DPC Cab stand at Madison Square, NY 1900

And January’s not over. 11 more months like that and we might land at a nice round number.

• Nearly $8 Trillion Wiped Off World Stocks In January (Reuters)

World stock market losses are approaching $8 trillion so far this year and investors last week poured the most money into government bond funds in a year, suggesting they fear the global economy could tip into recession, Bank of America Merrill Lynch said on Friday. The bank’s U.S. economists also said on Friday that the likelihood of the world’s largest economy entering a recession in the coming year has risen to 20% from 15%. While a repeat of the 2008-09 great recession “is a big stretch” and even the one-in-five chance of a normal recession remains low, they cut their 2016 growth forecast to 2.1% from 2.5%. Reflecting the increasingly bearish sentiment engulfing world markets, some $7.8 trillion was wiped off the value of global stocks in the three weeks to Jan. 21, BAML said.

“We cannot rule out a recession in the next year. Accidents will happen, and we are concerned about the lack of policy ammunition to deal with a major shock,” economists Ethan Harris and Emanuella Enenajor said in a note on Friday. “However, when markets are in such a fragile state there is a temptation to lose sight of the economic fundamentals. To us, the economy is okay and recession risks are low,” they said. Stocks around the world have had one of their worst Januarys on record, with slumping oil prices, deepening concern over China, and the Federal Reserve’s first interest rate hike in a decade all spooking investors. A recession is typically defined as two consecutive quarters of economic contraction.

The U.S. economy ground to a virtual standstill in the fourth quarter of last year, according to many estimates, and the manufacturing sector is already in recession. Earlier this week, economists at Citi said the risk of a global recession was rising, Morgan Stanley put the probability at 20% in a worst case scenario, and French bank Societe Generale said it was 10% and rising.

Not that hard to believe at all.

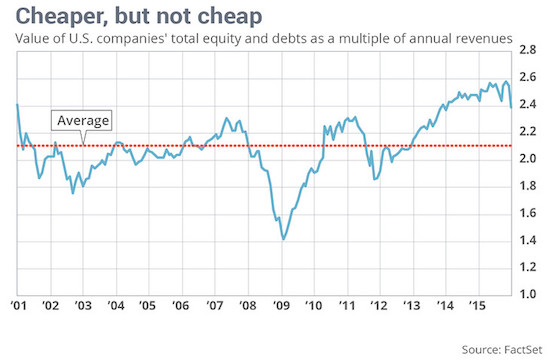

• Dow Could Fall 5,000 Points And Still Not Be ‘Cheap’ (MW)

Hard to believe, but the Dow Jones Industrial Average could fall by another 1,000 to 5,000 points and still not be “cheap” compared with long-term stock-valuation measures. That’s the stark conclusion from an analysis comparing current stock prices to underlying measures such as per-share revenue, earnings and corporate net worth. And it suggests that even if we are now overdue for a short-term bounce or rally of some kind, buying heavily into the latest sell-off isn’t the kind of one-way bet that value investors crave. Stocks are certainly much cheaper than they were a few weeks ago. After the worst start to a new year in Wall Street history, the Dow Jones Industrial Average is down about 10% since Jan. 1. Small-company stocks are now deep in a bear market after falling more than 20% from last spring’s highs.

But cheaper doesn’t necessarily mean cheap. Even after the sell-off, U.S. stocks are valued at around 1.4 times annual per-share revenue. FactSet says the average since 2001, when it began tracking the data, is 1.3 times revenue. So the Dow could fall another 7%, or over 1,000 points, and still be no lower than its modern-day average. And the picture looks even worse when you also add in those companies’ soaring debts. According to the Federal Reserve, nonfinancial corporations have increased their total debts since 2007 from $6.3 trillion to over $8 trillion. As FactSet says, total shares plus total debts — the so-called “enterprise value” — of U.S. public companies are now 2.4 times annual per-share revenue, compared with an average of 2.1 times since 2001.

Data from the U.S. Federal Reserve, meanwhile, say U.S. nonfinancial corporate stocks are now valued at about 90% of the replacement cost of company assets, a metric known as “Tobin’s Q.” But the historic average, going back a century, is in the region of 60% of replacement costs. By this measure, stocks could fall by another third, taking the Dow all the way down toward 10,000. (On Wednesday it closed at 15,767.) Similar calculations could be reached by comparing share prices to average per-share earnings, a measure known as the cyclically adjusted price-to-earnings ratio, commonly known as CAPE, after Yale finance professor Robert Shiller, who made it famous.

Draghi has made himself irrelevant.

• Mario Draghi Denies The ECB Bazooka Is Empty (AEP)

The ECB has ample ammunition to fight a fresh global downturn and is ready to act decisively to stave off deflation if necessary, Mario Draghi has assured nervous investors in Davos. The ECB’s president sought to play down the violent market squall of recent weeks, insisting that Europe’s economic recovery is well on track and may even accelerate as the refugee crisis leads to a surge of fiscal spending. “We have plenty of instruments. We have the determination, and the willingness of the governing council to act and deploy these instruments,” he said, speaking at the World Economic Forum. Signs that the ECB is preparing a fresh blast of stimulus have halted the increasingly ominous slide in global equities, but there are fears that the bounce of the last two days may soon fade.

