Alfred Palmer New B-25 bomber at Kansas City plant of North American Aviation 1942

Inevitably, the killing of Qassim Soleimani in Baghdad leads to the confirmation of US party lines’ divide. While the GOP stands behind the decision, the Dems have a hard time reconciling their own contradictions. They are a war party, if you look past Tulsi Gabbard and Bernie Sanders, but they can’t be seen to agree with Trump. So the likes of Schumer and Pelosi say that while Soleimani won’t be mourned by any American since he was a really terrible person, Trump should have asked for their permission.

The logic being that this could lead to WWIII, a theme that’s all over the internet, so much it makes one think independent thought is under threat. Be that as it may, the president needs permission to declare war, not to hit an individual. Moreover, since they agree killing the man might have been a good idea, they surely realize that he was in a spot where they could get at him, for a limited amount of time, so asking for permission would heve risked losing the opportunity. Weak.

The following two tweets are worth citing:

Nicole Alexander Fisher: “Pelosi voted for Trump’s NDAA which stripped a provison that would have prevented unauthorized war with Iran. She sided with Trump and warhawks on this, as did 188 other Democrats. 41 Dems like AOC, Ilhan Omar, Tulsi Gabbard, Ro Khanna, and Joe Kennedy voted no.”

Soleimani fought ISIS, Al-Nusra, Al-Qaeda etc., along with the US.

Sara Abdallah: “The “no. 1 bad guy” who led the counter-terrorism campaigns that defeated ISIS and Al-Qaeda in Iraq, Syria and Lebanon; the “no. 1 bad guy” who prevented a jihadist takeover of the Middle East.”

I’m still wondering how CNBC became the no. 1 warmonger for the MSM. This is some headline. As for the Dems and GOP, one would be inclined to say: pick your side. But if you look just a little bit closer, you see there is only one side.

• America Just Took Out The World’s No. 1 Bad Guy (CNBC)

So, just who is this top Iranian general the U.S. just eliminated? For many of us who watch and analyze news out of the Middle East daily, he was the world’s number one bad guy. Qassim Soleimani has been in control of Iran’s Quds Force for more than 20 years. His current greatest hits include helping Bashar al Assad slaughter hundreds of thousands of his own people in the Syrian civil war, stoking the Houthis in Yemen’s civil war, and overseeing the killing of hundreds of Iraqi protesters recently demonstrating against Iranian influence in their country. But most importantly for Americans, Soleimani was behind the deaths of hundreds of American soldiers during the Iraq War. Last year, the U.S. State Department put the number of Americans killed by Iranian proxies in Iraq at 608 since 2003.

The killing of Soleimani doesn’t have the emotional power of the takedown of Osama bin Laden, and he wasn’t even as well-known to Americans as ISIS founder Abu Bakr al Baghdadi. But in many ways, taking him out means much more in terms of saving current lives. Remember that bin Laden and al Baghdadi were mostly out of business and in hiding at the time of their deaths. Solemani was busier than ever, directing mayhem all over the Middle East and beyond. For example, these last few days have made it clear to the whole world just how much Iran controlled just about all of Iraq and Iraq’s Shia population. It appears Solemeini not only felt justified in being the likely mastermind behind Tuesday’s attack on the U.S. embassy in Baghdad, he also was comfortable enough to travel to Iraq personally to oversee it. But this time, he got too comfortable.

No, it doesn’t.

• US Strike That Killed Iranian Commander Starkly Divides US Lawmakers (CNN)

The US airstrike that killed Iran Quds Force commander Qasem Soleimani generated starkly different reactions along party lines Thursday night, with Republicans heaping praise on President Donald Trump and Democrats expressing concerns about the legality and consequences of the attack. The Pentagon confirmed in a statement that Trump had ordered the strike, saying Soleimani “was actively developing plans to attack American diplomats and service members in Iraq and throughout the region. General Soleimani and his Quds Force were responsible for the deaths of hundreds of American and coalition service members and the wounding of thousands more.”

[..] Some key members of Congress — such as Senate Minority Leader Chuck Schumer, a New York Democrat who is a member of the congressional Gang of Eight leaders, who are briefed on classified matters — had not been made aware of the attack ahead of time. It’s not clear how many other lawmakers had advance notice of the strike. The Pentagon added that “this strike was aimed at deterring future Iranian attack plans” and the US “will continue to take all necessary action to protect our people and our interests wherever they are around the world.”

