Gustave Doré Dream of the Eagle (Dante’s Purgatory) 1868

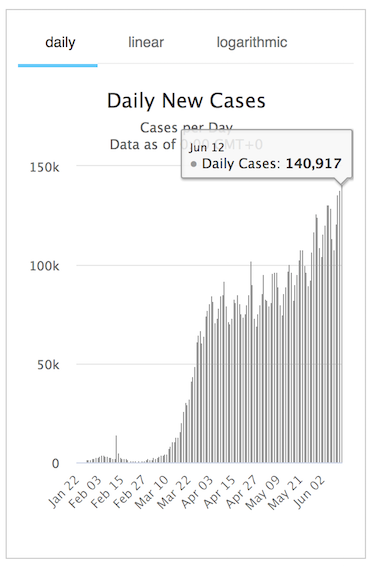

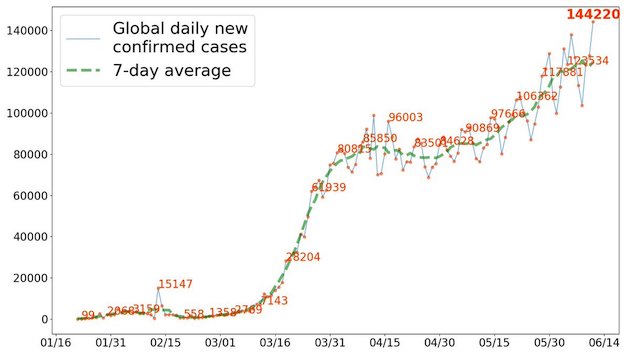

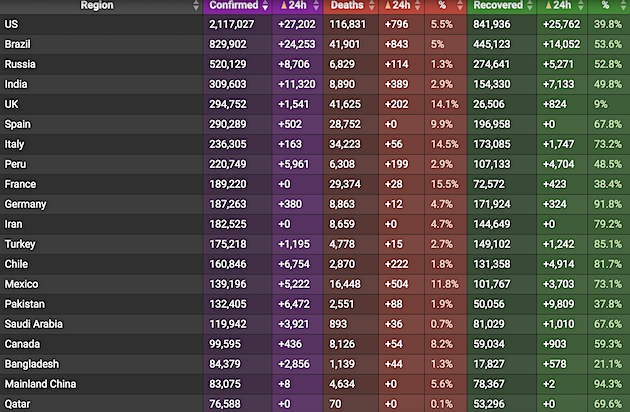

Worldometer reports new cases for June 9 (midnight to midnight GMT+0) at + 140,917. New record.

My count from about 6 am EDT to 6 am EDT is + 141,854 cases.

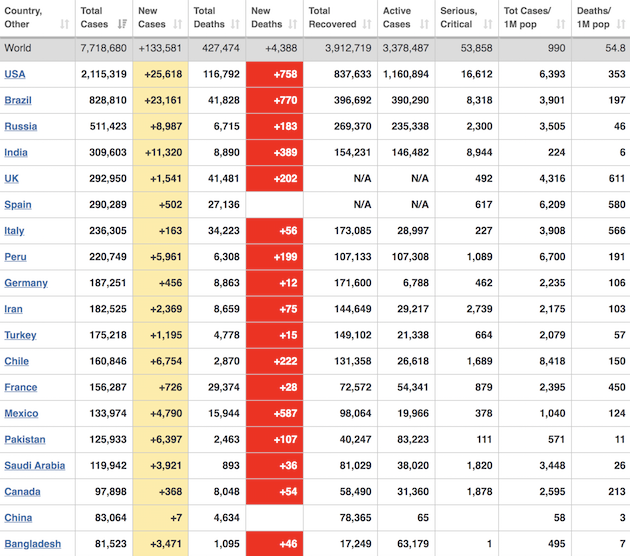

New cases past 24 hours in:

