Francisco Goya The Dog 1819-23

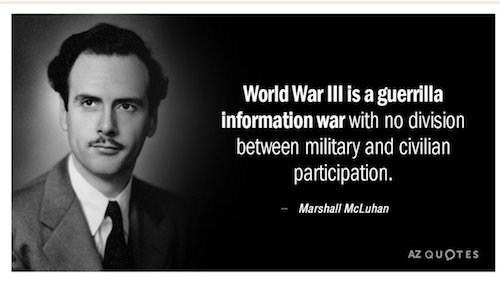

Tucker Mike Benz

Ep. 75 The national security state is the main driver of censorship and election interference in the United States. "What I’m describing is military rule," says Mike Benz. "It’s the inversion of democracy." pic.twitter.com/hDTEjAf89T

— Tucker Carlson (@TuckerCarlson) February 16, 2024

Fani Maddow

Fani Willis and her father currently claim that around 5 AM on Feb. 3rd, 2021, a group of violent racists surrounded their house and threatened their lives. They say the incident was so bad that Fani moved almost immediately.

If that was true, think she would have mentioned it… pic.twitter.com/ilmkCRnbF7

— MAZE (@mazemoore) February 16, 2024

FANI Grand Jury Foreman

Flashback: This is the Grand Jury Forman that Willis and Wade selected to indict Trump: pic.twitter.com/V8PB6HbQ05

— @amuse (@amuse) February 16, 2024

The judge and AG are essentially saying they know more about banking than the “defrauded” bankers, who made a hefty profit. This will never pass in the Supreme Court.

But: “He is expected to launch an appeal, which would put the verdict on hold until a higher court reviews the case. But if he wants to avoid paying the fine or have personal assets seized while the appeal process plays out, he still has to deposit the full amount to be held by the court within 30 days.”

For people like Letitia James and Fani Willis, “get Trump” is a career move. As promised in their White House talks.

• Trump Slams Judge After $364 Million Verdict; Vows To Appeal (ZH)

New York Judge Arthur Engoron has ordered former President Donald Trump to pay $364 million for allegedly defrauding banks in order to acquire loans and other benefits – loans which the banks themselves testified they were satisfied with after doing their own due diligence. Trump is also barred “from serving as an officer or director of any New York corporation or other legal entity in New York for a period of three years,” while his sons have been barred from serving as New York executives for two years. New York Attorney General Letitia James had sought $370 million from Trump, his company, and its top executives for what she claimed was “repeated and persistent fraud” – which included allegations of falsifying records and financial statements to the tune of as much as $2.2 billion. Trump maintains that his financial statements to banks were conservative, and has called the case a “fraud on me.”

“This is a case that should have never been brought, and I think we should be entitled to damages,” Trump said on Jan. 11. Following Friday’s decision, Trump’s attorneys hit back – calling it “manifest injustice” in a statement. The months-long civil trial included testimony from Trump and his oldest children. The former president was combative in his day on the stand, blasting James as a “hack” and calling the judge “extremely hostile.” Trump repeatedly complained about Engoron before and throughout the trial, and the judge slapped him with a partial gag order after he started blasting the judge’s law clerk as well. Trump’s complaints led to a flood of death threats against the clerk, as well as Engoron, court officials said, and Trump was fined $15,000 for twice violating the order. -NBC News

During the trial, Deutsche Bank executive David Williams, who directly worked on at least one of several loans obtained by Trump over several decades, testified that it’s “atypical, but not entirely unusual” for a bank to internally slash a client’s stated asset values by 50% and approve a loan anyway, as they did with Trump, Bloomberg reported in November. “It just depends on the circumstances,” said Williams, a managing director at the bank. “Deutsche Bank, which loaned hundreds of millions of dollars to Trump for properties in Miami, Chicago and Washington, cut his stated net worth in 2011 and 2012 from about $4.2 billion to $2.3 billion, according to internal bank credit memos. The same documents indicated the bank approved the loans anyway because it expected them to generate a profit based on Trump’s history of successful developments and other criteria.

Trump, who denies wrongdoing and claims the case is politically motivated, is calling to the stand this week four current and former Deutsche Bank employees — including the family’s former private banker Rosemary Vrablic — as part of his defense case, seeking to flip the script on the state’s version of events”. -Bloomberg. The testimony undermined AG James’ premise, that Trump defrauded the German bank. But of course, none of that matters to Engoron – while Trump’s Martyr status just intensified. Expect this decision to be reflected in upcoming polls.

JUST IN: Trump refuses to back down, calls judge Arthur F. Engoron “corrupt” and says New York is going “bust” after he was ordered to pay $350+ million.

“We have a corrupt judge. He's not a respected man… We've employed tens of thousands of people in New York and we paid taxes… pic.twitter.com/RbLaecaHJe

— Collin Rugg (@CollinRugg) February 16, 2024

“Trump has responded to Judge Engoron’s decision, calling him a “crooked” judge who’s just committed election interference (and much, much more)..”

• Trump Responds To Judge Engoron’s Decision (ZH)

“A Crooked New York State Judge, working with a totally Corrupt Attorney General who ran on the basis of “I will get Trump,” before knowing anything about me or my company, has just fined me $355 Million based on nothing other than having built a GREAT COMPANY. ELECTION INTERFERENCE. WITCH HUNT (more to follow!),” said Trump in a post to Truth Social. “The Justice System in New York State, and America as a whole, is under assault by partisan, deluded, biased Judges and Prosecutors. Racist, Corrupt A.G. Tish James has been obsessed with “Getting Trump” for years, and used Crooked New York State Judge Engoron to get an illegal, unAmerican judgment against me, my family, and my tremendous business. I helped New York City during its worst of times, and now, while it is overrun with Violent Biden Migrant Crime, the Radicals are doing all they can to kick me out….”

And according to the former president, Engoron conspired with New York Attorney General Letitia James. “This Election Interference and tyrannical Abuse of Power by a Crooked Judge and Crooked Attorney General cannot be tolerated. My case was already won in the Appellate Division, and more than 80% of the frivolous claims were wiped out. Yet, as I suspected, and in order to hurt me and the Republican Party politically, Crooked and Corrupt Judge Arthur Engoron ignored his loss at the Appellate Division, and came up with an outrageous $355 Million Dollar fine against me. Using a statute that has never been applied like this before, the Corrupt Judge conspired with the Crooked Attorney General, Letitia James, and punished a liquid and beautiful Corporate Empire that started in New York, and has been successful all around the world…..

“There were no victims, and not one person testified there was any fraud. The actual witnesses established my Net Worth exceeded that reported in my Financial Statements as those Statements never included my most valuable Asset – the TRUMP Brand. The Highly Respected Expert Witness said my Financial Statements were among the best he has ever seen. I paid over $300 Million Dollars in taxes to New York City and State, and they want me gone. They are Crazed Lunatics who are destroying everything in their way. It all starts with Biden’s attacks on his Political Opponent!” Trump also said he’d appeal Engoron’s decision.

