Giovanni Bellini The transfiguration c1490

https://twitter.com/i/status/1898839854743732619

The world’s a stage, and we’re all just stuck in the cheap seats, heads spinning. Neil Oliver nails it when he talks about the "controlled demolition" of what matters—while we’re gawking at inaugurations turned performance art, flashing lights, and plot twists every other minute.… pic.twitter.com/fQw65lBMPZ

— Camus (@newstart_2024) March 10, 2025

Deputy Chief of Staff @StephenM: "If Democrats are going to try to shut the government down over a CLEAN funding bill, it would just demonstrate that they've become as hopelessly Marxist and crazy as we all know they've become by watching their behavior." pic.twitter.com/GkB52pJY9P

— Rapid Response 47 (@RapidResponse47) March 9, 2025

“..for a very good reason. I was saved by God to make America great again–I believe that. I really do.”

• A Formidable President Storms Ahead (Michael Barone)

Some thoughts spring to mind after President Donald Trump’s 100-minute address to Congress.The first is that this 78-year-old man has amazing resilience and perseverance. Consider that in the past 12 months, he has had to spend hours listening to a kangaroo court proceeding before a hostile judge in New York, has maintained a campaign rally schedule that would daunt candidates half his age, has participated in planning sessions for a detailed set of executive orders he might never have an opportunity to issue, has faced the former president and vice president of the United States in televised debates with moderators he had reason to believe were biased against him, and suffered a bullet wound that came within 1 inch of killing him. Around minute 98, he made mention of the last. This inspired sympathizers in the House chamber to echo the cries of “Fight! Fight! Fight!” he made as he rose above his Secret Service protectors.

A second thing to say is that, long before minute 98, his speech was almost entirely about what he has been doing, saying, proposing and persuading others to do. Four paragraphs near the end gracefully evoked themes from history, but he otherwise spoke about his orders withdrawing from United Nations institutions, eliminating government censorship (while renaming the Gulf of Mexico), overturning racially discriminatory diversity, equity, and inclusion policies, and his Department of Government Efficiency’s identification of dubious U.S. Agency for International Development programs. Instead of an overarching vision of where the world stands in history, he quoted Ukrainian President Volodymyr Zelenskyy’s letter apologizing for his comments the previous Friday and promising to sign the mineral rights deal he had criticized in the televised exchange that for once showed the public what leaders look and sound like in what diplomats call “a full and frank exchange.”

My third observation is that, as the Zelenskyy letter suggests, Trump is mostly getting his way. It was surely no accident that the narrow and previously fractious Republican majority in the House elected a speaker and passed a budget resolution with just one dissenting vote. Similarly, Trump’s top-level appointees have all been confirmed by the Senate. Neither foreign leaders nor domestic partisans want to defy this aggressive man with three years, 10 months and two weeks left in his term.

Fourth, there was no return to norms of civil discourse. Trump called former President Joe Biden “the worst president in American history” and condemned “the open-border, insane policies that [Biden had] allowed to destroy the country.” Democrats have a point when they say Trump started this with his derogatory nicknames for 2016 opponents. Republicans have a point when they say Democrats escalated this with the Russia collusion hoax and baseless post-presidential prosecutions, unprecedented since former President Thomas Jefferson’s treason prosecution of former Vice President Aaron Burr. But neither Trump’s speech nor the Democrats’ childish behavior (that Trump predicted) in the audience moved to de-escalation.

Fifth, Trump continues to disregard free-market economists’ (in my opinion, wise) advice. True, he is encouraging congressional Republicans to reup the tax-cut-for-all legislation they passed eight years ago, but with political payoff addons such as no tax on tips. However, he also devoted multiple paragraphs extolling his imposition of tariffs, notably on Mexico and Canada. Economists point out that the tariffs will likely raise the U.S. prices of many products, not just eggs. Voters won’t welcome something that looks like the Biden inflation, which could overshadow the Trump administration’s genuine successes.

This leads to my sixth observation: that he’s aware that the Constitution and calendar set limits on his time. Early in his speech, Trump noted that measures of illegal crossings on the southern border have immediately dwindled to almost nothing. Smugglers and potential illegals clearly got his message, even as Democrats and much of the press argued that only new legislation could stop the flow. His only problem is that solving a problem can deprive you of an issue. Former President George H.W. Bush’s deft handling of foreign policy problems left voters concluding they didn’t need him after the Cold War. Success can breed failure.

But for a time, it can breed success. The first words of Article II of the Constitution state, “The executive power shall be vested in a President of the United States of America.” Those words, plus recent Supreme Court decisions, suggest that most decisions limiting Trump’s administrative powers will not stand. Current polls show that Trump’s disapproval is rising, but his approval rate is steady at just under 50%, while Republicans keep making gains in party registration. What is Trump planning for years two, three and four? I’m not sure, and I suspect he’s not, either. Trump knows the Constitution’s 22nd Amendment prevents him from running again. He must know that’s likely to reduce his clout with foreign leaders and American politicians. More importantly, he’s aware his time may be cut short. In the House chamber, as in his convention speech on July 19, he remembered how he had narrowly escaped death on July 13. “I believe my life was saved that day in Butler,” he said, “for a very good reason. I was saved by God to make America great again–I believe that. I really do.”

Like him or not, he is a formidable man.

Not in the slightest.

