Frances Benjamin Johnston Courtyard, 620-621 Gov. Nicholls Street, New Orleans 1937

Predators still rule. And that makes the economy look better for the moment.

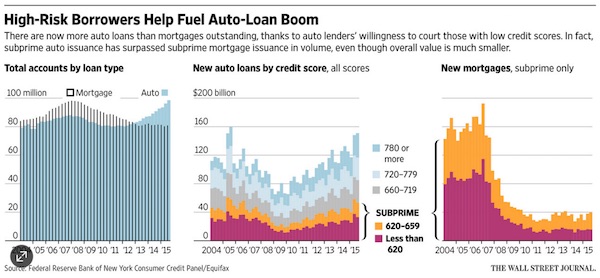

• Total US Household Debt Hits $12.1 Trillion As Subprime Auto Lending Jumps (WSJ)

Subprime auto lending is shifting into higher gear, raising some concerns in Washington where top financial regulators have sounded alarms about this category of loans. Over the six months through September, more than $110 billion of auto loans have been originated to borrowers with credit scores below 660, the bottom cutoff for having a credit score generally considered “good,” according to a report Thursday from the New York Fed. Of that sum, about $70 billion went to borrowers with credit scores below 620, scored that are considered “bad.” This rise in subprime auto lending comes against a backdrop of gradually improving credit across the economy. Overall household borrowing has climbed to $12.1 trillion, the highest level in more than 5 years, with rising balances for mortgages, auto loans, student loans and credit cards in the third quarter, according to the report.

But when it comes to auto loans, in particular, a rising volume of loans is going to borrowers with poor credit. The sum in that category has nearly reached the same level as in 2006, raising questions about the health of the nation’s auto-lending portfolio and drawing uncomfortable comparisons to the rise in subprime mortgages that helped fuel the housing collapse, financial crisis and recession. The comptroller of the currency, Thomas Curry, said in a speech last month that some of the activity in auto loans “reminds me of what happened in mortgage-backed securities in the run-up to the crisis.” And Richard Cordray, director of the Consumer Financial Protection Bureau, warned in September 2014 that subprime auto-loan borrowers “may be more vulnerable to predatory practices” and that “direct oversight of their lending practices is essential.”

2016 will be a disaster year for US oil. And the lenders that allowed the restructuring delay.

• US Oil Producer Bankruptcies Are Piling Up (WSJ)

It’s been a long year for oil and gas companies. After trading at an average price of $92.91 a barrel in 2014, the U.S. oil benchmark has averaged around $50 a barrel this year. It dipped below $40 a barrel briefly this morning. 36 North American oil and gas producers filed Chapter 11 bankruptcies this year through Nov. 8, according to law firm Haynes and Boone. The cases so far involve $13 billion in secured and unsecured debt, and “industry and economic indicators suggest more producer bankruptcy filings will occur before the year is out,” the law firm says. Sixteen of this year’s bankruptcies were filed in Texas, with another six in Canada, four each in Delaware and Colorado and the rest in Louisiana, Alaska, Massachusetts and New York. The biggest, with $4.3 billion of secured and unsecured debt, was KKR’s Samson Resources in September.

Earlier this week, a judge ruled that Samson’s resigning chief executive won’t be paid his bonus outright. Even so, some investors argue that not enough U.S. oil producers have gone under to help shrink the glut of crude that is weighing on oil prices. Oil producers have gotten more efficient, keeping production higher than some expected. U.S. production has fallen from 9.6 to about 9.2 million barrels a day, but recent weekly estimates from the Energy Information Administration show that the pace of declines has slowed. “There’s been more efficiency in the space than we all expected, and that’s helped current owners hold on a little longer,” said Rob Haworth at U.S. Bank Wealth Management. “We’re not seeing as much turnover in the oil patch as we’d expect, in terms of weak hands to strong hands. But things like that will need to happen at some point.”

“Forty-dollar to fifty-dollar oil prices don’t work in this business..”

• Low Crude Prices Catch Up With the US Oil Patch (WSJ)

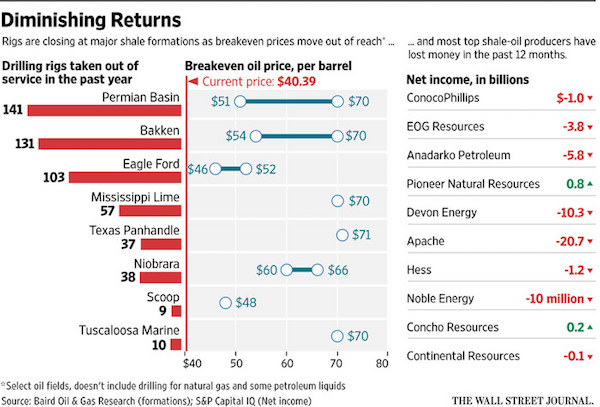

The ingenuity and easy money that allowed American oil companies to keep pumping through a year-long price crash appear to be petering out as U.S. crude slides toward $40 a barrel. U.S. companies have stunned global rivals by continuing to produce oil—particularly from shale deposits—ever more cheaply as American crude prices plunged from over $100 a barrel in 2014. But the recent drop toward $40 a barrel and below puts even the most efficient operators in a bind. “Forty-dollar to fifty-dollar oil prices don’t work in this business,” Ryan Lance, chief executive of ConocoPhillips, the largest independent U.S. oil producer, said in an interview. The worst-case scenario most major producers have discussed in the past six weeks with investors involved a price of $50 a barrel. That is beginning to look optimistic as Saudi Arabia continues to produce near-record volumes and major exporters such as Iraq have increased output.

