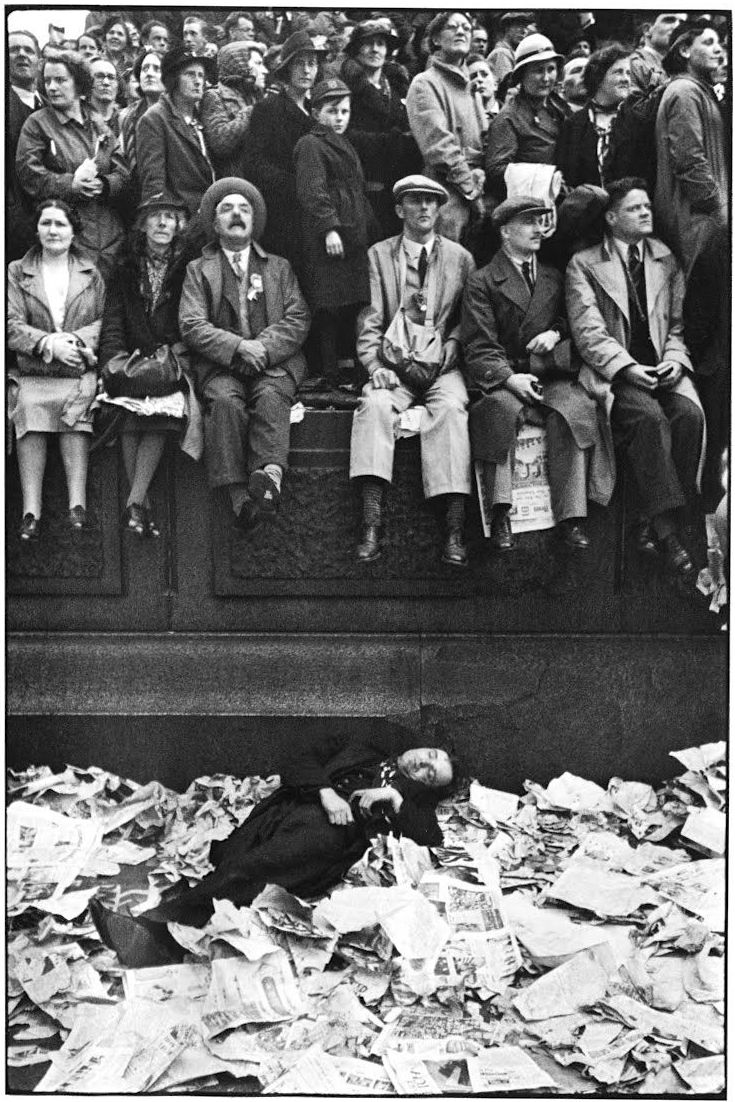

Russell Lee South Side market, Chicago 1941

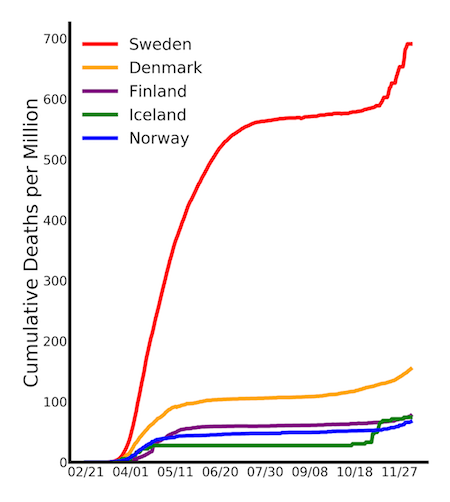

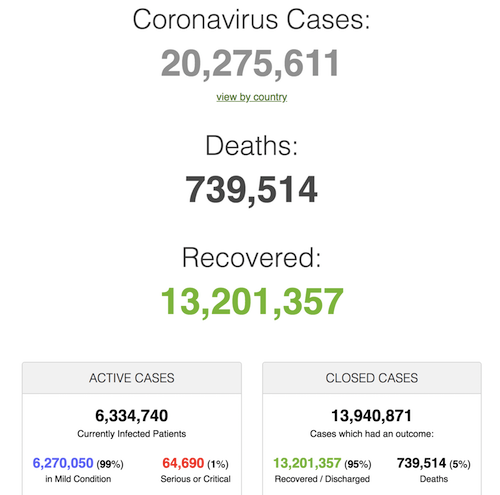

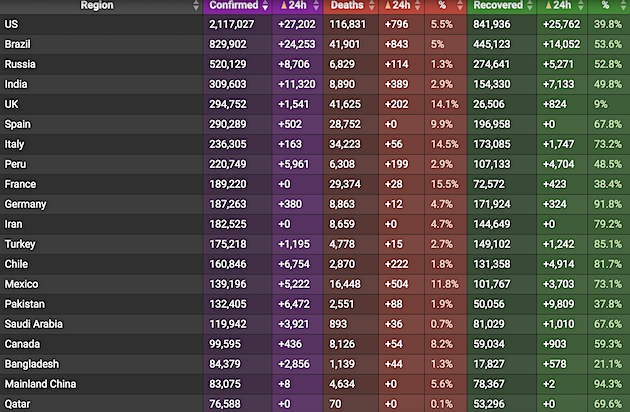

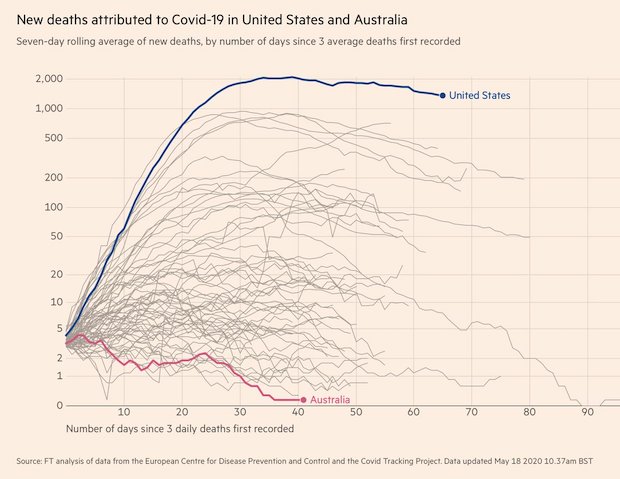

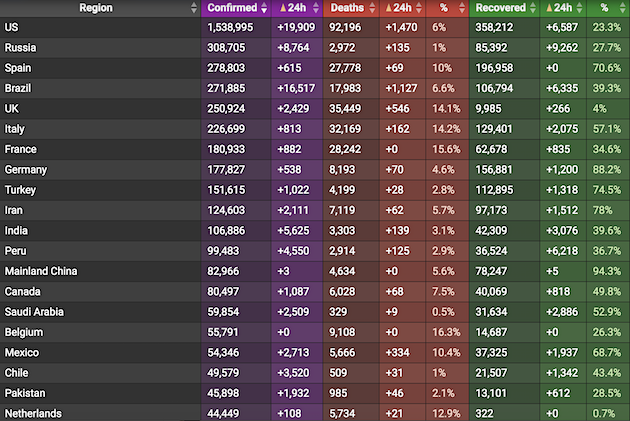

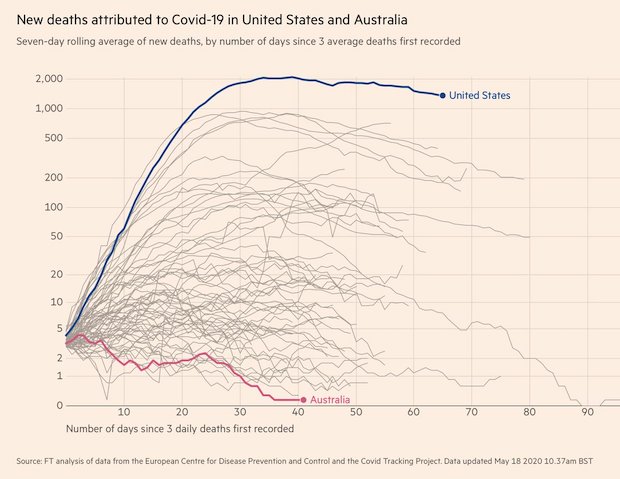

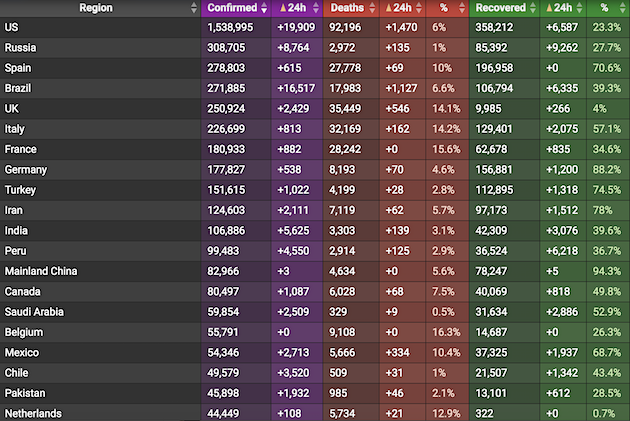

• Global cases top 5,000,000

• Russia +8,764 (down from 9,263 May 19 and 9709 May 18)

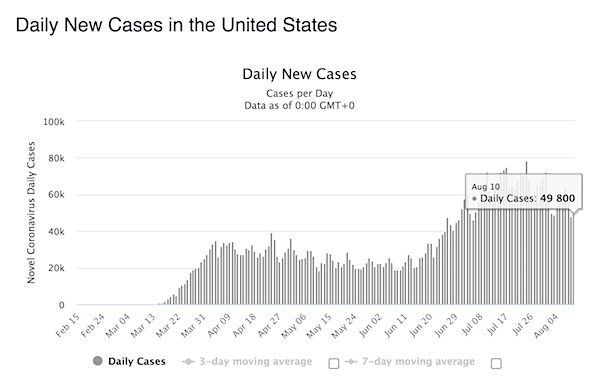

• US records over 21,000 new cases in past 24 hours

• US records 1,536 new deaths (vs 759 day before),

• Total US deaths 93,533, projected to be 113,000 by mid-June

Yesterday I wrote: Obesity means having a body mass index (BMI) of greater than 30. Morbid obesity means having a BMI of 40 or higher.

Well, “according to the results of his medical exam released last year, Trump, 73, had a listed height of 6 feet, 3 inches and a weight of 243 pounds. That would put his body mass index at 30.4, which narrowly qualifies him in the “obese” category of 30 or greater.”

And very far removed from morbidly obese. But Pelosi said it anyway, and then “quipped” that she didn’t know he’d be offended by it. Fine, if that’s the level of conversation you want….. But what do you think will happen if he pays her back in kind? Don’t you dare complain, Nancy.

