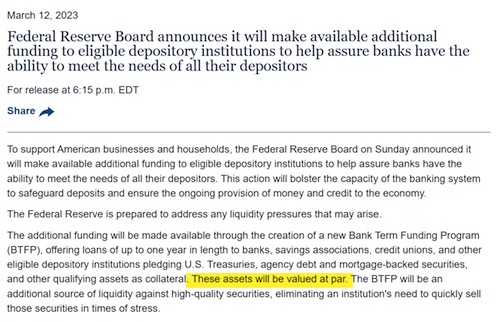

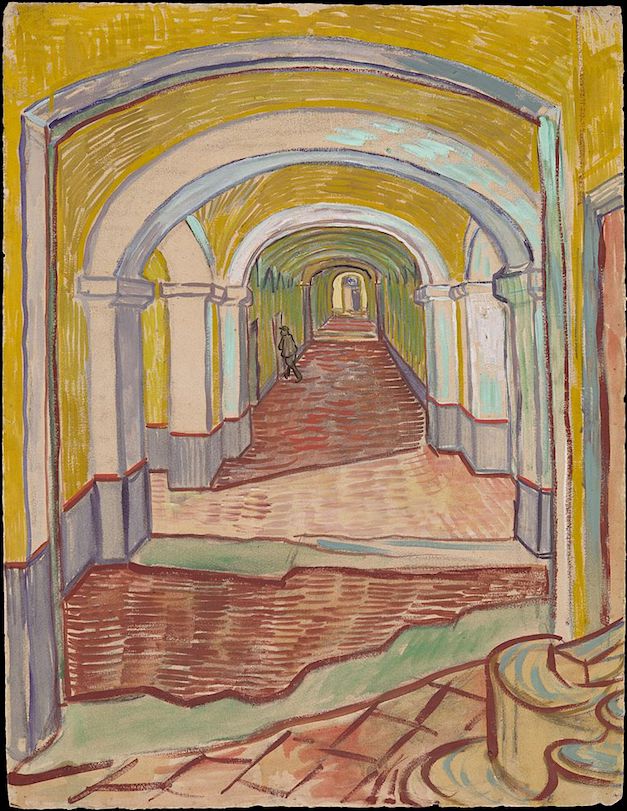

Vincent van Gogh Corridor In The Asylum 1889

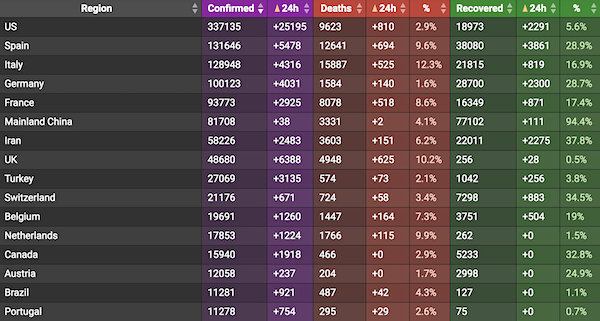

Tucker Macgregor

Douglas McGregor: The truth is that this war was not started by Russia

US cannot afford to go to war with Russia.

Ukrainians are under pressure. Even the Washington Times and the New York Times are finally starting to tell the truth. pic.twitter.com/XknwD3Nnf9

— Ignorance, the root and stem of all evil (@ivan_8848) March 16, 2023

RFK

https://twitter.com/i/status/1634345437560750080

https://twitter.com/i/status/1636441610022993950

Paul Keating

Well said!

"China does not threaten Australia, has not theatrened Australia, does not intend to threaten Australia" – Former Prime Minister of Australia Paul Keating pic.twitter.com/1f0K83ycD2

— Dominic Lee 李梓敬 (@dominictsz) March 16, 2023

Woody Allen?

https://twitter.com/i/status/1636104589299658763

Best I’ve read from Hedges in a while.

“There will come a time when the Ukrainians, like the Kurds, will become expendable. They will disappear, as many others before them have, from our national discourse and our consciousness..”

• Ukraine’s Death by Proxy (Chris Hedges)

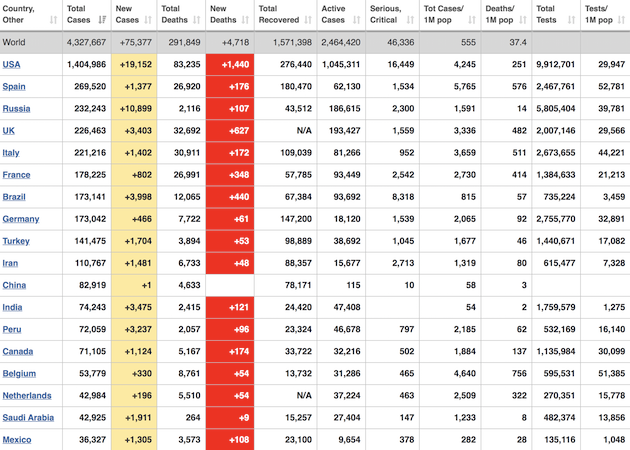

There are many ways for a state to project power and weaken adversaries, but proxy wars are one of the most cynical. Proxy wars devour the countries they purport to defend. They entice nations or insurgents to fight for geopolitical goals that are ultimately not in their interest. The war in Ukraine has little to do with Ukrainian freedom and a lot to do with degrading the Russian military and weakening Vladimir Putin’s grip on power. And when Ukraine looks headed for defeat, or the war reaches a stalemate, Ukraine will be sacrificed like many other states, in what one of the founding members of the CIA, Miles Copeland Jr., referred to as the “Game of Nations” and “the amorality of power politics.”

