Claude Monet Water lillies 1914 – 1917

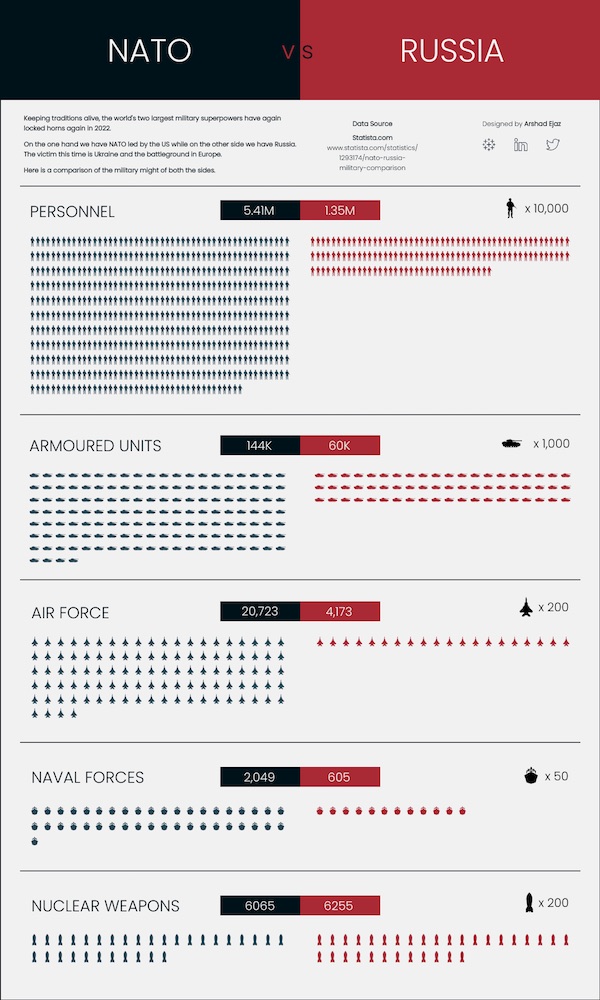

U.S. Not Prepared to take on Russia / Macgregor

Tucker Dore

Big Thanks to @TuckerCarlson for letting someone say this on TV. I would love to bring this message to @MSNBC @CNN @NPR @abcnews etc..but they won’t have me. We’re going to have to come together to stop the war machine: pic.twitter.com/KePBod5ASJ

— Jimmy Dore (@jimmy_dore) February 1, 2023

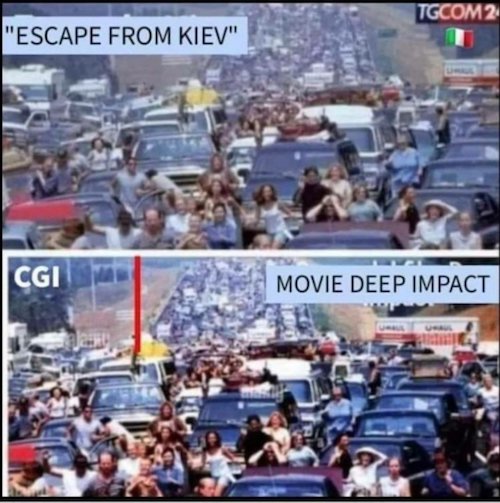

Winning

This what "winning" looks like. pic.twitter.com/mEvJhgSEon

— Donbass Devushka (@PeImeniPusha) January 30, 2023

Gonzalo primer

Involves the John Helmer piece we mentioned recently.

• A Panicked Empire Tries To Make Russia An ‘Offer It Can’t Refuse’ (Escobar)

Realizing NATO’s war with Russia will likely end unfavorably, the US is test-driving an exit offer. But why should Moscow take indirect proposals seriously, especially on the eve of its new military advance and while it is in the winning seat? Those behind the Throne are never more dangerous than when they have their backs against the wall. Their power is slipping away, fast: Militarily, via NATO’s progressive humiliation in Ukraine; Financially, sooner rather than later, most of the Global South will want nothing to do with the currency of a bankrupt rogue giant; Politically, the global majority is taking decisive steps to stop obeying a rapacious, discredited, de facto minority. So now those behind the Throne are plotting to at least try to stall the incoming disaster on the military front.

As confirmed by a high-level US establishment source, a new directive on NATO vs. Russia in Ukraine was relayed to US Secretary of State Antony Blinken. Blinken, in terms of actual power, is nothing but a messenger boy for the Straussian neocons and neoliberals who actually run US foreign policy. The secretary of state was instructed to relay the new directive – a sort of message to the Kremlin – via mainstream print media, which was promptly published by the Washington Post. In the elite US mainstream media division of labor, the New York Times is very close to the State Department. and the Washington Post to the CIA. In this case though the directive was too important, and needed to be relayed by the paper of record in the imperial capital. It was published as an Op-Ed.

