Salvador Dali Self portrait (Figueres) 1921

The White House deleted its preposterous tweet after Twitter commented. They tried to claim a 50-year old law’s provisions were due to Biden’s “leadership” today.

Biden social media geniuses are giving Biden credit for the biggest Social Security COLA in 10 years, but neglect to mention that SS COLA is an automatic formula based on government inflation metric (CPI). 🤦♂️ pic.twitter.com/1trGTRI9iV

— Thomas Massie (@RepThomasMassie) November 2, 2022

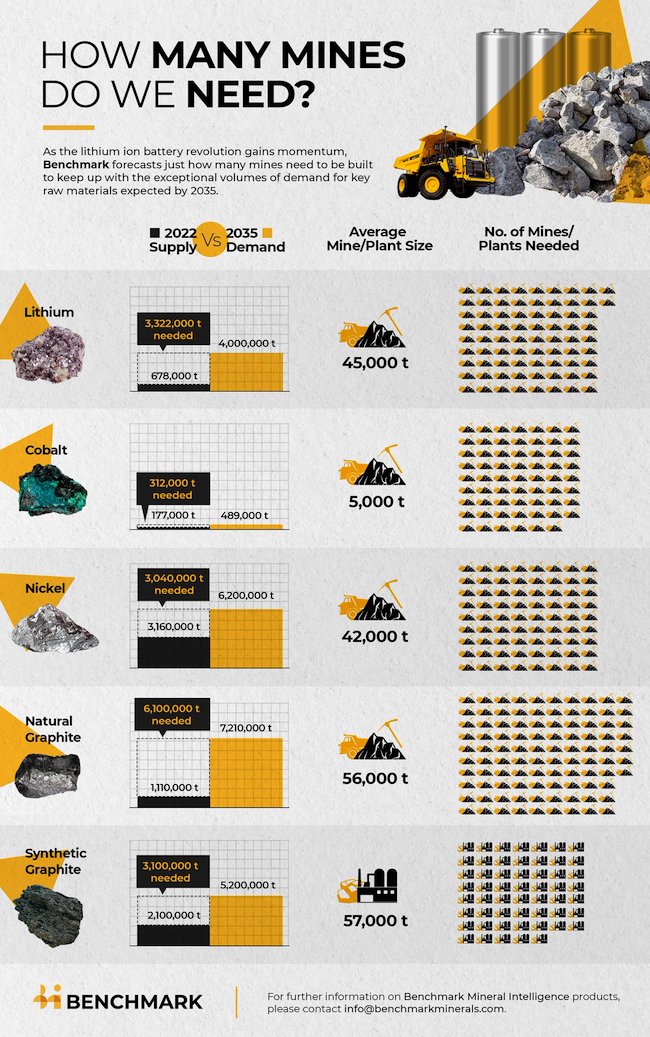

EV

Inconvenient fact about electric cars #1:

If you drive it 60,000 miles… you put MORE carbon in the air than a gas powered car.

Only after 60,000 miles do you use less. pic.twitter.com/WmiAjszdHE

— John Stossel (@JohnStossel) November 1, 2022

“..90% of weapons packages reportedly unaccounted for..”

“..into a big black hole..”

• US Struggling To Trace Arms Given To Ukraine – WaPo (RT)

Despite having a team of military overseers in the country, the US has only managed to account for around 10% of the weapons systems sent to Ukraine that require special oversight, the Washington Post reported on Tuesday. Earlier, Interpol had warned that foreign weapons can end up in the hands of criminals in Europe. Anonymous US officials told the newspaper that they can only hope to achieve a “reasonable” level of compliance with US oversight rules, and will have to be satisfied with “greater than zero” assurances from their Ukrainian colleagues. Some 22,000 US-provided weapons systems – including Stinger and Javelin missiles – need to be tracked once they enter Ukraine, the report stated. However, US inspectors have only managed to perform two in-person checks in recent months, verifying just 10% of this number.

Without these verifications, the US is relying on Ukraine to scan arms packages and send a record of their serial numbers to Washington. For smaller items such as rifles and body armor, a single American official in Poland signs off on all transfers to Ukraine. Larger weapons systems, such as HIMARS rocket artillery platforms and M777 howitzers, are not subject to inspections. The Post’s report came hours after a Pentagon official told reporters that in-person inspections had recently started again for the first time since Russia’s military operation began in February. Throughout the intervening months, US media reports suggested that Washington had no idea where its weapons shipments were actually ending up. One intelligence source told CNN in April that these weapons disappear “into a big black hole” once they enter the country, while CBS News in August quoted a Lithuanian arms supplier as saying that “like 30% of [military aid to Ukraine] reaches its final destination.”