Many oil executives, including BP CEO Bob Dudley, expect prices to be “lower for longer.” The U.S. Energy Department is forecasting the price of oil will average around $50 a barrel next year. More than 250,000 people world-wide have lost their jobs in the industry over the past year, according to Graves & Co., a Houston consulting firm. Many companies that were hoping to weather low energy prices without new rounds of layoffs and salary cuts may be forced to slash those costs yet again, said Eric Lee, an energy analyst with Citigroup. “Who’s going to take the brunt of this? Shale has already cut back a lot,” Mr. Lee said, adding that new oil projects are being deferred around the world. In a way, he added, oil companies are responsible for the current situation. During brief price rallies, they raced back into fields to drill new wells—adding to the global glut of crude and cutting off the price rebounds.

Even as the number of rigs operating in the U.S. fell 60% so far this year, American oil production through August dipped just 3% from its April peak, federal data show. What happened was a combination of declining costs for oil-field services and equipment and impressive feats of engineering. Companies doubled the amount of sand they pumped into wells, figuring out how to better prop open rock layers to draw out more oil and natural gas. Operators moved rigs into areas where crude flowed the most freely, cut the number of days it took to drill by nearly half and extended the length of horizontal oil wells to reach nearly 2 miles. Costs for such big wells fell by as much as a third as oil explorers put extreme pressure on the suppliers that help them coax more fuel from the ground, including Halliburton. And producers became far more efficient. In the seven most prolific U.S. shale fields, they boosted oil production per rig by as much as 60% this year.

“The Saudi strategy of flooding the world with oil in a bid to drive out rivals..” is a made-up idea. The Saudi’s simply looked at their forward contracts and thought: “Holy Sh*t!”

• Speculators Test Saudi Currency As Oil Crisis Deepens (AEP)

Saudi Arabia’s currency regime is at risk of blowing up if oil prices fall further and the US dollar spikes higher, Bank of America has warned. The Saudi strategy of flooding the world with oil in a bid to drive out rivals may be hard to square with the country’s fixed dollar-peg, which is increasingly under scrutiny by currency traders as the US Federal Reserve prepares to raise interest rates. “The crucial point is what happens to the Saudi riyal. Saudi Arabia’s foreign exchange reserves still provide an ample buffer, but they have been falling fast,” said Francisco Blanch, the bank’s energy strategist. “Should Brent crude oil prices drop to $30, we estimate the foreign exchange reserve drain could accelerate to $18bn per month. Saudi Arabia may face a critical choice: cut oil supply, or de-peg,” he said.

The 12-month riyal forward contracts – watched by experts for signs that traders are betting on a collapse of the peg – has spiked violently to 535 from just 13 points in June. This is even higher than the peak after the 9/11 terrorist attacks in New York, and is approaching extremes seen in January 1999. Credit default swaps pricing bankruptcy risk has jumped to 153, the highest since the global financial crisis. Mr Blanch said a devaluation by China would leave the Saudis badly exposed and might ultimately force their hand. “A de-peg of the Saudi riyal is our number one ‘black-swan’ event for oil in 2016,” he said. The 30-year old dollar peg is the weak link in Saudi strategy. It matters more than dissent within OPEC as the cartel prepares for a stormy meeting in Vienna on December 4. To varying degrees, Algeria, Venezuela, Nigeria, Iraq, and Iran all want production cuts to stabilize the market.

Russia has been able to cushion the effects of the oil price crash by letting the rouble fall from 32 to 65 against the dollar since mid-2014. This protects oil revenues of the Russian state in local-currency terms. Saudi Arabia is taking the blow head-on, and is facing an extra tourniquet effect as Fed tightening pushes the global dollar index to a 12-year high. The central bank’s holdings of foreign securities fell $23bn in October. They are down $90bn since February. Foreign reserves are still $647bn but not all is usable. The Saudi government has had to cancel a raft of infrastructure projects and push through drastic spending cuts to rein in a budget deficit near 20pc of GDP. It denies reports that contractors are not being paid. Bank of America warned that a break-down of the Saudi dollar-peg would send the riyal tumbling, with major knock-on effects. “Oil could collapse to $25,” it said in a client note.

2016: Annus Horribilis for Brazil.

• Petrobras’s Dangerous Debt Math: $24 Billion Owed in 24 Months (Bloomberg)

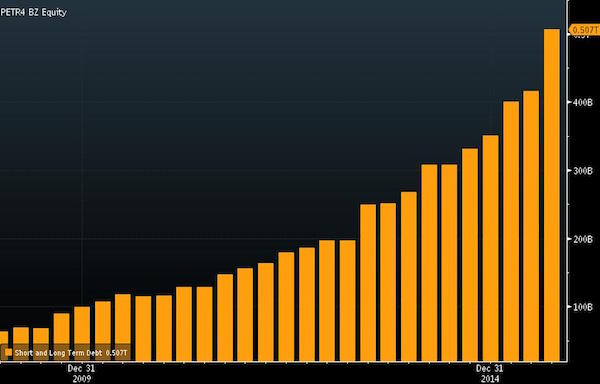

The debt clock is ticking down at Brazil’s troubled oil giant, Petrobras. Next up: $24 billion of repayments over 24 months. That’s a towering hurdle for a company that hasn’t generated free cash flow for eight years and whose borrowing rates are soaring. Annual debt servicing costs have doubled to 20.3 billion reais ($5.4 billion) in the past three years. The delicate task of managing the massive $128 billion mound of debt accumulated by Petroleo Brasileiro – 84% of it in foreign currencies – falls to the two banking veterans parachuted atop the company earlier this year, CEO Aldemir Bendine, 51, and Chief Financial Officer Ivan Monteiro, 55. The pair came from the state-controlled Banco de Brasil to contain the damage from the biggest corruption scandal in the country’s history.

