Happy New Year Bill Watterson

Happy New Year to you and yours!

UPDATE: There is a problem with our Paypal widget/account that makes donating hard for some people. What happens is that for some a message pops up that says “This recipient does not accept payments denominated in USD”. This is nonsense, we do.

We have no idea how many people have simply given up on donating, but we can suggest a workaround (works like a charm):

Through Paypal.com, you can simply donate to an email address. In our case that is recedinghorizons *at* gmail *com*. Use that, and your donations will arrive where they belong. Sorry for the inconvenience.

The Automatic Earth and its readers have been supporting refugees and homeless in Greece since June 2015. It has been an at times difficult and at all times expensive endeavor. Not at least because the problems do not just not get solved, they actually get worse. Because the people of Greece and the refugees that land on their shores increasingly find themselves pawns in political games.

Therefore, even if the generosity of our readership has been nothing short of miraculous, we must continue to humbly ask you for more support. Because our work is not done. Our latest essay on this is here: The Automatic Earth for Athens Fund – Christmas and 2018 . It contains links to all 14 previous articles on the situation.

Here’s how you can help:

For donations to Konstantinos and O Allos Anthropos, the Automatic Earth has a Paypal widget on our front page, top left hand corner. On our Sales and Donations page, there is an address to send money orders and checks if you don’t like Paypal. Our Bitcoin address is 1HYLLUR2JFs24X1zTS4XbNJidGo2XNHiTT. For other forms of payment, drop us a line at Contact • at • TheAutomaticEarth • com.

To tell donations for Kostantinos apart from those for the Automatic Earth (which badly needs them too!), any amounts that come in ending in either $0.99 or $0.37, will go to O Allos Anthropos.

Please give generously.

