Salvador Dali Apparition of My Cousin Carolinetta on the Beach at Rosas 1934

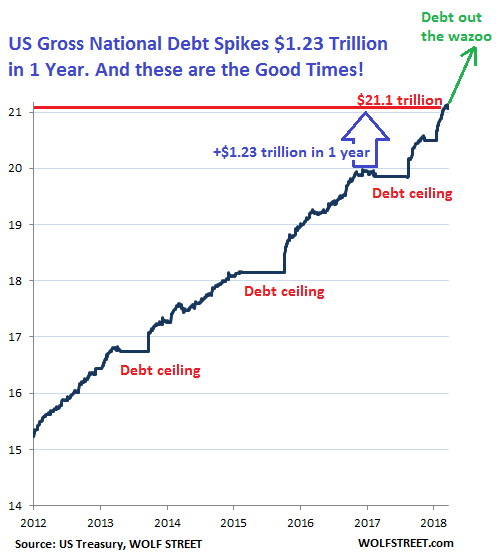

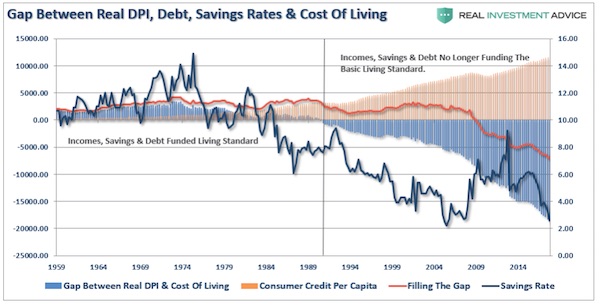

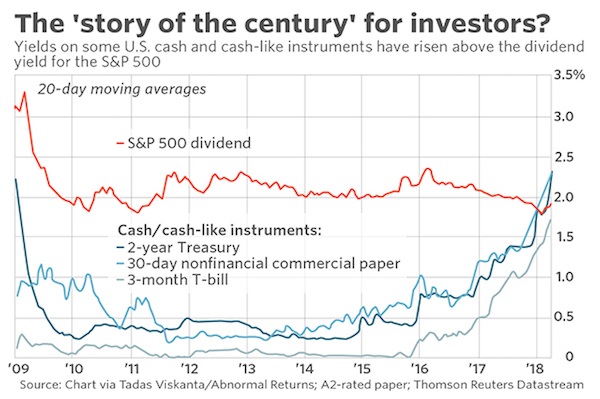

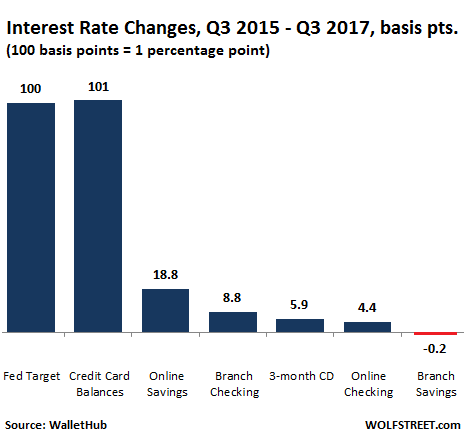

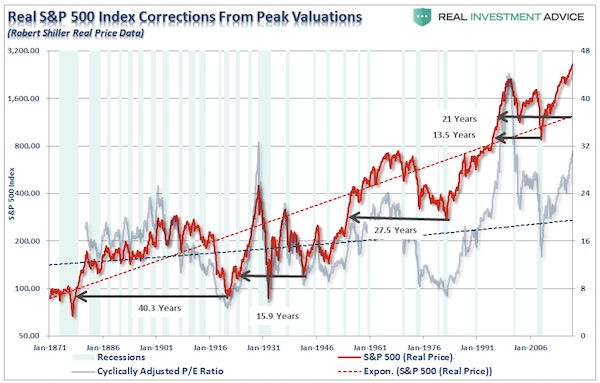

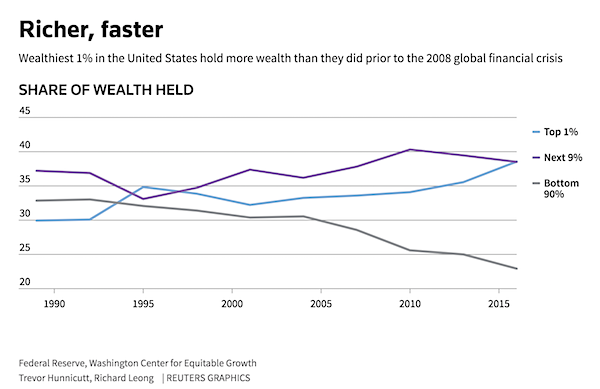

Richer faster. And poorer faster. This will implode.