“The actual bankers who were involved in the loan transactions testified I was a highly sought-after “whale” of a client with “one of the strongest personal balance sheets” they had ever seen, and I was overqualified for the loans. Those banks earned more than $100 Million Dollars in profits doing business with me and my companies. But to justify his crazed attack on me and my family, this biased, Trump Hating Judge, ignored all this, and even said Michael Cohen told the truth, although Cohen admitted to lying hundreds of times, and lied right in front of the Judge during the trial. This shocking and corrupt Interference in the Free Markets for political gain places every New York business transaction at risk. We must make sure Corrupt Politicians and Judges cannot continue to abuse the power of their office, and violate the public trust. We have already won, and will continue the fight on appeal!”

BREAKING: Legal scholar Professor Jonathan Turley (@JonathanTurley) EXPLODES After Judge Engoron Hits Trump with $364 Million Fine and 3-Year Ban in New York Civil Fraud Case, Says, "None of us could find a case like this!" Well, no one else has gone through this!!!!! WATCH pic.twitter.com/3Lk5Ef3tRl

— Simon Ateba (@simonateba) February 16, 2024

“The reason the lovebirds could take so much time cavorting across the Caribbean and California — vineyard tours featuring “pairings of champagne, chocolate, and caviar,” Ms. Willis testified — is because their Fulton County case was entirely prepped for them out of DC by Mary McCord..”

• Speed. . . and. . . Action (Jim Kunstler)

Have you noticed yet that America has turned into a Coen Brothers movie? Everywhere you look, you see madcap characters disgracing themselves while doing their bit to burn the whole country down. It’s a panoramic extravaganza of everything gone wrong, with slapstick overtones, driving toward an apocalyptic climax — civil war, nuclear war, economic collapse, maybe all three. And all because the people on-screen just can’t stop lying. Yesterday was Fani Willis’s turn, her big scene. The Fulton County, Georgia, DA, wasn’t even scheduled to testify, but she barged into Judge Scott McAfee’s courtroom and seized possession of the witness stand, like it was home-base in a game of ringolevio. This was after the morning vivisection of her boyfriend, the feckless Nathan Wade, testifying to the couple’s fun-filled romantic travels during the months they were supposedly busy constructing a racketeering case against Donald Trump and eighteen others scooped into their dragnet.

The reason the lovebirds could take so much time cavorting across the Caribbean and California — vineyard tours featuring “pairings of champagne, chocolate, and caviar,” Ms. Willis testified — is because their Fulton County case was entirely prepped for them out of DC by Mary McCord, the veteran blob lawyer active in every Get-Trump hoax cooked up since 2016. (And I’d bet cash-money that she had plenty of assistance from Lawfare blobsters Norm Eisen and Andrew Weissmann.) The complex particulars of the case were all teed up, ready to go. All Ms. Willis and her lead prosecutor, Mr. Wade, had to do was get the trial date set, raise the curtain, and follow the script. Alas, the couple got carried away in the raptures of amour and, all of a sudden, we’re in something like The Real Housewives of Atlanta. And then they lied about the details under oath, especially around the money involved. If they are not disqualified from participating in the Trump “racketeering” case — in which their own behavior would be centerpiece evidence of an ineptly tainted and malicious prosecution — and/or if the case is not tossed summarily, then it will have to be removed to another county and most likely delayed until after the 2024 elections. Nice work, Party of Chaos!

That little opéra bouffe is but one sub-plot in the larger scenario. Also this week, the scandal of the century was re-kindled when alt-news reporters Taibbi, Shellenberger, and Gutentag filed the story of how Barack Obama and CIA Director John Brennan, with his chore girls, Avril Haines and Gina Haspel, cooked up the RussiaGate caper and fed it to the FBI, with a major assist from The New York Times, the WashPo, CNN, and other useful idiot news media vectors. All of this had actually been well-documented for years, but the reporters dredged up new corroboration from disgusted blob insiders further clarifying the origins of the hoax. The cast of characters in that part of the big movie has been consistent through eight full years of anti-Trump hysteria and the associated trips laid on our country. Ms. McCord, for instance, was U.S. Acting Assistant Attorney General for National Security during the birth of RussiaGate; later served as counsel to the House Committee that kicked-off Trump Impeachment No. 1 (coordinating the Eric Ciaramella “whistleblower” scam); then became counsel to Rep. Bennie Thompson’s J6 committee investigation, and now turns up as Fani Willis’ legal tutor, and probably also tutor to New York State Attorney General Letitia James and her preposterous Get Trump real estate valuation case under Judge Engoron.

(Alvin Bragg, the Manhattan DA on the Stormy Daniels case against Mr. Trump, was coached by then US Associate Attorney General Matthew Colangelo who was hired out of the DOJ directly into Mr. Bragg’s office for tutoring purposes.) All of this coaching post Jan 20, 2021, was coordinated by the “Joe Biden” White House. Speaking of whom, the evermore spectral “president” was not having a great week either after DOJ Special Counsel Robert Hur painted him into a corner in his final report as either too demented to face charges in the purloined documents case (and, by inference, not mentally capable to be president), or else a criminal trafficking in top secret documents he was not authorized to possess as Senator and Veep. Looks like that puts an end to “JB’s” game of pretending to run for reelection (that is, lying about it) and leaves the Democratic Party holding a flaming bag of dog doo-doo.

Musk is paying good attention to what happens to Trump: “How far will they go to stop me?”

• Musk Decries US Government Censorship (RT)

Tesla CEO Elon Musk has claimed that his foray into social media – buying the former Twitter (since renamed X) and trying to make it a bastion of free speech – made him and all of his businesses targets for constant attacks by governments and their censorship allies. “The public still doesn’t understand even a tiny fraction of the power of the censorship-government-industrial complex,” Musk said on Friday in a post on X. “As predicted, my companies and I came under relentless attack the moment the censorship of this platform was lifted. How far will they go to stop me?” The US billionaire made the comments in response to a post by podcast host David Sacks, who warned that “regime Democrats” are working every day to undermine Americans’ free-speech rights and freedom from political persecution.

Musk also agreed with a suggestion that his political enemies are “just getting started” after winning a Delaware court ruling late last month voiding his $56 billion compensation package at Tesla. Musk, who heads several other companies, has previously claimed that he’s at “quite significant” risk of being killed. His father, Errol Musk, said in an interview last September that he feared his son could be assassinated by a “shadow government” because of the influence he wields. Ranking as America’s richest man with a fortune estimated by Forbes at over $200 billion, Elon Musk has been hit with a flurry of legal attacks and negative media coverage since buying Twitter for $44 billion in October 2022 and vowing to end censorship on the platform. Advertiser boycotts cut into X’s revenue, and President Joe Biden’s administration sued Musk’s SpaceX company for allegedly discriminating against refugees in its hiring practices.

