NPC Pittsburg Water Heater Co., Washington DC 1920

Take heed.

• Why The American Dream Is Unraveling, In 4 Charts (MarketWatch)

In “The Adventures of Huckleberry Finn,” the young protagonist gripes about his adopted mother’s efforts to “sivilize” him — particularly at the dinner table, where he observes that each dish is cooked and served separately. “In a barrel of odds and ends it is different;” Finn says. “Things get mixed up, and the juice kind of swaps around, and the things go better.” I thought about that line while reading Robert Putnam’s “Our Kids,” a jarring study of the growing opportunity gap between rich and poor children. America would like to think of itself as Huck’s “barrel of odds and ends,” a kind of democratic stew. But, as Putnam shows, our society is increasingly more like his adopted mother’s meal, with each dish cooked separately and cordoned off into different compartments on the dinner plate.

The upper-middle-class families Putnam profiles separate themselves into affluent suburbs, with separate public schools and social spheres from those of their poorer counterparts. As a result, the poorer children not only face greater hardships, but they also lack good models of what is possible. They are effectively cut off from opportunity. “The most important thing about the experience of being young and poor in America is that these kids are really isolated, and really don’t have close ties with anybody,” Putnam told MarketWatch. “They are completely clueless about the kinds of skills and savvy and connections needed to get ahead.” His analysis shows how family structure, parenting practices, schooling and health habits correlate with diminishing opportunities for poorer children. For instance:

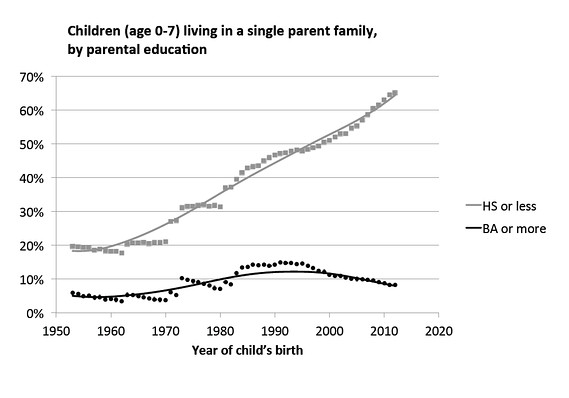

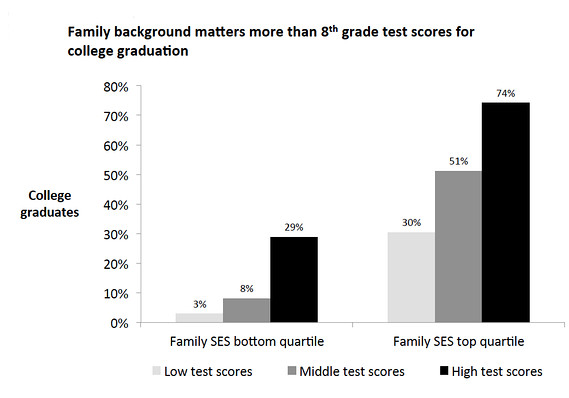

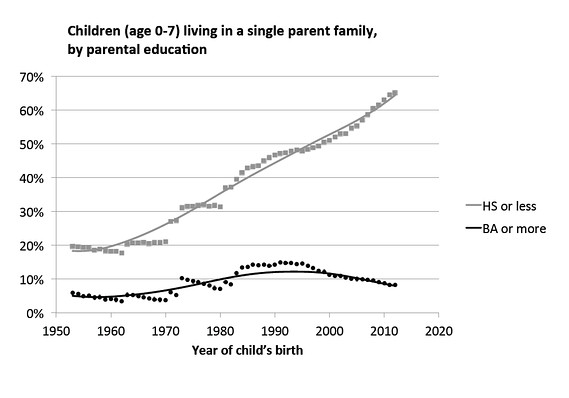

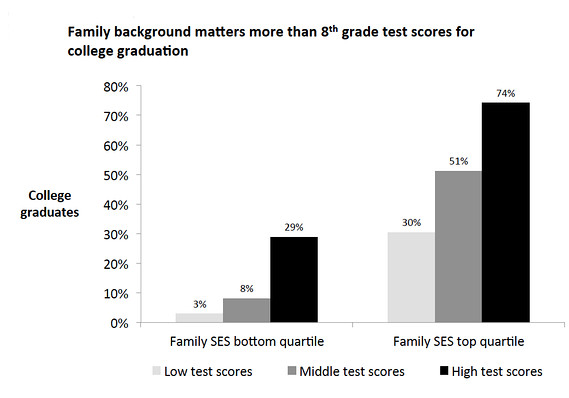

Children of poorer, less educated parents are far more likely to grow up in single-parent homes.

Due to lack of support networks and good models, perhaps, the highest-scoring poor children are less likely to graduate college than the lowest-scoring wealthy children.