Should Russia prevail in Ukraine, should Putin not be removed from power, the U.S. will have not only cemented into place a potent alliance between Russia and China, but ensured an antagonism with Russia that will come back to haunt us. The flood of billions of dollars of weapons into Ukraine, the use of U.S. intelligence to kill Russian generals and sink the battleship Moskva, the blowing up of the Nord Stream pipelines and the more than 2,500 U.S. sanctions targeting Russia, will not be forgotten by Moscow. “In a sense, blowback is simply another way of saying that a nation reaps what it sows,” [Chalmers] Johnson writes,“Although people usually know what they have sown, our national experience of blowback is seldom imagined in such terms because so much of what the managers of the American empire have sown has been kept secret.”

Those supported in proxy wars, including the Ukrainians, often have little chance of victory. Sophisticated weapons such as the M1 Abrams tanks are largely useless if those operating them have not spent months and years being trained. Prior to the Israeli invasion of Lebanon in June 1982, the Soviet bloc provided Palestinian fighters with heavy weapons, including tanks, anti-aircraft missiles and artillery. The lack of training made those weapons ineffective against Israeli air power, artillery and mechanized units. The U.S. knows time is running out for Ukraine. It knows that high-tech weapons will not be mastered in time to blunt a sustained Russian offensive. Defense Secretary Lloyd Austin warned in January that Ukraine has “a window of opportunity here, between now and the spring.” “That’s not a long time,” he added.

Victory, however, is not the point. The point is maximum destruction. Even if Ukraine is forced in defeat to negotiate with Russia and concede territory for peace, as well as accept status as a neutral nation, Washington will have achieved its primary goal of weakening Russia’s military capacity and isolating Putin from Europe. [..] There will come a time when the Ukrainians, like the Kurds, will become expendable. They will disappear, as many others before them have, from our national discourse and our consciousness. They will nurse for generations their betrayal and suffering. The American empire will move on to use others, perhaps the “heroic” people of Taiwan, to further its futile quest for global hegemony. China is the big prize for our Dr. Strangeloves. They will pile up even more corpses and flirt with nuclear war to curtail China’s growing economic and military power. This is an old and predictable game. It leaves in its wake nations in ruins and millions of people dead and displaced. It fuels the hubris and self-delusion of the mandarins in Washington who refuse to accept the emergence of a multipolar world. If left unchecked, this “game of nations” may get us all killed.

Assad

https://twitter.com/i/status/1636308180497055744

“The Ukrainians are willing to show they are capable of a counter-offensive and do not want “any damage to their image..”

• ‘Serious Military Developments’ Are Coming In Ukraine Conflict – Envoy (RT)

Ukraine is being plagued by mounting military problems which do not bode well for its fortunes on the battlefield, Russia’s deputy permanent representative to the UN said on Wednesday. Speaking to American journalist Kim Iversen, Dmitry Polyanskiy was asked where he thought the Ukraine conflict was heading, with one possible scenario being NATO’s direct involvement. The diplomat said Moscow would prefer to avoid such an outcome, as a stand-off between the US-led military bloc and Russia “would be dangerous for the whole world.” However, he claimed that the “Ukrainian troops are now in a very poor situation,”pointing to evidence that they “are really suffering heavy losses”. “The new conscripts are being used as cannon fodder after two-three days of training,” the senior diplomat claimed.

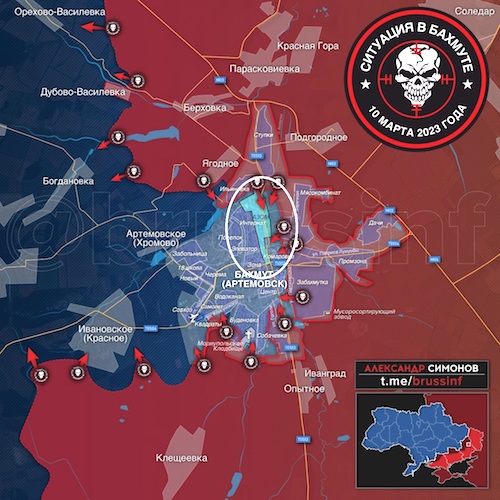

In his view, the “regime” of Ukrainian President Vladimir Zelensky “has become hostage of its own policy and of its promises to Western countries that it is capable of winning militarily over Russia” if it is being supplied with weapons. The Ukrainians are willing to show they are capable of a counter-offensive and do not want “any damage to their image,” which is why the situation around the key Donbass city of Artyomovsk, known as Bakhmut in Ukraine, “is really very bad” for the country, Polyanskiy said. “There are a lot of [Ukrainian] troops that are on the brink of being encircled. Casualties are immense,” the diplomat continued, suggesting that Kiev is throwing in troops “just to support the prestige” of Zelensky and his promises to the West. “The weather conditions are also not in favor of the Ukrainian army, because they can’t use heavy machines for their tasks. So I think we are on the eve of quite serious military developments there, not in favor of Ukraine,”Polyanskiy concluded.