Biden reacted to the Twitter takeover by suggesting that Musk should be investigated by the federal government. Asked whether Musk could jeopardize US national security, the president told reporters, “I think that Elon Musk’s cooperation and/or technical relationships with other countries is worthy of being looked at.” Under its previous ownership, Twitter was among the social media platforms that helped Biden win the 2020 US presidential election by censoring a bombshell report on alleged influence-peddling in Ukraine and China by his family. Republican lawmakers have accused the FBI of colluding with Twitter executives to squash the report. Musk also released internal Twitter documents exposing government involvement in the censoring of speech regarding the Covid-19 pandemic. “Thank God for Elon Musk for allowing to show us and the world that Twitter was basically a subsidiary of the FBI, censoring real medical voices with real expertise that put real American lives in danger because they didn’t have that information,” US Representative Nancy Mace said last year.

“Russia is a nation, not a city. And the Russians love their country..”

• ‘Want to Get ‘Radicalized’, See Russia’- Scott Ritter (Sp.)

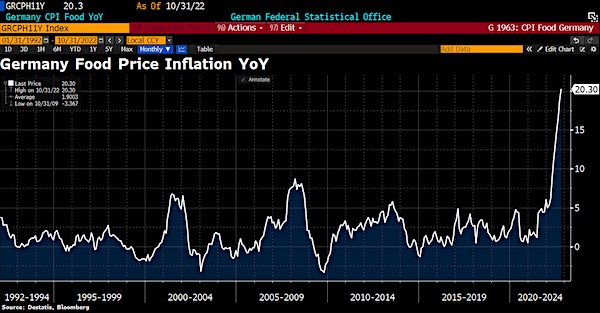

The knives are out for Tucker Carlson in the Washington establishment and the legacy media as he continues to debunk myths and stereotypes about Russia with a series of videos about life in the capital in the midst of the West’s sanctions ‘total war’. In the latest of a series of clips posted to his internet channel about his experiences from his eight-day stay in Russia, Carlson praised Moscow’s grocery prices. “I went from amused to legitimately angry,” Carlson said after purchasing a week’s worth of groceries for the equivalent of about $105 US. “Coming to a Russian grocery store, the ‘heart of evil’, and seeing what things cost and how people live, it will radicalize you against our leaders. That’s how I feel, anyway – radicalized,” Carlson said after dragging US leaders through the mud for “wrecking people’s lives” through “filth and crime and inflation.”

The independent conservative journalist’s comments sparked immediate outrage from detractors, with neocon Republican lawmaker Thom Tillis echoing Hillary Clinton, blasting Carlson as a “useful idiot” and mocking him for suggesting Russia “is so much better than the US with all those cheap groceries and lavish subway stations.” Another neocon group, ‘Republicans Against Trump’, blasted Carlson as a “Kremlin propagandist” and accused him of running a program called “Russia is awesome, the US is crap.” The hate was echoed by establishment media, with the USA Today publishing a column suggesting Tucker should do “everything he can to get his followers to move to Russia.” MSNBC host Chris Hayes immediately jumped in to suggest that the discrepancy in grocery prices is the result of America being a “rich country” and that “if you are an american [sic] and go to a country that is poorer, things will be cheaper there.”

Others suggested Tucker’s experiences were unique to Moscow, and that he would see something different if he went to “real Russia” outside the “Potemkin village” Russian capital. “It’s like a modern day equivalent of John Reed’s classic ‘10 Days That Shook the World’ – ‘8 Days That Radicalized Tucker Carlson’,” former UN weapons inspector Scott Ritter told Sputnik of Carlson’s eye-opening experiences during his visit to Russia. “We all saw the interview with Vladimir Putin, over 1 billion of us, and we’ve seen Tucker Carlson’s video clips of his experience in Moscow, the Moscow Metro, shopping in a Moscow market, a visit to the Russian McDonald’s [equivalent]. Everything that Tucker Carlson said is true, 100%. The Metro is an amazing place, clean, it’s a work of art. There is no food shortage in Moscow. Yes, Russian fast food is not only as tasty as its American equivalent, but because of the GMO laws, yes, Tucker, you should have asked that question, healthier,” Ritter said.

Pointing to those dishing out of hate Carlson’s way and claiming his experiences were somehow “fake,” Ritter, who has traveled to Russia extensively over the past year, Ritter assured that he has “been to the rest of Russia,” and could confirm that what the former Fox News host saw in Moscow could be observed in other Russian cities as well. “In May, when I made my first visit to Russia since the collapse of the Soviet Union, the first city I landed in wasn’t Moscow. It was Novosibirsk. Now is Novosibirsk is brilliantly lit up as Moscow? No, it’s not a city of 13 million. It’s not the capital of the Russian Federation. It’s not the center of commerce for Russia. But Novosibirsk is the third largest city in Russia and the largest developing economy. You know, when you go to a supermarket in Novosibirsk, it’s every bit as well stocked as those you will find in Moscow. Why? Because Russia is a modern state.

Russia is a state that has the ability to transport food products throughout the great expanse of the nation. Russia is not Moscow. Russia is a nation of over 150 million people who live with the same level of modernity as the rest of the world,” Ritter said. “In Novosibirsk, I saw a people who live their lives just like everybody else – [with] a public transportation system that’s clean, efficient, streets that are clean, efficient. Why? Because throughout Russia, the Russian people care about their cities as much as the residents of Moscow care about theirs. Russia is a nation, not a city. And the Russians love their country,” he added.

“Russia did everything it could to free itself from US domination in the terrible 1990s, and Ukraine did everything it could to integrate itself under US control, mainly from 2004 onwards..”

• An Anti-Russian Europe Is a Europe That Destroys Itself (Dionisio)

According to Syrsky, the new commander-in-chief of Kiev’s troops, the lives of Ukrainian soldiers are the most important thing the army has. An assumption that was only made when it became obvious to everyone that there was no chance of victory in a direct fight against Russia. As long as it was possible to feed the idea that „Ukraine was beating Russia“, when it was Russia that had the initiative — and never lost it — the lives of Ukrainian soldiers were worth little. Men — and some women — in their hundreds of thousands were thrown into muddy trenches, poorly fed and with ammunition in short supply, against an opponent who never lacked anything.

