DPC Coaches at Holland House Hotel on Fifth Avenue, NY 1905

A curious piece of two-bit theater. It failed before it started. Why do it then? The west trying to pit Saudi vs Iran/Russia?

• Oil Prices Plunge After Doha Output Talks Fail (AFP)

Oil prices plunged on Monday after the world’s top producers failed to reach an agreement on capping output aimed at easing a global supply glut during a meeting in Doha. Hopes the world’s main producer cartel, OPEC, and other major exporters like Russia would agree to freeze output has helped scrape oil prices off the 13-year lows they touched in February. But crude tanked after top producer Saudi Arabia walked away from the talks, which many hoped would ease a huge surplus in world supplies, because of a boycott by its rival Iran. Oil tumbled in early Asian trade after the collapse of Sunday’s talks, with prices dropping as much as seven% in opening deals.

At around 0100 GMT, US benchmark West Texas Intermediate for May delivery was down $2.11, or 5.23%, from Friday’s close at $38.25 a barrel. Global benchmark Brent crude for June lost 4.71%, or $2.03, to $41.07. “Despite many of the 18 oil producers believing the meeting in Doha was merely a rubber stamp affair for an oil production freeze, Saudi Arabia managed to throw a spanner in the works,” said Angus Nicholson at IG Markets. “With Saudi Arabia fighting proxy wars with Iran in Yemen and Syria/Iraq, it is understandable that they had little inclination to freeze their own production and make way for newly sanctions-free Iran to increase their market share.”

It’s impossible for a reporter to see that no output freeze was ever in the works, simply because no producer can afford a freeze.

• Oil Producers Get Worst Possible Outcome, Destroy Remaining Credibility (R.)

It was the worst possible outcome for oil producers at their weekend meeting in Doha, with their failure to reach even a weak agreement showing very publicly their divisions and inability to act in their own interests. Expectations for the meeting had been modest at best, with sources in the producer group predicting an agreement to freeze output. But even this meagre hope was dashed by Saudi Arabia’s insistence Iran join any deal, something the newly sanctions-free Islamic republic wouldn’t countenance. From a producer point of view, an agreement including Iran that shifted market perceptions on the amount of oil supply available would have been the best outcome.

The acceptable result would have been an agreement that froze production at already near record levels, with an accord that Iran would join in once it had reached its pre-sanctions level of exports. What was delivered instead was confirmation that the Saudis are prepared to take more pain in order not to deliver their regional rivals Iran any windfall gains from higher prices and exports. The meeting in Qatar on Sunday effectively pushed a reset button on the crude markets, putting the situation back to where the market was before hopes of producer discipline were first raised. What happens now is that the market will have to continue along its previous path of re-balancing, without any assistance from the OPEC or erstwhile ally Russia. Brent crude fell nearly 7% in early trade in Asia on Monday, before partly recovering to be down around 4%.

The potential is for crude to fall further in coming sessions as long positions built up in the expectation of some sort of producer agreement are liquidated in the face of the reality of no deal. It’s likely that recriminations will follow for some time among the oil producers, with the Russians and Venezuelans said to be annoyed at what they see as the Saudi scuppering of a deal that had almost been locked in. This will make it harder for any future agreement, with the OPEC meeting on June 2 the next chance for the grouping to reach some sort of agreement. For the time being, OPEC’s credibility is shot, and won’t be restored by even a future agreement as it will take actual, verifiable action to convince a now sceptical market. However, as the events in Doha showed, the Saudis are unlikely to agree to anything in the absence of Iranian participation, and that is also equally unlikely.

Naturally. Sell-off is waning already, by the way. But the trend is clear.

• Failure To Reach Oil Output Deal Sparks Selloff Across Emerging Markets (BBG)

The failure by the world’s biggest oil producers to agree on an output freeze spurred a selloff across emerging markets, with stocks halting a seven-day rally as Brent crude plunged as much as 7%. The ringgit led declines in developing-nation currencies as the disappointment stemming from the weekend meeting in Doha disrupted a recovery in commodity prices, putting pressure on Malaysian finances as a net oil exporter. Hopes an agreement would be reached had pushed Brent above $44 a barrel for the first time since December and spurred gains across asset classes in recent days. It’s now headed back toward $41 as the discussions to address a global oil glut stalled after Saudi Arabia and other Gulf nations wouldn’t commit to any deal unless all OPEC members joined, including Iran.

“We have seen a high correlation between oil, commodity prices and emerging assets this year and we have seen a strong run up, so the latest development on the failure to agree on an oil output freeze should spark profit-taking among investors,” said Miles Remington, head of equities at BNP Paribas Securities Indonesia. Energy-related companies fell the most among the 10 industry groups of the MSCI Emerging Markets Index, which dropped 0.7% and retreated from last week’s highest level since November. While that was the biggest decline since April 5, the energy component slid 1.4% and industrial stocks 1%.