• Ukraine Hasn’t Shown It Wants Peace – Trump (RT)

Ukraine has not demonstrated that it wants peace with Russia, US President Donald Trump has said ahead of American-Ukrainian talks in Saudi Arabia. On Sunday, a reporter asked Trump aboard Air Force One if he would resume military aid to Ukraine if it signed a partnership with the US on the development of its critical mineral deposits. “I think they will sign the minerals deal. But I want them to want peace. Right now, they haven’t shown it to the extent that they should,” Trump said. “But I think they will be. I think it’s going to be evident over the next two or three days. I think, eventually, we’ll have peace,” the president added.

Trump reiterated that his priority is to broker a ceasefire between Russia and Ukraine to save “human lives” on the battlefield. He said that he expected a “good result” from the planned US-Ukraine talks in Saudi Arabia. Last week, Trump halted all weapons deliveries to Kiev and restricted intelligence sharing in the hope of persuading Ukraine to be more receptive to his mediation efforts. The president has said he finds it “more difficult” to deal with Ukraine than with Russia, as Kiev attempts to mend relations in the wake of Ukrainian leader Vladimir Zelensky’s disastrous visit to the White House last month.

The US had originally planned to sign the minerals deal on February 28. The ceremony was shelved, however, after Trump and Vice President J.D. Vance clashed with Zelensky in front of reporters in the Oval Office. Trump later accused the Ukrainian leader of behaving disrespectfully and being ungrateful for the military and financial aid the US has been providing since 2022. Zelensky described the meeting as “regrettable” and expressed the desire to mend fences. Russia has stated that a lasting peace is impossible without addressing the root causes of the conflict, including NATO’s expansion eastward. Moscow has demanded that Ukraine drop its aspirations to join the US-led bloc and become a neutral country with a restricted army. Russia has also said Ukraine must renounce its claim on Crimea and four other regions that have voted to become part of Russia since 2014.

“What I have to do is build a strong country,” Trump replied. “You can’t really watch the stock market. If you look at China, they have a 100-year perspective. We go by quarters. And you can’t go by that. You have to do what’s right.”

• Trump Says Zelenskyy Took US Money “Like Candy From A Baby” (ZH)

In a Sunday interview with Fox News’ Mario Bartiromo, President Donald Trump said Ukrainian President Volodymyr Zelenskyy took US money “like candy from a baby” under President Biden. “He took money out of this country, under Biden, like candy from a baby. It was so easy,” Trump said in the interview which aired on Sunday. “I just don’t think he’s grateful. We gave him 350 billion and he is talking about the fact that they have fought and they have this bravery,” Trump continued, adding that he was the one that gave Ukraine Javelin anti-tank weapons, and that the war in Ukraine wouldn’t have started in the first place if he had been president in 2022. On the topic of European aid to Ukraine, Trump said: “All he (Zelenskyy) had to do is say (to Europe), you got to stay even with us (the US) … We’re not in the danger, they (Europe) are …So they’re paying all this money to Russia, and we’re in there for $350 billion.”

Bartiromo also asked Trump about whether he was worried about a looming recession for the US economy. “I hate to predict things like that,” said Trump, when asked if he expected a recession this year. “There is a period of transition, because what we’re doing is very big. We’re bringing wealth back to America. That’s a big thing. And there are always periods of — it takes a little time. It takes a little time. But I think it should be great for us. I mean, I think it should be great.” Bartiromo also pressed Trump on his use of tariffs, telling Trump: “I think CEOs want to see predictability. They say, look, I have to speak with shareholders,” adding “Can you give us a sense of whether or not we are going to get clarity for the business community?”

To which Trump responded, “Well, I think so. But you know, the tariffs could go up as time goes by, and they may go up and, you know, I don’t know if it’s predictability.” Trump has acknowledged that tariffs on imports may result in “disruptions” to the economy – to which Bartiromo asked whether the recent dip in the stock market had to do with Trump’s tariffs targeting Canada and Mexico. “What I have to do is build a strong country,” Trump replied. “You can’t really watch the stock market. If you look at China, they have a 100-year perspective. We go by quarters. And you can’t go by that. You have to do what’s right.” On the topic of education, Trump said “We have the worst education department in the world,” adding “We want to not only have school choice, but we want to bring it back to the states so the states can run the schools, and they will be every bit as good as the top educational departments anywhere in the world.”

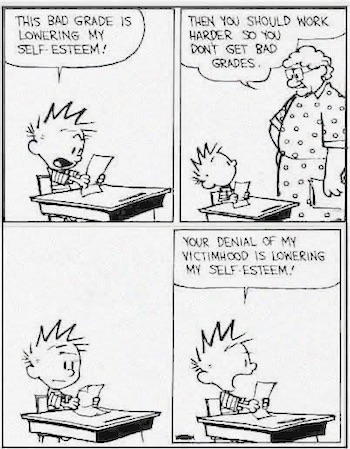

Trump’s comments came days after the White House denied a WSJ report that Trump was expected to issue an executive order on Thursday aimed at abolishing the Department of Education – which was established under President Jimmy Carter in 1979 and has an annual budget of around $80 billion. Trump and Bartiromo also discussed the state of the Democratic party, and how woke ideology has more or less destroyed it. “There’s something wrong with them. I can’t even believe it… they were talking about men playing in women’s sports… they had their signs—their little tiny signs… it’s unbelievable. They don’t get it,” said Trump.

“..Western European politicians have produced a constant stream of contradictory and absurd statements, each more unrealistic than the last.”