Putnam does not fault the wealthier parents for seeking the best for their children. “Perhaps unexpectedly, this is a book without upper-class villains,” he notes. But he makes the case that it’s not only in the moral interest of wealthier families to help improve the prospects of poorer children but also in their own economic interest. The U.S. economy would get a major boost if the opportunity gap were closed, he says. We cannot continue to live in our own bubbles, or compartments on a plate, without consequences, he suggests.

Read more …

Conclusion no. 1.

• Federal Reserve Ends Era Of Historically Low Interest Rates (Guardian)

The US Federal Reserve called time on an era of historically low interest rates on Wednesday. In its latest statement on the health of the US economy the central bank moved away from a pledge to be “patient” before deciding to raise interest rates. Economists expect that interest rates could now rise by the end of the summer, the first rise in more than six years. Stock markets, which had fallen ahead of the release, rose on the news as the Fed continued to signal a cautious approach to raising rates. “Just because we have removed the word patient from the statement does not mean we are going to be impatient,” Janet Yellen, chair of the Federal Reserve, said at a press conference.

The Fed said rates would not rise before “further improvement in the labor market” and only when it was confident inflation was moving back to its 2% objective over the medium term. “The committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the committee views as normal in the longer run,” the Fed said in its statement.

The Fed cut its benchmark short-term interest rate to zero on 16 December 2008 and it has remained close to zero ever since. The rock bottom rate policy was part of a massive stimulus programme aimed at revitalising the economy in the wake of the worst recession since the Great Depression. The Fed’s decision comes after months of impressive growth in the jobs market. Last month US unemployment rate fell to 5.5%, down from a peak of 10% in October 2009. Last year was the best year for job growth since the late 1990s.

Read more …

No. 2.

• Fed Indicates Rate Hikes Coming, But Not In April (CNBC)

The Federal Reserve fired its first warning shot Wednesday that it is going to start hiking interest rates–sometime. As the global investment community focused its attention on the U.S. central bank, the Fed Open Market Committee lived up to expectations: It dropped the word “patient” from its post-meeting statement, an indication, subtle though it may be, that the era of zero interest rates is about to end. But the mostly dovish statement made little fanfare over eliminating the word, and in fact stated specifically that “an increase in the target range for the federal funds rate remains unlikely at the April FOMC meeting,” a phrase missing from previous communiques.

“The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen further improvement in the labor market and is reasonably confident that inflation will move back to its 2% objective over the medium term,” the statement said. Stocks quick turned positive, with the Dow up 100 points 5 minutes after the statement was issued. Yields on US 10-year Treasurys fell below 2% for the first time since Feb. 25. The dollar weakened.

Read more …

No. 3.

• Fed Opens Door For Rate Hike Even As It Downgrades Economic Outlook (Reuters)

The Federal Reserve on Wednesday moved a step closer to a much anticipated first rate hike since 2006 by removing “patient” from its language, although markets bet on a September hike after it downgraded the expected pace of growth and inflation. Stock markets rallied after the Fed statement, while the U.S. 10-year Treasury yield dipped below 2% for the first time since March 2 and the euro rose against the dollar on the more dovish forecasts that appeared to argue against a June move. “This was largely what was expected, though some may have been fearing a more hawkish Fed, and that explains the rally we’re seeing right now, that it didn’t state a precise time for raising rates,” said John Carey at Pioneer Investment.

In its statement following a two-day meeting, the Fed’s policy-setting committee repeated its view that job market conditions had improved. While the statement put a June rate increase on the table it also allowed the Fed enough flexibility to move later in the year, stressing that any decision would depend on incoming data. “The committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen further improvement in the labor market and is reasonably confident that inflation will move back to its 2% objective over the medium-term,” the Fed said in its statement. The Fed said a rate increase remained “unlikely” at its April meeting and said its change in rate guidance did not mean the central bank has decided on the timing of a rate hike. It had previously said it would be patient in considering when to bring monetary policy back to normal.

Read more …

The Fed’s bullhorn speaks.

• Fed To Markets: No More Promises (Hilsenrath)

The Federal Reserve is about to inject uncertainty back into financial markets after spending years trying to calm investors’ nerves with explicit assurances that interest rates would remain low. Ahead of their policy meeting that ends Wednesday, Fed officials have signaled they want to drop the latest iteration in a succession of low-rate promises—a line in their policy statement pledging to be “patient” before deciding to raise rates. The move could be a test for investors. In theory, less-clear-cut interest-rate guidance from the Fed should lead to more volatility in financial markets. That’s because investors will be left less certain about a key variable in every asset-valuation model: the cost of funds.