• US + 27,221

• Brazil + 25,982

• Russia + 8,706

• India + 11,320

• Pakistan + 6.472

• Chile + 6,754

• Mexico + 5,222

US coronavirus deaths

90 days ago: 58 deaths

80 days ago: 704 deaths

70 days ago: 7,152 deaths

60 days ago: 23,649 deaths

50 days ago: 49,887 deaths

40 days ago: 67,682 deaths

30 days ago: 84,118 deaths

20 days ago: 97,087 deaths

10 days ago: 106,180 deaths

Today: 116,831 deaths

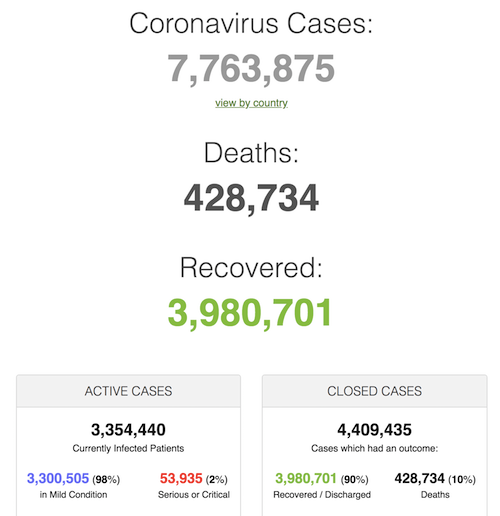

• Cases 7,763,875 (+ 141,854 from yesterday’s 7,622,021)

• Deaths 428,734 (+ 4,409 from yesterday’s 424,325)

⚠️AIRBORNE is the “dominant” route for the coronavirus transmission! New PNAS paper by a Nobel laureate’s group concludes this based on study of several studies and how transmission wasn’t truly slow until mask rules went into place. MASKS FOR ALL, please. https://t.co/nmergxbW20

— Eric Feigl-Ding (@DrEricDing) June 12, 2020

From Worldometer yesterday evening -before their day’s close-:

From Worldometer:

From COVID19Info.live:

The number only becomes significant when you read that only 560 patients have been reported.

• 32 Yemen Doctors Die Of Coronavirus (MEM)

Some 32 doctors in Yemen have died as a result of the coronavirus, the Yemeni Physicians and Pharmacists Syndicate announced yesterday. Doctor Mohammed Ahmed Seif was the latest fatality, he died in the southern province of Taiz. “Seif is the 32nd martyr from coronavirus,” the syndicate said in a statement. By Wednesday, a total of 560 people were reported to have been infected by the virus, 129 of whom have died and 23 have recovered, according to official data. The data does not include the Houthi-controlled areas, which were reported to have registered a total of four infections and one fatality, though many fear the actual number is far higher.

On Monday, the United Nations (UN) said that the mortality rate from the virus in Yemen was “alarmingly increasing”, warning of what it described as a “deteriorating health system”. Since 2014, Yemen has been suffering from an ongoing war between pro-government forces and the Houthis, who have captured most of the north, including the capital, Sanaa.

What’s the use of this? Is it not a case for Parliament instead?

• Italian Prosecutors Question PM Conte For 3 Hours Over Virus Response (R.)

Italian Prime Minister Giuseppe Conte was questioned by prosecutors on Friday about the country’s response to its coronavirus outbreak, which has killed more than 34,000 people. The prosecutors from Bergamo, one of the northern cities hit hardest by the pandemic, are looking into why badly affected small towns around the city were not locked down earlier in the outbreak, when infections were rising fast. Conte, who was questioned as a witness for three hours in his office in Rome and is not under criminal investigation, later told reporters via his spokesman: “I wanted to explain every stage to the smallest detail.” Prosecutors also questioned Interior Minister Luciana Lamorgese and Health Minister Roberto Speranza.

In interviews with several Italian newspapers on Friday, Conte said he would tell prosecutors everything he knew and was not worried by the possibility he could be personally investigated. If that did happen, it would be likely to weaken an already fractious coalition government and add fuel to already frequent speculation that Conte may be pushed out despite his high personal approval ratings in opinion polls. Prosecutor Maria Cristina Rota said the meeting had taken place “in an atmosphere of great calm and institutional collaboration”. The region of Lombardy, which includes Bergamo, was the original epicentre of Italy’s virus outbreak and has remained by far the worst hit of its 20 regions, accounting for about half of its total deaths and most new infections.

