Russell Lee Front of livery stable, East Side, New York City Jan 1938

“The key economic figures come just six days before general elections ..”

• Japan’s Economy Is Worse Than Feared (WSJ)

Japan’s economy contracted for the second straight quarter in the July-to-September period, revised data released Monday showed, serving as a bitter reminder to Prime Minister Shinzo Abe that the nation’s economy remains in the woods two years after he came into office. Gross domestic product shrank an annualized 1.9% in the third quarter from the previous three-month period. The government last month estimated that the economy shrank 1.6% in the third quarter after a 6.7% plunge in the second quarter, indicating that the economy had entered a recession.

The key economic figures come just six days before general elections, which Mr. Abe is framing as a referendum on his economic policy program known as Abenomics. Recession or not, Japan’s economy is in a funk. Private consumption, the most important pillar of the economy, has shown little sign of life after a one-two punch of a sales tax increase in April and inflation caused by the yen’s 30% fall against the dollar. The consumption slump had led businesses to slash production and capital investment, further undermining economic growth.

Read more …

How crazy will he get after being re-elected?

• Japan’s Recession Deepens as Election Looms for Abe (Bloomberg)

Japan’s recession was deeper than initially estimated as company investment unexpectedly shrank, a blow to Prime Minister Shinzo Abe as he campaigns for re-election on his economic credentials. The economy contracted an annualized 1.9% in the July to September period from the previous quarter, weaker than the 1.6% drop reported in preliminary data. The result was also below every forecast in a Bloomberg News survey that showed a median 0.5% decrease. The surprise decline in business investment sapped the strength of the world’s third-biggest economy, compounding damage from a slump in consumer spending after a sales-tax rise in April. With the main opposition party caught unprepared, Abe is on-track to win the Dec. 14 election, even as a decline in the yen cuts into people’s spending power. “Today’s report shows a pretty bleak picture of Japan’s economy,” said Taro Saito, director of economic research at NLI Research Institute in Tokyo. “We are going to see a recovery but only a gradual one. The weakening yen should provide a boost to manufacturers and those benefits will penetrate through a wide range of industries.”

Read more …

Not much use, these analysts.

• China Trade Data Miss Forecasts By A Wide Margin (MarketWatch)

China’s exports rose a disappointing 4.7% in November while imports unexpectedly fell, as the world’s second-largest economy grapples with sluggish global activity and weak demand at home. Analysts said the data the government released on Monday show that the country’s crucial export sector – the one segment of the economy that had been showing signs of strength – was struggling during the month. “This was worse than expected,” said Ma Xiaoping, economist at HSBC. “We can see there is considerable downward pressure on the economy.” China’s economy has been showing slower growth after years of double-digit expansion. Growth slipped to 7.3% year-over-year in the third quarter, its slowest pace in more than five years. Full-year growth could fail to reach the government target of about 7.5% for the year.

November exports were below market expectations of an 8% gain compared with a year earlier and much less robust than the 11.6% increase in October. Meanwhile, imports sank 6.7% against expectations for a 3% rise, after a 4.6% year-over-year rise in October. Analysts said a rebound in the yuan’s value against other currencies could have been a factor. CIMB economist Fan Zhang said the weak export growth also reflects a strong month in the year-earlier period, while the drop in imports includes the impact of a sharp decline in global commodities prices, particularly oil. “In 2015, I still expect exports to improve over 2014 because of U.S. economic growth,” Mr. Zhang said. China’s central bank in late November cut benchmark interest rates for the first time in more than two years in a bid to give the economy a boost and cut borrowing costs for struggling companies. It has also injected liquidity into the banking system and encouraged banks to lend to struggling small businesses and the agricultural sector.

Read more …

Time for Xi and Li to set a new, much power, growth target?!

• China Trade Data Paints Dreary Picture Of Economy (CNBC)

China’s annual import and export figures slowed sharply in November, data showed on Monday, reinforcing signs of fragility in the world’s second-largest economy. Exports rose 4.7% in November from a year earlier, much slower than an 11.6% rise in October and below expectations for an 8.2% increase in a Reuters poll. Imports fell an annual 6.7% in November, well below October’s 4.6% rise, and below expectations for a 3.9% increase. That left the country with a trade surplus of $54.5 billion for the month, above expectations of $43.5 billion. The Australian dollar weakened against the U.S. dollar after the data was released, recently trading at $0.8297.

“It’s clear domestic demand is pretty weak, most of the decline seems to be commodity related – which partly reflects lower prices, but is also because of the slowdown in the housing sector and overcapacity in industrial sectors,” Alaistair Chan, economist at Moody’s Analytics told CNBC. The slowdown in exports, meanwhile, was likely driven by a clamp down on over-invoicing seen earlier in the year and could suggest a cooling in global demand, said Dariusz Kowalczyk, senior economist and strategist at Credit Agricole.

Read more …

“The Asian powerhouse, which has been the world’s biggest consumer of raw materials, is now on course to post its slowest growth in nearly a quarter of a century.”