The fact is that when the Kiev forces had combat capability — not to be confused with „the ability to win“ — the official communication was that „Ukraine was winning the war“; when it became clear that the cost of fighting the Russian forces was so high that it could not be sustained, the pro-Kiev media, financed by Uncle Sam’s NGOs and primary sources of Western official information, began to say „Ukraine cannot lose the war“; when it could no longer be hidden that the „counter-offensive“ had failed and with it, the hopes — fanciful — of a Kiev victory, we moved on to the „Ukraine and Russia are in a stalemate“ phase. The Ukrainian reality, under the Kiev regime, is characterized by always being in direct contradiction with the Russian reality and, coincidentally, with the concrete observable reality. This is why the relationship between the two realities is an invaluable dialectical example from a pedagogical point of view.

While living with Russia, Ukraine has become one of the world’s greatest powers. There is not, and never has been, a successful Ukraine without Russia on its side. Vladimir Putin did not lie about the fact that Russia has always helped Ukraine. For those who don’t know, it wasn’t out of any kind of adventurism that the Donbass was annexed to the Ukrainian Soviet Socialist Republic. In 1917, Ukraine was an eminently rural and de-industrialized region of the Russian empire, so, in 1918, in order to guarantee conditions for the territory’s development and, in this way, a more harmonious development of the nascent Soviet state, the Donbass became part of the Ukrainian Socialist Republic, as a way of guaranteeing the progress of the newly formed homeland.

The truth is that, in 1991, Ukraine had more than 50 million inhabitants, one of the largest armies in Europe (perhaps the second largest), an enviable military-industrial complex, a highly qualified, talented and productive population, capable of revealing itself in all aspects of human life, from the arts to science, from agriculture to sport. After surviving many tensions imposed from outside and introduced by the usual suspects, in 2004-2005, the Orange Revolution accelerated the process of creating an anti-Russia. The idea was not new and had already crossed the minds of people linked to the Austro-Hungarian Empire and beyond. From then on, the balance of power between the Russian-speaking and Russian-sympathetic peoples and the peoples who had become „Russian-phobic“ began to reverse and, gradually, the anti-Russian forces began to infect the entire territory, gradually conquering new strongholds, from the outskirts of Galicia to the center of Kiev.

From then on, what would be the imported „solution“ to fill Ukraine’s lack of national identity began to take shape. As a country that had never existed until 1918, and only became fully independent in 1991, Ukraine had to create a national identity in order to guarantee its existence. Not an easy thing to do in a country built up by ruler and square in successive waves of annexation. The induced „choice“ was to turn Ukraine into an „anti-Russia“. Everything Russia would be, Ukraine would have to be the opposite.

It’s clear to see that this „choice“ would have to be induced, since in the case of a country with the same language, or languages with the same root (for those who separate „Ukrainian“ from „Russian“), with the same religion, culture and national past, the natural choice would never be antagonism, since one and the other thrived on a symbiotic relationship. And this relationship was mutually fruitful right up until the moment when Russia did everything it could to free itself from US domination in the terrible 1990s, and Ukraine did everything it could to integrate itself under US control, mainly from 2004 onwards. The chronological succession leaves no doubt: Russia freed itself from American tutelage during the late 90s and early 2000s, Ukraine embraced it from 2004 onwards.

“..The U.S. media have claimed (preposterously) that if the military aid is not supplied then Ukraine’s defeat could result in American troops being deployed to prevent Russian rampaging across Europe.”

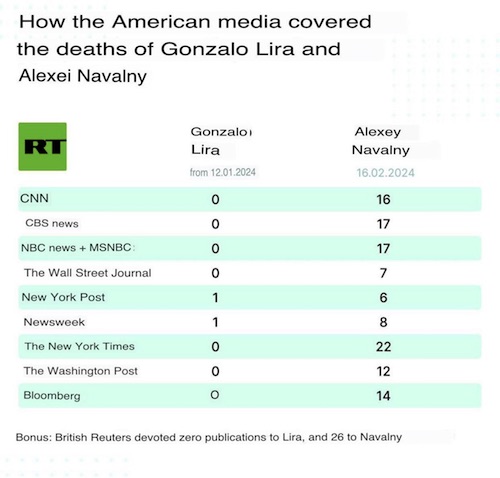

• Russian Space Nukes and Navalny’s Death… U.S. Psyops Go Ballistic (SCF)

The claims about Russian space-based nuclear weapons unraveled to become a joke. Fortunately, the death of Western-sponsored dissident Alexei Navalny then occurred to enable Western media to go into a frenzy of anti-Russia headlines. First up was the scaremongering story about Russia allegedly developing a space-based nuclear weapon. Initially, it was dramatically trailed as posing a serious national security threat to the United States. Despite the sensational reporting, the story quickly became a laughingstock. Even some U.S. lawmakers dismissed it as “bullshit” and a blatant attempt by the Biden White House and intelligence agencies to push Congress into passing a new mega military aid bill for Ukraine worth $61 billion.

We’ll get to the Navalny story in a moment. But let’s just first parse the orchestration of the alleged Russian space nukes. The drama began on Wednesday when Mike Turner, the Chairman of the House Intelligence Committee (a dodgy source if ever there was one), made public appeals to President Joe Biden to declassify intelligence on “a serious threat to national security”. Turner is a Republican member of the House of Representatives but he is a close ally of the Democrat White House in terms of keenly supporting military aid to Ukraine. The latest bill passed the upper chamber of the U.S. Senate the day before, February 13, but it is unlikely to be approved by the House where many Republican lawmakers are staunchly opposed to it.

Accompanying the “concerns” of the intel committee chairman Turner, media outlets then vented anonymous US intelligence sources “revealing” that the national security threat was from Russian nuclear weapons allegedly under development for destroying American communication satellites in space. The White House then “confirmed” the intel the next day, February 15. It was a flagrant put-up job. But the Biden administration sought to tamp down any public panic by saying that the threat was not imminent and the alleged Russian satellite-killing weapon had not been deployed in orbit, nor would there be any danger to Earth. (So, what was all the fuss about?)

Ironically, derisive comments from incredulous U.S. lawmakers were also echoed by the Kremlin. The latter’s spokesman, Dmitry Peskov made a similar assessment that the Biden administration was playing tricks to push through the military funding package for Ukraine. That bill has been delayed since the end of last year. The Biden administration has been cajoling Congress for months to vote it through. After the Senate finally passed the bill this week, President Biden put pressure on the House, saying that “history is watching you”. The bill has been exalted as having existential importance in defeating “Russian aggression” in Ukraine. The U.S. media have claimed (preposterously) that if the military aid is not supplied then Ukraine’s defeat could result in American troops being deployed to prevent Russian rampaging across Europe.