The novelty here is that for the first time since the start of Russia’s February 2022 Special Military Operation (SMO) in Ukraine, the Americans are actually proposing a variation of the “offer you can’t refuse” classic, including some concessions which may satisfy Russia’s security imperatives. Crucially, the US offer totally bypasses Kiev, once again certifying that this is a war against Russia conducted by Empire and its NATO minions – with the Ukrainians as mere expandable proxies. The Washington Post’s old school Moscow-based correspondent John Helmer has provided an important service, offering the full text of Blinken’s offer, of course extensively edited to include fantasist notions such as “US weapons help pulverize Putin’s invasion force” and a cringe-worthy explanation: “In other words, Russia should not be ready to rest, regroup and attack.”

The message from Washington may, at first glance, give the impression that the US would admit Russian control over Crimea, Donbass, Zaporozhye, and Kherson – “the land bridge that connects Crimea and Russia” – as a fait accompli. Ukraine would have a demilitarized status, and the deployment of HIMARS missiles and Leopard and Abrams tanks would be confined to western Ukraine, kept as a “deterrent against further Russian attacks.” What may have been offered, in quite hazy terms, is in fact a partition of Ukraine, demilitarized zone included, in exchange for the Russian General Staff cancelling its yet-unknown 2023 offensive, which may be as devastating as cutting off Kiev’s access to the Black Sea and/or cutting off the supply of NATO weapons across the Polish border.

RAND Corp.

• Desperate Actions (Dionísio)

Something is changing on Mount Olympus and it is leaving in tatters the union of tendencies connected to the U.S.-state falconry. To understand and predict the actions of the political elite that commands, through their transnational mandataries, our destinies, implies knowing what one of the most important US defense think tanks reflects and publishes. This research leads us to an entity that rarely appears in the “informative” moments of the North Atlantic press: the RAND Corporation. RAND’s best-known moment with regard to the conflict in Eastern Europe is signaled by the publication of the report “Extending Russia – Competing from Advantageous Ground”. This report contains the entire menu of malfeasance that, in the claims made public and repeated by the US power summit, would lead to a fulminating defeat of the political, economic, and military power of the Russian Federation.

The analysis expressed publicly, by the various political actors, was that the Russian Federation was nothing more than “a gasoline bomb with nuclear weapons,” a “paper tiger” with a GDP equal to that of Holland, and a people gagged by a “mad dictator” who remained in power only through “authoritarianism” and “repression”. Based on an analysis whose information seemed to substantiate such political positions, the RAND report advocated a type of intervention, some of which were well reported – others not so well reported – in the official press. This was the case with the attempted “colored” revolutions made in CIA in Belarus, Kazakhstan, and the Central Asian countries, which, together with Georgia and Moldova, would probably be “promoted” and “supported” to the condition of an actual Ukraine.

The Russian Federation, having to meet all the fires, some because they would become proxy armies (like Ukraine), others turned into bases of destabilizing operations launched by the CIA, would eventually “extend” itself until it broke into pieces and collapsed, putting an end to the current threat. Even without this partition, a point could always be reached where, after the destruction of the incumbent political power, a more docile “regime” would be installed, pointing to a more “advantageous position on the ground.” Given to be known only in 2019, we are forced to note that this strategy had long been in preparation, especially since the Russian president lost hope that he could count on a Western “partnership” and announce the end of the unipolar world. Fact is, the report has a logical connection with the 2018 National Defense Strategy (US national defense strategy).

At any rate, this strategy points to the “Yugoslavization” of the Russian Federation. The truth is that the constant itinerary of this work has been followed almost scrupulously by the U.S. security and defense establishment: “colored” revolutions; states transformed into proxy armies; communication and disinformation campaigns; destabilization and sabotage operations; economic sanctions and embargoes. A menu of fulminating “democratic” activities on the rise! And why is it important to talk about this today? It is important because in the last few days a new paper from the RAND corporation was published, but this time in reverse, a study entitled “Avoiding a Long War U.S. Policy and the Trajectory of the Russia-Ukraine Conflict.”

Lula

Lula says Brazil doesn't want to send tank ammunition to Ukraine because Brazil doesn't want the ammunition to be used in a war against Russia.

Bravo Lula and bravo Brazil. BRICS countries should stand with each other.pic.twitter.com/kckDnLlU9V

— Hassan Mafi (@thatdayin1992) January 31, 2023

“First of all, probably within the next fifteen months, we shall see the full liberation of the Ukraine..”

• The War and the Future (Batiushka)

Since the historic Special Military Operation to liberate the peoples of the Ukraine from their US puppet tyrants in Kiev began on 24 February 2022, the post-1945 settlement has been over. In fact, it should have been over with the fall of the Berlin Wall in 1989 or, at latest, at the dissolution of the USSR in 1991. However, the USA was blinded by its exceptionalist hubris as ‘the only Superpower’ and engaged in its latest fantasy of destroying Islam, which it mistakenly saw as a serious rival, arrogantly dismissing Russia, China and India as minor players. So, as a sectarian rogue-state, the USA began its war of terror on all who thought differently, which it so humiliatingly lost. This can be seen in the dramatic pictures of the last flights out of Kabul in 2021.

In other words, after the end of the Soviet Union, which had been born directly out of World War One and formally founded in 1922, the end of the American Union (= NATO) should have followed, and with it the end of the worldwide American Empire. Thus, today NATO is an anachronism, well past its best before date, which is why has begun meddling all over the world, from the foothills of the Himalaya to the Pacific Ocean. NATO is just like the alphabet soup of other US organisations and fronts, IMF, EU, WTO, OECD, G7, G20 and UN, with its mere five Security Council members, including minor Great Britain and France. What might await us as a result of the liberation of the Ukraine on the centenary of the 1945 settlement, in 2045?

