Pablo Picasso Head of a bearded man 1940

“The world will ask you who you are, and if you don’t know, the world will tell you.”

~ Carl Jung

Free them

Yes — Now it’s time to Free Them All: pic.twitter.com/UmwxPMFkVF

— Benny Johnson (@bennyjohnson) October 28, 2022

Tucker warming

Alarming… pic.twitter.com/8pd4i7bKOt

— Wittgenstein (@backtolife_2023) October 28, 2022

Here is a number of articles that paint the picture of how the world is changing. No coverage in the west whatsoever. I hope those of you who come here regularly do grasp -part of- that picture.

• Everybody Wants To Hop On The BRICS Express (Escobar)

Iran made known its interest to join BRICS even before Saudi Arabia. According to Persian Gulf diplomatic sources, they are already engaged in a somewhat secret channel via Iraq trying to get their act together. Turkey will soon follow – certainly on BRICS and possibly the SCO, where Ankara currently carries the status of extremely interested observer. Now imagine this triad – Riyadh, Tehran, Ankara – closely joined with Russia, India, China (the actual core of the BRICS), and eventually in the SCO, where Iran is as yet the only West Asian nation to be inducted as a full member. The strategic blow to the Empire will go off the charts. The discussions leading to BRICS+ are focusing on the challenging path towards a commodity-backed global currency capable of bypassing US dollar primacy.

Several interconnected steps point towards increasing symbiosis between BRICS+ and SCO. The latter’s members states have already agreed on a road map for gradually increasing trade in national currencies in mutual settlements. The State Bank of India – the nation’s top lender – is opening special rupee accounts for Russia-related trade. Russian natural gas to Turkey will be paid 25 percent in rubles and Turkish lira, complete with a 25 percent discount Erdogan personally asked of Putin. Russian bank VTB has launched money transfers to China in yuan, bypassing SWIFT, while Sberbank has started lending out money in yuan. Russian energy behemoth Gazprom agreed with China that gas supply payments should shift to rubles and yuan, split evenly.

Iran and Russia are unifying their banking systems for trade in rubles/rial. Egypt’s Central Bank is moving to establish an index for the pound – through a group of currencies plus gold – to move the national currency away from the US dollar. And then there’s the TurkStream saga. Ankara for years has been trying to position itself as a privileged East-West gas hub. After the sabotage of the Nord Streams, Putin has handed it on a plate by offering Turkey the possibility to increase Russian gas supplies to the EU via such a hub. The Turkish Energy Ministry stated that Ankara and Moscow have already reached an agreement in principle. This will mean in practice Turkey controlling the gas flow to Europe not only from Russia but also Azerbaijan and a great deal of West Asia, perhaps even including Iran, as well as Libya in northeast Africa. LNG terminals in Egypt, Greece and Turkiye itself may complete the network.

The consequences of American overreach. Once Saudi goes, so does the dollar. And Saudi can’t stay away much longer, it’s very much against their own interest.

• Russia’s Move Away From Dollar ‘Irreversible’ – Leading Banker (RT)

Russia is moving away from using the US dollar and euro in foreign trade, a process that is “irreversible,” claimed Andrei Kostin, the head of VTB Bank, one of Russia’s largest lenders. “Quitting the US dollar and euro is already an irreversible process for Russia. Taking into account the current trend, our main foreign trade partners in the medium term will be China, the EAEU countries, Turkey, India, Middle East, Latin America, and Africa. Switching to national currencies in trade with this particular group of countries is the top priority for us,” Kostin said at the Eurasian Economic Forum in Baku on Thursday.

Moreover, according to the banker, the decision made by the US and other Western nations to freeze Russia’s foreign exchange reserves earlier this year shows that no country is safe from such treatment, a state of affairs that will likely turn other nations away from the major reserve currencies. “No state can feel fully protected in the conditions of a dollar-centric global economy,” Kostin stressed. His words echoed statements made last month by President Vladimir Putin. In mid-September, while discussing measures for restructuring the country’s economy under Western sanctions, the Russian president called de-dollarization “an inevitable process.”

