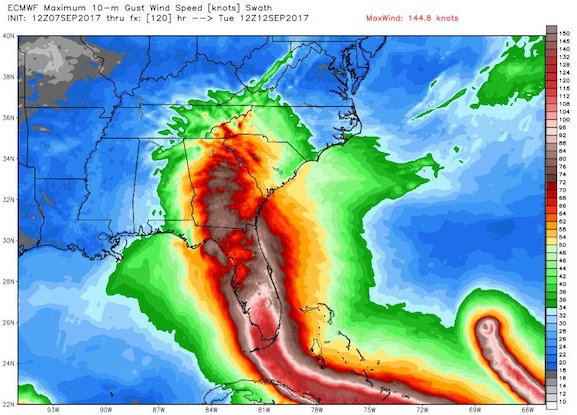

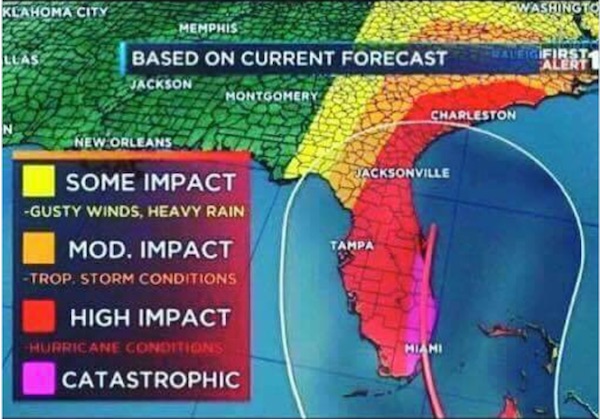

Irma heads for Florida

650,000 mandatory evacuations. But gas shortages make it hard to get away. Irma is twice the size of hurricane Andrew.

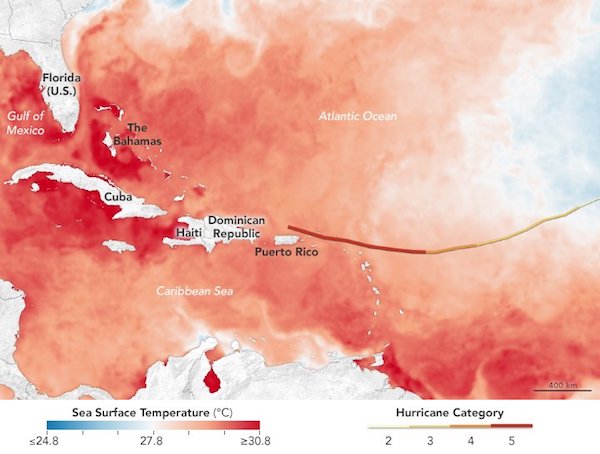

The eye of Hurricane Irma grazed the Turks and Caicos Islands on Thursday, rattling buildings after it smashed a string of Caribbean islands as one of the most powerful Atlantic storms in a century, killing 14 people on its way to Florida. With winds of around 185 miles per hour (290 km per hour), the storm the size of France has ravaged small islands in the northeast Caribbean in recent days, including Barbuda, Saint Martin and the British and U.S. Virgin Islands, ripping down trees and flattening homes and hospitals. Winds dipped on Thursday to 165 mph as Irma soaked the northern coasts of the Dominican Republic and Haiti and brought hurricane-force winds to the Turks and Caicos Islands. It remained an extremely dangerous Category 5 storm, the highest designation by the National Hurricane Center (NHC).

Irma was about 55 miles (85 km) south of Great Inagua Island and is expected to bring 20-foot (6-m) storm surges to the Bahamas, before moving to Cuba and ploughing into southern Florida as a very powerful Category 4 on Sunday, with storm surges and flooding due to begin within the next 48 hours. Across the Caribbean authorities rushed to evacuate tens of thousands of residents and tourists. On islands in its wake, shocked locals tried to comprehend the extent of the devastation while simultaneously preparing for another major hurricane, Jose, now a Category 3 and due to hit the northeastern Caribbean on Saturday.