[..] Democrats pushed back on Republican sentiments about the attack, stressing the potential consequences and lambasting the decision to carry out the strike without congressional authorization. Sen. Chris Murphy of Connecticut emphasized that Soleimani “was an enemy of the United States” in a tweet before stating, “The question is this – as reports suggest, did America just assassinate, without any congressional authorization, the second most powerful person in Iran, knowingly setting off a potential massive regional war?” In a more explicit statement, Sen. Tom Udall of New Mexico said, “President Trump is bringing our nation to the brink of an illegal war with Iran without any congressional approval as required under the Constitution of the United States.”

[..] On the campaign trail, Democratic former Vice President Joe Biden said “no American will mourn” Soleimani but that the strike that killed him is a “hugely escalatory move.” “President Trump just tossed a stick of dynamite into a tinderbox, and he owes the American people an explanation of the strategy and plan to keep safe our troops and embassy personnel, our people and our interests, both here at home and abroad, and our partners throughout the region and beyond,” Biden said in a statement. “I’m not privy to the intelligence and much remains unknown, but Iran will surely respond. We could be on the brink of a major conflict across the Middle East. I hope the Administration has thought through the second- and third-order consequences of the path they have chosen.”

This situation is not likely to improve after the assassination:

• Erdogan Questions Europe As 250,000 Flee Idlib (ZH)

As Russian and Syrian jets have dramatically stepped up their bombardment of jihadist-held Idlib over the past three weeks, Turkish President Recep Tayyip Erdogan has again warned a massive wave of refugees is headed into Turkey, but that his country is without help and thus is seeking to prevent the new influx. “Right now, 200,000 to 250,000 migrants are moving toward our borders,” Erdogan said while addressing a conference in Ankara. “We are trying to prevent them with some measures, but it’s not easy. It’s difficult, they are humans too.” This after the UN on Monday said that of Idlib province’s some 3 million civilian population, up to 284,000 are currently on the move.

International reports commonly put the current numbers of Syrian refugees hosted by Turkey at about 3.7 million, which Erdogan has of late constantly reminded Europe of as he seeks support for foreign military intervention in places like northeast Syria and now even Libya. During his latest comments, Erdogan actually put the number of refugees across all provinces of Turkey at a whopping 5 million — which would be larger than many small countries. Crucially, during his speech on Thursday, he alluded to his prior threats to “open the gates” and allow refugees to flood into Europe, starting with Greece and other Mediterranean nations:

“Although they [the West] have more resources than we do, why don’t they accept them, why don’t they open the gates?” Erdogan asked. While also slamming Arab League member states for not acting, he answered his own question with, “We are Turkey. Alone this gives us a power and superiority that nobody has.” In late December, Erdogan reiterated prior provocative threats underscoring that “Turkey cannot handle a fresh wave of migrants from Syria, President Tayyip Erdogan said on Sunday, warning that European countries will feel the impact of such an influx if violence in Syria’s northwest is not stopped,” as Reuters summarized of the statement.

Remarkably stable, really.

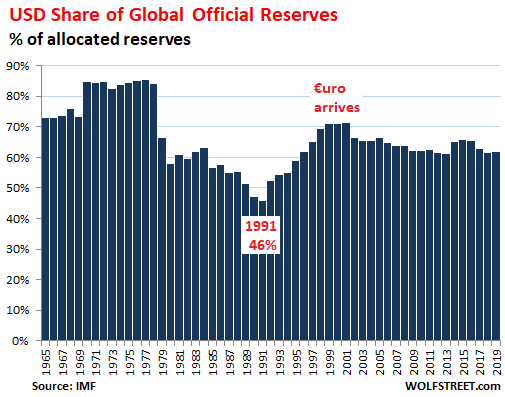

• US Dollar as Global Reserve Currency vs Euro, Yen, Renminbi, & Others (WS)

The US economy and financial system – including being able to maintain and fund the gargantuan trade deficits and fiscal deficits – has become reliant on the dollar being the dominant global reserve currency. And the IMF just released its next installment on how this status has been changing. Total foreign exchange reserves in all currencies combined declined 0.6% in the third quarter from the second quarter to $11.66 trillion, according to the IMF’s quarterly COFER data. US-dollar-denominated exchange reserves – such as Treasury securities, US corporate bonds, etc. held by foreign central banks – ticked down 0.4% to $6.51 trillion. But holdings denominated in other currencies fell faster, and the share of dollar-denominated reserves edged up to 61.8% of total exchange reserves.