Christine Lagarde, managing director of the IMF, warned Tuesday that markets could be heading for a repeat of the 2013 “taper tantrum,” in which stocks fell and interest rates rose around the world as the Fed considered winding down its “quantitative easing” bond-buying program. “I am afraid this may not be a one-off episode,” she said of 2013 in a speech at India’s central bank. “The timing of interest-rate liftoff and the pace of subsequent rate increase can still surprise markets.” The central bank for years has been using carefully chosen words about the likely level and direction of short-term rates as policy tool, hoping promises about the future will influence other borrowing costs today, such as the level of long-term rates on mortgages or car loans.

The approach has become particularly important since December 2008, when the Fed pushed its benchmark federal funds rate to zero amid the financial crisis and began promising it would stay there for an extended period. With the labor market healing and inflation expected to move back toward their 2% target, Fed officials hope they’re ready to move on, at least rhetorically. They see this as progress—before they believed the economy was so weak they shouldn’t signal rate increases were anywhere on the horizon. In addition to signaling that the Fed expects to consider raising rates later this year, the move away from a patience promise is part of the central bank’s broader effort to avoid pinning itself down in the future. Fed officials themselves are uncertain about when to start the process of raising rates and want flexibility to respond to new information about how the economy is evolving.

Read more …

And then of course oil prices surge after the Fed thingy today.

• Bond Traders to Yellen: You’re Wrong on Oil’s Impact on Economy (Bloomberg)

Janet Yellen has dismissed plunging oil values as a fleeting shock to the economy. Bond traders disagree. The latest slump in oil – including a 2% drop Wednesday – has investors dumping their junk-rated energy securities and slashing their predictions for inflation. Energy-related high-yield bonds have tumbled 3.4% this month and dollar-denominated notes that are hedged against accelerating prices have declined 2.1%. Debt investors aren’t waiting to find out whether Federal Reserve Chair Yellen will change her view that the impact from lower oil prices on inflation will be transitory. The 15% plunge in crude prices this month has them repricing the economic outlook years out and paring investments that are most vulnerable to further losses.

“Credit markets have been very keenly focused on oil prices,” said George Bory at Wells Fargo, in a Bloomberg Television interview Tuesday. The ballooning amount of energy-related debt has led investors “to use the credit markets as almost a proxy trade on oil.” The U.S. market for energy-related high-yield bonds has swelled to $201 billion from $65.6 billion at the end of 2007, according to Bank of America Merrill Lynch index data. Bets on oil bonds suggest an ugly outlook for pipeline and exploration companies – and all of the people they employ — after they borrowed record amounts over the past several years.

The extra yield, or spread, investors demand to own the typical junk-rated energy security has more than doubled since June to 7.44%age points above government debt, the Bank of America Merrill Lynch index shows. For context, the spread has averaged 4.82 points since the inception of the data in 1996. Bond markets are suggesting the oil collapse will also spill over into the broader economy. Investors have been selling inflation-linked bonds, causing the $1 trillion U.S. market for the debt to lose $23 billion of market value this month, according to Pimco index data.

Read more …

Why make a comment like this, and at this point in time? What kind of game is that?

• IMF Considers Greece Its Most Unhelpful Client Ever (Bloomberg)

International Monetary Fund officials told their euro-area colleagues that Greece is the most unhelpful country the organization has dealt with in its 70-year history, according to two people familiar with the talks. In a short and bad-tempered conference call on Tuesday, officials from the IMF, the ECB and the EC complained that Greek officials aren’t adhering to a bailout extension deal reached in February or cooperating with creditors, said the people, who asked not to be identified because the call was private. The IMF’s press office had no immediate comment on the discussions.

German finance officials said trying to persuade the Greek government to draw up a rigorous economic policy program is like riding a dead horse, the people said, while the IMF team said Greece’s attitude to its official creditors was unacceptable. Concern is growing among officials that the recalcitrance of Prime Minister Alexis Tsipras’s government may end up forcing Greece out of the euro, as the cash-strapped country refuses to take the action needed to trigger more financial support. Tsipras is pinning his hopes for a breakthrough on a meeting with ECB President Mario Draghi, German Chancellor Angela Merkel, French President Francois Hollande and European Commission head Jean-Claude Juncker this week in Brussels.

“These are difficult talks,” Merkel told her parliamentary group Tuesday about the negotiations with Greece, according to two participants. She said that the outcome of the talks is completely open, according to the two. The Greek government is seeking a political deal at a EU summit starting Thursday to unlock funds from the country’s €240 billion bailout package, government spokesman Gabriel Sakellaridis said. “After one-and-a-half months of contact, we believe that for there to be a political solution, it is important for the euro-area’s big countries to weigh in,” Sakellaridis said. “We’re not downplaying technical discussions, but we want there to be a framework, and for that we’re asking for a political solution.” Sakellaridis didn’t respond to a request for comment on the Tuesday conference call.

Read more …

“while the ECB is making it very clear what happens next in the case of a “Graccident”, it has yet to provide an explanation how it will resolve the billions of Greek debt held on its own balance sheet which are about to be “marked-to-default.”