• Rich Get Richer, Everyone Else Not So Much In Record US Expansion (R.)

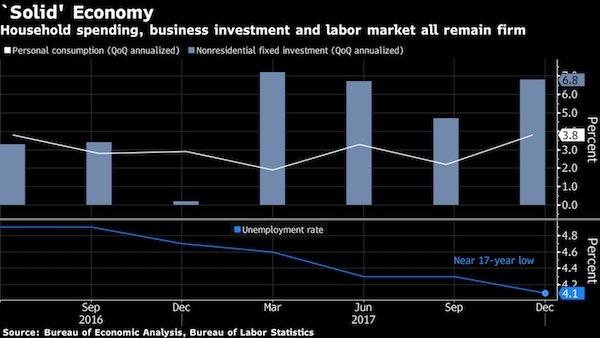

Welcome to the longest U.S. economic expansion in history, one perhaps best characterized by the excesses of extreme wealth and an ever-widening chasm between the unfathomably rich and everyone else. Indeed, as the expansion entered its record-setting 121st month on Monday, signs of a new Gilded Age are all over. Big-money deals are getting bigger, from corporate mergers and acquisitions, to individuals buying luxury penthouses, sports teams, yachts and all-frills pilgrimages to the ends of the earth. And while these deals grab headlines, there is a deeper trend at work. The number of billionaires in the United States has more than doubled in the last decade, from 267 in 2008 to 607 last year, according to UBS.

“The rich have gotten richer and they’ve gotten richer faster,” said John Mathews, Head of Private Wealth Management and Ultra High Net Worth at UBS Global Wealth Management. “The drive or the desire for consumption has just gone upscale.” But there are also signs of struggle and stagnation at lower-income levels. The wealthiest fifth of Americans hold 88% of the country’s wealth, a share that has grown since before the crisis, Federal Reserve data through 2016 shows. Meanwhile, the number of people receiving federal food stamps tops 39 million, below the peak in 2013 but still up 40% from 2008 even though the country’s population has only grown about 8%.

How many decades now? You cannot scare people into spending their savings. Quit trying.

• Japan Inc’s Inflation Expectations Stagnate (R.)

Japanese companies’ expectations for inflation over the next year stagnated, a Bank of Japan survey showed on Tuesday, adding pressure on the central bank to expand stimulus as the bitter U.S.-China trade war clouds economic prospects. Companies expect consumer prices to have risen 0.9% a year from now, unchanged from their projection three months ago and well below the BOJ’s 2% inflation target, according to the central bank’s detailed “tankan” survey for June. Firms expect consumer prices to have risen by an annual 1.0% three years from now, down slightly from 1.1% in the previous survey. Companies also saw inflation at 1.1% five years ahead, unchanged from three months ago.

The survey underscores the challenge of the BOJ’s monetary experiment that aims to boost inflation expectations with heavy money printing, in hope of prodding companies and households to boost spending now rather than save. “Six years have past since the BOJ deployed a radical stimulus and there’s no sign inflation expectations are approaching its 2% price target,” said Yasunari Ueno, chief market economist at Mizuho Securities. “There’s also no change to Japan’s deflationary structure created by a mix of a lack of demand and excess capacity.” The BOJ is maintaining a massive stimulus program to sustain a moderate economic expansion, so that companies will gradually raise wages and help push up inflation to its target.

“More than 100,000 U.S. citizens reside in Seoul alone..”

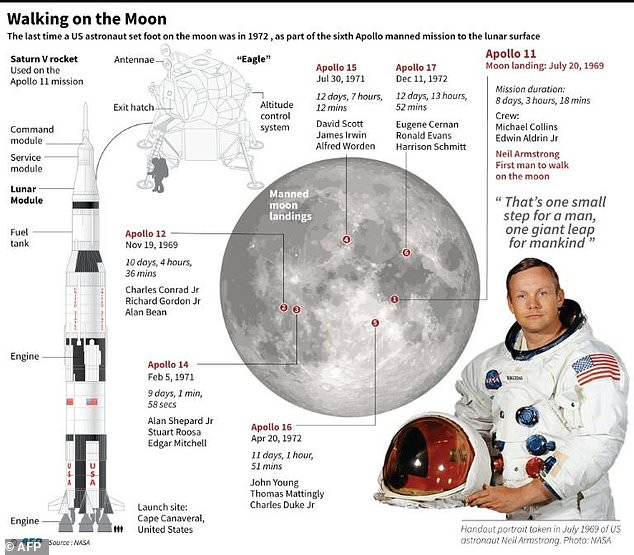

• Moon Calls DMZ Meeting End To North Korea-US Hostile Relations (Y.)

