Salvador Dali Elephants 1948

’Rand Paul has persuaded the president that we are not for regime change in Iran..’

• Rand Paul Against the World (AC)

President Trump has been known to be hawkish on Iran. Politico observed Wednesday: “Trump has drawn praise from the right-wing establishment for hammering the mullahs in Tehran, junking the Iran nuclear deal and responding to the regime’s saber rattling with aggressive rhetoric of his own….” There are also powerful factions in Congress and Washington with inroads to the president that have been itching for regime change for years. “The policy of the United States should be regime change in Iran,” says Senator Tom Cotton, once rumored to be Trump’s pick to head the CIA. So what, or who, is stopping the hawks?

Politico revealed Wednesday some interesting aspects of the relationship between Senator Rand Paul and the president, particularly on foreign policy: “While Trump tolerates his hawkish advisers, the [Trump] aide added, he shares a real bond with Paul: ‘He actually at gut level has the same instincts as Rand Paul…’.” On Iran, Politico notes, “Trump has stopped short of calling for regime change even though Secretary of State Mike Pompeo, Secretary of Defense James Mattis, and Bolton support it, aligning with Paul instead, according to a GOP foreign policy expert in frequent contact with the White House.”

But this part of the story was the most revelatory: “’Rand Paul has persuaded the president that we are not for regime change in Iran,’ this person said, because adopting that position would instigate another war in the Middle East.” This is significant, not because Trump couldn’t have arrived at the same position without Paul’s counsel, but because it’s easy to imagine him embracing regime change, what with virtually every major foreign policy advisor in his cabinet supporting something close to war with Iran. “Personnel is policy” is more than a cliché.

Musk will have to clarify his ‘Funding Secured’, either to his board or the SEC. Preferably both.

• Saudi Arabia’s PIF and SoftBank Not Interested in Tesla Buyout (WS)

The whole scheme kicked off when Tesla CEO Elon Musk tweeted during trading hours that he was “considering” taking Tesla private, “Funding secured,” which caused the already ludicrously overvalued shares to spike. Later he added, “Investor support is confirmed.” But no details, no names, no tidbits, not even a tease. Two days earlier, he’d tweeted that “even Hitler was shorting Tesla stock.” We can brush off the Hitler tweet as just one more Musk idiocy gone awry, but “Funding secured” and “Investor support is confirmed” are big-ass phrases for a public-company CEO discussing a buyout that would be valued at $72 billion. Now some folks, including those at the SEC’s San Francisco office, are wanting to know where exactly this money is going to come from – and if funding was even remotely “secured.”

The Tesla true believers instantly figured that a deal had already been worked out, either with SoftBank or with Saudi Arabia’s Public Investment Fund (PIF), or with both, or whatever. Turns out, it’s not going to be SoftBank, and it’s not going to be the Saudis, either. They’re not interested in creating the magic to pull this off. Reuters reported today that a source “familiar with PIF’s strategy,” said that the fund was not, as Reuters put it, “currently getting involved in any funding process for Tesla’s take-private deal.” PIF had made headlines recently when it came out that it had acquired a stake in Tesla of just below 5% by buying its shares (TSLA) in the market. None of this money went to Tesla. It went to Tesla shareholders that wanted to get out.

They don’t seem to be getting it done.

• China Scrambles to Cool Overheated Real Estate Market (ET)

The Chinese government went all out during the first half of 2018 to cool an overheated real estate market. Major cities in China have issued regulations for their local real estate markets more than 260 times through July of this year, according to data from Centaline Property Agency, one of the largest property agencies in Hong Kong. That’s an all-time high and marks an 80 percent increase in frequency compared to the same period in 2017. In July alone, more than 60 cities announced more than 70 revised sets of real estate regulatory policies. Chinese cities have sought to keep housing prices from skyrocketing by limiting the number of properties one can purchase and sell, raising the minimum down-payment ratio for homebuyers, and boosting the time period between a purchase and when a unit can be then listed on the market for resale.

