John M. Fox Midtown Dealers Corp. and Hudson showroom, Broadway at W. 62nd Street, NY 1947

But he had nothing to do with it!

• Mark Carney: World Is Facing The “First Lost Decade Since The 1860s” (BBG)

Mark Carney launched a defense of globalization and set out a manifesto for central bankers and governments to boost growth and make the world economy more equal. The Bank of England Governor said they must acknowledge that gains from trade and technology haven’t been felt by all, improve the balance of monetary and fiscal policy, and move to a more inclusive model where “everyone has a stake in globalization.” Carney’s speech in Liverpool, England, comes amid rising disquiet about the state of the world economy and political status quo that helped propel Donald Trump to victory in the U.S. presidential election and boost support for the U.K.’s exit from the European Union.

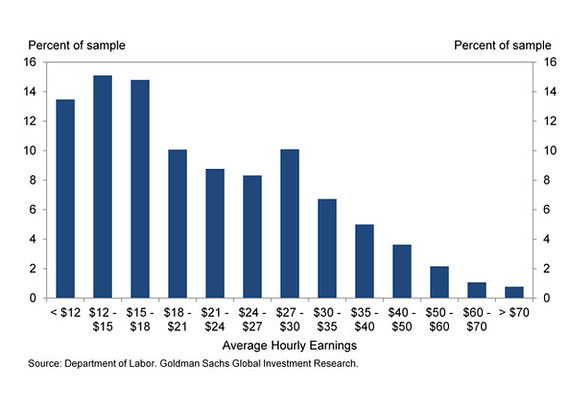

Trump isn’t right to favor more protectionist policies in response to globalization, Carney said in a television interview broadcast after his speech. The answer is to “redistribute some of the benefits of trade” and ensure that workers are able to acquire new skills. “Weak income growth has focused growing attention on its distribution,” Carney said in the speech. “Inequalities which might have been tolerated during generalized prosperity are felt more acutely when economies stagnate.” Describing the world as facing the “first lost decade since the 1860s,” the BOE governor said public support for open markets is under threat and rejecting them would be a “tragedy, but is a possibility.”

Carney also defended the central bank’s current policy stance. The BOE has faced criticism from politicians after officials took measures including cutting interest rates and expanding asset purchases in August to support the economy after Britain’s June vote to leave the EU. “Low rates are not the caprice of central bankers, but rather the consequence of powerful global forces, including debt, demographics and distribution,” he said, adding that they helped to prevent a deeper economic downturn.

“Essentially, the United States is held to be a closed economy resembling a giant bathtub.” Stockman says the Trump team have contacted him.

• Trump Must Fire Janet Yellen – First Thing! (Stockman)

The Keynesian statists at the Fed think the devastating financial busts we’ve suffered since 1987 were due to a mix of too much investor exuberance, too much deregulation, a one-time housing mania and a smattering of Wall Street greed and corruption, too. And that’s not to overlook some of the more far-fetched reasons for the two big financial meltdowns of this century. Foremost among these is the Greenspan-Bernanke fairy tale that Chinese workers making under $1 per hour were saving too much money, thereby causing low global mortgage rates and a runaway housing boom in America! Needless to say, not only are these rationalizations completely bogus; but so is the entire underlying rationale for Keynesian monetary central planning.

The claim that market capitalism is chronically and destructively unstable and that the business cycle needs constant management and stimulus by the state and its central banking branch is belied by the historical facts. Every economic setback of modern times, including the foundation events of the Great Depression — was caused by the state. The catalyst was either inflationary war finance or central bank fueled credit expansion, not the deficiencies or inherent instabilities’ of market capitalism. Nevertheless, the Fed’s model robs the millions of workers, entrepreneurs, investors and savers who comprise the ground level economy and the billions of supply-side prices for labor and capital through which they interact and ultimately generate output, income and wealth.

Instead, the Fed focuses on the macroeconomic aggregates as the key to achieving its so-called dual mandate of stable prices and maximum employment. Essentially, the United States is held to be a closed economy resembling a giant bathtub. In the pursuit of “full employment,” the central bank’s job is to keep it pumped full to the brim with “aggregate demand.” But the domestic macroeconomic aggregates of employment and inflation cannot be measured on an accurate and timely basis. Neither can they be reliably and directly influenced by the crude tools of the central bank, such as pegging the money market rate, manipulating the yield curve via QE, levitating Wall Street animal spirits via wealth-effects and various forms of open-mouth intervention such as “forward guidance.”