While prosecutors continue to grind away at years of suspicious dealings, Act II for the boys from the Bank of Brazil will further test their mettle. The challenge of Petrobras’s runaway debt, which has grown four-fold in five years, has been exacerbated by low oil prices, a weak currency and the Brazilian government’s own fiscal travails. “If you considered them to be totally independent and there were no chance of any kind of government support, I think the risk of default would certainly be there in a big way,” said Jason Trujillo at Invesco. Petrobras is not without options, but they tend to be either politically unpalatable or unattractive to the marketplace.

Bendine is actively trying to peddle off minority stakes in the Rio de Janeiro-based oil producer’s pipeline and gas station units, among others, but that plan is behind schedule and faces fierce opposition from the oil industry’s most powerful union. Other alternatives are also running up against resistance from one interest group or another. The only source of comfort for many bondholders is the belief the Brazilian government would stop at nothing to save the country’s biggest company – though, even at that, Trujillo said markets are “lessening the amount of implied government support.”

Inventing new accounting methods, that’ll help!

• Bank of Japan To Switch To Indicators That Show Rising Prices (Reuters)

The Bank of Japan will release a new set of price indicators this month that reconfigures the way price trends are measured as the central bank seeks to show the country’s below-target inflation rate is due to volatile items such as energy. Importantly, a new consumer price index (CPI) will exclude energy costs, which have been falling, but include the costs of items such as processed and imported foods, which have been rising. The BOJ currently uses the government’s core CPI, which excludes fresh food but includes energy costs, as its key price measurement in guiding monetary policy. With core CPI now slipping due largely to slumping oil prices, the central bank began internally calculating a new index that conveniently shows inflation exceeding 1% in the past few months.

That index strips away volatile fresh food and energy costs, but includes processed and imported food prices, which are rising. The BOJ said on Friday it will start publishing this month the new CPI, as well as other indicators such as one showing the ratio of goods seeing prices rise versus those that are falling, on a regular basis each month. “The performance of the government’s core CPI (in tracking broad price trends) seems to be deteriorating, although this is probably because of the temporary effect of large swings in crude oil prices,” the BOJ said in a research paper. The BOJ’s new indicators will be released on the day the government’s CPI figures are published. The upcoming release of the CPI and BOJ indicators is on Nov. 27. Government data showed core consumer prices fell 0.1% in the year to September, a second straight month of declines, keeping inflation distant from the BOJ’s 2% target.

Beggar all of thy global neighbors.

• Mario Draghi All But Announced an Expansion of ECB QE (Fortune)

The world’s two most important central banks are going separate ways. As the Federal Reserve drops increasingly heavy hints about raising interest rates for the first time in nearly a decade, ECB President Mario Draghi all but pre-announced a new round of stimulus for a Eurozone economy that is still flirting with deflation. In a closely-watched keynote speech at a banking conference in Frankfurt, Draghi dropped his clearest hint yet that the ECB will expand its program of asset purchases, which depresses interest rates by injecting money into the financial system, and may also push its official deposit rate even further into negative territory, from its current record low of -0.20%.

The latter move would be particularly radical, and has been bitterly resisted by banks who claim it effectively forces them to make losses. But the ECB’s chief economist Peter Praet said in an interview earlier this week that the evidence suggested it hadn’t had a negative impact so far. The ECB’s governing council is due to meet next on Dec. 3, two weeks before the Federal Open Market Committee Meeting where the Fed is expected to raise its official interest rates. Draghi said: “If we decide that the current trajectory of our policy is not sufficient to achieve our objective, we will do what we must to raise inflation as quickly as possible. If we decide that the current trajectory of our policy is not sufficient to achieve our objective, we will do what we must to raise inflation as quickly as possible.”

Speculation on further easing has been growing since Draghi’s last press conference in October, when he expressed concern about fresh risks to the economy from the slowdown in China and other emerging markets, and about the stubborn refusal of inflation to come back to its targeted level of just under 2%. Thanks to low oil prices, consumer prices in the Eurozone have barely changed all year, and were up only 0.1% in the year to October. Gross domestic product, meanwhile, grew only 0.3% in the third quarter, down from 0.4% in the summer. The euro has already lost nearly 6% against the dollar since Draghi’s October press conference, and is already trading close to the 12-year low it posted back in March.

“The King spoke, the subjects listened, and The King left. There was nothing his subjects could do about it but cope with its consequences.”

• The Power And The Impotence Of The ECB (Steve Keen)

I’ve attended two conferences in two days where both the power and the impotence of the European Central Bank (EBC) have been on vivid display. Its political power is considerable, both in form and in substance. At both seminars, the ECB speaker—ECB Board member Peter Praet at the first, and ECB President Mario Draghi at the second—spoke first, and then left. In form, the ECB has no need to defend its policies because it is unimpeachable in its execution of them. In substance, it does not even considering engaging with its subjects—I use the word deliberately—in open and robust discussion. It’s not unusual for a political leader to turn up at an event, speak and then immediately leave. But even political leaders have to tolerate sometimes being savaged by fearless CNBC moderators when they speak in public.

And I expected that economic leaders would want to hang around and get some feedback—positive or otherwise—from the economic elite that gathered to hear them. Might they not learn something about why their policies weren’t working as they had expected them to? Not a bit of that for the ECB. There was plenty that could be criticised, even within the context their speeches set. Speaking at the FAROS Institutional Investors Forum, Praet acknowledged, numerous times, that the ECB had failed to hit many of its policy targets—in particular, he noted how many times the ECB had to put off into the more distant future its objective to return to 2% inflation. But there was no chance to challenge him as to why they had failed, because after a couple of perfunctory exchanges with the moderator, he was out the door.

At the more prestigious Frankfurt European Banking Congress Draghi stated bluntly that the ECB would continue to do all it takes to support asset markets via QE—in the belief that this supported the real economy. This was a declaration of the intention to use unlimited power—since there is no effective limit to the ECB’s capacity to buy assets from the private sector. A politician would have to respond to sceptics about the use of such unlimited powers. But there was not even a single question, nor even a murmur, from the audience. There was however a jolt of recognition. Draghi was going to continue supporting asset markets, and that was that. The King spoke, the subjects listened, and The King left. There was nothing his subjects could do about it but cope with its consequences.

