Salvador Dali Remorse – Sphinx Embedded in the Sand 1931

“Looking at the earth from afar you realize it is too small for conflict and just big enough for co-operation” – Yuri Gagarin

Kirsch Cole

What in the actual HELL??? Dr Ryan Cole shows what he pulled out of an individual who bowed down at the altar of Big Pharma. If true, some people are gonna have a very interesting future. pic.twitter.com/xsyghVq3L8

— HighImpactFlix (@HighImpactFlix) March 18, 2022

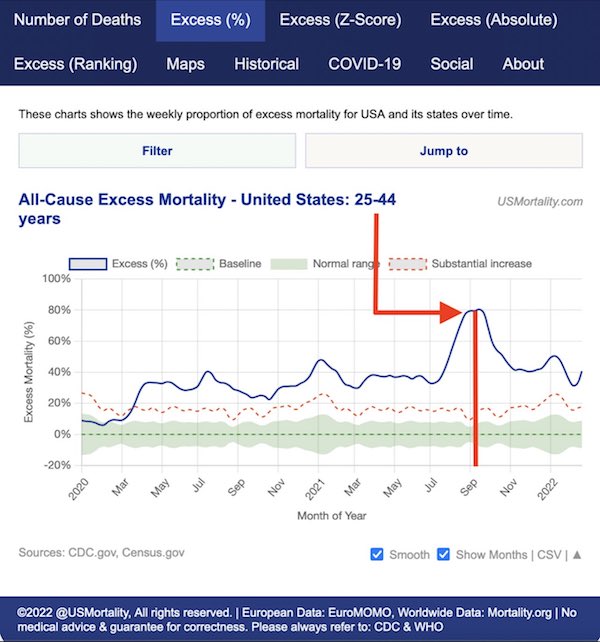

Where did the 80% excess mortality come from?

40% ethnic Russians. Think Russia would bomb them?

• Was Bombing Of Mariupol Theater Staged By Ukrainian Azov Extremists? (GZ)

Western media have reported that Russia’s military deliberately attacked the Donetsk Academic Regional Drama theater in Mariupol, Ukraine, claiming that it was filled with civilians and marked with signs reading “children” on its grounds. The supposed bombing took place just as Ukrainian President Volodymyr Zelensky appealed to US Congress for a no fly zone, fueling the chorus for direct military confrontation with Russia and apparently inspiring President Joseph Biden to brand Vladimir Putin, the Russian president, as a “war criminal.” A closer look reveals that local residents in Mariupol had warned three days before the March 16 incident that the theater would be the site of a false flag attack launched by the openly neo-Nazi Azov Battalion, which controlled the building and the territory around it.

Civilians that escaped the city through humanitarian corridors have testified that they were held by Azov as human shields in area, and that Azov fighters detonated parts of the theater as they retreated. Despite claims of a massive Russian airstrike that reduced the building to ashes, all civilians appear to have escaped with their lives. Video of the attack on the theater remains unavailable at the time of publication; only photographs of the damaged structure can be viewed. The Russian Ministry of Defense has denied conducting an airstrike on the theater, asserting that the site had no military value and that no sorties were flown in the area on March 16.

While the Russian military operation in Ukraine has triggered a humanitarian crisis in Mariupol, it is clear that Russia gained nothing by targeting the theater, and virtually guaranteed itself another public relations blow by targeting a building filled with civilians – including ethnic Russians. Azov, on the other hand, stood to benefit from a dramatic and grisly attack blamed on Russia. In full retreat all around Mariupol and facing the possibility of brutal treatment at the hands of a Russian military hellbent on “de-Nazification,” its fighters’ only hope seemed to lie in triggering direct NATO intervention.

Azov – series of videos

@MapsUkraine Testimony of Mariupol residents: Azov Batallion executed civilians triying to escape the city. pic.twitter.com/Q1BsQiapvj

— Juan Sinmiedo (@Youblacksoul) March 17, 2022

“Adding China as a target of its economic war could drive the populations of the U.S. and Europe against their own governments instead.”