1. After the Ukraine. First of all, probably within the next fifteen months, we shall see the full liberation of the Ukraine. With the eastern Novorossija half of the Ukraine returning to Russia, the remaining half, Central and Western Ukraine, perhaps minus Zakarpattia (returning to Hungary as an autonomous region under the Balogh brothers) and Chernivtsy (returning to Romania), will return to being Malorossija, its capital in Kiev. Thus, the way will at last be open to form the Confederation of Rus’. The at last freed East Slav lands and peoples, Eurasian Russia and the Eastern European Belarus and Malorossija, could together form such a Confederation of Rus’, with a total population of just under 200 million.

2. The Reconfiguration of Eurasia . After the Ukrainian question has been solved and the USA has lost its political, military and, above all, economic power to bully the rest of the world, all of us in Eurasia will be able to start living in our new-found Freedom and building Justice and Prosperity for all. We foresee first of all the expansion of the Eurasian Economic Union (EEU).

Wagner

Australian mercenary: “Wagner is near peer.”

-> He describes the overmatch in combat capability between Wagner and Ukrainian forces around Bakhmut. pic.twitter.com/TLiBiqrEZ7— Lord Bebo (@MyLordBebo) January 31, 2023

“..given training on the Abrams M1 tank could take at minimum six months, something as sophisticated as Western-made fighter jets could take years for pilots unfamiliar with their systems to get combat ready on..”

• France ‘Open’ To Sending Fighter Jets To Ukraine. UK Says “Not Practical” (ZH)

Here we go again… French President Emmanuel Macron in Monday comments signaled openness to sending Ukraine advanced fighter jets, something which Kiev has broadly asked its allies for since nearly the start of the Russian invasion. “Nothing is excluded in principle,” Macron said immediately following talks with Dutch Prime Minister Mark Rutte when pressed by reporters about the question of fighter jets for Ukraine. The Dutch premier himself had weighed in too saying, “There is no taboo but it would be a big step.” But he noted, “It is not at all a question of F-16s, there has been no demand (from Ukraine).” Macron added that the French “are not making this request at the moment for fighter jets” – in what appears a first confirmation that the Ukrainian government has not yet gone through with a formal ask.

Macron’s fresh remarks, however, are likely to be seen from Kiev as an invitation to proceed with a formal request, while will putting more pressure on Paris and the Western alliance. Ukrainian officials have long been going through Poland, it seems, to press the jet issue with NATO command in Brussels. Macron stipulated that jets for Ukraine must “not be escalatory” – meaning that they would “not be likely to hit Russian soil but purely to aid the resistance effort.” But obviously advanced fighters would be escalatory by the very nature of sending them after Moscow has reiterated its “red lines”. As for the rest of Europe, on the same day that the White House said that it would not be sending jets, Britain’s Prime Minister Rishi Sunak said it would not be practical.

“The UK’s … fighter jets are extremely sophisticated and take months to learn how to fly. Given that, we believe it is not practical to send those jets into Ukraine,” a spokesperson for the British prime minister told reporters. “We will continue to discuss with our allies about what we think what is the right approach.” Indeed given training on the Abrams M1 tank could take at minimum six months, something as sophisticated as Western-made fighter jets could take years for pilots unfamiliar with their systems to get combat ready on. Germany too has issued a firm “no” amid mounting pressure from Ukraine for jets. Meanwhile it’s no surprise that the European country pressing the hardest to send jets continues to be Poland. Warsaw has been pressing the rest of NATO to transfer jets since the opening months of the war. On Monday Polish officials expressed readiness to send US-made F-16s to Ukraine, but emphasized it would only do so in coordination with NATO. “We will act in full coordination here,” Polish Prime Minister Mateusz Morawiecki said.

Boris

Intentionally violating privacy of conversation, @BorisJohnson distorted its content to the exact opposite. Such claims lead to further escalation of acute military & political tensions in European continent, in which UK is getting more involved by the day.https://t.co/bgBsMboyOj pic.twitter.com/Y0RS6fh4vi

— Russian Embassy, UK (@RussianEmbassy) January 30, 2023

“..organized GOP members into “task forces” to come up with oversight and legislative priorities..”

• House GOP Kicks Off Biden Corruption Investigations (ZH)

Newly empowered House Republicans are kicking off their long-planned investigations into a wide variety of issues, beginning with hearings on the US-Mexico border crisis, the origins of Covid-19, and pandemic relief programs. The House Judiciary Committee’s first meeting of the new Congress, led by Chairman Jim Jordan (R-OH), will be “The Biden Border Crisis: Part I.” Then, the House Energy and Commerce investigations subcommittee will hold a hearing titled: “Challenges and Opportunities to Investigating the Origins of Pandemics and Other Biological Events,” as part of its probe into the origins of Covid-19. Meanwhile, the House Oversight and Accountability Committee, led by James Comer (R-KY) will kick off a hearing on waste, fraud and abuse related to federal pandemic spending, The Hill reports.