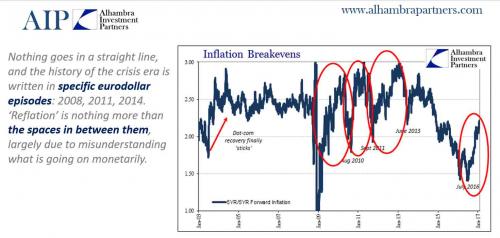

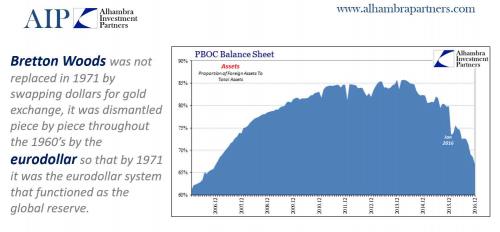

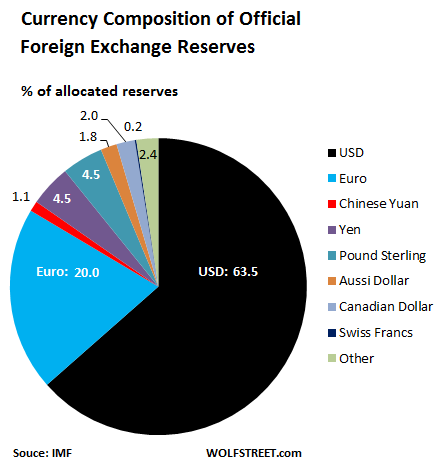

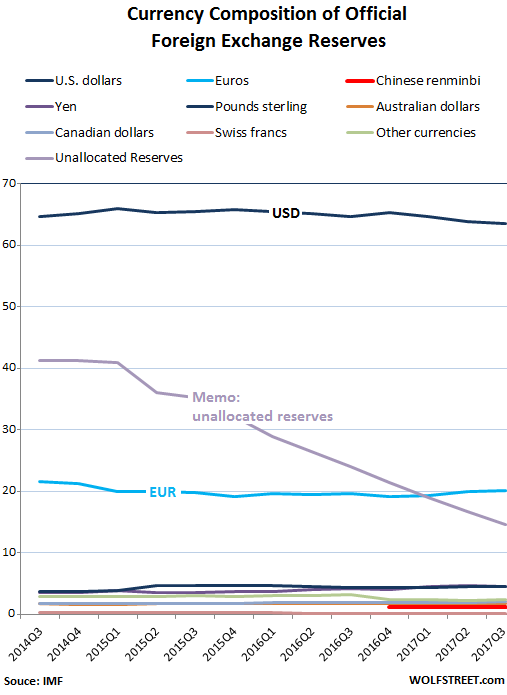

The graphs seem to say it all: the demise of the dollar (and petrodollar, eurodollar -dollars held outside US-) has been greatly exaggerated.

• US Dollar Refuses to Die as Top Global Reserve Currency (WS)

Over the decades, there have been a number of efforts to deflate the dollar’s hegemony as a global reserve currency, which it has maintained since World War II. Some of these efforts – such as the creation of the euro – have made a visible dent into the dollar’s status. Other efforts have essentially passed unnoticed. Now there’s a new contender: the Chinese yuan. On December 31, the IMF released its report on the Currency Composition of Official Foreign Exchange Reserves (COFER) for Q3 2017. So how has the US dollar fared as the top world reserve currency, now that the Chinese yuan has also been anointed as one, and that the euro has emerged from its debt crisis? First things, first. The IMF doesn’t really disclose all that much. The COFER data for the individual countries – the level of their reserve currencies and how they allocate them – is “strictly confidential,” it says.

So what we get to look at is the global allocation by currency. Total global foreign exchange reserves rose to $11.3 billion in Q3 2017, within the range of the past three years, between $10.7 trillion (Q4 2016) and $11.8 trillion (Q3, 2014). But something is happening to “allocated reserves.” Not all central banks disclose to the IMF how their foreign exchange reserves are allocated. In Q3 2017, 14.6% of the reserves hadn’t been allocated. But this number is plunging. In Q3 2014, just three years ago, it was still 41.2%. This means that more and more central banks report to the IMF their allocation of foreign exchange reserves, and the COFER is getting broader.

So of the 85.4% of the officially “allocated” reserve currencies in Q3 2017: • US dollar: 63.5% share, down from 64.6% in Q3 2014. • Euro: 20% share, down from 22.6% in Q3 2014. • Yen: 4.5% share, up from 3.6% in Q3 2014. • Pound Sterling: 4.5% share, up from 3.75% in Q3 2014. The Australian and Canadian dollars had a share of 1.8% and 2.0% respectively. • The Chinese yuan – that thin red sliver in the chart below – had a share of 1.1%, up from 1.08% in the prior three quarters, and up from zero before then. • The Swiss franc, the hair-fine black line in the chart below, has a share of 0.2%. • And a number of “other” currencies have a combined share of 2.4%.

The Chinese yuan made its entry after IMF boss Christine Lagarde and the IMF staff declared in mid-November 2015 that they were gung-ho about adding it to the IMF’s currency basket, the Special Drawing Rights (SDR), which is an important step toward becoming a major global reserve currency. At the end of November 2015, it was approved by the board. And it took effect in October 2016. Sure enough, in Q4 2016, the Chinese yuan started showing up in the COFER data as a global reserve currency with a share of 1.08%. But rather than soaring, it didn’t move at all over the first two quarters in 2017. And in Q3, it ticked up to a still minuscule 1.1%. Central banks do not appear to be overeager to hold this currency in large amounts. The chart below shows the changes since Q3 2014. The black line at the top is the US dollar – its hegemony unbroken.

Russia experienced dollar shortages with oil prices still at $95 a barrel. It can’t do without dollars. Maybe sometime in the future, but that may well be a long time away.

• The Rise And Fall Of The Eurodollar (ZH)

Gromen, who largely sat out this segment, offers a few thoughts toward the end that add to the picture of weakness defining the contemporary eurodollar system. Looking back to the summer of 2014, Gromen posits that the largest oil exporters were able to maintain current account surpluses because they’d already started settling an increasing percentage of their oil sales in dollars.