Russia approved a plan for the de-dollarization of the domestic economy back in 2018. A package of measures was introduced aimed at speeding up the process, with the goal of implementing the steps within six years. However, following the unprecedented economic sanctions imposed on Russia in the wake of its military operation in Ukraine, Moscow accelerated the process of moving away from what it calls the “compromised” dollar and euro. A ruble-based payment scheme for gas exports was implemented and national currencies started being used in settling Russia’s foreign trade with its trading partners.

We all wanted Turkey to gain influence, right?!

• Erdogan: Turkiye Will Ensure Distribution Of Russian Gas To Europe (Az.)

Ankara, through the Turkish Stream gas pipeline, will ensure the distribution of Russian gas to Europe, Turkish President Recep Tayyip Erdogan told members of the ruling Justice and Development Party in Ankara, Report informs, citing Anadolu. “As a result of our negotiations with Russia, we will ensure the distribution of natural gas from Russia to Europe through the Turkish Stream,” Erdogan said. Earlier, the presidents of Russia and Turkiye instructed to work out in detail and quickly the issue of creating a gas hub in Turkiye, through which, in particular, the Russian Federation could move gas transit from the Nord Streams to the Black Sea region and Turkiye. During a speech to members of the ruling party, Erdogan also touched upon the country’s success in the field of energy, noting that Turkiye had discovered a field in the Black Sea with gas reserves of 540 billion cubic meters.

“..Mikhelson suggested that the upcoming winter will be the easiest of the next three..”

• Russian Gas Supplies To EU Almost Halved – Novatek CEO (RT)

Russian gas supplies to the EU dropped by almost 50% since May, while exports to Japan and South Korea remained at about the same level as in 2021, the CEO of Novatek, Russia’s second largest gas producer, said on Thursday. “Russian supplies to Europe decreased by nearly 50 billion cubic meters of gas (bcm) in the past four-five months. As of October 1, the slump has reached 47%,” CEO Leonid Mikhelson said at the Eurasian Economic Forum in Baku, adding that the EU has almost replenished the shortfall by boosting LNG consumption by 65%. According to his estimates, the EU has received a total of 43bcm in additional volumes of gas via its LNG terminals, with 29bcm arriving from the US.

Mikhelson suggested that the upcoming winter will be the easiest of the next three, given that the bloc has managed to build up its gas stocks. However, he warned that with restored demand in China, the global economy may need about 60-70 million tons of LNG in the next two years to offset reduced pipeline gas supplies. Mikhelson also pointed to the lack of new major projects until 2026. In his view, global GDP will struggle to grow amid skyrocketing energy prices, and the only way to rein in the inflation and stabilize the markets is to beef up investment in new large-scale energy projects. And this, according to Mikhelson, is only possible with international cooperation.

” This is not progress, but enslavement, mixing economies to a primitive level..”

• Putin Explains Western Economic Model (RT)

As soon as any market is opened for certain goods, the West seizes it along with all the resources, pushing away local manufacturers, according to Russian President Vladimir Putin. “They build relationships this way – markets and resources are captured, countries are deprived of their technological, scientific potential. This is not progress, but enslavement, mixing economies to a primitive level,” he stated on Thursday at a plenary meeting of the Valdai Discussion Club. According to the Russian leader, Western countries lay claim to all the resources of mankind as they aim “to strengthen their unconditional dominance in the world economy and politics.”

On the topic of world trade, Putin said the beneficiaries of this should be the majority, not the super-rich corporations. “Together everyone will gain more than individually,” the president said. He also criticized Western companies who are leaving the Russian market and supposedly selling their entire businesses “for merely one ruble.” They are doing this while whispering in the ear of their management: “we will be back soon,” Putin added.

“It is the legitimate right of China and Russia to realize their own development and revitalization, which fully conforms to the development trend of the times..”

• China Will Support Russia In ‘Overcoming Difficulties’ – Wang (RT)

China has pledged to support Russia as it faces the combined power of the West, Foreign Minister Wang Yi reportedly told his Russian counterpart Sergey Lavrov during a phone conversation on Thursday, in which the two officials vowed to back each other in their geopolitical endeavors. Beijing will “firmly support the Russian side,” assisting President Vladimir Putin’s efforts to “unite and lead the Russian people to overcome difficulties and eliminate disturbances,” as well as realize “strategic development goals” to bolster Russia’s status as a major power on the international stage, according to the readout posted by the Chinese Ministry of Foreign Affairs.