• US Recklessly Eyes China as Target in Economic War (Lauria)

The U.S. already has sanctions on China, as it had earlier on Russia. However, if the United States is seriously planning similar types of sanctions on Beijing that it has leveled on Moscow — against its major banks, against the central bank, removing it from SWIFT and cutting off key exports — the impact on the world economy — including on Europe and the United States — could be catastrophic. The U.S. national security strategy for several years has been aimed at both Russia and China. Knowing it must avoid a direct military confrontation against either, given the potential consequences, the U.S. is turning to economic warfare to ultimately attempt to bring down both governments through popular uprisings. Washington wants to replace them with Western-friendly leaders who would open up their economies to Western exploitation — just like Boris Yeltsin did in the 1990s.

The United States is acting as though the whole world is the West and that this is the China of 30 years ago. In its bull-headed effort to impose its unilateral rule on the world, while its domestic social problems mount, the U.S. has not only driven Russia and China closer together than ever, but it has now brought in India, much of Latin America, Africa and the Middle East, (all of whom have refused to sanction Russia and continues to trade with it), into a new bloc with economic power that exceeds the West. The U.S. has turned the majority of the world’s population against it. And it is now threatening to blow up the world economy. Cutting off trade and finance to Russia has already boomeranged on Western countries, driving up prices, especially at the pump. Instead of prompting a popular uprising in Russia as a result of its sanctions, Russian President Vladimir Putin’s popularity has actually risen since the invasion. Adding China as a target of its economic war could drive the populations of the U.S. and Europe against their own governments instead.

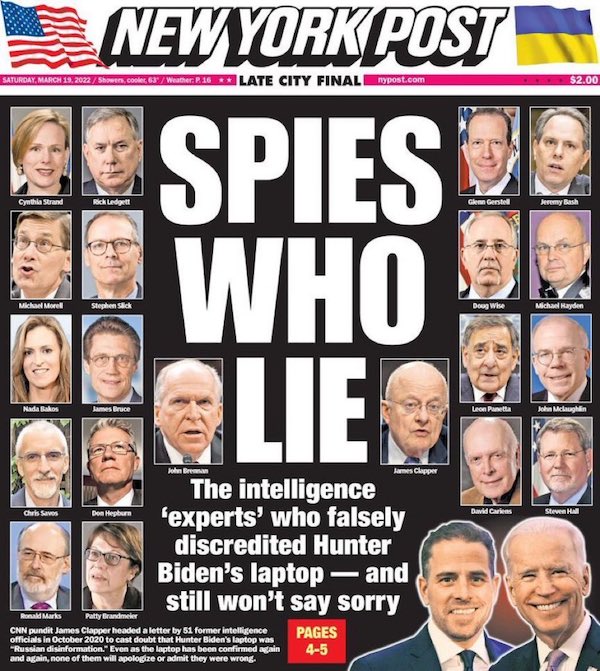

“51 ‘intelligence’ experts refuse to apologize for discrediting true Hunter Biden story..”

They are the supposed nonpartisan group of top spies looking out for the best interest of the nation. But the 51 former “intelligence” officials who cast doubt on The Post’s Hunter Biden laptop stories in a public letter really were just desperate to get Joe Biden elected president. And more than a year later, even after their Deep State sabotage has been shown again and again to be a lie, they refuse to own up to how they undermined an election. The officials, including CNN pundit and professional fabricator James Clapper – a man who was nearly charged for perjury for lying to Congress — signed a letter saying that the laptop “has the classic earmarks of a Russian information operation.” What proof did they have? By their own admission, none. “We do not know if the emails .. are genuine or not,” the letter said. They’re just “suspicious.”

Why? Because they hurt Biden’s campaign, that’s evidence enough. Keep in mind this was written Oct. 19, 2020, five days after The Post published its first story. Neither Joe Biden nor Hunter Biden had denied the story, they simply deflected questions. Didn’t these security experts think that if this was disinformation, the Biden campaign would have yelled to the heavens that the story was false? Meanwhile, though the letter was advertised as being signed by people who worked “for presidents of both political parties,” a majority of the officials were Democrats. Politico picked up the letter and ran the false headline “Hunter Biden story is Russian disinfo, dozens of former intel officials say.” That headline is still online today, even though the letter clearly says they don’t know if it’s Russian disinformation. That headline was tweeted out by legions of Democrats, including current White House spokeswoman Jen Psaki, as proof that it was all a con.