The US dollar’s share of total global reserve currencies declines when central banks other than the Fed proportionately reduce their dollar-denominated assets and add assets denominated in other foreign currencies. Over the long term, the recent moves in the dollar’s share are relatively small. There have been huge moves from 1977 through 1991, when the dollar’s share plunged from 85% to 46%, and then huge moves as the share rose again to 70% by 2000:

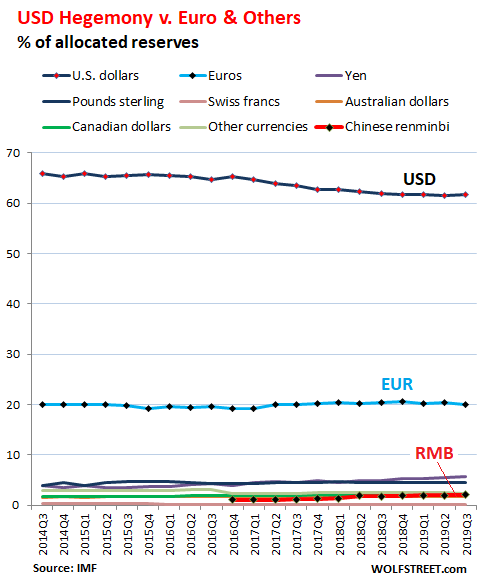

In October 2016, the IMF included the Chinese renminbi in the currency basket of the Special Drawing Rights (SDR), and the renminbi became officially a global reserve currency. But since then, progress of the currency has been exceedingly slow, and there are no signs the RMB would dethrone the US dollar anytime soon.The creation of the euro came with a lot of hopeful rhetoric that it would reach parity with the US dollar in every way, including as global trade currency, global financing currency, and global reserve currency. [..] During the initial phase of the conversion of European currencies to the euro, the euro’s share of global reserve currencies rose and the dollar’s share fell from 71.5% in 2001 to 66.5% in 2002.

Wait, so China is desperate for dollars, and then decides dollars are becoming less important? Yeah, we’ll all believe it.

• China Cuts US Dollar Weighting In Key Index To Boost Fortunes Of Yuan (SCMP)

China’s decision to cut the weighting of the US dollar in a basket of foreign currencies used to determine the strength of the yuan will help Beijing’s long-term efforts to weaken the international dominance of the American currency, economists said. The China Foreign Exchange Trade System (CFETS), a unit of the Chinese central bank, trimmed the weighting of the US dollar on Wednesday to 21.59 per cent from 22.40 per cent in a key yuan exchange index to make it “more representative” of current trade conditions. The new version of the index will be based on 2018 trade data, rather than data from 2015, when the CFETS was first established. The move, which comes amid heightened trade tensions between China and the United States, will help Beijing’s long-term efforts to create an alternative international payments system, economists said.

“The yuan hopes to become a reserve currency, to prevent the situation where the US dollar dominates the global financial system – or the so-called hegemony of the US dollar. This is a longer-term goal … and an inevitable trend,” said Shen Jianguan, vice-president and chief economist at JD Digits, although he added that the adjustment also reflected changes to China’s trading environment. His remarks were echoed by Lu Zhengwei, chief economist at China Industrial Bank, who said the cut would give the yuan marginally more independence against the US dollar. “The yuan should live its own way – now there is too much shadow from other [currencies] hanging over it,” he said.

The amount is symbolic.

• China’s Central Bank Frees Up $115 Billion To Support Growth (SCMP)

China’s central bank has announced a move to unleash 800 billion yuan (US$115 billion) from the banking system to support the economy, sending a pro-growth message on the first day of 2020. The People’s Bank of China (PBOC) will reduce the deposit reserve ratio in financial institutions by 0.5 percentage points from January 6, mainly to offer sufficient funding to the real economy, according to a notice published on the bank’s website. The announcement on Wednesday came after growth continued to weaken while China and the United States prepared to sign an interim trade deal in mid-January. The central bank said this round of funding was partially to offset cash withdrawals before the Lunar New Year, and would not change its stance on monetary policy.