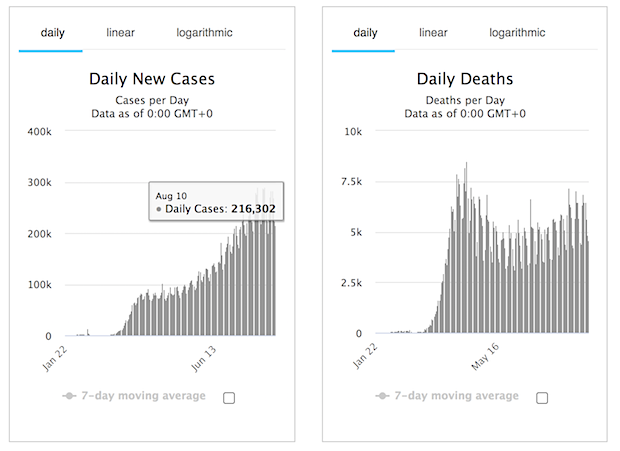

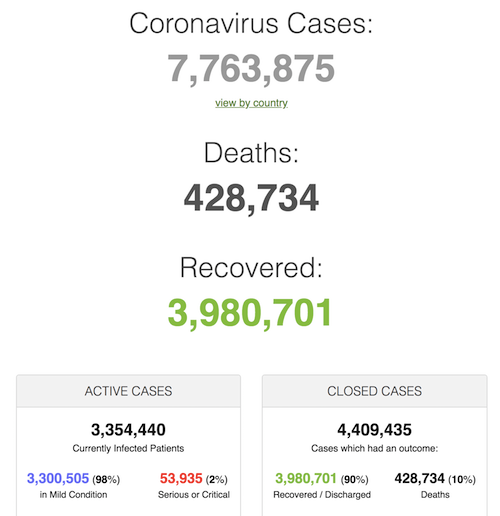

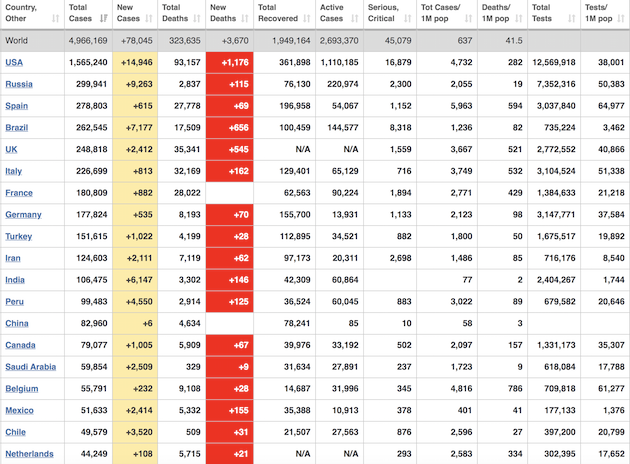

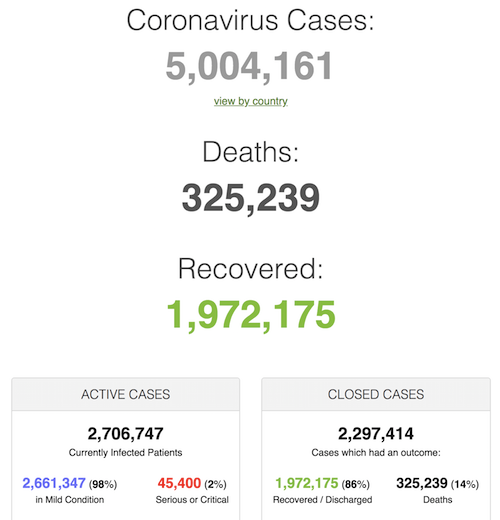

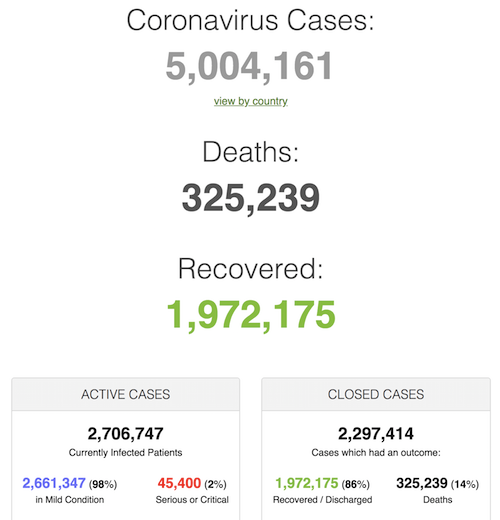

• Cases 5,006,675 (+ 94,955 from yesterday’s 4,911,720)

• Deaths 325,320 (+ 4,866 from yesterday’s 320,454)

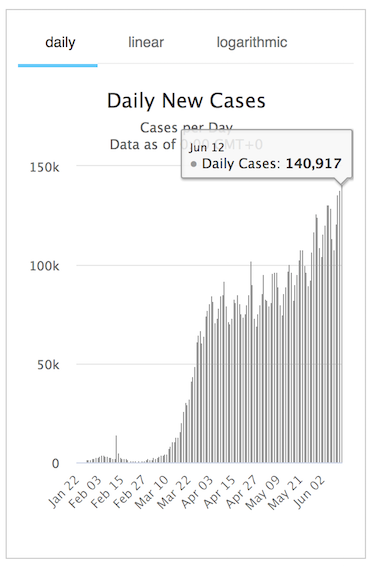

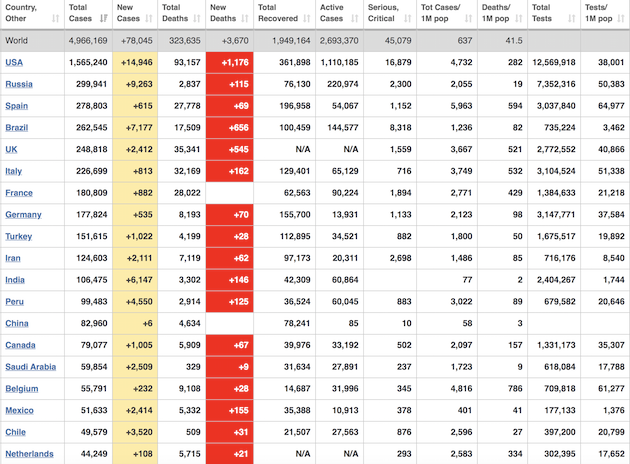

From Worldometer yesterday evening -before their day’s close-

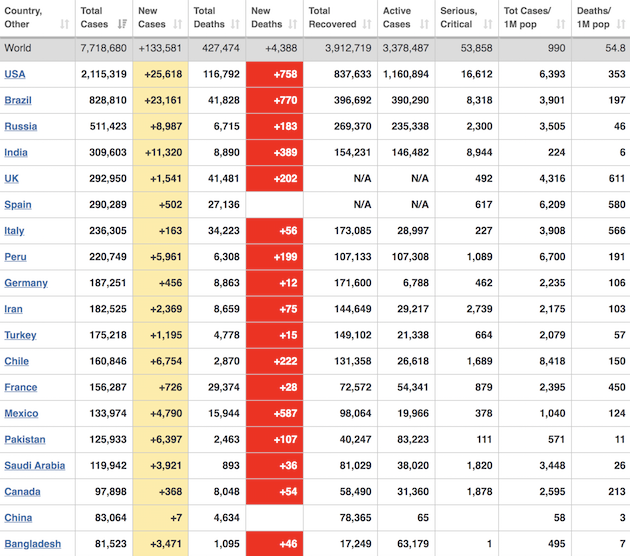

From Worldometer

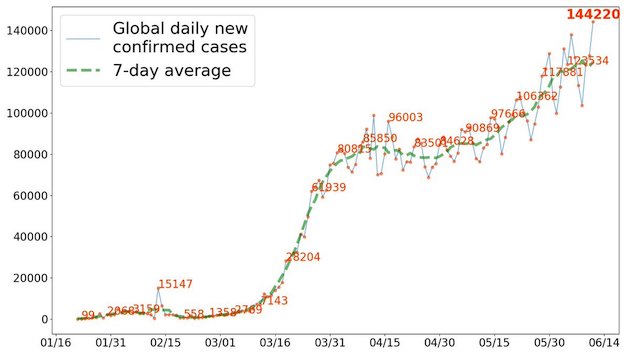

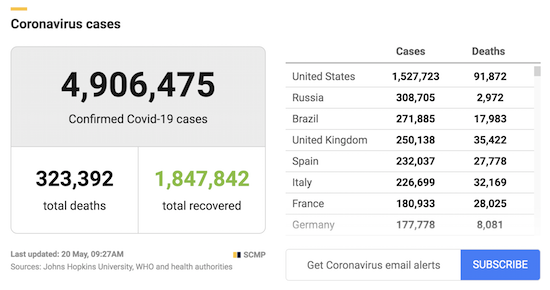

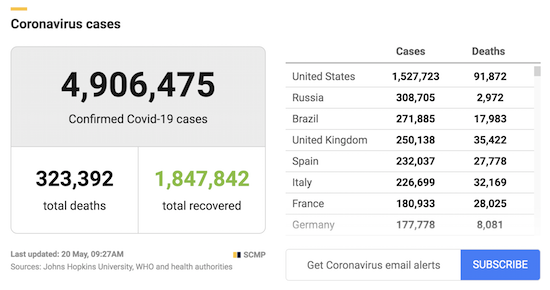

From SCMP:

From COVID19Info.live:

Tyler claims this is ground for reopening economies, but fear of reinfection has not been a major factor so far, it’s fear of first-time infection.

• Study Finds Recovered COVID Patients Who Test Positive Not Infectious (ZH)

[..] a study from the Korean Centers for Disease Control and Prevention has found that patients who test positive for COVID-19 after recovering from the illness appear to be shedding dead copies of the virus. That would suggest that these patients are not infectious, the scientists said, which helped dispel fears that some patients can remain infectious for months after being infected. While the study doesn’t answer every question about the virus’s longevity – such as patients who almost appear to have developed a “chronic” form of the illness because their symptoms have persisted for so long. But still, the finding was greeted as a major relief, and, if anything, should encourage economies to reopen more quickly, as a potential trigger for reinfection that had panicked some experts appears to be a non-issue.