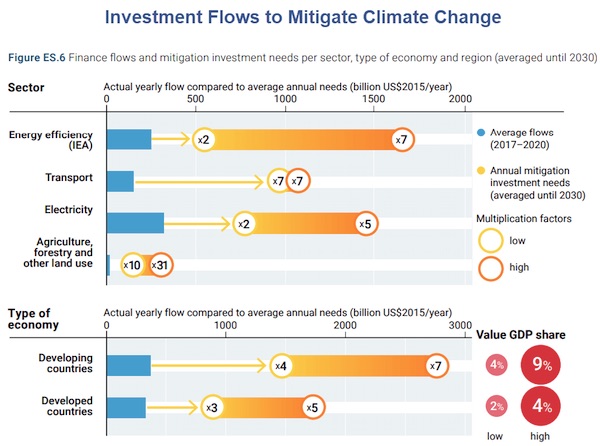

The American public, as with the European public, has become increasingly skeptical about the relentless funneling of taxpayer funds and weapons to Ukraine. Many citizens in the West – a majority, according to polls – have become critical of fueling a bloody war for the dubious cause of “defending democracy” in a regime dominated by NeoNazis. At a time of deep social and economic hardship in the U.S. and Europe, the Western public is rightly disdainful of hundreds of billions of dollars and euros being wasted on death and destruction and also being siphoned off by a corrupt cabal in Kiev. The $61 billion in military aid to Ukraine is just the latest tranche that Washington is seeking to throw at the black hole of its proxy war against Russia – a war that is really all about defeating Russia as a geopolitical obstacle to U.S. hegemony. Another driver is the massive profits that taxpayers are subsidizing the military-industrial complex at the rotten heart of Western capitalism.

Navalny

Navalny just died in Prison.

He is an opposition (2%) figure in Russia, Western sponsored puppet.Now….Before they give him a fake "Nobel Peace Prize"

Here is a video of him comparing Chechens & Mulslims to cockroaches and advocating their eradication

So now you have a… pic.twitter.com/fNyz5QzmwM

— Angelo Giuliano (@angeloinchina) February 16, 2024

“There’s no ammunition left. There’s nothing left. Ukraine has got nothing.” “And he [Turner] knows he’s looking at it, saying ‘it’s over, game set match – Russia, they win,’” he added.“

• Ohio Rep. Part of Shadowy Cabal Aiming to Destroy Russia – Scott Ritter (Sp.)

Ohio Representative Mike Turner (R-OH) made waves this week when he warned of an alleged “serious national security threat” to the United States. The supposed risk was soon revealed to be Russian in nature, with a media cycle quickly emerging over the danger of alleged “space nukes” the country could detonate to disable US satellite communications. The timing of the revelation raised eyebrows as Turner had visited Ukraine just days ago as part of a Congressional delegation in solidarity with the country’s embattled President Volodymyr Zelensky. Turner’s claims also come as the Biden administration struggles to continue funding the US-backed Ukrainian proxy war, with key Republicans blocking a compromise bill with aid for Kiev and Tel Aviv.

Former UN weapons inspector and whistleblower Scott Ritter joined Sputnik’s Fault Lines program on Thursday to discuss the latest Russophobic hysteria, speculating Turner is part of a secret group of lawmakers and intelligence officials hellbent on undermining Russia at any cost. “There’s a cabal,” claimed Ritter, who was shunned in Washington after defying intelligence claims of Iraqi weapons of mass destruction during the George W. Bush administration. “Turner is… part of the cabal of people that view this Ukrainian conflict [as] not about defense of democracy – knock off this nonsense – it’s about defeating Russia, the strategic objective of the United States by using Ukraine as a proxy in a conflict against Russia.”

“You’ve heard everybody say this, ‘we’re killing them without losing a single American, we’re weakening Russia, we’re creating the conditions to destroy Russia, to collapse Russian society, to bring down [Russian President] Vladimir Putin,’” noted Ritter. “He believes that this is a good thing. He believes that’s the direction the United States should be going. And he understands that Ukraine right now is in freefall. Their military is being slaughtered on the battlefield. The Americans have no clue what’s happening on the battlefield right now.”

Ukraine has faced declining fortunes in the Donbass conflict since the spectacular failure of the country’s vaunted “counteroffensive” last year. In recent days Russian forces have achieved an advantage in the city of Avdeyevka, where for months they’ve endured a stalemate with Ukrainian troops. Shortages in ammunition have undermined Ukrainian reinforcements in the past weeks, allowing Russia to break down Kiev’s foritifications. “The Russians aren’t losing anywhere,” said Ritter. “Maybe in the Black Sea they lost a ship, big deal, but on the ground, they’re routing Ukraine. There’s no ammunition left. There’s nothing left. Ukraine has got nothing.” “And he [Turner] knows he’s looking at it, saying ‘it’s over, game set match – Russia, they win,’” he added. “‘Therefore, we need to make people understand the consequences of a Russian victory.’”

“Pravda argued that Germany will eventually have to return to buying Russian gas because it will have no other choice..”

• Russian Media Thrilled By Biden’s LNG “Gift” To Putin (ZH)

This week, President Vladimir Putin praised President Joe Biden as a more experienced and predictable president than Donald Trump, hoping the 81yo president “with a poor memory” wins a second term. Meanwhile, Trump made remarks during a campaign rally Wednesday night in South Carolina on Putin’s comments: “He’s just said that he would much rather have Joe Biden as president than Trump. Now that’s a compliment. A lot of people said, ‘Oh, gee, that’s too bad.’ No, no, that’s a good thing.” Democrats spent years framing Trump as ‘Putin’s puppet,’ but the actions by Biden, essentially handing over the global energy kingdom to Moscow by halting permits for new liquefied natural gas (LNG) export projects in Texas, is a stark reminder of why Putin prefers the elderly and weak president. Last month, the Wall Street Journal editorial board called Biden’s LNG export license halt “an election-year gift to Russia and Iran.” And the editorial board is out with another piece titled “Biden’s LNG ‘Gift’ to Vladimir Putin.”

This latest note by the editorial board points out how Russian media is “thrilled” by Biden’s LNG gas export ban: “Now it is not Russia, but the United States that wants to bring the Germans to their knees,” gloated the Russian newspaper Pravda after the Energy Department imposed a moratorium on permits for new LNG export projects last month. Pravda argued that Germany will eventually have to return to buying Russian gas because it will have no other choice, and it may be right. They cite another Russian media outlet: RedDigest, a Russian-based news source, also predicted Europe will need to buy more Russian gas and be forced to pay a higher price. “The EU may well turn to Moscow for additional supplies. Of course, there will be no talk of any discounts,” a Feb. 3 article sneered. Mr. Biden’s LNG embargo will leave Europe more vulnerable to Mr. Putin’s energy blackmail.

