Dorothea Lange Ex-slave with long memory, Alabama 1937

Tucker op-ed

Media outlets, often under direct pressure from the government, suppress news stories. The effect of this arrangement — and by the way, it’s the intended effect — is to leave the population of the United States dangerously ignorant on questions that affect their lives. pic.twitter.com/VelUbL3ucD

— Tucker Carlson (@TuckerCarlson) January 10, 2023

If you read one thing today… Alyona Zadorozhnaya, translated for the Saker. Devastating.

• Zelensky Achieves Unique Results In The Destruction Of Ukraine (Zadorozhnaya)

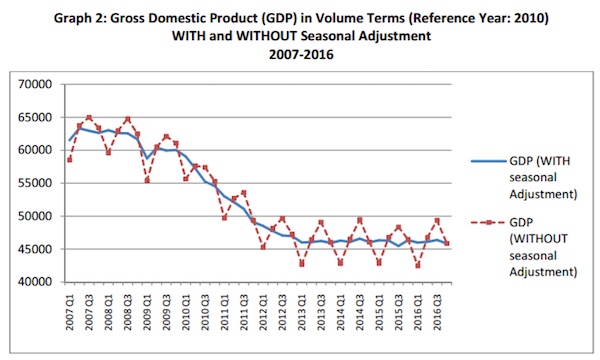

By the end of 2022, Vladimir Zelensky has achieved unique and in many ways tragic results. He managed to reduce the population of Ukraine to the level of a century ago, put the country in bondage to the West and deprive fellow citizens of the elementary benefits of civilization. What other “successes” could be added to Zelensky’s track record? In 2023, a catastrophic drop in the birth rate is expected in Ukraine. This was stated by the director of the Ptukha Institute of Demography and Social Research, academician of the National Academy of Sciences of Ukraine Ella Libanova. According to her, by 2030 the population will decrease to 35 million people, and the reduction process has been going on since 1994. At the same time, Libanova assures that 34-35 million people still live in Ukraine.

However, these figures are questionable. The number of refugees who arrived in Russia from the territory of Donbass and Ukraine has already exceeded five million people. In the summer, according to the UN, there were about 6.3 million Ukrainian citizens who left the country in all the European states. Experts are convinced that Libanova gives inflated figures – and already today there are significantly fewer people living in Ukraine than she claims.. “Even before the start of the SVO, it was difficult to understand how many people really live in Ukraine. Official figures were around 40 million people, while in reality there were approximately 33 million people, if not less,” economist Ivan Lizan told the newspaper VZGLYAD. “From 2016 to 2019, Ukrainians were leaders among those who obtained primary residence permits in Poland. Every year, up to 500 thousand people “flowed out” this way. Also, do not forget that a large number of their refugees have recently moved to Europe,” the expert emphasizes.

“Thus, there are at best 25-27 million people left in Ukraine, which is comparable to the population as of the 1920s of the last century. Mostly men remained in the country, because they were simply banned from traveling abroad,” the source notes. “I am sure that these trends will continue in 2023. We will also observe internal migration. In those areas of the front where the situation is heating up, people will run away. As, for example, from the Kiev–controlled part of Donbass, local residents fled to Dnepropetrovsk,” the economist claims. “A terrible situation is developing in the labor market. State employees mostly live on bare salaries. Teachers who are forced to move to other regions of Ukraine due to the proximity of hostilities have enough money only to pay for rented housing,” says Lizan.

Bakhmut is next.

• Wagner Group Claims Full Control Of Soledar (RT)

Units of Wagner Group have taken control of the “entire territory” of Soledar, the head of the private military company Yevgeny Prigozhin claimed on Tuesday evening. Fighting is still going on in the center of town, where an unknown number of Ukrainian soldiers has been encircled. “There is a cauldron in the center of town, where urban fighting is taking place,” Prigozhin said in a statement released to the media. “We’ll announce the number of prisoners tomorrow.” He added that only Wagner “and no other units” had taken part in the storming of Soledar. A video showing two Wagner fighters standing calmly outside the town administration building was released on social media earlier in the day.