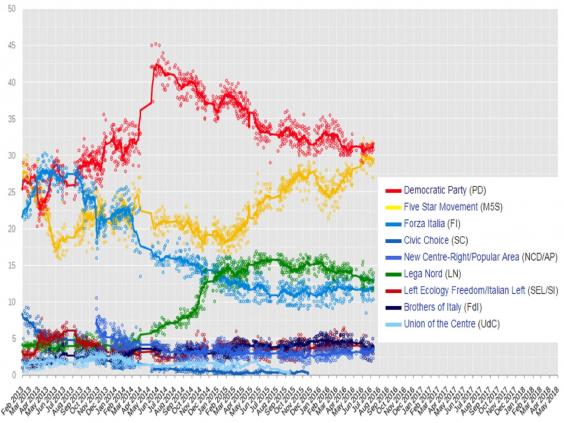

The president picking favorites. Dangerous at this stage. Italy’s had technocrat ‘caretakers’ before, and that didn’t go well. But everything to keep M5S out of power, including new changes to election laws.

• Matteo Renzi’s Resignation Temporarily ‘Frozen’ By Italian President (G.)

Matteo Renzi will remain in office for at least a week after Italy’s head of state asked the centre-left prime minister to “freeze” his resignation temporarily until the senate passed a 2017 budget. Renzi met Sergio Mattarella on Monday at the presidential palace – the Quirinale – in order to formally submit his resignation following a stunning defeat in a referendum on Sunday. Renzi was expected to step down immediately but his departure could now be delayed until Christmas. Mattarella signalled that he will not call snap elections in response to the referendum results, putting him on a collision course with populist and rightwing parties that want a new poll to be called right away.

The Sicilian head of state said he believed it was important for Italy’s institutions to respect “commitments and deadlines”, and that they worked hard to find solutions that were worthy of the “demands of the time”. While the president must always appear to be independent of political allegiances, his comments were taken as a clear sign that he believed the current government needed to fulfil its obligation to not only pass a budget but also make changes to an election law that has been put in flux by the referendum results. Renzi’s months-long campaign to convince Italians to vote yes and overhaul the constitution and parliament was roundly rejected by 59.1% of voters on Sunday, on a turnout of 68%.

The high interest in the plebiscite did not escape Mattarella, who said it was a “testament to a solid democracy [and] an impassioned country capable of active participation”. Mattarella’s call for “serenity” after Italy was plunged into political chaos by the vote may have assuaged worries in Europe about what Renzi’s defeat signified for Europe, Italy’s fragile banking system, and the future of the euro. Germany’s foreign minister, Frank-Walter Steinmeier, said the result was a “concern”, while finance minister Wolfgang Schäuble said Italy ought to continue on an economic path that had been adopted by Renzi. The results, however, were celebrated by French far-right candidate Marine Le Pen who said that, with the no win, Italians joined the British in turning their backs on “absurd European policies which are plunging the continent into poverty”.

Wikipedia

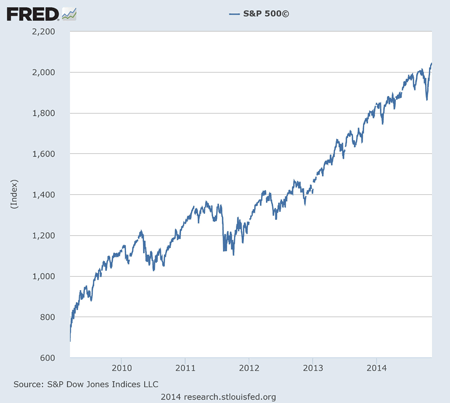

Oh well, everything else went up…

• Italian Bank Shares Slump as Renzi Loss Adds to Uncertainty (BBG)

UniCredit and Banca Monte dei Paschi di Siena fell along with most Italian bank shares after Prime Minister Matteo Renzi’s decision to resign added to uncertainty about their plans for shoring up their finances. Monte Paschi will decide within the next few days whether it will proceed with a planned capital increase, people with knowledge of the matter said. The underwriters, who met with the bank’s executives on Monday, are still waiting for a formal commitment from possible anchor investors, the people said, asking to not be identified because the matter is private. Potential investors are seeking more time to review the political situation after the referendum, according to the people. Italy’s political vacuum threatens to usher in a period of uncertainty that may weigh on plans to reduce a pile of bad loans estimated at €360 billion.