• The Two Main Threats That Are Shaking Global Firms: China And Deflation (CNBC)

With an uneasiness looming over the global economy as the year draws to a close, chief financial officers (CFOs) have told CNBC that softer growth in China and the threat of deflation in the euro zone are the two biggest issues their firms are facing. Fifty-one CFOs from Europe and Asia – who make up the CNBC CFO Global Council – were asked what the major risks that their firms are currently up against. Coming ahead of the pack by a clear margin was the threat of falling growth in China. It came top of the list for Asian CFOs and was the third biggest risk for their European counterparts. When asked which of the year’s geopolitical or economic risks had the greatest impact on their businesses, 57% pointed at the warning signs coming from the world’s second largest economy.

The results underline how important China is for global confidence as the country shifts from its traditional role as the world’s factory floor to becoming a consumer-led economy. The Asian powerhouse, which has been the world’s biggest consumer of raw materials, is now on course to post its slowest growth in nearly a quarter of a century. It grew 7.3% year-on-year during the July-September period, its slowest pace in more than five years, jeopardizing Beijing’s 7.5% target for 2014. The slowdown comes after years of double-digit growth and at a time when the country’s new leadership is stepping up regulation and trying to curb an overheated credit market. As well as the tougher stance by Beijing, there has been a more gentle touch from the People’s Bank of China.

The central bank looks increasingly ready to backstop the economy and manage the fall in growth after announcing a surprise rate cut last month. Diana Choyleva, the head of macroeconomic research at Lombard Street Research, believes that growth and monetary conditions in China are actually much weaker than the official numbers suggest. She regularly concentrates her research on the country and said in a note last week that Beijing is battling an ongoing correction in investment and capital flight from its shores. “China’s banks are one of the victims of Beijing’s past excesses and will have to pay the price as the needed cleanup and financial market reforms unfold,” she said.

Read more …

“.. what the Fed has been worrying about is already happening in the energy sector: leveraged loans are getting mauled. And it’s just the beginning.”

• Oil, Gas Bloodbath Spreads to Junk Bonds, Leveraged Loans. Defaults Next (Wolf)

The price of oil has plunged nearly 40% since June to $65.63, and junk bonds in the US energy sector are getting hammered, after a phenomenal boom that peaked this year. Energy companies sold $50 billion in junk bonds through October, 14% of all junk bonds issued! But junk-rated energy companies trying to raise new money to service old debt or to fund costly fracking or off-shore drilling operations are suddenly hitting resistance.

And the erstwhile booming leveraged loans, the ugly sisters of junk bonds, are causing the Fed to have conniptions. Even Fed Chair Yellen singled them out because they involve banks and represent risks to the financial system. Regulators are investigating them and are trying to curtail them through “macroprudential” means, such as cracking down on banks, rather than through monetary means, such as raising rates. And what the Fed has been worrying about is already happening in the energy sector: leveraged loans are getting mauled. And it’s just the beginning.

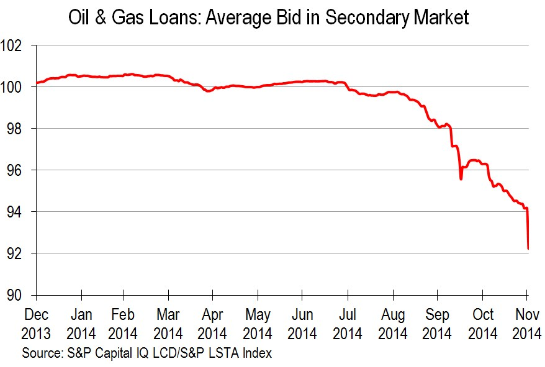

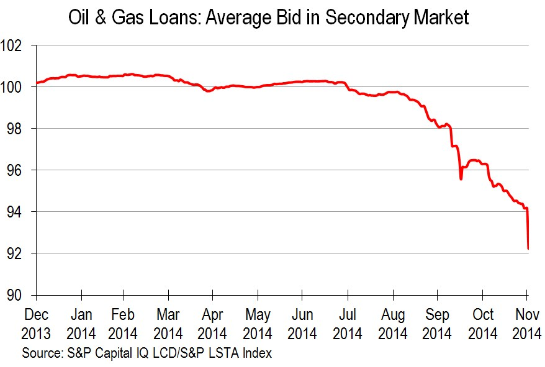

This monthly chart by S&P Capital IQ’s LeveragedLoan.com shows the leveraged loan index for the oil and gas sector. Earlier this year, when optimism about the US shale revolution was still defying gravity, these loans were trading at over 100 cents on the dollar. In July, when oil began to swoon, these loans fell below 100 cents on the dollar. The trend accelerated during the fall. And in November, these loans dropped to around 92 cents on the dollar.