German Finance Minister Wolfgang Schäuble, who book-ended the EBC conference, had no such luxury of freedom from interlocution—nor did he need it. He engaged in a lively banter with his interviewer as he defended the far more limited power he has over expenditure in Germany. I doubt that Schäuble will suffer electoral defeat any time soon, but unlike Draghi he faces the prospect that it could happen. That doesn’t make him any less resolute in defending his policies; it just means that he has to defend them. This is what the originally principled concept of “Central Bank Independence” has transmuted into.

One buybacks start failing to support stocks, there’s a big black hole looming beneath.

• Financially Engineered Stocks Drag Down S&P 500 (WolfStreet)

Stocks have been on a tear to nowhere this year. Now investors are praying for a Santa rally to pull them out of the mire. They’re counting on desperate amounts of share buybacks that companies fund by loading up on debt. But the magic trick that had performed miracles over the past few years is backfiring. And there’s a reason. IBM has blown $125 billion on buybacks since 2005, more than the $111 billion it invested in capital expenditures and R&D. It’s staggering under its debt, while revenues have been declining for 14 quarters in a row. It cut its workforce by 55,000 people since 2012. And its stock is down 38% since March 2013.

Big-pharma icon Pfizer plowed $139 billion into buybacks and dividends in the past decade, compared to $82 billion in R&D and $18 billion in capital spending. 3M spent $48 billion on buybacks and dividends, and $30 billion on R&D and capital expenditures. They’re all doing it. “Activist investors” – hedge funds – have been clamoring for it. An investigative report by Reuters, titled The Cannibalized Company, lined some of them up:

In March, General Motors acceded to a $5 billion share buyback to satisfy investor Harry Wilson. He had threatened a proxy fight if the auto maker didn’t distribute some of the $25 billion cash hoard it had built up after emerging from bankruptcy just a few years earlier. DuPont early this year announced a $4 billion buyback program – on top of a $5 billion program announced a year earlier – to beat back activist investor Nelson Peltz’s Trian Fund Management, which was seeking four board seats to get its way.

In March, Qualcomm Inc., under pressure from hedge fund Jana Partners, agreed to boost its program to purchase $10 billion of its shares over the next 12 months; the company already had an existing $7.8 billion buyback program and a commitment to return three quarters of its free cash flow to shareholders.

And in July, Qualcomm announced 5,000 layoffs. It’s hard to innovate when you’re trying to please a hedge fund. CEOs with a long-term outlook and a focus on innovation and investment, rather than financial engineering, come under intense pressure. “None of it is optional; if you ignore them, you go away,” Russ Daniels, a tech executive with 15 years at Apple and 13 years at HP, told Reuters. “It’s all just resource allocation,” he said. “The situation right now is there are a lot of investors who believe that they can make a better decision about how to apply that resource than the management of the business can.”

VW keeps flipping regulators the bird. “VW never told regulators about the software, in violation of U.S. law.”

• Volkswagen’s Emissions Scandal Is Getting Even Bigger, Again (AP)

Volkswagen’s emissions cheating scandal widened Friday after the U.S. Environmental Protection Agency said the German automaker used software to cheat on pollution tests on more six-cylinder diesel vehicles than originally thought. Volkswagen told the EPA and the California Air Resources Board the software is on about 85,000 Volkswagen, Audi and Porsche vehicles with 3-liter engines going back to the 2009 model year. Earlier this month the regulators accused VW of installing the so-called “defeat device” software on about 10,000 cars from the 2014 through 2016 model years, in violation of the Clean Air Act. The regulators said in a statement they will investigate and take appropriate action on the software, which they claim allowed the six-cylinder diesels to emit fewer pollutants during tests than in real-world driving.

The latest allegation means that more Volkswagen, Audi and Porsche owners could face recalls of their cars to fix the software, and VW could face steeper fines and more intense scrutiny from U.S. regulators and lawmakers. Audi spokesman Brad Stertz on Friday conceded that VW never told regulators about the software, in violation of U.S. law. He said the company agreed with the agencies to reprogram it “so that the regulators see it, understand it and approve it and feel comfortable with the way it’s performing.” The software is on Audi Q7 and Volkswagen Touareg SUVs from the 2009 through 2016 model years, as well as the Porsche Cayenne from 2013 to 2016. Also covered are Audi A6, A7, A8, and Q5s from the 2014 to 2016 model years, according to the EPA.

Stertz said the software is legal in Europe and it’s not the same as a device that enabled four-cylinder VW diesel engines to deliberately cheat on emissions tests. VW has told dealers not to sell any of the models until the software is fixed. VW made the disclosure on a day it was meeting with the agencies about how it plans to fix 482,000 four-cylinder diesel cars equipped with emissions-cheating software. U.S. regulators continue to tell owners of all the affected cars they are safe to drive, even as they emit nitrogen oxide, a contributor to smog and respiratory problems, in amounts that exceed EPA standards — up to nine times above accepted levels in the six-cylinder engines and up to 40 times in the four-cylinders.

Letting politicians self-regulate their own spending?! Great idea!

• EU Journalists Take European Parliament To Court Over Expense Accounts (EUO)

A group of 29 European journalists have filed complaints with the EU’s Court of Justice, demanding access to documents that will show how members of the European Parliament (MEPs) have been spending their allowances. The reporters filed freedom of information (FOI) requests with the European Parliament, asking for copies of documents that show details for the MEPs’ travel expenses, accommodation expenses, office expenses, and assistants expenses for the past four years. “We are not demanding access to records about how MEPs spend their salaries, which are intended for their personal and private use,” the group said in a statement. “We are demanding access to records that show details of how they spend all the extra payments they receive on top of their salaries, and only those extras which are paid to them solely for the exercise of their professional public mandates as elected representatives of European citizens,” they added.