The US has provided $18 billion in military aid to Ukraine since February. Russian President Vladimr Putin has warned that this influx of arms prolongs the conflict while making the US a de-facto participant. Last month, Putin also claimed that “powerful weapons, including portable air defense systems and precision weapons,” are being smuggled out of Ukraine and onto the black market. Up to $1 billion worth of arms are funneled from Ukraine to criminals, terrorists and extremists every month, the spokeswoman for the Russian Foreign Ministry, Maria Zakharova, stated in October. Russia’s concern over the matter is shared by Interpol. In a briefing in June, agency chief Jurgen Stock cautioned that the sheer volume of arms being pumped into Ukraine “will lead to the proliferation of illicit weapons in the post-conflict phase.”

“..Biden’s dismissal of diplomacy prolongs the destruction of Ukraine and threatens nuclear war..”

• Biden’s Foreign Policy Sinking His Party & Ukraine (Jeffrey Sachs)

President Joe Biden is undermining his party’s congressional prospects through a deeply flawed foreign policy. Biden believes that America’s global reputation is at stake in the Ukraine War and has consistently rejected a diplomatic off-ramp. The Ukraine War, combined with the administration’s disruptions of economic relations with China, is aggravating the stagflation that will likely deliver one or both houses of Congress to the Republicans. Far worse, Biden’s dismissal of diplomacy prolongs the destruction of Ukraine and threatens nuclear war. Biden inherited an economy beset by deep disruptions to global supply chains caused by the pandemic and by former President Donald Trump’s erratic trade policies.

Yet instead of trying to calm the waters and repair the disruptions, Biden escalated the U.S. conflicts with both Russia and China. Biden attacked Republican House Minority Leader Kevin McCarthy for expressing doubts on another large financial package Ukraine, declaring: “They [House Republicans] said that if they win, they’re not likely to fund — to help — continue to fund Ukraine, the Ukrainian war against the Russians. These guys don’t get it. It’s a lot bigger than Ukraine — it’s Eastern Europe. It’s NATO. It’s real, serious, serious consequential outcomes. They have no sense of American foreign policy.” Similarly, when a group of progressive congressional Democrats urged negotiations to end the Ukraine War, they were excoriated by Democrats following the White House line and forced to recant their call for diplomacy.

[..] The last thing the U.S. and Europe need is a long war with Russia. Yet that’s just where Biden’s insistence on NATO enlargement to Ukraine has brought about. The U.S. and Ukraine should accept three absolutely reasonable terms to end the war: Ukraine’s military neutrality; Russia’s de facto hold on Crimea, home to its Black Sea naval fleet since 1783; and a negotiated autonomy for the ethnic-Russian regions, as was called for in the Minsk Agreements but which Ukraine failed to implement. Instead of this kind of sensible outcome, the Biden administration has repeatedly told Ukraine to fight on. It poured cold water on the negotiations in March, when Ukrainians were contemplating a negotiated end to the war but instead walked away from the negotiating table.

Ritter

Former US Marine Corps intelligence officer Scott Ritter says the Ukraine war started in 2014, not in 2022. pic.twitter.com/xrqPVhkuzR

— Hassan Mafi (@thatdayin1992) November 1, 2022

“..Russia can reliably destroy the West (which is not nearly as well defended) but will not do so unless the West attacks first..”

• The New Cuban Missile Crisis That Isn’t (Dmitri Orlov)

Unless you spent the last few weeks hiding under a rock, you have probably heard that some sort of new nuclear crisis is underway because of “Putin’s nuclear blackmail” or some such. Some people have suffered nervous exhaustion as a result, neglecting their duties and generally letting themselves go. [..] I am here to tell you that there is nothing going on beyond the usual—the usual Western propaganda fakery, that is. In particular, this has nothing to do with anything Putin or with anything nuclear. Instead, this is all part of a desperate attempt to compensate for narrative failure, and a failed attempt at that. The problem for the collective West is simply this: 80% of the world’s population has refused to join it in condemning, sanctioning or otherwise punishing Russia, with some very large countries (China, India) either supportive or neutral on the subject.

Most of the world, including Asia, the Middle East, Africa and Latin America, is carefully watching Russia systematically destroy what was by far the largest and most capable NATO-equipped, NATO-commanded army in the world (the Ukrainian army, that is), understanding full well that what is unfolding is Washington’s Waterloo. Some countries (Saudi Arabia, for instance) are so sure of the result that they are already refusing to obey Washington’s dictates. This is a problem, because all the Washingtonians know how to do is impose their will on the world. Treating others as equals or looking for opportunities to negotiate a win-win is simply not part of their core competence—or any of their competence, for that matter. Once defanged, all they know how to do is bark and drool.