Monetary experts fear that the law of diminishing returns for quantitative easing is setting in and that ever-more extreme measures by central banks are creating insidious new risks. Axel Weber, the former Bundesbank chief and now head of UBS, said the balance of advantage had already turned negative. “There is a very clear limit to what the ECB can achieve. The problem is that monetary policy has largely run its course,” he said in Davos. “The side effects of the medicine are getting stronger and stronger: the curative effects are getting weaker and weaker,” he said, adding that the current turmoil in the markets is the first taste of the hangover, evidence of the price we may have to pay. Mr Weber said the ECB was likely to keep pushing interest rates deeper in negative territory but this could backfire: “There is a big risk that it may actually drive cash out of the economy.”

Benoit Coeure, France’s member of the ECB executive, insisted that the latest stimulus measures have been a success. “QE is working. We’ve seen a tremendous improvement on European capital markets. Borrowing costs for companies have come down by 80 basis points, and 140 points for Italy,” he said. “We’re mindful of the consequences of monetary policy. But we’re not going to have a conversation next month on tapering or exiting the low-rates policy because that is in the best interest of Europe.” Mr Draghi said a mix of monetary stimulus, cheap oil, and the end of fiscal austerity was finally powering a lasting pick-up in European growth. “All these drivers should ensure a continuation of the recovery. I don’t think there is any reason to think things have changed,” he said.

The great unknown is whether the refugee crisis mushrooms out of control and further destroys confidence in Europe, or whether it acts as a ‘positive economic shock’ and a catalyst for change. “It could turn out to be the largest public expenditure we’ve had for a number of years. Our society will be changed by this. In which direction, we can only guess,” he said. There are already signs of a tectonic shift. Wolfgang Schauble, Germany’s finance minister, called for a multi-billion euro “Marshall Plan” to blanket the North Africa and most vulnerable areas of the Middle East with investment. He also called for a “coalition of the willing” to confront the migrant crisis head on before it causes the European project to unravel. “We can no longer wait for Brussels,” he said.

“China is the epicenter of the looming crisis. China in today’s cycle is what US housing was during the financial crisis in 2008.” “Since one and a half years China is doing everything wrong. It started with the government trying to prop up the stock market. China wanted to attract money from abroad in order to stem the capital outflows. However, this was contrary to the fundamentals as company earnings were falling during the entire bull market. That’s why it collapsed under its own weight in the end.”

• Felix Zulauf: The Era Of QE Is Over (FuW)

According to macro strategist Felix Zulauf, founder and president of Zulauf Asset Management and Vicenda Asset Management in Zug, the almost seven-year-old bull market is over. China is to the current cycle what the US housing market was for the Global Financial Crisis in 2008. It will take years to correct the excesses that were built up in China.

Mr. Zulauf, the markets had a terrible start into the new year. Is the almost seven-year old equity bull market over? Yes, the bull market came to an end last spring. A new bear market has begun. The coming downturn will be proportional to the excesses that were built up during the boom years. The bull market lasted for a very long time and was primarily fuelled by monetary excesses. And these excesses will now be corrected. And bear in mind, there is no longer any backstop for markets.

What do you mean? In the past, investors could count on the Fed to bail them out – the Greenspan and Bernanke Put, if you will. Now, however, the US central bank – and it’s still the world’s most important central bank – is keen on raising interest rates. It wants to normalize monetary policy and to end quantitative easing. As a consequence, a sudden about-turn in the Fed’s policy is unlikely.

How big a correction do you expect? A typical bear market in the US since the Second World War was about 23%. However, this time around I expect a more vicious downdraft. I expect the S&P 500 to drop to a range of 1200 to 1400 – right now the index stands at about 1870. Compared to its all-time high that’s a correction of almost 50%. The German Dax could fall to around 7000, while the Swiss Market Index will see a similar down-leg. There is a real chance of a bigger correction than many investors realize. This is particularly true when there is a weak economy – which I expect.

Do you think the Fed will continue to raise interest rates? Hardly. I think that the December rate hike will remain the only increase in this cycle and that there will be no additional moves. Depending on how severe the impact of the falling stock market will be on the economy, the Fed might even reverse their rate hike. That could happen towards the end of this year or at the beginning of 2017. The US economy could cool much more rapidly than many expect.

What makes you think that? Right now, inventories both in the US but also in many Asian economies are much higher than usual. If sales do not increase materially from current levels – and that is my base case – companies are forced to slash production. As a consequence, data from the manufacturing sector are bound to disappoint in the months ahead. At the same time the Fed balance sheet is shrinking slightly, whereas in China it is falling precipitously, while in Europe we have the situation that Mario Draghi’s verbal interventions might no longer work. We are at the end of an era.

The end of the era of quantitative easing? Exactly, the era of QE is over or at least nearing its end. Central banks and economists have learned that printing money does not solve any economic problems and does not lead to stronger growth. It did not even help to push inflation higher. The Fed’s interventions during the financial crisis in 2008 were crucial and the right thing to do. Everything that followed, however, was a mistake. In light of the lessons learned over the past years, I do not expect central banks to resort to quantitative easing again anytime soon.