The research also undermines the reliability of ‘antibody’ tests like the ones NY Gov Andrew Cuomo insisted would be ‘critical’ for NY’s reopening. The results mean health authorities in South Korea will no longer consider people infectious after recovering from the illness. Research last month showed that so-called PCR tests for the coronavirus’s nucleic acid can’t distinguish between dead and viable virus particles, potentially giving the wrong impression that someone who tests positive for the virus remains infectious. The research may also aid in the debate over antibody tests, which look for markers in the blood that indicate exposure to the novel coronavirus. Experts believe antibodies probably convey some level of protection against the virus, but they don’t have any solid proof yet. Nor do they know how long any immunity may last.

[..] As a result of the findings in the South Korea study, authorities said that under revised protocols, people should no longer be required to test negative for the virus before returning to work or school after they have recovered from their illness and completed their period of isolation. “Under the new protocols, no additional tests are required for cases that have been discharged from isolation,” the Korean CDC said in a report. The agency said it will now refer to “re-positive” cases as “PCR re-detected after discharge from isolation.” Some coronavirus patients have tested positive again for the virus up to 82 days after becoming infected. Almost all of the cases for which blood tests were taken had antibodies against the virus. If nothing else, this study is just the latest reminder of how much we don’t know about the virus.

Read more …

One study says nothing. Are you going to send your kids to school BECAUSE one Australian study says this?

• Australian Study: COVID19 Spreads In Schools ‘Considerably Less’ Than Flu (JTN)

A study out of Australia shows the spread of COVID-19 is not driven by children in educational environments, a finding expected to influence the ongoing debate about when to reopen schools in many Western countries. Authorities in the United States, the European countries and other nations around the world began shutting down schools in February and March under the assumption that schoolhouses – packed full of children and usually hotspots of community virus transmission – would contribute to major coronavirus outbreaks. Many public officials, particularly in the U.S., have vowed to keep schools closed until the fall and possibly beyond. Yet health authorities are beginning to question that approach to pandemic mitigation.

Soumya Swaminathan, the chief scientist at the World Health Organization, said last week that “children don’t seem to be getting severely ill from this infection,” that there “have not been big outbreaks in schools” where they have remained open, and that it sees “children are less capable of spreading” the virus. The study out of Australia, released last month by the National Centre for Immunisation Research and Surveillance, found that “SARS-CoV-2 transmission in children in schools appears considerably less than seen for other respiratory viruses, such as influenza.” The study determined that, out of hundreds of “close contacts” that were in proximity to numerous positive COVID-19 patients in a school environment, only a scant number contracted the disease there.

“In contrast to influenza, data from both virus and antibody testing to date suggest that children are not the primary drivers of COVID-19 spread in schools or in the community,” the researchers said. “This is consistent with data from international studies showing low rates of disease in children and suggesting limited spread among children and from children to adults,” they also said. The researchers do note that, in mid-March, the government advised parents to keep their children at home for online learning even as schools remained open. Following that advice, “face-to-face attendance in schools decreased significantly and this may have impacted the results of this investigation.” School holidays in early April may have also affected the results.

Read more …

Steve Keen: ‘Give $100,000 per person as a flat rate to everyone to eliminate the private debt..’

• Why Australia Must SPEND Its Way Out Of The COVID19 Crisis (DM)

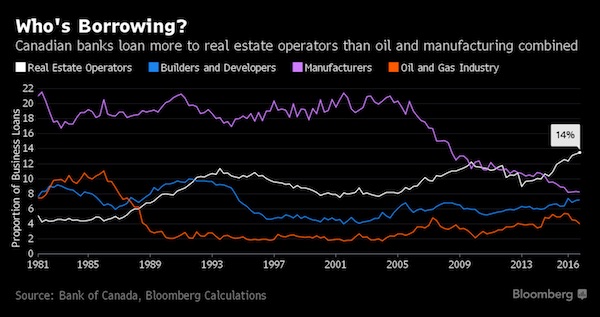

[Economist Martin North] said Australia just has to accept it’s been hit by a one-in-a-hundred-year storm and that the Budget will not be balanced for a long time. Australia’s government debt level is hovering around 30 per cent of GDP which is low compared to Japans which hit 238 per cent of GDP in 2018. ‘Interest rates have never been as low as now and from a debt servicing perspective we have the capacity to get more funds,’ he said. Mr North said now was the time to invest in solid nation-building infrastructure that would set the groundwork for the next 30 years of Australia’s future. However, Mr North said he feared the Government would be pressured to prop up old economic distortions such as the over-reliance on housing construction which fueled a house price bubble and unsustainable mass migration. ‘We can’t just go back to pre-covid days, it would be a major mistake,’ he said.

[..] Economist Leith Van Onselen, who worked for Treasury, Goldman Sachs and now writes for website Macrobusiness, said governments should take advantage of the low borrowing rates to build infrastructure now. ‘Not only would this help overcome Australia’s massive infrastructure deficit brought about by 15 years of mass immigration, but would also help stimulate the economy during a period of weak private demand and high unemployment,’ he told Daily Mail Australia. Mr Van Onselen said the nation-building benefits would be undone if the government reverted back to mass migration. ‘This would overload the new infrastructure and lift labour supply, thus being self defeating,’ he said. Wages had already stagnated due to an oversupply of labour before the coronavirus pandemic hit.

[..] Australia’s economy has also been distorted by runaway house prices in recent years. Professor Steve Keen of the University College of London said this had resulted in Australia’s private debt levels becoming the ‘biggest bubble in human history’ at 190 per cent of GDP, far greater than the government’s relatively modest debt to GDP ratio of 30 per cent. Professor Keen has advocated massive cash handouts to every Australian to get rid of the enormous levels of private debt so the economy can have a chance to recover. ‘Give $100,000 per person as a flat rate to everyone to eliminate the private debt,’ he told Daily Mail Australia.

The money would need to be distributed in such a way that it would go directly to paying down debt, Professor Keen said. But those without debt should still receive the payment so they are not penalised. The Australian economy may be unable to recover from the coronavirus shock unless the private debt burden is reduced, Professor Keen said. He said the solution was a debt jubilee, reducing private debt from 190 per cent of GDP to just 90 per cent of GDP.

Read more …

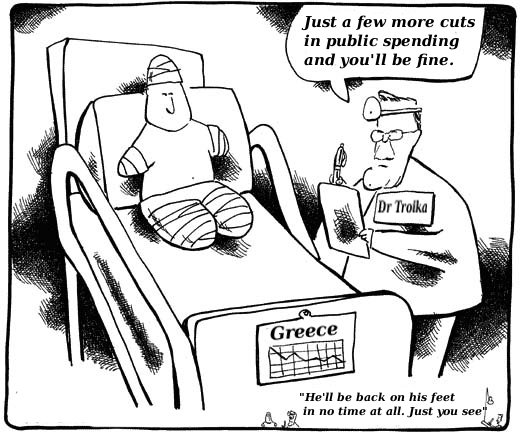

Guaranteed to fail spectacularly. The EU should stay out of this.

• EU Exec To Propose €1 Trillion Euro Recovery Plan With Grants And Loans (R.)