That tweet also is still up despite being proven false. Thus pure speculation by a group of biased officials became gospel among the media. This was “fake news,” and could be safely ignored. Keep in mind that Twitter already had banned The New York Post a few days before. The rationale was that this was “hacked materials,” even though it wasn’t – and Twitter had no evidence to think it was. A Facebook official, meanwhile, said it wasn’t going to allow the sharing of The Post’s story until it was “fact checked” by a third party — a check that never happened. Thus, Big Tech, former government officials, and the media conspired together to bury a story. No, not just bury — create a false narrative that flipped the script to make Joe Biden the victim of a conspiracy. In short, they peddled online disinformation to sway an election.

But they do not.

• Media That Dismissed Hunter Biden Laptop Story Need To Correct The Record (Fox)

The New York Times on Wednesday subtly confirmed the Hunter Biden laptop story that was largely written off by mainstream news outlets as disinformation when the New York Post first reported it ahead of the 2020 presidential election and media watchdogs want to see the organizations that initially dismissed it correct their reporting and analysis. “Outlets who actively tried to cover up the original New York Post laptop story absolutely need to correct the record,” journalist Drew Holden told Fox News Digital. “These weren’t simple misgivings — they smeared the accurate, significant scoops of a competitor as disinformation, and they absolutely have an obligation to correct the record,” Holden said.

The Post reported the laptop’s contents included emails, text messages, photos and financial documents between himself, his family and business associates that showed how he used his political influence in his foreign business dealings, specifically in his work as a board member of Burisma Holdings, a Ukrainian energy company. However, voters who relied on the mainstream press for information ahead of the presidential election were told not to believe the report. Washington Post columnist Greg Sargent quickly declared the day after the Post first began reporting on the laptop that it was “Trump’s fake new Biden scandal,” calling the allegations “laughably weak.”

NPR public editor Kelly McBride addressed a listener’s question about the news outlet’s blackout of the Hunter Biden story at the time. After claiming the Post’s reporting had “many, many red flags,” including its potential ties to Russia, NPR determined the “assertions don’t amount to much.” “We don’t want to waste our time on stories that are not really stories, and we don’t want to waste the listeners’ and readers’ time on stories that are just pure distractions,” NPR managing editor Terence Samuel told McBride. In December 2020, Project Veritas published leaked audio recordings of conference calls featuring CNN’s top executives urging staff to avoid the Biden scandal during the election.

“Obviously, we’re not going with the New York Post story right now on Hunter Biden,” CNN political director David Chalian said during a conference call on Oct. 14, the same day the Post published its first story on Hunter Biden’s emails. MSNBC anchor Katy Tur mocked the Post’s story, saying it “dropped like a bomb,” but to “wither under scrutiny, not really dropping like a bomb,” while MSNBC’s Stephanie Ruhle attacked those who were covering the Hunter Biden controversy, referring to it as a “so-called story” with “unverified claims.” These are just a small sample of the corporate media’s overwhelming attempt to silence the story, which was even censored on Twitter.

All the hallmarks

FLASHBACK: Media pundits lied to you, falsely claiming that the Hunter Biden laptop story was "Russian disinformation." pic.twitter.com/fSmQgfIq0N

— MediaResearchCenter (@theMRC) March 18, 2022

The MSM maintain their silence.

• Biden’s State Department Backed Into a Corner, Forced to Turn on Hunter (WJ)

It’s very possible that Kenneth Vogel, a reporter with The New York Times, may actually be practicing journalism. Last year, Vogel filed several Freedom of Information Act requests with the State Department. Among the information he was seeking were copies of all correspondence that “mentioned” Hunter Biden, among officials at the U.S. embassy in Romania, between August 2015 and December 2019, according to Business Insider. Upon learning that the agency wouldn’t start producing these records until April 2023, Vogel filed a FOIA lawsuit in January. A hearing in the case was scheduled for March 17. Last Friday, however, the Times’ attorney David McCraw filed a court motion, which said the State Department had agreed to begin handing over the records next month.