To fix this problem, the narrative-mongers in Washington and Brussels have decided to play the nuclear card and accuse Russia of nuclear blackmail. Meanwhile, all that Russia has done is decimate the Ukrainian army several times over, then accept four former Ukrainian regions into the Russian Federation based on highly conclusive local referenda closely watched by a goodly number of international observers, and then announce that it will defend these regions against foreign attack by all means necessary. These, obviously, include nuclear means, since Russia does have them, and would use them in accordance with its nuclear doctrine, which precludes their first use. Meanwhile, the US has no such stipulation in its nuclear doctrine, has actually used nuclear weapons against civilians (in Japan), and has for decades dreamed of developing a nuclear first strike capability that could not be countered.

If any country should be judged to be a nuclear threat, it is the US, not Russia… except, as I will explain, the US is no longer much of a nuclear threat either. Putin barely hinted at this, but a mere hint was enough to utterly infuriate the US national defense establishment, whose worst enemy is reality itself. Putin pointed out that at this point Russia has some weapons in its nuclear deterrent arsenal that are superior to that of the West. These new weapons, of which more later, guarantee that any nuclear attack on Russia would be a suicidal move. That is, the West has no way of reliably destroying Russia (it is too big and its economic core is too independent and too well defended with air and space defense systems) while Russia can reliably destroy the West (which is not nearly as well defended) but will not do so unless the West attacks first.

“Just as Western weapons are now targeting cities in the Donbass and the liberated territories, Western propaganda is firing ‘information shells’ at its own citizens..”

• Whole World Suffers From Western Propaganda – Russia (RT)

Amid the Ukraine conflict, Western countries are waging an information war not only against Russia but also the entire international community, Vassily Nebenzia, the nation’s Permanent Representative to the United Nations, said on Tuesday. Speaking at a presentation at the UN of the RT documentary ‘Journalists Under Fire,’ the top diplomat noted that Russia had found itself under massive media pressure after it launched its military operation in Ukraine in late February. Nebenzia noted that Western coverage of the conflict is typified by “a huge number of ‘fakes’ about the activities of the [Russian] military, as well as about the goals, objectives and motives” of its campaign in Ukraine.

“It’s no secret that the West has launched a real information war against us, which affects not only the residents of Russia and Ukraine but also people around the world,” he reiterated. He went on to compare Western media coverage with actual Ukrainian bombings of civilian infrastructure. “Just as Western weapons are now targeting cities in the Donbass and the liberated territories, Western propaganda is firing ‘information shells’ at its own citizens,” he claimed. According to Nebenzia, the media onslaught is harmful to ordinary people, who “are losing touch with reality, become distressed and confused” when being overwhelmed with an endless barrage of falsehoods. They also lose the ability to think critically, he claimed.

After Russia launched its military operation against Ukraine, Western countries unleashed an unprecedented crackdown on Russian media abroad, with the European Union banning RT and Sputnik channels. Moscow has repeatedly criticized the move, with Foreign Ministry spokeswoman Maria Zakharova claiming that it has shown the world the true worth of so-called Western values.

And NATO will tell them they cannot have it.

• Russia Ready To Provide Grain To Poorest Countries Free Of Charge – Putin (Az.)

Russian President Vladimir Putin confirmed the country’s readiness to provide a significant grain volume to the poorest countries free of charge in a telephone conversation with President of Indonesia Joko Widodo, the Kremlin’s press service said on Wednesday. “In the context of supporting the global food security, Vladimir Putin stated the fundamental Russian approaches towards implementation of Istanbul package agreements pertaining to Ukrainian grain export from Black Sea ports and unblocking of Russian agricultural produce and fertilizers exports to global markets,” the Kremlin said. Russian President also noted readiness of the country to provide significant grain volumes to the poorest countries free of charge as the humanitarian aid, the Kremlin’s press service added.

“Joko Widodo supported such an approach,” the Kremlin noted. The Russian President also informed his Indonesian counterpart about the situation evolved in consequence of the marine humanitarian corridor use by the Kiev regime for the sabotage action against the infrastructure and ships of the Black Sea Fleet in Sevastopol and that the Russian side resumes implementation of the grain deal after the receipt of required guarantees from Ukraine regarding the non-use of the humanitarian route for military purposes.

“..We cannot allow accomplices of the Ukrainian Nazi regime to earn money on our territory..”

• Russia Strips Ukrainian ‘Oligarchs’ Of Crimean Property – Official (RT)

Russian officials have nationalized more than 130 properties in Crimea that previously belonged to Ukrainian ‘oligarchs’ who have been supporting Kiev in its conflict with Moscow, Vladimir Konstantinov, the head of the republic’s State Council, revealed on Wednesday. He wrote on Telegram that Crimean officials had been thinking about nationalizing “enterprises located on the territory of the peninsula and owned by Ukrainian oligarchs” for a long time. According to Konstantinov, the registry of enterprises subject to nationalization features properties of “foreign citizens and states that have been committing unfriendly actions against Russia” and includes some major plants, such as the cement plant Stroyindustriya in Bakhchisaray and the Zaliv shipyard in Kerch.