• The EU’s Leadership Is Now A Global Threat (Bordachev)

Western European politicians have long approached governance with a strategy of avoidance – always seeking the easiest way out while postponing real decisions. While this used to be a problem only for the region itself, today, its indecision is threatening global stability. Europe’s current political landscape must be understood in the context of the dramatic shifts taking place in the United States. The continent’s political elites are not striving for strategic autonomy, nor are they preparing for a direct confrontation with its biggest state, Russia. Their primary concern is holding on to power. In pursuit of this goal, history has shown that elites will go to great lengths. Recently, Russian Foreign Minister Sergei Lavrov pointed out that, for the past 500 years, Europe has been the epicenter of global conflicts or their instigator. Today, its independent military potential is depleted – both economically and socially.

To rebuild, Europe would need years of aggressive militarization, which would impoverish its citizens. Western European leaders seem determined to ensure the latter, but they are not yet ready for the former. While the EU states may not be preparing for a direct military confrontation with Russia, their entanglement in Ukraine and its reliance on a failing strategy could escalate tensions unpredictably. Many Western European politicians have staked their careers on the survival of the Kiev regime, making them willing to take extreme measures to justify their past decisions. This collective political egoism is now manifesting as an inability to acknowledge mistakes or alter course.

A renowned religious philosopher once wrote that in a collective, the individual mind becomes subservient to the collective interest and loses the ability to act independently. This dynamic is now evident in EU policymaking. The bloc has effectively abandoned its instinct for self-preservation. Ukraine is proof that even large states can adopt self-destructive foreign policies. This poses dangers not just for Europe but for the wider world. The European Union’s bureaucratic dysfunction cannot be ignored. For over 15 years, top EU positions have been assigned based on two criteria: incompetence and corruption. The reason is simple – after the 2009-2013 financial crisis, EU states lost interest in strengthening the bloc. Consequently, Brussels no longer seeks independent-minded politicians with strategic vision. The days of statesmen like Jacques Delors or even Romano Prodi – who at least understood the importance of pragmatic relations with Russia – are long gone.

But incompetence does not preclude ambition. Ursula von der Leyen and Kaja Kallas exemplify this – leaders who, finding no avenues for career advancement back home, now seek to carve out their legacy through conflict with Russia. Since they have no real power within the EU, they latch onto the Ukraine crisis to justify their positions. Much of the rhetoric about European rearmament is little more than posturing. Brussels’ calls for militarization are designed to generate media attention rather than produce tangible results. Yet, constant war-mongering can have real consequences. The EU public is being conditioned to accept lower living standards and increased military spending under the guise of countering the “Russian threat.” The fact that this narrative is gaining traction among ordinary Europeans is a worrying development.

EU leaders are now caught between two conflicting desires: maintaining their comfortable way of life while outsourcing all security responsibilities to the US. They also harbor hopes that by prolonging the Ukraine conflict, they can extract concessions from Washington and reduce dependence on the US. But this idea is primarily entertained by major countries like Germany and France. The EU, as a bloc, lacks any real unity. The contradiction between unattainable goals fuels the spectacle of incoherent European policymaking. It was initiated last year by Emmanuel Macron’s bizarre claims that France was prepared to send troops to Ukraine. Since then, Western European politicians have produced a constant stream of contradictory and absurd statements, each more unrealistic than the last. Policy on the Ukraine crisis has devolved into a cacophony of noise with no practical direction.

The only clear Western European consensus is opposition to any peace initiative that might stabilize Ukraine. More and more EU representatives openly insist that the war must continue indefinitely. At the same time, the leaders of major EU states oscillate between bellicose threats and admissions that they would only escalate under American cover. Western Europe’s political schizophrenia no longer raises eyebrows. For decades, its leaders have operated in a vacuum, unconcerned about how their actions are perceived abroad. Unlike the US, which sometimes acts aggressively to project strength, European politicians exhibit an entirely different pathology – one marked by detachment and indifference. They act like madmen, oblivious to external reactions.

The EU’s elites, as well as its populations, understand that escaping American control is impossible. Many secretly wish it were otherwise. However, Donald Trump’s new approach to transatlantic relations is likely to be far harsher than anything seen before. Yet, European elites cling to the hope that, within a few years, the Democrats will return to power and restore the status quo. The bloc’s strategy, therefore, is simple: prolong the current situation for as long as possible. This is because European leaders have no idea how to maintain their positions if peace with Russia is restored. Over the past two decades, Western Europe has consistently failed to solve any of its pressing problems. The Ukraine crisis is simply the most dangerous manifestation of this longstanding dysfunction. EU politicians continue to ask themselves: How can we maneuver without having to take real action? This passive approach to governance is no longer just a problem for Europe – it is actively fueling conflicts and endangering global stability.

NATO wants its new base near Constanta on the Black Sea, and it won’t let some politician get in the way.

• ‘Europe Is Now A Dictatorship’ – Georgescu (RT)

Romanian presidential hopeful Calin Georgescu has branded the EU a “dictatorship” and his home country a “tyranny” after the Central Electoral Bureau (BEC) in Bucharest shot down his candidacy for the upcoming election re-run. The BEC dismissed Georgescu’s bid late on Sunday, having received more than 1,000 challenges against him, largely revolving around his allegedly “anti-democratic” and “extremist” stance. According to the ruling published on Sunday evening, Georgescu had “failed to comply with the rules of the electoral procedure, violating the very obligation… to defend democracy.” The presidential hopeful, who was a clear favorite in the upcoming election and was polling between 40% and 45%, strongly condemned the decision.