The decision not to isolate Bergamo and the surrounding towns has been one of the most contentious episodes, with the central government and Lombardy’s regional authorities each saying the other was responsible. In Lombardy, which is led by the right-wing opposition League party, the Bergamo prosecutors have already interrogated the regional president and health chief. League leader Matteo Salvini was quick to seek political capital from Conte’s interrogation, tweeting that it was Rome’s decision not to set up a so-called “red zone” to seal off Bergamo and enforce it with the army and police. “Now we expect that Conte will at least apologise to the relatives and the friends of too many Bergamo citizens who have died,” he tweeted.

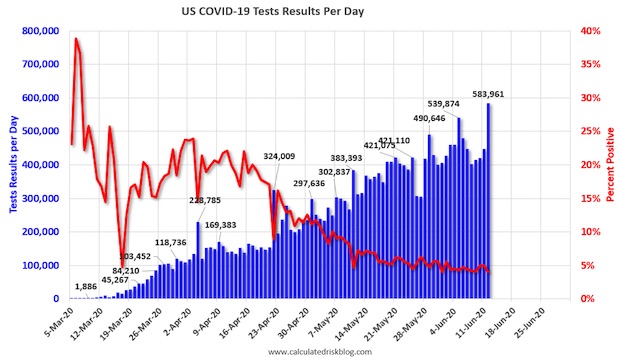

US still not testing nearly enough. Like so many other countries. Without testing there’s no crushing the curve.

• June 12 COVID-19 Test Results (McBride)

Note: I started posting this graph when the US was doing a few thousand tests per day. Clearly the US was way under testing early in the pandemic. I’ll continue posting this graph daily at least until the percent positive is continuously under 3% and the daily positive is significantly lower than today.

The US is now usually conducting over 400,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly. According to Dr. Jha of Harvard’s Global Health Institute, the US might need more than 900,000 tests per day . There were 583,961 test results reported over the last 24 hours. This was a new high for the number of test results reported (some states might have had a data dump). The percent positive over the last 24 hours was 4.1% (red line).

Except for protests.

What on earth will happen if a new lockdown is declared? Should have done the first one right.

• CDC Warns Restrictions May Be Needed Again If US COVID-19 Cases Spike (R.)

U.S. health officials on Friday urged Americans to continue adhering to social distancing and other COVID-19 safety measures, and warned that states may need to reimpose strict restrictions if COVID-19 cases spike. In recent weeks, experts have raised concerns that the reopening of the U.S. economy could lead to a fresh wave of infections. About half a dozen states, including Texas and Arizona, are grappling with a rising number of coronavirus patients filling hospital beds. Officials from the U.S. Centers for Disease Control and Prevention (CDC) said the public should continue to maintain 6 feet of social distance, wash hands regularly and wear facial coverings to reduce the risk of infection.

“If cases begin to go up again, particularly if they go up dramatically, it is important to recognize that more mitigation efforts such as what were implemented back in March may be needed again,” said Jay Butler, the deputy director of infectious diseases at the CDC, who spoke to reporters along with CDC Director Robert Redfield. As the United States reopens its economy, a number of U.S. states, including Texas, Arizona and Florida, have relaxed social distancing guidelines in recent weeks. Many U.S. states also do not require residents to wear protective masks. Most Americans support stay-at-home orders and said they always or often wear face coverings in public , according to an online survey conducted early May of over 2,000 adults in New York City and Los Angeles. Most also said they would feel unsafe if restrictions were lifted.

In the history books this will be known as: “How Medicare for All Got Started.”