Japan can’t keep this up much longer.

• Loonie, Aussie Drop After Doha Failure; Yen Near 1 1/2-Year High (BBG)

The Canadian and Australian dollars dropped as crude tumbled after oil-producing nations failed to reach an accord to freeze output. The yen, used by investors as a haven, rose toward a 17-month high. The currencies of Australia, Canada, Malaysia and Norway all retreated at least 0.7% after negotiations in Doha ended without an agreement from OPEC and other oil producers to freeze supplies. Foreign-exchange traders sought the safety of Japan’s currency as the diplomatic failure threatens to send crude back toward the more than 13-year lows reached in February. World leaders at the end of last week signaled opposition to any efforts from Japan to directly halt the yen’s 11% climb this year.

“Lack of agreement from Doha has hit commodity currencies lower,” said Robert Rennie at Westpac Banking in Sydney. “The prospects of another near-term round of talks appear limited ahead of the June OPEC meeting.” The Aussie dropped 0.8% to 76.65 U.S. cents as of 7:01 a.m. London time, set for the largest decline since April 7. Canada’s loonie tumbled 1.1% to C$1.2962 against the greenback. Crude is the nation’s second-largest export. Malaysia’s ringgit slid 0.8% to 3.9348 per dollar. Oil futures fell as much as 6.8%, the biggest intraday drop since Feb. 1. “The oil price will reset lower and could even retest $30 over the next three months,”said James Purcell at UBS’s wealth-management business in Hong Kong.

“Short term, that will dampen enthusiasm for risk assets. However, markets are being slightly myopic. Economic data have improved in both China and the U.S. of late.” The lack of agreement at Doha highlights the deep divisions between OPEC members, and importantly, within Saudi Arabia, Westpac’s Rennie said. The Aussie should hold support from about 75.75 cents to 76 cents at least through the next day or so, he said. The yen jumped 0.7% to 107.96 per dollar, and touched 107.77. It reached 107.63 on April 11, the strongest since October 2014. Hedge funds and other large speculators pushed wagers on yen strength to a record last week as Japanese authorities appeared reluctant to intervene to reverse the strengthening currency.

Price discovery is the economy’s biggest enemy.

• The Bad Smell Hovering Over The Global Economy (G.)

All is calm. All is still. Share prices are going up. Oil prices are rising. China has stabilised. The eurozone is over the worst. After a panicky start to 2016, investors have decided that things aren’t so bad after all. Put your ear to the ground though, and it is possible to hear the blades whirring. Far away, preparations are being made for helicopter drops of money onto the global economy. With due honour to one of Humphrey Bogart’s many great lines from Casablanca: “Maybe not today, maybe not tomorrow but soon.” But isn’t it true that action by Beijing has boosted activity in China, helping to push oil prices back above $40 a barrel? Has Mario Draghi not announced a fresh stimulus package from the European Central Bank designed to remove the threat of deflation? Are hundreds of thousands of jobs not being created in the US each month?

In each case, the answer is yes. China’s economy appears to have bottomed out. Fears of a $20 oil price have receded. Prices have stopped falling in the eurozone. Employment growth has continued in the US. The International Monetary Fund is forecasting growth in the global economy of just over 3% this year – nothing spectacular, but not a disaster either. Don’t be fooled. China’s growth is the result of a surge in investment and the strongest credit growth in almost two years. There has been a return to a model that burdened the country with excess manufacturing capacity, a property bubble and a rising number of non-performing loans. The economy has been stabilised, but at a cost. The upward trend in oil prices also looks brittle. The fundamentals of the market – supply continues to exceed demand – have not changed.

Then there’s the US. Here there are two problems – one glaringly apparent, the other lurking in the shadows. The overt weakness is that real incomes continue to be squeezed, despite the fall in unemployment. Americans are finding that wages are barely keeping pace with prices, and that the amount left over for discretionary spending is being eaten into by higher rents and medical bills. For a while, consumer spending was kept going because rock-bottom interest rates allowed auto dealers to offer tempting terms to those of limited means wanting to buy a new car or truck. In an echo of the subprime real estate crisis, vehicle sales are now falling. The hidden problem has been highlighted by Andrew Lapthorne of the French bank Société Générale. Companies have exploited the Federal Reserve’s low interest-rate regime to load up on debt they don’t actually need.