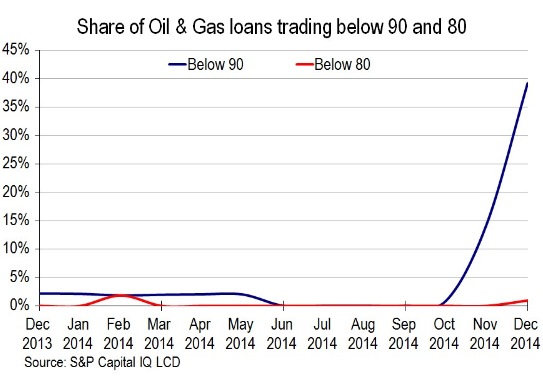

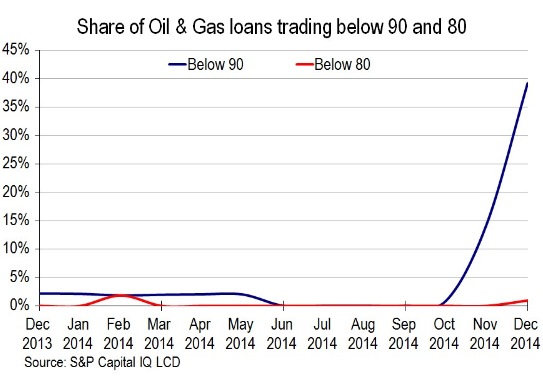

How bad is it? The number of leveraged loans in the oil and gas sector trading between 80 and 90 cents on the dollar (blue line in the chart below) has soared parabolically from 0% in September to 40% now. These loans are now between 10% and 20% in the hole! And some leveraged loans are now trading below 80 cents on the dollar:

Read more …

And so is Australia’s.

• Canada’s LNG Export Dream Is Dead (Oilprice.com)

Lower oil prices have killed off major plans for liquefied natural gas exports from Canada’s west coast. On December 2 the state-owned oil company of Malaysia, Petronas, decided to shelve plans to build an enormous LNG export terminal in British Columbia, citing the falling price of oil. It is common for LNG contracts to be priced using a formula linked to the price of crude oil, so declining oil prices pushes down prices for LNG. Petronas’ Pacific NorthWest LNG, as it was known, was a proposed $32 billion export terminal that would send LNG to Asia. The decision highlights how competitive global LNG trade has become, despite growing demand. Greenfield projects, such as Pacific Northwest LNG, face steep startup costs that become prohibitive when oil prices fall. Although low oil prices may have been the icing on the cake, Canadian LNG projects were facing serious obstacles before oil prices plummeted.

There is stiff competition from a slew of LNG projects already under construction in the U.S. and Australia, which will come online much earlier than anything from British Columbia. Several LNG export facilities in the U.S. are not starting from scratch, for example. The Sabine Pass terminal on the Gulf Coast and the Cove Point facility on the Chesapeake Bay were both originally constructed to import LNG rather than export. The original facilities were put on ice when the U.S. no longer needed LNG imports. Now, companies are retrofitting them to handle exports – a much cheaper process than building a new facility. The indefinite cancellation of Pacific NorthWest LNG is a major setback for Canada’s plans to export natural gas. The move comes after BG Group abandoned plans to build a separate LNG export terminal on Canada’s west coast. Chevron is also in limbo with its Kitimat LNG project after its partner Apache pulled out.

Read more …

“BIS officials are worried that tightening by the US Federal Reserve will transmit a credit shock through East Asia and the emerging world, both by raising the cost of borrowing and by pushing up the dollar.”

• Dollar Surge Endangers Global Debt Edifice, Warns BIS (AEP)

Off-shore lending in US dollars has soared to $9 trillion and poses a growing risk to both emerging markets and the world’s financial stability, the Bank for International Settlements has warned. The Swiss-based global watchdog said dollar loans to Chinese banks and companies are rising at annual rate of 47%. They have jumped to $1.1 trillion from almost nothing five years ago. Cross-border dollar credit has ballooned to $456bn in Brazil, and $381bn in Mexico. External debt has reached $715bn in Russia, mostly in dollars. A chunk of China’s borrowing is disguised as intra-firm financing. This replicates practices by German industrial companies in the 1920s, which hid their real level of exposure as the 1929 debt trauma was building up. “To the extent that these flows are driven by financial operations rather than real activities, they could give rise to financial stability concerns,” said the BIS in its quarterly report. “More than a quantum of fragility underlies the current elevated mood in financial markets,” it warned.

Officials are disturbed by the “risk-on, risk-off, flip-flopping” by investors. Some of the violent moves lately go beyond stress seen in earlier crises, a sign that markets may be dangerously stretched and that many fund managers do not really believe their own Goldilocks narrative. “Mid-October’s extreme intraday price movements underscore how sensitive markets have become to even small surprises. On 15 October, the yield on 10-year US Treasury bonds fell almost 37 basis points, more than the drop on 15 September 2008 when Lehman Brothers filed for bankruptcy.” “These fluctuations were large relative to actual economic and policy surprises, as the only notable negative piece of news that day was the release of somewhat weaker than expected retail sales data for the US one hour before the event,” it said.

The BIS said 55% of collateralised debt obligations (CDOs) now being issued are based on leveraged loans, an “unprecedented level”. This raises eyebrows because CDOs were pivotal in the 2008 crash. “Activity in the leveraged loan markets even surpassed the levels recorded before the crisis: average quarterly announcements during the year to end-September 2014 were $250bn,” it said. BIS officials are worried that tightening by the US Federal Reserve will transmit a credit shock through East Asia and the emerging world, both by raising the cost of borrowing and by pushing up the dollar. “The appreciation of the dollar against the backdrop of divergent monetary policies may, if persistent, have a profound impact on the global economy. A continued depreciation of the domestic currency against the dollar could reduce the creditworthiness of many firms, potentially inducing a tightening of financial conditions,” it said.

Read more …

They do know.