“I don’t think history will be kind to the PPP loan program,” said Comer during a Monday appearance at a National Press Club event, referring to the program that provided businesses with forgivable loans. “I think it’ll be eventually viewed in the same manner that the big bank bailouts were when people find out where a lot of that money was going.” Republicans had been plotting extensive investigations into the Biden administration for more than a year before the midterm elections. Speaker Kevin McCarthy (R-Calif.), in preparation for taking the House majority, organized GOP members into “task forces” to come up with oversight and legislative priorities. Republican members of committees started investigations last year when they were in the minority.

Republicans now have control over committee hearing topics, a better chance of getting answers from administration officials, and are armed with subpoena power to compel testimony and documents — though no committee has used it yet. Next week, the Oversight panel is set to hold a hearing on the U.S.-Mexico border and a hearing with former Twitter employees about the platform’s suppression of the New York Post’s story on the Hunter Biden hard drive in 2020. -The Hill Speaking of the Bidens, the Oversight panel is also conducting an ‘extensive probe’ into the business dealings of President Biden’s family which will focus on Hunter Biden. Republicans on the House Oversight, Judiciary and Intelligence committees have also sought information related to President Biden’s mishandling of classified information, while the House Foreign Affairs and Armed Services committees are going to be investigating the botched withdrawal from Afghanistan.

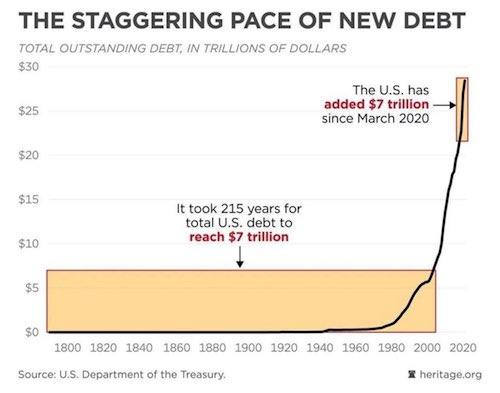

“..the military industrial complex is starting (potentially nuclear) wars all over the place. Government debt is growing exponentially. Wall Street has turned the markets into one big casino. Universities have become (very expensive) insane asylums. Congress is full of insider traders who amass fortunes while “serving the public.”

• Gold And The Shrinking Trust Horizon (John Rubino)

[..] believe it or not, the public health establishment losing its credibility is related to precious metals, via something called the trust horizon. It works like this: When things are good and the people in charge of big systems seem to be running them well, we’re content to trust the experts. We keep most of our money in banks, brokerage houses, and crypto wallets that exist for us only as websites. We buy produce that’s grown in a different hemisphere and shipped via boats, trains, and trucks to corporate chain grocery stores. We vaccinate ourselves and our kids according to the schedules set by the NIH or the CDC. We pop pills on our doctor’s orders without doing any research. We eat processed foods on the assumption that the FDA keeps them free of dangerous additives. And we believe what we see on cable news.

In other words, our trust horizon, defined as the distance from ourselves at which we’ll believe what we’re told, is global. We assume everything everywhere is working for our benefit and we’re thus willing to put our welfare in those distant hands. But let some big systems fail to take proper care of us and we pull back, finding people and institutions closer to home that we can see and judge first-hand. We move our money out of distant banks and brokers and into local credit unions whose managers live down the street. We start buying groceries from farmers markets or directly from local farmers. Instead of popping whatever pill is standard for our ailments we look into “food as medicine” and other lifestyle remedies like exercise, supplements, and meditation. We homeschool our kids and join gun clubs. We buy homesteads and start raising chickens.

So where are today’s Americans on the trust horizon spectrum? Well, the military industrial complex is starting (potentially nuclear) wars all over the place. Government debt is growing exponentially. Wall Street has turned the markets into one big casino. Universities have become (very expensive) insane asylums. Congress is full of insider traders who amass fortunes while “serving the public.” And our presidents, well, insert your sarcastic phrase here. It’s safe to say that for a growing number of disillusioned people, trust now extends to – maybe — the governor’s mansion, city hall, local farmers, their church and one or two community banks. And that’s about it.

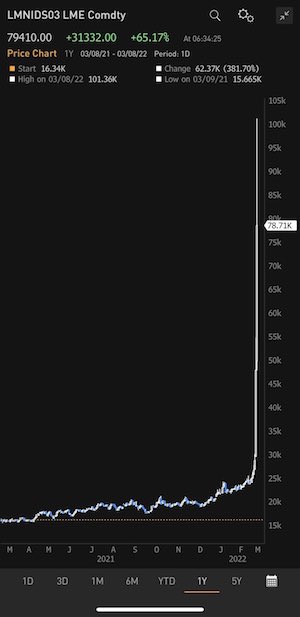

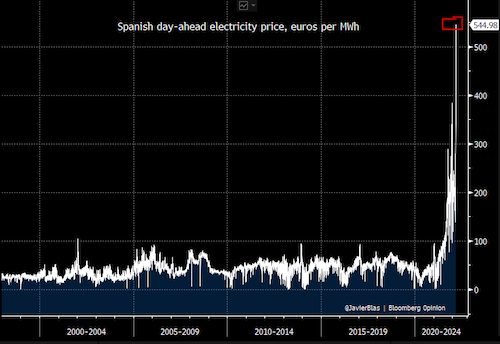

“The market was impacted by war in Europe, high inflation, and rising interest rates. This negatively impacted both the equity market and bond market at the same time, which is very unusual. All the sectors in the equity market had negative returns, with the exception of energy.”