• ECB Prepares For Grexit, Anticipates 95% Loss On Greek Debt (Zero Hedge)

..when the ECB “leaks” that it is modelling a Grexit, something Draghi lied about over and over in 2012 and directly in our face too, take it seriously, because it is time to start planning about what happens on “the day after.” And incidentally to all those curious what the fair value of peripheral European bonds is excluding ECB backstops, the ECB has a handy back of the envelope calculation: a 95% loss. Which also is the punchline, because while the ECB is making it very clear what happens next in the case of a “Graccident”, it has yet to provide an explanation how it will resolve the billions of Greek debt held on its own balance sheet which are about to be “marked-to-default”… … and on which it is prohibited from suffering a loss, or else Draghi will have to fabricate even more on the run rules about how the ECB balance sheet is loss-proof… expect in this case, or that, or the other. From Manager Magazin, google-translated:

The European Central Bank (ECB) is preparing for a possible Greek exit from the euro zone. In internal model calculations, the central bank has already calculated the consequences of different scenarios on the prices of Greek government bonds. Fernando González Miranda, head of risk analysis of the ECB, assumed for his model calculations three different developments of the Greek crisis, the magazine reports. These variants have also been presented to our colleagues from the Bundesbank few days ago. Under this method, the value of Greek government debt – currently around €320 billion – in the event of a sudden, “accident-like” Farewell to the Greeks from the Euro-zone (“Graccident”) shrink to around 5% of the principal amount.

If it were the Greek Government, however, to complete the withdrawal on the basis of ordered negotiations (“Grexit”), the ECB expects a residual value of government bonds by nearly 14%. And should it even create the country to negotiate a recent haircut, without having to give up the single currency, the government securities could keep at least a quarter of its original value. A central bankers feared compared with manager magazin especially the “Graccident”. The risk is high that the Greek government members “lose track and suddenly unable to settle their bills.” In such a case, the rating agencies Greece would classify as necessarily insolvent, with the result that the central bank should have stopped emergency loans.

Read more …

“If they’re doing it to frighten us, the answer is: we will not be frightened..”

• Tsipras Demands EU Stop ‘Unilateral Actions’ As Tensions Flare (Reuters)

Greek Prime Minister Alexis Tsipras lambasted European partners on Wednesday for criticizing a new anti-poverty law hours before it is voted on, saying it was the euro zone rather than Athens that must stop “unilateral actions” and keep its word. Tsipras’s impassioned speech to parliament as it prepared to vote on his government’s first bill marked the latest escalation in a war of words between Athens and its creditors that has raised the risk of a Greek bankruptcy and euro zone exit. European Council President Donald Tusk called a meeting on Greece for Thursday evening at Tsipras’ request on the sidelines of an EU summit with the leaders of Germany, France, the ECB, the EC and the chairman of euro zone finance ministers.

The leftist Greek leader is pressing for a political decision to break Greece’s cash crunch, while the creditors have insisted Athens must first start implementing previously agreed economic reforms and hold detailed talks on its financial plans. Tensions over Greek flip-flopping on the terms of a bailout extension agreed last month flared again after an EU official wrote to Athens urging more talks with lenders on the bill before the vote. The letter told Tsipras’s leftist government to hold further talks with the EU on the bill or risk “proceeding unilaterally” against the terms of a Feb. 20 accord that extended the bailout and staved off a Greek banking collapse. European Economics Commissioner Pierre Moscovici denied the EU was trying to stop Athens from passing the law but that the official had been correct to remind the Greek government to consult with lenders first.

“The European Union as a whole wants Greece in the eurozone,” Moscovici said, but added that the February deal must be respected. “Greece must stay in the euro zone… but at these conditions.” An indignant Tsipras defended the so-called “humanitarian crisis” law – which offers food stamps and free electricity to the poor – as the first bill in five years drawn up in Athens rather than ordered by EU technocrats. “If they’re doing it to frighten us, the answer is: we will not be frightened,” Tsipras told parliament. “The Greek government is determined to stick to the Feb. 20 agreement. However, we demand the same from our partners. Let them stop unilateral actions, respecting the agreement they signed.”

Read more …

Over a measly €200 million, strictly targeted at poverty relief, the EU is going to be difficult?

• Greece Defies EC With Anti-Austerity Law (BBC)

The Greek parliament has approved a package of social measures, despite warnings from the European Commission against “proceeding unilaterally”. In parliament, the Greek Prime Minister Alexis Tsipras defended what he called a “humanitarian crisis” law. The law – the first to be introduced since Mr Tsipras’s party won elections in January – offers food stamps and free electricity to the very poorest. The total amount of assistance is worth about €200m. It is the kind of anti-austerity measure that Mr Tsipras had promised before his election victory in January. In a 30-minute speech he defended the legislation, which he described as the first bill in five years to be drawn up in Athens, rather than ordered by EU technocrats. He also criticised a leaked letter from an EU official, which had advised Greece to consult with its international creditors before proceeding with the legislation.

