Jackson Pollock Shooting Star 1947

It’s amusing to see how views start to converge, at the same time that it’s tiresome to see how long that takes. It’s a good thing that more and more people ‘discover’ how and why austerity, especially in Europe, is such a losing and damaging strategy. It’s just a shame that this happens only after the horses have left the barn and the cows have come home, been fed, bathed, put on lipstick and gone back out to pasture again. Along the same lines, it’s beneficial that the recognition that for a long time economic growth has not been what ‘we’ think it should be, is spreading.

But we lost so much time that we could have used to adapt to the consequences. The stronger parties in all this, the governments, companies, richer individuals, may be wrong, but they have no reason to correct their wrongs: the system appears to work fine for them. They actually make good money because all corrections, all policies and all efforts to hide the negative effects of the gross ‘mistakes’, honest or not, made in economic and political circles are geared towards making them ‘whole’.

The faith in the absurd notion of trickle down ‘economics’ allows them to siphon off future resources from the lower rungs of society, towards themselves in the present. It will take a while for the lower rungs to figure this out. The St. Louis Fed laid it out so clearly this week that I wrote to Nicole saying ‘We’ve been vindicated by the Fed itself.’ That is, the Automatic Earth has said for many years that the peak of our wealth was sometime in the 1970’s or even late 1960’s.

Intriguing questions: was America at its richest right before or right after Nixon took the country off the gold standard in 1971? And whichever of the two one would argue for, why did he do it smack in the middle of peak wealth? Did he cause the downfall or was it already happening?

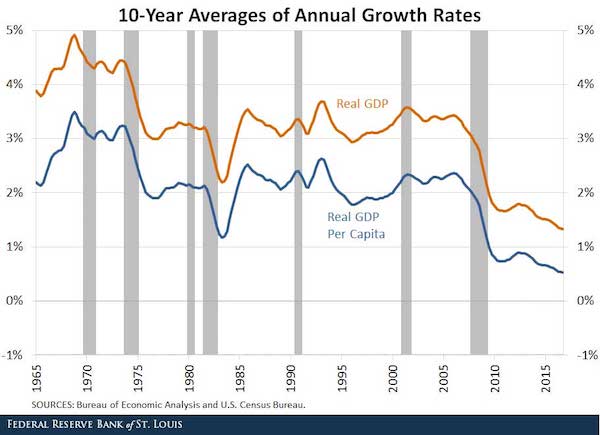

As per the St. Louis Fed report: “Real GDP growth fell and leveled off in the mid-1970s, then started falling again in the mid-2000s”. What happened during that 30-year period was that we started printing and borrowing with abandon, making both those activities much easier while we did, until the debt load overwhelmed even our widest fantasies ten years ago. And we’ve never recovered from that, if that was not obvious yet. Nor will we.

As the first graph below shows, there was still growth post-Gold Standard but the rate of growth fell and then “leveled off”, only to fall more after, to a point where Real GDP per Capita is presently 0.5% or so -little more than a margin error-. How one would want to combine that with talk of an economic recovery is hard to see. In fact, such talk should be under serious scrutiny by now.

Still, the numbers remain positive, you say. Yes, that’s true. But there’s a caveat, roughly similar to the one regarding energy and the return on it. Where we used to pump oil and get 100 times the energy in return that we needed to pump it, that ratio (EROEI) is now down to 10:1 or less. Alternative energy sources do little better, if at all. Whereas to run a complex society, let alone one like ours that must become more complex as we go along – or die-, we would need somewhere along the lines of a 20:1 to even 30:1 EROEI rate.

Another place where a similar caveat can be found is the amount of dollars it takes to produce a dollar of real growth. That amount has been increasing, and fast, to the point where it takes over $10 to create $1 or growth in the US and Europe, and China too moves towards such numbers.