“For us, this measure is an act of justice. We cannot allow accomplices of the Ukrainian Nazi regime to earn money on our territory,” Konstantinov stressed. He added that it would be even “fairer”to transfer the property to the “defenders, who risk their lives on the frontline of the special military operation.” Later, in an interview on the Rossiya 24 TV channel, Konstantinov revealed that provisional administrations have been appointed at all the nationalized enterprises. “People who used to work there, keep working, there are no problems,” he reassured. Wednesday’s announcement came two days after the head of Crimea, Sergey Aksyonov, ordered the nationalization of the property of “organizations and individuals associated with the Kiev authorities,” including Stroyindustriya and Zaliv.

He revealed the initial plans to nationalize the property of Ukrainian oligarchs and politicians who supported Kiev back in March, soon after Russia launched its military operation in Ukraine. He said at the time that many Ukrainian officials, including President Vladimir Zelensky, owned property on the peninsula. In October, the republic’s State Council amended the 2014 legislation on property management in Crimea to allow foreign states and citizens’ assets to be nationalized. Meanwhile, Kiev took similar steps in early April: The country’s parliament voted to expand a law which allowed Russian government property to be nationalized by the Ukrainian state. The rule was extended to Russian citizens in Ukraine, those with a “close relation” to Russia, and Ukrainians who publicly supported or ignored Moscow’s ongoing military operation.

If you see Putin as a ruthless war-mongering dictator, all you see here is raw power. Me, I think he would love to retire to his dacha. But he fears the CIA and/or Russian hardliners would move -back- in. Medvedev could do some of what Putin does, but not all of it. Putin wants Russia safe before he retires.

• Kremlin Comments On Putin’s Re-election Plans (RT)

Russian President Vladimir Putin has not made a decision on whether he will run for re-election in 2024 when the country is set to vote for the next head of state, the Kremlin spokesman has said. Dmitry Peskov answered “no” when a reporter asked him about the matter on Wednesday. Putin is currently in his fourth term as president. The national constitution sets a limit of up to two consecutive terms. He held the presidency between 2000 and 2008 and has been in office again since 2012, with Dmitry Medvedev serving a single four-year term in between. The country has changed its constitution on several occasions in its modern history. The original five-year term was reduced to four years in 1993, under president, Boris Yeltsin, but increased to six years in 2008. The first presidential election for the newly increased tenure was held in 2012.

In 2020, Russia held a referendum on the most recent round of constitutional amendments, which included extending term limits. It was approved, opening the way for President Putin to potentially stay in power until 2036. Putin neither confirmed nor denied an ambition to do so. When he was asked about it during the plenary session of the Valdai Discussion Club in October 2020, shortly after the amendments came into force, he said he was well aware that “this has to end at some point.” “What happens in 2024, or later – that needs to be seen when the time comes,” he added. The amendments, Putin explained, “were not aimed at giving the incumbent head of state the right to be re-elected in 2024” but rather to update the constitution and strengthen national sovereignty.

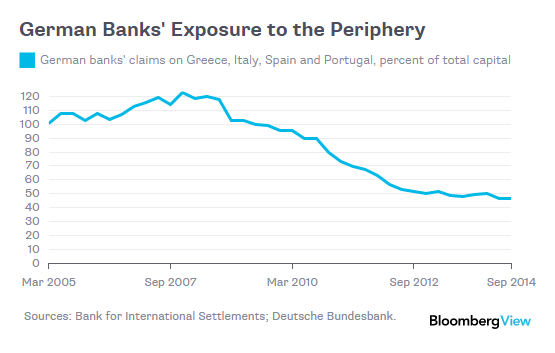

“..Germany has been told to cut itself off from Russian gas and de-industrialize…”

How can Germans NOT rise up?

• Germany’s Position In America’s New World Order (Michael Hudson)

Germany has become an economic satellite of America’s New Cold War with Russia, China and the rest of Eurasia. Germany and other NATO countries have been told to impose trade and investment sanctions upon themselves that will outlast today’s proxy war in Ukraine. U.S. President Biden and his State Department spokesmen have explained that Ukraine is just the opening arena in a much broader dynamic that is splitting the world into two opposing sets of economic alliances. This global fracture promises to be a ten- or twenty-year struggle to determine whether the world economy will be a unipolar U.S.-centered dollarized economy, or a multipolar, multi-currency world centered on the Eurasian heartland with mixed public/private economies.

President Biden has characterized this split as being between democracies and autocracies. The terminology is typical Orwellian double-speak. By “democracies” he means the U.S. and allied Western financial oligarchies. Their aim is to shift economic planning out of the hands of elected governments to Wall Street and other financial centers under U.S. control. U.S. diplomats use the International Monetary Fund and World Bank to demand privatization of the world’s infrastructure and dependency on U.S. technology, oil and food exports. By “autocracy,” Biden means countries resisting this financialization and privatization takeover. In practice, U.S. rhettoric means promoting its own economic growth and living standards, keeping finance and banking as public utilities.