The fight for Artyomovsk, a major foothold and logistics hub for Kiev’s forces, has been raging for months now, with Moscow’s troops recently capturing several villages around the strategic city. Earlier this month, Wagner Private Military Company chief Evgeny Prigozhin claimed that Russian forces were in full control of the eastern part of Artyomovsk. Ukrainian President Vladimir Zelensky has described this battle as “one of the hardest.” On Wednesday, he promised to reinforce the city. Both sides recognize the strategic importance of the city in the Donetsk People’s Republic. Last week, Russian Defense Minister Sergy Shoigu said control over Artyomovsk would allow Moscow’s forces “further offensive actions deep” into Ukrainian defenses, a statement which was largely echoed by Zelensky himself.

Delusion:

“Some US and EU officials now worry that Ukraine is using up “thousands” of shells a day in the battle for Artyomovsk, at a pace that is “unsustainable” and “could jeopardize a planned springtime campaign” that Kiev’s western sponsors “hope will prove decisive..”

• West Warns Ukraine Not To Blow ‘Last Ditch Effort’ – NYT (RT)

A New York Times story on Thursday suggested that the US and its allies are running out of ammunition they can supply to Ukraine, while Kiev is using up the troops and shells that will be needed for a planned spring offensive to fight for Artyomovsk instead. Called Bakhmut by the Kiev authorities, Artyomovsk is now almost entirely surrounded by Russian forces. Ukrainian troops attempting to hold the town are running out of ammunition, the Times reported, with one brigade commander complaining of a “catastrophic shortage” of artillery shells. Some US and EU officials now worry that Ukraine is using up “thousands” of shells a day in the battle for Artyomovsk, at a pace that is “unsustainable” and “could jeopardize a planned springtime campaign” that Kiev’s western sponsors “hope will prove decisive,” according to the Times.

The Pentagon has reportedly even “raised concerns” with Kiev about this, warning Ukraine about “wasting ammunition.” The US and its allies “did not stockpile weaponry in anticipation of supplying an artillery war,” the outlet noted. A “secret British task force” is trying to track down and buy Soviet-caliber ammunition from around the world. The US and NATO have managed to put together some shells, but they are supposed to be used in the upcoming offensive. One Pentagon official described the push as a “last-ditch effort,” because the West does not have enough ammunition to keep up with Ukrainian expenditures. NATO’s own stocks are “critically low” and it will take “many months” for efforts to boost production to have an effect, again according to the Times. Without artillery, the paper explained, “hundreds” of new tanks and armored vehicles that the West is sending Ukraine will have a “limited” effect.

The anonymous officials who spoke to the Times also claimed that Ukrainian casualties have been so severe, with “more than 100,000” troops wounded or killed so far, that Kiev must decide whether to hold onto Artyomovsk or save soldiers for the “one meaningful opportunity this year” to go on the offensive. Though the US has tried to downplay the significance of Artyomovsk, President Vladimir Zelensky has decided to hold the town at seemingly all cost, declaring there is no part of Ukraine that can be abandoned. The only logic of “expending so much blood and ammo” on the town would be to “drain Russia of resources and prevent its troops from heading farther west,” Camille Grand, NATO’s former assistant secretary general for defense investment and now a defense expert at the European Council on Foreign Relations, told the Times. “The alternative is that they got dragged into a situation that, in the long term, plays in Russia’s favor and now it’s difficult to get out of it.”

No troops, no ammo.

• Kiev’s Plan For Counteroffensive Revealed In Media Report (RT)

Washington expects Kiev to launch a counterattack against Russian troops in May, using the weapons that NATO countries have been sending to Ukraine, Politico reported on Wednesday, citing unnamed US officials. US military aid packages “going back four or five months have been geared toward what Ukraine needs for this counteroffensive,” one source cited by the outlet said on condition of anonymity. Kiev is preparing the operation even as its manpower and resources are being drained, Politico reports, by its continued clinging to the Donbass city of Artyomovsk, which it calls Bakhmut. The city, which senior US officials assessed has only symbolic significance, became the scene of some of the most intensive fighting between Russia and Ukraine this year.

While both sides reportedly suffered significant casualties fighting for Artyomovsk, Kiev lost some of its most experienced troops, Politico said. US officials have suggested that Ukraine should pull out of the city, which President Vladimir Zelensky declared a fortress. With the advice unheeded, America is now urging Ukrainian troops to conserve artillery munitions, the report explained. According to the outlet, Kiev is yet to settle on a strategy for its counteroffensive. One scenario involving a push across the Dnieper River near the city of Kherson is “not realistic,” US officials believe, since Ukraine does not have the manpower for an amphibious operation of that kind. The second one would require advancing from the north in an attempt to cut off Russian troops from Crimea.

The US has been stressing that it was up to Zelensky and the Ukrainian leadership to decide how exactly they would conduct a military operation. But senior American generals hosted Ukrainian officials in Wiesbaden, Germany this month to help them with wargaming the upcoming operation, Politico’s report notes. There has also been an effort to train Ukrainian troops in NATO tactics to replenish battlefield losses. Russia believes that the Ukrainian conflict is a US proxy war against it, with Ukrainian soldiers serving as cannon fodder. Moscow said Washington prevented Kiev from signing a peace agreement with Russia in the first months of the conflict, telling Zelensky to continue fighting instead.