“It’s interesting, Jeff and Mark (this is Luke of course) when you look back to September – and we put this in our slide deck (which we can touch on later) – but if you look back at the actual timing of events it’s kind of interesting. And it’s, to me it hints to motive. So I’d love to get your thought on it, Jeff or Mark, of – if you go back to August of 2014, actually back even to May of ‘14, you had the Holy Grail gas and energy deal signed between China and Russia. It was rumored that that deal was going to be done in non-dollars, but no proof of that. It was later proven to be the case. In August of 2014, Putin announced that they wanted to start moving away from the dollar in oil trade, because the dollar’s monopoly in the global energy trade was damaging their economy.

And, what’s kind of interesting – and we wrote about this at the time – at this point oil is still $100 a barrel. And then, all of a sudden, by late September, with oil still $96 a barrel, $95 a barrel, Russia’s having dollar shortages. Russia was still – and they weren’t the only ones – Venezuela, Ecuador, a couple of others – you have three major oil exporters that are running still current account surpluses in the low- to mid-single digits at this point, starting to run into dollar shortages. And it was, I think, an underappreciated point at the time that, basically, if you’re an oil exporter you’re only selling in dollars, you’re running a current account surplus.

And so, if you’re only selling in dollars, in theory, there’s only two explanations for that, for those dollar shortages that began to pop up well before the price of oil crashed. Which was (#1) Russia and other places got dramatically more corrupt in the three months versus the three months before. Or they were starting to sell energy at an accelerating rate in non-dollar terms. And, as a result, you were seeing – where you were getting $100 before, now you were getting whatever, $90, $80, whatever the mix was. And at that point, then you started to see some of the devaluations etc. I guess I’d love to hear your thoughts on that.”

Alastair Crooke also looks at the dollar demise.

• Behind Korea, Iran & Russia Tensions: The Lurking Financial War (Crooke)

What have the tensions between the US and North Korea, Iran and Russia in common? Answer: It is that they are components to a wider financial war. Russia and Iran (together with China) happen to be the three key players shaping a huge (almost half the global population) alternative currency zone. The North Korean issue is important as it potentially may precipitate the US – depending on events – towards a more aggressive policy toward China (whether out of anger at Chinese hesitations over Korea, or as part and parcel of the US Administration’s desire to clip China’s trading wings). The US has embarked on a project to restore America’s economic primacy through suppressing its main trade competitors (through quasi-protectionism), and in the military context to ensure America’s continued political dominance.

The US ‘America First’ National Security Strategy made it plain: China and Russia are America’s ‘revisionist’ adversaries, and the US must and intends to win in this competition. The sub-text is that potential main rivals must be reminded of their ‘place’ in the global order. This part is clear and quite explicit, but what is left unsaid is that America is staking all on the dollar’s global, reserve currency status being maintained, for without it, President Trump’s aims are unlikely to be delivered. The dollar status is crucial – precisely because of what has occurred in the wake of the Great Financial crisis – the explosion of further debt. But here is a paradox: how is it that a Presidential Candidate who promised less military belligerence, less foreign intervention, and no western cultural-identity imposition, has, in the space of one year, become, as President, a hawk in respect to Korea and Iran.

What changed in his thinking? The course being pursued by both states was well-known, and has offered no sudden surprise (though North Korea’s progress may have proved quantitatively more rapid than, perhaps, US Intelligence was expecting: i.e. instead of 2020 – 2021, North Korea may have achieved its weapons objective in 2018 – some two years or so earlier that estimated)? But essentially Korea’s desire to be accepted as a nuclear weapon state is nothing new. It is ‘the Federal debt’, and a pending ‘debt ceiling’ that is crucial. There is little doubt that the US military is not what it used to be, and the Republican Party possesses a wing that is quite fundamentalist about limiting debt (Freedom Caucus). A serious military crisis is possibly the only way Trump is likely to get a huge ramp-up of military expenditure past Congress’ fiscal hawks.