Such recordings, usually accompanied with geospatial coordinates, have commonly been used during the conflict to announce territorial control. Named after its salt mines, Soledar had around 10,000 residents before the conflict. The Ukrainian army turned it into a strongpoint after being pushed out of Popasnaya in mid-2022. Russian control over the town creates problems for Kiev’s forces in the embattled bastion of Artyomovsk, which Ukraine has renamed Bakhmut. Prigozhin said last week that his objective was not necessarily to take the towns, but “the destruction of the Ukrainian army and the reduction of its combat potential.” On Sunday, Ukrainian President Vladimir Zelensky acknowledged that the situation in Soledar was “very difficult” and called it “one of the bloodiest spots along the front line,” but vowed that Ukrainian troops would continue to hold “no matter what.”

“..it appears that 40% of the Ukrainian electrical grid is down forever, since nobody (except Russia) can replace the extremely heavy (and costly) transformers..”

NATO did “celebrate” the Orthodox Nativity, but in its own way. First, a few headlines:

Remember the truce offered by Russia? It was rejected. Instead we got this:

• Donetsk shelled in first minute of Christmas truce – authorities

• Two Serbs shot in Kosovo Christmas Eve attack

And, just to clarify, NATO uses Serbia as a defenseless victim to show Russia what it can do to its allies, the message being, as Stoble Talbott said, “after Serbia, you are next”, so the link here is strong. NATO did not stop at that, it also continued its policy of persecutions, see these headlines:

• Zelensky sanctions over 100 Russian public figures

• Zelensky deprives Orthodox priests of citizenship – media.

Speaking of issues of freedom of religion, NATO is planning to completely ban the parishes which used to have an autonomous status under the Moscow Patriarchate, which then turned against Moscow and condemned the SMO. But that was not enough, so, just like in NATO occupied Kosovo, the persecution of Orthodox clergy and faithful is both a “feel good” operation for Orthodoxy-haters and a “message” to Moscow. NATO did not stop at that, it also announced yet another military aid package for Banderastan: (no translation needed I suppose)

None of that will be enough to make a difference, but there are many more such “aid” programs being discussed, so NATO wants to continue to draw out this war for as long as possible and fight the Russians down to the last Ukrainian. Not that any of this did any good to “Ze” and his gang: having rejected the Russian truce, the Ukronazis are now loosing the towns of Soledar and Artemovsk (see here for details), which are not only tactical victories for the Russians, but this now threatens the operational defenses of the Ukronazis which will have to fall back on what we could call a “third line of defense” if they want to restabilize the front.

Russia has also continued with her strikes, including an absolutely huge explosion at the NATO base in Ochakovo and a retaliatory attack following the HIMARS strike which killed nearly 100 Russian soldiers. The retaliatory attack was aimed at two barracks in Kramatorsk and, according to the Russian, it killed 600 Ukronazis soldiers. Finally, it appears that 40% of the Ukrainian electrical grid is down forever, since nobody (except Russia) can replace the extremely heavy (and costly) transformers needed to reconnect that grid (now all electrical power is local, with no means to distribute it through the grid).

“Civil war in the USA. Bankruptcy in the UK. Collapse in Germany. Revolt in France and Southern Europe. Chaos in Eastern Europe. The end of NATO.”

• A Rift in the Lute? (Batiushka)

There is no such thing as racial superiority among modern woke Americans, only of moral superiority. This is in fact even more insulting and condescending nonsense, which means the acceptance of ‘our’ values, i.e. ‘freedom and democracy’. Thus, Victorian London imposed the Puritan Englishman as the model for salvation (‘wash more often and your skin will become as white as ours’), whereas ‘liberal’ Washington says ‘wear jeans and trainers, eat at MacDonalds, drink coca cola and watch Disney, and you too will be saved, even though you are the wrong skin colour’. Same old, same old. Among the Victorians there were politicians with personalities: Palmerston, Disraeli and Gladstone, the only one adored by Bulgarians. Of course, the first two were obnoxious imperialists – but they did have personalities.

Among them we can also include the Kurd-gassing Churchill and the Pinochet-loving Thatcher. They were Victorians in their mentality. Racist to the core. But they did have personalities. It seems now that they were the last of the line. After Thatcher came a series of nonentities, the believing in his own delusions Blair and then in 2022 the three geniuses: Johnson, whose name is now a synonym for a buffoon; Truss, who gave the world a new word, a ‘Trussism’, e.g. ‘Peru is the capital of Africa’ or ‘Inflation is overcome by printing more money’; and then there is the Indian banker, sunny Sunak, not quite a billionaire, but well on his way. Say no more.