In September, the parliament denied access to these documents, either because they contain personal data or, they argue, because no such records are held. A week ago, the reporters filed complaints with the Luxembourg-based Court of Justice of the European Union, with assistance from Natassa Pirc Musar, Slovenia’s former Information Commissioner. EP press spokesperson Marjory van den Broeke said the parliament has not yet received a formal notification from the court. “So formally, officially we cannot react to this, as we haven’t received it,” she told this website at a press conference Friday (20 November). However, she pointed out that when the EP does receive a FOI request, a balance must be struck between the EU’s rules on access to documents and its rules on personal data protection.

“Both these different aspects are taken into account when there is a proper investigation into the need to transfer personal data [to the FOI applicant],” said Van den Broeke, adding as an example of personal data that “some of these data could reveal political activities, which are the prerogative of an MEP to have, and which are their personal political convictions”. No clarification on the difference between personal political activities and public political activities was offered. According to the EP, around 27% of its almost €1.8 billion budget in 2014 was spent on MEP salaries and expenses, which include travel, office costs and assistants’ salaries. The journalists already know that there will be little information they can expect on the office costs, which are covered by the so-called general expenditure allowance (GEA), because little is recorded.

While MEPs are required to hand in receipts for their travel, accommodation and assistants expenses, they receive the GEA, which covers costs such as rent, phone bills, software, and furniture, as a monthly lump sum of €4,299 per MEP office. “The European Parliament spends €3.2 million each month solely on MEPs’ general expenditure allowance (almost €40 million per year). No one is monitoring this spending,” the journalists’ group noted.

That’s still putting it mildly.

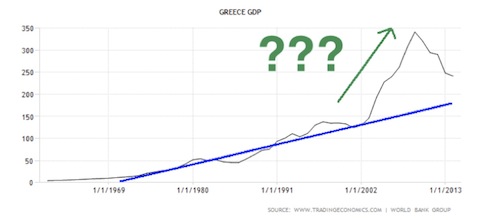

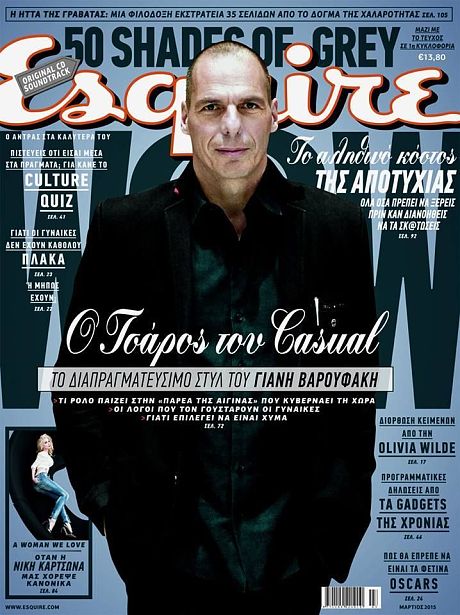

• Australia Is A ‘Plaything’ Of World Economic Forces It Can’t Control (Guardian)

Australia is a “plaything” of forces it cannot control as the world economy heads into another phase of the global financial crisis, according to the former Greek finance minister Yanis Varoufakis. The “remarkable” flow of overseas money into the economy in recent years had created a “false sense of well-being”, he said, but the economy needed to change direction quickly to avert a crisis. Varoufakis, who quit as finance minister after a tumultuous six months in charge of the near-bankrupt Greek economy, taught economics at Sydney University for 12 years up to 2000 before he returned to Europe in dismay at Australia’s turn to the right under John Howard. The economist, who has dual Greek and Australian citizenship and whose daughter lives in Sydney, said Australia had become “complacent” about the health of its economy.

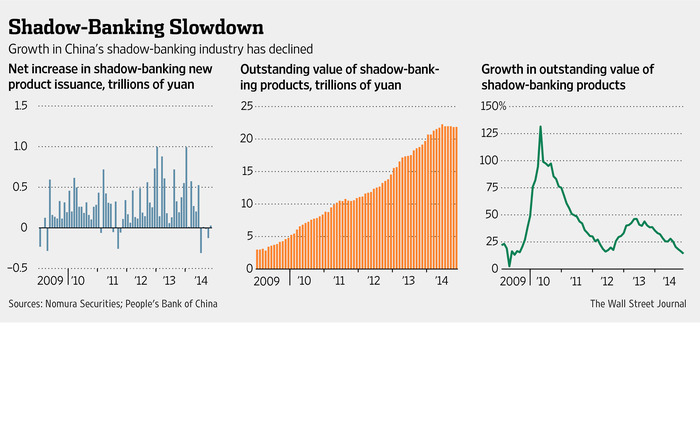

The Sydney and Melbourne housing boom, where price growth has been in double figures, was particularly alarming, said Varoufakis, who is in Australia for a short speaking tour. “Australia – especially Sydney and Melbourne – has always insulated itself from facts about the world. Aided and abetted by the remarkable flow of capital towards the property market in Sydney and Melbourne, it has created a false sense of wellbeing,” he told the Guardian. “People have always said to me that Australia is immune to the crisis because during the good times money has come as an investment. Then if things go wrong the rich Chinese will emigrate here and bring their dosh with them.” But Australia had become a “plaything of forces out of its control”, he said, and risked an economic shock as the credit bubble created by China in the wake of the global financial crisis began to deflate.