“The proceeds of this debt raising are then largely reinvested back into the equity market via M&A or share buybacks in an attempt to boost share prices in the absence of actual demand,” Lapthorne says. “The effect on US non-financial balance sheets is now starting to look devastating.” He adds that the trigger for a US corporate debt crisis would be falling share prices, something that might easily be caused by the Fed increasing interest rates.

BBG senior editor David Shipley displays the general fallacy: all that’s there are desperate attempts to go back to something that once was, only in a more centralized fashion. But there’s no going back.

• Untried, Untested, Ready: Remedies for the Global Economy (BBG Ed.)

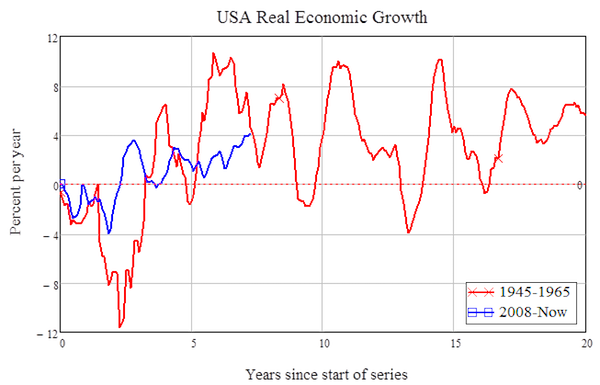

The deeper the slump, economists used to say, the stronger the recovery. They don’t say that anymore. The effects of the crash of 2008 still reverberate, with the latest forecasts for global growth even more dismal than the last. The persistently stagnant world economy is more than just a rebuke to economic theory, of course; it exacts a human toll. And while politicians and central bankers – or economists, for that matter – can’t be faulted for their creativity, their remedies might have more impact if they were bolder and better-coordinated. By ordinary standards, to be sure, governments haven’t been timid. Without fiscal stimulus and aggressive monetary easing in the U.S. and other countries, things would look even worse. And yet, worldwide output is predicted to rise only 3.2% this year, falling still further below the pre-crash trend.

Simply doubling down on current strategies is unlikely to work. Large-scale bond-buying, or so-called quantitative easing, has run into diminishing returns. Negative interest rates, where they’ve been tried, haven’t revived lending, and central banks are unable or unwilling to cut further. What about new fiscal stimulus? Where possible, that would be good – but it’s hardest to do in the very countries that need it most, because that’s where public debt is already dangerously high. True, as the IMF’s new fiscal report says, almost all countries could become more growth-friendly by combining measures to curb public spending in the longer term (for instance, raising the retirement age) with steps to increase demand in the short term (cutting payroll taxes, raising employment subsidies and building infrastructure).

Getting fiscal policy right country by country would surely help – yet probably wouldn’t be enough: No single country can adequately deal with a global shortfall of demand. A finance ministry for the world isn’t happening any time soon. Still, it’s a pity that governments aren’t trying harder to coordinate their fiscal policies more intelligently, or indeed at all. The global slump persists partly because of international spillovers. Better coordination would take these into account: Countries that could safely deploy fiscal stimulus would give some weight to global as well as national conditions, and fiscal policy would be formed interactively. Even within the EU, where you’d expect economic coordination to be the norm, and where the single currency makes it essential, there’s no sign of it.

At the global level, in forums such as the IMF, you might expect the U.S. to take the lead in any such effort. So it should – but it will need to mend its shattered policy-making machinery first. If Washington can’t come to a decision on its own on taxes or spending, the question of coordination doesn’t arise. The last resort, if the slump goes on and governments can’t coordinate better, might be to combine monetary and fiscal policy in a hybrid known (unfortunately) as helicopter money. Governments would cut taxes and/or spend more, but meet the cost by printing money rather than by borrowing. In one variant, central banks might simply send out checks to taxpayers. That’s a startling idea, no doubt – but so was quantitative easing not long ago.

Quarter-on-quarter annualized growth rate is 4.5%..

• China’s QoQ and YoY GDP Data Don’t Add Up (BBG)

China’s growth rates for quarter-on-quarter and year-on-year GDP for the past year don’t match. That, combined with confirmation that 1Q output was underpinned by an unsustainable resurgence in real estate, tarnishes the newly acquired shine on the country’s economic prospects. The initial reaction to the 1Q GDP data, published Friday, was a sigh of relief. Growth at 6.7% year on year was in line with expectations and comfortably inside the government’s 6.5-7% target range. If anyone noticed that the normal quarter-on- quarter data was missing from the National Bureau of Statistics release, few thought anything of it. Then, on Saturday, the quarter-on-quarter data was published, and some of the relief turned to consternation.