President Moon Jae-in said Thursday that North Korea and the United States have effectively declared an end to their hostile relations with the symbolic weekend meeting between their leaders at the inter-Korean border. Although they did not sign any document, their action was tantamount to a “de facto declaration of an end to hostile relations and the beginning of a full-fledged peace era,” Moon stressed, speaking at a Cabinet meeting. He was referring to a meeting between U.S. President Donald Trump and North Korean leader Kim Jong-un at the truce village of Panmunjom in the Demilitarized Zone (DMZ) on Sunday.

Trump even stepped over into North Korea, together with Kim, becoming the first sitting American president to set foot in the communist nation. The U.S. and North Korea fought fiercely against each other during the 1950-53 Korean War, which ended in an armistice. The two Koreas remain technically at war, as a formal peace treaty has yet to be signed. Moon had a brief three-way meeting with Kim and Trump at Panmunjom, although he stayed away from their talks, which lasted for nearly an hour. Moon also offered an account of his joint visit with Trump to a DMZ observation post, named Ouellette.

He noted that it marked the first time the presidents of the allies had traveled to the DMZ together. It was also meaningful, Moon added, that he and Trump wore suits, not military uniforms or bulletproof vests. Moon told Trump there that half of the South Korean population of 51 million live in Seoul and nearby Gyeonggi Province, as little as 40 kilometers away from the inter-Korean border. More than 100,000 U.S. citizens reside in Seoul alone, he added.

“Trump presumably had a good meeting with Russian President Vladimir Putin which likely set the stage for his meeting with Chairman Kim Jong-un.”

• Only Trump Could Go To North Korea (Luongo)

Donald Trump did the unthinkable. He went to North Korea. He stepped over the line in the sand demarked by Washington protocol for nearly seventy years. And that Washington establishment, predictably, hates him for it. It can be felt from all sides of the political rotunda. They hate that Trump realizes their position, one of maximum pressure, isn’t working. They despise that Russia and China will benefit from ending this frozen conflict not to mention Koreans on both sides of the DMZ. The cynic in me thinks they are angry that the American people will benefit as well. So this weekend was a good one for peaceniks around the world. Trump and Chinese Premier Xi Jinping agreed to back down on the worst of his trade war demands.

Trump presumably had a good meeting with Russian President Vladimir Putin which likely set the stage for his meeting with Chairman Kim Jong-un. Remember Kim met with Putin earlier this year and designated him as his go-between with Trump after the talks in Hanoi fell apart. This event should not be downplayed. Trump showed great humility and generosity towards Kim at the moment of truth. We should be cheering this regardless of what we think of him personally. Diplomacy is not groveling. It is the acknowledgment of the other person’s basic humanity, a fundamental point lost in the political cesspit that is D.C. Because of his previous mistakes and belligerence, only Trump could have made the walk across the DMZ to meet Kim on his territory.

Only someone as blunt as Trump could cut through the nonsense that North Korea isn’t capable of independent action. And only people so full of bile and despite would not be happy about this. Only people so enthralled with the thought of war and their own political and social ambitions would look at this event and seek to tear it down. These are the people who lost yesterday in Trump’s historic and brilliant bit of diplomacy. And they are complaining bitterly about it today. Everyone else wins.

Scary. Xi can’t afford to lose this much face.

• Chinese State Paper Calls For ‘Zero Tolerance’ Over Hong Kong Protests (R.)

A Chinese state paper on Tuesday called for “zero tolerance” after protestors in Hong Kong stormed and ransacked the city’s legislature following a day of protests against a controversial extradition bill. Tensions over the weeks-long movement against the bill escalated on Monday, and Hong Kong police fired tear gas early on Tuesday to disperse hundreds of defiant protesters who had occupied the city’s legislature on the anniversary of Hong Kong’s 1997 return to Chinese rule. “Out of blind arrogance and rage, protestors showed a complete disregard for law and order,” the Global Times, published by the ruling Communist Party’s People’s Daily, said in an editorial.