Business Insider reported that, in a letter to the presiding judge in the case, U.S. District Court Judge J. Paul Oetken, McGraw wrote: “The State Department has started identifying records responsive to The Times’s FOIA requests. It has agreed to begin processing records for production as it continues to identify the remaining responsive records.” “The parties are still negotiating the number of pages to be processed in and the frequency of each production. The parties respectfully propose to provide a status report to the Court on March 25, 2022, informing the Court of the results of this negotiation,” McGraw added. In addition, Vogel requested all records mentioning Tony Bobulinski, who made headlines in October 2020 when emails contained on Hunter Biden’s lap top were revealed.

It turned out that Hunter had introduced Bobulinski to now-President Joe Biden in a May 2017 meeting at the Beverly Hilton Hotel in Los Angeles, California. He was to serve as CEO of SinoHawk Holdings LLC, a joint venture between the Biden family and Chinese energy company, CEFC. Bobulinski famously confirmed that “The Big Guy” referred to in one of the emails on the laptop, who was to receive 10 percent of the potential profits, was none other than Joe Biden. Vogel has also asked for all correspondence mentioning former FBI Director Louis Freeh, who, according to The New York Post, is alleged to have contributed $100,000 to a trust for Hunter’s children in April 2016 ahead of a meeting with then-Vice President Joe Biden to discuss “some very good and profitable matters.”

The Post published a screenshot of a July 2016 email in which Freeh wrote to Hunter, “I would be delighted to do future work with you.” Apparently, he was very delighted. [..] An October 2019 story published in The New York Times may provide a clue. Vogel wrote about Hunter Biden’s association with a Romanian executive who was facing corruption charges. The headline and lede read: “Giuliani Is Drawing Attention to Hunter Biden’s Work in Romania. But There’s a Problem. … Hunter Biden worked to help a Romanian executive facing corruption charges. But so did the former New York mayor — and a former F.B.I. director.” For whatever the reason, the State Department tried to slow-walk Vogel’s FOIA request, so much so that he was forced to file a lawsuit. We know that Hunter Biden has conducted business with the Chinese and the Ukrainians, but we’ve heard very little about his involvement with anyone in Romania.

Why now?

Media outlets dismissed The Hunter Biden story pic.twitter.com/p7UpA50Bse

— Wittgenstein (@backtolife_2022) March 19, 2022

“we will never forget who bombed our embassy in the Federal Republic of Yugoslavia”. “We need no lecture on justice from the abuser of international law..”

• Biden Boasted He Proposed NATO’s 78-Day Airstrikes On Belgrade (ZH)

Both Russian and Chinese media and state officials have in the last days been widely circulating a resurfaced video from 1999 wherein then senator Joe Biden bragged about being the first US official to propose bombing Belgrade and destroying the city’s infrastructure. State media in Russia wrote this week while featuring the footage: “The head of Roscosmos, Dmitry Rogozin, reposted the footage on his social media account, reminding the current US President of the NATO bombing of Yugoslavia that is estimated to have killed about 2,500 people, including 89 children.” Russian officials used the clip to blast Biden over his latest description of Vladimir Putin as a “war criminal” and “thug” due to the invasion of Ukraine. It’s also getting wide circulation on Chinese social media.

“I suggested bombing of Belgrade. I suggested that American pilots go there and destroy all bridges on the Drina,” Biden had said at the time. The 78 days of air strikes lasted from 24 March 1999 to 10 June 1999. The bombs kept falling even on Serbia’s Easter – called Pascha – which is the holiest day of the Orthodox Christian year. “I was suggesting very specific action,” Biden said while seeming to praise his own ‘muscular’ proposals which helped lead to the NATO war against the Serbs. China’s mission to the EU also called out prior US action over what was Yugoslavia, condemning the outrageous May NATO bombing of the Chinese embassy – which killed and injured multiple Chinese nationals and journalists.