• Sudden Swings Expose Fragility Of Financial Markets: BIS (Reuters)

Sudden swings in financial markets recently suggest they are becoming increasingly sensitive to unexpected events, the global organization of central banks said on Sunday, warning “more than a quantum of fragility” underlies the current bullish mood. MSCI’s all-country world stock index is hovering around multi-year highs after rebounding from sell-offs in August and October. The downturns were triggered by uncertainty over the global economic outlook and monetary policy, as well as geopolitical tensions, and the Bank for International Settlements (BIS) said the sharp and sudden dips pointed to frailty in the markets. “These abrupt market movements (in October) were even more pronounced than similar developments in August, when a sudden correction in global financial markets was quickly succeeded by renewed buoyant market conditions,” the BIS said in its quarterly review.

“This suggests that more than a quantum of fragility underlies the current elevated mood in financial markets,” it said, adding that recent developments suggest markets are becoming “increasingly fragile” “Global equity markets plummeted in early August and mid-October. Mid-October’s extreme intra-day price movements underscore how sensitive markets have become to even small surprises,” it said in the report. The comments followed the organization’s warning in September that financial asset prices were at “elevated” levels and market volatility remained “exceptionally subdued” thanks to ultra-loose monetary policies being implemented by central banks around the world.

Since then, the U.S. Federal Reserve has brought its monthly bond-purchase program to an expected end. However, Japan’s central bank has spurred global markets by expanding its massive stimulus spending while China unexpectedly cut interest rates, adding to stimulus measures from the European Central Bank. The BIS said these divergent monetary policies, coupled with the recent appreciation of the dollar, could have a “profound impact” on the global economy, particularly in emerging markets where many companies have large dollar-denominated liabilities. Separately, the BIS report said that international banking activity expanded for the second quarter running between end-March and end-June. Cross-border claims of BIS reporting banks rose by $401 billion. The annual growth rate of cross-border claims rose to 1.2% in the year to end-June, the first move into positive territory since late 2011.

Read more …

“China’s share of BIS reporting banks’ foreign claims on all emerging markets stood at 28% in mid-2014, up from just 6% at the end of 2008.”

• International Lending To China Soars In 2014: BIS (Reuters)

China has become the largest emerging market destination for international bank lending, accounting for more than a quarter of cross-border claims on all emerging market economies, a central banking report shows. Cross-border claims on China increased by $65 billion in the second quarter of 2014 to $1.1 trillion, and were up nearly 50% in the year to the end of June, according to a quarterly report from the Bank for International Settlements on Sunday. “China has become by far the largest (emerging market) borrower for BIS reporting banks. Outstanding cross-border claims on residents of China totaled $1.1 trillion at end-June 2014, compared with $311 billion on Brazil and slightly more than $200 billion each on India and Korea,” the report says.

It said China’s share of BIS reporting banks’ foreign claims on all emerging markets stood at 28% in mid-2014, up from just 6% at the end of 2008. The BIS, often referred to as the central bankers’ central bank, says China’s status as the principal emerging market destination for international bank lending reflects a “remarkable evolution” since the financial crisis of 2008-9. However, concerns are mounting among international investors of a credit bubble developing in China, with the country’s property market seen as the biggest risk to the economy.

In late November, after saying for months that China did not need any big economic stimulus, the People’s Bank of China surprised financial markets with its first interest rate cut in more than two years to shore up growth and help firms pay off mountains of debt. Outside China, cross-border claims on emerging market economies rose 2.7%, or $33 billion, in the three months to the end of June, the BIS said, with the increase coming mainly from Asia. However, cross-border lending to Russia declined 10%. Russia has seen its finances come under strain from western sanctions over Moscow’s role in the Ukraine crisis and the falling price of oil, its main export.

Read more …

“We argue that the dollar’s role may reflect instead the share of global output produced in countries with relatively stable dollar exchange rates – the ‘dollar zone’ ..”

• Why The Dollar Is Still King: BIS (CNBC)

A question that has frustrated even the most experienced economists in the last few decades is how the dollar has remained the most prominent reserve currency in the world despite the global share of U.S. output eroding away. The Bank for International Settlements (BIS), a Basel-based institution that is known as the central bank of central banks, thinks it has found the answer. “We argue that the dollar’s role may reflect instead the share of global output produced in countries with relatively stable dollar exchange rates – the ‘dollar zone’,” it said in its new quarterly report released on Sunday. In 1978, economists Robert Heller and Malcolm Knight were credited as first to draw attention to the fact that countries held an average of 66% of their foreign-exchange reserves in dollars. Even today that number hasn’t budged much with the latest statistics from the International Monetary Fund showing that just over 60% of allocated funds are held in the greenback.

The higher the correlation in price between a given currency and the dollar, the higher the economy’s dollar share of that country’s official reserves, according to Robert McCauley and Tracy Chan, the two authors of the BIS report. The report adds that the dollar’s robustness comes despite an 18% decline against major currencies since 1978 and the U.S. economy’s share of global GDP (gross domestic product) shrinking 6% in those 36 years. “The ‘dollar zone’ still accounts for more than half of the global economy. In countries whose currencies are more stable against the dollar than against the euro, reserve composition that favors the dollar produces more stable returns in terms of the domestic currency,” they said.