UniCredit and Monte Paschi are among banks looking to raise capital as part of overhauls to clean up their balance sheets and strengthen profitability. UniCredit CEO Jean Pierre Mustier said he’s not worried that market volatility will compromise a strategic plan due next week, just as Renzi prepares to step down. “The events overnight won’t change our strategy,” he said on Monday, without elaborating on the changes ahead. Mustier is trying to restore confidence in a systemically important lender after a slide in its share price eroded more than 60% of the company’s market value this year. Italy’s biggest bank was trading 2.9% lower at 5:24 p.m. in Milan, while Monte Paschi was down 4.2%, after falling as much as 7.5% earlier Monday. Italy’s biggest bank plans to raise as much as €13 billion through a combination of asset sales and a stock offering.

Italy will have to bail out banks, but doesn’t want EU rules to force it to victimize its own citizens, who hold a huge amount of bank bonds. Maybe they should let Beppe have a go at this.

• Italy Already Requested Monte Dei Paschi Bailout Before Referendum (R.)

Italy is discussing with the European Commission the terms of a state bailout of ailing bank Monte dei Paschi that has already been requested and could be launched next week if needed, Italian daily Corriere della Sera reported on Friday. Italy’s third-largest bank needs to raise €5 billion by the end of the year to plug a capital shortfall identified by ECB stress tests or face the risk of being wound down. Quoting sources with knowledge of the matter, Corriere said that Italy had already filed a request to launch a public recapitalization of Monte dei Paschi as early as next week. The newspaper reported that the Commission was willing to limit the burden on shareholders and subordinated bondholders and it was being discussed to what extent retail investors who held subordinated bonds could be spared.

The bank’s finance chief Francesco Mele said this week that the Commission was expected to agree that only shareholders and junior bondholders share the bank’s losses before Monte dei Paschi is given any state aid. New EU rules on state aid to banks require investors to take a hit before lenders tap public money, but a lighter version of the rules can apply in cases such as Monte dei Paschi’s. Sources told Reuters last week that authorities would apply EU rules with flexibility with regard to a Monte dei Paschi bailout to avoid damage to the entire Italian banking system. A debt-to-equity swap aimed at reducing the size of a share sale ends on Friday, with Monte dei Paschi planning to launch its share issue after Italy’s referendum on constitutional reform this Sunday.

Yup, Draghi.

• Could Renzi’s Exit Lead To An Italian Bank Rescue? (G.)

Investors’ ability to look on the bright side on political turmoil is remarkable. In the case of Italy, the departure of Matteo Renzi, the market-friendly centre-left prime minister, was followed quickly by the thought that the crisis in the country’s banking system may, counterintuitively, become easier to address. That wasn’t last week’s theory, of course. Back then, Renzi’s survival was seen as critical to encouraging private sector investors to cough up billions of euros of new capital to refinance the likes of Banca Monte dei Paschi di Siena and UniCredit. This week’s silver lining theory holds that a political vacuum isn’t so bad if it prods the ECBand the eurozone authorities to take a flexible approach to Italy’s banking mess.

Ireland’s finance minister, Michael Noonan, captured the new mood: “The president of the ECB, Mario Draghi, is Italian and I can’t envisage a situation in which the ECB under Mario Draghi will let the Italian banks get into difficulty.” He’s probably right. It seems quite possible that, if MPS struggles to get its required €5bn (£4.2bn) from big private sector investors such as Qatar’s sovereign wealth fund, the bank could be nationalised with ways found to compensate ordinary savers who hold bonds that would be wiped out. A wipeout of senior bondholders is meant to be an essential requirement of state bailouts in the eurozone these days. It causes problems in Italy because so many bondholders are retail savers.