“Chinese society is all too aware that a zero-tolerance policy is the only remedy for such destructive behavior witnessed. Otherwise, and without this policy, it would be similar to opening a Pandora’s Box,” it said. Opponents of the extradition bill, which would allow people to be sent to mainland China for trial in courts controlled by the Communist Party, fear it is a threat to Hong Kong’s much-cherished rule of law. In a separate editorial, the state-run China Daily reiterated the principle of “one country, two systems” in Hong Kong — a formula that allows freedoms not enjoyed in mainland China — saying the former British colony is an “inalienable” part of the China, and that Hong Kong affairs concern China.

Keep pushing it forward…

• Southwest Expects Boeing 737 MAX Cancellations Beyond Oct. 1 (R.)

Southwest Airlines expects it will have to remove the grounded Boeing 737 MAX jets from its flying schedule beyond the current Oct. 1 re-entry date following the discovery of a fresh safety issue, Chief Executive Gary Kelly told employees on Monday. Last week, Boeing said that it would take until at least September to solve 737 MAX software issues – later than airlines had been expecting – after U.S. aviation regulators uncovered a new problem during simulator sessions. “I’m sure this will cause us to have to take the MAX out of the schedule beyond Oct. 1,” Kelly said in an internal update, adding that the company would also see “what other modifications we might need to make our plans for this year because it’s obviously extending well beyond what I had hoped.”

Kelly did not elaborate on the possible modifications. So far, the Texas-based airline has tried to substitute its MAX routes with spare aircraft but has still been forced to cancel about 115 daily flights. American Airlines Group and United Airlines Holdings, the other two U.S. carriers that operate the 737 MAX, have removed the jetliner from their flying schedules until early September. The three airlines are expected to provide more details on the financial toll of a prolonged MAX grounding during second quarter results later in July.

Subsidies are not Boeing’s main problem.

• USTR Proposes $4 Billion In Additional Tariffs Over EU Aircraft Subsidies (R.)

Just days after reaching a truce in the U.S.-China trade war, the U.S. government on Monday ratcheted up pressure on Europe in a long-running dispute over aircraft subsidies, threatening tariffs on $4 billion of additional EU goods. The U.S. Trade Representative’s office released a list of additional products – including olives, Italian cheese and Scotch whiskey – that could be hit with tariffs, on top of products worth $21 billion that were announced in April. USTR said it was adding 89 tariff sub-categories to its initial list, including a variety of metals, in response to public comments, but gave no further explanation. Over 40 individuals testified about products included on the initial list at a public hearing on May 15 and 16.

The United States and the EU have threatened to impose billions of dollars of tit-for-tat tariffs on planes, tractors and food in a nearly 15-year dispute at the World Trade Organization over aircraft subsidies given to U.S. planemaker Boeing and its European rival, Airbus. Senior officials from Boeing and a U.S. aerospace trade group urged the U.S. government last month to narrowly tailor any tariffs imposed on the EU over illegal aircraft subsidies to avoid harming American manufacturers.

Blah.

• New York Governor Cuomo Orders Probe Into Facebook’s Advertising Platform (R.)

New York Governor Andrew Cuomo on Monday ordered the U.S. Department of Financial Services to investigate reports that state-regulated advertisers were using Facebook Inc’s advertising platform in a discriminatory manner. This is the second investigation that the state governor has ordered into the social media company this year. In February, Cuomo ordered two state agencies to investigate a report that Facebook may be accessing far more personal information from smartphone users, including health and other sensitive data, than had previously been known.

On Monday, Cuomo cited reports which said the social network allows advertisers to modify or block ads using ZIP code information to exclude consumers based on race, color, national origin, religion, familial status, sex and disability, among other classifications. The company is facing a similar probe at the federal level, in which the Trump administration has accused Facebook of selling targeted advertising that discriminated on the basis of race, in violation of the U.S. Fair Housing Act. The probes have come despite Facebook agreeing in March to overhaul its paid advertising platform, as part of a wide-ranging settlement with U.S. civil rights groups, which had filed five separate lawsuits accusing the company of enabling discrimination in advertising.

The entire union risks falling apart.

• How Merkel’s Plan For EU Top Jobs Fell Apart (Pol.eu)

It was a humiliation, the likes of which Angela Merkel had never experienced in her thirteen and a half years as chancellor of Germany, and as the undisputed supremo of the EU’s dominant political family, the center-right European People’s Party. With EPP leaders, including at least six of the party’s other prime ministers and presidents, arrayed before her at the neoclassical Academy Palace in downtown Brussels on Sunday afternoon, Merkel laid out a plan for filling the EU’s top leadership posts that would install Frans Timmermans, a Social Democrat, as Commission president, the bloc’s top job, instead of the EPP’s own nominee, German MEP Manfred Weber.