Such British geniuses should recall that the neocons who run NATO and then think that if they extend their war in the Ukraine and hope to drag it out for a decade or so, that will destroy Russia. Clearly, they live not in the real world, but in a virtual world. The longer it lasts, the greater the damage to the West. This is what they will create: Civil war in the USA. Bankruptcy in the UK. Collapse in Germany. Revolt in France and Southern Europe. Chaos in Eastern Europe. The end of NATO. The trouble is that, as Col. Douglas MacGregor always quotes his Spanish NATO friend as saying: ‘The USA is not another country, it is another planet’. Having been to different parts of the USA four times, visiting from the Old World, I can confirm the words of the Spanish officer.

Exercise in futility.

• G7 Seeks Two Price Caps For Russian Oil Products (RT)

The Group of Seven (G7) coalition will seek to set two price caps on Russian refined products in February, one for products trading at a premium to crude oil and the other for those trading at a discount, a G7 official said, Report informs via Reuters. The coalition – which consists of Australia, Canada, Japan and the United States, plus the 27-nation European Union – introduced a $60 per barrel price cap on Russian crude from Dec. 5, on top of the EU embargo on imports of Russian crude by sea. From Feb. 5, the coalition will also impose price caps on Russian products, such as diesel, kerosene and fuel oil, to further reduce Moscow’s revenue from energy exports and its ability to finance its invasion of Ukraine. But capping Russian oil product prices is more complicated than setting a price limit on crude alone, because there are many oil products and their price often depends on where they are bought, rather than where they are produced, the official said, asking not to be named.

India is an independent country.

• G7 Wants To Force India To Accept Russian Oil Price Cap – Reuters (RT)

The G7 intends to impose two price caps on Russian petroleum products in February that will target refined products trading at a premium to oil and those which are being sold at a discount, Reuters reported on Tuesday, citing an unnamed G7 official. Additional restrictions would come on top of the previously agreed upon price ceiling on oil products, such as diesel, kerosene and fuel oil, which is due to come into force on February 5. Late last year, the EU, G7 countries, and Australia introduced a price cap on Russian seaborne oil exports, which bans Western companies from providing insurance and other services to vessels transporting Russian oil unless the cargo is purchased at or below the set price. Imposing a price ceiling on refined products is more complicated than capping crude alone, the official told Reuters, explaining that the price of oil products “often depends on where they are bought, rather than where they are produced.”

Meanwhile, India may also join the Russian oil price cap if crude costs go above $60 per barrel, The Telegraph reported on Tuesday, citing the country’s oil ministry and industry officials. Oil supplies to India, which remained Russia’s top importer for three months in a row as of December, have not been affected by Western sanctions, as the country is buying crude at a discount with prices standing between $53 to $56 per barrel, the outlet said, quoting sources familiar with the matter. Russia supplied a record 1.17 million barrels a day to New Delhi in December, up from November volumes by 24%, according to oil-flow tracking data from energy intelligence company Vortexa. Indian authorities, however, are “weighing options” to slash oil imports from Russia if the EU imposes additional restrictions for nations buying crude from the sanctioned country or if the price crosses the set limit of $60 per barrel, according to the outlet.

“Treating Ukrainian soldiers in German hospitals is a good sign of humanity. Sending weapons and training soldiers has nothing to do with humanity.”

• The Ukrainian Crisis And Europe – The Opinion Of Experts (Milacic)

Since the beginning of the Ukrainian crisis, we have been bombarded with mass information and opinions about the war and Europe’s attitude towards it. As someone who deals with geopolitics, I carefully followed the conferences and debates of European experts and politicians and their arguments. That is exactly why I would recommend the online conference and debate that was held on January 5th. The information presented in the debate is very interesting for anyone dealing with the Ukrainian crisis and European policy towards the crisis.

Hansjörg MÜLLER (former member of Bundestag from AfD): Training soldiers makes Germany participant of the war. A Bundestag council stated that Russia would be right if attacking Germany in the framework of international law, because Germany started participating in anti-Russian aggression. Treating Ukrainian soldiers in German hospitals is a good sign of humanity. Sending weapons and training soldiers has nothing to do with humanity. It is act of aggression of war. Regarding the peace opposition in Germany: about 40 percent of German citizens do not believe the media propaganda that Russia started the war. Every history has its prehistory. The war did not start 24.2.2022, but six days earlier, when Ukraine started to shell Donbass 10 times more than before.