And another: Bloknot, a pro-war Russian media outlet, accused the U.S. of scheming to replace Russian gas and then pulling the rug from under Europeans. “A brilliant scam: how the States fooled Europe with gas,” read a Bloknot headline. RT (formerly Russia Today) gloated that Mr. Biden’s “very timely decision to ban LNG exports” was a “gift to Russian leader Vladimir Putin.” In a separate note, WSJ said Biden’s attempt to punish Texas over the border dispute is part of a campaign by wealthy donors – including the Rockefeller family – to pressure the government into shifting away from LNG. Why are America’s elites and an elderly president with a “poor memory” giving Putin the keys to the global energy kingdom under the guise of ‘climate change’?

“Scratch the veneer of who’s in power in Kiev and Tel Aviv, and who pulls their strings, and you will find the same puppet masters controlling Ukraine, Israel, the US, the UK, and nearly all NATO members..”

• Axis of Resistance: from Donbass to Gaza (Pepe Escobar)

During my recent vertiginous journey in Donbass tracking Orthodox Christian battalions defending their land, Novorossiya, it became starkly evident that the resistance in these newly liberated Russian republics is fighting much the same battle as their counterparts in West Asia. Nearly 10 years after Maidan in Kiev, and two years after the start of Russia’s Special Military Operation (SMO) in Ukraine, the resolve of the resistance has only deepened. It’s impossible to do full justice to the strength, resilience, and faith of the people of Donbass, who stand on the front line of a US proxy war against Russia. The battle they have been fighting since 2014 has now visibly shed its cover and revealed itself to be, at its core, a cosmic war of the collective West against Russian civilization.

As Russian President Vladimir Putin made very clear during his Tucker Carlson interview seen by one billion people worldwide, Ukraine is part of Russian civilization – even if it is not part of the Russian Federation. So shelling ethnic Russian civilians in Donbass – still ongoing – translates as attacks on Russia. He shares the same reasoning as Yemen’s Ansarallah resistance movement, which describes the Israeli genocide in Gaza as one launched against “our people”: people of the lands of Islam. Just as the rich black soil of Novorossiya is where the “rules-based international order” came to die; the Gaza Strip in West Asia – an ancestral land, Palestine – may ultimately be the site where Zionism will perish. Both the rules-based order and Zionism, after all, are essential constructs of the western unipolar world and key to advancing its global economic and military interests.

Today’s incandescent geopolitical fault lines are already configured: the collective west versus Islam, the collective west versus Russia, and soon a substantial part of the west, even reluctantly, versus China. Yet a serious counterpunch is at play. As much as the Axis of Resistance in West Asia will keep boosting their “swarm” strategy, those Orthodox Christian battalions in Donbass cannot but be regarded as the vanguard of the Slavic Axis of Resistance. When mentioning this Shia–Orthodox Christianity connection to two top commanders in Donetsk, only 2 kilometers away from the front line, they smiled, bemused, but definitely got the message. After all, more than anyone else in Europe, these soldiers are able to grasp this unifying theme: on the two top imperial fronts – Donbass and West Asia – the crisis of the western hegemon is deepening and fast accelerating collapse.

NATO’s cosmic humiliation-in-progress in the steppes of Novorossiya is mirrored by the Anglo–American–Zionist combo sleepwalking into a larger conflagration throughout West Asia – frantically insisting they don’t want war while bombing every Axis of Resistance vector except Iran (they can’t, because the Pentagon gamed all scenarios, and they all spell out doom). Scratch the veneer of who’s in power in Kiev and Tel Aviv, and who pulls their strings, and you will find the same puppet masters controlling Ukraine, Israel, the US, the UK, and nearly all NATO members.

“I =srael’s allegations are not based on any evidence. They are instead part of a classified plan prepared in advance by Israel’s foreign ministry to destroy UNRWA..”

• Why Israel’s War on UNRWA is so Sinister (Cradle)

The UN Relief and Works Agency for Palestine Refugees in the Near East (UNRWA) is facing the gravest existential crisis in its 74-year history, as funding cuts by several western countries come on top of ongoing atrocities perpetrated by Israel in Gaza. The UN agency is unique in being the only one dedicated to a specific group of refugees in specific areas, and the only relief organization that operates a full-fledged educational system. UNRWA is also the only organization mandated to work in Gaza and distribute aid to the two million people currently trapped and starved in the besieged enclave. To compound these challenges, the occupation wants to see it dismantled. In January, Israel alleged that Palestinian members of UNRWA’s staff participated in the resistance’s Operation Al-Aqsa Flood on 7 October, leading the US and 18 other nations to swiftly suspend funding for the organization.

The suspensions were met with shock, as UNRWA plays a key role in providing food and medicine to starving Gazans struggling to survive Israel’s siege and bombardment of the coastal enclave. However, Israel’s allegations are not based on any evidence. They are instead part of a classified plan prepared in advance by Israel’s foreign ministry to destroy UNRWA. It believes that UNRWA “works against Israel’s interests” by perpetuating the dream of the right of return of Palestinian refugees and the idea of armed struggle against occupation. The foreign ministry plan leaked to Israel’s Channel 12 on 28 December, set out a three-stage process to eliminate UNRWA in Gaza, using the Hamas-led resistance operation as a pretext:

First, prepare a case alleging UNRWA’s cooperation with Hamas; second, reduce UNRWA’s field of activity and find replacement service providers; and third, transfer UNRWA’s responsibilities to another entity. Channel 12 noted that Israel wants to move slowly, given that the US government sees UNRWA as crucial to humanitarian efforts in Gaza. The foreign ministry is seeking to gradually build the case for ousting the organization as part of the discussions on “the day after” the war – should Hamas be dismantled. According to a report by The New York Times, the “sequence of events” that led the US to suspend UNRWA funding began on 18 January when Amir Weissbrod, a deputy director general at the Israeli Foreign Ministry, met with Philippe Lazzarini, the head of UNRWA in Tel Aviv.

Weissbrod showed Lazzarini a dossier from Israeli intelligence claiming that 12 UNRWA employees had participated in the 7 October attacks. After the meeting in Israel, Lazzarini made no effort to confirm the validity of the claims. Instead, he flew to New York to meet with UN Secretary-General Antonio Guterres and immediately began firing the employees, a UN official said. The Guardian reported that Lazzarini was later asked in a press conference if he had looked into whether there was any evidence for the allegations presented to him by Weissbrod. “No,” Lazzarini replied, “the investigation is going on now.” Lazzarini said he made the “exceptional, swift decision” due to “the explosive nature of the claims,” rather than any evidence. Lazzarini said he did not even read the dossier himself because it was in Hebrew. Instead, Weissbrod “was reading this and translating for me,” he said.