What basically is at issue is whether economies will be planned by banking centers to create financial wealth – by privatizing basic infrastructure, public utilities and social services such as health care into monopolies – or by raising living standards and prosperity by keeping banking and money creation, public health, education, transportation and communications in public hands. The country suffering the most “collateral damage” in this global fracture is Germany. As Europe’s most advanced industrial economy, German steel, chemicals, machinery, automotives and other consumer goods are the most highly dependent on imports of Russian gas, oil and metals from aluminum to titanium and palladium. Yet despite two Nord Stream pipelines built to provide Germany with low-priced energy, Germany has been told to cut itself off from Russian gas and de-industrialize.

This means the end of its economic preeminence. The key to GDP growth in Germany, as in other countries, is energy consumption per worker. These anti-Russian sanctions make today’s New Cold War inherently anti-German. U.S. Secretary of State Anthony Blinken has said that Germany should replace low-priced Russian pipeline gas with high-priced U.S. LNG gas. To import this gas, Germany will have to spend over $5 billion quickly to build port capacity to handle LNG tankers. The effect will be to make German industry uncompetitive. Bankruptcies will spread, employment will decline, and Germany’s pro-NATO leaders will impose a chronic depression and falling living standards.

“We got to remember this is just weeks after President Biden told us that he had this all under control..”

• Double Whammy Ahead? Rep. Warns Of Diesel Shortage, Rail Strike Impact (JTN)

Wisconsin Rep. Bryan Steil says that the economy could take a dual hit after the election if diesel shortages persist and rail unions strike as promised. In September, rail workers threatened to strike after the election if they could not agree to a new contract with railroad companies, which would result in substantial problems for the U.S. economy and its already challenged supply chain. “It’s incredibly concerning,” Steil said Tuesday on the “Just the News, No Noise” TV show. “We got to remember this is just weeks after President Biden told us that he had this all under control, and the trains would be running on time.

”We’re now learning it’s anything but that. It’s another game where the Biden administration has kicked the can down the road and kicked it past this election.” Biden announced he had struck a tentative deal with the railroad unions that the workers cannot strike until after a so-called cooling-off period in late November, right after the midterm elections. “I think people see through this case where it’s very clear that the deal he struck was political in nature and will likely or possibly crumble following the election,” Steil said. “But this is just one more thing that we all are concerned about. As it relates to the economy, pretty much every light on the switchboard is flashing. We got to be concerned. It’s one of the reasons we need to put a check on this administration.”

Diesel

Robert Bryce – A looming diesel shortage could cripple economy pic.twitter.com/YWWa7UHtVg

— Wittgenstein (@backtolife_2023) November 2, 2022

France will have enough electricity this winter. How do you think the neighboring Germans will look at that from their dark and cold homes?

• France To Restart Nuclear Reactors – Energy Ministry (RT)

Six of the 12 nuclear reactors in France that were found to have corrosion issues in May have been repaired and will be restarted soon, French Energy Minister Agnès Pannier-Runacher has revealed. She told France Inter radio on Wednesday that, at the moment, there was “no reason” to believe that energy operator EDF would not be able to meet the schedule for restarting all shutdown reactors before winter. Earlier, media reports stated that EDF had hired about 100 American welders from Westinghouse in order to repair the power units on time. France generates roughly 70% of its electricity from a nuclear fleet of 56 reactors, all operated by EDF. However, many of them have been closed down for maintenance, some due to corrosion-related issues.

Currently, only 31 units are reportedly operating. EDF has pledged to restart all shutdown reactors before winter to avoid power shortages in the country. However, since October 6, there have been strikes among EDF employees involved in repair work at 19 reactors, delaying maintenance by several weeks. Last month, the French national electricity grid operator RTE warned that it would not rule out the risk of blackouts this winter due to prolonged strikes halting the repair. According to RTE, outages could only be avoided if power consumption was reduced by 1% to 5%, while in the event of an extremely cold winter – by 15%. Failure to restart the plants on time could have “heavy consequences” for power supply over the winter period, the operator has warned.

“..from over $330 per share in January to nearly $90 per share this week. The company’s market cap has also plunged [..] from just over $1 trillion in August of 2021 to under $250 billion in November..”

• Investors Reportedly Disgruntled As Facebook Stock Down 70% (JTN)

Investors in Facebook parent company Meta are reportedly growing dissatisfied with the company’s fixation on the “metaverse” as the corporations’ stock continues to plunge and its market capitalization continues a long slide. The company has seen its stock plummet throughout 2022, shedding more than 70% of its value from the start of the year as it fell from over $330 per share in January to nearly $90 per share this week. The company’s market cap has also plunged from its high last year, dropping from just over $1 trillion in August of 2021 to under $250 billion in November. Investors, meanwhile, are reported to be unhappy with the company’s business direction, specifically founder Mark Zuckerberg’s fixation on the virtual reality “metaverse,” a project that has generated relatively little excitement outside of esoteric tech circles.