But the eurozone’s capacity to bend its own rules is legendary: compensation for some bondholders, even if that is supposed to be a no-no, might be deemed a price worth paying after Renzi’s exit. Yet would that really be a cause for celebration? Only if the health of the Italian banking system is addressed once and for all. But it seems far more likely that a weak Italian government and reluctant eurozone authorities will serve up only half a solution – one big enough to get through the current crisis but insufficient to allow a proper cleansing of the bad loans in the system, which are estimated to stand at €360bn.

Italy has a lot of small enterprises, often family owned. That doesn’t fit today’s globalization model (not competitive enough). But globalization is over anyway. The country had better save what’s left of its business model, because it’s ideal for a post-centralized world.

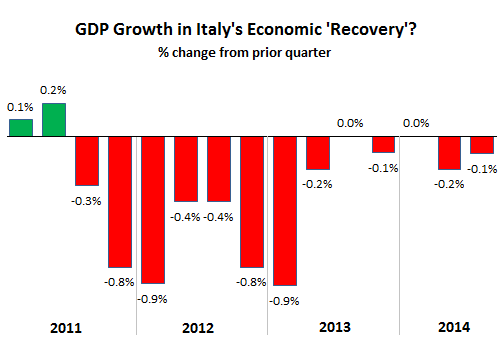

• How Italy Became This Century’s ‘Sick Man Of Europe’ (G.)

On New Year’s Day in 2002, Italians gathered in Rome to throw their lire into the Trevi fountain. There were celebrations as Italians took possession of the new euro notes and coins that became legal tender as the clocks struck midnight. But hopes that the advent of the single currency would provide a fresh start for Italy’s economy were misplaced. The growth performance of the eurozone as a whole has been poor, but Italy’s has been dismal. Greece and Spain at least had booms before their painful busts; Germany and France have managed to claw back the ground lost in the deep recession of 2008-09. But national output per head in Italy is only 4% higher than it was 15 years ago. The economy is still smaller than it was in 2008.

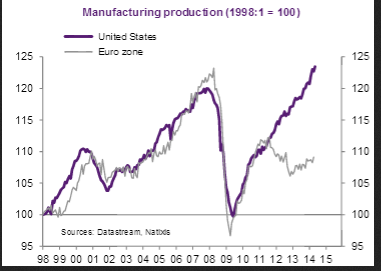

Unemployment is at 11.6%, labour market participation is low, and its birthrate in 2014 was the lowest since the modern Italian state was founded in 1861. If there was a contest for the unwanted title of the sick man of Europe in the 21st century, Italy would walk it. The eurozone’s third biggest economy has one central problem: the goods and services it produces are more expensive than those of its rivals. This lack of competitiveness means that it has suffered the biggest drop in export market share of any developed country. There are three reasons for this. Firstly, Italy’s manufacturing sector has traditionally been dominated by small companies, many of them family-owned. These businesses have been reluctant to invest, poor at innovation, and were slow to take advantage of the the new information technology when it came on stream in the 1990s.

Productivity has increased less rapidly than in Germany or France. Secondly, Italy has tended to specialise in low-cost manufactured goods, a segment of the global economy that has been dominated by China since it gained membership of the World Trade Organisation in 2001. Italy’s competitiveness problem is not new. Since the second world war, it has tended to have higher costs and higher inflation than rival countries. But up until it joined the euro, Italy was able to restore competitiveness by devaluing the lire, which made exports cheaper. With that option no longer available, Matteo Renzi has been trying a different approach: structural reforms of Italy’s labour market.

A bit overdone this, but not entirely.

• Standing Rock Is A Modern-Day Indian War. This Time Indians Are Winning (G.)

As Indigenous peoples faced off against armed police and tanks near the Standing Rock Sioux reservation in Dakota, theirs wasn’t just a battle over a pipeline. It was a battle over a story that could define the future of America. The Obama administration’s decision yesterday to refuse the Dakota Access pipeline permission to complete its construction has now shaken up that story. Its old version was that Indigenous peoples have always been in the way of progress, their interests a nuisance or threat, their treaties a discardable artifact. In that story, the American heroes forged on these high plains of the west were never the Indians: they were the gold-diggers or gamblers, the cowboys or cavalry.