“The crisis of 2008 won’t go away. It is a unified, solid crisis, although it is metamorphisising and changing. Between the 80s and 2008 the world economy was fuelled by US debt, then financialisation [the huge increase in credit] which created a pyramid of money which collapsed in 2008. “The world economy lost its capacity to create demand for factories, but China reacted by creating a huge bubble. They were hoping the west would stabilise but it didn’t because America is ungovernable and Europe even more so.” After his bruising experience trying to face down the might of Germany, the ECB, the EU and the IMF, Varoufakis has become an outspoken critic of economic policy. He has described the settlement imposed on Greece in July as doomed to failure and will “go down in history as the greatest disaster of macroeconomic management ever”.

And they’re thinking of making him PM?

• ‘Terrible’ Public Finance Figures Heap Pressure On UK Chancellor (Ind.)

The weakest set of October public finance figures for six years has given George Osborne a serious headache ahead of next week’s Autumn Statement. The borrowing figures for last month came in well above expectations, meaning the Chancellor is likely to fall short of his budget deficit reduction target set by the Office for Budget Responsibility only in July. Borrowing shot up to £8.2bn for the month – £1.1bn higher than the same month last year. Most City experts had pencilled in a £1.1bn fall to £6bn. The last time the Government borrowed more in an October was in 2009, when the deficit for the month was £9.6bn and the economy was still mired in recession. The figures are the latest in a run of disappointments in the monthly public finances. In the seven months of the financial year so far, cumulative borrowing is £54.3bn.

Although 10.9% below last year, it means the Chancellor needs a minor miracle to hit the Office for Budget Responsibility’s £69.5bn deficit target for the full year. Analysts said it was likely the OBR would revise up its full-year 2015-16 deficit forecast next month and that the deterioration would make the Chancellor’s job of mitigating his controversial tax credit cuts more difficult. “A critical question will be to what extent the OBR believes that this has implications for the fiscal targets further out,” said Howard Archer of IHS Global Insight. Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said the deficit could hit £80bn this year, adding that the “terrible borrowing figures provide a grim backdrop to the Autumn Statement”. He said: “Barring revisions, borrowing would have to be an implausible 48% lower year-over-year in the second half of this fiscal year for the official forecast to be met.”

The horse has long bolted. It’ll take many years to repair that door.

• Is It Time To Close The Door To Foreign Buyers Of British Property? (Guardian)

A global super-rich elite, some of them criminal, are snapping up property in Britain, pushing up costs for all of us and throwing the poor to the edge of the cities. Rampant landlordism is dividing Britain into a nation of housing haves and have-nots. Tax breaks for buy-to-lets are still too generous. Tenants are in despair. Many young people will never be able to buy their own home. This, extraordinarily, is not the language of some lefty academic or pressure group, but comes from the heart of the Conservative party in a new report by the Bow Group, the oldest Tory thinktank in the UK, which styles itself as the “intellectual home to conservatives”. It is a dramatic repudiation of decades of thinking in the Conservative party.

These are the people who have, until now, equated rising house prices with wealth and prosperity, and who have profited enormously from buy-to-let and billions in foreign cash. But the Bow Group now recognises that Britain’s housing market is broken – and its prescription for reform may stagger traditional Tory supporters. It turns conventional thinking on its head by saying the solution to Britain’s housing crisis is not millions of new homes, as so many argue, but cutting demand. The report’s author, Daniel Valentine, traces the phenomenal increase in house price inflation to the mid-1990s when three factors came together: a sudden surge in population growth, the explosion in buy-to-let lending, and the entry of China and Russia into the global economy, producing a global elite seeking a safe home for their cash.

These factors have corrupted the market, creating an insatiable “investment demand” divorced from the underlying needs of the people of Britain. Foreign buyers now own close to 10% of the UK’s housing stock, he claims, and, unchecked, will gobble up much more, increasingly in Manchester, Edinburgh and other regional cities. With the global financial elite numbering at least 15 million, “increasing housing supply can never bring down prices, no matter how much public land and green belt is turned into flats, because the demand for investment returns is almost infinite.” The accepted wisdom is that Chinese billionaires buying in Belgravia have no impact on Bromley or Birmingham. Not so, says the report, citing academic studies that prove that top-end buyers pull up prices through the entire market.

The Bow Group’s solution? To follow the example of Denmark, Switzerland and Australia and make it much tougher for foreign buyers to snap up homes as investment vehicles. It is astonishing that we allow, for example, millionaires in Singapore to buy land and property in Britain, but Singapore bars British and other foreign nationals from buying in their country. Denmark prohibits non-EU nationals from buying a home unless they have lived in the country for five years – and, like Finland and Malta, is allowed by the EU to restrict EU citizens from buying second homes in the country.

“Yes, it’s happened before. (See European Jews and World War II.) It was not our finest hour.”

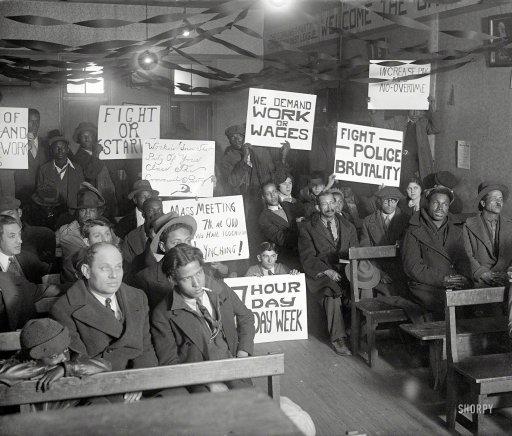

• A Nation Of Immigrants Wants To Close Its Doors (MarketWatch)

Close the borders! Deny refugees from war-torn Syria asylum in the U.S.! Pass a bill to provide a safe haven to Syrian Christians, not Syrian Muslims! Such knee-jerk reactions to the multipronged terrorist attacks in Paris last Friday only exacerbated the growing anti-immigrant sentiment in the U.S. Republican presidential candidate Donald Trump may be the loudest proponent of build-a-wall and ship-’em-back, but evidence of the expanding reach of Islamic State has won him many converts. So far 28 governors have said they will refuse to accept Syrian refugees in their states. (It’s not clear they have the legal authority to deny refugees entry to a particular state once they have been admitted to the U.S.) Another 20 are lobbying for increased screening. Congressional leaders have called for a suspension of President Barack Obama’s announced program to settle 10,000 Syrian refugees in fiscal 2016.