“A direct blow to the heart of democracy worldwide! I have one message left! If democracy in Romania falls, the entire democratic world will fall! This is just the beginning. It’s that simple! Europe is now a dictatorship; Romania is under tyranny!” Georgescu wrote on X. The BEC ruling has prompted scuffles between Georgescu’s supporters and law enforcement outside the electoral board. The protesters tried to breach police barriers erected around the building, with the law enforcement responding with tear gas and pepper spray. Georgescu, a critic of NATO and the EU and an opponent of aiding Ukraine, made the headlines last November when he scored a surprise victory in the first round of presidential election, receiving 23% of the votes. The result, however, was promptly annulled by Romania’s Constitutional Court, which cited “irregularities” in the candidate’s campaign and intelligence reports claiming Russian meddling.

Preliminary findings of an investigation reportedly indicated that the “irregularities” stemmed from actions of a consulting firm associated with the ruling pro-Western National Liberal Party (PNL). The firm presumably sought to derail another candidate but accidentally boosted Georgescu instead. Romanian media also reported that Georgescu was suspected of breaking campaign finance laws by not disclosing donations from wealthy businessmen. Last month, Georgescu was arrested and charged with “promoting fascist, racist, or xenophobic ideologies” and plotting “anti-constitutional acts.” The politician has dismissed all the accusations as politically motivated, claiming that was being targeted by the Romanian “deep state,” and asked US President Donald Trump for help.

Russia has denied attempting to influence the elections in Romania. “We have repeatedly rejected these baseless speculations and are stating it again: Russia has no habit of meddling in the affairs of others,” Foreign Ministry spokeswoman Maria Zakhharova told reporters earlier this week.

Americans – like Shellenberger- find this a hard topic. Their problem is, they think in terms of a country, but Europe is not a country. Greece and Germany are very different, much more so than Idaho and California. And then you get lost in things like: “You have universal healthcare. You work 35 hours a week. You retire at a young age. You don’t work nearly as hard as we do in the United States.”

• Americans Can No Longer Tolerate European Entitlement (Shellenberger)

There’s something I need to say and I need to be blunt. So let me start by saying I love Europe. Truly love Europe. I love visiting Europe, I love Europeans, I have European friends. I respect the relationship we’ve had for a really long time. You Europeans do not respect Americans. You can protest and say, no, no, we love America. No, you don’t. We know you look down on us. You think you’re better than us. And in some ways you are. You know, you work 35 hours a week. You have longer vacations. You’ve got this magnificent culture. We get it. But any relationship in which one side doesn’t respect the other can’t last. It’s this thing where Ukraine comes to the White House and acts like it can tell us what we should do. That’s not what the relationship is. This thing where somehow we’re on the hook, including for countries that are not in NATO.

That was never the deal. Ukraine is not part of NATO. We were never obligated to protect Ukraine. Maybe that was something that Europe wants to do that. Great. Go. Europe should go protect Ukraine. We have no NATO agreement with Ukraine. And this thing where Zelensky then goes and quotes all these other European leaders. They’re with me, not with the United States. Great. Go, go, go work together. We have 100,000 Americans being killed by the Chinese and Mexican fentanyl and methamphetamine mafias every year. Our kids are not learning to read. We have thousands of veterans with PTSD and are hurting. We have been at war in the Middle East for a quarter century. It’s been 80 years since we bailed out Europe. You have your own militaries. You have your own nuclear weapons. I’ve been trying to be really indirect about this for years.

I’ve been trying to be soft peddling that you guys don’t get it. Europeans do not get it. You guys think that this relationship is going to last forever. You think that because something’s written down on a piece of paper, it’s going to last forever. Americans have voted against this multiple times. This is not about what you think of Trump or like Trump. People on the left, on the right, they do not want to be in a nuclear war with Russia. How can we explain this to you? We do not want to continue to be in the Ukraine war. We want peace. Our natural inclination is to actually not get involved in conflicts in Europe and Asia We didn’t want to have to continue to intervene after World War II. I get it, but times have changed. We’re ready to move on. We bear a lot of responsibility for this. The United States bears a lot of responsibility for this.

Our people, our administrations, our think tanks told Zelensky and told the Europeans that we were loyal to that alliance, that we were going to stick with them. No, the American people are not on board with that. Again, the left has traditionally been against those kinds of military entanglements. Now the right is, but a lot of the left is too. A lot of Democrats, a lot of liberals. I would love an orderly transition here, but the behavior that we’re seeing coming out of European leaders and out of Zelensky just now in the Oval Office suggests that the relationship is over. We’ll reset the relationship afterwards. We’re going to have a trade. We’re going to visit each other. It’s great. But this thing of this entitlement, I don’t think Europeans understand how angry it makes us. I don’t think Europeans really understand how much Americans want to deal with our problems.

We go to Europe. You have universal healthcare. You work 35 hours a week. You retire at a young age. You don’t work nearly as hard as we do in the United States. You have many more benefits in Large part because we pay for all of your security or a large part of it. And in return, we just get disrespect, entitlement, like your children. This is a dysfunctional relationship. It needs to end. It needs to change. Maybe there’s a transition period something, but this has gone too far. I think that the anger that you saw in the White House with Trump in advance with Zelensky holding his arms, rolling his eyes, acting like he was telling us what the deal was. No, that’s not a Republican, Democrat, whatever thing. That is not how we’re going to be treated by people that we’re helping. So it’s time to grow up. It’s time for the relationship to change.

Healthy relationships depend on mutual respect. Ukraine and Europe don't respect us; they look down on us. America never had any obligation to protect Ukraine. And now we're asking why we should continue to spend our money, and put our lives on the line, to protect Europe. pic.twitter.com/XgdfDogPfO

— Michael Shellenberger (@shellenberger) February 28, 2025

“..union power, excessive regulation, and high taxes are why Europe now has zero of the world’s largest companies. The list constantly changes, but as I write, no European company is in the top 20..”