The European Commission will present a pandemic recovery plan next week that will exceed 1 trillion euros in a mix of grants and loans, Executive Vice President Valdis Dombrovskis said on Tuesday. Dombrovskis, speaking after a meeting of EU finance ministers, welcomed a proposal by France and Germany for a 500 billion euro fund to disburse grants to worst-hit regions and sectors. But he said the Commission would be bolder. “Our ambition is not to increase the financing capacity in the range of hundreds of billions, but rather by a figure exceeding a trillion euros,” he said. “Of course in this case we are talking about both in loans and grants.”

Dombrovskis said the Commission, like France and Germany, would link access to the recovery money to sound economic policies and structural reforms. This could become a friction point with Italy and Spain, worst affected by the epidemic, who are wary of northern fiscal hawks dictating policies in exchange for grants. “We not only need additional money for the recovery, but we also need reforms, we need to ensure a business environment that is conducive to investment,” Dombrovskis said. “So, as part of our recovery instrument, we intend to propose… a Recovery and Resilience Facility, which will be concentrating on investments and structural reforms,” he said.

Dombrovskis also said the recovery money would have to follow the EU’s long-term priorities of making the bloc climate-neutral by 2050, digitalising the economy and investing in research and innovation. mEU governments are divided if the recovery money should be loans or transfers, with the highly indebted southerners like Italy, Greece or Spain calling for grants and less indebted and fiscally frugal countries in favour of loans. The commission’s proposal on May 27, linking the Recovery Fund with the EU’s next long-term budget for 2021-2027, will be the basis for discussions of all EU governments in June. Dombrovskis said the Commission was examining if some of the cash could be available in 2020, but said most was likely to be available in 2021.

Read more …

“Spooky as it’s been, the Covid-19 virus has also been a great cover-story for the natural collapse of a severely unbalanced, ecologically unsound, and dishonestly represented set of arrangements..”

• The Great Opening-up (Jim Kunstler)

The current nostalgia for pre-Covid-19 business-as-usual is understandably intense. Gone especially from daily life are all the ceremonies of human togetherness, from gatherings of friends to the casual shoulder-rubbings of urban life to the crowded venues of the lively arts to the great moiling orgies of pro sports. The life of the perpetual jigsaw puzzle, YouTube, and Netflix has proved inadequate to human aspiration. Gone, too, are livelihoods, revenue streams, and rewarding roles in everyday existence. The itch to get out and do, get out and make, get out and be, is overwhelming. Behind those plain yearnings, though, looms the specter of a system that appeared to be already foundering before Covid-19 entered the scene.

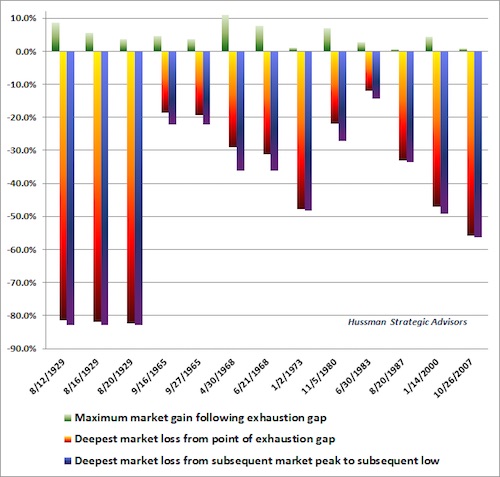

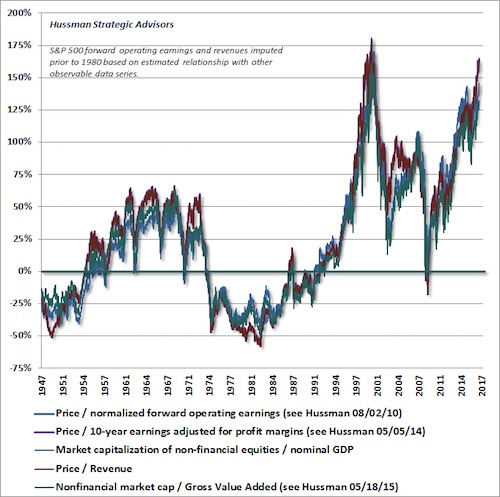

There is, at least, considerable agreement that the disease catalyzed the disorders of finance and economy and accelerated the damage – just not among the people most responsible for engineering the fragilities that actually crashed things Jerome Powell, Pope of the Church of the Federal Reserve, went on the 60-Minutes show last night to reassure the nation that things will eventually get back to normal. “I think you’ll see the economy recover steadily through the second half of this year.” Yessir, if you say so. Were his fingers crossed? You couldn’t tell because the camera had him framed in a head-shot. Personally, I think the Fed Chairman was blowing smoke up the nation’s wazoo. Spooky as it’s been, the Covid-19 virus has also been a great cover-story for the natural collapse of a severely unbalanced, ecologically unsound, and dishonestly represented set of arrangements that are now unspooling at horrifying speed.

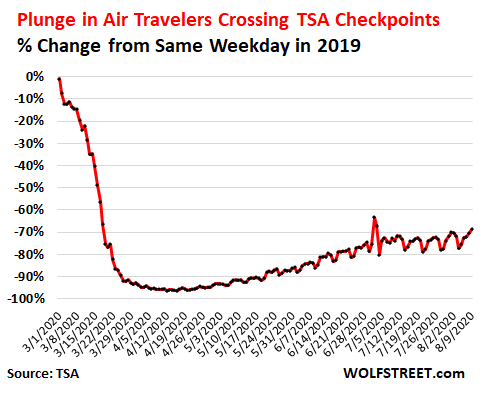

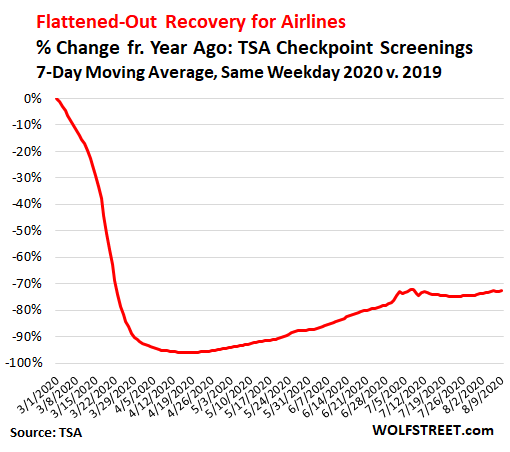

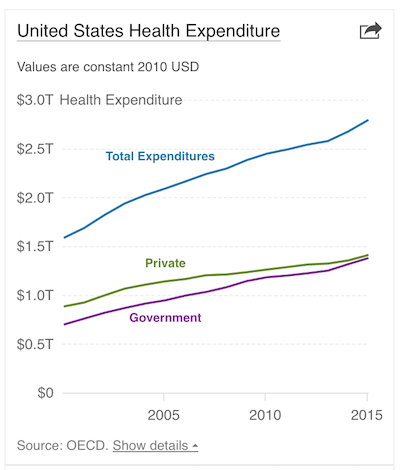

The car industry is dying. The airline industry is laying out its fleet of big birds in desert graveyards. The college racketeering operation went off a cliff, along with medical profiteering. Agribusiness no longer has a business model. Hundreds of kinds of services no longer have customers who can afford their offerings from acupuncture to zymurgy. None of that will be fixed by injections of miracle money borrowed from ourselves in quantities that would turn every US citizen into a millionaire – if it wasn’t just pounded down the rat-holes of the stock and bond markets. The big question about the Great Opening-up is when the recognition of all that turns to raw emotion. Covid-19 may still be with us then, but it will be the least of our problems. The masks will come off. The dance will commence.