“If they’re doing it to frighten us, the answer is: we will not be frightened,” Mr Tsipras told parliament. “What else can one say to those who have the audacity to say that dealing with a humanitarian crisis is a ‘unilateral action’?” The new law, and Mr Tsipras’s defiant speech, come ahead of an expected meeting with Angela Merkel and Francois Hollande on the sidelines of an EU summit in Brussels this week. Greece is still in dispute with its international creditors about the terms of an extension to its huge financial bailout, with the eurozone demanding that Athens commit to spending cuts to release further loans. Relations between Brussels and Athens have soured dramatically. With Greece currently shut out of debt markets, concerns have been expressed that the country could soon run out of money.

Read more …

At the very least too high-handed. She should have invited Tsipras on day one.

• Merkel to Seek Accommodation With Tsipras in Talks (Bloomberg)

German Chancellor Angela Merkel will seek accommodation in talks with Greek Prime Minister Alexis Tsipras to calm the increasingly combative rhetoric between the nations and regain control over efforts to keep Greece in the euro. Merkel, as leader of the biggest contributor to Greece’s €240 billion bailout, is willing to go a long way to find a compromise, said a German official with knowledge of her thinking, who asked not to be identified discussing internal strategy. Nonetheless, she’ll tell Tsipras during meetings in Brussels and Berlin over the next five days that she expects Greece to play by the rules, the person said. After weeks of sparring between Greece and Germany, Merkel is pursuing the talks now to try and get the discussion back on track, the official said.

Any suggestion that she will deliver an ultimatum to Tsipras is complete nonsense and propagated by those who want to inflame the standoff, the official said. Merkel sees the meetings with Tsipras as more of a chance to get to know him, and doesn’t plan to directly negotiate the details of Greece’s fate, which she sees as a matter between Athens and its creditors, the official said. Her room for leeway on Greece is in any case limited by resistance from within her own parliamentary group, according to the official. Merkel is convinced that now is the “right time to hold extensive talks,” Steffen Seibert, her chief spokesman, said Wednesday in Berlin. “The talks will be about the situation between Greece and the other members of the euro area and how a way forward can be achieved.”

Tsipras is pinning his hopes to reach a breakthrough on a meeting he’s requested with Merkel, ECB President Mario Draghi, French President Francois Hollande and European Commission head Jean-Claude Juncker on the sidelines of a European Union summit that starts Thursday. Merkel has also invited Tsipras to Berlin March 23 for one-on-one talks. The two nations have been locked in acrimonious exchanges in recent weeks over the continuation of Greece’s austerity program and whether Germany should pay additional reparations for the Nazi occupation of the country during World War II. “Many Greek people falsely believe that what is at stake is not Greece’s very problematic economic performance and the European Union’s mismanagement of the euro-zone crisis but a dispute between Greece and Germany,” said Dimitris Sotiropoulos at the University of Athens.

Read more …

The ECB is occupied by idiots.

• At Least 350 People Arrested In Protest At New ECB HQ in Frankfurt (Guardian)

Dozens of police officers have been injured and hundreds of people detained after anti-austerity protesters clashed with riot police near the new headquarters of the ECB in Frankfurt. At least seven police cars were set on fire as streets were barricaded at the “Blockupy” demonstration to mark the opening of the €1.3 billion building on Wednesday morning. Some protesters said they were injured when police used pepper spray. At least 350 people were held by police, according to the German news site Deutsche Welle. Police used water cannon to try to make a path through the mass of black-clad protesters to the entrance of the building. The new building was targeted because the ECB has come to symbolise spending cuts and market reforms of the kind being forced on Greece.

The German justice minister, Heiko Maas, said that “everyone has the right to criticise institutions like the ECB. But pure rioting goes beyond all limits in the battle for political opinion.” Hundreds of officers ringed the ECB. The inauguration ceremony took place as planned, with the ECB president, Mario Draghi, thanking guests “for being here despite the difficult situation outside”. He said the new headquarters for the currency union’s central bank was “a symbol of what Europe can achieve together”. “European unity is being strained,” Draghi said, according to an advance text quoted by Reuters. “People are going through very difficult times. There are some, like many of the protesters outside today, who believe the problem is that Europe is doing too little. “But the euro area is not a political union of the sort where some countries permanently pay for others.”

Read more …

“Average prices there have gone up nearly £200,000 over the past two years..”

• Welcome To London, Where Homes Earn More Than Their Owners (Guardian)

Homes have earned more than their homeowners for the past two years in one in five local authorities – almost exclusively in London and the south-east – according to analysis by Halifax. The London borough of Hammersmith and Fulham has seen the biggest explosion in house prices relative to pay, Halifax said. Average prices there have gone up nearly £200,000 over the past two years, while households in the area have had median earnings totalling £56,698 over the same period. Hammersmith is one of just two areas where houses have earned more than their occupants for the past 10 years. The other is Hackney, another London borough.