The Chinese Communist Party has made it a political priority to “resolutely contain the rise of housing prices,” as discussed during a meeting of the Party’s powerful 25-member Politburo on July 31, according to state-run media Xinhua. While prices in the real estate markets of some first- and second-tier cities appear to have leveled off, prices in most third- and fourth-tier cities continue to soar. In June, among China’s designated 70 large and medium-sized cities, 63 experienced a price increase for newly built commodity housing units, or privately developed housing on leased land, compared with last year, according to official data released by China’s National Bureau of Statistics. Prices for new commodity housing and “second-hand housing”—units previously owned that are now on the market for sale—in 31 second-tier cities also increased, by 6.3 percent and 4.6 percent, respectively, in June.

Shadow banks and P2P -there’s overlap- have been instrumental in China’s runaway growth.

• Beijing Struggles To Defuse Anger Over China’s P2P Lending Crisis (R.)

Peter Wang was asleep at his home in Beijing last Monday when police officers arrived before dawn to detain him, saying he had helped organize a protest planned for later that day. Across the city, others who had lost money investing in China’s online peer-to-peer (P2P) lending platforms – including some who had traveled from as far away as Shandong and Shanxi provinces – got similar visits from police. By the time they were released, the demonstration they had planned using social media chat groups had fizzled amid a massive security response around the China Banking and Insurance Regulatory Commission (CBIRC) headquarters in the heart of Beijing’s financial district.

[..] The size of China’s P2P industry is far bigger than in the rest of the world combined, with outstanding loans of 1.49 trillion yuan ($217.96 billion), according to data tracker p2p001.com, run by the Shenzhen Qiancheng Internet Finance Research Institute. P2P, in which platforms gather funds from retail investors and loan the money to small corporate and individual borrowers, promising high returns, started flourishing nearly unregulated in China in 2011. At its peak in 2015, there were about 3,500 such businesses. But after Beijing began a campaign to defuse debt bubbles and reduce risks in the economy, including the country’s enormous non-bank lending sector, cracks began to appear as investors pulled their funds.

Since June, 243 online lending platforms have gone bust, according to wdzj.com, another P2P industry data provider. In that period, the industry saw its first monthly net fund outflows since at least 2014, the data provider said. The latest burst of anger, which led to the planned protests, flared up ahead of a June 30 deadline for companies to comply with new business practice standards, which are still being finalised but could include bank custodianship of investor funds and tougher disclosure requirements. Many of them shut down rather than do so, Zane Wang, chief executive of online micro-loan provider China Rapid Finance, told Reuters. That caused panic in the broader market. Investors tried to pull funds from P2P companies, causing liquidity problems for many smaller operators, Wang said, although larger ones are faring better.

But who exactly has been served? Assange can’t read Twitter.

• DNC Serves WikiLeaks With Lawsuit Via Twitter (CBS)

The Democratic National Committee on Friday officially served its lawsuit to WikiLeaks via Twitter, employing a rare method to serve its suit to the elusive group that has thus far been unresponsive. As CBS News first reported last month, the DNC filed a motion with a federal court in Manhattan requesting permission to serve its complaint to WikiLeaks on Twitter, a platform the DNC argued the website uses regularly. The DNC filed a lawsuit in April against the Trump campaign, Russian government and WikiLeaks, alleging a massive conspiracy to tilt the 2016 election in Donald Trump’s favor. All of the DNC’s attempts to serve the lawsuit via email failed, the DNC said in last month’s motion to the judge, which was ultimately approved.

The lawsuit was served through a tweet from a Twitter account established Friday by Cohen Milstein, the law firm representing the DNC in the suit, with the intent of serving the lawsuit. The DNC argued the unusual method of serving a lawsuit over Twitter was feasible because WikiLeaks, founded by Julian Assange, frequently uses Twitter and had even suggested it had read the DNC’s lawsuit. On April 21, the WikiLeaks Twitter account tweeted, “Democrats have gone all Scientology against @WikiLeaks. We read the DNC lawsuit. Its primary claim against @WikiLeaks is that we published their ‘trade secrets.’ Scientology infamously tried this trick when we published their secret bibles. Didn’t work out well for them.'”

The DNC also noted last month that there is some legal precedent for serving the lawsuit on Twitter. The U.S. District Court for the Northern District of California, the DNC notes, decided service by Twitter was a reasonable way to alert the defendant, who had an active Twitter account. “WikiLeaks seems to tweet daily,” the DNC said in the motion made to the judge last month.

Cats in a sack.

• More Than 100 Constituencies That Backed Brexit Now Want To Stay In EU (G.)