Not willing to admit defeat.

• In Ukraine, US Focused On Delivering Weapons, Not Diplomacy – Blinken (TASS)

At present, the United States prefers providing weapons and military equipment to the Kiev government over reconciliation-themed diplomatic contacts with Russia, US Secretary of State Antony Blinken said on Thursday. In Blinken’s opinion, “there has to be a just and durable peace” in Ukraine. “Just in the sense that it reflects the principles of the United Nations Charter. If it’s a peace that allows Russia to keep all the territory seized by force, that’s not justice,” the secretary of state said. He also explained that by ‘durable,’ he implied “that no one wants to see Russia repeat this a year or two or three years later.”

“With those principles in mind, every day we are looking for ways to see if we can bring the war to an end. I see no evidence that right now Russia is interested in a diplomatic resolution and negotiation that would end this war,” Blinken told reporters during his visit to Niger’s capital Niamey. “And so the quickest way to end it is to continue to support Ukraine so that it is strong on the battlefield <…> so that hopefully, at some point, Mr. Putin recognizes the reality that this has to stop, that he’s not going to succeed. And he’s prepared for diplomacy and for negotiation. When that day comes we’ll be the first to engage to try to end things. But as I said, in this moment, at least, I don’t see any evidence of that,” he said.

The US top diplomat is now on an African tour that includes Ethiopia and Niger. His press conference was broadcast live via the Department of State’s official YouTube channel. Russian Foreign Minister Sergey Lavrov said earlier that Moscow was still ready for negotiations on Ukraine. He said Russia will listen to the West’s proposals if it suggests discussing ways to ease tensions that take Moscow’s interests into account. Kremlin spokesman Dmitry Peskov said Ukraine-themed negotiations should be conducted with Washington in the first place.

Bolton will claim that NATO lost because they didn’t go all in.

• Moscow Spooked NATO From Going All In For Ukraine – John Bolton (RT)

Russia intimidated NATO nations, stopping them from giving Ukraine the weapons it needed and allowing it to attack any targets it wanted, including key European infrastructure, US arch-hawk John Bolton has claimed. That must change, he added, urging President Joe Biden to change his policies. “[Russian President] Vladimir Putin has masterfully deterred NATO from responding robustly enough to end the conflict promptly and victoriously. Time to solve this problem is growing short,” Bolton wrote in an opinion piece published by the Wall Street Journal on Wednesday. The former national security adviser to President Donald Trump blamed Biden for failing to aim for “ambiguous goals” and claimed his “fear of Russian escalation” had led to a military gridlock in Ukraine.

The current president “barely tried” to prevent the Russian military operation, Bolton argued, before criticizing the reported limitations imposed by Washington in terms of which targets Kiev can attack with the weapons it gets from the West. “NATO pressures Ukraine not to strike inside Russia, and to spare key assets like Nord Stream, whereas the Kremlin can strike anywhere within Ukraine,” he wrote. Nord Stream comprises two undersea gas pipelines, which were built to deliver Russian natural gas directly to Germany. They were blown up in September. Bolton mentioned claims in the Western press, which said US intelligence suspected that a “pro-Ukrainian group” not connected with any government had carried out the sophisticated operation. Even if Kiev ordered the attack, he said, it should not impact the level of support it gets.

According to Bolton, debates in NATO on whether to deliver longer-range ATACMS missiles or F-16 fighter jets to Kiev “reflect a disjointed strategy” and harm Ukraine’s war effort. He said it was clear to him that “fears of Russian escalation are unwarranted.” Bolton is a lifelong advocate for using US hard power against other nations, including nuclear powers Russia and China. US political observers suggest that he may seek the Republican nomination for president in the 2024 election. Fox News host Tucker Carlson included him on a list of GOP candidates to whom he sent a questionnaire on the Ukraine conflict to get them on record. One question was whether the US should support regime change in Russia. Bolton failed to respond, Carlson said during his show on Monday.

Scott Ritter Loses It Over Lindsey Graham’s Mindless Warmongering

“..Washington and Brussels can only guess the extent of Ukraine’s losses, as Kiev keeps this information secret even from its Western backers, who have provided it with billions of dollars’ worth of weapons..”