But over the past months, it became impossible to watch peaceful Indigenous people and supporters attacked by snarling dogs, maced, and shot with rubber bullets and water cannons in freezing conditions, and still see in them a threat. It was impossible to look upon these young Indigenous men and women, in jingle dresses or on horseback, and not observe the courage that America desperately needs. It was impossible to listen to the cry of their slogan and not hear a rallying vision for all of us: Water is Life. Along the snowy banks of the Missouri river, a new story is being painfully birthed. It tells us that frontiers must at some point close. That endless taking must become care-taking.

And that Indigenous rights, cast aside for too long, are a key to protecting land and water and preventing climate chaos. America is waking up to new heroes. This is not high-minded romanticism. It is hard-bitten reality. All over the world, there are massive pools of fossil fuels—and the infrastructure to rip and ship it—concentrated in the traditional territories of Indigenous peoples. This rush for extreme energy on their lands was never a new crisis for them—it was only the latest stage in a very old colonial pillage.

Seems ridiculous, but he has support from various tribes and leaders.

• Trump Advisors Aim To Privatize Oil-Rich Indian Reservations (R.)

Native American reservations cover just 2% of the United States, but they may contain about a fifth of the nation’s oil and gas, along with vast coal reserves. Now, a group of advisors to President-elect Donald Trump on Native American issues wants to free those resources from what they call a suffocating federal bureaucracy that holds title to 56 million acres of tribal lands, two chairmen of the coalition told Reuters in exclusive interviews. The group proposes to put those lands into private ownership – a politically explosive idea that could upend more than century of policy designed to preserve Indian tribes on U.S.-owned reservations, which are governed by tribal leaders as sovereign nations.

The tribes have rights to use the land, but they do not own it. They can drill it and reap the profits, but only under regulations that are far more burdensome than those applied to private property. “We should take tribal land away from public treatment,” said Markwayne Mullin, a Republican U.S. Representative from Oklahoma and a Cherokee tribe member who is co-chairing Trump’s Native American Affairs Coalition. “As long as we can do it without unintended consequences, I think we will have broad support around Indian country.” [..] The plan dovetails with Trump’s larger aim of slashing regulation to boost energy production. It could deeply divide Native American leaders, who hold a range of opinions on the proper balance between development and conservation.

The proposed path to deregulated drilling – privatizing reservations – could prove even more divisive. Many Native Americans view such efforts as a violation of tribal self-determination and culture. “Our spiritual leaders are opposed to the privatization of our lands, which means the commoditization of the nature, water, air we hold sacred,” said Tom Goldtooth, a member of both the Navajo and the Dakota tribes who runs the Indigenous Environmental Network. “Privatization has been the goal since colonization – to strip Native Nations of their sovereignty.” Reservations governed by the U.S. Bureau of Indian Affairs are intended in part to keep Native American lands off the private real estate market, preventing sales to non-Indians.

Go Yves!

• Naked Capitalism Demands Retraction, Apology Over WaPo Fake News Story (NC)

As the lawyers like to say, res ipsa loquitur. Please tweet and circulate this letter widely. You will notice that our attorney Jim Moody is a seasoned litigator who has won cases before the Supreme Court. He has considerable experience in First Amendment and defamation actions. Past high profile representations include Westomoreland v. CBS and defending Linda Tripp. I also hope, particularly for those of you who don’t regularly visit Naked Capitalism, that you’ll check out our related pieces that give more color to how the fact the Washington Post was taken for a ride by inept propagandists, particularly our introduction to our spoof PropOrNot.org site, which uses the PropOrNot project as an example of sorely deficient propaganda and shows where it went wrong, or the humor site itself. Be sure not to miss its FAQ.

We have another post today that describes how the few things that are verifiable on the PropOrNot site don’t pan out, as in the organization is not simply a group of inept propagandists but also appears to deal solely in fabrications. If the site is flagrantly false with respect to things that can be checked, why pray tell did the Washington Post and its fellow useful idiots in the mainstream media validate and amplify its message? Strong claims demand strong proofs, yet the Post appeared content to give a megaphone to people who make stuff up with abandon. No wonder the members of PropOrNot hide as much as they can about what they are up to; more transparency would expose their work to be a tissue of lies.

NATO expands in multiple dimensions.