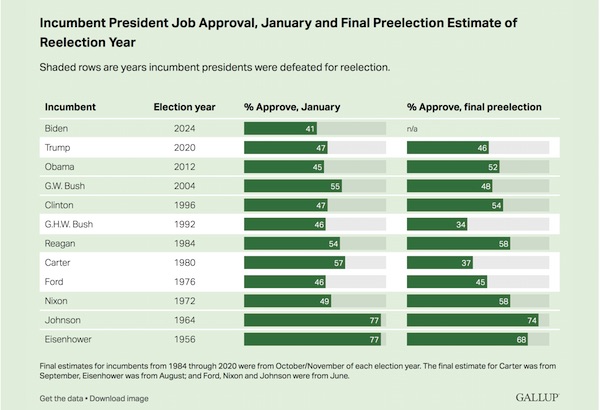

Better grow the economy, Joe.

• Political, Economic Indicators Not Promising for Biden (Gallup)

Several key indicators of the 2024 election environment indicate that President Joe Biden faces an uphill climb to win a second term. His job approval rating, Americans’ satisfaction with how things are going in the country and their confidence in the economy are below the levels associated with successful reelection bids in recent elections. While Democrats hold a slight edge in national party identification and partisan leanings, that advantage is smaller than what it has been in past presidential elections won by Democratic incumbents. In less direct measures of the electoral environment, Americans are more inclined to say that they are worse off financially, that it is harder to buy things and that the U.S. is as respected throughout the world as it was before Biden took office.

Biden’s fate will ultimately be determined by whether Americans’ views on these metrics improve over the course of the year (as they did for Bill Clinton in 1996 and Barack Obama in 2012), stay the same or get worse (as they did for George H.W. Bush in 1992 and Donald Trump in 2020). Incumbent job approval is arguably the best predictor of reelection success. Presidents with approval ratings of 50% or higher close to Election Day have all been reelected. All but one president with a sub-50% approval rating lost, the exception being George W. Bush. He won reelection with a 48% approval rating in Gallup’s final 2004 preelection poll taken in late October. However, he registered multiple 50% readings earlier in the month and had a 51% approval rating among likely voters in that final survey.

Among the approval ratings that did not carry incumbents to victory, Trump’s 46% approval rating is the highest and Gerald Ford’s 45% is close behind. The inauspicious ratings descend from there, all the way down to 34% for George H.W. Bush. Biden’s 41% job approval rating, the lowest among incumbents in January of an election year, puts him in a precarious spot. It has not been unusual for incumbents to be below the 50% threshold this early on. But Biden’s reelection may depend on his ability to boost his numbers close to that threshold, something Clinton, Obama and Richard Nixon were able to do but Trump and Ford were not. Other presidents, including George W. Bush, George H.W. Bush and Jimmy Carter, saw significant declines in approval during their fourth year in office.

“..Given Burns’ stature and diplomatic accomplishments, perhaps he would support the urgently needed accountability..”

• How the CIA Destabilizes the World (Jeffrey Sachs)

Once in a while, a former U.S. official spills the beans, such as when Zbigniew Brzezinski revealed that he had induced Jimmy Carter to assign the CIA to train Islamic jihadists to destabilize the government of Afghanistan, with the aim of inducing the Soviet Union to invade that country. In the case of Syria, we learned from a few stories in the New York Times in 2016 and 2017 of the CIA’s subversive operations to destabilize Syria and overthrow Assad, as ordered by President Barack Obama. Here is the case of a dreadfully misguided CIA operation, blatantly in violation of international law, that has led to a decade of mayhem, an escalating regional war, hundreds of thousands of deaths, and millions of displaced people, and yet there has not been a single honest acknowledgment of this CIA-led disaster by the White House or Congress.

In the case of Ukraine, we know that the U.S. played a major covert role in the violent coup that brought down Yanukovych and that swept Ukraine into a decade of bloodshed but to this day, we don’t know the details. Russia offered the world a window into the coup by intercepting and then posting a call between Victoria Nuland, then U.S. Assistant Secretary of State (now Under-Secretary of State) and U.S. Ambassador to Ukraine Geoffrey Pyatt (now Assistant Secretary of State), in which they plot the post-coup government. Following the coup, the CIA covertly trained special operations forces of the post-coup regime the U.S. had helped bring to power. The U.S. government has been mum about the CIA’s covert operations in Ukraine. We have good reason to believe that CIA operatives carried out the destruction of the Nord Stream pipeline, as per Seymour Hersh, who is now an independent reporter. Unlike in 1975, when Hersh was with the New York Times at a time when the paper still tried to hold the government to account, the Times does not even deign to look into Hersh’s account.

Holding the CIA to public account is of course a steep uphill struggle. Presidents and the Congress don’t even try. The mainstream media don’t investigate the CIA, preferring instead to quote “senior unnamed officials” and the official cover-up. Are the mainstream media outlets lazy, suborned, afraid of advertising revenues from the military-industrial complex, threatened, ignorant, or all of the above? Who knows. There is a tiny glimmer of hope. Back in 1975, the CIA was led by a reformer. Today, the CIA is led by William Burns, one of America’s long-standing leading diplomats. Burns knows the truth about Ukraine, since he served as Ambassador to Russia in 2008 and cabled Washington about the grave error of pushing NATO enlargement to Ukraine. Given Burns’ stature and diplomatic accomplishments, perhaps he would support the urgently needed accountability.

The extent of the continuing mayhem resulting from CIA operations gone awry is astounding. In Afghanistan, Haiti, Syria, Venezuela, Kosovo, Ukraine, and far beyond, the needless deaths, instability, and destruction unleashed by CIA subversion continues to this day. The mainstream media, academic institutions, and Congress should be investigating these operations to the best of their ability and demanding the release of documents to enable democratic accountability. Next year is the 50th anniversary of the Church Committee hearings. Fifty years on, with the precedent, inspiration, and guidance of the Church Committee itself, it’s urgently time to open the blinds, expose the truth about the U.S.-led mayhem, and begin a new era in which U.S. foreign policy becomes transparent, accountable, subject to the rule of law both domestic and international, and directed towards global peace rather than subversion of supposed enemies.

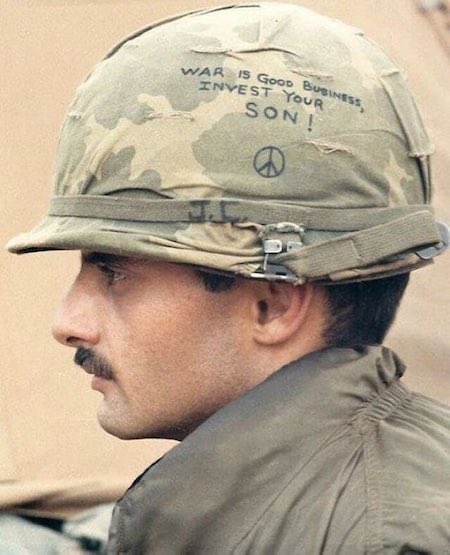

“..Think of them as being possessed by a monomania for war akin to my urge to play with toy soldiers. The key difference? When I played at war, I was a wet-behind-the-ears 10 year old..”