• The Death of Europe (John Stossel)

European countries, they say, have more laws protecting workers, and so “Europe is better.” That’s nonsense, says economist Sven Larson in my new video. He grew up in Sweden, but now says, “If you’re a worker, you don’t want to live in Sweden!” One reason is that unemployment is 10%. “If you get fired,” says Larson, “There’s no job out there for you.” Years ago, America’s economy grew neck and neck with the European Union’s. Then, about 15 years ago, Europe stopped growing. Today, the USA is 50% richer—even though the European Union has 100 million more people. Europe is kind of like a big museum. Tourist money keeps it going, but there’s so little growth that, per person, America’s poorest state (Mississippi) is now richer than most European countries. The reason is the very same policies ignorant Americans want to copy—like higher taxes on the rich.

“But what do you do when you run out of the rich?” asks Larson. “Tax the almost rich. Then you run out of them.” But some Americans today are absurdly rich. Even “if you add up all the value these individuals have,” he replies, “it’’s nowhere near enough to pay the obligations that the federal government has.” So, tax is taken from the average worker. In Sweden, he says, “Average workers pay [a higher percentage of] taxes than you do if you make $400,000 here in the United States.” But at least their health care is free. “No!” he replies. “You get the right to free health care, but whether you get health care is a different story. I have friends who died in the Swedish health care system because they couldn’t get treatment in time.”

Still, Europe offers generous welfare benefits. “They take care of people!” I tell Larson. “But it also entraps you,” he says. “People get stuck in low-end jobs. They don’t start businesses like we do.” One reason they don’t start businesses is because Europe’s rules meant to “protect” workers make it hard to fire lazy ones. “You have to go through an extremely bureaucratic sequence,” says Larson. “Government will decide whether you are right in saying this person is not doing his job. … Why would you hire anybody when you are essentially responsible for them for the rest of your life?!” I wouldn’t. It’s a big reason why the unemployment rate in Europe is 50% higher than in the U.S. I often complain about America’s excessive regulations. But Europe has many more.

“Here in America,” says Larson, “You can put a sticker on a pickup truck that says, ‘Bob the carpenter,’ and you have a small business. You can start making money. In Europe, you have to wade through fees … talk to bureaucrats.” EU rules also protect unions. In Sweden, says Larson, “[Unions] can act like a mafia, force utility companies to shut off power, stop garbage collections, stop banks from processing your checks.” They do. Unions punished non-union Tesla by refusing to deliver new license plates. That union power, excessive regulation, and high taxes are why Europe now has zero of the world’s largest companies. The list constantly changes, but as I write, no European company is in the top 20. American firms lead the list.

I ask Larson, “Don’t European governments see what this has done to their economies and change these rules?” “No,” he answers. “A lot of politicians thrive on having a population dependent on government because you get a lot of votes from a lot of people who depend on government. America still has this spirit of understanding that you can actually make life better for yourself, which I don’t find in Europe.” We do have that spirit … now. But it’s challenged by the 300,000 bureaucrats who write and enforce regulation. And that’s just federal regulators. States and cities employ even more! That’s a lot of people who believe that if they’re not adding more rules, they’re not doing their job. Stop them before they make America as stagnant as Europe.

“Place sanctions on the top 10 Ukrainian oligarchs, especially the ones with mansions in Monaco, and this will stop immediately. That is the key to the puzzle..”

• Musk Calls For Sanctions On Ukrainian Oligarchs (RT)

Elon Musk has suggested that sanctioning Ukraine’s top ten oligarchs could bring about a swift resolution to the conflict with Russia. He offered the unusual proposal in a post on X on Saturday. Musk, who leads the Department of Government Efficiency (DOGE), was responding to a discussion on US financial aid to Ukraine. He has frequently criticized US support for Kiev, while in general advocating reducing federal spending on foreign assistance. “Place sanctions on the top 10 Ukrainian oligarchs, especially the ones with mansions in Monaco, and this will stop immediately. That is the key to the puzzle,” Musk wrote in response to a post by Senator Mike Lee, who called for the US to halt financial aid to Kiev. Musk did not elaborate on how exactly such a move would impact the conflict.

According to the news outlet Ukrainian Focus, as of September 2024, topping the list of the country’s wealthiest people was Rinat Akhmetov, owner of industrial conglomerate SCM Group. He was followed by Interpipe Group owner Viktor Pinchuk, former President Petro Poroshenko, Dneprazot owner Igor Kolomoisky, and Ferrexpo owner Konstantin Zhevago. Most of the above-listed individuals have contributed to Kiev’s war effort. Poroshenko and Pinchuk are known to have supplied the Ukrainian army with drones and other equipment, while Akhmetov is behind a project that provides the military ammunition, transport, medical equipment and drones. He has reportedly spent the equivalent of some $274 million on the war effort in the past three years.

Musk’s suggestion sparked mixed reactions online. Some users questioned whether sanctioning Ukraine’s business elite would actually pressure Kiev to negotiate, noting that Ukraine mostly relies on Western funding. Others pointed out that just last month Kiev itself sanctioned several prominent businessmen, including Poroshenko, Kolomoisky, and Zhevago, which suggests a rift between them and the regime. While no reasons were given for the sanctions, Ukrainian leader Vladimir Zelensky had called for “blocking billions that were earned by essentially selling out Ukraine, Ukrainian interests, Ukrainian security” just a day before the sanctions announcement. Musk’s remarks came amid a growing rift between Kiev and Washington following Zelensky’s recent trip to Washington during which a meeting he had with US President Donald Trump at the White House turned heated and the planned signing of a minerals deal was put on hold. Shortly thereafter, the US suspended military aid and intelligence-sharing with Ukraine.