• Russia Remains The Only Target Country Of NATO’s Nuclear Weapons (SC)

For many years before the 2016 Warsaw summit, NATO had been deploying aircraft all round Europe that were capable of delivering nuclear weapons against Russia. The only difference in recent times is that NATO, as recorded by Arms Control in June 2016, «is beefing up its nuclear posture. Polish F-16s participated for the first time on the sidelines of a NATO nuclear strike exercise at the end of 2014. As a clear signal to Russian President Vladimir Putin, four B-52 bombers flew a nuclear strike mission over the North Pole and the North Sea in a bomber exercise in April 2015. Although these planes did not have nuclear weapons on board, they were equipped to carry 80 nuclear air-launched cruise missiles».

It goes further than that, because NATO’s most recent nuclear-associated deployments to the Baltic have involved aircraft from Belgium’s 10th Tactical Wing which is based at Kleine Brogel Air Base and flies US-supplied F-16 nuclear-capable strike aircraft. NATO reported that four of them are currently conducting missions from Ämari Air Base in Estonia, in order «to guard the Baltic skies against unauthorised overflights» and that their duties included «intercepting Russian aircraft flying in international airspace at the Baltic borders». According to NATO, the Mission of the 10th Tactical Wing is «to generate air power effects in the full operational spectrum by putting into action the best combat ready people and equipment to execute or support both conventional and nuclear operations in a joint, national or multinational environment, anytime and anywhere, in the most proficient, safe and efficient manner».

So it sends four of 10 Wing’s nuclear-capable F-16s, flown by nuclear-delivery trained pilots to Estonia to guard the Baltic skies. In Bulgaria, Estonia, Hungary, Latvia, Lithuania, Poland, Romania and Slovakia the Alliance has established «NATO Force Integration Units» which are advanced military headquarters whose Mission is «to improve cooperation and coordination between NATO and national forces, and prepare and support exercises and any deployments needed». The relentless expansion of US-NATO forces right up to Russia’s borders continues apace, with formation of a «new standing Joint Logistic Support Group Headquarters, to support deployed forces».

NATO is on a war footing, and has made it clear that «nuclear weapons are a core component of the Alliance’s overall capabilities». The Belgian F-16 deployments, deliberately and provocatively in a most sensitive area on Russia’s borders, together with creation of advanced military control organisations in eight countries, have been authorised and greeted with approval by western governments whose citizens have little understanding that the west’s policy of confrontation is increasing tension day by day. Russia has no intention of invading any of the Baltic nations, or, indeed, any other country. It has no interest whatever in becoming engaged in conflict that could result only in vast expenditure, no territorial gain of any value, and destruction of much-valued trade and other commercial arrangements.

“..these newspapers and their handmaidens on TV, were far less concerned as to whether the leaked information was true or not..”

• The Deepening Deep State (Jim Kunstler)

Pretty obviously, the struggle between mainstream news and Web news climaxed over the election, with the mainstream overwhelmingly pimping for Hillary, and then having a nervous breakdown when she lost. Desperate to explain the loss, the two leading old-line newspapers, The New York Times and The Washington Post, ran with the Russia-Hacks-Election story — because only Satanic intervention could explain the fall of Ms. It’s-My-Turn / I’m-With-Her. Thus, the story went, Russia hacked the Democratic National Committee (DNC), gave the hacked emails to Wikileaks, and sabotaged not only Hillary herself but the livelihoods of every myrmidon in the American Deep State termite mound, an unforgivable act.

Also interestingly, these newspapers and their handmaidens on TV, were far less concerned as to whether the leaked information was true or not — e.g. the Clinton Foundation donors’ influence-peddling around arms deals made in the State Department; the DNC’s campaign to undermine Bernie Sanders in the primaries; DNC temporary chair (and CNN employee) Donna Brazille conveying debate questions to HRC; the content of HRC’s quarter-million-dollar speeches to Wall Street banks. All of that turned out to be true, of course. Then, a few weeks after the election, the US House of Representatives passed H.R. 6393, the Intelligence Authorization Act for Fiscal Year 2017. Blogger Ronald Thomas West reports:

“Section 501 calls for the government to “counter active measures by Russia to exert covert influence … carried out in coordination with, or at the behest of, political leaders or the security services of the Russian Federation and the role of the Russian Federation has been hidden or not acknowledged publicly.”