From Monday, the reserve requirement ratio (RRR) for big banks will be lowered to 12.5 per cent, while the ratio for medium and small banks will be reduced to 10.5 per cent and 7 per cent respectively. In 2019, the central bank cut the RRR rate three times. “The RRR cut will help boost investor confidence and support the economy, which is gradually steadying,” said Wen Bin, an economist at Minsheng Bank in Beijing, who also expects another cut in China’s new loan prime rate this month. After 18 months of the trade war between China and the United States, the Chinese economy, the world’s second largest, is facing external and domestic headwinds, with growth slowing to 6 per cent in the third quarter, the lowest since 1992. By value of goods, China’s export growth fell 0.3 per cent between January and November 2019, while import growth was down 4.5 per cent for the same period.

End the Fed. They lost control a decade ago.

• What the Fed Did to Calm Year-End Hissy-Fit of its Crybaby Cronies (WS)

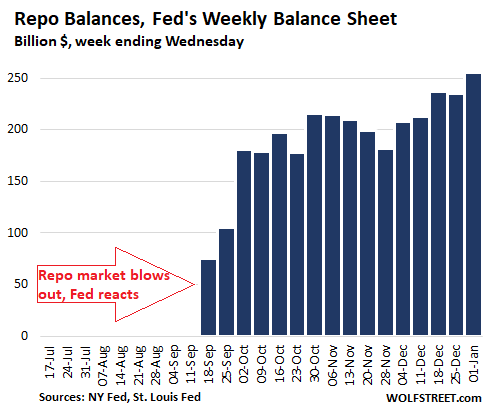

The big fear was that the repo market would blow out again at the end of 2019, as banks would be window-dressing their balance sheets by building up reserves to certain levels. In the process, they would refuse to lend to the repo market. And borrowing pressure on the other side – such as hedge funds or mortgage REITs that borrow cheaply in the repo market to fund long-term bets – would drive up repo rates. At the end of 2018, repo rates blew out, but quickly settled down without the Fed’s involvement. In September 2019, repo rates blew out again. At this point, the rattled Fed started dousing the market with hundreds of billions of dollars to calm the repo market and prevent another year-end blowout.

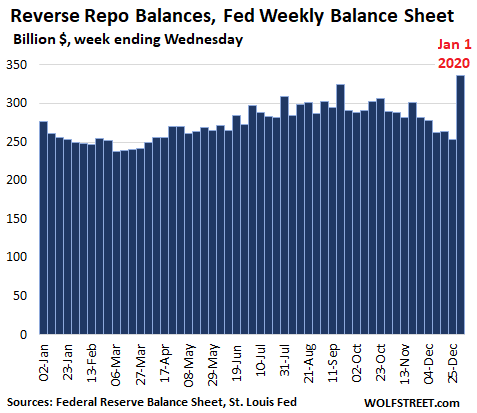

To do this, the Fed engaged in repo operations and also began purchasing short-term Treasury bills. This calmed the repo market, and at the end of December, repo rates didn’t blow out. But on January 1, the Fed did a huge $64 billion reverse repo, the opposite of a repo, thus draining overnight $64 billion in liquidity from the market. This astounding spike in reverse repo balances showed up on its balance sheet for the week ended January 1, released today:

In a reverse repo, the Fed sells securities and takes in cash, under an agreement to buy back those securities at a fixed price on a set date. A reverse repo drains liquidity from the market. When the reverse repo unwinds on the maturity date, as the Fed buys back those securities, it adds liquidity to the market. Reverse repos are liabilities on the Fed balance sheet. In a normal repo, the Fed buys Treasury securities and mortgage-backed securities (MBS) guaranteed by Fannie Mae and Freddie Mac, or Ginnie Mae, under agreements to repurchase them at a fixed price on a specific date, such as the next day or in a longer period. This adds liquidity to the market for the duration of the repo.

When the repo matures and unwinds, the liquidity gets drained. But a new repo can roll this over. Repos are assets on the Fed’s balance sheet. Total repos on the Fed’s balance sheet on January 1 rose to $256 billion, up $48 billion from a month earlier (as of Dec 4 balance sheet):

Erdogan is not sitting pretty.

• Greece, Israel, Cyprus: Turkey’s Libya Troops Bill Dangerous Escalation (R.)

Turkey’s bill allowing troop deployment in Libya marks a dangerous escalation in the North African country’s civil war and severely threatens stability in the region, a joint statement by Greece, Israel and Cyprus said late on Thursday. “This decision constitutes a gross violation of the UNSC resolution…imposing an arms embargo in Libya and seriously undermines the international community’s efforts to find a peaceful, political solution to the Libyan conflict,” Greek Prime Minister Kyriakos Mitsotakis, Israel’s Prime Minister Benjamin Netanyahu and Cyprus President Nicos Anastasiades said in the statement.