Read more …

But not now. Try again in 5 years.

• China Backs Investigation Of WHO And Coronavirus Pandemic (SCMP)

Member states of the World Health Organisation, including China, backed a call on Tuesday for an independent investigation into the coronavirus pandemic that has killed more than 318,000 people around the world. The resolution, which was drafted and promoted by the European Union but did not identify any country by name, called for an “impartial, independent and comprehensive evaluation” of the pandemic, including the actions of the WHO. At a virtual meeting of the WHO’s decision-making body, the World Health Assembly, the United States, which has accused the WHO of being a “puppet of China”, did not block the adoption of the resolution.

The US said the resolution was the “first critical step” in ensuring the world health body could play its roles and there was an international system capable of “responding effectively” to the next pandemic. But it also “dissociated” itself from the resolution’s statement on rights for poor countries to waive intellectual property rules in obtaining medicine in emergencies, Reuters reported. Earlier on Tuesday, US President Donald Trump threatened to permanently freeze US funding to the WHO and reconsider his country’s membership if the United Nations agency did not commit to “major substantive improvements” within the next 30 days.[..]

Chinese foreign ministry spokesman Zhao Lijian said the resolution was in line with Beijing’s positions that countries should support the WHO and that the evaluation should be carried out at “appropriate time”. “These are all consistent with China’s positions and also reflect the common wishes of the majority of countries in the world,” Zhao said. Zhao also hit out at Australia for pushing for an investigation into China’s handling of the outbreak. The two-day gathering did not include discussions of a proposal for Taiwan to regain its observer status. [..] Liu Weidong, a specialist in international affairs at the Chinese Academy of Social Sciences, said that after weeks of posturing by countries such as the US and Australia, Beijing’s cooperative approach at the gathering had softened criticism of China.

“China’s performance at this assembly and its stance, were open and very selfless,” Liu said. “China’s actions do make it seem that it is selflessly contributing to building a global community of health for all.” He said US calls to trace the origins of Sars-CoV-2, the official name for the virus that causes Covid-19, were losing support. “Everybody will realise the [US] criticised China and found fault with China due to internal politics, which is a very calculating behaviour. Not many countries may end up following [the US] because it will affect their own soft power,” he said. “America’s international influence now compared to before Covid-19 definitely has fallen a lot.”

Read more …

A country of 83 million people that sees numbers rise again, should perhaps not export its tests.

• 8 Countries to Import Iran-Made Coronavirus Test Kits (FARS)

Vice President for Science and Technology Sorena Sattari said that Iranian knowledge-based firms have started manufacturing coronavirus test kits and eight countries have agreed to import such items from the country.

“Iran presently has a capacity of producing 1 million serology test kits per day and 1.5 million of C-Creative Protein (CPR) test kits per month,” Sattari said on Tuesday. “Part of the mentioned figure is used inside the country and the rest is exported,” he added. In relevant remarks on May 10, Deputy head of the Iranian presidency’s office for scientific affairs Mehdi Qalenoyee said that Iranian firms are going to export serological test kits to eight more countries after a first successful cargo was sent to Germany earlier in the week.

Qalenoyee said export of two types of coronavirus test kits to the Philippines and Pakistan was waiting for confirmation from the local officials after Iranian companies manufacturing the special tools sent sample kits to labs in those countries. He added that India, Nigeria and Armenia will receive the items once travel restrictions are eased. The official also said that Qatar, Georgia and Syria will soon be included in the list of export destination for the Iranian test kits. The announcement comes a few days after Iran sent a first cargo of serological test kits to Germany, where officials are trying to conduct the tests on a great scale to identify the immunity rate against COVID-19.

Exports of diagnostic devices and equipment from Iran to other countries is a sign of success for home-grown efforts to fight the coronavirus. Iran has been highly praised for its robust response to the disease as many governments and organizations keep castigating the US for its refusal to lift illegal sanctions to let the country access medical supplies and vital equipment needed to confront the virus.

Read more …

Half the global economy is on hold, and the reduction is still only 20% of what is called for.

• Global Carbon Emissions Down Nearly 20% Since Lockdowns Began (JTN)

Carbon emissions worldwide are reportedly down by nearly 20% since the beginning of the coronavirus lockdowns, another highlighting the impact of ongoing shutdowns on human activity and the worldwide economy. A study published in the journal Nature Climate Change, titled “Temporary reduction in daily global CO2 emissions during the COVID-19 forced confinement,” states that the reduction in average global emissions peaked at 26% before settling at 17%, compared mean emission levels in 2019. The authors, who hail from the U.K., the U.S., Norway and other countries, say that the total level of emission reductions for the whole year could range anywhere from 4% to 7%, depending on the disease mitigation procedures that remain in place, and for how long.

“Government actions and economic incentives post-crisis will likely influence the global CO2emissions path for decades,” they write. “At present it is unclear how long and deep the [economic] crisis will be, and how the recovery path will look, and therefore how CO2 emissions will be affected.” Governments worldwide have enacted severe and open-ended lockdowns and shutdowns since the disease began spreading late last year, with presidents, governors and other executives around the world unilaterally closing down huge swaths of their economies in an effort to prevent the spread of the virus.

Read more …

CNN sets out to discredit Worldometer, mentions that Wikipedia editors find it makes errors. First, that would be a badge of honor for anyone not working at either CNN or Wikipedia, and second, it’s not possible to get every detail right when tracking multiple data from 200+ countries. If only because they themselves track data in different ways from each other.

The story falls apart when CNN finds that Johns Hopkins, which it thinks is much more reliable, cites Worldometer on a very regular basis.

• The Mystery Behind Worldometer (CNN)

When Spanish Prime Minister Pedro Sánchez boasted of Spain’s high rankings, he didn’t pull his numbers out of thin air. On April 27, the OECD wrongly ranked Spain eighth in testing per capita. Initially, the OECD had used data from OWID to compile its statistics. But it sourced the Spanish numbers independently because OWID’s data was incomplete. [..] In its statement, the OECD said “we regret the confusion created on a sensitive issue by any debate on methodological issues” and stressed that increasing the availability of testing in general is more important than knowing where any particular country ranks. Sánchez’s later reference to a Johns Hopkins study, in which he said Spain ranked fifth for testing worldwide, appears to have been a case of mixed-up attribution by the prime minister.

JHU has not published international testing figures. Jill Rosen, a spokeswoman for the school, told CNN the university couldn’t identify a report that matched Sánchez’s description. At a press conference on May 9, Sánchez evaded a CNN question pressing him on the JHU study’s existence and listed the government’s numbers on testing totals instead. In comments made to a Spanish reporter the next day, health minister Salvador Illa continued to insist the testing data had been released by JHU, though he pointed to Worldometer as the underlying source. Since Johns Hopkins gets its data from Worldometer, he argued, it’s just as good. “It is data given by the John Hopkins University […] taken from as a fundamental source of information, the website Worldometer,” Illa said. “You can check it.”