The measure has not been passed by the Senate or signed into law yet, and the holiday recess may prevent that. But it is easy to see how it would empower the Deep State to shut down whichever websites they happened to not like. My reference to the Deep State might even imply to some readers that I’m infected by the paranoia virus. But I’m simply talking about the massive “security” and surveillance matrix that has unquestionably expanded since the 9/11 airplane attacks, creating a gigantic NSA superstructure above and beyond the Central Intelligence Agency, the Department of Defense’s DIA, and the hoary old FBI.

They will continue to demand a full hand for every finger given. A road to nowhere for Greece.

• Eurozone Agrees Debt Relief For Greece Amid IMF Row (AFP)

Eurozone finance ministers on Monday approved new debt relief measures to relieve Greece’s colossal debt mountain in the wake of its huge €86 billion bailout, but at levels far short of those demanded by the IMF. “The Eurogroup endorsed today the full set of short-term measures” including extending the repayment period and an adjustment to interest rates, the eurozone’s 19 finance ministers said in a statement. The ministers accorded Athens the small measures to reduce Greece’s debt as a reward for completing the latest round of reforms demanded in the country’s massive bailout programme – its third since 2010. “We will start implementing them in the next weeks,” said Klaus Regling, the head of the European Stability Mechanism, the eurozone’s bailout fund.

However the ministers refused to officially sign off on the bailout’s second review as expected, telling Athens that there still remained a few open questions on Greece’s reform efforts. The talks were marred by a row with the IMF, as Europe and the fund remain as far apart as ever on the level of need for debt relief measures. This is a crucial demand for the fund to back the bailout programme in which for now it plays only a technical role. The hardline stance on debt relief by the ministers, led by Germany’s powerful Wolfgang Schaeuble, comes as key elections approach next year in Germany and the Netherlands, where bailout fatigue is running rife with voters.

Capital flight in thinly veiled disguise.

• Greek Home Sellers Getting Paid In Banks Abroad (Kath.)

The bulk of transactions concerning Greek real estate acquired by foreign nationals are conducted outside the domestic banking system, making it even harder to get a clear idea of the situation in the Greek residential properties market, particularly as regards holiday homes. Estate agents who mainly work with foreign buyers say that the majority of sellers in agreed transactions ask for the money to be deposited in banks abroad. Sellers are even prepared to travel abroad themselves, with contracts in hand, in order to open a bank account.

“After the imposition of the capital controls [at end-June 2015], the cases of sellers requesting that money be deposited abroad have multiplied. Of course such transactions are entirely legitimate and taxed in Greece, but the revenues remain in other countries,” says Yiannis Ploumis, general director at the Ploumis-Sotiropoulos estate agency, which specializes in the luxury property market. That way, the funds paid by foreign property buyers do not enter the Greek credit system or the local economy in general. This trend concerns virtually the entire construction sector, as well as private owners, especially those selling houses of significant value, as transactions of €50,000-100,000 hardly ever lead sellers to open a new bank account abroad.

• Greek Court Rejects Extradition Of 3 Turkish Officers Accused Of Coup (AFP)

A Greek court on Monday rejected the extradition of three military officers demanded by Turkey over their alleged involvement in July’s failed coup, a judicial source said. The decision outraged Ankara, which has arrested tens of thousands of people as part of a wide-ranging crackdown since the attempted putsch. “Greece is in the NATO alliance with Turkey and is a NATO ally. Our expectation is that the Greek government make every effort to return” those individuals to Turkey, Defence Minister Fikri Isik said. The Greek court determined that the three men – out of a total eight officers seeking asylum in Greece – faced threats to their personal safety if returned to Turkey.

It also deemed that Turkish authorities have not provided sufficient evidence tying them to the coup attempt against President Recep Tayyip Erdogan, the source said. The court is expected to decide the fate of the other five officers on Tuesday. Turkey may still appeal the case, and any final decision to extradite rests with the Greek minister of justice. The two Turkish commanders, four captains and two sergeants requested asylum in Greece after landing a military helicopter in the northern city of Alexandroupoli shortly after the attempted government takeover in mid-July. The officers are currently appealing against a Greek refusal to grant them asylum in September.