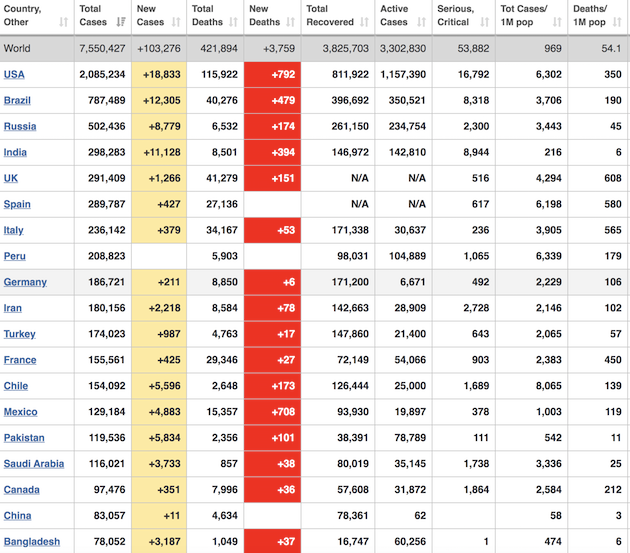

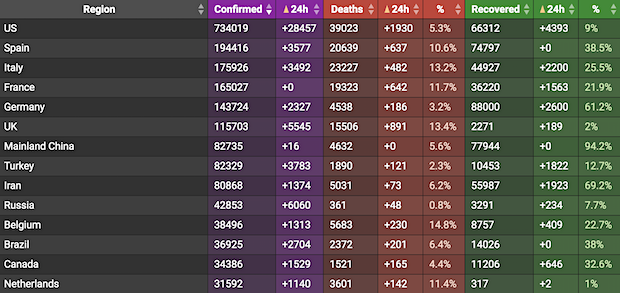

• US Estimates ‘Upwards’ Of 100,000 Ukrainian Soldiers Killed – Politico (RT)

US officials estimate that more than 100,000 Ukrainian troops have been killed since the outbreak of the conflict with Russia last February, Politico has reported, without disclosing its sources. Washington is concerned by Kiev’s lack of ammunition, air defenses and experienced soldiers in the run-up to a major Ukrainian offensive expected later in spring, the US news website said in a report on Wednesday. “Upwards of 100,000 Ukrainian forces have died in the year-long war, US officials estimate, including the most experienced soldiers,” Politico wrote. “Many of these losses are taking place in Bakhmut,” it added. The city, which Russia calls Artyomovsk, is a key Ukrainian stronghold and logistics hub in the People’s Republic of Donetsk.

Russian forces have been advancing on Artyomovsk since August last year, and, according to Wagner Private Military Company chief Evgeny Prigozhin, have now almost fully encircled the city and taken control of its eastern part. Ukrainian President Vladimir Zelensky has repeatedly insisted that he will not surrender Artyomovsk, despite reports of tensions with US officials, who have allegedly urged Kiev to withdraw and cut its losses. Earlier this week, Zelensky again said that that the defense of the key city would be reinforced. On Monday, the Washington Post reported: “US and European officials have estimated that as many as 120,000 Ukrainian soldiers have been killed or wounded since the start of Russia’s invasion early last year.”

Politico pointed out that Washington and Brussels can only guess the extent of Ukraine’s losses, as Kiev keeps this information secret even from its Western backers, who have provided it with billions of dollars’ worth of weapons. Speaking after Wednesday’s virtual meeting of the multinational Ukraine Defense Contact Group, US Defense Secretary Lloyd Austin said, “Ukraine doesn’t have any time to waste.” “We have to deliver swiftly and fully on our promised commitments” to Kiev, including supplies of “armored capabilities,” training for Ukrainian troops, spare parts and other things, he urged.

Last week, Russia’s Defense Minister Sergey Shoigu announced that Ukraine has lost at least 11,000 troops during the fighting in February. The number of killed and wounded on the Ukrainian side had risen by more than 40% since January when it stood at 6,500, he added. “The support of the Kiev regime by NATO countries doesn’t lead to the success of the Ukrainian troops on the battlefield. On the contrary, there is a significant increase in losses among the personnel of the Armed Forces of Ukraine,” the minister said. Shoigu last provided an estimate of Ukraine’s casualties in the conflict back in September. At the time, he said that they amounted to more than 100,000, with at least 61,000 troops killed and almost 50,000 wounded.

One road is still open.

• Kiev Has No Plans To Leave Bakhmut – DPR Head (TASS)

Kiev has no plans to withdraw troops from the city of Artyomovsk (called Bakhmut in Ukraine) even though it is facing issues with ammunition supplies, Acting Head of the Donetsk People’s Republic (DPR) Denis Pushilin said on Thursday. “As for Artyomovsk, the situation remains difficult and complicated. I mean that we don’t see any signs of the enemy planning to simply withdraw troops,” he told the Rossiya-24 TV channel. Pushilin added, however, that “it’s extremely difficult to supply ammunition and food or bring in any reinforcements” along the only road that is now “under even tighter fire control by the Wagner PMC.” The Donetsk leader also said that fighting had moved to the industrial zone, with battles taking place both in the southern and northern parts of the city. According to Pushilin, Ukraine has amassed forces in the city of Chasov Yar.

Artyomovsk, located in the Kiev-controlled part of the Donetsk People’s Republic, is an important transport hub in terms of Ukrainian military supplies. Heavy fighting is raging in the area. According to the latest reports, all paved roads to the city have either been cut off or have come under fire control by Russian artillery, while the spring mud season is seriously impeding the delivery of ammunition and reserves to the entrenched Ukrainian forces. Founder of the Wagner Private Military Company Yevgeny Prigozhin said on March 11 that Russian forces were about 1.2 kilometers from the city’s administrative center.

“If you cannot give a comment after the monks made a direct appeal to the international community in several languages, Stephane, then you should probably admit being biased..”