Read more …

It’s a shame this guy feels he needs to resort to Putin bashing.

• Why The World Is Like A Real-Life Game Of Global Domination (Guardian)

Putin gives a speech and the rouble falls. Europe’s central bank boss gives a speech and the stock markets fall. Opec meets in Vienna and the oil price plummets. Japan’s prime minister calls a snap election and the yen’s slide against the dollar accelerates. All these things in the last six weeks of an already fractious year. There are suddenly multiple conflicts being played out in the global markets, conflicts the global game’s usual rules are not built to handle. The first concerns a clear game of beggar thy neighbour between China and Japan. Since 2012 Japan has printed money hand over fist, with the aim of kickstarting economic growth. With growth stalling for a third time in the final quarter of 2014 its premier Shinzo Abe printed more. China perceives this as unfair competition, and with its own growth slowing, it responded in late November with a surprise interest-rate cut.

Many see this as the outbreak of a classic currency war, along 1930s lines, where rival economic giants engage in a pointless game of devaluing their own currency – boosting exports but hitting the spending power of their people – to their mutual detriment. By hitting each other’s capacity to export, they edge the region towards deglobalisation. The second new dynamic is the game of chicken being played over the oil price between America, Russia and Opec. Oil demand is falling because growth in the emerging markets – China, Brasil and the like – is slowing down. Yet supply has risen – by 11m barrels to 92m barrels per day since the global financial crisis began. America has become the world’s biggest oil producer thanks to the rapid rollout of shale and deep sea oilfields.

Since June 2014 the price of a barrel of Brent crude has fallen from $115 to $68 – and after Opec met in late November and rejected calls to cut production some analysts predicted the price could collapse to $40. Saudi Arabia and the other gulf monarchies were the key players in the decision to keep production high and prices falling – and few doubt there is politics behind the move. It hurts Russia, Venezuela and Iran. For Saudi Arabia there are scores to settle with both Russia and Iran over their role in crushing the Syrian revolution, and with Venezuela for being Russia’s perpetual Bolivarian cheerleader.

As a result, Vladimir Putin has had to admit to his people that a combination of western sanctions and Saudi oil strategy will push Russia into recession next year. At times like this economists resort to game theory, warning sparring countries that, in a game where everybody is trying to shrink something – whether it be prices or currencies – everybody loses out. So let’s game it out – not in the austere language of theory but of the empire-building “god games” popular on games consoles.

Read more …

The whole shebang is still under lockdown after all this time.

• Citigroup Panicked Over Fraud at Chinese Ports (Bloomberg)

Citigroup was in a “state of panic” when alleged fraud was uncovered in two Chinese ports, Mercuria Energy’s lawyer said as a London trial over disputed metal finance deals got under way. “The discovery of the fraud was a massive problem for Citi as it was their metal and it was at their risk,” Mercuria lawyer Graham Dunning told a London judge. “There was a state of panic.” The disputed copper and aluminum is under lockdown in the ports of Qingdao and Penglai, where Chinese authorities are investigating an alleged fraud. Neither side can get access and they don’t know how much of the metal is there, Dunning said at a pre-trial hearing in August. Citigroup argues that it effectively delivered the metal to Mercuria under the terms of a sale-and-repurchase agreement by handing over warehouse receipts. The bank says it is owed about $270 million. Mercuria, a Cyprus-based firm with major trading operations in Geneva, argues the products were never properly delivered.

“It appears that substantial quantities may be missing from the warehouses or may be the subject of multiple pledges,” Dunning said today. The probe at Qingdao, China’s third-largest port, is examining companies owned by a Chinese-Singaporean metals trader, Chen Jihong, who is alleged to have pledged the same metal inventories multiple times for collateral on loans. Chinese authorities have uncovered almost $10 billion in fraudulent trade, including irregularities at Qingdao, according to the country’s currency regulator. Standard Chartered, Standard Bank and ABN Amro have also made loans affected by the alleged fraud. “Mercuria’s apparent goal is for it to be Citi, not Mercuria, which is left out of pocket,” Citigroup said in documents from the trial. Mercuria was responsible for safeguarding and insuring the metal, the bank said.

Read more …

What do they do all day?

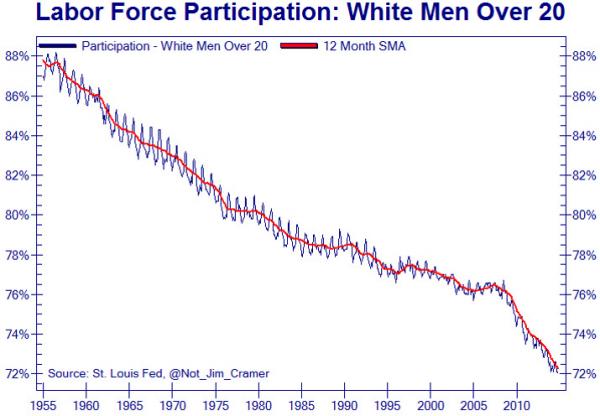

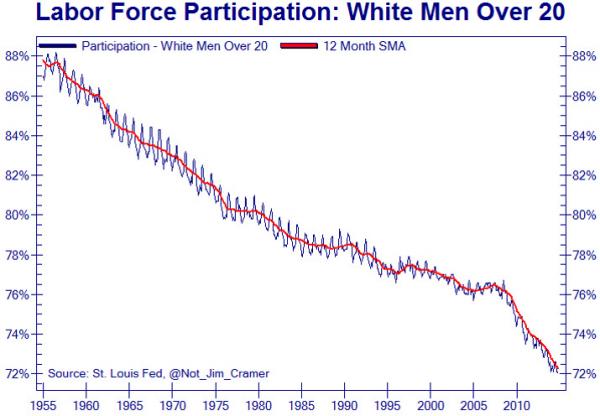

• The Long Slow Inexorable Demise Of America’s Working-White-Male (Zero Hedge)