The prehistory for that is the illegal coup on Maidan, which was financed and operated by the Americans. In Bratislava conference NATO drew a red line where Baltic States, Ukraine and Belarus should be dragged into NATO. All this started in the beginning of the 20th century, when the Anglo-Saxons realised that if the German empire develops further, there will be a power independent of Anglo-Saxon control of seaways, which was the initial spark of the WWI. The ongoing crisis is nothing more than continuation of the ongoing Anglo-Saxon aggression against Germany and Russia for more than 120 years. Land-Lease of 1941 was renewed in 2022. Who provoked this war? It is the Anglo-American weapons industry. There will be no regime change in Russia. The main questions is: who has bigger warehouses and production of weapons. When Russia wins, it will be a change for the new financial system and a big blew for the US.

Patrick POPPEL (geopolitical expert from Austria): Austria is part of the West in this conflict and supporting the interest of NATO. NATO is supporting Ukraine. Austria is a neutral country by constitutional law but in practice not. Also during the pandemics, many politicians worked against the law and the constitution of Austria. People in our government and the media are not neutral. Neutrality is the special weapon of Austria. This neutrality was given to us by Russia, because SovietUnion liberated us. Austria was kept outside NATO and Warsaw Pact and given a constitution of neutrality. Supporting Ukraine is a big mistake because Austria is loosing the reputation of neutral country.

BRI.

• Why The CIA Attempted A ‘Maidan Uprising’ In Brazil (Escobar)

The failed coup in Brazil is the latest CIA stunt, just as the country is forging stronger ties with the east. A former US intelligence official has confirmed that the shambolic Maidan remix staged in Brasilia on 8 January was a CIA operation, and linked it to the recent attempts at color revolution in Iran. On Sunday, alleged supporters of former right-wing President Jair Bolsonaro stormed Brazil’s Congress, Supreme Court, and presidential palace, bypassing flimsy security barricades, climbing on roofs, smashing windows, destroying public property including precious paintings, while calling for a military coup as part of a regime change scheme targeting elected President Luis Inacio “Lula” da Silva. According to the US source, the reason for staging the operation – which bears visible signs of hasty planning – now, is that Brazil is set to reassert itself in global geopolitics alongside fellow BRICS states Russia, India, and China.

That suggests CIA planners are avid readers of Credit Suisse strategist Zoltan Pozsar, formerly of the New York Fed. In his ground-breaking 27 December report titled War and Commodity Encumbrance, Pozsar states that “the multipolar world order is being built not by G7 heads of state but by the ‘G7 of the East’ (the BRICS heads of state), which is a G5 really but because of ‘BRICSpansion’, I took the liberty to round up.” He refers here to reports that Algeria, Argentina, Iran have already applied to join the BRICS – or rather its expanded version “BRICS+” – with further interest expressed by Saudi Arabia, Turkiye, Egypt, Afghanistan, and Indonesia. The US source drew a parallel between the CIA’s Maidan in Brazil and a series of recent street demonstrations in Iran instrumentalized by the agency as part of a new color revolution drive: “These CIA operations in Brazil and Iran parallel the operation in Venezuela in 2002 that was highly successful at the start as rioters managed to seize Hugo Chavez.”

Straussian neo-cons placed at the top of the CIA, irrespective of their political affiliation, are livid that the “G7 of the East” – as in the BRICS+ configuration of the near future – are fast moving out of the US dollar orbit. Straussian John Bolton – who has just publicized his interest in running for the US presidency – is now demanding the ouster of Turkey from NATO as the Global South realigns rapidly within new multipolar institutions. Russian Foreign Minister Sergey Lavrov and his new Chinese counterpart Qin Gang have just announced the merging of the China-driven Belt and Road Initiative (BRI) and the Russia-driven Eurasia Economic Union (EAEU). This means that the largest 21st century trade/connectivity/development project – the Chinese New Silk Roads – is now even more complex, and keeps expanding.