Jim Tierney, an investment officer for Meta shareholder AllianceBernstein, told the Financial Times that, had any other company plowed so much money into a strategically dubious project, “you’d have activist investors writing letters, proposing alternative slates of directors, demanding change.” “I think Mark heard crystal clear what investors wanted. He’s made his decision,” Tierney told the publication. David Older, an asset manager at Carmignac, claimed that Zuckerberg has been “tone-deaf to the investment community, doubling down on everything.” “The timeline for the metaverse is very stretched. I don’t think you’re going to know if it is the right move for five or 10 years,” he told FT.

He gets a lot of heat for not firing the head of censorship, Yoel Roth, @yoyoel.

• Elon Musk To Fire Half Of Twitter On Friday (ZH)

[..] in two days Elon Musk will finally do what he has repeatedly warned he would do: unleash mass layoffs at the company he just acquired. According to Bloomberg, the world’s richest man will eliminate 3,700 jobs at Twitter – roughly half of the company’s entire workforce – in a bid to drive down costs following his $44 billion acquisition; Musk will inform affected staffers Friday, said the Bloomberg sources. Oh, and all those masked snowflakes who previously raged against the previous management’s “draconian” demand to come back to the office, you’re out of luck too: Musk intends to reverse the company’s existing work-from-anywhere policy asking what few employees remain to report to offices.

Musk and a team of advisers have been weighing a range of scenarios for job cuts and other policy changes at San Francisco-based Twitter, the people said, adding that the terms of the headcount reduction could still change. In one scenario being considered, laid off workers will be offered 60 days’ worth of severance pay, two of the people said. With the “liberal and tolerant” left putting Musk under the financial deplatforming squeeze, as various woke advertisers are pressured by vocal ultra-left radicals to drop Twitter unless the social media platform is fully MSNBC’ed; which will leave advertisers showing their ads to a handful of socialist-preapproved media outlets catering to those whose entire income comes from the government, who pay zero taxes, and can’t really afford to buy anything, Musk is under pressure to find ways to slash costs of a business for which he overpaid.

To be sure, the mass exodus won’t come as a surprise: Twitter employees have been bracing for layoffs ever since Musk took over last Thursday and fired the top executive team, including CEO Parag Agrawal and top censor, Vijaya Gadde. Over the weekend, a few employees with director and vice president jobs were cut, while other leaders were asked to make lists of employees on their teams who can be cut, Bloomberg reported, adding that senior personnel on the product teams were asked to target a 50% reduction in headcount. Engineers and director-level staff from Tesla reviewed the lists.

A bit idealistic?

• Writing as Microcosm, Part One: Publish and Perish (Greer)

I’m not sure how many of my readers have noticed the massive realignment going on right now at the foundations of the industrial economy. Venture below the towering abstractions of notional wealth that fill business websites, all the way to the base, and you’ll find that the whole gargantuan structure rests on certain relationships between individuals and the economy. Most people in the industrial world participate in economic activities in two ways: selling their time and labor to businesses as employees, and buying goods and services from businesses as consumers. That’s the base from which the whole tottering mess rises.

What we’re seeing now is that a growing number of people have lost interest in continuing to fill those particular roles. Intractable labor shortages are becoming the norm in today’s industrial societies. Part of that is a function of the soaring number of people who are struggling with bad health just now—no, we don’t have to get into why that’s happening—but not all of it. At the same time, the consumer side of the equation is also collapsing, and stores are floundering as inventory builds up and sales slump. Quite a bit of that is a function of the wicked blend of inflation and recession that’s got the global economy in its grip, but again, that’s not all of it.

You can catch a whisper of what else is going on if you listen to the frequent rants heard from the managerial class these days about how young people just don’t want to work any more. Talk to the young people in question and you’ll find that quite a few of them are working very hard on projects of their own. What they’re not willing to do is waste their lives working in abusive and humiliating environments to make someone else rich, in exchange for rock-bottom wages, no prospect for advancement, and no benefits worth mentioning. That their reaction comes as a surprise to anyone is a good measure of just how detached our society’s comfortable classes have become from the reality their preferred policies have created.

“Pfizer had their most profitable year and they’ve just jacked up the prices of their vaccine by 10,000%..”

“So we’re asking, how much profit do they need before they’ll release those bloody redacted pages?”

