a glimmer of what the internet might mean for society. Not the internet that we fantasised about in the early years, but the network as it has evolved from an exotic curiosity into the mundane underpinning of our lives – a general-purpose technology or GPT. And, in a way, the timescale is about right. The internet that we use today was switched on in January 1983, but it didn’t really become a mainstream medium until the web began to explode in 1993. So we’re about 21 years into the revolution. And what we know from the history of other GPTs is that it generally takes at least two decades before they form the unremarked-upon backdrops to everyday life.

In 1999, Andy Grove, then the CEO of Intel, the dominant chip-maker of the time, made a famous prediction. In five years’ time, he said, “companies that aren’t internet companies won’t be companies at all”. He was widely ridiculed for this pronouncement at the time. But in fact he was just being prescient. What he was trying to communicate was that the internet would one day become like the telephone or mains electricity – something that we take for granted. Grove’s point was that companies that boasted that they “were now on the internet” in 2004 would already be regarded as ridiculous. And so indeed they were.

Could we live without the net? Answer: on an individual level possibly, but on a societal level no – simply because so many of the services on which industrialised societies depend now rely on internet connectivity. In that sense, the network has become the nervous system of the planet. This is why it now makes no more sense to argue about whether the internet is good or bad than to debate whether oxygen or water are desirable. We’ve got it and we’re stuck with it. Which means that we’re also stuck with its downsides. While offline crime has decreased dramatically – car-related theft has reduced by 79% since 1995 and burglary by 67%, for example, what’s happened is that much serious crime has now moved online, where its scale is staggering, even if the official statistics do not count it.

The same goes for industrial espionage (at which the Chinese are currently the world champions) and counter-espionage and counter-terrorism (at which the NSA and GCHQ currently top the international league tables). And we’re just getting started on cyberwarfare. So here we are at the end of 2014, finally wising up to what we’ve got ourselves into: an internet that provides us with much that we love and value and would be hard put to do without. But an internet that is also dangerous, untrustworthy and comprehensively monitored. The question for 2015 and beyond is whether we can have more of the former and less of the latter. Happy New Year!

A problem still in its infancy.

• China Needs Millions of Brides ASAP (Bloomberg)

In the villages outside of Handan, China, a bachelor looking to marry a local girl needs to have as much as $64,000 – the price tag for a suitable home and obligatory gifts. That’s a bit out of the price range of many of the farmers who live in the area. So in recent years, according to the Beijing News, local men have been turning to a Vietnamese marriage broker, paying as much as $18,500 for an imported wife, complete with a money-back guarantee in case the bride fled. But that fairy tale soon fell apart. On the morning of November 21, sometime after breakfast, as many as 100 of Handan’s imported Vietnamese wives – together with the broker – disappeared without a trace. It was a peculiarly Chinese instance of fraud. The victims are a local subset of a fast-growing underclass: millions of poor, mostly rural men, who can’t meet familial and social expectations that a man marry and start a family because of the country’s skewed demographics.

In January, the director of China’s National Bureau of Statistics announced that China is home to 33.8 million more men than women out of a population exceeding 1.3 billion. China’s vast population of unmarried men is sure to pose an array of challenges for China, and perhaps its neighbors, for decades to come. What’s already clear is that fraudulent mail-order wives are only the start of a much larger problem. The immediate cause of China’s gender imbalance is a long-standing cultural preference for boys. In China’s patrilineal culture, they’re expected to carry on the family name, as well as serve as a social security policy for aging parents. In the 1970s, China’s so-called One Child policy transformed this preference into an imperative that parents fulfilled via sex selective abortions (made possible by the widespread availability of ultrasounds). As a result, millions of girls never made it onto China’s population rolls.

In 2013, for example, the government reported 117.6 boys were born for every 100 girls. (The natural rate is 103 to 106 boys to every 100 girls.) In the countryside, the ratio can run much higher — Mara Hvistendahl, in her 2011 book, Unnatural Selection, reports on a town where ratios run as high as 150 to 100. Long-term, such imbalances can create an excess of males that might reach 20% of the overall male population by 2020, according to one estimate. Of course, social expectations aren’t just confined to boys. In China, daughters are expected to marry up – and in a country where men far outnumber women, the opportunities to do so are excellent, especially in the cities to which so many of China’s rural women move. The result is that bride prices – essentially dowries paid to the families of daughters – are rising, especially in the countryside. One 2011 study on bride prices found that they’d increased seventy-fold between the 1960s and 1990s in just one representative, rural hamlet.