What she proposed would amount to a stunning climbdown for the conservative party that has long commanded the leading role on the EU stage and currently holds the presidencies of the European Commission, Council and Parliament. Under Merkel’s plan, which she had agreed with a small group of other leaders on the sidelines of a G20 summit in Osaka, Japan, the EPP would have been left with only the Parliament post and the job of high representative for foreign policy. Party bigwigs, including some of her fellow national leaders, were livid. And they quickly gave voice to their rage at the Sunday EPP meeting ahead of an EU summit — complaining the deal had been thrust upon them with no consultation, and that they would not support it. No one rose to her defense.

“Not a single intervention in favor,” said one senior EPP member. “People were very angry.” Merkel, the senior EPP member said, arrived “thinking that it was a little gathering, and that the Osaka agreement would be agreed.” Instead, “everybody said no … It was impossible.” The official said Merkel had not consulted with her fellow EPP leaders before sealing the deal in Japan. “There was no organization and it was all out of the blue,” the official said, adding “Merkel was highly surprised at the lack of agreement.”

“Our acts of defiance became exhibitions. Our love and rage were commodified turned into something that could be packaged and branded and sold.”

• Chelsea Manning on the 50th Anniversary of Stonewall (M.)

The following is a message from Chelsea Manning, who is currently being jailed for a resisting a grand jury in Alexandria, VA. The statement was relayed by her supporters on June 30th, 2019, during the NYC Queer Liberation March, on the occasion of the 50th anniversary of the Stonewall Uprising: “Friends, I’m deeply saddened that I can not be here with you today. A few months ago, while speaking on the phone from jail with one of my friends out in Brooklyn, I came to a startling realization. I said: “I remember growing up as a kid searching for someone to look up to – someone to lean on for inspiration. I needed a role model. Right then I realized, the thing I needed as a young kid is now available. I said, Wow, look at all these kids and teens and young adults in the queer community – They found each other.

I felt something so profound that I broke down crying, and my friend did too. I finally felt that word that gets thrown around so much I felt PRIDE. I almost yelled into the phone: I m so fucking proud of my community. I m proud of you. I m proud of what we have, of what we ve built together. Despite everything, we as a community face daunting challenges every day. The world feels colder and more alien. Our society constantly reminds us in both obvious and subtle ways of the need for us to meet their standards. To meet their expectations. We somehow always need their approval. Our spaces changed. Our neighborhoods gentrified. Our protests became parades. Our acts of defiance became exhibitions. Our love and rage were commodified turned into something that could be packaged and branded and sold.

Story: 200+ academics sent an Open Letter to UN officials protesting the way Nils Melzer defined “rape” in his op-ed. Now the narrative is not Assange’s torture, but the rape he never committed.

Why, as an academic, would you want to become part of the smear team? Suzie offeres a very personal reaction to it all, and dissects the flawed accusations.

• Academics Publicly Attacking UN Torture Rapporteur (Suzie Dawson)

I am a survivor of rape, gang rape and the abusive police process I was subjected to when I reported it and I am fed up with watching sexual violence being used as a cover for political attacks on Julian Assange, his colleagues and his supporters. I am not alone. Numerous other survivors have reached out to me tonight expressing the same sentiment and we deserve to be heard. Today, members of what is supposedly a women’s advocacy group published an open letter addressed to UN top brass, from the Secretary-General on down, complaining about an article written by UN Special Rapporteur on Torture Nils Melzer and attempting to call into question his suitability for his role.

Melzer has recently transformed the debate around 2019 Nobel Peace Prize Nominee Julian Assange’s situation by formally finding that Assange is a victim of state-sponsored (and publicly perpetuated) psychological torture. The content of the open letter undermining Melzer is founded on a premise of advocating for and protecting the rights of women and of survivors of sexual violence. Yet when I self-identified as a survivor in tweets to the organisers of the open letter and dissented against their opinions, they belittled me and were dismissive of my arguments.

Yes, the very women who should have been most sincere about unpacking the experiences and feelings of a survivor of sexual assault could not muster a single shred of empathy for me, nor did they express even the mildest concern for my wellbeing or safety, despite my clearly having been triggered by the conversation. The very women who complained in their open letter against Melzer, of “insensitivity to victims of sexual assault” and “..a profound lack of understanding…” were themselves apparently incapable of demonstrating any sensitivity or understanding when dealing directly with a survivor.