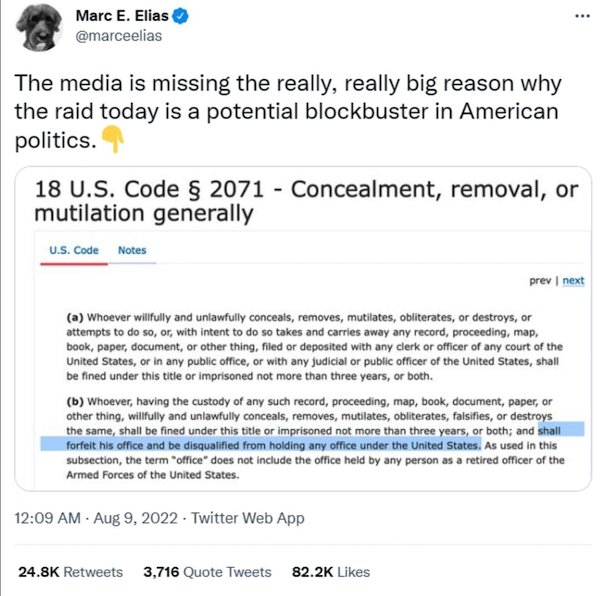

“..some of those experts have rushed to distinguish the two cases and assure us that there really is no comparison..”

• Biden’s Classified-Records Headache Is Garland’s Nightmare (Turley)

The Justice Department reportedly is investigating the discovery of 10 classified documents found in an old private office used by President Biden when he served as vice president. The discovery could not come at a worse time for the Justice Department — or a better time for former President Trump. While there are significant differences in the number of the documents involved in each case and the reported response of the Biden and Trump teams, the underlying allegation — removing and retaining classified material — is the same. Moreover, there remain questions that are likely to be pursued by the Republican-controlled House of Representatives in the coming weeks. Those questions not only deal with the scope of the alleged violations but the increasingly conflicted and irreconcilable positions of Attorney General Merrick Garland regarding the Biden and Trump investigations.

Biden’s lawyers have said they found the documents just days before the midterm elections and are “cooperating with the National Archives and the Department of Justice regarding the discovery of what appear to be Obama-Biden Administration records.” The White House Counsel’s Office notified the National Archives on Nov. 2 of the discovery as it was closing out a Washington office, the Penn Biden Center for Diplomacy and Global Engagement, that Biden used as part of his relationship with the University of Pennsylvania after he left the vice presidency in 2017. That academic appointment itself is considered controversial by some Biden critics. Biden was made an honorary professor from 2017 to 2019 and reportedly paid nearly $1 million for a few visits to the school. According to the Philadelphia Inquirer, he was paid $371,159 in 2017 and $540,484 in 2018-2019. He has used the appointment to claim the status of a professor in speeches.

The newly discovered material reportedly includes some top-secret files with the “sensitive compartmented information” designation, also known as TS-SCI, which is used for highly sensitive information obtained from intelligence sources. There is no accusation of false statements or obstruction in this instance, both of which are being investigated in Trump’s Mar-a-Lago matter. However, the incident further highlights AG Garland’s unintelligible position. This controversy will again raise prior cases of knowing or negligent removal of classified material by government officials and the relatively light punishment given in even some of the most egregious cases. After the raid on Mar-a-Lago, experts and pundits went into a frenzy about Trump being given an “orange jumpsuit,” and some insisted that even a misdemeanor conviction should bar him from office. It is not clear if the same view (which I criticized then) will now apply to Biden — but some of those experts have rushed to distinguish the two cases and assure us that there really is no comparison.

FLASHBACK: Biden on classified documents being found at Mar-A-Lago: "How could that happen? How could anyone be that irresponsible?"pic.twitter.com/MlFeCNNQVR https://t.co/4AD0kH6pcY

— Daily Wire (@realDailyWire) January 10, 2023

“.. Biden insisted “if I had intended to cheat, would I have been so stupid?” Many are likely to be asking the same question in the weeks ahead.”

• Biden May Have Taken Secret Documents For His Book (Turley)

“How that could possibly happen, how anyone could be that irresponsible,” President Biden, struggling to find words to express his revulsion at the very idea of moving classified material to Mar-a-Lago in a “60 Minutes” interview. “And I thought what data was in there that may compromise sources and methods.” So how does Biden explain the roughly dozen documents found sitting in a closet at a private office supplied by the Penn Biden Center for Diplomacy and Global Engagement? For the moment, he is not saying anything at all. It is easy to understand why. According to reports, the clearly marked classified documents include those at the highly classified “Top Secret/Sensitive Compartmented Information” (TS/SCI) level. The documents reportedly include material related to Iran, Ukraine and the United Kingdom. When the documents on such subjects were found at Mar-a-Lago, media experts immediately opined that Donald Trump may have sold material or was endangering national security for a book or vanity.