Quarter-on-quarter growth in 1Q was just 1.1% – an annualized growth rate of 4.5%, and the lowest print since the data series became available in 2011. Worse, based on the accumulated quarter-on-quarter data over the last year, annual growth in 1Q was just 6.3% – substantially below the NBS’s 6.7% reading for year-on-year growth. Explaining the inconsistency between the two data points is tough to do. Accumulated quarter-on-quarter growth over four quarters should add up to year-on-year growth. In the past, it has. The divergence in the 1Q readings might reflect something as simple as difficulties with seasonal adjustment. Even so, against a backdrop of concerns about data reliability, it can only add to skepticism about China’s true growth rate.

Xi’s dilemma.

• Is China Ready To Let More State-Owned Enterprises Default? (BBG)

China’s state-owned enterprises are likely to suffer more defaults over the next year as the government shows its readiness to shut companies in industries struggling with overcapacity, according to Standard & Poor’s. “In a major policy shift, the central government appears willing to close and liquidate struggling enterprises in the steel, mining, building materials, and shipbuilding industries,” S&P analyst Christopher Lee wrote in a report Monday. “We believe this stance will exacerbate the problems of companies in these cyclical and capital-intensive sectors, which are facing sluggish demand amid slowing investment growth.”

The warning follows S&P’s decision earlier this month to cut China’s sovereign rating outlook to negative from stable because economic rebalancing is likely to proceed more slowly than it had expected. Moody’s Investors Service also downgraded the outlook to negative in March, highlighting surging debt and the government’s ability to enact reforms. The revisions were biased, Finance Minister Lou Jiwei said in Washington on Friday. Premier Li Keqiang has pledged to withdraw support from so-called zombie firms that have wasted financial resources and dragged on economic growth, which is at the slowest in a quarter century. China’s central bank has lowered benchmark interest rates six times since 2014, underpinning a jump in debt to 247% of GDP.

China Railway Materials, a state-backed commodities trader, is seeking to reorganize debt and halted trading on 16.8 billion yuan ($2.6 billion) of bonds this month. Baoding Tianwei last year became the first government-backed company to renege on onshore bonds. Sinosteel defaulted on onshore debt in October. Leverage among the largest state-owned enterprises has reached a “critical” level, according to Lee. It is likely to worsen in 2016 as a weak top line is not fully offset by cost cuts and capital expenditure reductions, he wrote in the report.

1.8 million is a rounding error in China.

• China Makes Plans for 1.8 Million Workers Facing Unemployment (WSJ)

China etched in details of plans to help workers laid off from the bloated coal and steel industries, saying assistance would include career counseling, early retirement and help in starting businesses, among other measures. New guidelines released by seven Chinese ministries over the weekend build on previously announced commitments to restructure the coal and steel industries, whose excess production is dragging on the economy, and to take care of an estimated 1.8 million workers who will be displaced. The new measures place priority on finding jobs and cushioning the transition to reduce the unemployment that the authoritarian government sees as a threat to social stability.

“Proper placement of workers is the key to working to resolve excess capacity,” said the document issued by the labor ministry, the top economic planning agency and others. It urged local governments to “take timely measures to resolve conflicts” and to “avoid ignoring the issue.” Unlike a far-reaching restructuring of state industries two decades ago, Beijing is taking a cautious approach this time around, prompting some economists to caution that the protracted pace may make the situation worse. Government data released Friday showed economic growth slowing slightly in the first quarter, buoyed by new loans, debt and investment in real estate and factories—methods that are likely to lengthen the transition to a more consumer-driven society from one driven by investment and manufacturing.

Western-style “restructuring is not on the horizon here,” said ING economist Tim Condon. “Rebalancing, forget that. That’s for another day.” Government plans call for reducing some 10% to 15% of the excess capacity in the steel and coal sectors over the next several years. That is less than half the portion analysts say is needed to bring supply closer in line with demand. And steel and coal are only two of numerous other industries plagued by overcapacity that haven’t been addressed. The large number of ministries that have signed off on the plan dated April 7 but released more than a week later underscore the sensitivity, importance and breadth of resources China is devoting to the unemployment problem.

Europe goes blindly into the night.

• The Trucker’s Nightmare That Could Flatten Europe’s Economy (BBG)

[..] Germany, Austria, France and Sweden, among others, have reintroduced border checkpoints in some places. They are pressured by Europe’s biggest refugee crisis since World War II – about 1 million migrants arrived in Greece and Italy in 2015 – terrorist attacks, and the growth of anti-immigration movements. But the economic cost of dumping Schengen, at a time when growth across the continent is still weak, would be massive. A permanent return to border controls could lop €470 billion of GDP growth from the European economy over the next 10 years, based on a relatively conservative assumption of costs, according to research published by Germany’s Bertelsmann Foundation. That’s like losing a company almost the size of BMW AG every year for a decade.