• Norway’s Wealth Fund Posts Heavy Losses (RT)

Norway’s sovereign wealth fund, Government Pension Fund Global, posted a record loss of 1.64 trillion kroner ($164.4 billion) in 2022, according to data published on the fund’s website on Tuesday. The return on investment last year was negative 14.1%, according to the released figures. The fund’s equities holdings posted a 15.3% loss, while its fixed-income portfolio was down 12.1%. Nicolai Tangen, CEO of Norges Bank Investment Management, the entity that manages the fund, commented: “The market was impacted by war in Europe, high inflation, and rising interest rates. This negatively impacted both the equity market and bond market at the same time, which is very unusual. All the sectors in the equity market had negative returns, with the exception of energy.”

Despite the record loss, the overall value of the fund increased by 89 billion kroner ($8.9 billion) year-on-year. This was largely due to a record 1.1 trillion kroner ($109 billion) inflow, a figure roughly three times larger than the previous high from 2008. Currency fluctuations also helped, adding some 642 billion kroner ($64 billion) to the fund’s value. The fund, which reportedly lost the status of the world’s largest sovereign wealth fund to China Investment Corporation, had a value of 12.4 trillion kroner ($1.2 trillion) as of December 31, 2022. The fund invests the revenue from Norway’s oil and gas sales, which grew substantially last year after the country became Europe’s largest gas supplier due to the drop in Russian flows. The fund holds stakes in some 9,300 companies globally and owns the equivalent of 1.3% of all listed stocks.

“..the use of the technology could be extended further to help “create, personalize, and animate the content itself..”

• Buzzfeed Sacks 180 Journalists, Replaces Them With AI (RT)

Struggling online publisher BuzzFeed will start using artificial intelligence (AI) to help write its quizzes after laying off dozens of employees, Report informs referring to The Telegraph. The media company, known for its light-hearted articles and “listicles”, will work with OpenAI, the creator of ChatGPT, on the initiative. The chatbot, which provides human-like written responses to prompts, has attracted praise from tech executives, academics and politicians amid hopes it could simplify and transform tasks across a range of industries. The technology will be used to create quizzes on the website that are tailored to an individual, with, for example, a pitch for a personalized rom com.

The quiz would ask prompt questions such as “Pick a trope for your rom com” and “Tell us an endearing flaw you have” before using AI to generate a write-up based on the responses, according to a memo to staff from chief executive Jonah Peretti. Peretti said he planned to increase the use of AI across BuzzFeed’s editorial output and business operations this year, according to the memo seen by the Wall Street Journal. Peretti said he expected AI to assist the creative process and enhance the content, while humans would provide “cultural currency” and “inspired prompts”. But he suggested the use of the technology could be extended further to help “create, personalize, and animate the content itself” over the next 15 years. sThe company’s push into AI comes just over a month after it sacked 12pc of its workforce – around 180 employees.

4-part series.

• The Press Versus The President, Part Two (CJR)

In a windowless conference room at Trump Tower, on January 6, 2017, Comey briefed the president-elect about the dossier about him and Russia. Trump had heard, from aides, media “rumblings” about Russia, but, in an interview, he said he was unaware of the dossier until he met with Comey. Comey’s one-on-one with Trump came after the intelligence community briefed him on a new “Intelligence Community Assessment” (ICA) on Russian activities in 2016. The ICA claimed that Russia had mounted an “influence campaign” aimed at the election but had not targeted or compromised vote-tallying systems. Its most important, and controversial, finding was that “Putin and the Russian government developed a clear preference for President-elect Trump,” as opposed to Russia’s usual goal, which was generally sowing chaos in the United States.

An unclassified version of the ICA was released the same day in Washington. The dossier, actually a series of reports in 2016, was included in the assessment, but it remained secret, temporarily, because a summary of it was attached as a classified appendix. “The only thing that really resonated,” Trump said about the briefing, “was when he said four hookers,” a reference to the unsubstantiated claim of a salacious encounter in Moscow. Trump’s immediate reaction was that “this is not going to be good for the family,” he recalled. But his wife, Melania, “did not believe it at all,” telling him, “That’s not your deal with the golden shower,” Trump recalled. Trump’s marriage might have survived but his hoped for honeymoon with the press was about to end. The dossier, largely suppressed by the media in 2016, was about to surface.

But first came the ICA. It received massive, and largely uncritical coverage. Some other reporters weren’t convinced. Gessen called the ICA “flawed” because it was based on “conjecture” and incorporated “misreported or mistranslated” and “false” public statements. They criticized the major media, including the New York Times, for describing the ICA as a “strong statement.” In an interview, Gessen said that their skepticism left them isolated and they began to “lose confidence.” The dossier wound up in the ICA because the FBI pushed it, despite reservations at the CIA. Agency analysts saw it as an “internet rumor,” according to Justice Department documents. Two “senior managers in the CIA mission center responsible for Russia” also had reservations, according to a memoir by Brennan, the head of the agency at the time.