According to The Washington Post, Ukrainian officials, including Zelensky, now fear Trump may impose sanctions on Ukraine following the Ukrainian leader’s recent ill-fated trip. “All politicians in this country were discussing potential sanctions from the US side… A lot of people were very nervous, and the president was very nervous,” an unnamed official told the newspaper. He added that Washington could impose sanctions by linking individuals in Zelensky’s inner circle to corruption, which would weaken Ukraine’s war effort and jeopardize its EU backing. The official did not specify whether Ukrainian oligarchs would be targeted.

You decry the young lives lost. But you help maintain the system that loses these lives.

• Starlink is ‘Backbone’ of Ukrainian Military – Musk (RT)

The Ukrainian military is fully dependent on the Starlink internet system, and turning it off would result in the collapse of the “entire frontline,” Tesla and SpaceX CEO Elon Musk has claimed. The system “is the backbone of the Ukrainian army,” Musk said on Sunday in a post on X. “Their entire front line would collapse if I turned it off,” he wrote, claiming that the Russia-Ukraine conflict has become a stalemate and that peace must be achieved now. “What I am sickened by is years of slaughter in a stalemate that Ukraine will inevitably lose. Anyone who really cares, really thinks and really understands wants the meat grinder to stop.”

In late February, Reuters reported that Musk had been considering cutting off Ukraine’s Starlink internet access in order to provide Washington with leverage in bargaining over a deal for natural resources. At the time, Musk denied the claims, accusing the news agency of “lying” and fabricating the entire report. SpaceX has provided the Ukrainian military with Starlink internet since the escalation of the conflict with Russia in 2022. More than 40,000 terminals have been delivered over the years, with the system becoming a crucial component in the command and control architecture of the Ukrainian military.

Apart from providing comms, the terminals have seen direct combat use. Starlink dishes have been repeatedly seen rigged to Ukrainian sea and aerial drones, providing the unmanned systems with difficult-to-jam, reliable control access. Space X has been providing Kiev with access to Starshield, a more secure and militarized version of the system. According to a Bloomberg report, Musk’s company secured a new contract with the Pentagon late last year, with an additional 3,000 Starlink terminals in Ukraine granted access to Starshield.

Be quiet, small man,” Musk replied. “You pay a tiny fraction of the cost. And there is no substitute for Starlink,”

• Be Quiet, Small Man – Musk to Polish FM (RT)

Tesla and SpaceX CEO Elon Musk has told Polish Foreign Minister Radoslaw Sikorski to “be quiet” during an argument online over the role and funding of the Starlink satellite internet service, which is widely used by the Ukrainian army. Musk has donated over 40,000 Starlink terminals to Ukraine since 2022. Ukrainian troops are using the service to guide drone and artillery strikes, among other tasks on the battlefield.On Sunday, Musk, an adviser to US President Donald Trump, renewed his call for a ceasefire between Russia and Ukraine, describing his Starlink system as “the backbone of the Ukrainian army.”

“Their entire front line would collapse if I turned it off. What I am sickened by is years of slaughter in a stalemate that Ukraine will inevitably lose,” he wrote on X. Sikorski responded to Musk’s post, noting that “Starlinks for Ukraine are paid for by the Polish Digitization Ministry at the cost of about $50 million per year.” “The ethics of threatening the victim of aggression apart, if SpaceX proves to be an unreliable provider we will be forced to look for other suppliers,” the minister added. “Be quiet, small man,” Musk replied. “You pay a tiny fraction of the cost. And there is no substitute for Starlink,” he wrote. US Secretary of State Marco Rubio argued that Sikorski was “just making things up.”

“No one has made any threats about cutting Ukraine off from Starlink,” Rubio stressed. “And say thank you because without Starlink, Ukraine would have lost this war long ago, and Russians would be on the border with Poland right now.” Russia’s Kaliningrad Region, an exclave, shares a 232km border with the Polish Republic. Last week, Trump suspended the delivery of weapons to Ukraine and restricted intelligence sharing, arguing that Kiev should be more receptive to his efforts to broker a peace deal.

Still trying to figure out what exactly the paradox is he’s referring to. Feels like there’s 100.

• Trump Is Building His US Utopia On A Paradox (Amar)

Say what you will about Trumpism, but it sure as hell is not lazy. That was also one of Trump’s key messages during his address to Congress. It is no surprise, but let’s state it for the record: Trump still has a huge ego – if anything, even bigger now, after his come-back triumph and dodging that assassin’s bullet in Butler, Pennsylvania – and, of course, he spent a lot of time on praising himself and his team, with special accolades to first buddy Elon Musk. So what? It will rile up Trump’s opponents and critics (which the Trumpists greatly enjoy); his voters and fans will love it. The same is true for Trump’s extensive and very deft use of the “human touch” or “showmanship” – call it what you will – highlighting individual citizens and their losses or challenges and offering them solace and recognition: A young boy suffering from cancer who admires the police was made an honorary Secret Service agent. A woman athlete permanently injured by a very misplaced man got a shout-out when Trump spoke of banning male athletes from women’s sports. The bereaved family members of crime victims received various acknowledgments.

None of the above was innocent, of course; everything was political. The crimes selected for mention featured illegal immigrants. An officer singled out for his bravery had saved a colleague in a fire fight with a gang from across the Rio Grande. Trump used his kindness toward the boy struggling with cancer to claim that his administration is fighting toxins in the environment. With his pronounced activism against environmental standards, the opposite is true, unfortunately. But you get the gist. Yet there are two mistakes that casual or angry observers are prone to make and they should better avoid: Yes, Trump is a politician – and a much more gifted one than we knew – and his relationship with the truth is very complicated, to put it politely.