The open borders power an economy of more than 400 million people, with 24 million business trips and 57 million cross-border freight transfers happening every year, the European Parliament says. Firms in Germany’s industrial heartland rely on elaborate, just-in-time supply chains that take advantage of lower costs in Hungary and Poland. French supermarket chains are supplied with fresh produce that speeds north from Spain and Portugal. And trans-national commutes have become commonplace since Europeans can easily choose to, say, live in Belgium and work in France. For many Europeans, passport-free travel is part of being, simply, European. For the company hiring driver Unczorg, the security checks increase costs in terms of delays, storage and inventory.

Permanent controls would destroy the business model of German industry, says Rainer Hundsdoerfer, chairman of EBM-Papst. “You get the products you need for assembly here in Germany just in time,” he said by phone. “That’s why the trucks go nonstop. They come here, they unload, they load, and off they go. The cost isn’t the only prime issue” in reinstating border checks. “It’s that we couldn’t even do it.” Nor could anyone else, he adds: “Nothing in German industry, regardless of whether it’s automotives or appliances or ventilators, could exist without the extended workbenches in eastern Europe.”

This sort of over the top comment could be the biggest gift to the Leave side. Then again, they have Boris Johnson and Nigel Farage as their figureheads. Not going to work.

• George Osborne: Brexit Would Leave UK ‘Permanently Poorer’ (G.)

Britain would be “permanently poorer” if voters choose to leave the EU, George Osborne has warned, as a Treasury study claimed the economy would shrink by 6% by 2030, costing every household the equivalent of £4,300 a year. In the starkest warning so far by the government in the referendum campaign, the chancellor describes Brexit as the “most extraordinary self-inflicted wound”. Osborne will embark on one of the government’s most significant moves in the referendum campaign on Monday when he publishes a 200-page Treasury report which sets out the costs and benefits of EU membership. In a Times article the chancellor wrote: “The conclusion is clear for Britain’s economy and for families – leaving the EU would be the most extraordinary self-inflicted wound.”

Osborne warned that the option favoured by Boris Johnson – a deal along the lines of the EU-Canada arrangement – would lead to an economic contraction of 6% by 2030. Supporters of Britain’s EU membership say the EU-Canadian deal would be a disaster for the UK because it excludes financial services, a crucial part of the British economy. The chancellor asked whether this was a “price worth paying” as he said there was no other model for the UK that gave it access to the single market without quotas and tariffs while retaining a say over the rules. Osborne continued: “Put simply : over many years, are you better off or worse off if we leave the EU? The answer is: Britain would be worse off, permanently so, and to the tune of £4,300 a year for every household.”

“It is a well-established doctrine of economic thought that greater openness and interconnectedness boosts the productive potential of our economy. That’s because being an open economy increases competition between our companies, making them more efficient in the face of consumer choice, and creates incentives for business to innovate and to adopt new technologies.”

One corrupt clan fights the other. Rousseff may well be the cleanest of the bunch.

• Brazilian Congress Votes To Impeach President Dilma Rousseff (G.)

Brazilian president Dilma Rousseff suffered a crushing defeat on Sunday as a hostile and corruption-tainted congress voted to impeach her. In a rowdy session of the lower house presided over by the president’s nemesis, house speaker Eduardo Cunha, voting ended late on Sunday evening with 367 of the 513 deputies backing impeachment – comfortably beyond the two-thirds majority of 342 needed to advance the case to the upper house. As the outcome became clear, Jose Guimarães, the leader of the Workers party in the lower house, conceded defeat with more than 80 votes still to be counted. “The fight is now in the courts, the street and the senate,” he said. As the crucial 342nd vote was cast for impeachment, the chamber erupted into cheers and Eu sou Brasileiro, the football chant that has become the anthem of the anti-government protest.

Opposition cries of “coup, coup,coup” were drowned out. In the midst of the raucous scenes the most impassive figure in the chamber was the architect of the political demolition, Cunha. Watched by tens of millions at home and in the streets, the vote – which was announced deputy by deputy – saw the conservative opposition comfortably secure its motion to remove the elected head of state less than halfway through her mandate. There were seven abstentions and two absences, and 137 deputies voted against the move. Once the senate agrees to consider the motion, which is likely within weeks, Rousseff will have to step aside for 180 days and the Workers party government, which has ruled Brazil since 2002, will be at least temporarily replaced by a centre-right administration led by vice-president Michel Temer.