• Pfizer’s Lack of Transparency, Accountability ‘Creates a New Tyranny’ (CHD)

Pfizer executive Angela Lukin on Oct. 20 said the drugmaker plans to raise the price of its COVID-19 vaccines by about 400%, to $110 to $130 per dose, after the U.S. government’s purchase program expires — even though new estimates suggest the vaccines can be produced for as little as $1.18 a dose. “Pfizer had their most profitable year and they’ve just jacked up the prices of their vaccine by 10,000%,” Russell Brand said in his latest video. “So we’re asking, how much profit do they need before they’ll release those bloody redacted pages?” The comedian and political commentator was referring to a request by the European Parliament’s COVID-19 committee to see Pfizer’s contract with the EU for its COVID-19 vaccine. Pfizer handed over the documents — but with many pages completely redacted.

Not only that, but Pfizer’s CEO Albert Bourla, Ph.D., who was due to testify Oct. 10 before the committee, pulled out of the appointment, effectively refusing to answer any of the committee’s questions. When the committee requested to review Pfizer’s contract with the EU for the COVID-19 vaccine, Bourla’s representative told the committee, “They can’t fully disclose these contracts because they have some ‘commercial secrets’ over there and they have to ‘protect their interests,’” member of the European Parliament (MEP) Cristian Terhes said on Oct. 12. “Now I’m asking you: ‘What about the interests of our people?’” asked Terhes, who is also a human rights activist. Terhes showed page after page of heavy redactions from Pfizer’s contracts that it handed over to the committee.

Brand made fun of Pfizer for bothering to share the heavily redacted documents with the public because they were “black as night” and showed no information. “What’s the point?” Brand asked. “Just say, ‘We’re not going to show you.’ It’ll save your photocopier,” he added. Brand also pointed out that according to a September 2021 report by Investigate Europe, negotiations between the EU and pharmaceutical companies for the COVID-19 vaccine happened behind closed doors. “Why is this stuff all so shady?” Brand asked. “Why is it the contract has to be blacked out? Why are the deals happening in secret? This is supposed to be democracy.”

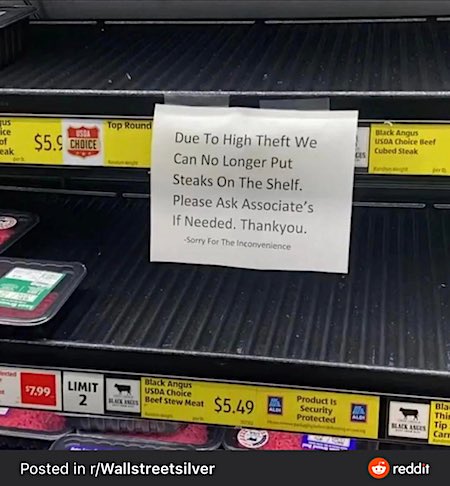

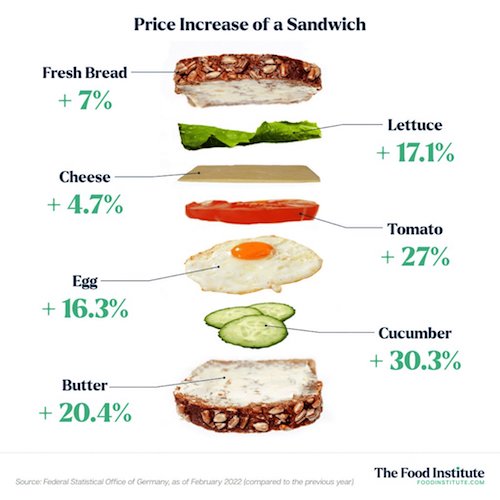

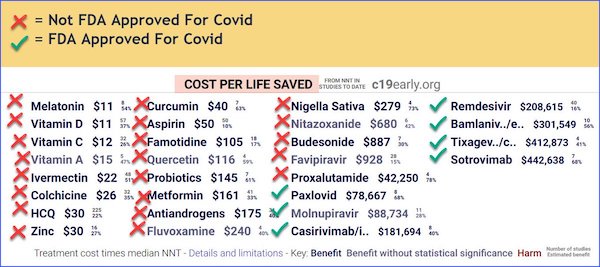

Check the prices

Malone addresses the Springer article posted here yesterday: Censorship and Suppression of Covid-19 Heterodoxy

• Censorship and Defamation- Weapons of Control (Malone)

In a stunning article published in the relatively obscure academic journal “Minerva”, the mainstream academic publisher Springer has allowed truth to be spoken. Censorship and Suppression of Covid-19 Heterodoxy: Tactics and Counter-Tactics. Having personally lived through what may be among the most intensive slander, defamation and derision campaigns of the COVIDcrisis, none of what was described in this article surprised me. I think that I can probably guess the names of some of the interviewed physicians and medical scientists discussed in the article, as so many have shared their own experiences with me. But seeing it written out in a dry academic style and published like a case series study of global corporate, organizational and governmental psychopathology and greed is another thing altogether.