• Seattle Coronavirus Survivor Gets A $1.1 Million, 181-Page Hospital Bill (ST)

Remember Michael Flor, the longest-hospitalized COVID-19 patient who, when he unexpectedly did not die, was jokingly dubbed “the miracle child?” Now they can also call him the million-dollar baby. Flor, 70, who came so close to death in the spring that a night-shift nurse held a phone to his ear while his wife and kids said their final goodbyes, is recovering nicely these days at his home in West Seattle. But he says his heart almost failed a second time when he got the bill from his health care odyssey the other day. “I opened it and said ‘holy [bleep]!’ “ Flor says. The total tab for his bout with the coronavirus: $1.1 million. $1,122,501.04, to be exact. All in one bill that’s more like a book because it runs to 181 pages.

The bill is technically an explanation of charges, and because Flor has insurance including Medicare, he won’t have to pay the vast majority of it. In fact because he had COVID-19, and not a different disease, he might not have to pay anything — a quirk of this situation I’ll get to in a minute. But for now it’s got him and his family and friends marveling at the extreme expense, and bizarre economics, of American health care. Flor was in Swedish Medical Center in Issaquah with COVID-19 for 62 days, so he knew the bill would be a doozy. He was unconscious for much of his stay, but once near the beginning his wife Elisa Del Rosario remembers him waking up and saying: “You gotta get me out of here, we can’t afford this.”

Just the charge for his room in the intensive care unit was billed at $9,736 per day. Due to the contagious nature of the virus, the room was sealed and could only be entered by medical workers wearing plastic suits and headgear. For 42 days he was in this isolation chamber, for a total charged cost of $408,912. He also was on a mechanical ventilator for 29 days, with the use of the machine billed at $2,835 per day, for a total of $82,215. About a quarter of the bill is drug costs.

For now, I’ll stick to the pandemic having become embedded, but not yet endemic.

Ben’s point is salient: if -when- COVID19 becomes endemic, other health care options must vanish, while premiums rise.

• No Country for Old Men (Ben Hunt)

Connecticut is opening up a bit, so I’ve got an outpatient surgery scheduled at the big local hospital (specialty clinics are still closed) next Friday. I feel lucky to get on the calendar so soon. I also feel nervous. My dad was an ER doc. My brother is a healthcare lawyer. Again, these are things that have certainly made an impression on me. To be clear, my lack of healthcare options today and over the past 3 months isn’t because of the lockdown. That’s how a child would see this. My lack of healthcare options is because of the virus. In its acute phase, Covid-19 shuts down non-emergency healthcare provision entirely. In its endemic phase, Covid-19 forces enormous and costly changes in healthcare provision. There is no “v-shaped recovery” for medicine. Covid-19 is now in its endemic phase. The enormous and costly changes in healthcare provision that Covid-19 requires and the resulting impact on healthcare consumption lead me to three conclusions about the healthcare industry and national politics.

Conclusion #1: Endemic Covid-19 permanently dents healthcare provision (and consumption). The days of “efficient” (i.e., insanely lucrative) specialty medical clinics where docs go through 3 knee replacements or 10 lasik procedures in an afternoon are GONE.

Conclusion #2: Although both acute and endemic Covid-19 sharply reduce my healthcare options and healthcare consumption, my healthcare insurance costs have not gone down. They’ve gone up. Healthcare payers (insurance cos) are a public utility. They should be regulated as such. #BITFD

Conclusion #3: For the past 30 years, US fiscal policy has been largely driven by Boomers’ insatiable demand for more and more healthcare, to the advantage of both the Dems AND the GOP. Covid-19 destroys that cozy political dynamic, but neither party realizes this yet.

I’m sure we can find a few very wrong things that the Queen is, or has been, invested in. Why stop here?

• Churchill Statue Boarded Up Ahead Of Expected UK Protests On Saturday (R.)

Statues of historical figures including Winston Churchill have been boarded up ahead of more expected protests on Saturday as Prime Minister Boris Johnson said it was “shameful” that the monument to Britain’s wartime leader was at risk of attack. Anti-racism protesters, who have taken to the streets following the death of African American George Floyd, have put statues at the forefront of their challenge to Britain’s imperialist past. A statue of Edward Colston, who made a fortune in the 17th century from the slave trade, was torn down in the city of Bristol last Sunday, and authorities have acted to protect monuments they believe could be next.