“Their governments and financial sectors talked up anaemic recovery as an impressive comeback, propagating the myth that huge bubbles are a measure of economic health.”

• The ‘Recovery’ Was Built On Bubbles (Chang)

Those who put forward the narrative are now trying to blame China in advance for the coming economic woes. George Osborne has been at the forefront, warning this month of a “dangerous cocktail of new threats” in which the devaluation of the Chinese currency and the fall in oil prices (both in large part due to China’s economic slowdown) figured most prominently. If our recovery was to be blown off course, he implied, it would be because China had mismanaged its economy. China is, of course, an important factor in the global economy. Only 2.5% of the world economy in 1978, on the eve of its economic reform, it now accounts for around 13%. However, its importance should not be exaggerated. As of 2014, the US (22.5%) the eurozone (17%) and Japan (7%) together accounted for nearly half of the world economy. The rich world vastly overshadows China.

Unless you are a developing economy whose export basket is mainly made up of primary commodities destined for China, you cannot blame your economic ills on its slowdown. The truth is that there has never been a real recovery from the 2008 crisis in North America and western Europe. According to the IMF, at the end of 2015, inflation-adjusted income per head (in national currency) was lower than the pre-crisis peak in 11 out of 20 of those countries. In five (Austria, Iceland, Ireland, Switzerland and the UK), it was only just higher – by between 0.05% (Austria) and 0.3% (Ireland). Only in four countries – Germany, Canada, the US and Sweden – was per-capita income materially higher than the pre-crisis peak. Even in Germany, the best performing of those four countries, per capita income growth rate was just 0.8% a year between its last peak (2008) and 2015.

The US growth rate, at 0.4% per year, was half that. Compare that with the 1% annual growth rate that Japan notched up during its so-called “lost two decades” between 1990 and 2010. To make things worse, much of the recovery has been driven by asset market bubbles, blown up by the injection of cash into the financial market through quantitative easing. These asset bubbles have been most dramatic in the US and UK. They were already at an unprecedented level in 2013 and 2014, but scaled new heights in 2015. The US stock market reached the highest ever level in May 2015 and, after the dip over the summer, more or less came back to that level in December. Having come down by nearly a quarter from its April 2015 peak, Britain’s stock market is currently not quite so inflated, but the UK has another bubble to reckon with, in the housing market, where prices are 7% higher than the pre-crisis peak of 2007.

Thus seen, the main causes of the current economic turmoil lie firmly in the rich nations – especially in the finance-driven US and UK. Having refused to fundamentally restructure their economies after 2008, the only way they could generate any sort of recovery was with another set of asset bubbles. Their governments and financial sectors talked up anaemic recovery as an impressive comeback, propagating the myth that huge bubbles are a measure of economic health.

“A major Chinese devaluation would be a global earthquake, transmitting a wave of deflation through a world economy already uncomfortably close to a deflation-trap.”

• China’s Banking Stress Looms Like Banquo’s Ghost In Davos (AEP)

Bad debts in the Chinese banking system are four or five times higher than officially admitted and pose a mounting risk to the country’s financial stability, the world’s leading expert on debt has warned. Harvard professor Ken Rogoff said China is the last big domino to fall as the global “debt supercycle” unwinds. This is likely to expose the sheer scale of malinvestment that has built up during the country’s $26 trillion credit bubble. Prof Rogoff said the official 1.5pc rate of non-performing loans held by banks is fictitious. “People believe that as much as they believe the GDP data,” he told the World Economic Forum in Davos. The real figure is between 6pc and 8pc. He warned that unexpected problems can come “jumping out of the woodwork” once a debt denouement unfolds in earnest.

Banks are disguising the damage by rolling over bad loans and pretending all is well, with the collusion of regulators, but this draws out the agony and ultimately furs up the financial arteries. Ray Dalio, founder of Bridgewater, said the worry is that credit in China is still growing faster than the economy even at this late stage, storing up greater problems down the road. The efficiency of credit has collapsed. It now takes four yuan of extra debt to generate a single yuan of economic growth, compared to a ratio of almost one to one a decade ago. China’s foreign reserves have dropped by $700bn to $3.3 trillion as capital flight overwhelms the inflows from the country’s trade surplus. Mr Dalio said the historical pattern is that falls of this magnitude are typically followed by 25pc devaluation.

“It is not always easy for governments to maintain clear control over the currency,” he said. A major Chinese devaluation would be a global earthquake, transmitting a wave of deflation through a world economy already uncomfortably close to a deflation-trap. Fang Xinghai, a top financial adviser to Chinese president Xi Jinping, said his country is absolutely committed to the defence of its new trade-weighted currency basket. “It is the decided policy of China,” he said. Analysts say the central bank (PBOC) spent roughly $140bn defending the yuan in December, clear evidence that they have pinned their colours to the mast. Mr Fang admitted that the switch from a crawling dollar peg to the new regime had been badly handled. “We’re learning. We have to do a better job. Our system is not able to communicate seamlessly with the markets,” he said.