I expected the article to bring a tear of relief at being heard and validated, but instead it just left me numb. The publication summarized much of what I have personally experienced (and by way of disclosure of conflict of interest, I was mentioned as an example in the introduction, although I did not participate in the survey). Much but not all. It missed the ubiquitous Wikipedia re-writing of personal history (and in my case, writing me out of the history of nine of my issued US patents). It missed Amazon deleting the very credible and well referenced book on “Prepare and protect from the novel Coronavirus” which Dr. Jill Glasspool-Malone PhD (Biotechnology and Public Policy) had worked so hard to publish in the first week of February 2020 – with the only explanation being that it “violated community standards”.

It missed the concerted effort to deny my contributions as a young man to coming up with the whole idea of using mRNA as a drug or vaccine, and developing the technology to the point where it was proven in a mouse model. It missed the (largely successful) stolen valor campaign to credit two scientists (one a Fauci post doc, the other a Bio-N-Tech VP) who came along almost a decade after my work and sought to take credit for my contributions while writing me out of history. It missed the professional infiltration and disruption campaigns designed to destroy the American trucker protest movement and the medical freedom movements. It missed the YouTube deletions of US Senate testimony convened by a sitting US Senator, Ron Johnson. Etc etc.

Very well done. His notes are all in pics, so go to the original.

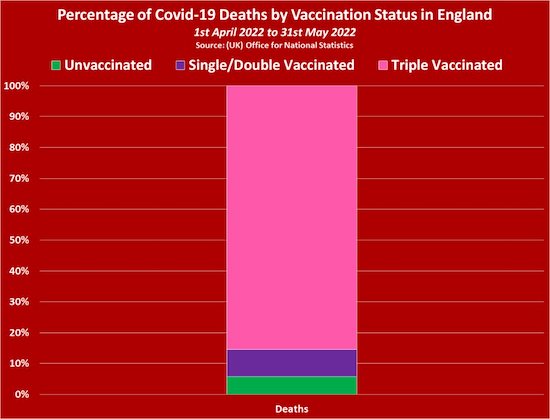

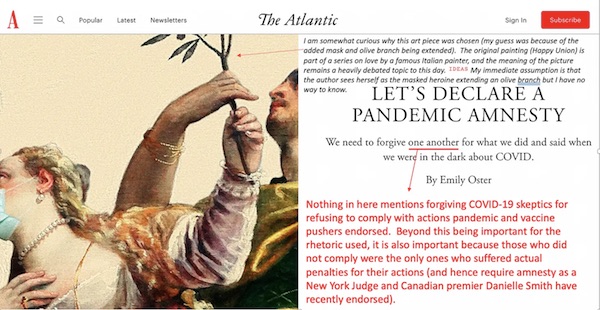

• Dissecting the Deceptive Plea for COVID-19 Amnesty (A Midwestern Doctor)

Recently an article began circulating stating that the pandemic pushers deserved amnesty for their actions over the last two years. This article was repeatedly shared in our community as a way of politely saying “How About No” to the author, and to illustrate that enough consequences from the vaccine are starting to emerge that the government has realized they may need to pivot to a new approach (which suggests additional issues from the vaccines will emerge in the future). From having thought this article over, my best guess is that this article was primarily targeted at assuaging the guilt of the left leaning voters who trusted their leaders on these vaccines and are not the most motivated to vote for them in the midterms (as the polling data presently indicates a landslide for the Republican party).

When I read through this article, I realize the author highlighted a very common problem I observe in human interactions (which I will admit I have also been guilty of). The author is demanding to receive forgiveness for their conduct, but in their apology, is refusing to admit they did anything wrong. In order to accomplish this, they utilized a variety of manipulative rhetorical constructs that are relatively simple and frequently utilized. [..] Thinking about this article more, I believe the fundamental logical error in this article is that leaders should be absolved of their responsibility for making incorrect decisions if there was a degree of uncertainty with the information at hand.

This is not the standard we have held our leaders to, as their job is always to make the best decision they can with the information that is available, and in most eras, if the decision was correct they were praised for their leadership, whereas if the decision was incorrect they were blamed for their mistakes. The “but I couldn’t have known!” excuse has never been deemed an acceptable way for leaders to justify their mistakes. In the past, leaders have successfully navigated much greater degrees of uncertainty. In the case of COVID-19, Ron DeSantis, who had no previous training in public health or medicine, was able to look at the data himself and correct discern what policy needed to be followed.

Although DeSantis deserves praise for his leadership, the fact that he was able to successfully figure this out without a scientific background demonstrates that the degree of “uncertainty” here was clearly manageable. As this post shows, it can credibly be argued much of this article was intentionally deceptive. What I am more surprised by is the degree of a lack of insight the author shows into the mistakes that were made. I should note that this is very common behavior you will observe from those who have been influenced by cults or cult like groups. As one reader remarked, it is astounding how much the quality of journalism has declined over the last few years and that an article of that quality made it to publication.

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.