They have now boarded up a statue opposite parliament of Churchill after demonstrators daubed it with paint last weekend. “It is absurd and shameful that this national monument should today be at risk of attack by violent protesters,” Johnson wrote on Twitter. On Friday, around 500 people gathered in Hyde Park chanting “the UK is not innocent” and “Black Lives Matter”, before marching through central London, with many saying that statues such as Colston’s were legitimate targets. “If we have these big images, and we’re telling people that these people and what they stood for is OK, we’re just allowing everything that they did to pass,” said student Samantha Halsall.

Meanwhile in Britain:

Next up: the music scene. Imagine what they can do to country music.

• Films Aiming To Win Oscars Will Need To Meet Diversity Criteria – Academy (R.)

The organization that hands out the Academy Awards said Friday it would form a group to develop diversity and inclusion guidelines that filmmakers will have to meet in order for their work to be eligible for Oscars. The Academy of Motion Picture Arts and Sciences, which has been criticized for honoring few movies and creators of color, said the move and other steps represented a new phase of a 5-year effort to promote diversity. The group said in a statement it would work with the Producers Guild of America to convene a task force of industry leaders to develop “representation and inclusion standards” for Oscars eligibility by July 31 that will “encourage equitable hiring practices on and off screen.”

The rules will not apply to films vying for Oscars at the next ceremony in 2021. Criticism of the movie academy intensified in 2015 with the hashtag #OscarsSoWhite, a backlash against an all-white field of acting contenders. The academy responded in part by doubling the number of women and people color in its invitation-only ranks. Still, by 2019 just 32% of its roughly 8,000 members were women, and 16% were people of color. New members will be announced next month. “We know there is much more work to be done in order to ensure equitable opportunities across the board,” Academy Chief Executive Dawn Hudson said. “The need to address this issue is urgent.”

Good theme, pretty weak execution. The press has been destroying itself for years. Everything they say has become full-blown partisan.

• The American Press Is Destroying Itself (Taibbi)

Probably the most disturbing story involved Intercept writer Lee Fang, one of a fast-shrinking number of young reporters actually skilled in investigative journalism. Fang’s work in the area of campaign finance especially has led to concrete impact, including a record fine to a conservative Super PAC: few young reporters have done more to combat corruption. Yet Fang found himself denounced online as a racist, then hauled before H.R. His crime? During protests, he tweeted this interview with an African-American man named Maximum Fr, who described having two cousins murdered in the East Oakland neighborhood where he grew up. Saying his aunt is still not over those killings, Max asked:

“I always question, why does a Black life matter only when a white man takes it?… Like, if a white man takes my life tonight, it’s going to be national news, but if a black man takes my life, it might not even be spoken of… It’s stuff just like that that I just want in the mix.”

Shortly after, a co-worker of Fang’s, Akela Lacy, wrote, “Tired of being made to deal continually with my co-worker @lhfang continuing to push black on black crime narratives after being repeatedly asked not to. This isn’t about me and him, it’s about institutional racism and using free speech to couch anti-blackness. I am so fucking tired.” She followed with, “Stop being racist Lee.” [..] If there’s an edge to Fang at all, it seems geared toward people in our business who grew up in affluent circumstances and might intellectualize topics that have personal meaning for him.

In the tweets that got him in trouble with Lacy and other co-workers, he questioned the logic of protesters attacking immigrant-owned businesses “with no connection to police brutality at all.” He also offered his opinion on Martin Luther King’s attitude toward violent protest (Fang’s take was that King did not support it; Lacy responded, “you know they killed him too right”). These are issues around which there is still considerable disagreement among self-described liberals, even among self-described leftists. Fang also commented, presciently as it turns out, that many reporters were “terrified of openly challenging the lefty conventional wisdom around riots.”