• Russia May Question UN Secretariat Impartiality On Ukraine – Zakharova (TASS)

The United Nations Secretariat needs to be more balanced in how it treats information with regard to the Ukraine issue, otherwise Russia will question its impartiality at a session of the General Assembly’s Committee on Information, Russian Foreign Ministry Spokeswoman Maria Zakharova wrote on Telegram on Thursday. Earlier, the UN secretary general’s spokesperson Stephane Dujarric said that the Secretariat was unable to comment on the Ukrainian authorities’ demand that monks affiliated with the Ukrainian Orthodox Church leave the Kiev-Pechersk Lavra monastery. “If you cannot give a comment after the monks made a direct appeal to the international community in several languages, Stephane, then you should probably admit being biased in order not to frame the United Nations because it means either a complete loss of qualifications or that there is a political agenda in place. Regularly saying that you don’t know anything about developments in Ukraine, while your chief visits Kiev on a regular basis (the last trip taking place as recently as March 8), means causing distrust in the UN and its Secretariat,” Zakharova pointed out.

On March 10, an eviction notice from the acting director general of the Kiev-Pechersk Lavra Historical and Cultural Reserve (subordinate to the Ukrainian Culture Ministry) was published on the monastery’s website, stating that monks affiliated with the canonical Ukrainian Orthodox Church must leave the Holy Dormition Kiev-Pechersk Lavra by March 29, when the current lease expires. According to the document, a working group that identified a violation of the lease terms had been created by Ukrainian President Vladimir Zelensky’s decree. Father Superior of the Kiev-Pechersk Lavra Metropolitan Pavel said on March 13 that the monks would not comply with the order to leave the monastery. On March 14, Russian Foreign Minister Sergey Lavrov sent letters to UN Secretary General Antonio Guterres and OSCE Chairperson-in-Office Bujar Osmani, urging them to demand that Kiev stop its arbitrariness against the canonical Ukrainian Orthodox Church. Dujarric said in response to a TASS request for comment on Lavrov’s letter that the UN chief believed every country should ensure religious freedom and protect religious sites.

“..the political systems in many countries “often bring people to prominence who have a rather low level of education and general cultural awareness..”

• Label ‘Unfriendly Countries’ More About Elites Than Countries – Putin (TASS)

Russian President Vladimir Putin has termed the phrase ‘unfriendly countries’ inexact and incorrect, because it is not so much the countries themselves but rather their elites or leaders that are unfriendly. “The phrase ‘unfriendly countries’ has entered the public consciousness and into common usage here. But, it does not accurately reflect existing realities. You could say that it doesn’t reflect the reality at all, because what we have are unfriendly elites in a certain number of countries, unfriendly rulers,” Putin stated at the congress of the Russian Union of Industrialists and Entrepreneurs (RSPP) on Thursday.

He lamented the fact that the political systems in many countries “often bring people to prominence who have a rather low level of education and general cultural awareness; at times they do not understand what they say and do.” “The result, as is well known, is clear for all to see. Their activities are detrimental to their own people and to their own businesses,” the president stressed.

“According to Putin, well-timed investment decisions today will pay off a hundredfold tomorrow..”

• Desperate West Will Turn To Russia For Turnips – Putin (RT)

The Russian economy is now developing in a new way, with GDP expected to grow as soon as the second quarter of this year, President Vladimir Putin said on Thursday. Speaking at a plenary session of the Congress of the Russian Union of Industrialists and Entrepreneurs (RSPP) in Moscow, Putin said the country has managed to fully compensate for the loss of access to Western markets. According to the head of state, Russia’s foreign trade grew by more than 8% last year, while last year’s trade surplus hit $332 billion. The president noted that former European partners are trying “to convince everyone of the imminent collapse of the Russian economy,” even though EU inflation rates are higher.

Inflation in Russia is expected at around 4%, while retail growth is projected to reach 5% in April, thanks to a stable labor market, lower inflation and higher wages, according to the president. “A year ago, Western governments twisted the arms of their companies, forcing some of them, many of them, to leave the Russian market, then foreign analysts predicted a depression and a decline in the consumer sector for us, promised empty store shelves, a massive shortage of goods, and the failure of the service sector,” the Russian leader said.

However, according to Putin, life took a different turn, with Western countries now urging their people to eat turnips instead of fruit and vegetables. “Turnips are a good product, but you will probably have to turn to us [Russia] for turnips too, because our crop level still significantly exceeds those of our neighbors in Europe,” he joked. The Russian president also urged Russia’s billionaires to invest in new technology, production facilities and enterprises to help overcome what he called Western attempts to destroy the national economy. According to Putin, well-timed investment decisions today will pay off a hundredfold tomorrow.

https://twitter.com/i/status/1636536713664143360

They won all 11 provinces. Next, do Caada.

• Dutch Farmers’ Protest Party Scores Big Election Win, Shaking Up Senate (R.)

A farmers’ protest party shook up the political landscape in the Netherlands on Wednesday, emerging as the big winner in provincial elections that determine the make-up of the Senate. The BBB or BoerBurgerBeweging (Farmer-Citizen Movement) party rode a wave of protests against the government’s environmental policies and looked set to have won more Senate seats than Prime Minister Mark Rutte’s conservative VVD party. A first exit poll projected BBB won 15 of a total of 75 seats in the Senate, which has the power to block legislation agreed in the Lower House of parliament, with the VVD dropping from 12 to 10 seats. The meteoric rise of BBB is a major blow for Rutte’s governing coalition, casting doubt over its aim to drastically cut nitrogen pollution on farms, the single issue upon which BBB was founded in 2019.