The figures reveal a deep north-south divide. Of the 73 local authority areas where homes have earned more than their owners over the past two years, 68 are in London, the south-east or the east. The Cotswolds and the Leicestershire areas of Melton and Harborough were the best “performers” outside of the south. Islington in London tops the table for house prices versus earnings over five years. Householders in the borough typically earned £135,457 in the five years from 2010-2014. Meanwhile, the average home in Islington soared in price by £258,498.

Every one of the 23 local authority areas where homes outstripped homeowner incomes over the past five years were in London and the south-east. Outside of the capital, Elmbridge and Mole Valley in Surrey, and South Buckinghamshire are areas where homes have earned more than their owners. Halifax acknowledged that the huge house price gains have benefitted some, but left others struggling. “This is good news for some homeowners. At the same time, it is challenging news for many looking to buy their first home in such areas, with prices being pushed out of range for many young people,” said Halifax housing economist Martin Ellis.

Read more …

“Immediately after the withdrawal of heavy weapons, a dialogue on the modalities of the election in the respective regions of Donetsk and Lugansk was supposed to begin,” Lavrov said. The modality of the elections, in line with the Minsk agreements, must be in accord with Donetsk and Lugansk. Nobody even tried to do it.”

• Russia Urges France, Germany To Act On Ukraine’s ‘Glaring Breach’ of Minsk (RT)

Moscow has called on Berlin and Paris to take action in regards to Kiev’s non-compliance with the Minsk peace agreement, in what Russia’s Foreign Minister has called a “glaring breach of the first steps of the Minsk package.” “I don’t know how the political process will unfold now,” Lavrov told a news conference on Wednesday. “Yesterday I sent special notes to the foreign ministers of France and Germany, and drew their attention to the glaring breach of the first steps of the political part of the Minsk package by Kiev. I urged them to take a trilateral joint demarche in regards to our Ukrainian colleagues in order to encourage them to implement agreements which they signed, and what was supported by the leaders of Germany, France, Russia and Ukraine.”

Kiev didn’t even take an effort in an attempt to start dialogue with the self-proclaimed republics of Donetsk and Lugansk on the modalities of elections there, Lavrov said after negotiations with his Gabonese counterpart, Emmanuel Issoze-Ngondet. At the OSCE Permanent Council session on Thursday Russia is set to raise the question of the violation of the Minsk agreements when adopting laws on Donbass, RIA Novosti reported. “Immediately after the withdrawal of heavy weapons, a dialogue on the modalities of the election in the respective regions of Donetsk and Lugansk was supposed to begin,” Lavrov said. The modality of the elections, in line with the Minsk agreements, must be in accord with Donetsk and Lugansk. Nobody even tried to do it.” On Tuesday, the Ukrainian parliament, the Verkhovna Rada, failed to introduce a special order of government in Donbass until the elections are held there in accordance with Ukrainian laws.

Read more …

“..sharing the need for frenzied spectacles of mass humiliation and destruction.”

• The Rage of the Cultural Elites (Yu Shan at Orlov)

A certain unhappy incident happened to my aunt in the summer of 1966. The Cultural Revolution a political movement initiated by Mao Zedong was beginning to engulf the country. That same year many American college students were protesting against the Vietnam War and Leonid Brezhnev was keeping his seat warm as the General Secretary of CPSU, having replaced the somewhat volatile Nikita Khrushchev two years earlier. My aunt was then a freshman studying literature at Fudan University in Shanghai. It so happened that my aunt, then a sensitive and somewhat dreamy young woman, had stubbornly and haplessly clung to certain musical tastes which at that time in China came to be regarded as politically incorrect, being said, in the trendy ideological jargon of that time, to reflect decadent bourgeois revisionist aesthetics.

To wit, my aunt had kept in her record collection a rendition of The Urals Mountain-Ash, a Russian folk song in which a young girl meets two nice boys under a mountain-ash tree and must choose between them, performed by the National Choir of the Ukrainian Soviet Socialist Republic. It was an old-style LP spinning at 78 RPM. It had a red emblem in the middle emblazoned with CCCP. One of my aunt’s roommates, who probably had always resented her for one reason or another, found out about it and reported her to the authorities. For this rather serious infraction, student members of the Red Guard made my aunt publicly smash her beloved record, then kneel upon the fragments and recite an apology to Chairman Mao while fellow-students threw trash at her face shouting Down with Soviet revisionists!

This generation of Chinese young people, who once donned Red Guard uniforms, beat people up around the country and smashed various cultural artifacts, is now mostly living on government pensions or earning meagre profits from home businesses, but some have prospered and can be found among the upper crust of contemporary China’s business, cultural, and political elites. This episode came to my mind when in the summer of 2014 I came upon video clips of Ukrainian student activists storming university classrooms in mid-lecture and ordering everyone to stand up and sing the Ukrainian national anthem, then forcing the professor to apologize for the lecture not being adequately patriotic. There were also ghastly spectacles of Enemies of the People (guilty only of having served under the overthrown president Yanukovich) being paraded around in trash bins.