On a dark night, arguably the lowest point was when Jair Bolsonaro, the far-right deputy from Rio de Janeiro, dedicated his yes vote to Carlos Brilhante Ustra, the colonel who headed the Doi-Codi torture unit during the dictatorship era. Rousseff, a former guerrilla, was among those tortured. Bolsonaro’s move prompted left-wing deputy Jean Wyllys to spit towards him. Eduardo Bolsonaro, his son and also a deputy, used his time at the microphone to honour the general responsible for the military coup in 1964. Deputies were called one by one to the microphone by the instigator of the impeachment process, Cunha – an evangelical conservative who is himself accused of perjury and corruption – and one by one they condemned the president. Yes, voted Paulo Maluf, who is on Interpol’s red list for conspiracy. Yes, voted Nilton Capixiba, who is accused of money laundering. “For the love of God, yes!” declared Silas Camara, who is under investigation for forging documents and misappropriating public funds.

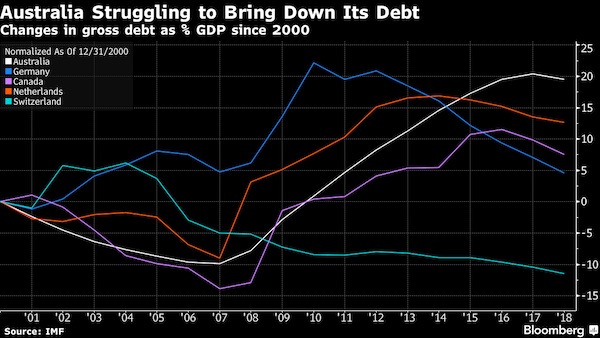

Australia played all on red. Which can you take to mean either China, for exports, or debt, for housing. Realizing that in the ned the house always wins, it’s a suicide strategy.

• Australia’s Debt Dilemma Raises Downgrade Fears (BBG)

1986 may seem like a long time ago, but for Australian Treasurer Scott Morrison some of the parallels with his current budget balancing act are getting too close for comfort. Back then, Moody’s and Standard & Poor’s pulled their AAA ratings as weak commodity prices wrecked government income and external finances. With resources again in a funk and a widening funding gap, National Australia Bank and JPMorgan said last week Morrison needs to undertake repairs in his May 3 budget to safeguard the country’s top rankings. Moody’s warned Thursday that debt will grow without revenue-boosting measures. “Moody’s are understandably getting impatient,” said Shane Oliver at Sydney-based AMP Capital Investors.

“We’ve seen each successive budget update push out the return to surplus. This time around – like back in the middle of the ’80s when we did suffer downgrades – we again have a twin deficit problem.” Thirty years ago, then-Treasurer Paul Keating warned the country risked becoming a “banana republic” because of its reliance on resources and it took nearly 17 years to regain the two top credit scores. While Morrison’s language hasn’t been as strident, he has said Australia must live within its means and indicated a focus on reduced spending. The government expects Australia’s budget position to improve in coming years despite the environment for commodity prices as it controls expenditure growth, Finance Minister Mathias Cormann said Thursday in an e-mailed response to questions.

“The Government is committed to responsible budget management which protects our AAA credit rating,” he said. “Our public debt remains low internationally and consistent with our plan, the government is committed to stabilizing and reducing our debt over time.” Australia’s general government net debt is projected to peak at 19.9% in 2017, lower than any Group of Seven economy, according to the IMF’s fiscal monitor. That number has climbed from minus 0.6% in 2009. “One differentiating feature between Australia and other Aaa rated sovereigns is that, while government debt has increased markedly in Australia, it has been more stable for other Aaa sovereigns,” Marie Diron at Moody’s in Singapore wrote. “We expect a further increase in debt and will look at policy measures and the economic environment to review our analysis on this.”

Japan and Europe are in a much better position than the US? Really?

• Peter Schiff: ‘Trump’s Right, America Is Broke’ (ZH)

Euro Pacific Capital’s Peter Schiff sat down with Alex Jones last week to discuss the state of the economy, and where he sees everything going from here. Here are some notable moments from the interview. Regarding how bad things are, and what’s really going on in the economy, Schiff lays out all of the horrible economic data that has come out recently, as well as making sure to take away the crutch everyone uses to explain any and all data misses, which is weather.

“It’s no way to know exactly the timetable, but obviously this economy is already back in recession, and if it’s not in a recession it’s certainly on the cusp of one” “We could be in a negative GDP quarter right now, and I think that if the first quarter is bad the second quarter is going to be worse” “The last couple years we had a rebound in the second quarter because we’ve had very cold winters. Well this winter was the warmest in 120 years so there is nothing to rebound from.”

On the Fed, and current policies, he very bluntly points out that nothing is working, nor has it worked, but of course the central planners will try it all anyway. He also takes a moment to agree with Donald Trump regarding the fact that the U.S. is flat out, undeniably broke.