The 2,150 Syrian refugees that have been admitted to the U.S. so far have undergone extensive background checks, including biometric screening, a process that can take years, according to the Obama administration. To deny these victims of ISIS terror entry to the U.S. is, quite frankly, un-American. Yes, it’s happened before. (See European Jews and World War II.) It was not our finest hour. U.S. authorities do need to practice smarter security and improve screening procedures in light of the heightened risk. Have you ever wondered how many terrorists the Transportation Security Agency has nabbed asking travelers, “Did you pack your own bags?” As a nation of immigrants, the U.S. reaps considerable benefits from foreigners who come here to live and work.

Consider some statistics from the Kauffman Foundation, which focuses on entrepreneurship:

• More than 40% of the 2010 Fortune 500 companies were founded by immigrants or their children;

• Between 2006 and 2012, one quarter of all technology and engineering startups had at least one immigrant founder.

• Immigrants are twice as likely as native-born Americans to become entrepreneurs;

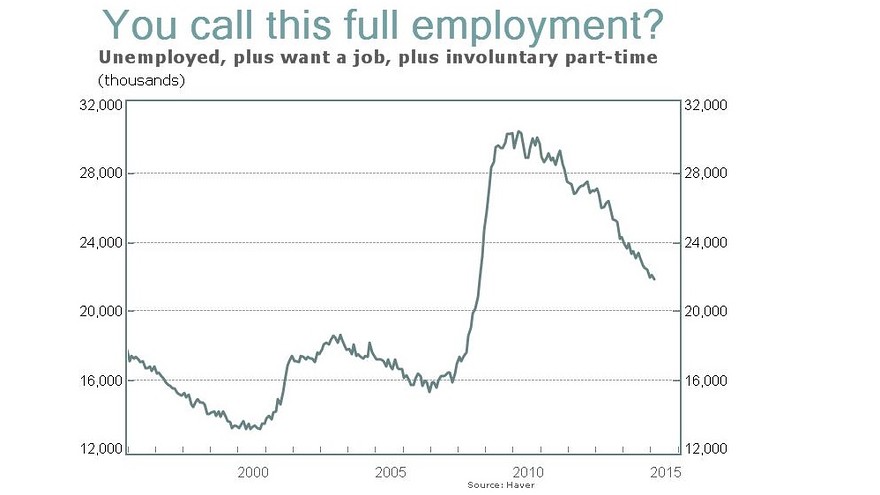

• Immigrant entrepreneurs accounted for 28.5% of all new entrepreneurs in the U.S. last year, up from 13.3% in 1997.Small companies, especially startups, are responsible for most, if not all, of the job growth in the U.S. To the extent that immigrants are drawn to entrepreneurship, they are a big plus. You may have heard it said that immigrants steal jobs from American citizens. (You can substitute “machines” or “automation” for immigrants.) This is one of those silly ideas that persists despite evidence to the contrary. So prevalent is the notion that immigrants and innovation steal jobs that economists have a name for it: the lump of labor fallacy. It’s based on the false idea that there is a fixed amount of work in an economy, to be divided up among the pool of workers. This discredited notion inspired France to implement a 35-hour workweek in 2000, widely considered to be a failure. While the official 35-hour workweek still exists — most businesses apply for an exemption — it has failed to reduce unemployment in France.

Very thoroughly. The rest is all just fearmongering.

• How Refugees Are Selected, Vetted, And Settled In The United States (Quartz)

Who are the refugees coming to the US? Every year, the President, in consultation with Congress, determines how many refugees should come into the U.S. In FY16, the ceiling is 85,000, up from 70,000 last year. They come from diverse areas. The largest groups of refugees the U.S. received last year came from Iraq, Burma, Somalia and Bhutan. In the past five years, the U.S. has received less than 2,500 Syrian refugees, most of whom were women and children.

How does the vetting process work? The vetting process for each refugee is highly rigorous, and usually takes two to three years to complete. Refugees first have to prove that they are actually refugee by registering and being accepted by the United Nations’s refugee agency overseas. This means they have to have a well-founded fear of persecution based on five specific grounds: nationality, race, religion, political opinion or membership in a particular social group. A small number of those registered—the most vulnerable cases—are referred to the U.S to be considered for resettlement. Only those who cannot return home or locally integrate in the country of asylum are referred for resettlement.

The US State Department’s Resettlement Support Center then collects biographical information and personal data for security clearance. The Department of Homeland Security, the FBI, the Department of Defense and multiple intelligence agencies then work together to carry out multiple security screenings based on biometric and biographic data, photographs, and other background information over a period that lasts on average 18 to 24 months. Any refugee who is deemed to pose a threat to our national security is denied. Syrian refugees also undergo “enhanced reviews” in which specially trained officers examine each case biography for accuracy and authenticity. In addition to these security checks, every single refugee is interviewed face-to-face by a Department of Homeland Security official and must undergo a medical screening.

How are refugees resettled in the US? Once refugees are conditionally approved for resettlement, they go through cultural orientation and pay for their own plane tickets to come to the U.S. World Relief, which is one of nine refugee resettlement agencies in the U.S, partners with local communities to help refugees get on their feet upon their arrival. This includes, partnering with local businesses and churches to assist with living arrangements, providing English classes, aiding in their job search, and much more. Refugees have been welcomed all over the country where they have become integrated, and become tax-paying, contributing members of many communities.