Turkish parliament overwhelmingly approved a bill that allows troops to be deployed in Libya, in a move that paves the way for further military cooperation between Ankara and Tripoli but is unlikely to put boots on the ground immediately. Turkey’s move comes after Ankara and the internationally recognized government of Libyan Prime Minister Fayez al-Serraj signed two separate agreements in November: one on security and military cooperation and another on maritime boundaries in the eastern Mediterranean, infuriating Greece, Israel, Egypt and Cyprus.

The exact same countries want to cut a pipeline straight through an area claimed by Turkey. Think there’s a connection?

• Leaders Of Greece, Israel, Cyprus Ink Deal For Pipeline (K.)

The intergovernmental agreement signed on Thursday by Greece, Israel and Cyprus for the construction of the EastMed pipeline sent out multiple diplomatic messages. The first of these relates to the endurance of the trilateral cooperation itself. In the 10 years since its inception, Cyprus President Nicos Anastasiades and the prime ministers of Israel, Benjamin Netanyahu, and Greece, Kyriakos Mitsotakis, confirmed that the relationship between the three countries is not circumstantial. Skepticism concerning the situation in Jerusalem after three consecutive national elections which will have been held by March is reasonable. However, it will be very difficult for any Israeli government to roll back years of planning.

The second message concerns Turkey, as the pipeline will link Israel’s reserves with Cyprus, then Crete and mainland Greece through an area that Ankara says belongs to Turkey, according to the pact it signed with Libya’s Tripoli-based government. The EastMed agreement is essentially a legal act stemming from international law as it expresses the will of three sovereign and elected governments (in contrast to that in Tripoli) to deepen their cooperation. At the same time it is a message of cooperation which leaves the door open for Ankara to take part if it decides so. However, signs Thursday were not encouraging as a pair of Turkish F-16s fighter jets made six overflights over Oinousses and the nearby island of Panagia, while the presence of the Turkish fleet around Cyprus remains emphatic.

Moreover, the Turkish Parliament decided on Thursday to approve the deployment of troops to Libya, if deemed necessary. A Turkish Foreign Ministry spokesman said any project that ignores the rights of Turkey and Turkish Cypriots in the region will fail, while Turkish-Cypriot leader Mustafa Akinci said the pipeline is an obstacle to efforts for a solution to the Cyprus problem. The third message is to countries such as Italy and Egypt. With the signing of the deal, Athens, Nicosia and Jerusalem showed they were not willing to wait for the perfect conditions to prevail before moving ahead.

“..the western powers are now busily attacking the Iraqi Shia majority government they themselves installed, for the crime of being a Shia majority government.”

• The Terrifying Rise of the Zombie State Narrative (Craig Murray)

The ruling Establishment has learnt a profound lesson from the debacle over Iraqi Weapons of Mass Destruction. The lesson they have learnt is not that it is wrong to attack and destroy an entire country on the basis of lies. They have not learnt that lesson despite the fact the western powers are now busily attacking the Iraqi Shia majority government they themselves installed, for the crime of being a Shia majority government. No, the lesson they have learnt is never to admit they lied, never to admit they were wrong. They see the ghost-like waxen visage of Tony Blair wandering around, stinking rich but less popular than an Epstein birthday party, and realise that being widely recognised as a lying mass murderer is not a good career choice.

[..] The security services outlet Bellingcat would publish some photos of big missiles planted in the sand. The Washington Post, Guardian, New York Times, BBC and CNN would republish and amplify these pictures and copy and paste the official statements from government spokesmen. Robert Fisk would get to the scene and interview a few eye witnesses who saw the missiles being planted, and he would be derided as a senile old has-been. Seymour Hersh and Peter Hitchens would interview whistleblowers and be shunned by their colleagues and left off the airwaves. Bloggers like myself would be derided as mad conspiracy theorists or paid Russian agents if we cast any doubt on the Bellingcat “evidence”.

Wikipedia would ruthlessly expunge any alternative narrative as being from unreliable sources. The Integrity Initiative, 77th Brigade, GCHQ and their US equivalents would be pumping out the “Iraqi WMD found” narrative all over social media. Mad Ben Nimmo of the Atlantic Council would be banning dissenting accounts all over the place in his role as Facebook Witchfinder-General.

Include the Automatic Earth in your 2020 charity list. Support us on Paypal and Patreon.