Yet he insisted that the yuan has been been basically stable on basket-basis for several months and stressed that the country is a net creditor with little reliance on foreign funding.”We have a sizeable current account surplus. There really is no basis for China to depreciate the currency,” he said. Mr Fang said a devaluation goes against the whole thrust of policy and the Communist Party’s strategic switch to consumption-led growth. “China is different from other developing countries. Our growth is largely fueled by domestic savings and capital. That gives us confidence to deal with whatever risks come out of financial markets,” he said. “If China was relying largely on foreign capital, you bet, any major financial risk could derail our growth. But China is different and this is a fact that a lot of people need to pay attention to,” he said.

The entire world does.

• The EU Prioritizes The Old And The Rich (FT)

A longer-term assessment would start with the founders of (western) European co-operation in the late 1940s. They did not contemplate integration as a way to supersede nation-states; rather they welcomed the revival of nation-states and saw co-operation as a way to help them flourish. Integration was not only unprecedented but also modest in scope. Economies flourished: growth was high, unemployment low and exchange controls curtailed cross-border capital flows, enabling governments to support managed capitalism through fiscal policy and strategic investment. It was in this era, so different in its core values from today, that the political capital was laid down for Europe, which the union is now spending so fast This phase ended in the mid-1970s. In the past 30 years, European institutions and law expanded even faster than membership.

The European Communities (later the EU) acquired a flag, and began to worry about political legitimacy. New institutions such as the Court of Justice and the European Central Bank acquired sweeping powers with little public discussion. The driving events were German reunification and a new conception of democracy, in which national parliaments were carefully monitored by judges and central bankers as supposedly independent guarantors of fiscal probity. The creation of a common currency, the euro, intensified this mistrust of parliaments, but nobody cared much before 2008 because growth was good and there was enough to go round. Now the money has dried up, what can the EU’s defenders say? That it provides peace? Voters take that for granted. That the euro remains strong? A great political project will never flourish on monetary stability alone.

That the EU encourages growth? Hardly. Democracy? Not when Europe is identified with a fiscal regime enforced by constitutional lawyers and central bankers that sees millions forever consigned to joblessness: an EU with an inflation rate of 0.1% and a youth unemployment rate of over 20% is a body that, to put it crudely, prioritises the old and the rich. No dream there unless something changes fast. It is no longer in supporting the union but in proposing resistance to it that nationalist politicians see the chance to burnish their democratic credentials. The union faces a deep crisis of institutional legitimacy. It is now commonly acknowledged that monetary policy has shot its bolt. That border controls are unenforceable, too. But it is the underlying legitimacy problem that awaits a change of heart on the part of the elites.

Interesting angle. But it begs the question who’s really in power.

• Will The Big Banks Break Themselves Up? (Forbes)

[..] midway through a half-hour conversation, Thomas B. Michaud, CEO of Keefe, Bruyette & Woods, begins to sound as if he’s an organizer of the Bernie Sanders campaign, not a CEO who’s contributed thousands to Jeb Bush’s Right To Rise PAC, and sees a lot of sense in (R-Ala.) Richard Shelby’s effort to give lenders relief from the Dodd Frank Act. “JPMorgan Chase is a trillion dollars bigger after the crisis than it was before the crisis. That’s almost unfathomable. You’ve got these big banks that were too-big-to-fail and their response was to get bigger,” Michaud says. He collects his thoughts and then lobs another bomb at the titans atop his industry. “My opinion is when you have a few big banks that dominate the market like they do, it can be anti-competitive. What we learned in the crisis is that the government will bail out the biggest banks… Not only is it dangerous to the tax payer, it is dangerous to the global economy,” he says.

A day earlier, it was Sanders who was in midtown Manhattan making these pronouncements, during an hour-long rally that caused #BreakEmUp to begin trending on Twitter. Sanders vowed to re-instate the Glass-Steagall Act, thus separating commercial banking from investment banking. “Within one year, my administration will break these institutions up so that they no longer pose a grave threat to the economy,” Sanders bellowed, to raucous applause. Michaud isn’t going to be stumping with Sanders on the campaign trail anytime soon. While Sanders vowed to invoke Section 121 of the Dodd Frank Act to break up the big banks, Michaud believes market forces may do that work before a new President even takes office. “The reality is we are not going to get a Glass Steagall re-enactment,” he says before adding, “the regulators are going to force the boards of directors to make that decision on their own because it is in the best interest of their shareholders.”

New rules are punitive enough that too-big-to-fail banks will have no choice but to trim down. The leverage that once gave megabanks their competitive advantage – and the ability to make money in virtually every corner of the market – is gone. CEOs are increasingly finding it hard justify many of their businesses to impatient shareholders. “The regulatory drumbeat is going to cause the biggest banks to disaggregate,” Michaud says, pointing out that General Electric divested most of its financial services operations last year because simply wasn’t as lucrative. He adds, “I have a lot of respect for Citigroup’s current management team. But they sell a business almost every few weeks I didn’t even know they owned.”