A lot of people will like an alternative to Paypal.

• Twitter Makes Move That Could Take Out ‘Woke’ PayPal (TPN)

Twitter CEO Elon Musk is not messing around. The billionaire truly does want to take over the world. Back in October, Musk purchased Twitter for $44 billion and made it clear from day one that he had high ambitions. As Elon Musk strives to revive Twitter, the company has taken action by submitting applications for regulatory licenses in various parts of the US and developing the necessary software to incorporate payments within the social media platform. This would directly compete with PayPal who has been slammed by Conservatives for their ‘woke’ practices including banning and suspending payments from people who they don’t agree with. Check out what the Financial Times reported:

“Esther Crawford, a fast-rising lieutenant to Musk inside Twitter, has started to map out the architecture needed to facilitate payments on the platform with a small team, according to two people familiar with the company’s plans. The nascent moves to allow payments through the site are a critical part of Musk’s plan to open up fresh revenue streams. Twitter’s $5bn-a-year advertising business has cratered since he bought the platform for $44bn in October, with marketers citing concerns over its management and moderation. Musk has previously said he wants Twitter to offer fintech services such as peer-to-peer transactions, savings accounts and debit cards, as part of a masterplan to launch an “everything app” that incorporates messaging, payments and commerce. In 1999, Musk co-founded X.com, one of the first online banks, which later became part of payments giant PayPal. [..] Twitter is also pushing forward with the regulatory checks needed before launching a payment service. In November, Twitter registered with the US Treasury as a payments processor, according to a regulatory filing. It had now also begun to apply for some of the state licences it would need in order to launch, these people said.

Shortly after he acquired the tech company, Musk hinted that a payment processor would be coming soon. “The man who reinvented the payment system back in 1999 is all set to do it again,” tweeted ‘DogeDesigner’ on Twitter. Musk responded to the tweet, agreeing that he would be reinventing the payment system again. “It’s gonna be great,” Musk said.

“..80% of the Pfizer deaths have come from ~30% of lots, whereas 80% of the Moderna deaths have come from 20% of lots…”

• Who Will be Spared from COVID-19 Vaccine Injury? (McCullough)

Americans have become numb with newsreels of sudden cardiac death, blood clots, stroke, seizures, hospitalization, and death after COVID-19 vaccination. Many have vowed to decline future boosters and get off the vaccination train. However, a common question is: will I be spared? A Zobgy survey in 2022 found that 15% of individuals who took a COVID-19 vaccine had some new medical problem for which they were seeking care.1 A concordant survey done by Dr. Mark Skidmore at Michigan State University found that 22% of Americans knew someone who was seriously damaged by the vaccines.2 The CDC V-Safe data showed that 7-8% of those who took received a COVID-19 vaccine had to seek urgent care from an emergency department or similar facility.

These data suggest that ~85% of those who have received COVID-19 vaccines have no significant problems, and ~15% have been damaged. While this number is unacceptably high, and the vaccine campaign should be stopped, many are wondering now: “why me?” There are almost certainly factors related to the vaccine product that plays a role. In general, Moderna with 100 mcg of mRNA appears to be more toxic than Pfizer with 30 mcg of mRNA.Janssen seems to be similar acutely to Pfizer, but with a better longer-term safety profile. Novavax, with 5 mcg of purified Spike protein, appears to have the most favorable safety profile with no genetic material being injected into the body.

It has been reported that 80% of the Pfizer deaths have come from ~30% of lots, whereas 80% of the Moderna deaths have come from 20% of lots. Thus, the lot number must be a proxy for mRNA content, contaminants, or some other factor related to the product. Patient susceptibility factors make a syndrome more likely to be expressed if it is going to occur. For example, a family or personal history of a genetic blood clotting disorder, use of estrogens, obesity, and immobility make a person more likely to develop severe thromboembolic syndromes after vaccination. Atherosclerotic cardiovascular disease makes it more likely for the vaccines to cause a heart attack or stroke. Baseline cardiomyopathy, mutations in various ion channels, and possibly internal adrenalin during sleep or sports may trigger vaccine-induced myocarditis and sudden death.

https://twitter.com/i/status/1620546600799195136

Starting to look that way.

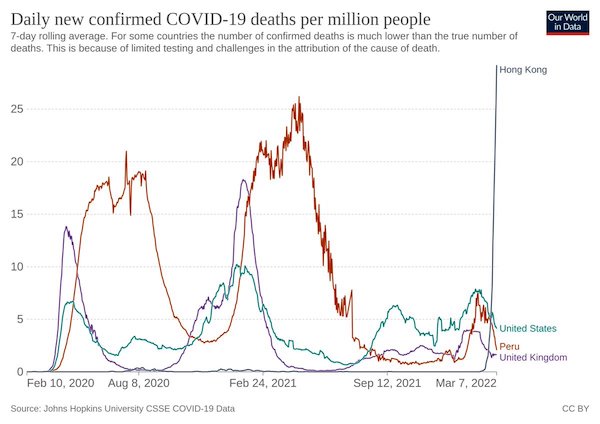

• Did 7.5 Million People Die From Covid Shots? (Horowitz)