“The problem for the Fed is how do they launch a new round of stimulus and still pretend the economy is in good shape.” “Negative interest rates are a disaster. It’s not working in Japan, it’s not working in Europe, it’s not going to work here. Just because it doesn’t work doesn’t mean we’re not going to do it, because everything we do doesn’t work and we do it anyway. It shows desperation, that you’ve had all these central bankers lowering interest rates and expecting it to revive the economy. And then when they get down to zero, rather than admit that it didn’t work, because clearly if you go to zero and you still haven’t achieved your objective, maybe it doesn’t work. Instead of admitting that they were wrong, they’re now going negative.”

“The United States, no matter how high inflation gets, we’ll do our best to pretend it doesn’t exist or rationalize it away because we have a lot more debt. America is broke, if you look at Europe and Japan even though there is some debt there, overall those are still creditor nations. The world still owes Europe money, the world still owes Japan money, but America owes more money than all of the other debtor nations combined. Trump is right about that, we are broke, we’re flat broke, and we’re living off this credit bubble and we can’t prick it. Other central banks may be able to raise their rates, but the Fed can’t.”

On how he sees everything unfolding from this point, Peter again points out that the economy is weak and it’s only a matter of time before this entire centrally planned manipulation is exposed for what it is, and becomes a disaster for the Federal Reserve. He likens how investors are behaving today to the dot-com bubble, and the beginning of the global financial crisis.

“Let each wage-earning citizen hold the whole of his or her untaxed earnings–actually touch them. Then let the government pluck its taxes.” “..in six months we would have either a tax revolution or a startling contraction of the budget!”

• Make America Solvent Again (Jim Grant)

[..] The public debt will fall due someday. It will have to be repaid or refinanced. If repaid, where would the money come from? It would come from you, naturally. The debt is ultimately a deferred tax. You can calculate your pro rata obligation on your smartphone. Just visit the Treasury website, which posts the debt to the penny, then the Census Bureau’s website, which reports the up-to-the-minute size of the population. Divide the latter by the former and you have the scary truth: $42,998.12 for every man, woman and child, as I write this. In the short term, the debt would no doubt be refinanced, but at which interest rate? At 4.8%, the rate prevailing as recently as 2007, the government would pay more in interest expense –$654 billion– than it does for national defense.

At a blended rate of 6.7%, the average prevailing in the 1990s, the net federal-interest bill would reach $913 billion, which very nearly equals this year’s projected outlay on Social Security. We always need protection against cockeyed economic experimentation. Once a national consensus on money and debt furnished this protective armor. Money was gold and debt was bad, Americans assumed. Most credentialed economists today will smile at these ancient prejudices. Allow me to suggest that our forebears knew something. Keynes himself would recoil at 0% bank-deposit rates, chronically low economic growth and the towering trillions that we have so generously pledged to one another. (All we have to do now is earn the money to pay them.) How do we escape from our self-constructed fiscal jail? According to the Government Accountability Office, unpaid taxes add up to more than $450 billion a year.

Even so, according to the Tax Foundation, Americans spend 6.1 billion hours and $233.8 billion each tax season complying with a federal tax code that runs to 10 million words. Are we quite sure we want no part of the flat-tax idea? An identical low rate on most incomes. No deductions, no H&R Block. Impractical? So is the debt. So is the spending (and the promises to spend more down the road). We need to stop the squandermania. How? By resuming the principled fight that Vivien Kellems waged against the IRS during the Truman Administration. It enraged Kellems, a doughty Connecticut entrepreneur, that she was forced to withhold federal taxes from her employees’ wages. She called it involuntary servitude, and she itched to make her constitutional argument in court. She never got that chance, but she published her plan for a peaceful revolution.

She asked her readers –I ask mine– to really examine the stub of their paycheck. Observe how much your employer pays you and how much less you take home. Notice the dollars withheld for Medicare, Social Security and so forth. If you are like most of us, you stopped looking long ago. You don’t miss the income that you never get to touch. Picking up where Kellems left off, I propose a slight alteration in payday policy. Let each wage-earning citizen hold the whole of his or her untaxed earnings–actually touch them. Then let the government pluck its taxes. “Such a payroll policy,” wrote Kellems in her memoir, Taxes, Toil and Trouble, “is entirely legal and if it were universally adopted, in six months we would have either a tax revolution or a startling contraction of the budget!” Black ink, sound money and the spirit of Vivien Kellems are the way forward. “Make America solvent again” is my credo and battle cry. You can fit it on a cap.

“The message of today’s populist revolts is that politicians must tear up their pre-crisis rulebooks and encourage a revolution in economic thinking.” No, it’s that today’s politicians must go.