Michaud hasn’t invited FORBES to his offices just to wax about Wall Street’s biggest firms, but he sees their challenges as an opportunity for a different group of lenders – a crop of regional banks between $5 billion-to-$50 billion in assets such as Bank of the Ozarks in Arkansas, Columbia Banking System in the northwest, Pinnacle Financial in Nashville, and Eagle Bancorp in Maryland — which are taking market share and growing far-faster than the Citi’s and the JPMorgan’s of the world. “It used to be pre-crisis that the nation’s largest banks were the most profitable. That has dramatically changed,” Michaud says. The best profits and stock performance comes from mid-sized banks, not the trillion-dollar firms that get the attention of regulators, the media and presidential candidates.

“..the effect of slowing growth in China indicates a fundamental change..”

• Moody’s Just Put $540 Billion In Energy Debt On Downgrade Review (ZH)

One week ago, in the aftermath of the dramatic downgrade to junk of Asian commodity giant Noble Group, we showed readers the list of potential “fallen angel” companies, those “investment “grade companies (such as Freeport McMoRan whose CDS trades at near-default levels) who are about to be badly junked, focusing on the 18 or so US energy companies that are about to lose their investment grade rating. Perhaps inspired by this preview, earlier today Moody’s took the global energy sector to the woodshed, placing 175 global oil, gas and mining companies and groups on review for a downgrade due to a prolonged rout in global commodities prices that it says could remain depressed indefinitely. The wholesale credit rating warning came alongside Moody’s cut to its oil price forecast deck.

In 2016, it now expects the Brent and WTI to average $33 a barrel, a $10 drop for Brent and $7 for WTI. Warning of possible downgrades for 120 energy companies, among which 69 public and private US corporations, the rating agency said there was a “substantial risk” of a slow recovery in oil that would compound the stress on oil and gas firms. As first reported first by Reuters, the global review includes all major regions and ranges from the world’s top international oil and gas companies such as Royal Dutch Shell and France’s Total to 69 U.S. and 19 Canadian E&P and services firms. Notably absent, however, were the two top U.S. oil companies ExxonMobil and Chevron.

Moody’s said it was likely to conclude the review by the end of the first quarter which could include multiple-notch downgrades for some companies, particularly in North America, in other words, one of the biggest event risks toward the end of Q1 is a familiar one: unexpected announcements by the rating agencies, which will force banks to override their instructions by the Dallas Fed and proceed to boost their loss reserves dramatically. What Moody’s admitted is something profound, and which not even the equity holders of many energy companies have realized, namely that “Even under a scenario with a modest recovery from current prices, producing companies and the drillers and service companies that support them will experience rising financial stress with much lower cash flows,” it said.

This means far less value going to equity as the companies lurch ever deeper into financial distress, unless of course oil does rebound back to $100, which paradoxically can only happen – if only briefly – after a massive default wave (which ultimately will lower the all in cost of production). Worse, Moody’s also said that it sees “a substantial risk that prices may recover much more slowly over the medium term than many companies expect, as well as a risk that prices might fall further.” But the most dire warning from the rating agency which is suddenly showing far more perceptiveness than is typical, is the admission that China, as a source of global debt-funded demand, is no more: “Moody’s believes that this downturn will mark an unprecedented shift for the mining industry. Whereas previous downturns have been cyclical, the effect of slowing growth in China indicates a fundamental change that will heighten credit risk for mining companies.”

Might as well stop altogether.

• North Sea Drilling Sinks to Record Low (BBG)

The pace of drilling in the North Sea, the center of U.K. oil production for the past 40 years, has sunk to a record as crashing energy prices force explorers to abandon costly projects. Just 63% of oil and gas rigs in the U.K. North Sea were being used as of Jan. 19, according to data provider RigLogix. That’s the lowest since the Houston-based company started tracking their operation in 2000. In the Norwegian North Sea, the 71% rate is also the worst on record. Producers in the region, home of the Brent benchmark, boosted output the past two years as projects approved in the era of $100 oil came on stream. Yet crude’s subsequent plunge has forced many to shelve growth plans as they reduce spending and staff.

BP intends to eliminate 600 North Sea positions over the next two years, adding to more than 90,000 jobs the industry has cut in the area since the start of 2014. “In the U.K. North Sea, you’re looking anywhere between $15 and $45 a barrel for operating costs,” according to Kate Sloan, a Macquarie Group Ltd. analyst who said many older fields are at the top end of that range since they need specialized drilling to prolong their lives. “I wouldn’t expect anyone to be doing that kind of work so that takes quite a few of the rigs out of the market.” Drilling off Norway also has been expensive historically. A 2012 government-commissioned report showed drilling costs there were the highest in the world, as much as 45% higher than in the U.K. While companies operating off Norway can claim a portion of their costs back from the state, they’ve still put projects on hold.

There are many towns around the world like Aberdeen.