There is simply no macro epidemiological evidence that the COVID jabs saved any lives from the virus. To the contrary, there are numerous data points showing negative efficacy. Moreover, over 70% of the 6.75 million recorded COVID deaths occurred precisely after the shots were unleashed. In fact, many parts of the world that barely experienced COVID deaths during the first year, such as Scandinavia, Australia, and far East Asia, incurred almost all of their deaths after the shots were in the arms of every senior. So now that we established there was no mortality benefit, what was the cost? What if I told you it was 7.5 million – even more than the recorded number of COVID deaths? A new peer-reviewed study from Michigan State University estimated that as of Dec. 18, 2021, the time of the survey, 278,000 Americans died of reactions to the jabs.

The study, published last week in BMC Infectious Diseases, used Dynata, the world’s largest first-party data platform, to create a random sample of 2,840 Americans to report their experience with the shots: 15% of those surveyed indicated they had experienced a health issue after vaccination, and 13% of those indicated that a severe adverse event had occurred, in line with many other surveys. Using extrapolations from the survey juxtaposed to state-by-state VAERS deaths, the researcher estimates that, as of Dec. 18, 2021, there were a total of 278,000 vaccine fatalities in the U.S. Further, “severe” adverse events are estimated to be about one million nationwide, and “less severe” adverse events are about 2.1 million. Estimated nationwide fatalities, “severe” injuries, and “less severe” injuries tally to 3.4 million.

This is just after the first year of the vaccine. The results should shock the conscience of the public. So how many died in the world over two years of vaccination? Using the numbers from Our World in Data, 493 million doses of the vaccine were administered in the U.S. at the time of the Michigan State survey. So, if 493 million doses were enough to kill 278 thousand Americans, how many would have died at the same rate globally from the beginning until today? At 13.24 billion doses administered globally, that would result in 7.47 million vaccine fatalities, more than the Holocaust! That would be in addition to 27 million severe injuries globally!

What is shockingly eerie about this projection is that it’s almost identical to what I estimated in terms of the global death toll two months ago based on the CDC’s V-SAFE data demonstrating an underreporting factor in VAERS of 26. Using the URF of 26, and multiplying for the global doses administered, I estimated a back-of-the-envelope total of 7.855 million COVID shot deaths globally. Using this extrapolation just for the U.S. based on the total current number of doses, it would work out to about 372,000 deaths in the U.S. Some estimate as many as 550,000 non-COVID excess deaths, which could demonstrate potentially an even higher death toll.

Insurance analyst

https://twitter.com/i/status/1620512597798977539

“..failed to find even a modest effect on infection or illness rates from masks of all qualities..”

• Massive Mask Meta-study Undermines Remaining Covid Mandates (JTN)

An international research collaboration that reviewed several dozen rigorous studies of “physical interventions” against influenza and COVID-19 through last year failed to find even a modest effect on infection or illness rates from masks of all qualities. Published in the peer-reviewed Cochrane Database of Systematic Reviews, run by the British evidence-based medicine charity Cochrane, the study raises new doubts about ongoing mask mandates and public health recommendations worldwide. The CDC is still recommending masking in areas with “high” transmission levels — fewer than 4% of U.S. counties — as well as indoor masking to protect high-risk contacts in “medium” counties (27%).

Masks are still required in educational institutions in Democratic strongholds such as New York, New Jersey, Massachusetts, Pennsylvania, Washington and California, according to the Daily Mail. Boston Public Schools denied its “temporary masking protocol” in early January was a “mandate,” following a public letter against the policy by student Enrique Abud Evereteze. South Korea is still requiring masks on public transport and in medical facilities after dropping COVID mandates in most indoor settings, including gyms, Monday, Reuters reported. The researchers for the Cochrane study are affiliated with a geographically disparate range of institutions in the U.K., Canada, Australia, Italy and Saudi Arabia. Half are affiliated with the Institute for Evidence-Based Healthcare at Australia’s Bond University. The corresponding author is the University of Calgary’s John Conly.

The team added 11 new randomized controlled trials and “cluster-RCTs,” which randomize groups of subjects rather than individuals, to its prior review from November 2020, for a total of 78 studies. The additions included COVID pandemic trials: two from Mexico and one each from England, Norway, Denmark and Bangladesh, the latter two well known internationally. The Danish study had trouble finding a major journal willing to publish its controversial findings that wearing surgical masks had no statistically significant effect on infection rates, even among those who claimed to wear them “exactly as instructed.” Mainstream media overlooked red flags in the Bangladeshi mask study, which found no effect for surgical masks under age 50 and a difference of only 20 infections between control and treatment groups among 342,000 adults.

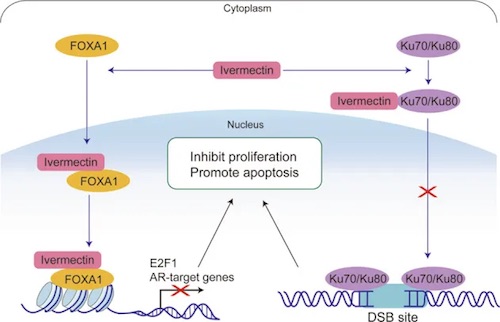

Very interesting. But there’s still no profit in IVM.