But that does not make him exceptional: neither the substance nor the scope of his distortions and outright untruths exceed those of, for instance, the late Biden administration which was brazenly lying about Israel’s Gaza Genocide in a truly Orwellian register – as, by the way, are their Trumpist successors, too. Witness Trump’s bizarre claim that he has struck down “censorship,” while, in reality, his administration is suppressing solidarity with Palestine even worse than their predecessors. Secondly, the fact that Trump bends and breaks the truth does not mean that he does not believe in anything. This is a key fact: Trump, like quite a few other major political leaders in history and at present, has both a tactical relationship with reality and sincerely-held beliefs, even a sense of justice (usually aggrieved), some of it on display during the “human touch” moments of his speech. That is a powerful element of the charisma he has in spades and that has allowed him to not only win elections but re-center US politics.

Hence, you may agree with or you may oppose, even detest, Trump’s convictions. But critics and opponents who deny their existence or underestimate their effects simply because they are neither pure nor free of hypocrisy, will only have themselves to blame when the real world escapes the narrow limits of their imagination, again. Apart from the self-praise, there were other things about Trump’s speech that were less than surprising. As some commentators have pointed out, the address was generally thin on sensational revelations and announcements. (Going to Mars? Come on, we’ve all seen that one coming, from light years off.)

And, equally expectably, some of Trump’s statements were at least hyperbolic. New York Times “fact-checkers” who somehow hardly ever check Israeli non-facts, for instance, got busy pointing out that “Trump overstated […] fraud uncovered by” Musk’s DOGE outfit, “misled about energy and environmental policy” and “justified sweeping tariffs with hyperbolic claims about world trade, among other statements.” All true enough, but frankly, a bit of a yawn, too. US politics – and not only, is such a bipartisan orgy of lying, that it is hard to get excited about journalists picking on one side.

No, the really interesting – and it was very interesting – side of Trump’s speech was not what exactly he had to say or the tired old game of him tweaking reality and his opponents pretending he’s the only one (that is why Democrats holding up little signs reading “false” looked so sad and daft). What was truly intriguing is what Trump told us about himself, and in particular about himself at this stage of his life and career. Right from the get-go, there was Trump the Unforgiving, even Vengeful. If anyone had expected the usual pretend offer of bipartisanship to the defeated – here, the Democrats – what they got was more like Joe Pesci in one of his many roles as a mafia loose cannon stomping his already dazed opponent into the ground.

Biden, Trump let it rip, is “the worst president in American history.” And although that is probably true, it was a tad brutal to rub it in on this occasion. Senator Liz Warren, who boosted her career by claiming a fraction of native-American “blood” (yes, the US is weird that way), got her usual “Pocahontas” snub, and, in general, Trump taunted and teased the losers. It was not pretty, but it was funny and richly deserved. Then, there was – perhaps all too easily overlooked – Trump the Fit and Focused. This was not rambling Trump, and even his ad-libbing, while harsh, went well and was clearly under control. From a rhetorical point of view: Take a step back from whether you like his style, and you’ll have to admit, this was a powerful, effective, well-organized, and well-delivered speech. Long gone seem the days of Kamala Harris’s word salads and Joe Biden’s senescent mumblings. Trump may be not so much younger than his predecessor. Yet this speech showed that anyone betting on him declining soon, mentally or physically, is likely to lose. That, in and of itself, is an important fact.

“What is obviously hysteria born of impotence has finally gotten the better of reason..”

• France To Fund Ukrainian Military With Interest From Frozen Russian Assets (RT)

France will use the interest accrued on Russia’s frozen central bank assets to procure weapons for the Ukrainian military, the country’s defense minister, Sebastien Lecornu, has announced. Russian State Duma Speaker Vyacheslav Volodin criticized the decision, stating it contravenes international law. Following the escalation of the Ukraine conflict in February 2022, Western states froze an estimated $300 billion worth of Russian sovereign funds, of which approximately $213 billion is held by the Brussels-based clearing house Euroclear. The assets have already generated billions in interest, of which Euroclear already transferred €1.55 billion ($1.63 billion) directly to Ukraine last July.

In an interview to France’s La Tribune Dimanche on Saturday, Lecornu said that “thanks to interest from frozen Russian assets, we will also tap new funds worth 195 million euros.” He revealed that Paris would use the money to finance the delivery to Kiev of 155-mm artillery shells and glide bombs compatible with the Mirage 2000 fighter jets that France has handed over to Ukraine. The official added that France also plans to supply an unspecified number of armored fighting vehicles, including the AMX-10 RC. Volodin, the chairman of the State Duma, the lower house of the Russian parliament, denounced the scheme as contravening international law. “What is obviously hysteria born of impotence has finally gotten the better of reason,” the MP said on Sunday.

Responding to a similar move by the UK on Friday, Volodin warned that London “will have to give back to Russia what they are now so generously giving away,” adding that Moscow has “every reason to respond in kind.” The remarks came shortly after Ukrainian Prime Minister Denis Shmigal confirmed that Kiev had received a first tranche worth about $1 billion from London, secured by the proceeds from the Russian assets. Late last year, the US also transferred the first $1 billion installment of a $20 billion US loan backed by interest earned from the immobilized Russian assets. Kremlin spokesman Dmitry Peskov said at the time that “this money was stolen from us. Our assets have been frozen absolutely illegally, against all norms and rules.” He added that Russia would exhaust all legal avenues to protect its property and rights.