President Trump – the Tax Bill saga tells us — is going to be a big spender as part of MAGA (Make America Great Again). The increase in proposed US defence spending alone, more or less equates to the whole annual Russian defence spending. US Federal debt is already above $20 Trillion, and accelerating fast: the borrowing requirement is ballooning and interest payments to service this additional borrowing, normally would be expected to rise. But Trump is also explicitly a low interest rate, expanding balance-sheet, sort of guy. So, how does one finance a truly ballooning budget deficit, whilst keeping interest rates low, or at zero? Well a fear-driven rush by foreigners into ‘risk free’ US Treasuries (i.e. military crisis again), historically serves to keep rates low – and dollars plentiful — as ‘overseas dollars’ return ‘home’ to Wall Street.

No sure why economists et al have such a hard time understanding why limitless liberalization must by definition backfire.

• Polanyi Best Explains Trump, Brexit And The Failure Of Neoliberalism (Prime)

It’s good to see the latest (21 December) New York Review of Books give space to a review – by Robert Kuttner of American Prospect– of a biography of “Karl Polanyi: a Life on the Left” by Gareth Dale. For as we have been arguing for a long time, it was Polanyi who better than any other historian/analyst got to the heart of the contradictions of free market globalised liberalism, and saw that it was such economic liberalism, pushed too far, that is likely to lead to authoritarian, or even fascist, outcomes. As Kuttner puts it, “Global capitalism has escaped the bounds of the postwar mixed economy that had reconciled dynamism with security through the regulation of finance, the empowerment of labor, a welfare state, and elements of public ownership”.

The outcome is extreme inequality and instability. However, as Kuttner reminds, “We have been here before. During the period between the two world wars, free-market liberals governing Britain, France, and the US tried to restore the pre–World War I laissez-faire system. They resurrected the gold standard and put war debts and reparations ahead of economic recovery. It was an era of free trade and rampant speculation, with no controls on private capital. The result was a decade of economic insecurity ending in depression, a weakening of parliamentary democracy, and fascist backlash. Right up until the German election of July 1932, when the Nazis became the largest party in the Reichstag, the pre-Hitler governing coalition was practicing the economic austerity commended by Germany’s creditors.”

It was these extremist policies of free market liberalism that Polanyi dissected in his most famous work, “The Great Transformation”, published in 1944. The worst consequences were in Germany and other continental European states, but declining imperial Britain was still the heart of ultra-liberal ideology. I am currently reading David Kynaston’s rambling History of the Bank of England, which sets out the disgraceful pressure that Governor Montagu Norman and the City of London put on elected governments to return to the Gold Standard (at the pre-war rate) and impose harsh austerity, with terrible economic consequences. [..] “[T]he simple proposition that all factors of production must have free markets implies in practice that the whole of society must be subordinated to the needs of the market system.” We see Polanyi’s key insight – in the essays and in the later book – as encapsulated in these passages:

“The real nature of the dangers thus become apparent which are inseparable from the market-utopia. For the sake of society the market mechanism must be restricted. But this cannot be done without grave peril to economic life and therefore to society as a whole. We are caught up on the horns of a dilemma: – either to continue on the paths of a utopia bound for destruction, or to halt on this path and risk the throwing out of gear of this marvellous but extremely artificial system.” “A self-regulating market-system is a utopia. No society could stand its devastating effects once it got really going. Hardly had laissez-faire started when the State and voluntary organizations intervened to protect society through factory laws, Trade Union and Church action from the mechanism of the market.”

All western countries do. It’s why interest rates are so low.

• UK Government Relies On Rising Household Debt To Hit Targets – Labour (G.)