• How Ivermectin Kills Prostate Cancer Cells (PR)

I spent the first semester of my course, The Biology of Cancer, reviewing all of the aspects of The Hallmarks of Cancer. This morning, firing up Pubmed to continue preparing my lecture prostate cancer, I found this gem of a study, which happens to be a collaboration between my former employer, The University of Pittsburgh, and Southern Medical University-Guangzhou. I don’t know the authors:

Title: “Integrated analysis reveals FOXA1 and Ku70/Ku80 as targets of ivermectin in prostate cancer” The authors exposed various prostate cancer cells lines to Ivermectin and found that ivermectin binds to two proteins: FOXA1 and Ku70/Ku80. This leads to the inhibition of androgen receptor (AR), E2F1 expression, and DNA damage repair activity. The cells stopped dividing (G0/G1 cell cycle arrest), experience extensive DNA damage, and die. A retrospective study of the rates of cancer and rates of death from cancer among unvaccinated people who prophylactically used Ivermectin over a long period of time vs those who did not is in order.

Study Abstract:

Ivermectin is a widely used antiparasitic drug and shows promising anticancer activity in various cancer types. Although multiple signaling pathways modulated by ivermectin have been identified in tumor cells, few studies have focused on the exact target of ivermectin. Herein, we report the pharmacological effects and targets of ivermectin in prostate cancer. Ivermectin caused G0/G1 cell cycle arrest, induced cell apoptosis and DNA damage, and decreased androgen receptor (AR) signaling in prostate cancer cells. Further in vivo analysis showed ivermectin could suppress 22RV1 xenograft progression. Using integrated omics profiling, including RNA-seq and thermal proteome profiling, the forkhead box protein A1 (FOXA1) and non-homologous end joining (NHEJ) repair executer Ku70/Ku80 were strongly suggested as direct targets of ivermectin in prostate cancer. The interaction of ivermectin and FOXA1 reduced the chromatin accessibility of AR signaling and the G0/G1 cell cycle regulator E2F1, leading to cell proliferation inhibition. The interaction of ivermectin and Ku70/Ku80 impaired the NHEJ repair ability. Cooperating with the downregulation of homologous recombination repair ability after AR signaling inhibition, ivermectin increased intracellular DNA double-strand breaks and finally triggered cell death. Our findings demonstrate the anticancer effect of ivermectin in prostate cancer, indicating that its use may be a new therapeutic approach for prostate cancer.

“..multiple quanta have inherent properties that are both indeterminate, but the properties of each one aren’t independent of the other..”

• Quantum Entanglement Just Got A Whole Lot Weirder (Siegel)

In the quantum Universe, things behave very differently than our common experience would suggest. In the macroscopic world we’re familiar with, any object we can measure appears to have intrinsic properties that are independent of whether we observe it or not. We can measure things like mass, position, motion, duration, etc., without worrying about whether that object is affected by our measurements; reality exists completely independently of the observer. But in the quantum world, that’s demonstrably not true. The act of measuring a system fundamentally changes its properties in an irrevocable way. One of the weirdest quantum properties of all is entanglement: where multiple quanta have inherent properties that are both indeterminate, but the properties of each one aren’t independent of the other.

We’ve seen this demonstrated for photons, electrons, and all sorts of identical particles before, enabling us to test and probe the fundamental and surprising nature of reality. In fact, the 2022 Nobel Prize in Physics was awarded precisely for investigations into this phenomenon. But in a novel experiment, quantum entanglement has just been demonstrated between different particles for the first time, and already the technique has been used to see an atom’s nucleus like never before. In principle, quantum entanglement is a simple idea to understand, and it’s built on the idea of quantum indeterminism. Imagine you pull a ball out of a hat, and there’s a 50/50 chance that the ball has one of two properties.

• Perhaps it’s color: the ball could be black or white. • Perhaps it’s mass: either you pulled out a light ball or a heavy ball. • Perhaps it’s which direction it’s spinning: the ball could be “spin up” or “spin down.” If you only had one ball, you might wonder: upon pulling it out and examining the ball, did it always have those properties, even before you looked at it? Or did the ball have a set of indeterminate parameters, where it was a mix of: • black-and-white • light-and-heavy, • and spinning as a mix of both up-and-down, that was only determined at the instant you took the critical measurement?

Thessaloniki 2023 Greece

The regal moth (Citheronia regalis), also called the royal walnut moth or the hickory horned devil, is one of the largest moths in North America. Its caterpillar can grow up to 15 centimetres (5.9 in) long

Jellyfish don’t have hearts, brains, or blood and have been that way for more than 650 million years. Photo: Jeff Hamilton

Charles Darwin brought back a 5 year old Tortoise named Harriet from the Galápagos Islands that would be later owned by Steve Irwin. Harriet died in 2006 at the age of 176

Up

No opening to a movie has ever hit harder than the relationship montage in…

…UP (2009). pic.twitter.com/LiB6OaBQXp

— James Leighton (@JamesL1927) January 31, 2023

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.