Not “off the lows”…

Read more …

Germany holds the levers here.

• ECB’s Loans Offer Clues In QE Guessing Game (Reuters)

The guessing game over the timing of euro zone money printing will intensify as the European Central Bank unveils a closely watched gauge of policy in the coming week, the highlight of a calendar dominated by Europe’s malaise. On the other side of the Atlantic, investors will continue placing their bets on a different but equally crucial event: when the U.S. Federal Reserve might raise interest rates. U.S. data and several Fed central bankers will give a sense of the speed of the recovery and when a rate rise might be merited, while oil prices and Chinese data will provide plenty more for markets to digest. “The key story is going to be in the euro zone,” said James Knightley, ING’s senior economist, referring to the results of the ECB’s targeted long-term refinancing operations (TLTROs) on Thursday. The cheap loans for banks are one of the ECB’s main ways to flush money into the stagnating euro zone economy. “If the take-up is poor, that could increase market talk that the ECB is going to step in and use other tools,” Knightley said.

That means a sovereign bond-buying program like those used in the United States, Britain and Japan, but which Germany fears would encourage reckless state borrowing and fuel inflation. Such a program may come early next year. “The take-up of TLTROs could swing the ECB’s Governing Council between January and March, depending on how the number looks,” said Citigroup economist Guillaume Menuet. The first TLTRO was taken up only to the tune of €83 billion. Hopes are higher for this time but forecasts hover around the €150 billion mark, leaving the ECB short of the €400 billion it was prepared to offer banks in total. On Monday in Brussels, ECB President Mario Draghi will tell euro zone finance ministers no amount of stimulus can replace reforms to tax, labor and pension systems to bring down near-record unemployment.

Read more …

Rate rises will be murder.

• Bank of England: Half A Million Housebuyers Face Mortgage Arrears (Guardian)

The Bank of England has warned half a million families would be at risk of falling into mortgage arrears once it started to raise interest rates from their emergency level of 0.5%. Threadneedle Street said the number of households running into difficulties would increase by a third to 480,000 in the event of a two-percentage-point increase in the cost of borrowing. The Bank stressed the proportion of borrowers having trouble paying their home loans should remain well below the levels of the early 1990s – when Britain suffered its worst postwar property crash – provided incomes rose alongside interest rates. “Higher interest rates will increase financial pressure on households with high levels of debt,” the Bank said in its Quarterly Bulletin. “The%age of households with high debt-servicing ratios, who would be most at risk of financial distress, is not expected to exceed previous peaks given the likely paths of interest rates and income.

“But developments in incomes for the households who are potentially most vulnerable will be an important determinant of the extent to which financial distress does increase.” The findings were based on a survey for the Bank conducted by NMG consulting. It found that the average outstanding mortgage debt was £83,000 per household, with average household income of £33,000 a year (£43,000 for those with a mortgage) and unsecured debt £8,000. Interest rates have been pegged at 0.5% – the lowest in the Bank’s 320-year history – since March 2009 and cheap borrowing costs have made it easier for households with large home loans to keep up payments on their mortgages. The Bank has used its forward guidance policy to stress that interest rate rises, when they come, will be gradual and limited in size. Financial markets do not anticipate the first rise to come before the second half of 2015 but the Bank is exploring the impact of tighter policy on households where more than 40% of income is spent on mortgage repayments, since these housebuyers are most likely to fall into arrears.“

Read more …

Oh, great! 950% of GDP. What could go wrong?

• Bank of England: UK Banking To Double In Size, Reach 950% of GDP (Guardian)

Britain’s exposure to its banks, already the largest in the G20 group of leading nations, is set to double in the next 35 years. “The size of the UK banking system might roughly double from its current size to over 950% of GDP by 2050, far outstripping the projected increase in other G20 banking systems,” the Bank of England said. The UK’s banking system is currently 450% of GDP, Threadneedle Street said. In money terms, it would amount to a rise from over £5tn to £60tn. “Some have suggested that the current size of the UK banking system represents a material risk to economic stability and that action should be taken to reduce its size,” the central bank said in its latest quarterly bulletin. However, in an article asking “Why is the banking system so big and is that a problem?” the Bank of England said it had not found evidence of a link between the size of the economy and the risk of a crisis.