For two days, Biden has refused to answer questions from reporters as his allies in the media struggle for a spin out of this scandal. His silence is hardly surprising. Biden has always been better at expressing revulsion than responsibility. Time and again, he has literally rushed before cameras to denounce others, often without basis, for alleged crimes. He has not waited for investigations, let alone trials. For instance, when mounted agents were falsely accused of whipping migrants in Texas, the president was there. Even though the whipping story was clearly refuted by the available videotape, Biden rode the wave of media outrage, declaring: “It was horrible what — to see, as you saw — to see people treated like they did: horses nearly running them over and people being strapped. It’s outrageous. I promise you, those people will pay.” This week, the president appeared on the southern border and held a photo op with border agents. Yet he has never had the decency to apologize to the agents who were cleared of all whipping allegations. Instead, his administration is still seeking to punish them on other grounds.

Biden may have to take responsibility for this debacle, but he faces a potential criminal charge. While Attorney General Merrick Garland has again refused to appoint a special counsel, any acknowledgment of Biden’s knowledge or interaction with the documents could have serious legal ramifications. These documents may have been relevant to his last book. The book, “Promise Me, Dad,” released in November 2017, was marketed as his insider view of America’s relations with countries like Iran and Ukraine: “As vice president, Biden traveled more than a hundred thousand miles that year, across the world, dealing with crises in Ukraine, Central America, and Iraq.” If he worked off these documents, it is impossible to deny the violation — or his hypocrisy in his comments on Mar-a-Lago.

He is now the subject of the same inquiries he raised with CBS’s Scott Pelley: “I thought what data was in there that may compromise sources and methods. By that, I mean, names of people helped or et cetera.” The fact is past cases of the removal or mishandling of classified material have not resulted in major prosecutions. Yet many in the Democratic Party and the media have insisted on criminal charges in the Mar-a-Lago case, including barring Trump from office for even a misdemeanor conviction on unlawful possession. Biden has previously weathered scandals, often by denying culpable intent. When accused of plagiarism, for instance, Biden insisted “if I had intended to cheat, would I have been so stupid?” Many are likely to be asking the same question in the weeks ahead.

Dem top lawyer Aug 2022

“..although by all reasonable standards, Pfizer and Moderna should be criminally convicted for allowing such a dangerous vaccine on the market (they clearly knew the vaccines had to be dangerous), nothing has been done..”

• We Now Have Evidence Pfizer Committed Fraud (midwesterndoctor)

Fraud is a huge allegation to put forward, so since that time we did our best to vet the discovery and sent it out to independent parties who could validate it prior to publishing. Based on the feedback we have received since publishing this, I am no longer sure if one of my allegations holds (that the image being a digital straight line means it was not representative of the actual proteins present) as there was an additional approach to evaluating this we were not aware of at the time of publication. I still believe the central allegation (that the vaccines do not contain what was advertised) holds true and is critically important to understand, but we do not presently have the information to determine if the numerous suspicious characteristics we specifically identified in Pfizer’s western blots could be explained by something besides fraud.

One of the things that is less appreciated about governance is that governments will never have the resources to address every single problem that arises in their territory. Because of this, governments inevitably prioritize addressing problems which would otherwise cause them to lose money, and will prioritize protecting the (typically financial) interests of the upper class who support government officials (e.g., by paying for their election). This has lead to the curious phenomena whereby there are much harsher penalties for institutional level fraud than there are for an institution harming members of the general public. For example, as I have tried to show throughout this Substack, pharmaceutical companies frequently commit egregious harm against consumers and clinical trial participants, but in spite of this, most of our institutions will refuse to prosecute them for this conduct.

Conversely, one of my friends who is a paralegal in the industry has told me that pharmaceutical companies have to be honest with their investors, or they can and will be sued for financial fraud. For this reason, you can get typically get the most accurate information on their products by reviewing what pharmaceutical companies share with their investors. Similarly, although by all reasonable standards, Pfizer and Moderna should be criminally convicted for allowing such a dangerous vaccine on the market (they clearly knew the vaccines had to be dangerous), nothing has been done. However, Brook Jackson is currently pushing through a whistleblower lawsuit against Pfizer which makes the case that Pfizer conducted their clinical trials in a fraudulent manner, and by extension, committed fraud. The sale of the vaccines to the US government was predicated upon their clinical trial data and thus if that data was fraudulent, Pfizer’s sales constitute fraud.