[..] Max himself was stunned to find out that his comments on all this had created a Twitter firestorm. “I couldn’t believe they were coming for the man’s job over something I said,” he recounts. “It was not Lee’s opinion. It was my opinion.” By phone, Max spoke of a responsibility he feels Black people have to speak out against all forms of violence, “precisely because we experience it the most.”

Jim reintroduces Hillary as a candidate. But I think she is simply too unpopular.

• The Party of Chaos and Falsehood (Jim Kunstler)

The Democratic Party Resistance apparently believes that all this mayhem, and the false sanctimony excusing it, works to their advantage in the coming national election. They may be disappointed about how that works out, as they’ve been disappointed in three years of previous gambits to overthrow the government and seize power by any means necessary. The picture of them is resolving into the party of bad faith, foul play, coercion, and tyranny. Even the corona virus scare carries a taint of Resistance manipulation. One moment the populace is hustled into an economically devastating lockdown; and then suddenly, on a fine spring day, they’re incited to mix in moiling mobs of street protests with the predictable result of a fresh spike in virus contagion and the possibility of a second lockdown.

Like many activities in our national life lately, it’s another hostage racket, and, guess what, you’re the hostage. Their most transparent artifice is the utterly false elevation of Joe Biden as their candidate for president. Everybody knows he’s incapable of performing the job, and probably even of functioning through a campaign. His inchoate utterances on events and policy make Donald Trump sound like Ralph Waldo Emerson. He’s left behind himself an evidence trail of financial crimes running to at least nine digits of grift. And, of course, if you believe all women, he’s a sexual molester. Everything about his public presentation is false, including his hair, teeth, and soul. This past week, his handlers posed him as Grief Counselor-in-Chief (via video from his basement) at the state funeral for George Floyd, accompanied by an inspirational music soundtrack to shore up the sham sentimentality.

Never have so many hollow platitudes been woven into such garment of alternative reality for public consumption. Most pathetically of all, the audience of mourners, mere props, as black America has long been employed by the cynical party, went along with the charade that George Floyd was a model citizen and father, now soaring on golden wings to the place on high where you don’t need methedrine and fentanyl to feel happy. A couple of days later, Democratic Party bigwig and Clinton henchperson, Terry McAuliffe, told a meeting of the faithful that Joe Biden should remain confined to his basement. In a matter of weeks, you may be sure, we’ll learn that the party is compelled to draft Hillary Clinton as poor Joe’s replacement. It can’t be helped. Her turn will not be denied, even if she has to destroy the country to take it.

Everyone agrees and knows the case will be dismissed. But the “lead” judge says: “There’s nothing wrong with him holding a hearing; there’s no authority I know of that says he can’t hold a hearing,”

No wonder people think thiis all just to get this past the election. But I’m convinced Flynn and Sidney Powell have long seen this coming.

• Lawyer For Flynn Judge Says Court Will Eventually Dismiss The Case (JTN)

A lawyer representing the judge overseeing the Michael Flynn trial suggested Friday that the court will eventually dismiss the case against the former Trump national security adviser, arguing that the judge’s decision to call in outside opinions on the matter was merely an issue of seeking advice before the probable dismissal. The lawyer, Beth Wilkinson, made the acknowledgement during a roughly two-hour federal appeals court hearing on whether the court should order a lower court to immediately dismiss the case, as was requested last month by the Justice Department, or allow the case to proceed through at least July.

“There’s no reason at this point to fear that the District Court is going to deny the government’s motion to dismiss,” she told the three-judge panel Friday morning, stating that the lower court is simply “getting advice” from third parties before likely doing so. It was unclear at the end of hearing, at about noon, when the panel of judges—Neomi Rao, Robert Wilkins and Karen Henderson—would make a decision. A ruling could come before the weekend but is expected to likely happen no sooner than Monday. Principal Deputy Solicitor General of the United States Jeff Wall argued Friday in the virtual hearing that the federal government has gone “beyond what we thought we were obligated to do” in explaining its reasoning behind its dismissal request, and that Sullivan should honor that decision and drop the case rather than draw it out.