More than 100 Westminster constituencies that voted to leave the EU have now switched their support to Remain, according to a stark new analysis seen by the Observer. In findings that could have a significant impact on the parliamentary battle of Brexit later this year, the study concludes that most seats in Britain now contain a majority of voters who want to stay in the EU. The analysis, one of the most comprehensive assessments of Brexit sentiment since the referendum, suggests the shift has been driven by doubts among Labour voters who backed Leave. As a result, the trend is starkest in the north of England and Wales – Labour heartlands in which Brexit sentiment appears to be changing.

The development will heap further pressure on Jeremy Corbyn to soften the party’s opposition to reconsidering Britain’s EU departure. Researchers at the Focaldata consumer analytics company compiled the breakdown by modelling two YouGov polls of more than 15,000 people in total, conducted before and after Theresa May published her proposed Brexit deal on 6 July. It combined the polling with detailed census information and data from the Office for National Statistics. The study was jointly commissioned by Best for Britain, which is campaigning against Brexit, and the anti-racist Hope Not Hate group. The 632 seats in England, Scotland and Wales were examined for the study. It found that 112 had switched from Leave to Remain. The new analysis suggests there are now 341 seats with majority Remain support, up from 229 seats at the referendum.

Russia remembers Germany 70 years ago.

• Russia Defense Minister Warns Germany Against ‘Strength & Unity’ Strategy (RT)

The Russian defense minister has reminded his German counterpart that approaching Moscow from a “position of unity and strength” is not the wisest idea, citing the bitter history of WWII that should’ve made Berlin more prudent. “We are open for dialogue. We are ready for a normal cooperation, but not at all from a position of strength,” Sergey Shoigu told Rossiya 24 TV station. “I certainly hope that the time when we could be talked to, as someone once said, as a second- or third-class country has now irretrievably passed.”

Referring to the original question from the host, Yevgeniy Popov, who noted the recent call by the German Defense Minister, Ursula von der Leyen, to engage in dialogue with Moscow only from a “position of unity and strength,” Shoigu reminded his counterpart that, while Russia seeks peace, it will not tolerate being coerced. “After everything Germany has done to our country, I think, they should not talk on the issue for another two hundred years,” Shoigu said. “Ask your grandparents about their experience of talking to Russia from the position of strength. They will probably be able to tell you.” Shoigu explained that NATO, including Germany, cannot come to grips with the reality of seeing Russia return to the world stage as an independent actor with a strong and powerful military force.

“We are not going to threaten anyone. We’re not going to start a war with anyone,” Shoigu said, noting, however, that Russian President Vladimir Putin is taking unprecedented measures to make sure the military is fully ready for any untoward surprises. “We’re doing a massive job to restore our army. Yes, the time has passed when we had no funds or time for the army.” “We now have a totally different army. And if that frightens someone, do come visit to see how we live,” he added, in an interview recorded after the wrap-up of the Army Games in Russia, extending an invitation to the NATO militaries so far missing out on the biggest annual international military competition.

But there are exceptions.

• New Zealand To Ban Foreigners From Buying Homes (SMH)

Foreigners face a ban on buying homes in New Zealand after a spending splurge by millionaires seeking doomsday bolt-holes crowded out local buyers and pushed up property prices. Home purchases by tycoons such as tech billionaire Peter Thiel, the PayPal founder, and Matt Lauer, the former NBC host who lost his job after allegations of sexual misconduct, have led the New Zealand government to crack down on the trend. The country’s allure for the mega-rich planning a safe space to ride out the apocalypse has become almost a cliché in recent years. Reid Hoffman, LinkedIn co-founder, told The New Yorker last year: “Saying you’re buying a house in New Zealand is kind of a wink, wink, say no more”.

But the country’s centre-Left government, led by prime minister Jacinda Ardern, is blaming the apocalypse preppers for a major housing crisis, with rates of homelessness among the highest in the developed world. Ms Ardern’s Labour Party is adamant that a law change banning foreigners from buying most types of homes in the country – due to pass through parliament next week – will help damp down property prices. It also plans to build 100,000 affordable properties in a decade, resolve New Zealand’s zoning and infrastructure woes, and bolster its ailing construction industry. The bill will still allow foreigners to buy new apartments in large developments and multi-storey blocks. Existing homes remain off limits to non-residents, but people from Australia and Singapore will be exempt from the ban, due to free-trade rules.