“It is the legitimate right of China and Russia to realize their own development and revitalization, which fully conforms to the development trend of the times,”said Beijing’s press release. “Any attempt to block the progress of China and Russia will never succeed.” The top diplomats reaffirmed their “mutual trust and firm support” and vowed to work together to take both of their countries to the next level in such a way that would not only benefit both nations but “provide more stability to the turbulent world.” Lavrov also congratulated Xi Jinping on his recent reelection as general secretary of the Chinese Communist Party.

According the Russian Foreign Ministry, Lavrov thanked Beijing for supporting Russia’s efforts to achieve a “fair settlement of the situation around Ukraine” and derail Kiev’s alleged plans to set off a weapon of mass destruction in a false-flag provocation that could be used to demand more pressure on Moscow and additional military aid from the West. Russian Defense Minister Sergey Shoigu has been contacting his counterparts in the US, UK, France, Turkey, India and China about the possible Ukrainian provocation this week. The top diplomats of the US, UK, and France issued a joint statement on Monday rejecting Moscow’s claims as “transparently false allegations,”however. Their Ukrainian counterpart Dmitry Kuleba also denied the accusations and blamed Moscow for waging a disinformation campaign that “might be aimed at creating a pretext for a false flag operation.”

Not a new idea, but it gained urgency.

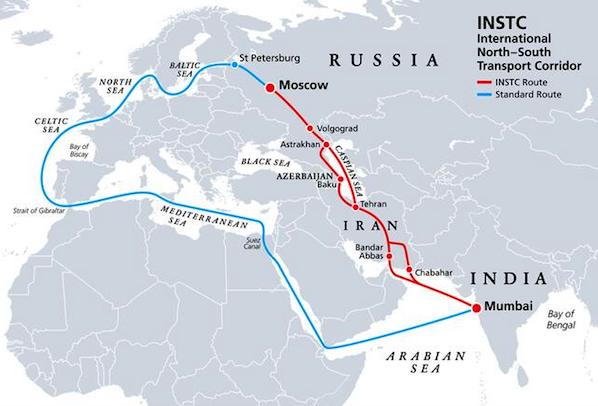

• Russia Suggests Alternative To Suez Canal (RT)

The North-South corridor could become a safe substitute for the Suez Canal, Russia’s Deputy Prime Minister Andrey Belousov said on Friday, adding that he expects the volume of Russian cargo via this route to double by 2030. Speaking at the Eurasian Economic Forum, he noted that the International North South Transport Corridor (INSTC) and other alternative routes are gaining importance due to “global shifts of world markets” to China, South-East Asia and the Persian Gulf. Existing transport infrastructure which has been historically focused on the “East-West horizon ceases to meet global trends,” according to the Deputy premier, while the “North-South route may become a real competitor to the Suez Canal.” The route is currently the only deep-sea trade artery which connects Europe and Asia, and such “monopolarity” poses risks to the global economy, the official said.

He recalled an incident in 2021 when a container ship became stuck in the Suez Canal, triggering knock-on effects on global trade.The INSTC is a 7,200-kilometer multi-mode transit system that connects ship, rail, and road routes for moving cargo between India, Iran, Azerbaijan, Russia, Central Asia, and Europe. Experts say the route could cut costs by about 50% and save up to 20 days of travel time. In an effort to build up new logistics chains and make the route viable, Russia has proposed establishing an international operator for the North-South corridor along with Iran and Azerbaijan, the minister said. The construction of the INSTC began in the early 2000s, but developing it further has taken on a new importance in light of Western sanctions, which have forced Russia to shift its trade flows from Europe to Asia and the Middle East.

”If NATO desires to fortify Odessa against the Russian advance, or use Odessa as a base to engage Russian forces near Nikolaev, they have a serious logistical problem.”