“There’s no reason not to take that final step. This has already become, and I think is only becoming more of, a public spectacle,” he said, arguing that the appeals court should force the lower court to end the trial. Sidney Powell, one of Flynn’s attorneys, made similar arguments, saying the Justice Department provided an “extensive and thoroughly documented” argument in favor of dropping the case and that Sullivan should obey the request and bring the prosecution to an immediate end. The trial “cannot go on any longer,” Powell argued, claiming that the judge overseeing the case “has no authority” to continue it after the executive branch requested it be dropped.

Failing to bring the trial to an end immediately, Powell said, would simply be “delaying the inevitable,” arguing that Sullivan will eventually be found to have exceeded his authority in this case. Yet the court at times appeared reluctant to quickly dismiss the case. Henderson pointed out that Sullivan has scheduled a hearing for July on the matter instead of electing to keep the trial “waiting and languishing.” “There’s nothing wrong with him holding a hearing; there’s no authority I know of that says he can’t hold a hearing,” she said.

“Eventually“

after the election

am I right or am I right https://t.co/ypjlm2GadK

— ThunderB, DennisTuttle’sLifeMattered (@ThunderB) June 12, 2020

TEXT

• Judges Appear Skeptical Of DOJ Move To Dismiss Flynn Case (Fox)

Judges on a D.C. appeals court Friday seemed skeptical of arguments that they should force a federal judge to dismiss a case against President Trump’s former National Security Adviser Michael Flynn as sought by the Department of Justice (DOJ) – after Flynn’s lawyer said the case was “concocted” and slammed previous “government misconduct” against him. The unusual move from Judge Emmet Sullivan to keep the case alive despite prosecutors’ wishes was preceded by an unusual move from the DOJ itself to drop the charges against Flynn even after he had pleaded guilty – saying the FBI interview that led to his charge of lying to investigators had no “legitimate investigative basis.”

But the long-running case continues to drag on. The latest twist involved the higher D.C. appeals court panel agreeing to review the handling of the matter. After Sullivan moved to accept input from outside parties, he was called to defend his own decisionmaking before the panel in response to a petition from Flynn to force the judge to let the case die. At issue is the discretion of the judiciary to delay, deny or question the prosecution’s decision to continue pursuing a criminal case. “This record contains enormous evidence now of government misconduct,” Flynn’s lawyer Sidney Powell said. She added that she believes Sullivan doesn’t have the authority to do anything but approve the DOJ motion, and that continuing the case would be an unnecessary burden on Flynn.

“We would simply be delaying the inevitable,” Powell said. “He just got dumped on a 72-page brief that we have to answer by Wednesday … the toll it takes on a defendant to go through this is absolutely enormous.” “The government’s just wasting resources out the wazoo,” she said. Powell also complimented the government’s claim that the case against Flynn was flawed: “This is the most impressive motion to dismiss I have ever seen in decades of practice.” [..] For his part, government lawyer Jeff Wall told the judges that it is the government’s position that it does not need to tell the court all of the reasons why it wants to dismiss a case — just those it chooses to disclose.

“..the president’s attack on the Russia investigation..”?

The 3-year $40 million investigation ended in utter and complete disgrace for Robert Mueller and the people who appointed him, and now you’re saying none of this should be looked into?

• Graham Granted Significant Subpoena Power For Russia Probe Investigation (JTN)

Senate Judiciary Committee Chairman Lindsey Graham on Thursday was granted broad subpoena power in his probe into the federal government’s 2016 Russia-Trump campaign probe, allowing him call more than 50 people for interviews, including high-profile Obama administration officials. Graham received the authorization in a party-line vote in the GOP-controlled committee. “I find myself in a position where I think we need to look long and hard about how the Mueller investigation got off the rails. This committee is not going to sit on the sidelines and move on,” said Graham, a South Carolina Republican.