It said more work was needed and that it had not looked at the interconnectedness of the banking system and its opacity as it increases in size. “The empirical analysis in this article does not find a strong link between banking system size and the probability or output cost of a crisis, at least once the resilience of the system is taken into account,” the bank said in the article. “Establishing empirically whether banking system size is a leading indicator of banking crises is not straightforward,” it said. The banking system has undergone a dramatic shift in past 40 years, with assets rising from about 100% of GDP in 1975, the Bank of England said. It said the UK’s banking system was the largest out of Japan, the US and the 10 biggest EU economies. Nearly a fifth of global banking activity is booked in the UK, where there are 150 deposit-taking foreign branches of banks and almost 100 foreign subsidiaries from more than 50 countries.

Read more …

“Since peaking at $4.07 trillion last August, the Fed’s monetary base has been reduced by $259.2 billion as of the latest reserve reporting date on November 26, 2014.”

• Keep An Eye On The Fed’s Accelerating Asset Sales (CNBC)

The U.S. monetary authorities (Fed) are stepping up the contraction of their balance sheet at a surprisingly fast pace. Since peaking at $4.07 trillion last August, the Fed’s monetary base has been reduced by $259.2 billion as of the latest reserve reporting date on November 26, 2014. More than half of these Fed asset sales occurred between the end of October and the end of November. But the balance sheet remains an impressive $3.8 trillion – a huge difference with the pre-crisis monetary base of $820-$830 billion. It is interesting to note that even at these comparatively modest amounts of high-powered money, the pre-crisis U.S. monetary policy was very expansionary: the federal funds rate was fluctuating around 3% while the inflation rate was accelerating above 4%.

Obviously, these are different times now: the U.S. financial system and the economy have changed in a rapidly evolving global context. Still, the comparison is useful because it shows how much the Fed’s balance sheet will have to adjust in the months ahead. One key aspect of that adjustment process is the Fed’s statement that interest rates will remain low well after the beginning of large liquidity withdrawals to “normalize” the policy stance. The question is: how is that possible? If the quantity of money is being reduced in as large amounts as is currently the case, would it not be normal to expect that its price (i.e., interest rate) would also have to rise? Certainly it would.

But what makes the Fed’s statement credible is the fact that huge excess reserves (money banks can use to make loans) of the U.S. banking system – $2.4 trillion at the last count – will continue to keep an extraordinarily liquid interbank market for some time. Last Friday, for example, the effective federal funds rate (overnight money banks lend to each other) closed trading at 0.11% – more than half way below the Fed’s target of 0.25%. These excess reserves are now being drained by the Fed’s bond sales; they have been cut by $286.1 billion from their peak of last August. There is still plenty of cutting to do, though. Just think that during the pre-crisis period from January 2007 to June 2008 banks’ average excess reserves were fluctuating around monthly levels of $1.9 billion (sic). That is a far cry from the $2.4 trillion we have now.

Read more …

Not exactly a new point, but ..

• Bill Gross: You Can’t Cure Debt With More Debt (CNBC)

Central banks are trying to solve a debt crisis by piling on more debt, creating a “point of low return” for investors, bond guru Bill Gross said in a letter to clients. The Janus Capital portfolio manager and Pimco founder takes the Federal Reserve, Bank of Japan and European Central Bank to task for using monetary policy to make it easier for governments to run up debt, all in the hopes of stimulating anemic global growth. “How could they?” Gross asks, using nursery rhymes including the characters Punch and Judy to bemoan the possibility of “inflationary horror” that characterized the 1970s. It’s probably better to read the Gross letter in its entirety – get it here – to see how he connects the dots, but his conclusion is stark:

Ah, policymakers. Perhaps the last five years have been one giant nursery rhyme. But each of these central bankers is trying to achieve the same basic objective: Solve a debt crisis by creating more debt. Can it be done? A few years ago, I wrote that this uncommonsensical feat could be accomplished, but with a number of caveats: 1) Initial conditions must not be onerous; 2) Both monetary and fiscal policies must be coordinated and lead to acceptable structural growth rates; and 3) Private investors must continue to participate in the capital market charade that such policies produced.

Several pitfalls have occurred within each caveat, not the least of which is stagnant growth and companies using the easy money of the past six years not to propel the economy but to jack up their own stock prices and reward themselves and shareholders. At the same time, the much-awaited handoff from monetary to fiscal policy has not happened, in large part because the Fed and others have been willing to provide trillions in accommodation:

In the U.S., as elsewhere, there has been little focus on public investment and infrastructure spending. It’s been all monetary policy, all of the time, with most of the positives flowing over to markets as opposed to the real economy. The debt currently being created is not promoting real growth and solving a debt crisis – it is being used by corporations to repurchase shares and accentuate the growing inequality between the very rich and the middle class.

Read more …

” .. as Dr. Paul so clearly points out, the sole purpose of H. Res. 758 is simply a pouring of the legal foundation for something much more substantive. You see, this is how wars begin.”

• The Most Essential Lesson of History That No One Wants To Admit (Beversdorf)

Ron Paul wrote an eye opening article recently about some legislation that was just signed in Congress, namely H. Res. 758. In the article Dr. Paul explains the purpose of the resolution. It’s not a new law but provides a basis of facts that will be relied on for future action. So essentially the resolution purports that Russia behaved badly in various ways and by way of signing H. Res. 758 each congressman was indicating their agreement that the propositions contained therein are factual. Now just because a group of obnoxiously arrogant A-holes stand around in a tax-revenue financed chamber and say “yeah” to several assertions does not make those assertions factual, but here in the United Orwellian States of America it kinda does. Because those assertions that were voted to be fact (similar to the First Council of Nicaea) will now be written as factual history and taught to our children as having happened that way. The very same way we all attained our ideas of American superiority.