• NATO Set To Attack Tiraspol? (Sant)

Many years ago I was an officer in the National Guard sister Brigade to the 101st. Both Brigades are “air assault light infantry,” which was developed in the Vietnam War with the 7th Air Cavalry Division. “We Were Soldiers Once and Young,” tells that story. Though the 101st is called “airborne” in reference to its World War II days, today its soldiers are not trained to jump out of airplanes; the 82nd Airborne Division does that. The 101st deploys using UH-60 Blackhawk helicopters. Each division in the brigade has an aviation battalion with three companies of Blackhawk helicopters. Their primary combat mission is to secure a bridgehead. When deploying, an air assault infantry battalion goes to a designated pickup zone, and a company of Blackhawks comes in to ferry them to the landing zone.

Although they are trained to rappel out of the helicopters in a hot Landing Zone, in practice the helicopters usually land, and the troops jump out. It is much faster and safer. Two minutes later the chopper is back in the air and goes back for another squad at the pickup zone. Thus it might take the better part of an hour with two or three round trips to move an entire infantry battalion from the PZ to the LZ, longer if the distance is longer. While an air assault infantry brigade can move 105 mm light artillery pieces via helicopter, the main supply and logistics assets of the brigade must follow the main force on the ground in trucks. Therefore, unlike the 82nd Airborne Division, or the Rangers, both of which are designed to jump into areas far behind enemy lines, an air assault brigade like the 101st is limited in how far it can leapfrog ahead of its support assets.

If NATO desires to fortify Odessa against the Russian advance, or use Odessa as a base to engage Russian forces near Nikolaev, they have a serious logistical problem. Supply lines from Poland on main Ukrainian highways or railroads must travel 700 kilometers to reach Odessa. The shortest supply lines to Odessa for NATO would be from Romania, which has two segments of border with Ukraine. However, the best paved route would be through Moldova, which is not a member of NATO. Romania has state of the art NATO air defense batteries which can cover most of the route to Odesssa. Therefore, assuming they are effective against Russian cruise missiles, which may be a bad assumption, it would be safer to supply forces in Odessa from Romania than from Poland.

Video transcript. Konstantin Sivkov (Navy Captain 1st Rank, retired) holds a doctorate of military sciences and is the deputy president of the Russian Academy of Missile and Artillery Sciences.

• Nuclear blackmail. Escalation scenarios – Konstantin Sivkov (Saker)

“Only the West needs nuclear weapons. Only the west. And the West needs them for the following reasons. Because winter is coming. Western sanctions brought not just .. not led to the collapse of the Russian economy, but on the contrary put on the brink of collapse the European economy. And in these conditions the Europeans … if Russia persists through the winter. Now, when the “greenery” withers and falls, cold weather comes, winter .. Ukrainians will have it much worse than now. It will be easier for us to attack and act. Therefore, under these conditions, Western elites are in a position where they are about to die as result of the revolution, actually, inside countries, their own countries. This is brewing there.

Especially against the backdrop of cold weather this will be inevitable, in the apartments, in the houses, when problems begin with food .. with food supplies, with other goods. When their factories stop, completely shut down as the result of the lack of gas shortage, or rather its absense. And they – yes, they need a nuclear war now. Because they have not been able to mobilize their peoples to go to war, yet. A regular war. But to unleash a nuclear war and against the backdrop of a nuclear war and the resulting threats of radioactive contamination to wide, large areas on the territory of Ukraine, on the territory of Poland, Germany, other countries in Europe and then mobilize the European population to a war against Russia, this may well be part of their plan.

Therefore, they are extremely interested in doing this. Now, a natural scenario can be suggested to explain how this may be realized and why they scream [in the media]. Because Russia will use nuclear weapons. There are two clear options here. The first option is that .. the Americans, the americans themselves fire a missile MGM-140 ATACMS in the direction from East to West, in this direction [showing with his hand] – from East to West, from one territory controlled by the Armed Forces of Ukraine to a nuclear power plant located in the west of Ukraine, with it being destroyed. ATACMS missile. Not one, but several ATACMS missiles. As a result, a new Chernobyl is created .. Chernobyl is possible, by the way, Chernobyl might be hit. Cannot be completely ruled out. After that, Russia is blamed for this.”