Both our energy systems and our financial systems are examples of what happens when what we should perhaps call the rate of ‘productivity’ (rather than growth) falls below a critical mass: it becomes impossible to maintain, even keep alive, a society as complex as ours, which requires an increase in complexity to survive. In other words: a Real GDP per Capita growth rate of 0.5% is not enough to stand still, just like oil EROEI of 5:1 is not; there is growth, but not -nearly- enough to keep growing.

One does not get the impression that the St. Louis Fed economists who wrote the report are aware of this -though the title is suggestive enough-, they seem to lean towards the eternal desire for a recovery, but they did write it nonetheless. Do note the sharp drop that coincides with the 1973 oil crisis. We never ‘recovered’.

Why Does Economic Growth Keep Slowing Down?

The U.S. economy expanded by 1.6% in 2016, as measured by real GDP. Real GDP has averaged 2.1% growth per year since the end of the last recession, which is significantly smaller than the average over the postwar period (about 3% per year). These lower growth rates could in part be explained by a slowdown in productivity growth and a decline in factor utilization. However, demographic factors and attitudes toward the labor market may also have played significant roles.

The figure below shows a measure of long-run trends in economic activity. It displays the average annual growth rate over the preceding 40 quarters (10 years) for the period 1955 through 2016. (Hence, the first observation in the graph is the first quarter of 1965, and the last is the fourth quarter of 2016.)

Long-run growth rates were high until the mid-1970s. Then, they quickly declined and leveled off at around 3% per year for the following three decades. In the second half of the 2000s, around the last recession, growth contracted again sharply and has been declining ever since. The 10-year average growth rate as of the fourth quarter of 2016 was only 1.3% per year. Total output grows because the economy is more productive and capital is accumulated, but also because the population increases over time.

The same dynamics (or lack thereof) are reflected in a recent piece by Chris Hamilton, in which he argues that global growth -as expressed by growth in energy consumption- has largely been non-existent for years, other than in China. Moreover, China has added a stunning amount of debt to achieve that growth, and since its population growth is about to stagnate -and then turn negative-, this was pretty much all she wrote.

Global Growth is All About China…Nothing but China

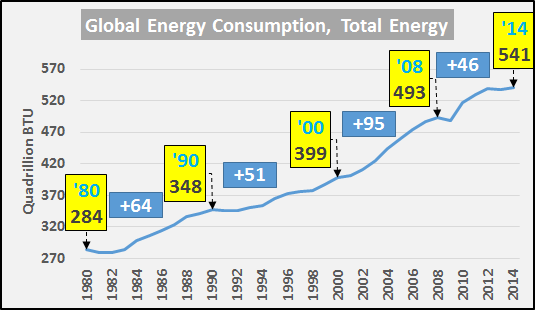

Since 2000, China has been the nearly singular force for growth in global energy consumption and economic activity. However, this article will make it plain and simple why China is exiting the spotlight and unfortunately, for global economic growth, there is no one else to take center stage. To put things into perspective I’ll show this using four very inter-related variables…(1) total energy consumption, (2) core population (25-54yr/olds) size and growth, (3) GDP (flawed as it is), and (4) debt. First off, the chart below shows total global energy consumption (all fossil fuels, nuclear, hydro, renewable, etc…data from US EIA) from 1980 through 2014, and the change per period. The growth in global energy consumption from ’00-’08 was astounding and an absolute aberration, nearly 50% greater than any previous period.

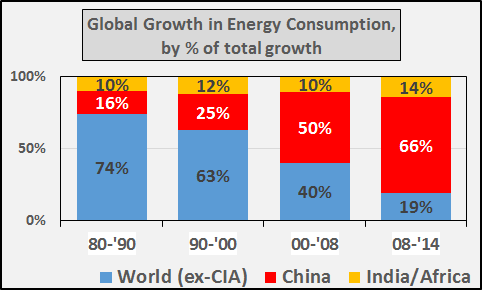

[..] here is the money chart, pointing out that the growth in energy consumption (by period) has shifted away from “the world” squarely to China. From 2008 through 2014 (most recent data available), 2/3rds or 66% of global energy consumption growth was China. Also very noteworthy is that India nor Africa have taken any more relevance, from a growth perspective, over time. The fate of global economic growth rests solely upon China’s shoulders.