John McDonnell has accused the government of relying on millions of British families going further into debt in order to meet Treasury targets. The shadow chancellor said families were set to borrow £445bn by the end of the parliament. He also highlighted official figures showing the ratio between household debt and income had reached a five-year high, with forecasts suggesting it will hit 150% by 2022. That means families will have amassed debts worth a year and a half’s income – which Labour warned could result in people falling into financial difficulties. McDonnell is planning for the Labour party to focus heavily on the question of household debt as part of its new year strategy. “The alarming increase in household debt at a time when wages are not keeping up with prices is creating the perfect storm for our economy,” McDonnell told the Guardian.

“There needs to be more done to protect working households from extortionate rates of interest, and also ensure that their earnings are not being squeezed just so Philip Hammond can pretend to meet his own targets, which he has so far failed to meet.” The Labour frontbencher said his party had already promised to cap interest on insecure lending, but would be unveiling a string of further interventions in 2018 about how to protect households from burgeoning debt. He has described the situation as a “personal debt crisis” with levels of unsecured borrowing predicted to hit a record of £19,000 per household by the end of this parliament. Analysis from Labour shows unsecured debt is on course to exceed £15,000 per household next year and could go on to exceed £19,000 per household by 2022 if it follows the current trajectory.

They had an excellent health care service. Those days are gone. The poor have become expendable.

• ‘Desperate Times’ For Overcrowded British Hospitals (PA)

Pressures on the NHS have “escalated rapidly” over the festive period, with hospitals experiencing significant bed shortages, a leading doctor has warned. Dr Nick Scriven, president of the Society for Acute Medicine (SAM), said many hospitals reported more than 99% capacity in the week before Christmas. He said services are being placed under significant strain as they enter the new year and called for non-urgent operations to be postponed until at least the end of January. Doctors have described corridors overflowing with patients and used social media in a bid to find extra staff to cope with demand. Portsmouth hospitals NHS trust, in Hampshire, tweeted on Sunday: “The hospital is extremely busy at the moment and we are asking any medical or nursing staff available for a shift tonight or tomorrow to make contact.”

Epsom and St Helier University hospitals trust, in London, also appealed for staff to work on New Year’s Eve “due to sickness and high volumes of patients”. Dr Richard Fawcett, from the Royal Stoke University hospital, wrote on Saturday that it had run out corridor space in A&E after ambulances were diverted from County hospital, Stafford. NHS England said hospitals were “generally coping”, with overall bed occupancy levels down from 95% in the lead-up to Christmas to about 93%. Scriven said: “Since the bank holiday, things have escalated rapidly and we are on the cusp of a major issue at least as bad as last year when it was described by the Red Cross as a humanitarian crisis. “There is an awful lot of respiratory illness causing a lot of severe symptoms in the old and young and 10- to 12-hour delays in emergency departments are now not uncommon – along with patients being placed on inappropriate wards.”

Good story for 2018.

• China’s Growth Engine Stutters As Factories Slow Down (G.)

Growth in China’s manufacturing sector slowed in December as a punishing crackdown on air pollution and a cooling property market start to weigh on the world’s second-largest economy. The data supports the view that the Chinese economy is beginning to gradually lose steam after growing by a forecast-beating 6.9% in the first nine months of the year. However, signs of a sharper slowdown – a major fear among global investors – have yet to materialise. The official Purchasing Managers’ Index (PMI) released on Sunday dipped to 51.6 in December, down from 51.8 in November and in line with forecasts from economists in a Reuters poll. The 50-point level divides growth from contraction on a monthly basis. The figures showed that China’s full-year 2017 economic growth would be at about 6.9% and 6.5% for 2018, according to the China Federation of Logistics and Purchasing, which compiles the data.

Boosted by hefty government infrastructure spending, a resilient property market and unexpected strength in exports, China’s manufacturing and industrial firms have driven solid economic growth this year, with their strong appetite for raw materials boosting global commodity prices. However, a slowdown has started to take hold in the last few months due to a wide-ranging combination of government measures, from a crackdown on smog in some heavily industrialised provinces to continued curbs on the housing market, which are weighing on property investment. Chinese steelmakers in 28 cities have been ordered to curb output between mid-November and mid-March, while a campaign to promote cleaner energy by converting coal to natural gas has also hampered manufacturing activity in some cities, leading to shortages and price rises.