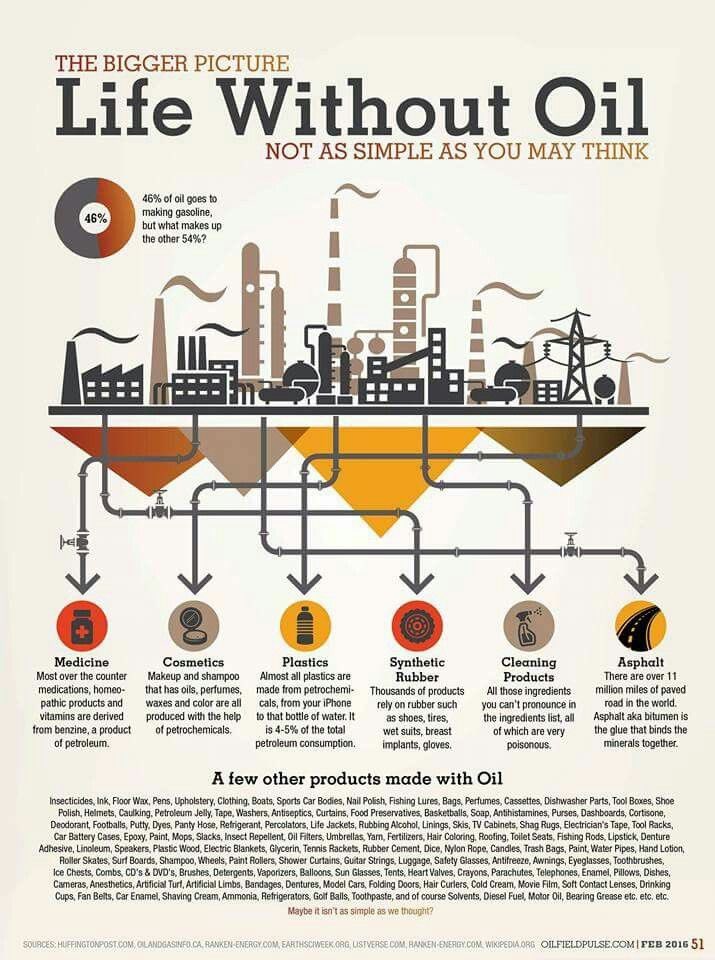

Due to the lack of sufficient cobalt, lithium, nickel, Europe (and California) will resemble Cuba with tons of old internal combustion cars.. And bicycles, mopeds.

• EU Approves Gasoline Car Ban In 2035 (RT)

The EU has reached an agreement that would oblige carmakers to achieve a 100% cut in CO2 emissions by 2035. The measure would effectively ban the sale of new petrol and diesel-fueled cars in the bloc starting from that year. The deal was struck on Thursday between negotiators from EU member states, the European Parliament, and the European Commission, which all must agree when a new law is to be adopted within the EU.“The European Commission welcomes the agreement reached last night by the European Parliament and Council ensuring all new cars and vans registered in Europe will be zero-emission by 2035,” the Commission said in a press release following the deal’s announcement.

The agreement also included a 55% cut in CO2 emissions for new cars sold from 2030 against 2021 levels, which exceeds the existing target of a 37.5% reduction. EU climate policy chief Frans Timmermans said the agreement is a signal to all that “Europe is embracing the shift to zero-emission mobility.” According to the press release, the new regulation aims “to make the EU’s transport system more sustainable, provide cleaner air for Europeans, and marks an important step in delivering the European Green Deal.” The agreement is provisionary and now requires formal adoption by both the European Parliament and the EU Council. The timeframe for this is so far unclear.

The German president is an absolute airhead. And that is scary. Telling his people they have no choice but to freeze and fight.

• World Is Moving Into Phase Of Confrontation – German President (Az.)

The world is moving into a phase of confrontation, and harder years lie ahead for Germany, President Frank-Walter Steinmeier said on Friday, according to Anadolu Agency. In a major speech, Steinmeier warned about the severe consequences of the Russia-Ukraine war, underlining that Germany will have to face new challenges, and calling for public solidarity in the face of ongoing crises. “The 24th of February was a turning point in history,” Steinmeier said, referring to the start of Russia’s war on Ukraine, adding that the war ended an era of peace and stability which Germans profited from greatly and reduced the European security order to “rubble.” “With his imperial obsession, the Russian president has broken international law, challenged borders, committed land grabs. The Russian attack is an attack on all the lessons the world had learned from the two world wars,” said Steinmeier.