Very real. Not some theory.

• Rising Oceans Force Bangladeshi Farmers Inland for New Jobs (Bloomberg)

About seven years ago, Gaur Mondol noticed he couldn’t grow as much rice on his land as salty water seeped in from the Passur River, which stretches from his home in Bangladesh’s interior all the way to the Indian Ocean. Now the rice paddies are completely inundated, leaving the land barren. To find work, he must walk for miles each day to other villages. His annual income has fallen by half to 36,000 taka ($460). He makes about $4 a day if he’s lucky, and most of that goes to buy food for his family of four. “I’m always worried that my house will be washed away someday,” Mondol said from his home in Mongla sub-district, pointing to a river-side tamarind tree with water swirling around its exposed roots. “My family is constantly under threat as the river creeps in.” Rising sea levels are one of the biggest threats to the $150-billion economy over the next half a century, with farmers like Mondol already facing the consequences.

Bangladesh, which needs to grow at 8% pace to pull people out of poverty, stands to lose about 2% of gross domestic product each year by 2050, according to the Asian Development Bank. “The sea-level rise and extreme climate events are the two ways that salinity intrudes into the freshwater system,” Mahfuzuddin Ahmed, an adviser in the ADB’s regional and sustainable development department, said by phone from Manila. “The implication for food security is quite big.” Bangladesh is one of the world’s most densely populated countries, with half the U.S. population crammed into an area the size of New York state. About 50% of its citizens are directly dependent on agriculture for their livelihoods, a quarter live in the coastal zone, and 21% of these lands are affected by an excess of salinity.

The proportion of arable land has fallen 7.3% between 2000-2010, faster than South Asia’s 2% decline, with geography playing a large role. Bangladesh is nestled at a point where tidal waves from the Indian Ocean flow into the Bay of Bengal. While these create the Sundarbans mangroves, home to the endangered Bengal tiger, winds and currents cause saline water to mix with upstream rivers. Global weather changes worsen this. Bangladesh’s average peak-summer temperature in May has climbed to 28.1 degrees Celsius (83 Fahrenheit) in 1990-2009 from 26.9 in 1900-1930, and could rise to 31.5 degrees in 2080-2099, World Bank data show. Average June rainfall has dropped to 467.1 millimeter from 517.5 in that time.

Wonderful.

• Siberian Dog Allowed To Stay In Hospital Where Owner Died 1 Year Ago (RT)

The holiday spirit is alive and well in a hospital in Siberia, where Masha, Russia’s own ‘Hachiko’ dog was given permanent residence status. For a whole year the loyal pet kept ‘dogging’ the hospital, waiting for her owner who had passed away. Despite a number of attempts to have Masha adopted, the heartbroken pooch kept running away and coming back to the Novosibirsk District Hospital Number One, where she last saw her owner in December, 2013. “Masha will always stay here, because she is waiting for her owner. I think that even if we took her to his grave, she wouldn’t believe it. She’s waiting for him alive, not dead,” nurse Alla Vorontsova told the Siberian Times.

The dog’s heartbreaking story has gathered quite a bit of attention in Russia and even abroad, after it went viral in the media. The sad dachshund was adopted a number of times, but all unsuccessfully. “People in Russia tried to adopt her three times, but she always came back. I also heard that a number of foreigners wanted to adopt her too, but it is impossible – she doesn’t want to leave the hospital. And besides, we love her and she loves us. How could she live somewhere far away? She would just pine away,” Vorontsova said. For a year, hospital workers fed and walked Masha, and now they have finally managed to make it official; Masha has her own cozy spot inside the building.

“Here all the patients come to her, stroke her and give something tasty, especially the older people. She warms their hearts,” the nurse added. Masha’s elderly owner was admitted to the hospital and his dog was his sole visitor there. Masha’s loyalty earned her the media nickname Hachiko – in reference to the famous story of a Japanese Akita dog. Agricultural science professor Hidesaburo Ueno got Hachiko in 1924. The dog would greet the owner at the station every day. After Ueno passed away, Hachiko kept returning to the train station for 10 years, waiting for him to come back. The amazing story turned the pet into a national hero and later inspired a Hollywood movie, ‘Hachiko: A Dog’s Tale,’ starring Richard Gere.

Home › Forums › Debt Rattle December 28 2014