“Nobody can ignore us any longer,” BBB leader Caroline van der Plas told broadcaster Radio 1. “Voters have spoken out very clearly against this government’s policies.” The government aims to cut nitrogen emissions in half by 2030, as relatively large numbers of livestock and heavy use of fertilizers have led to levels of nitrogen oxides in the soil and water that violate European Union regulations. The nitrogen problem has crippled construction in the Netherlands as environmental groups have won a string of court cases ordering the government to limit the emissions and preserve nature, before new building permits can be granted. The BBB says the problem has been exaggerated and that proposed solutions are unfairly balanced against farmers, leading to the closure of many farms and food production shortages.

Rutte’s government has not had a Senate majority since the previous provincial elections in 2019 and must negotiate deals with mostly left-wing opponents. The two most cooperative parties, Labour and GreenLeft, looked set to have held on to their seats, keeping their combined group at a par with BBB and possibly enough to maintain support for Rutte’s policies. BBB won a single Lower House seat in 2021, but its popularity has surged on the back of growing distrust of the government and anger over issues such as immigration. Rutte’s government, in its fourth consecutive term since 2010, has dropped to a 20% approval rating, its lowest in a decade.

Why do we get a new leak every day from Comer? What’s the use?

• Hallie Biden Revealed As ‘New’ Biden Family Member Who Got China Cash (NYP)

President Biden’s daughter-in-law Hallie is the mysterious “new” Biden family member who got paid Chinese cash in 2017, House Oversight Committee Chairman James Comer revealed exclusively to The Post Thursday. Comer said the payments to first son Hunter Biden’s sister-in-law-turned-former lover were revealed in subpoenaed bank records. The records show Hallie Biden received $35,000 over two transfers in 2017 from Biden family associate Rob Walker, who got $3 million on March 1, 2017, from State Energy HK Limited, a firm affiliated with CEFC China Energy. President Biden, who allegedly was the “big guy” mentioned in communications about the same Chinese venture, dined at Hallie Biden’s residence last Friday during his regular weekend trip home to Delaware.

It’s unclear if they discussed the looming bombshell, which Comer (R-Ky.) publicly teased Monday night on Fox News’ “Hannity.” One transfer to Hallie from Robinson Walker LLC was for $25,000 on March 20, 2017, Comer’s staff wrote in a Thursday morning memo to committee members. Another $10,000 was transferred on Feb. 13 — raising “many questions” according to a committee aide because it came shortly before, rather than after, the $3 million haul. The information creates an unexpected new avenue for investigation — and the memo notes the bank records don’t include the first names of all Biden family recipients, meaning there may be others involved, in addition to Hunter Biden and first brother James Biden.

Hallie Biden is the widow of Beau Biden, who died of brain cancer in 2015, and the mother of two of the president’s grandchildren, Natalie and Robert Hunter. She dated the president’s other son, Hunter, from around 2016 to 2019, a timeframe that included the Chinese dealings. “Democrats described our subpoena as providing nothing more than records for Papa John’s and Starbucks, but they failed to mention the records we’ve received documenting the Biden family’s business schemes,” Comer told The Post, referring to committee ranking member Rep. Jamie Raskin’s disclosure of the subpoenas this week. “Over the course of several years, members of the Biden family and their companies received over $1.3 million in payments from accounts related to their associate, Rob Walker,” Comer said.

“Most of this money came as a result of a wire from a Chinese energy company and went not only to Hunter and James Biden but also to Hallie Biden and an unknown ‘Biden.’” Comer added, “It is unclear what services were provided to obtain this exorbitant amount of money.” More than a third of the $3 million that Walker’s firm received was forwarded to Biden family associate James Gilliar and “almost the exact same amount,” $1,065,000, was distributed among Biden family members over three months, the committee memo says.

https://twitter.com/i/status/1636549045509406721

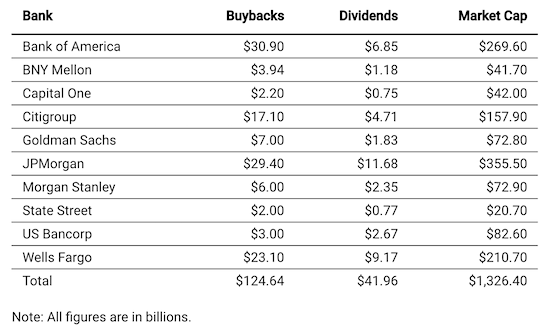

“They are sold as insurance against risk, which is passed off to the counterparty to the bet. But the risk is still there..”

• The Looming Quadrillion Dollar Derivatives Tsunami (Ellen Brown)

In 2002, mega-investor Warren Buffett wrote that derivatives were “financial weapons of mass destruction.” At that time, their total “notional” value (the value of the underlying assets from which the “derivatives” were “derived”) was estimated at $56 trillion. Investopedia reported in May 2022 that the derivatives bubble had reached an estimated $600 trillion according to the Bank for International Settlements (BIS), and that the total is often estimated at over $1 quadrillion. No one knows for sure, because most of the trades are done privately.

As of the third quarter of 2022, according to the “Quarterly Report on Bank Trading and Derivatives Activities” of the Office of the Comptroller of the Currency (the federal bank regulator), a total of 1,211 insured U.S. national and state commercial banks and savings associations held derivatives, but 88.6% of these were concentrated in only four large banks: J.P. Morgan Chase ($54.3 trillion), Goldman Sachs ($51 trillion), Citibank ($46 trillion), Bank of America ($21.6 trillion), followed by Wells Fargo ($12.2 trillion). Unlike in 2008-09, when the big derivative concerns were mortgage-backed securities and credit default swaps, today the largest and riskiest category is interest rate products.