“Mexico earthquake is most powerful to hit the country in a century, president says”

• Magnitude 8.4 Earthquake Strikes Off Mexico’s Southern Coast (DW)

The quake struck late on Thursday, and was recorded as a magnitude 8.4 on the Richter scale according to Mexico’s National Seismological Service. Government officials said that at least five people died in the country’s south. The US Tsunami Warning Center has cautioned that widespread, devastating tidal waves were possible on Mexico’s coast, as well as in Guatemala, El Salvador, Costa Rica, Nicaragua, Panama, Honduras and Ecuador. Shortly thereafter, authorities reported a tsunami was indeed headed towards the coast, fortunately only 0.7 meters (2.3 feet) tall. While there were no immediate reports of major damage, Mexico’s civil protection agency reported that it was the strongest tremor to hit the country since a 1985 earthquake that killed thousands and destroyed entire buildings.

Its epicenter was about 123 km (76 miles) south of the town of Pijijiapan in Chiapas state, but the shock was felt as far away as Mexico City, sending residents fleeing swaying buildings and knocking out electricity in parts of the city. The quake was also felt in much of Guatemala, which borders Chiapas. Civil Defense officials wrote on Twitter that their personnel were patrolling the streets in Chiapas aiding residents and looking for damage. They also issued a warning for aftershocks, several of which themselves registered a 5.0 magnitude according to the US Geological Survey (USGS). Chiapas Governor Manuel Velasco told broadcaster Televisa some homes had been damaged and a shopping center had collapsed in the town of San Cristobal. “Homes, schools and hospitals have been affected,” Velasco said.

The execs delayed reporting the hack so they could offload their shares. Why are these guys walking around free?

• Worst US Consumer Data Hack Ever? Equifax Confesses (WS)

Equifax, as a consumer credit bureau, collects financial, credit, and other data on every US consumer. It has names, birth dates, social security numbers, driver’s license numbers, bank account numbers, credit card numbers, mortgage data, and payment history data, including to utilities, wireless service providers, and the like. It collects data on bank balances, loan balances, credit card balances, credit card purchases, and myriad personal details. It has massive digital dossiers on every consumer in the US and in some other countries. And it sells this data to other companies, such as banks, credit card companies, car dealerships, retailers, and others, as a routine part of its business model. That’s how it makes money. But when someone breaks in and steals this data without paying Equifax for it, well, that’s a huge deal. And it is.

Turns out, Equifax got hacked – um, no, not today. Today it disclosed that it had discovered on July 29 – six weeks ago – that it had been hacked sometime between “mid-May through July,” and that key data on 143 million US consumers was stolen. There was no need to notify consumers right away. They’re screwed anyway. But it gave executives enough time to sell 2 million shares between the discovery of the hack and today, when they crashed 13% in late trading. Given the quantity and sensitivity of the stolen data, it may well be the biggest and worst breach in US history. That stolen data “primarily includes”:• Names • Social Security numbers • Birth dates • Addresses • “In some instances,” driver’s license numbers.

In addition, the stolen data includes: • Credit card numbers of around 209,000 US consumers • “Certain dispute documents with personal identifying information” of around 182,000 US consumers. • “Limited personal information for certain UK and Canadian residents.” This is the kind of information with which identities can be stolen and money can be borrowed in your name. Those data points are the crown jewels for hackers.

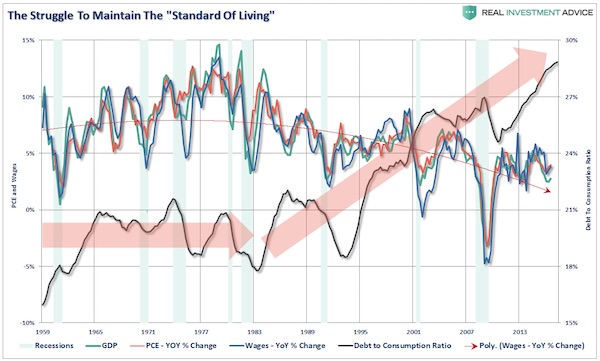

It has all been built on debt for decades.

• Consumer Credit & The American Conundrum (Roberts)