In Ukrainian schools, children were made to jump up and down, and told that ‘Whoever doesn’t jump is a Moscal’ (a derogatory term for Russian ). Add to this the destruction of public monuments to World War II and the ridiculous rewriting of history (turns out that, during World War II, Germany liberated Ukraine, but then Russia invaded and occupied Germany!) and a complete picture emerges: the Ukrainian Maidan movement is one of a species of cultural revolution. The new, fashionable term being thrown around is civilizational pivot, but it and the old cultural revolution can be understood as approximate synonyms, sharing the need for frenzied spectacles of mass humiliation and destruction.

Read more …

Wow…

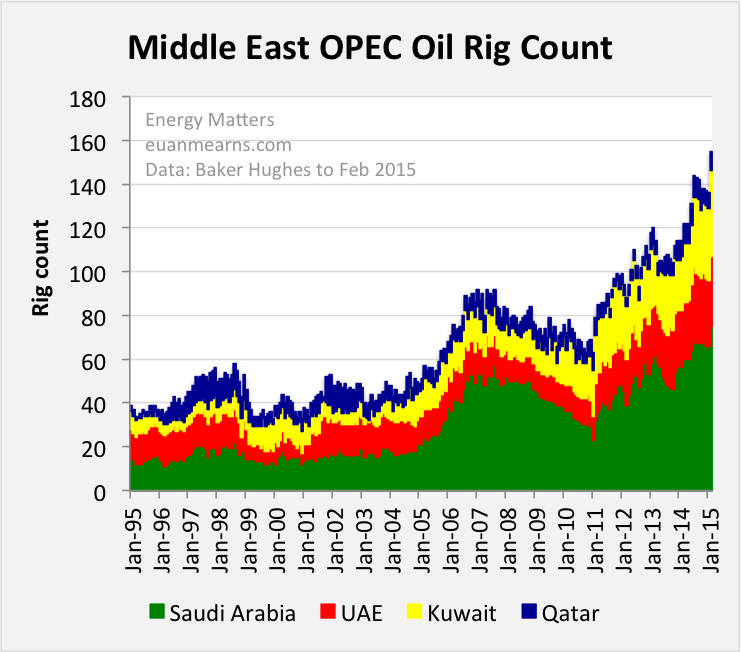

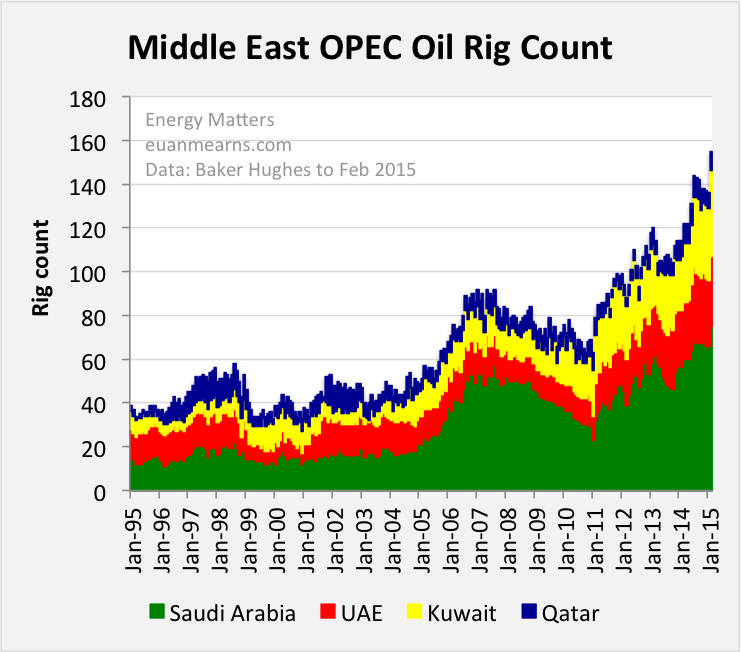

• Middle East OPEC Oil Rig Count Jumps 14% (EM)

As if to rub salt in the wounds of the US shale industry, Middle East OPEC oil rig count has jumped by 19 rigs to 155 units in February 2015 setting a new rig count record for the region. Since 2005 the supergiant oil fields of the region developed symptoms of mortality and increased drilling has been required to combat natural production declines in order to maintain production at static levels. More on international and US rig counts below the fold.

Figure 1 Middle East OPEC oil rig count for Saudi Arabia, UAE, Kuwait and Qatar. Baker Hughes is not reporting data for Iran and activity in Iraq is affected by ongoing conflict. While the rest of the world is heading for the drilling exits these four Middle East countries are preparing to expand market share. All data from Baker Hughes.