[..] One Wikipedia editor, James Heilman, a clinical assistant professor of emergency medicine at the University of British Columbia, said Wikipedia volunteers have noticed persistent errors with Worldometer, but also with “a more reputable name with a longer history of accuracy,” referring to Johns Hopkins. “We hope they also double check the numbers.” In an article published in February, JHU said it began manually tracking Covid-19 data for its dashboard in January. When that became unsustainable, the university began scraping data from primary sources and aggregation websites. Lauren Gardner, the associate engineering professor who runs the university’s Covid-19 dashboard, told CNN in a statement that the university uses a “two-stage anomaly detection system” to catch potential data problems.

“Moderate” changes are automatically added to the dashboard but flagged so staff can double-check them in real time. Changes beyond a certain threshold require “a human to manually check and approve the values before publication to the dashboard,” Gardner said. The university’s reliance on Worldometer has surprised some academics. Phil Beaver, a data scientist at the University of Denver, seemed at a loss for words when he was asked what he thought of JHU citing Worldometer. “I am not sure, that is a great question, I kind of got the impression that Worldometer was relying on [Johns] Hopkins,” he told CNN after a lengthy pause.

Read more …

Reuters labels it “foot-dragging”. Like we are clueless nitwits.

• Venezuela Files Claim To Force Bank Of England To Hand Over Gold (R.)

Venezuela’s central bank has made a legal claim to try to force the Bank of England to hand over €930 million ($1.02 billion) of gold so President Nicolas Maduro’s government can fund its coronavirus response, according to the document submitted in a London court. The claim follows a request Venezuela made to the Bank of England in April to sell part of its gold reserves there and send the proceeds to the United Nations to help with the country’s coronavirus-fighting efforts. Since 2018, the Bank of England has delayed the transfer of 31 tonnes of Venezuelan gold stored there to Maduro, who Britain does not recognize as the country’s legitimate leader. The bank offers gold custodian services to many developing nations.

The claim, submitted in a commercial court and dated May 14, says the Venezuelan central bank “seeks an order requiring BoE to comply with the proposed instruction.” The funds, once transferred to the United Nations Development Programme, would be used to buy healthcare equipment, medicine, and food to address Venezuela’s “COVID-19 emergency,” the document seen by Reuters said. Selling off the country’s gold reserves has become one of the Maduro administration’s few options to raise funds due to U.S. sanctions. The collapse in global oil prices and a paralyzing coronavirus quarantine has further crippled Venezuela’s moribund economy. “The foot-dragging by the Bank of England is critically hampering Venezuela and the UN’s efforts to combat COVID-19 in the country,” Sarosh Zaiwalla, a London-based lawyer representing the central bank, said in a statement.

Read more …

Nice list.

• Senate GOP Compile Massive Subpoena List For FBI Abuse Probe (ZH)

In the wake of bombshell evidence that shows the Obama DOJ inappropriately targeted the 2016 Trump campaign, Senate Republicans have compiled a list of 53 individuals they want to interview as part of their own comprehensive probe into the matter, separate of the Trump DOJ’s separate criminal investigation headed up by US Attorney John Durham. That said, as Fox News reports, the effort is being led by Senate Judiciary Committee Chairman Lindsey Graham (R-SC), so we expect weekly cable news appearances in which Graham wags his finger and issues the sternest of empty threats to investigate the swamp. Graham has previously come under fire for failing to follow through on promises to seek testimony from current and former DOJ and FBI officials – telling Fox News’ Maria Bartiromo that he doesn’t want to interfere with Durham’s probe.

But – in the unlikely event Graham isn’t going to simply run cover for the swamp in a sham investigation designed to placate those who seek justice, here are the names of those on the subpoena list, via Fox News: The majors: [former FBI Director] James Comey, [former FBI Deputy Director] Andrew McCabe, [former Director of National Intelligence] James Clapper, [former CIA Director] John Brennan, [former Deputy Attorney General] Sally Yates. We note that the names of both President Obama and his VP Joe Biden are conspicuously absent, despite the fact that both of them were in a January 5, 2017 meeting in which Obama gave Comey the nod to conceal information from the incoming Trump administration. Graham, in response, said that asking for testimony from a former president would set a ‘dangerous precedent.’

Everyone else: “Trisha Anderson, Brian Auten, James Baker, William Barr, Dana Boente, Jennifer Boone, Kevin Clinesmith [the FBI lawyer who allegedly falsified a CIA email to secure the Carter Page FISA warrant], Patrick Conlon, Michael Dempsey, Stuart Evans, Tashina Gauhar [a top DOJ deputy when classified details of Flynn’s calls with the Russian ambassador were illegally leaked to The Washington Post], Carl Ghattas, Curtis Heide, Kathleen Kavalec, David Laufman [who arranged a key meeting with a Steele dossier source], Stephen Laycock, Jacob Lew, Loretta Lynch, Mary McCord, Denis McDonough, Arthur McGlynn, Jonathan Moffa, Sally Moyer, Mike Neufield, Sean Newell, Victoria Nuland, Bruce Ohr, Nellie Ohr, Stephanie L. O’Sullivan, Lisa Page, Joseph Pientka [who interviewed Flynn at the White House while also playing a key role in the Carter Page probe, and whom the FBI has hidden from scrutiny], John Podesta, Samantha Power, E.W. “Bill” Priestap [who authored the memo debating whether the bureau simply wanted Flynn “fired”], Sarah Raskin, Steve Ricchetti, Susan Rice, Rod Rosenstein, Gabriel Sanz-Rexach, Nathan Sheets, Elizabeth Sherwood-Randall, Glenn Simpson, Steve Somma [an FBI case agent who apparently was involved in several key FISA omissions], Peter Strzok, Michael Sussman, Adam Szubin, Jonathan Winer, and Christopher Wray.”

Read more …

The more they resist, the harder Powell will come.

• Flynn Lawyers Appeal Requests Case Dismissal, Removal Of Judge Sullivan (JTN)

Attorneys for former National Security Advisor Michael Flynn on Tuesday asked a federal appeals court to force a district court to dismiss the case, as the Justice Department has requested. The petition also asks that the judge, Emmet Sullivan, be removed from Flynn’s case and that his U.S. District Court for the District of Columbia vacate his order to appoint former federal judge John Gleeson to argue against the dismissal of Flynn’s case and discuss whether the retired lieutenant general deserves to face contempt for perjury. Flynn in 2017 plead guilty to lying to the FBI but later sought to withdraw his plea. Evidence has since emerged suggesting the FBI had no case against Flynn but set up an interview hoping it would catch him lying, his lawyers and Justice officials have said.

Sullivan last week announced his intention to allow the filing of amicus curiae briefs, which meant that Flynn’s case would not immediately conclude. These “friend of the court” briefs allow parties interested in but not involved in a case to present their views. Sullivan also announced last week the appointment of Gleeson. In the petition filed Tuesday, Flynn’s legal team, which includes attorney Sidney Powell, blasted Sullivan and requested that the case be reassigned to a different judge.