Yanis reviews a book by Adam Tooze.

• Crashed: How a Decade of Financial Crises Changed the World (Varoufakis)

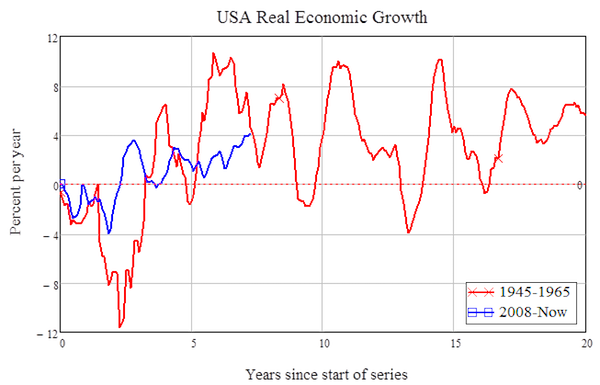

Every so often, humanity manages genuinely to surprise itself. Events to which we had previously assigned zero probability push us into what the ancient Greeks referred to as aporia: intense bafflement urgently demanding a new model of the world we live in. The financial crash of 2008 was such a moment. Suddenly the world ceased to make sense in terms of what, a few weeks before, passed as conventional wisdom – even McDonald’s, for goodness sake, could not secure an overdraft from Bank of America!

Moments of aporia produce collective efforts to respond to our bewilderment. In the late 18th century, the pains of the Industrial Revolution begat free-market economics. The crisis of 1848 brought us the Marxist tradition. The great depression produced both Keynes’s General Theory and Friedman’s monetarism. Over the past decade, the 2008 crash has given rise to a cottage industry of books, articles, documentaries, even films but not, so far, an overarching theory. Now, a compelling new book has arrived which deserves to be at the top of the reading list of anyone interested in the events of 2008 and eager to make sense of the aftermath .

Written by Adam Tooze, an English economic historian at Columbia University (and, in the interest of full disclosure, a colleague), Crashed: How a Decade of Financial Crisis Changed the World combines simple explanations of complex financial concepts with a majestic narrative tracing the prehistory and destructive path of the crisis across the planet (including long, apt and erudite chapters on Russia, the former Soviet satellites, China and south-east Asia). It also offers original insights into the nature of the wounded beast (financialised capitalism). Of the myriad unacknowledged truths that Tooze illuminates, some examples follow.

Nowhere is mankind’s insanity more on display than here. If you can’t oversee the consequences of your actions, the precautionary principle applies. Not the profit principle.

• Gene-Editing Startups Ignite The Next ‘Frankenfood’ Fight (R.)

In a suburban Minneapolis laboratory, a tiny company that has never turned a profit is poised to beat the world’s biggest agriculture firms to market with the next potential breakthrough in genetic engineering – a crop with “edited” DNA. Calyxt Inc, an eight-year-old firm co-founded by a genetics professor, altered the genes of a soybean plant to produce healthier oil using the cutting-edge editing technique rather than conventional genetic modification. Seventy-eight farmers planted those soybeans this spring across 17,000 acres in South Dakota and Minnesota, a crop expected to be the first gene-edited crop to sell commercially, beating out Fortune 500 companies.

Seed development giants such as Monsanto, Syngenta and DowDuPont have dominated genetically modified crop technology that emerged in the 1990s. But they face a wider field of competition from start-ups and other smaller competitors because gene-edited crops have drastically lower development costs and the U.S. Department of Agriculture (USDA) has decided not to regulate them. Relatively unknown firms including Calyxt, Cibus, and Benson Hill Biosystems are already advancing their own gene-edited projects in a race against Big Ag for dominance of the potentially transformational technology. “It’s a very exciting time for such a young company,” said Calyxt CEO Federico Tripodi, who oversees 45 people. “The fact a company so small and nimble can accomplish those things has picked up interest in the industry.”

Gene-editing technology involves targeting specific genes in a single organism and disrupting those linked to undesirable characteristics or altering them to make a positive change. Traditional genetic modification, by contrast, involves transferring a gene from one kind of organism to another, a process that still does not have full consumer acceptance. Gene-editing could mean bigger harvests of crops with a wide array of desirable traits – better-tasting tomatoes, low-gluten wheat, apples that don’t turn brown, drought-resistant soybeans or potatoes better suited for cold storage. The advances could also double the $15 billion global biotechnology seed market within a decade, said analyst Nick Anderson of investment bank Berenberg.