Steinmeier said the consequences of the war, new security threats, the energy crisis, and inflation have greatly challenged Germany’s successful economic model. “I believe many of the concerns are valid. We are experiencing the deepest crisis since the reunification of Germany,” he stressed.Steinmeier underlined that Germany will cut its dependency on Russian gas and oil, and adapt to new challenges by taking the necessary steps, but will not end its efforts to promote international dialogue and cooperation.“A new bloc confrontation, a division of the world into ‘us against them’ is not in our interest,” he stressed.“Yes, we must reduce our vulnerability, reduce one-sided dependencies. But that doesn’t mean less networking with the world, but more,” he added.

This is what you call a tirade.

• They Will Blame WWIII On Germany Too (Pattberg)

Mr. Scholz will humiliate Germany in China so much, will offend the Chinese commentators so much, that all hell will break loose and hatred and bitter rivalry ensues. Hundreds of millions will suffer from lost trade, war, and poverty. Who gives. Scholzes don’t care if all goes to pot. As the Buddhists say: All life is suffering. Say the Germans: Done! Displacement, violence, and misery all equal eastward expansion, remember? If you are German, and you are already dead in 80 years, why not start World War III now while you can? The Americans arranged it, but they will probably say the Germans did it, because “Germany started World War I and II AND III”… is just the better story. The Germans are the perfect closet assholes because they have passion but no compassion. They lack empathy.

This lack of empathy passed on from generation to generation of surviving Huns and became the genealogy of Evil. Just read the archaeologists of Evil, from Hannah Arendt to Andrew Lobaczewski. The Germans are the world’s main source of Evil. Their own leaders say this much about themselves. Said former President of Germany, Joachim Gauck: “I feel ashamed to be a German” or “I am suspicious about the German language… because it breeds pride, hatred, and bestiality,” and… wait for it: “I hate and despise this country!” This is real, folks. It is what it is. We must deal with these murderous lunatics before they murder everyone or themselves. Evil oozes from their huge foreheads, streaking their oily white skin.

And if everyone says you are part of the historic Evil, you will probably turn out to be an asshole, just like Gauck and Scholz and the rest of them. Evil goes with German as the Devil goes with Dr. Faust. There is no Mao or Stalin in this world that could have existed without German Hegel, Marx, and Nietzsche, verstehst Du?! The coming War will be blamed on the assholes in the closet. It is too awesome an award to be handed to the Russians, Chinese, or the Iews. “Germany did it once again,” will they all sing, the voices of doom. Or they’ll clap “The Death of Europe!” and all its rotten brains. Either way, the Germans will be the peons, the scapegoats, the blame race.

World War I and II kind of won our attention, remember? Blood, soil, women, and resources. If you are a small militant nation, you can always destroy more than you can build. World War III is the most progressive thing that could ever happen to Berlin and Europe. The world would be indifferent if China had never existed. But if the Germans had never existed, we would never have had Charles Bukowski, Klaus Schwab, or Donald Trump. Beijing knows that Evil always triumphs for the Europeans. This law of History must be obeyed. My God, what have the Europeans done! Why would China even cater to forgetful Mr. Scholz in Beijing where Germans murdered Chinamen in the past? Why would China tolerate another military German-Japan axis? Because Mr. Xi is wise and will go with the flow of History. That much attitude he shares with most world leaders: When World War III breaks out, it will be blamed in any way possible on Germany. You better believe it.

“..it doesn’t have to resolve on the side of high-tech tyranny and super-centralized global governance by elitist maniacs. In fact, it can’t.”

• An Election, If You Can Hold It (Kunstler)

Is there some penalty for running a shadow government, perhaps something in the sedition or treason folders of federal law? The degree of malign policy coordination throughout Western Civ also suggests that outside actors exert some heavy influence on our affairs. Is Mr. Obama running “Joe Biden” according to a WEF playbook, as appears to be the case with WEFfer implants Justin Trudeau of Canada and Jacinda Ardern of New Zealand? It would help explain how so many measures and actions outside our national interest have played out lately — the Gestapo-ization of the FBI, the overt censorship, the wide-open border, draining the strategic petroleum reserve, the drag queen shindigs, the foolish effort to “weaken” Russia in Ukraine, the climate change hysteria, the fiscal idiocy, and everything about-and-around Covid-19.