According to a summary of the incident in The National Review, “Despite the seemingly extensive target vetting, on May 7 the Chinese embassy in Belgrade was struck by five Joint Directed Attack Munition satellite-guided bombs, delivered by U.S. Air Force B-2 Spirit bombers. Three Chinese journalists—Shao Yunhuan of Xinhua, and Xu Xinghu and his wife Zhu Ying of the Guangming Daily—were killed in the attack. Twenty other Chinese nationals were injured, five seriously.” On Thursday China’s foreign ministry said in a statement “we will never forget” – and related it to Washington’s outrage over ongoing Russian military action in Ukraine:

The Chinese diplomatic mission in the European Union said on Thursday that Chinese people could fully relate to the suffering of other countries because “we will never forget who bombed our embassy in the Federal Republic of Yugoslavia”. “We need no lecture on justice from the abuser of international law,” it said. “As a Cold War remnant and the world’s largest military alliance, Nato continues to expand its geographical scope and range of operations. What kind of role has it played in world peace and stability? Nato needs to have good reflection.”

There’s a reason US oil(field) service companies operate in Russia, and their withdrawal may hurt Russia.

• Halliburton, Schlumberger Draw Back From Russia Amid US Energy Sanctions (R.)

U.S. oilfield services companies Halliburton Co and Schlumberger said on Friday they have suspended or halted Russia operations in response to U.S. sanctions over Moscow’s invasion of Ukraine. The disclosures followed widespread departures by energy, retail and consumer goods businesses and a series of European Union and U.S. bans on providing oil technology to Russia or importing its energy products. Halliburton said it immediately suspended future business and would wind down its operations in Russia after earlier ending shipments of sanctioned parts and products to the country.

Schlumberger has ceased new investment and technology deployment while continuing with existing activity in compliance with international laws and sanctions, the company said in a statement late on Friday. “We urge a cessation of the conflict and a restoration of safety and security in the region,” Schlumberger Chief Executive Olivier Le Peuch said. Oilfield services provider Baker Hughes declined to comment on its Russia operations. Energy companies BP PLC, Shell, Equinor ASA and Exxon Mobil have suspended business or announced plans to exit their Russia operations.

“I fear he underestimates the intellect of the nation which did three-quarters of the fighting and dying to defeat fascism 77 years ago.”

What is fascism? With the Russian ‘de-Nazification operation’ in the Ukraine entering its fourth week and “Black Lives Matter” replaced with “I Stand With Ukraine” as the virtue-signal de jour, now seems like a good time to define it. While I’m a big fan of the Iranian journalist Ramin Mazaheri, I have to disagree with his latest article on The Vineyard of the Saker. Mazaheri says Russia misinterprets Nazism as simply Russophobia. I fear he underestimates the intellect of the nation which did three-quarters of the fighting and dying to defeat fascism 77 years ago. Rather than trying to suck the meaning of the word ‘fascism’ out of our thumbs, let us instead compare two well-known definitions by Georgi Dimitrov and Umberto Eco, a Marxist and a Liberal.

Eco, the Italian author of the historical whodunnit The Name Of the Rose, listed 14 different features in his 1995 essay Eternal Fascism. The problem is, none of them individually are proof that we’re living in a fascist state. Eco admits at the start: “These features cannot be organized into a system; many of them contradict each other, and are also typical of other kinds of despotism or fanaticism.” But he claims: “it is enough that one of them be present to allow fascism to coagulate around it.” The first item on Eco’s list, ‘the cult of tradition’, is common to most ‘small-c’ social conservatives. The syncretism that Eco speaks of here is found in his own eclectic list. Points three to five, ‘action for action’s sake’, ‘disagreement is treason’ and ‘fear of difference’ are true of the dozens of Trotskyite and anarchist sects jumping on the Ukraine bandwagon.

Points six to eight, ‘appeal to a frustrated middle class’, an ‘obsession with a plot’ and the belief that their ‘enemies are at the same time too strong and too weak’ describe the US ‘Never Trumpers’ and British liberals still desperate to rejoin the European Union (EU). Nine and 11, ‘ life is lived for struggle’ and ‘everybody is educated to become a hero’ apply to the ‘woke’ millennials obsessed with their own perceived victimhood. Dimitrov, the Bulgarian general secretary of the Communist (Third) International, characterised fascism in a speech to the 7th Comintern congress in 1935 as: “the open, terrorist dictatorship of the most reactionary, most chauvinistic, and most imperialist elements of finance capital.”