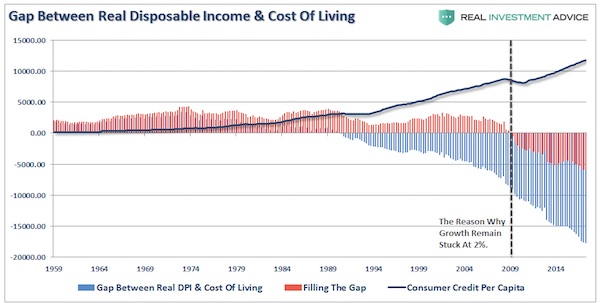

Under more normal circumstances rising consumer credit would mean more consumption. The rise in consumption should, in theory, led to stronger rates of economic growth. I say, in theory, only because the data doesn’t support the claim. Prior to 1980, when the amount of debt used to support consumption was fairly stagnant, the economy, wages, and personal consumption expanded. However, as I noted previously, that all changed with financial deregulation in the early 80’s which fostered three generations of debt driven excesses. In the past, if they wanted to expand their consumption beyond the constraint of incomes they turned to credit in order to leverage their consumptive purchasing power. Steadily declining interest rates and lax lending standards put excess credit in the hands of every American. (Seriously, my dog Jake got a Visa in 1999 with a $5000 credit limit) .

This is why during the 80’s and 90’s, as the ease of credit permeated its way through the system, the standard of living seemingly rose in America even while economic growth rate slowed in America along with incomes. Therefore, as the gap between the “desired” living standard and disposable income expanded it led to a decrease in the personal savings rates and increase in leverage. It is a simple function of math. But the following chart shows why this has likely come to the inevitable conclusion, and why tax cuts and reforms are unlikely to spur higher rates of economic growth.

Draghi has a fight on his hands. And he’s going to lose it.

• Low Interest Rates Major Source Of Concern – German Financial Watchdog (CNBC)

The continued low interest environment in key markets such as Europe, the U.S. and the U.K. is a “major source of concern”, according to Felix Hufeld, the president of the German financial regulatory authority. Alluding to the results of a recent survey, the authority over which he presides carried out alongside staff at Germany’s central bank, the Bundesbank, Hufeld described the effect on domestic banks. “The impact is massive and is creeping into the balance sheets more and more. The longer it continues, the higher the risk for a change of interest rates is increasing as well,” he warned, speaking from the Handelsblatt annual banking summit in Frankfurt on Thursday. His wariness comes despite his acknowledgment that the banking system has become much more solid than it was 10 years ago when the financial crisis broke out.

“Both the amount as well as the quality of capital has been massively increased. Risk management procedures have been improved, governance procedures have been improved. Remuneration has been curbed – so all sorts of things – a very wide range of things have been done,” he explained before sounding a note of caution. “But one thing should be clear – no regulatory system and no financial market in the world is invulnerable. There can be and there will be new crises coming up somewhere in the future,” Hufeld declared, pointing to real estate as the most notable cause for concern. The BaFin president’s comments echoed those of fellow Handelsblatt summit participants such as Deutsche Bank CEO John Cryan and Goldman Sachs’s CEO Lloyd Blankfein. Cryan joined Hufeld in warning of the possibility of bubbles forming in certain asset classes, adding, “If you look at the higher risk end of the market, I don’t think you get the right reward for the risk you’re taking right now.”

What a surprise.

• Japan’s April-June Economic Growth Much Slower Than Preliminary Reading (R.)

Japan’s economic growth in the second quarter was much slower than seen in a stellar preliminary reading, government data showed on Friday, confounding hopes for a long awaited pick-up in domestic demand. The downgrade was widely expected after data used to revise gross domestic product figures showed capital spending in April-June rose at a slower annual pace than the previous quarter. While the disappointing data may weaken confidence in the government’s economic policies and the business outlook, analysts still expect the economy to sustain a steady recovery as robust global demand underpins exports and a tightening job market improves the prospects for higher wages.

Japan’s economy, the world’s third largest, expanded at an annualized rate of 2.5% in the April-June quarter, less than the initial estimate of annualized 4.0% growth, Cabinet Office data showed. That was also lower than a median market forecast for a revision to a 2.9%. On the quarter, the economy grew a revised 0.6% in real, price-adjusted terms, against a preliminary reading of a 1.0% increase and the median estimate of a 0.7% expansion. Capital expenditure, a key component of GDP, rose 0.5% for the quarter, marked down from the preliminary estimate of a 2.4% increase.

“The United States is facing a six month window to act and I believe they will.”

• The North Korean Endgame is Playing Out Now – Rickards (DR)

“North Korea has already beaten the world to the punch. They’ve been building up their strategic oil reserves. What that means is they have an estimated year’s worth of held in reserve and China has played a role in these things in the past.” “The area that would be effective for a reactionary measure would be for the United States to exclude the People’s Bank of China, the Industrial and Commercial Bank of China and some of the other major Chinese banks from within the U.S dollar payment systems. The U.S could completely shut down the U.S operations.” “Ultimately, the Chinese are facilitating the North Korean finance. The move would be a kind of sanction with bite behind it. My expectation would be that China wouldn’t necessarily put pressure on North Korea. In reaction we could see escalation of further sanctions from the Chinese against the United States leaving for a trade and financial war without solving the North Korean situation.”