This is not to say that we shouldn’t carefully vet refugees, but let’s get the facts first before making generalizations and shutting down a program that has literally saved thousands of lives. To turn our backs on refugees now would betray our nation’s core values to provide refuge for the persecuted and affirm the very message those who perpetrate terrorism are trying to send.

Nothing funnier than the truth: “Mr Erdogan at one point referred to Mr Juncker as the former premier of Luxembourg, “a country the size of a Turkish city”.

• EU-Turkey Refugee Talks Turn Sour As Erdogan Belittles Juncker

The potential deal between the EU and Turkey to stem the migrant flow to Europe is floundering as Ankara pushes Brussels to deliver on a multibillion-euro aid package and other elements of the bargain. The challenge of completing the deal, hammered out in a month of negotiations, was underlined at a difficult meeting on Monday between EU officials and Turkish president Recep Tayyip Erdogan. According to people familiar with the talks, Mr Erdogan balked as Jean-Claude Juncker and Donald Tusk, the respective presidents of the European Commission and Council, pressed him for a timetable for measures intended to discourage migrants in Turkey from continuing their journey to Europe. These include tighter border controls and awarding work rights to 2m Syrian refugees.

One official familiar with the discussion said the meeting turned “sour” as Mr Erdogan demanded that Europe move first on its pledges. Ankara is seeking €3bn in financial support, regular Turkey-EU summits, and a clear political path to open several chapters in stalled EU membership talks. There was also disagreement as to whether a planned EU assistance package covered one or two years. According to another European official briefed on the meeting, Mr Erdogan at one point referred to Mr Juncker as the former premier of Luxembourg, “a country the size of a Turkish city”. On Thursday, Mr Juncker described the meeting as “sportive and exhausting”. German and other EU officials are convinced Mr Erdogan has the ability to sharply cut the outflow from Turkey and want to see tangible results by the end of the year. But it remains unclear how much Turkey can actually do to make that happen, even if it reaches an agreement with the EU.

Frans Timmermans, the commission’s vice-president, went to Ankara on Thursday to try to rescue the plan with Feridun Sinirlioglu, Turkey’s foreign minister. It was supposed to have been fleshed out and formally signed off at an EU-Turkey summit on November 29. Mr Juncker said the discussions with Mr Timmermans showed the will of “both sides to get closer together”. Thursday’s talks helped to steady the situation but diplomats worry that difficulties with Mr Erdogan may jeopardise the final sign-off. “We don’t want a summit for the sake of a summit,” said one Turkish official. “We have to see they are serious.” One European diplomat said the “tough exchange of views” underlined how difficult it was to negotiate with Turkey — particularly at a time when some member states are desperate for assistance with the crisis and have a weak bargaining position. “They are trying to exploit this situation in a way that some countries find unacceptable,” he said.

Angela better stop the ugly side of Germany from rising from its ashes.

• Merkel Slowly Changes Tune on Refugee Issue (Spiegel)

In early September, German Chancellor Angela Merkel issued an order to bring thousands of refugees who were stranded in Hungary to Germany. Germany’s basic right to asylum has no upper limits, she said. It was a moment of unaccustomed conviction from a chancellor who had become notorious for her ability to avoid making decisions until the last possible moment. But she went even further. She equated the refugee issue with other significant turning points in the history of her party, the center-right Christian Democrats (CDU). Issues such as West Germany’s integration into Western alliances and Kohl’s commitment to keeping nuclear weapons stationed in West Germany in the 1980s. It was as though she were elevating her refugee policy into the pantheon of Christian Democratic basic principles.

And she didn’t even bother to inform the CDU’s Bavarian sister party, the Christian Social Union (CSU), before doing so. Now, though, Merkel is in the process of preparing a reversal of her refugee policy. At the G-20 summit in Antalya, Turkey at the beginning of the week, she spoke of quotas – fixed numbers of refugees that Europe is willing to accept. On the one hand, of course, introduction the idea of quotas is a concession to reality, because the chancellor knows that the ongoing arrival to Germany of up to 10,000 refugees every day is not sustainable. But the change is also a silent capitulation to her critics. Horst Seehofer, the head of the CSU, and Interior Minister Thomas de Maizière are now setting the tone in Germany’s refugee policy, and the Paris terrorist attacks have only given them more leverage.

Seehofer and de Maizière have been calling for an upper limit on immigration for months. “Quota” is simply a different word for the same thing. Merkel is in a tight spot. She made the right decision by accepting the desperate refugees who set out from Budapest for Germany on foot in early September. But in the period that followed, the dimensions of the inflow kept growing and Merkel never conveyed the message that Germany’s capacity is limited. Even the coming winter has not stopped the flow of refugees, and leading conservatives are now more openly questioning the efficacy and wisdom of Merkel’s plan to limit immigration by combating the underlying causes of migration. For many, the notion of Germany serving as an intermediary and arbiter of global crises borders on megalomania.

Even though she is still publicly sticking to her rhetoric, Merkel has been on the retreat for about two weeks. Leading CDU parliamentarians received the first signs of her change of heart in early November, when they met with her at the Chancellery. In the meeting, the chancellor clearly promised that she would support a reduction in refugee numbers, says one of the attendees. “I cannot guarantee that you will already see a change in the coming weeks,” the attendee said, quoting Merkel. But she also said that the current situation could not continue as it was.

It’ll be well over 1 million by year’s end.

• Over 900,000 Migrants Arrived In Germany This Year (Reuters)

More than 900,000 migrants have been registered in Germany since the beginning of the year, the Bavarian Interior Ministry said on Friday. “The number of 900,000 was surpassed in the nationwide registration system last night,” a spokesman for Bavarian Interior Minister Joachim Herrmann said. The federal government had forecast that some 800,000 refugees would arrive in Germany this year, but senior politicians have said there could be as many as 1 million new arrivals.