“Fascism is not a power standing above class, nor government of the petty bourgeoisie or the lumpen-proletariat over finance capital,” he elaborated. “Fascism is the power of finance capital itself. It is the organization of terrorist vengeance against the working class and the revolutionary section of the peasantry and intelligentsia.”

Data scientist files internal appeal of Bank of Canada’s mandatory vaccination policy. 766-page submission cites more than 1000 peer-reviewed articles showing evidence of harm.

Joseph Hickey is also the OCLA’s (volunteer) ED.

• Data Scientist Files Internal Appeal Of Bank Of Canada Vaccination Policy (OCLA)

Dr. Joseph Hickey, a data scientist at the Bank of Canada (Canada’s central bank) was placed on unpaid leave without benefits by his employer in November 2021, for declining to receive injections of a COVID-19 vaccine. On March 16, 2022, Dr. Hickey submitted an internal appeal of the Bank’s decision. His 766-page submission describes and cites the scientific evidence that demonstrates there are many medical reasons for declining vaccination, including that:

• There was no emergency that caused large amounts of deaths in Canada in 2020-2021 that would justify vaccinating the entire population;

• There is no reliable evidence that the COVID-19 vaccine products provide any health benefit;

• Vaccine products injected via intramuscular routes are in-effect physiologically incapable of preventing infection and transmission of respiratory illnesses;

• There is autopsy, surveillance, and statistical evidence of grave dangers of COVID-19 vaccine products;

• There are more than 1000 peer-reviewed articles providing evidence of harm from COVID-19 vaccine products;

• There is a significantly increased risk of dangerous heart inflammation following injection with a COVID-19 vaccine product, especially for younger males, and this danger is heightened for those who engage in strenuous physical activity;

• Natural immunity provides robust and sufficient protection against respiratory illnesses; and

• It is a fundamental principle of medicine that individual assessment of risk is a personal and confidential choice and the decision to receive or not receive a medical intervention must be made with free and informed consent.

Better be fast: “..we may have only a decade, at most two, to prevent this digital dictatorship from taking over.”

• The Digital Dictatorship Is Coming — Can We Stop It? (Mercola)

According to Klaus Schwab, founder and executive chairman of the World Economic Forum (WEF), the goal of The Fourth Industrial Revolution is to change what it means to be human by merging man and machine. In short, while the term “transhumanism” is not being used, that’s exactly where the global cabal intends to take us, willing or not. In a November 2019 interview with CNN, history professor and bestselling author Yuval Noah Harari, a Klaus Schwab disciple, warned that “humans are now hackable animals,” meaning, the technology now exists by which a company or government can know you better than you know yourself, and that can be very dangerous if misused.

He predicted that algorithms will increasingly be used to make decisions that historically have been made by humans, either yourself or someone else, including whether or not you’ll be hired for a particular job, whether you’ll be granted a loan, what scholastic curriculum you will follow and even who you will marry. There’s also an ever-increasing risk of being manipulated by these outside forces that you’re not even fully aware of. Looking back over the last two years, it’s rather easy to confirm that mass manipulation is taking place at a staggering scale and that it’s phenomenally effective. As noted by Harari in 2019, the available capabilities already go far beyond Orwell’s “1984” authoritarian vision, and it’s only going to become more powerful from here.

He’s certain that in short order, there will be the ability to monitor your emotional state through something as simple as a wearable wristband. You may dutifully smile and clap when listening to a speech by a government official, but they’ll know you’re angry or don’t agree with what’s being said, and could therefore take action against you based on your most personal, internal emotions rather than what you outwardly express. Importantly, Harari warned that if we allow the establishment of this kind of digital dictatorship, where the system, be it a corporation or a government, knows the most intimate details about each and every person, it will be impossible to dismantle it. Its control will be total and irreversible. And, Harari believes we may have only a decade, at most two, to prevent this digital dictatorship from taking over.

Subtle

— john (@johnhackerla) March 19, 2022

Imperialism

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.