“The district judge’s latest actions – failing to grant the Government’s Motion to Dismiss, appointing a biased and highly-political amicus who has expressed hostility and disdain towards the Justice Department’s decision to dismiss the prosecution, and the promise to set a briefing schedule for widespread amicus participation in further proceedings – bespeaks a judge who is not only biased against Petitioner, but also revels in the notoriety he has created by failing to take the simple step of granting a motion he has no authority to deny,” the petition says of Sullivan. “This is an umpire who has decided to steal public attention from the players and focus it on himself. He wants to pitch, bat, run bases, and play shortstop. In truth, he is way out in left field” the petition also states.

Read more …

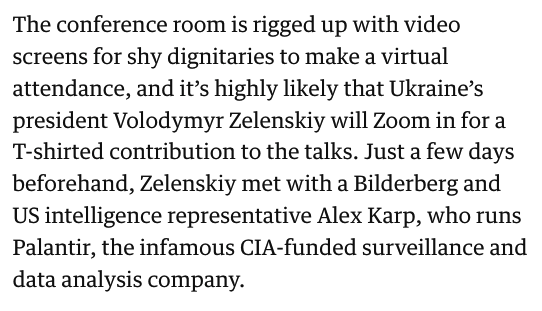

Haven’t heard from Zelensky for a while.

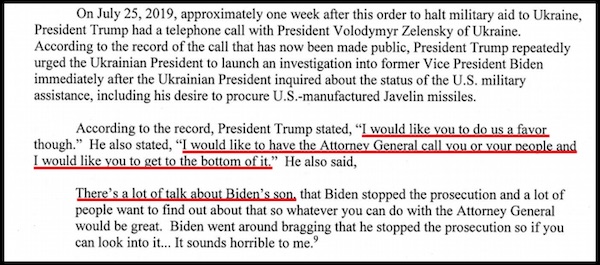

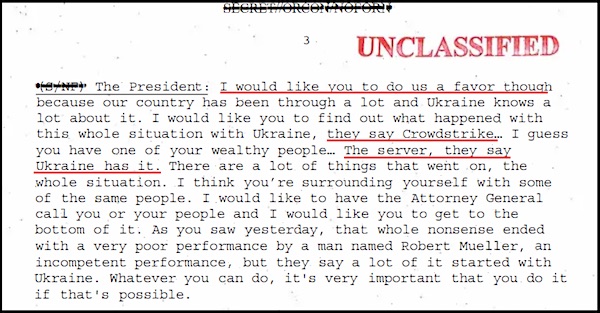

• Phone Calls Between Biden And Ukraine’s Poroshenko Leaked (ZH)

Leaked phone calls between Joe Biden and former Ukrainian President Petro Poroshenko explicitly detail the quid-pro-quo arrangement to fire former Ukrainian Prosecutor General Victor Shokin – who Poroshenko admits did nothing wrong – in exchange for $1 billion in US loan guarantees (which Biden openly bragged about in January, 2018). The calls were leaked by Ukrainian MP Andrii Derkach, who says the recordings of “voices similar to Poroshenko and Biden” were given to him by investigative journalists who claim Poroshenko made them. Shokin was notably investigating Burisma, the Ukrainian energy company that hired Biden’s son, Hunter, to sit on its board.

Shokin had opened a case against Burisma’s founder, Mykola Zlochevsky, who granted Burisma permits to drill for oil and gas in Ukraine while he was Minister of Ecology and Natural Resources. In January, 2019, Shokin stated in a deposition that there were five criminal cases against Zlochevesky, including money laundering, corruption, illegal funds transfers, and profiteering through shell corporations while he was a sitting minister. The leaked calls begin on December 3, 2015, when former Secretary of State John Kerry starts laying out the case to fire Shokin – who he says “blocked the cleanup of the Prosecutor Generals’ Office,” and sated that Biden “is very concerned about it,” to which Poroshenko replies that the newly reorganized prosecutor general’s office (NABU) won’t be able to pursue corruption charges, and that it may be difficult to fire Shokin without cause.

Later in the leaked audio on February 18, 2016 – less than three months after the Kerry conversation – Poroshenko delivers some “positive news.” “Yesterday I met with General Prosecutor Shokin,” says Poroshenko. And despite of the fact that we didn’t have any corruption charges, we don’t have any information about him doing something wrong, I specially asked him – no, it was day before yesterday – I specially asked him to resign. In, uh, as his, uh, position as a state person. And despite of the fact that he has a support in the power. And as a finish of my meeting with him, he promised to give me the statement on resignation. And one hour ago he bring me the written statement of his resignation. And this is my second step for keeping my promises.” To which Biden replied: “I agree.”

Four weeks later on March 22, 2016, Biden says “Tell me that there is a new government and a new Prosecutor General. I am prepared to do a public signing of the commitment for the billion dollars.” Poroshenko tells Biden that one of the leading candidates is the man who replaced Shokin, Yuriy Lutsenko who later said in a deposition that Hunter Biden and his business partners were receiving millions of dollars in compensation from Burisma. Then, on May 13, 2016, Biden congratulates Poroshenko on “getting the new Prosecutor General,” saying that it will be “critical for him to work quickly to repair the damage Shokin did.” “And I’m a man of my word,” Biden adds. “And now that the new Prosecutor General is in place, we’re ready to move forward to signing that one billion dollar loan guarantee.”

Read more …

Next nail. Same coffin.

• Ukraine Judge Orders Joe Biden Listed As Alleged Perpetrator Of Crime (Solomon)

The infamous story of Joe Biden’s effort to force the firing of Ukraine’s chief prosecutor in 2016 has taken a new legal twist in Kiev, just as the former vice president is sewing up the 2020 Democratic presidential nomination in America. In Kiev late last month, District Court Judge S. V. Vovk ordered the country’s law enforcement services to formally list the fired prosecutor, Victor Shokin, as the victim of an alleged crime by the former U.S. vice president, according to an official English translation of the ruling obtained by Just the News. The court had previously ordered the Prosecutor General’s Office and the State Bureau of Investigations in February to investigate Shokin’s claim that he was fired in spring 2016 under pressure from Biden because he was investigating Burisma Holdings, the natural gas company where Biden’s son Hunter worked.

The court ruled then that there was adequate evidence to investigate Shokin’s claim that Biden’s pressure on then-President Petro Poroshenko, including a threat to withhold $1 billion in U.S. loan guarantees, amounted to unlawful interference in Shokin’s work as Ukraine’s chief prosecutor. But when law enforcement agencies opened the probe they refused to name Biden as the alleged perpetrator of the crime, instead listing the potential defendant as an unnamed American. Vovk ruled that anonymous listing was improper and ordered the law enforcement agencies to formally name Biden as the accused perpetrator.

Read more …

We try to run the Automatic Earth on people’s kind donations. Since their revenue has collapsed, ads no longer pay for all you read, and your support is now an integral part of the process.

Thank you.

Taleb likes to say it’s not the state that shuts down an economy, it’s the people:

Support the Automatic Earth in virustime.