The original purpose of derivatives was to help farmers and other producers manage the risks of dramatic changes in the markets for raw materials. But in recent times they have exploded into powerful vehicles for leveraged speculation (borrowing to gamble). In their basic form, derivatives are just bets – a giant casino in which players hedge against a variety of changes in market conditions (interest rates, exchange rates, defaults, etc.). They are sold as insurance against risk, which is passed off to the counterparty to the bet. But the risk is still there, and if the counterparty can’t pay, both parties lose. In “systemically important” situations, the government winds up footing the bill.

Like at a race track, players can bet although they have no interest in the underlying asset (the horse). This has allowed derivative bets to grow to many times global GDP and has added another element of risk: if you don’t own the barn on which you are betting, the temptation is there to burn down the barn to get the insurance. The financial entities taking these bets typically hedge by betting both ways, and they are highly interconnected. If counterparties don’t get paid, they can’t pay their own counterparties, and the whole system can go down very quickly, a systemic risk called “the domino effect.”

That is why insolvent SIFIs had to be bailed out in the Global Financial Crisis (GFC) of 2007-09, first with $700 billion of taxpayer money and then by the Federal Reserve with “quantitative easing.” Derivatives were at the heart of that crisis. Lehman Brothers was one of the derivative entities with bets across the system. So was insurance company AIG, which managed to survive due to a whopping $182 billion bailout from the U.S. Treasury; but Lehman was considered too weakly collateralized to salvage. It went down, and the Great Recession followed.

They cover for each other. That’s the best the US can do in 2023. Feel lucky, punk?

• Big Banks Inject $30 Billion Unsecured Deposit In First Republic Bank (ZH)

The following statement was released by Secretary of the Treasury Janet L. Yellen, Federal Reserve Board Chair Jerome H. Powell, FDIC Chairman Martin J. Gruenberg and Acting Comptroller of the Currency Michael J. Hsu. “Today, 11 banks announced $30 billion in deposits into First Republic Bank. This show of support by a group of large banks is most welcome, and demonstrates the resilience of the banking system.” This bailout is very similar to the 1998 bailout of LTCM when fourteen banks and brokerage firms invested $3.6 billion in Long-Term Capital Management L.P. (LTCM) to prevent the firm’s imminent collapse; the bailout was orchestrated by – but did not involve – Fed funding. That said, LTCM was a hedge fund, and was not a direct competitor.

Rickards: This Is The Biggest Bailout In History

The bailout is also very different to what happened when Bear Stearns collapsed, as the Big Banks again tried, but refused to save Bear in 2008. And now they have agreed to inject $30BN in the form of unsecured deposits in First Republic, effectively backstopping the entire capital structure and making the equity money good, because they have explicitly guaranteed that no matter how bad the deposit run is, they will keep the bank funded (using deposits that just a few days ago may have been parked at First Republic). The next question: why did the banks agree to this? Was it guilt that banks such as SIVB and SBNY collapsed because of their actions/behind the scenes negotiations with regulators?

We don’t know, but Wall Street is hardly known for being a good Samaritan, and if given the choice, banks would have opted to wait until the bankruptcy and pick choice assets for pennies on the dollar. As one might expect, First Republic executives are relieved and expressed their thanks: “We would like to share our deep appreciation for Bank of America, Citigroup, JPMorgan Chase, Wells Fargo, Goldman Sachs, Morgan Stanley, Bank of New York Mellon, PNC Bank, State Street, Truist, and U.S. Bank. Their collective support strengthens our liquidity position, reflects the ongoing quality of our business, and is a vote of confidence for First Republic and the entire U.S. banking system”

Big Suit

Love this.

DAVID BYRNE #StopMakingSense2023 pic.twitter.com/Vd0yOYnBaz

— Michael Warburton (@MichaelWarbur17) March 16, 2023

English guy explains in 2 minutes how he beat Starbucks ‘Cashless policy’

Use cash wherever you can people – it’s that simple.#Cash #DigitalID #wef2030agenda pic.twitter.com/dKi7XpRPCf

— Concerned Citizen (@cotupacs) March 15, 2023

Lyrebird

Lyrebirds are Australian birds most notable for their superb ability to mimic natural and artificial sounds from their environment (and other environments, if it's the case)

[full video by Saeed Lajami: https://t.co/1hjnGVbT8P]pic.twitter.com/LUaeF1aWKh

— Massimo (@Rainmaker1973) March 16, 2023

Tarsier

Photographer Joel Sartore captured this footage of a Horsfield’s tarsier at Taman Safari in Indonesia. It's a carnivorous, nocturnal species of tarsier living in Borneo and Sumatra

[read more: https://t.co/sbuNAlBY4T]

[source: https://t.co/0z9jjR0wcD]pic.twitter.com/inw2r0fym3— Massimo (@Rainmaker1973) March 16, 2023

Mancini – Moon River

The iconic & beautiful opening titles featuring Henry Mancini’s exquisite ‘Moon River’

BREAKFAST AT TIFFANY’S (1961)#AudreyHepburn

— Michael Warburton (@MichaelWarbur17) March 16, 2023

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.