• Aberdeen: Once-Rich Oil City Now Relying On Food Banks (Guardian)

Former oil workers are queuing up to use food banks in Aberdeen, formerly one of the UK’s most prosperous cities, as 12-year lows in the price of crude this week propel the North Sea industry deeper into crisis. Hundreds of staff are being laid off every week as producers, drillers and service companies slash their spending in moves which are hurting local businesses, from estate agents to hoteliers and taxi drivers. Those claiming out of works benefits in the north-east of Scotland rocketed by 72% in December and the total number of UK oil-related jobs lost could already be 70,000, with some predicting 200,000 out of 400,000 could eventually go. Dave Simmers, who leads the Aberdeen Food Banks partnership, said demand for free access had soared in a city which is so dependent on oil and gas.

“The number of food parcels delivered in 2015 was double the number in 2014 and we are seeing increases all the time. People can be used to earning good money in the oil industry but when the pay checks stop the problems start,” Simmers added. “We had a man draw up in a Porsche outside and come in here. His house was going to be repossessed and the car was on credit and going to be handed back. Whoever you are, you can be two or three wage slips away from a hole.” Simmers said the social enterprise he runs, Community Food Initiatives North East, lead partner in the Aberdeen Food Banks partnership, has also lost a huge amount of revenue because it used to supply much more paid fruit to the industry – including to crews on offshore vessels anchored in the harbour just yards away.

Jake Molloy, a former oil worker and now Scottish regional officer for the Rail, Maritime, Transport (RMT) union said he has personally been made aware of more than 250 job losses in the last four days alone. “Every day I see HR1s [statutory redundancy notices] like these,” he said, shuffling sheets of paper and reading out: “150 at Petrofac, 90 at Sparrows, 70 at Gulfmark, 60 at ConocoPhillips … ” Molloy said that along with those actually losing their livelihoods, almost everyone is having their terms and conditions changed. “Offshore workers are being made to work an extra 320 hours a year for no extra pay, pension arrangements are being slashed and travel allowances removed in some cases.” His worst nightmare is that there is a growing backlog of maintenance work as oil companies cut spending, which could affect safety.

He is also worried that decommissioning of platforms will hasten an early end to some fields. Britain is one of the highest cost producers of oil in the world at around $60(£42) a barrel, not a good situation when the global price is about half that.

10,000 is just a start. Schlumberger employs over 100,000 people.

• Oil Services Giant Schlumberger Axes 10,000 Jobs (Guardian)

The world’s largest oilfield services company Schlumberger has lost more than $1bn and cut a further 10,000 jobs. Like others in the industry, Schlumberger has been hard hit by the fall in energy prices and the downturn in the sector. It warned on Thursday that it does not expect a turnaround in the near future. Schlumberger said it streamlined costs and cut 10,000 jobs during the last three months of 2015 to prepare for weaker business in early 2016. The company, which has principal offices in Paris, Houston, London and The Hague, had announced at least 20,000 job cuts earlier in 2015. It currently employs about 105,000 people. Amid an oil glut, crude prices are down about 38%, with natural gas prices down about 27% from a year ago.

The downturn has led energy companies to cut thousands of jobs over the past year. Earlier on Thursday, Southwestern Energy, the third-largest natural gas producer in the US, said it would cut 1,100 jobs, about 44% of its workforce. The Schlumberger chairman and CEO, Paal Kibsgaard, noted that the number of rigs exploring on land for oil and gas in the US fell to fewer than 700 at the end of 2015, down 68% from the 2014 peak. “The decrease in land activity was the sharpest seen since 1986,” he said, adding that “massive over-capacity in the land services market offers no signs of pricing recovery in the short to medium term.” Schlumberger’s fourth-quarter results were hurt by a 39% drop in revenue and huge accounting charges, producing a loss of $1.02bn.

Gee, what a surprise.

• UK Treasury ‘To Count £139 Million Of Made Up Money’ As Foreign Aid (Ind.)

The UK Treasury will count £139 million of “made up money” as overseas aid, according to debt campaigners. The UK Government enshrined in law a commitment to spend 0.7% of national income, or around £12 billion, on aid in 2015, finally meeting a target set by the UN in 1970. Under an agreement with Cuba on its debt to the UK, the Treasury is to count £139 million of cancelled late interest payments towards this target, or around 1.2% of the projected £12 billion spend. Debt campaigners have called the debt “made up money” that was never expected to be paid. The loans were backed by UK Export Finance, a Government arm that lends money to fund the purchase of UK Exports.

“British people think UK aid money should be used to reduce poverty and inequality around the world. But too often it is driven by the interests of British companies at the expense of increased poverty and inequality,” said Tim Jones, policy officer at the Jubilee Debt Campaign. The amount of interest to be written off is more aid that the UK gave to Kenya in total in 2014, according to data from Statista. Cuba defaulted on the original £42 million debt in 1987 and has since accrued £139 million in late interest payments at an annual interest rate of 11%. This money will be counted as Overseas Development Assistance in line with OECD rules over an 18-year repayment term, the Treasury said. “Debt cancellation has always been part of Britain’s development assistance and related aid targets, and is totally consistent with the internationally recognised definition of aid monitored by the OECD”, a Government spokesperson said.�

Cuba reached a debt agreement with 14 Western governments last year. Under the agreement, $2.6 billion of late interest payments will be cancelled, all of which is likely to be counted as aid in the respective countries, Jubilee said. Cuba has agreed to repay the UK the £42 million that was lent originally, plus £21 million of contractual interest. If Cuba does not pay international lenders by October 31 each year, it will be charged 9% interest until payment, plus late interest for the portion in arrears, Reuters reported. “Government policy, which is the same for all countries, is to seek to recover as much debt as possible. The agreement to restructure Cuba’s debt is an important step for the Cuban economy,” the Treasury said. But debt campaigners said that the high annual interest rate charged to Cuba is higher than the interest rate the UK Government pays and that there was no expectation that it would ever be paid.