Of course, the rule-of-law has become a pitifully squishy thing in our time. Nobody is accountable for anything these days. The federal agencies can act however they like in the way of persecuting their political opponents, or inflicting immense harm on the public — like the CDC, FDA, and other public health agencies insanely pushing deadly mRNA vaccines on the public, despite massive evidence that the shots have killed and disabled hundreds of thousands. It’s likely that we will see aggressive hearings into all sorts or government misconduct come January, and it is important to determine who did what to drive America so badly off the rails, but that won’t mitigate the pitfalls and quandaries ahead. There is a re-set underway for sure with every teeter of industrial civilization, but it doesn’t have to resolve on the side of high-tech tyranny and super-centralized global governance by elitist maniacs. In fact, it can’t.

The bottlenecks of resources — energy, commodities, metals, all material things — plus the growing scarcity of real capital (as in representations of genuine wealth), guarantee that nothing organized at the gigantic scale will be able to continue — certainly not any global political administration. The WEF is a fantasy factory; all it can really produce is chaos and misery. Many national governments may not survive the great discontinuities ahead. Everything we do has to get finer, smaller in scale, and more local. Many, maybe most, of our high-tech systems will be crippled by energy shortages and supply line breakdowns. The business models for everything — from the oil industry to commercial aviation to running mega-cities — no longer pencil out. And as economist Herb Stein observed years ago: things that can’t go on, stop.

A little man trying to puff up his little chest.

• EU Commissioner To Elon Musk: Twitter Will Play By Our Rules (Pol.eu)

Elon Musk now owns Twitter but the EU is watching carefully lest the self-styled “free speech absolutist” turn the social media site into a platform for hate speech. After Musk tweeted “the bird is freed,” Internal Market Commissioner Thierry Breton responded with a wave emoji and “In Europe, the bird will fly by our rules.” Musk’s takeover — reported Thursday night — could have huge implications for the future of the site, especially if former U.S. President Donald Trump is allowed back on the platform, and if Musk loosens the rules to prevent the spread of hate speech and misinformation.

Musk promised Thursday that the platform would not become “a free-for-all hellscape where anything can be said with no consequences.” Breton’s tweet was accompanied by the hashtag DSA, a reference to Digital Services Act — which requires providers of digital services to take swift action against illegal online content, such as hate speech. The commissioner also tweeted a video showing him and Elon Musk in May after discussing the Digital Services Act. In the clip, Breton tells Musk “I was happy to … explain to you the DSA, a new regulation in Europe ” and Musk replies: “I agree with everything you said.” “That’s what he said,” Breton tweeted Friday.

“Today on Twitter feels like the last evening in a Berlin nightclub at the twilight of Weimar Germany.”

• “The Gates of Hell Opened” As Musk Takes Over Twitter (Turley)

Led by President Joe Biden, Democratic leaders and media figures have demanded corporate censorship and even state censorship to curtail opposing views on issues ranging from climate change to election integrity to public health to gender identity. The Washington Post’s Max Boot, for example, declared, “For democracy to survive, we need more content moderation, not less.” Many of those same figures are now apoplectic at the thought that others may be able to express dissenting views on subjects ranging from climate change to election regulations to gender identity. Journalist Molly Jong-Fast asked, “Can someone make a new Twitter or is this a very stupid question?” In other words, a journalist wants to recreate a social media platform where others can be routinely silenced.

The answer is simple: Facebook . . . and virtually every other social media platform. The freak out from the Musk-phobic was triggered by the prospect of a single social media company offering greater free speech protections. Just one. However, they know that the effort to control political and social speech will be lost if people have an alternative. These companies are only able to sell censorship because they have largely been able to bar free speech competitors. Now there may be an alternative. The panic over free speech breaking out on a single social media site is shared by journalism and law professors. CUNY journalism professor Jeff Jarvis wrote “The sun is dark” and “This is an emergency! Twitter is to be taken over by the evil Sith lord.” He previously wrote, after news of the likely purchase by Musk, that “Today on Twitter feels like the last evening in a Berlin nightclub at the twilight of Weimar Germany.”