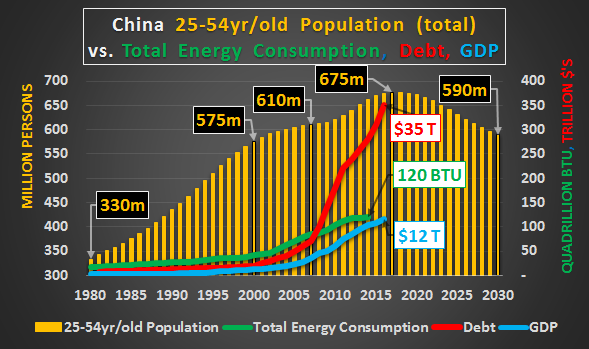

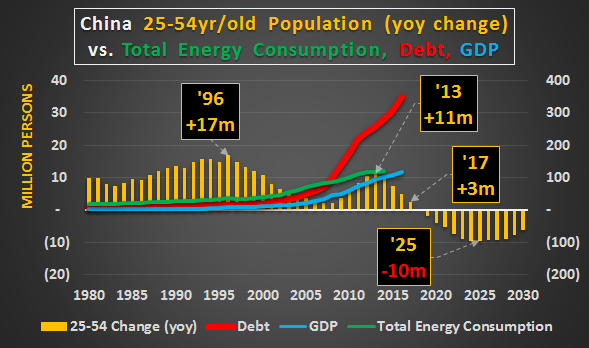

China’s core population is essentially peaking this year and beginning a decades long decline (not unlike the world. The chart below shows total Chinese core population peaking, energy consumption stalling, and debt skyrocketing.

The chart below shows China’s core population (annual change) again against total debt, GDP, and energy consumption. The reliance on debt creation as the core population growth decelerated is really hard not to see. This shrinking base of consumption will destroy the meme that a surging Chinese middle class will drive domestic and global consumption…but I expect this misconception will continue to be peddled for some time.

• China of ’85-’00 grew on population and demographic trends.

• China of ’00-’15 grew despite decelerating population growth but on accelerating debt growth…this growth in China kept global growth alive.

• China of ’15-’30 will not grow, will not drive the global economy and absent Chinese growth…the world economy is set to begin an indefinite period of secular contraction. China ceased accumulating US Treasury debt as of July of 2011 and continues to sell while busy accumulating gold since 2011.

Unfortunately, neither quasi-democracies nor quasi-communist states have any politically acceptable solutions to this problem of structural decelerating growth and eventual outright contraction…but that won’t keep them from meddling to stall the inevitable global restructuring.

I can only hope that these data will convince more people that all the times I’ve said that growth is over, it was true. And perhaps even make them think about what follows from there: that when growth is gone, so is all centralization, including globalization, other than by force. This will change the world a lot, and unfortunately not always in peaceful ways.

What seems to have started (but was in the air long before) with Brexit and Trump, is merely a first indication of what’s to come. People will not accept that important decisions that affect them directly are taken by anonymous ‘actors’ somewhere far away, unless this promises and delivers them very concrete and tangible benefits. In fact, many have lost all faith in the whole idea, and that’s why we have Trump and Brexit in the first place.

This turn inward -protectionism if you will-, in the UK, US and many other places, is an inevitable development that follows from declining growth and soaring debt. Entire societies will have to be re-built from the ground up, and people will want to do that themselves, not have it dictated by strangers. At the same time, of course, those who profit most from centralization want that to continue. They can’t, but they will try, and hard.

Equally important, people who wish to try and save existing ‘central institutions’ for less selfish and more peaceful reasons should think twice, because they will fail too. It’s centralization itself that is failing, and the demise of the structures that represent it is but a consequence of that. We will see local structures being built, and only after that possibly -and hopefully- connect to each other. This is a big change, and therefore a big challenge.

Home › Forums › Not Nearly Enough Growth To Keep Growing