When in a hole… Look, emissions were like 20-40 times over limit. Nothing vague about that. But if VW feels like antagonizing both Europe AND the US, go right ahead.

• VW Blames Emissions Scandal on EU’s ‘Vague Testing Requirements’ (Ind.)

European carmakers have pleaded for time and understanding after the European Parliament announced a special inquiry into the Volkswagen emissions scandal that erupted last year. A cross-party committee of 45 MEPs will spend 12 months examining how VW was able to rig emissions tests with so-called “defeat devices” – software that cosmetically cut nitrogen oxide (NOx) exhaust emissions during regulators’ examinations. It will also look at whether the German car company was given political cover by the European Commission and national governments in the EU. But Dieter Zetsche, the chairman of Daimler and head of Mercedes-Benz Cars, said that the industry was committed to cleaner cars.

“Let me be clear: we fully accept our responsibility to bring down emissions,” he said in Brussels. “But rushing new measures will fail to bring the intended results.” Mr Zetsche – who is also the president of the European Automobile Manufacturers’ Association (ACEA) – blamed the scandal on the vague testing requirements. “We recognise what has gone wrong,” he added. “By definition, by physics, you get more emissions by full acceleration and a full load, at low temperatures and climbing a hill, than on a flat autobahn.” Up to 11 million VW diesel vehicles worldwide are thought to have been fitted with software to mask NOx emissions. The European Parliament’s inquiry will also look into whether governments knew about the defeat devices before the scandal emerged and why there were no defined penalties in place to deter such cheating.

Getting hard to mount any defense.

• VW Probe Finds Manipulation Was Open Secret In Department (Reuters)

Volkswagen’s development of software to cheat diesel-emissions tests was an open secret in the company department striving to make its engines meet environmental standards, Germany’s Sueddeutsche Zeitung newspaper said on Friday, citing results from VW’s internal investigation. Many managers and staff dealing with emissions problems in the engine-development department knew of or were involved in developing the “defeat devices”, said the newspaper, which researched the matter with regional broadcasters NDR and WDR. A culture of collective secrecy prevailed within the department, where the installation of the defeat software that would cause the carmaker’s biggest ever corporate crisis was openly discussed as long ago as 2006, Sueddeutsche said.

But it said there were exceptions: a whistleblower, who was himself involved in the deception and has been giving evidence to investigators hired by Volkswagen, alerted a senior manager outside the department in 2011. This manager, however, did not react, the newspaper said. Volkswagen has said that to the best of its knowledge only a small circle of people knew about the manipulation, which Europe’s biggest carmaker admitted to U.S. environmental authorities in September last year. It has said it is not aware of any involvement by top management or supervisory board members in the affair, which toppled its chief executive last year and is likely to cost billions of dollars for recalls, technical fixes and lawsuits.

“What they have produced is endless war financed by runaway debt which is leading to economic ruin. But ignorance helps a lot here.”

• DEFEAT IS VICTORY (Dmitry Orlov)

On the wall of George Orwell’s Ministry of Truth from his novel 1984 there were three slogans: WAR IS PEACE FREEDOM IS SLAVERY IGNORANCE IS STRENGTH. It occurred to me that these apply just a little bit too well to the way the Washington, DC establishment operates. War certainly is peace: just look at how peaceful Iraq, Afghanistan, Yemen, Libya, Syria and the Ukraine have become thanks to their peacemaking efforts. The only departures from absolute peacefulness which might be taking place there have to do with the fact that there are some people still alive there. This should resolve itself on its own, especially in the Ukraine, where the people now face the prospect of surviving a cold winter without heat or electricity.

Freedom is indeed slavery: to enjoy their “freedom,” Americans spend most of their lives working off debt, be it a mortgage, medical debt incurred due to an illness, or student loans. Alternatively, they can also enjoy it by rotting in jail. They also work longer hours with less time off and worse benefits than in any other developed country, and their wages haven’t increased in two generations. And what keeps it all happening is the fact that ignorance is indeed strength; if it wasn’t for the Americans’ overwhelming, willful ignorance of both their own affairs and the world at large, they would have rebelled by now, and the whole house of cards would have come tumbling down. But there is a fourth slogan they need to add to the wall of Washington’s Ministry of Truth. It is this: DEFEAT IS VICTORY.