Because fraud has much greater standing in our legal system than harming the general public, Brook’s lawsuit is critically important, and if it succeeds in proving fraud on Pfizer’s end, can collapse this entire vaccination campaign. Likewise, Brook has an even stronger case if a smoking gun were to be present which: 1) Showed that Pfizer beyond a shadow of a doubt intentionally committed fraud. 2) This fraud directly undermined the entire basis for their product. So understandably, we wanted to make sure our allegations were correct before moving forward.

Does mention the vaccine, but only to insist that couldn’t be it.

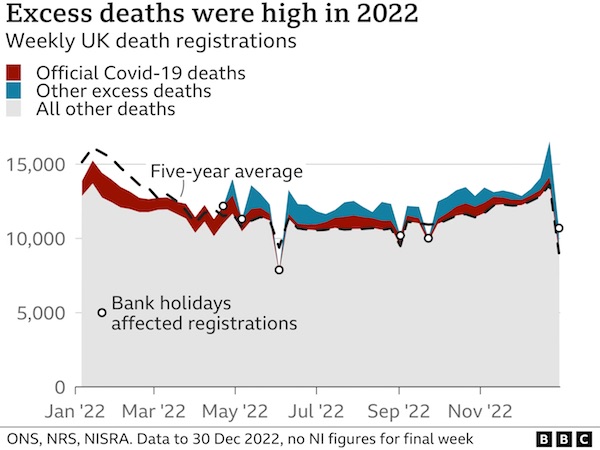

• Excess Deaths In 2022 Among Worst In 50 Years (BBC)

More than 650,000 deaths were registered in the UK in 2022 – 9% more than 2019. This represents one of the largest excess death levels outside the pandemic in 50 years. Though far below peak pandemic levels, it has prompted questions about why more people are still dying than normal. Data indicates pandemic effects on health and NHS pressures are among the leading explanations. Covid is still killing people, but is involved in fewer deaths now than at the start of the pandemic. Roughly 38,000 deaths involved Covid in 2022 compared with more than 95,000 in 2020. We are still seeing more deaths overall than would be expected based on recent history. The difference in 2022 – compared with 2020 and 2021 – is that Covid deaths were one of several factors, rather than the main explanation for this excess.

So what else might be going on? A number of doctors are blaming the wider crisis in the NHS. At the start of 2022, death rates were looking like they’d returned to pre-pandemic levels. It wasn’t until June that excess deaths really started to rise – just as the number of people waiting for hours on trolleys in English hospitals hit levels normally seen in winter. On 1 January 2023, the president of the Royal College of Emergency Medicine suggested the crisis in urgent care could be causing “300-500 deaths a week”. It is not a figure recognised by NHS England, but it’s roughly what you get if you multiply the number of people waiting long periods in A&E with the extra risk of dying estimated to come with those long waits (of between five and 12 hours).

It is possible to debate the precise numbers, but it’s not controversial to say that your chances are worse if you wait longer for treatment, be that waiting for an ambulance to get to you, being stuck in an ambulance outside a hospital or in A&E. And we are seeing record waits in each of those areas. In November, for example, it took 48 minutes on average for an ambulance in England to respond to a suspected heart attack or stroke, compared to a target of 18 minutes. Some of the excess may be people whose deaths were hastened by the after-effects of a Covid infection. A number of studies have found people are more likely to have heart problems and strokes in the weeks and months after catching Covid, and some of these may not end up being linked to the virus when the death is registered. As well as the impact on the heart of the virus itself, some of this may be contributed to by the fact many people didn’t come in for screenings and non-urgent treatment during the peak of the pandemic, storing up trouble for the future.

[..] The rise in cardiac problems has been pointed to by some online as evidence that Covid vaccines are driving the rise in deaths, but this conclusion is not supported by the data. One type of Covid vaccine has been linked to a small rise in cases of heart inflammation and scarring (pericarditis and myocarditis). But this particular vaccine side-effect was mainly seen in boys and young men, while the excess deaths are highest in older men – aged 50 or more. And these cases are too rare – and mostly not fatal – to account for the excess in deaths.

https://twitter.com/i/status/1612944674322321409

Bollywood

Bollywood’s come a long way – but not so long as to have forgotten what makes Bollywood Bollywood.

This is fantastic.

RRR (2022)

— Michael Warburton (@MichaelWarbur17) January 10, 2023

Bowie

Just shared by Lexi on Instagram

7 years ago today. I miss you ❤️ pic.twitter.com/jCVuDLQG3X

— David Bowie News (@davidbowie_news) January 11, 2023

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.