• Bombing Muslims for Peace (Bill Astore)

Like many American boys of the baby-boomer generation, I played “war” with those old, olive-drab, plastic toy soldiers meant to evoke our great victory over the Nazis and “the Japs” during World War II. At age 10, I also kept a scrapbook of the 1973 Yom Kippur War between Israel and its various Arab enemies in the Middle East. It was, I suppose, an early sign that I would make both the military and the study of history into careers. I recall rooting for the Israelis, advertised then as crucial American allies, against Egypt, Syria, and other regional enemies at least ostensibly allied with the Soviet Union in that Cold War era. I bought the prevailing narrative of a David-versus-Goliath struggle. I even got a book on the Yom Kippur War that captivated me by displaying all the weaponry the U.S. military had rushed to Israel to turn the tide there, including F-4 Phantom jets and M-60 main battle tanks. (David’s high-tech slingshots, if you will.)

Little did I know that, in the next 50 years of my life, I would witness increasingly destructive U.S. military attacks in the Middle East, especially after the oil cartel OPEC (largely Middle Eastern then) hit back hard with an embargo in 1973 that sent our petroleum-based economy into a tailspin. As one jokester quipped: Who put America’s oil under the sands of all those ungrateful Muslim countries in the Middle East? With declarations like the Carter Doctrine in 1980, the U.S. was obviously ready to show the world just how eagerly it would defend its “vital interests” (meaning fossil fuels, of course) in that region. And even today, as we watch the latest round in this country’s painfully consistent record of attempting to pound various countries and entities there into submission, mainly via repetitive air strikes, we should never forget the importance of oil, and lots of it, to keep the engines of industry and war churning along in a devastating fashion.

Right now, of course, the world is witnessing yet another U.S. bombing campaign, the latest in a series that seems all too predictable (and futile), meant to teach the restless rebels of Iraq, Syria, Yemen, and possibly even Iran a lesson when it comes to messing with the United States of America. As the recently deceased country singer Toby Keith put it: Mess with this country and “We’ll put a boot (think: bomb) in your ass.” You kill three soldiers of ours and we’ll kill scores, if not hundreds, if not thousands of yours (and it doesn’t really matter if they’re soldiers or not), because… well, because we damn well can! America’s leaders, possessing a peerless Air Force, regularly exhibit a visceral willingness to use it to bomb and missile perceived enemies into submission or, if need be, nothingness. And don’t for a second think that they’re going to be stopped by international law, humanitarian concerns, well-meaning protesters, or indeed any force on this planet. America bombs because it can, because it believes in the efficacy of violence, and because it’s run by appeasers.

Yes, America’s presidents, its bombers-in-chief, are indeed appeasers. Of course, they think they’re being strong when they’re blowing distant people to bits, but their actions invariably showcase a distinctive kind of weakness. They eternally seek to appease the military-industrial-congressional complex, aka the national (in)security state, a complex state-within-a-state with an unappeasable hunger for power, profit, and ever more destruction. They fail and fail and fail again in the Middle East, yet they’re incapable of not ordering more bombing, more droning, more killing there. Think of them as being possessed by a monomania for war akin to my urge to play with toy soldiers. The key difference? When I played at war, I was a wet-behind-the-ears 10 year old.

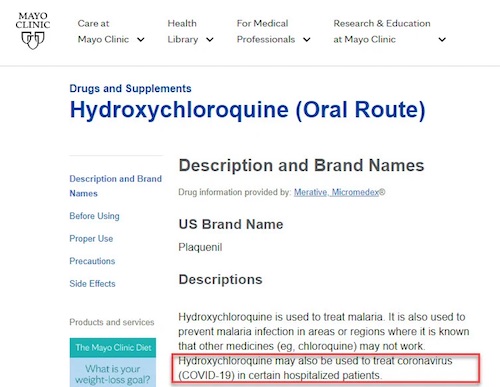

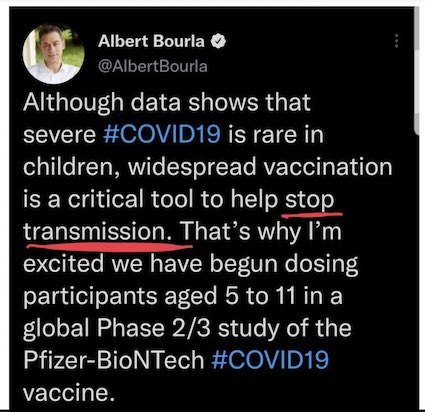

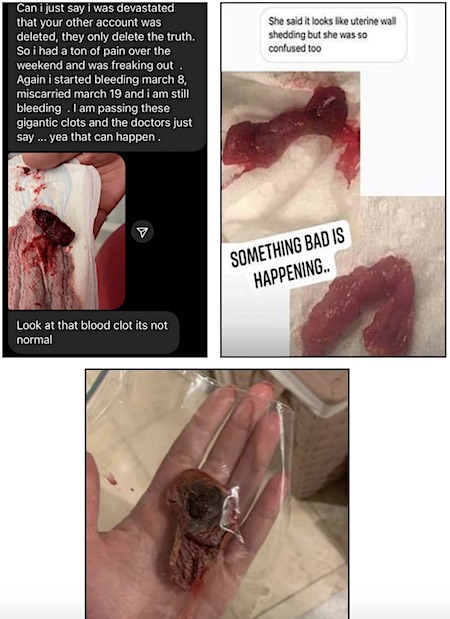

On purpose

“You can’t make something [ the vaccine ] this damaging… without doing it on purpose.” “It’s your immune system going after the spike [ protein that the body is producing after getting the vaccine that is causing the damage ]…” “It would not be able to hijack your immune… pic.twitter.com/WGmNPjXkN3

— Camus (@newstart_2024) February 15, 2024

Donuts

Loyal customers buy donuts in bulk at 5 a.m. every day so the owner can care for his ailing wife, who is recovering from a brain aneurysm pic.twitter.com/jWJVYEzkmb

— Historic Vids (@historyinmemes) February 16, 2024

Jaguar

https://twitter.com/i/status/1758482520239214824

Pelican

This man helping a pelican with fishing wire stuck to its beak

pic.twitter.com/FgdqofeacA— Science girl (@gunsnrosesgirl3) February 16, 2024

Newborn dolphin

https://twitter.com/i/status/1758471327562809740

Goats Jump

Family of Goats Jump Over a Mountain Gap pic.twitter.com/2XFGw5L3d0

— Nature is Amazing ☘️ (@AMAZlNGNATURE) February 16, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.