The committee is currently conducting a broad investigation into the 2016 Russia probe, including “Crossfire Hurricane,” which was the FBI’s name for their investigation into Russian election interference by way of the Trump campaign. The FBI’s actions during that operation gave way to what is broadly referred to as the (now mostly debunked) Russia-collusion narrative. With Thursday’s vote, Graham now has the authority to subpoena former intelligence officials, including former FBI Director James Comey, former national security adviser Susan Rice, and former Director of National Intelligence James Clapper.

The committee chairman has also been granted the authority to subpoena documents and records reference in Justice Department Inspector General Michael Horowitz’s report assessing the use of FISA warrants against former Trump campaign aide Carter Page. Tensions ran high during the committee meeting in which member voted on the subpoenas. To issue a subpoena, the committee chairman needs to either strike a deal with the top Democrat – now California Sen. Dianne Feinstein – or secure a majority vote by the committee. Republicans hold a 12-10 majority, so they were able to grant Graham unilateral subpoena power, rejecting several amendments by the Democrats.

“Unfortunately, it appears that Senate Republicans now plan to spend the next several months bolstering the president’s attack on the Russia investigation and his Democratic nominee, Democrat Joe Biden. Congress should not conduct politically motivated investigations designed to attack or help any presidential candidate,” Feinstein said.

Joe Biden doesn't know what Juneteenth is:

"He’s going down to Texas on Juneteenth, right? The first major massacre … of the Black Wall Street, right?"

1. President Trump is going to Texas today, not June 19

2. Juneteenth is about emancipation

3. The massacre was in Oklahoma pic.twitter.com/vpNDQLwqBj— Trump War Room – Text TRUMP to 88022 & get the APP (@TrumpWarRoom) June 11, 2020

Compared to actual news these days, even this is light reading.

• Some Claim Mayan Calendar Was Wrong, ‘World Will End On June 21’ (Mirror)

From the coronavirus pandemic to an influx of terrifying murder hornets, 2020 has thrown a number of tricky obstacles in humanity’s way. But the worst is yet to come, according to conspiracy theorists, who claim that the world will end next week. The bizarre theory is based on the fact that when the Gregorian calendar was introduced in 1582, 11 days were lost from the year, to better reflect the time it takes Earth to orbit the sun. While 11 days might not sound a lot, over 286 years it adds up, with some conspiracy theorists claiming we ‘should be in 2012.’ In a now-deleted Twitter post, scientist Paolo Tagaloguin said: “Following the Julian Calendar, we are technically in 2012.

“The number of days lost in a year due to the shift into Gregorian Calendar is 11 days. For 268 years using the Gregorian Calendar (1752-2020) times 11 days = 2,948 days. 2,948 days / 365 days (per year) = 8 years”. According to this theory, June 21 2020 should actually be December 21, 2012. If you cast your mind back to 2012, you may remember various theories, indicating the world would end on December 21. NASA said: “The story started with claims that Nibiru, a supposed planet discovered by the Sumerians, is headed toward Earth. This catastrophe was initially predicted for May 2003, but when nothing happened the doomsday date was moved forward to December 2012 and linked to the end of one of the cycles in the ancient Mayan calendar at the winter solstice in 2012 – hence the predicted doomsday date of December 21, 2012.”

We try to run the Automatic Earth on people’s kind donations. Since their revenue has collapsed, ads no longer pay for all you read, and your support is now an integral part of the interaction.

Thank you.

Hard to tell if I recorded this 30 years or 10 minutes ago… pic.twitter.com/GPDURhYIJL

— John Cleese (@JohnCleese) June 12, 2020

https://twitter.com/i/status/1271121354226642948

Apparently a happy mountain lion sounds exactly like an idling car engine pic.twitter.com/efj0ctxGE1

— Life on Earth (@planetpng) June 11, 2020

Five months into 2020, and there has been a huge, record-breaking warm anomaly over Asia (up to +8°C).

If 2020 goes on to be the warmest recorded year, despite the lack of an El Niño event, then this year's monstrous Asian anomaly will be the reason why.https://t.co/vjpQnxMaHJ pic.twitter.com/raPOz241HP

— Robert Rohde (@RARohde) June 12, 2020

Support the Automatic Earth in virustime.