Any politician seen as giving in to Turkish strong-arming faces a huge problem at home. Long history and all that.

• Greece Dismisses Turkey’s Threats Over Asylum Row (GR)

Greece dismissed Turkish angry threats on Sunday over its decision to grant asylum to a soldier who Ankara accuses of involvement in the abortive coup against President Tayyip Erdogan in July 2016. Turkey said on Saturday the decision by a Greek asylum board undermined relations between the two countries. The soldier was one of eight who fled after the July 15 coup attempt. It also accused Athens of harbouring “coup plotters”, a charge Greece denies. Turkey also threatened that the incident would affect bilateral relations over a host of issues from ethnically split Cyprus to sovereignty over airspace. The asylum board rejected the applications by the other seven soldiers, and the Greek government has appealed the decision to grant the soldier asylum and sought its annulment.

The government announcement that it will appeal the decision has caused a minor political storm, with opposition parties accusing the PM of hypocrisy and of bowing to Turkish threats. the row began when the government added to its appeal release that the country’s judiciary is independent. “Our faith in democratic principles and practices is not a weakness, but a source of strength,” the Greek foreign ministry said in a statement on Sunday. “Democracies do not threaten, or can be threatened,” the foreign ministry said. “On the contrary, they work responsibly and methodically to promote understanding and entrench stability and good neighbourly relations. Greece will continue this path and hopes its neighbours will do the same.” The eight soldiers had flown by helicopter to Greece in the early hours of July 16, 2016, as the attempted coup against Erdogan crumbled. They have denied any involvement in the attempt.

Erdogan is not going to like this one.

• Greece: Turkish Soldiers Won’t Be Extradited Regardless Of Asylum Process (K.)

Greek government spokesman Dimitris Tzanakopoulos has said the eight Turkish soldiers wanted by Ankara in connection with a failed coup attempt in 2016 “will not be extradited regardless of the outcome of their asylum applications.” In a message posted on social media late Sunday, Tzanakopoulos said the asylum claims submitted by the soldiers concerns their granting of refugee status. “This is a completely different from their non-extradition,” he said. Turkey said on Saturday the decision by a Greek asylum board to grant asylum to one of the eight soldiers undermined relations between the two countries. It also accused Athens of harboring “coup plotters.”

On Sunday, Tzanakopoulos said it was up to the Greek justice system to decide if the suspect in question is entitled to refugee protection, “in light of the enormous political significance of the issue which directly impacts on relations with the neighboring country.” “The political position of the Greek government is nevertheless clear,” Tzanakopoulos said. “Those suspected of being involved in Turkey’s coup are not welcome.”

It’s not as if this is a British issue. Just refuse to use all the packaging etc.

• UK ‘Faces Build-Up Of Plastic Waste’ (BBC)

The UK’s recycling industry says it doesn’t know how to cope with a Chinese ban on imports of plastic waste. Britain has been shipping up to 500,000 tonnes of plastic for recycling in China every year, but now the trade has been stopped. At the moment the UK cannot deal with much of that waste, says the UK Recycling Association. Its chief executive, Simon Ellin, told the BBC he had no idea how the problem would be solved in the short term. “It’s a huge blow for us… a game-changer for our industry,” he said. “We’ve relied on China so long for our waste… 55% of paper, 25% plus of plastics. “We simply don’t have the markets in the UK. It’s going to mean big changes in our industry.”

China has introduced the ban from this month on “foreign garbage” as part of a move to upgrade its industries. Other Asian nations will take some of the plastic, but there will still be a lot left. Environment Secretary Michael Gove has admitted that he was slow to spot the problem coming. The UK organisation Recoup, which recycles plastics, said the imports ban would lead to stock-piling of plastic waste and a move towards incineration and landfill. Peter Fleming, from the Local Government Association, told the BBC: “Clearly there’s a part to play for incineration but not all parts of the country have incinerators.