“Currently, North Korea is in what is classified as a ‘break out.’ Under typical nuclear development phases, we’ve normally seen countries that are cheating on nuclear development programs complete their operations in baby steps. In the process they proceed gradually and when they do draw attention will stall programs until beginning again at a later date. North Korea has put that pattern aside and is in complete breakout.” “To give a U.S football comparison, they’re in the red zone and the quarterback is simply about to throw a pass into the end zone. The leader of North Korea is going for it and not hiding anything. The leadership in North Korea is hoping that the United States is bluffing and that they will be able to get a serviceable intercontinental ballistic missile (ICBM) with a hydrogen bomb that could threaten or destroy Los Angeles before the U.S could do anything. The United States is facing a six month window to act and I believe they will.”

The mess keeps getting bigger.

• Theresa May Apponts Cronies In ‘Sweeping Power Grab’ (Ind.)

Theresa May is poised to make an unprecedented attempt to fix the parliamentary system, allowing her to grab sweeping powers ahead of Brexit, The Independent can reveal. A late-night Commons vote to secure the Conservatives the muscle to use so-called “Henry VIII powers” to make new laws – behind the backs of MPs – will be staged next week. The move has been disguised on the Commons order paper under the innocuous description of “motions relating to House business”, but will be a decisive act in the Brexit process. It will allow the Tories to pack a crucial Commons committee with their own MPs, in defiance of Parliament’s rules, in order to carry out the power grab. To win the vote, the Conservatives will need the backing of the Democratic Unionist Party (DUP), under the much-criticised “cash-for-votes” deal that props up Ms May in power.

Opposition parties immediately accused the Prime Minister of a bid to “sideline Parliament and grant ministers unprecedented powers” – despite promises to restore sovereignty to MPs. “This is an unprecedented power grab by a minority government that lost its moral authority as well as its majority at the general election,” Valerie Vaz, Labour’s Shadow Commons Leader, told The Independent. And Alistair Carmichael, the Liberal Democrat chief whip, said: “The Tories seem determined to ram through their destructive hard Brexit even though they have no mandate for it.” The bid to seize control of the Committee of Selection comes despite unequivocal advice from parliamentary officials that the Tories must not do so, after losing their Commons majority at the election. Without the fix, it would be impossible to force through up to 1,000 “corrections” to EU law as intended through the EU (Withdrawal) Bill – the reason for the accusations of a power grab.

Europe 2.0 won’t be a democracy.

• At Democracy’s Birthplace, Macron Dreams Of Europe 2.0 (AP)

Standing at a Greek site where democracy was conceived, French President Emmanuel Macron called on members of the European Union to reboot the 60-year-old bloc with sweeping political reforms or risk a “slow disintegration.” Macron, on a visit on Thursday to Athens, urged EU nations to carry out six-month national reviews on EU reforms before imposing them — signaling his distance with the German-backed approach based on fiscal discipline within the eurozone. “It would be a mistake to abandon the European ideal,” Macron said. “We must rediscover the enthusiasm that the union was founded upon and change, not with technocrats and not with bureaucracy.” Elected by a landslide in May, the 39-year-old Macron has vowed to back efforts for closer integration in the EU, which has been rattled by a financial crisis, migration issues, a populist backlash and Britain’s decision to leave.

His proposal found enthusiastic support in bailout-stricken Greece, which considers France a vital ally and counterweight to fiscally hawkish Germany in its efforts to ease the stringent terms of its international rescue loans. Reinforcing his message, Macron urged the IMF to step back from its role in European bailouts — breaking with a widely accepted policy adopted when Greece sought international help seven years ago. “I don’t think it was the right method for the IMF to supervise European programs and intervene in the way it did,” he said. “Let’s work within Europe and not turn to outside agencies.” The eurozone rescue fund, the European Stability Mechanism, should play the lead role in financial rescue within the euro currency zone, he said. France, Europe’s No. 2 economy, had previously backed Germany’s insistence in involving the IMF to enforce austerity measures that came with bailout programs in Greece and other rescued economies including Ireland, Portugal and Cyprus.

Home › Forums › Debt Rattle September 8 2017