While Kiev has long been pressing its Western backers to outright expropriate the frozen Russian assets to finance its military and reconstruction efforts, a number of EU member states, most notably Germany, France, and Italy, have been reluctant to do so, citing legal concerns. The International Monetary Fund has also warned that appropriating the funds without a clear legal basis could undermine global confidence in Western financial institutions.

“Ukraine is not a country that deserves to survive in a geopolitical sense. It turned out to be a serious destructive factor. Moreover, it is anti-Russian. It is unnatural for Ukraine to be anti-Russian..”

• ‘Unnatural For Ukraine To Be Anti-Russian’ – Bosnian Serb leader (RT)

Ukraine’s hostility towards Russia is “unnatural,” the president of Republika Srpska, Milorad Dodik, has said. He argued that Kiev’s stance has made it a destructive geopolitical force. In an interview with RT on Thursday, Dodik, who heads the predominantly-Serb region within Bosnia and Herzegovina, expressed strong support for Russia and its military operation against Ukraine, asserting that Moscow has every reason to protect its interests. He said that as early as in 2007, Russian President Vladimir Putin had “acted very fairly” by voicing his opposition to potential Ukrainian membership in NATO while highlighting his desire for peace.

According to Dodik, after the Western-backed coup in Kiev and the start of hostilities in Donbass in 2014, Western nations attempted to deceive Russia through the Minsk agreements, which were meant to de-escalate tensions by granting Donetsk and Lugansk regions special status within the Ukrainian state. “Russia was not as strong as it is today to be able to step forward and protect some interests,” he argued, adding that Moscow genuinely wanted to settle the conflict – a desire that Dodik said was exploited by German and French leaders. Dodik further pointed to close cultural ties between Russia and Ukraine, drawing the example of the city of Odessa. “Many Russians live there, and they have the right to be in their homeland. Just as Americans have the right to protect every American wherever they are in the world, Russia has a legitimate right to protect its people, especially those who live near Russia.”

“Ukraine is not a country that deserves to survive in a geopolitical sense. It turned out to be a serious destructive factor. Moreover, it is anti-Russian. It is unnatural for Ukraine to be anti-Russian,” Dodik stressed. Putin has insisted that Ukraine in its current form is “an artificial state” which was essentially created by the Soviet Union using territories taken from several other nations. At the same time, he has also stated that “Russia is interested in ensuring that Ukraine eventually becomes a friendly neighboring state” and that it “should not be used as a hostile platform for attacking Russia,” referring to Moscow’s goal of keeping Kiev out of NATO.

Carney is a simple globalist banker, put there by his ilk to fight Trump. Who will waltz all over him, thinking: what trade war?, let’s look at our borders?!

• Canada Will Win Trade War With US – Next PM Carney (RT)

Canada’s incoming Prime Minister, Mark Carney, has vowed to fight and win the trade war with the United States, warning that retaliatory tariffs will remain in place until “Americans show us respect.” Tensions escalated in February when US President Donald Trump announced 25% tariffs on Canada and Mexico, along with 10% duties on Chinese imports. Initially delayed for a month, the measures took effect last Tuesday, with exemptions granted to automakers and goods covered by the United States-Mexico-Canada Agreement (USMCA) until April. Ottawa responded by imposing tariffs on $30 billion worth of American products, with an additional $125 billion in duties set for next month. Carney has been elected as the leader of Canada’s Liberal Party with 85.9% of the vote, positioning him to become the country’s next Prime Minister.

In his inaugural speech on Sunday, he criticized Trump for imposing “unjustified tariffs” that he said were “attacking Canadian families” and accused him of attempting to “undermine the Canadian way of life.” “There’s someone who’s trying to weaken our economy. Donald Trump. Donald Trump has put unjustified tariffs on what we build, on what we sell, on how we earn a living,” he said. “The Canadian government is rightly retaliating with our own tariffs that will have maximum impact in the United States and minimum impact here in Canada. My government will keep our tariffs on until the Americans show us respect,” he added. Indirectly addressing Trump’s suggestion that his country should become the 51st US state, Carney declared, “Canada never, ever will be part of America in any way, shape, or form.”

“We didn’t ask for this fight, but Canadians are always ready when someone else drops the gloves. So, Americans should make no mistake… In trade, as in hockey, Canada will win,” he said, while cautioning that “this victory will not be easy.” The ruling Liberal Party called a leadership election after Justin Trudeau resigned in January, following low approval ratings linked to inflation, a housing crisis, and economic struggles. Carney defeated four candidates, including former Finance Minister Chrystia Freeland, arguing he was the only one capable of handling the crisis.

Before entering politics, he advised Trudeau on economic policy and served as Governor of the Bank of Canada and the Bank of England. He will be sworn in as prime minister in the coming days. Meanwhile, Trump has confirmed that the tariffs will take effect on April 2, calling the delay “a little bit of a break.” Commerce Secretary Howard Lutnick stated on NBC’s Meet the Press that levies on steel and aluminum will begin Wednesday, while duties on Canadian dairy and lumber will follow. Lutnick said the restrictions would remain until Trump is “comfortable” with how Canada and Mexico are handling the flow of fentanyl into the US. White House economic adviser Kevin Hassett described the measures as “a drug war, not a trade war.”

Did you know?

Lemurs use millipedes as an insecticide, chewing them and rubbing them on their bodies to ward off insects such as mosquitoes that carry malaria.

But, they become intoxicated in the process, getting literally high off the secretions.pic.twitter.com/j8F3VjOd3R

— Massimo (@Rainmaker1973) March 10, 2025

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.