The preposterous nature of the first three slogans can be finessed away in various ways. It’s awkward to claim that American involvements in Iraq, Afghanistan, Yemen, Libya, Syria or the Ukraine have produced “peace,” exactly, but various lying officials and assorted national teletubbies still find it possible to claim that they somehow averted worse (totally made-up) dangers like Iraqi/Syrian “weapons of mass destruction.” What they have produced is endless war financed by runaway debt which is leading to economic ruin. But ignorance helps a lot here.

Likewise, it is possible, though a bit awkward, to claim that slavery is freedom—because, you see, once you have discharged your duties as a slave, can go home and read whatever crazy nonsense you want on some blog or other. This is of course silly; you can stuff your head with whatever “knowledge” you like, but if you try acting on it you will quickly discover that you aren’t allowed to. “Back in line, slave!” You can also take the opposite tack and claim that freedom is for layabouts while we the productive people have to rush from one scheduled activity to another, and herd our children around in the same manner, avoiding “unstructured time” like a plague, and that this is not at all like slavery. Not at all. Not even close. Nobody tells me what to do! (Looks down at smartphone to see what’s next on today’s to-do list).

How is this not obvious? “It is impossible to stop. Those who believe in some way that we can erect fences and stop migration are living in Cloud Cuckoo Land..”

• Top UN Official Says Mass Migration ‘Unavoidable Reality’ (AFP)

Mass cross-border migration is an “unavoidable reality” and it is “impossible to stop” the flow of refugees in need of sanctuary, the United Nations’ top official in charge of migration said during a visit to Bangladesh. In an interview with AFP in Dhaka, Peter Sutherland, the UN’s special representative for migration, said the world needed to accept millions of people fleeing conflicts in Syria and elsewhere and find ways to live together. Sutherland is visiting Bangladesh for the Global Forum on Migration and Development in Dhaka where he said he would discuss the plight of Rohingya refugees in Bangladesh. The refugees, fleeing ongoing persecution in Myanmar – which Naypyidaw denies – have been living in Bangladeshi camps or jungle hideouts, some for generations, often without access to basic food or shelter.

The forum in Dhaka takes place as Europe is facing its biggest migration crisis since World War II, with more than a million asylum seekers arriving in Germany alone in 2015 – triggereing a fierce backlash. “We must find ways to be living together. Today (migration) is an unavoidable reality, we are living in the era of globalisation,” Sutherland said in the Bangladeshi capital late on Thursday. “It is impossible to stop. Those who believe in some way that we can erect fences and stop migration are living in Cloud Cuckoo Land,” he said. Turkey is currently hosting 2.2 million Syrian refugees, while between 2,000 and 3,000 people arrive daily in the main European landing point of Greece, although many die making the journey.

Sutherland criticised world leaders who stoke xenophobia for political gain and link refugees with a heightened terror threat. “They represent the world of yesterday, a world of conflict and not a world of consensus. They represent a world which creates division rather than harmony,” he said. “Humanity demands responsibility and care for those who need sanctuary.” The European Union’s passport-free Schengen area has come under huge strain from the migrant influx, with wealthier countries including Denmark and Sweden introducing border controls to deal with the flow of people.

No, it’s long since failed. About 800 human lives ago. “A manageable crisis has become a moral test that Europe is in danger of failing dismally..”

• Europe’s Refugee Crisis Claims At Least Another 46 Lives In Aegean (AP)

The death toll in Europe’s migration crisis rose Friday when two overcrowded smuggling boats foundered off Greece and at least 46 people drowned — more than a third of them children — as European officials remained deeply divided on how to handle the influx. More than 70 people survived, and a large air and sea search-and-rescue effort was underway off the eastern islet of Kalolimnos, the site of the worst accident. It was unclear how many people were aboard the wooden sailboat that sank there indeep water, leaving at least 35 dead. Coast guard divers were due to descend to the sunken wreck early Saturday, amid fears that more people had been trapped below deck.

At least 800 people have died or vanished in the Aegean Sea since the start of 2015, as a record of more than 1 million refugees and economic migrants entered Europe. About 85% of them crossed to the Greek islands from nearby Turkey, paying large sums to smuggling gangs for berths in unseaworthy boats. Rights groups said the deaths highlight the need for Europe to provide those desperate to reach the prosperous continent’s shores with a better alternative to smuggling boats. European policy toward its worst immigration crisis since World War II has diverged wildly so far. Germany — where most are heading — has welcomed those it considers refugees. Other countries, led by Hungary, have blocked or restricted them from entering and resisted plans to share the burden of refugees.

“These deaths highlight both the heartlessness and the futility of the growing chorus demanding greater restrictions on refugee access to Europe,” said John Dalhuisen, Amnesty International’s Europe and Central Asia program director. “A manageable crisis has become a moral test that Europe is in danger of failing dismally,” he said. The U.N. refugee agency said daily arrivals on the Greek islands have surged to more than 3,000 in the past two days, and it cited refugee testimony that smugglers have recently halved their rates amid deteriorating weather conditions. “It is tragic that refugees, including families with young children, feel compelled to entrust their lives to unscrupulous smugglers in view of lack of safe and legal ways for refugees to find protection,” said Philippe Leclerc of UNHCR Greece.