The dishonesty and ignorance it creates is reason enough not to do such things, however, the real stinker of it is, as Dr. Paul so clearly points out, the sole purpose of H. Res. 758 is simply a pouring of the legal foundation for something much more substantive. You see this is how wars begin. And the wheels for this particular war have been in motion for many years now. We’ve been told our actions heretofore are simply a necessary response to the Ukraine situation. However, those who can objectively look at the Ukraine situation will realize the US sponsored coup in Ukraine was simply a spark to light the fuse of a much larger detonation.

Now I understand many at this point are thinking “yep another conspiracy theory, why can’t it ever just be the US government thinks what they are doing is best for Americans”? And it can, it just never is anymore and perhaps ever was. Lies are told and public opinion is manipulated. For war must be every bit good theatre in the press, as good strategy on the ground. It is the theatre that makes war so ugly. Fighting a war for what one believes in is unfortunate and brutal but fighting for lies and deceit to an end that benefits only those telling the lies is a type of ugliness most of us cannot comprehend. It is only in the world ruled by sociopaths where such things can happen.

Read more …

“No worries, Father Allen, Brother Ben and Sister Janet figured out how to turn the universe’s economic waters into wine.”

• Uncork the Central Bank Bubbly (StealthFlation)

What a glorious global economic gala! Apparently, contracting world GDP growth, monumental sovereign debt loads, ballooning central bank balance sheets, crashing commodity prices, competitive currency devaluations and synthetically suppressed interest rates, as far as the eye can see, are all great tidings to be joyously celebrated throughout this holiday season. Well, at least that’s the takeaway from the whooping wonderful world of capital markets. Have no fear, all is perfectly in order. Jamie Dimon, Jim Cramer, Larry Fink and Company have our back. The rest of us mere mortals are simply supposed to stand aside and take their professional word for it, silently sipping the financial establishment’s spiked eggnog until we attain a sheepish state of stupid stupor. After all, the money experts at the Fed are on the case, what could possibly go wrong?

Joy to the world! es, it’s true, your Nation too can enjoy the very same blissful state of economic euphoria, all you need is the will to turn your monetary policy completely on its head, a la festive freeloading Fed. No need to maintain the integrity of your means of exchange, that’s so old school. That’s right, you too are absolutely invited to enter the ZIRP zero bound party zone, just buy out all your own newly issued treasury obligations and be sure to lap up any illiquid debt that may be languishing. Set it and forget it, that’s it, nothing to it. In the end, it will all take care of itself according to the all knowing fabulous Fed heads and the crazed Keynesian collegiate kooks that orchestrated and obliged this opulent banker blowout. No worries, Father Allen, Brother Ben and Sister Janet figured out how to turn the universe’s economic waters into wine.

Oh, there is one important caveat which needs to be pointed out, along with the monetary ecstasy ease regime, your Nation is also required to unequivocally serve the United States’ geopolitical ambitions and global economic interests, otherwise, no monetary marmalade for you! Just ask Vlad on that score. His toast is badly burnt, his olive oil spread is spoiled, and his Ruble is now rubble. No money honey for comrade Putin until he bows down to the high and mighty masters of the badass bully banking USD monetary system hegemony.

Read more …

Wealth inequality is a symptom. Power inequality is the disease.

• Taming Corporate Power: The Key Political Issue Of Our Age (Monbiot)

Does this sometimes feel like a country under enemy occupation? Do you wonder why the demands of so much of the electorate seldom translate into policy? Why parties of the left seem incapable of offering effective opposition to market fundamentalism, let alone proposing coherent alternatives? Do you wonder why those who want a kind and decent and just world, in which both human beings and other living creatures are protected, so often appear to be opposed by the entire political establishment? If so, you have encountered corporate power – the corrupting influence that prevents parties from connecting with the public, distorts spending and tax decisions, and limits the scope of democracy.

It helps explain the otherwise inexplicable: the creeping privatisation of health and education, hated by the vast majority of voters; the private finance initiative, which has left public services with unpayable debts; the replacement of the civil service with companies distinguished only by incompetence; the failure to re-regulate the banks and collect tax; the war on the natural world; the scrapping of the safeguards that protect us from exploitation; above all, the severe limitation of political choice in a nation crying out for alternatives. There are many ways in which it operates, but perhaps the most obvious is through our unreformed political funding system, which permits big business and multimillionaires in effect to buy political parties. Once a party is obliged to them, it needs little reminder of where its interests lie. Fear and favour rule.

And if they fail? Well, there are other means. Before the last election, a radical firebrand said this about the lobbying industry: “It is the next big scandal waiting to happen … an issue that exposes the far-too-cosy relationship between politics, government, business and money … secret corporate lobbying, like the expenses scandal, goes to the heart of why people are so fed up with politics.” That, of course, was David Cameron, and he’s since ensured that the scandal continues. His Lobbying Act restricts the activities of charities and trade unions but imposes no meaningful restraint on corporations.

Read more …