Read more …

Count me not surprised.

• US Oil Inventory Expands Faster Than Expected (Bloomberg)

America has raised the roof again. That’s what the roofs of oil storage tanks do – they rise and fall depending on the volume of oil inside. And America’s oil in storage just hit a new record after surging for the 10th consecutive week. Stockpiles rose 9.6 million barrels, or 2.1%, to 458.5 million barrels last week, the EIA reported today. Analysts had expected an increase of 4.4 million barrels. The amount of oil the U.S. is cranking out also rose, for the sixth consecutive week, to a rate of 9.42 million barrels a day. Oil investors have been glued to the levels of storage tanks, which have been climbing steadily since the oil-price crash started last year. American stockpiles are more than 25% above their five-year average.

Inventories aren’t likely to max out, but even the possibility of that happening is adding pressure to an oversupplied oil market. U.S. inventories will probably continue to rise for the next few months, as refineries conduct seasonal maintenance and investors hold out for higher prices, according to Bloomberg Intelligence. In addition to traditional storage in tanks represented in today’s numbers, drillers have left thousands of nearly finished wells untapped in what’s become de facto storage, sometimes known as the fracklog. Prices are low, storage is filling up, and oil-drilling rigs are being idled at an unprecedented rate. But the U.S. oil boom hasn’t slowed yet.

Read more …

Make of it what you will…

• Renewable Energy: The Most Expensive Policy Disaster in Modern UK History (EM)

In a new report ‘Central Planning with Market Features: How Renewable Subsidies Destroyed The UK Electricity Market’, published by the Centre for Policy Studies on Wednesday 18 March, Rupert Darwall shows that recent energy policy represents the biggest expansion of state power since the nationalisations of the 1940s and 1950s – and is on course to be the most expensive domestic policy disaster in modern British history.

Darwall shows that:

• The electricity sector is being transformed into a vast, ramshackle Public Private Partnership, an outcome that promises the worst of both worlds – state control of investment funded by high cost private sector capital, with energy companies being set up as the fall guys to take the rap for higher electricity bills.

• Post-privatisation gains in productivity are now being reversed as a result of plunging labour productivity. By 2013, three quarters of the productivity gains recorded between 1994 and 2004 had been lost.

• Competition between electricity suppliers is an expensive sideshow (which Ofgem estimated cost £730m in 2008) if it does not drive competition between generators and market investment in the most efficient generating technologies.

• Government policies aim to hide the full costs of intermittent renewables, which as a result are systematically understated. In addition to their higher plant-level costs, renewables require massive amounts of extra generating capacity to provide cover for intermittent generation when the wind doesn’t blow and the sun doesn’t shine.

• Highly subsidised wind and solar capacity flooding the market with near random amounts of zero marginal cost electricity wrecks the economics of conventional power stations. It is therefore impossible to integrate large amounts of intermittent renewables into a private sector system and still expect it to function as such.

• As a result, the State has stepped in with a patchwork of interventions to support prices. Because revenues are dependent on continued government interventions, private investors end up having to price and manage political risk, imparting a further upwards twist to electricity bills.

• Without renewables, the UK market would require 22GW of new capacity to replace old coal and nuclear. With renewables, 50GW is required, i.e. 28GW more to deal with the intermittency problem. Then there are extra grid costs to connect both remote onshore wind farms (£8 billion) and even more costly offshore capacity (£15 billion) – a near trebling of grid costs.

Read more …

And dogs..

• Bacteria Programmed To Find Tumours (BBC)

Bacteria programmed to spot tumours in the liver have been shown off at the Ted (Technology, Entertainment and Design) conference in Vancouver. Tal Danino, a researcher at MIT, described how he programmed the bacteria with genetic code. The system could be developed to identify other cancers, he said. So far the research has only been tested on mice. The results will be published in Science Translational Medicine. The mice are fed pre-programmed probiotic bacteria – a similar type to that found in some health-promoting yogurts. The bacteria produce enzymes when they encounter a tumour which will, in turn, change the colour of urine. So far, the system has proved accurate at detecting liver cancer. “Liver cancer is hard to detect, and there really is a need for new technology to help spot it,” Mr Danino told the BBC ahead of his talk.

Worldwide, liver was the second most lethal cancer in 2012, resulting in 745,000 deaths, according to the World Health Organization (WHO). Mr Danino was the first of 21 Ted fellows – young researchers engaged in cutting-edge work – chosen each year by the non-profit Ted organisation. Their five-minute speeches kick off the conference which, for the second year running, is being hosted in Canada. “There are more bacteria in the body than there are stars in the galaxy,” Mr Danino told the Ted audience. “It is a fascinating universe in our body and we can now program bacteria like we program computers.” But the intersection between biology and computer is still at a “very early stage”, he said. “We don’t know what the exact impact will be,” he told the BBC.

Read more …