• Is Capitalism Entering A New Era? (Kaletsky)

The defining feature of each successive stage of global capitalism has been a shift in the boundary between economics and politics. In classical nineteenth-century capitalism, politics and economics were idealized as distinct spheres, with interactions between government and business confined to the (necessary) raising of taxes for military adventures and the (harmful) protection of powerful vested interests. In the second, Keynesian version of capitalism, markets were viewed with suspicion, while government intervention was assumed to be correct. In the third phase, dominated by Thatcher and Reagan, these assumptions were reversed: government was usually wrong and the market always right. The fourth phase may come to be defined by the recognition that governments and markets can both be catastrophically wrong.

Acknowledging such thoroughgoing fallibility may seem paralyzing – and the current political mood certainly seems to reflect this. But recognizing fallibility can actually be empowering, because it implies the possibility of improvement in both economics and politics. If the world is too complex and unpredictable for either markets or governments to achieve social objectives, then new systems of checks and balances must be designed so that political decision-making can constrain economic incentives and vice versa. If the world is characterized by ambiguity and unpredictability, then the economic theories of the pre-crisis period – rational expectations, efficient markets, and the neutrality of money – must be revised. Moreover, politicians must reconsider much of the ideological super-structure erected on market fundamentalist assumptions.

This includes not only financial deregulation, but also central bank independence, the separation of monetary and fiscal policies, and the assumption that competitive markets require no government intervention to produce an acceptable income distribution, drive innovation, provide necessary infrastructure, and deliver public goods. It is obvious that new technology and the integration of billions of additional workers into global markets have created opportunities that should mean greater prosperity in the decades ahead than before the crisis. Yet “responsible” politicians everywhere warn citizens about a “new normal” of stagnant growth. No wonder voters are up in arms. People sense that their leaders have powerful economic tools that could boost living standards.

Money could be printed and distributed directly to citizens. Minimum wages could be raised to reduce inequality. Governments could invest much more in infrastructure and innovation at zero cost. Bank regulation could encourage lending, instead of restricting it. But deploying such radical policies would mean rejecting the theories that have dominated economics since the 1980s, together with the institutional arrangements based upon them, such as Europe’s Maastricht Treaty. Few “responsible” people are yet willing to challenge pre-crisis economic orthodoxy. The message of today’s populist revolts is that politicians must tear up their pre-crisis rulebooks and encourage a revolution in economic thinking. If responsible politicians refuse, “some rough beast, its hour come at last” will do it for them.

Japan, Philippines, Tonga, Vanuatu, Ecuador and more

• Fears Of ‘The Big One’ As 7 Major Earthquakes Strike Pacific In 96 Hours (E.)

Japan has been worst hit by the tremors. The latest quake to hit the country yesterday, measuring 7.3 on the Richter scale, injured more than 1,000 and trapped people in collapsed buildings, only a day after a quake killed nine people in the same region. Rescue crews searched for survivors of a magnitude 7.3 earthquake that struck Japan’s Kyushu Island, the same region rattled by a 6.2 quake two days earlier. Around 20,000 troops have had to be deployed following the latest 7.3 earthquake at 1.25am local time on Saturday. Roads have also been damaged and big landslides have been reported, there are also 200,000 households without power. The death toll in the latest Kyushu earthquake is 16 people and a previous earthquake that struck the area on Thursday had killed nine people.

There have been other large earthquakes recorded in recent days, including a major one in southern Japan which destroyed buildings and left at least 45 people injured, after Myanmar was rocked on Wednesday. Japan’s Fire and Disaster Management Agency said 7,262 people have sought shelter at 375 centers since Friday in Kumamoto Prefecture. Prime Minister Shinzo Abe vowed to do everything he could to save lives following the disaster. He said: “Nothing is more important than human life and it’s a race against time.” On Thursday, The Japanese Red Cross Kumamoto Hospital confirmed 45 were injured, including five with serious injuries after a quake of magnitude 6.2 to 6.5 and a series of strong aftershocks ripped through Kumamoto city.

Several buildings were damaged or destroyed and at least six people are believed to be trapped under homes in Mashiki. Local reports said one woman was rescued in a critical condition Scientists say there has been an above average number of significant earthquakes across south Asia and the Pacific since the start of the year. The increased frequency has sparked fears of a repeat of the Nepal quake of 2015, where 8,000 people died, or even worse. Roger Bilham, seismologist of University of Colorado, said: “The current conditions might trigger at least four earthquakes greater than 8.0 in magnitude. “And if they delay, the strain accumulated during the centuries provokes more catastrophic mega earthquakes.”