[..] Biotech firms hope the technology can avoid the “Frankenfood” label that critics have pinned on traditional genetically modified crops. But acceptance by regulators and the public globally remains uncertain. The Court of Justice of the European Union ruled on July 25 that gene-editing techniques are subject to regulations governing genetically modified crops. The ruling will limit gene-editing in Europe to research and make it illegal to grow commercial crops. The German chemical industry association called the decision “hostile to progress.”

Afraid they’ll be sued too?

• UK Outlets Review Sale Of Monsanto’s Roundup After US Cancer Verdict (G.)

One of the UK’s largest DIY retailers is reviewing the sale of Roundup weedkiller products amid mounting concerns about their use, after a US jury found that the herbicide had caused a terminally ill man’s cancer. The manufacturer of the weedkiller, Monsanto, has insisted that British consumers are safe to continue using Roundup products, which are widely sold at DIY stores and used by British farmers. But a spokesperson for Homebase said it would be reviewing its product range after the ruling in California. A spokesperson for B&Q said it had already been undertaking a broader review of all garden products in an attempt to manage the range responsibly.

[..] Monsanto’s vice-president, Scott Partridge, said on Friday that hundreds of studies had shown that glyphosate, one of the world’s most widely used herbicides and a key ingredient of Roundup, does not cause cancer. Monsanto would be appealing against the jury’s verdict, he added. “It is completely and totally safe, and the public should not be concerned about this verdict. It is one that we will work through the legal process to see if we can get the right result. The science is crystal-clear,” he said. “The jury made a decision, but the decision that a jury or a judge makes has to be based on the weight of the evidence, and the overwhelming weight of the evidence that went in the trial was that science demonstrates glyphosate is safe; there’s no credible evidence to the contrary.”

[..] The scientific world, however, has raised doubts about glyphosate. A ruling in 2015 by the World Health Organization’s international agency for research on cancer (IARC) classified glyphosate as “probably carcinogenic to humans”. Campaigners are now calling for a review of pesticide regulations in the UK after the case, saying that glyphosate poses a risk to public health, soils and the environment. More than 2m hectares (5m acres) of farmland across Britain are treated with glyphosate annually, according to a study of government data by Oxford Economics. Emma Hockridge, head of policy at the Soil Association, described the ruling as a “dramatic blow” to the pesticide industry. “This is a landmark case, which highlights not only the problems caused by glyphosate, but also the whole system of pesticide use. We need to urgently change our systems of weed control to stop relying on herbicides,” she said.

“It has taken years of negotiations to set up this conference. If we miss this opportunity, we will probably not get another opportunity to save the high seas for another 40 years. By then, there will probably not be much left that is worth protecting.”

• The Oceans’ Last Chance (G.)

The leatherback turtle is one of our planet’s most distinctive creatures. It can live for decades and grow to weigh up to two tonnes. It is the largest living reptile on Earth and its evolutionary roots reach back more than 100 million years. “Leatherbacks are living fossils,” says oceanographer Professor Callum Roberts, of York University. “But they are not flourishing. In fact, they are being wiped out at an extraordinary rate, particularly in the Pacific Ocean, where their numbers have declined by 97% over the past three decades. They are now critically endangered there.” Leatherbacks are suffering for several reasons. They have been hunted for their meat for centuries and the spread of tourist resorts disrupts turtles when they come ashore to lay their eggs on sandy beaches.

But the cause of the most recent, most massive decline in numbers of Dermochelys coriacea has a far more pernicious cause: long-line fishing in the high seas. Some trawlers now drag fishing lines that are more than 75 miles long, each bristling with hooks. Tens of thousands of sea turtles get snagged on these and drown every year. “It is tragic,” says Roberts. And this carnage goes unchecked – for the simple reason that there is no protection at all for species, endangered or otherwise, on seas outside national waters. The list includes fish and seabirds, plus fragile ecosystems such as deep-sea corals. “Outside national waters, in the high seas, it is essentially a no man’s land when it comes to protecting sensitive environments and their inhabitants,” says Paul Snelgrove, a deep-sea biologist at Memorial University in St John’s, Canada. “It is a highly unsatisfactory state of affairs.”