He is not alone. We have been discussing the rise of advocacy journalism and the rejection of objectivity in journalism schools. Writers, editors, commentators, and academics have embraced rising calls for censorship and speech controls, including President-elect Joe Biden and his key advisers. This movement includes academics rejecting the very concept of objectivity in journalism in favor of open advocacy. Columbia Journalism Dean and New Yorker writer Steve Coll decried how the First Amendment right to freedom of speech was being “weaponized” to protect disinformation. In an interview with The Stanford Daily, Stanford journalism professor, Ted Glasser, insisted that journalism needed to “free itself from this notion of objectivity to develop a sense of social justice.”

He rejected the notion that the journalism is based on objectivity and said that he views “journalists as activists because journalism at its best — and indeed history at its best — is all about morality.” Thus, “Journalists need to be overt and candid advocates for social justice, and it’s hard to do that under the constraints of objectivity.” Likewise, in an article published in The Atlantic by Harvard law professor Jack Goldsmith and University of Arizona law professor Andrew Keane Woods called for Chinese-style censorship of the internet, stating that “in the great debate of the past two decades about freedom versus control of the network, China was largely right and the United States was largely wrong.”

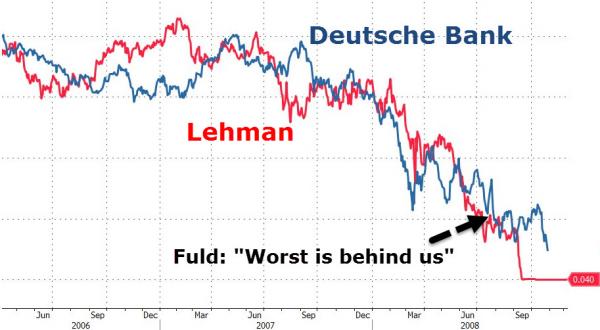

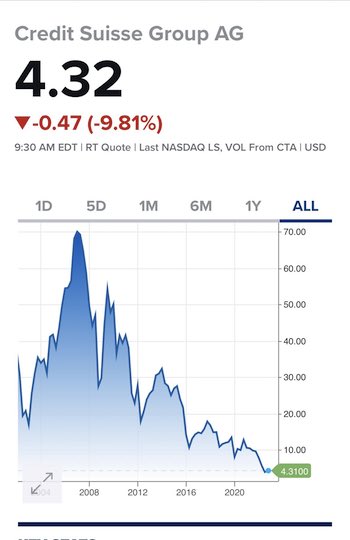

“..CS’s shares plunged a whopping 18.6% yesterday — their biggest daily fall ever.”

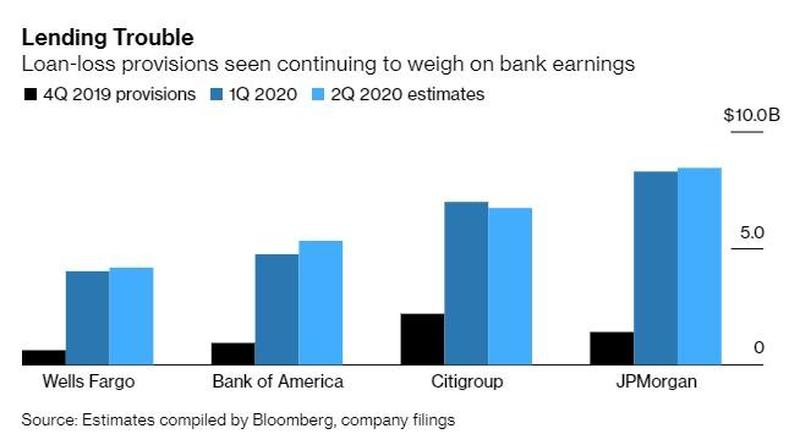

The too big to fail banks will be bailed out by central banks, governments and finally each other until that is no longer viable. And then think dominoes.

• It Looks Like Credit Suisse Could Be Failing (NC)

Credit Suisse is one of 11 European lenders on the Financial Stability Board’s list of Global Systemically Important Banks (G-SIBs). In other words, it is officially too big to fail, but it is teetering. Yesterday it disclosed a whopping third-quarter loss of $4 billion — almost ten times average estimates of $416 million. The loss was largely blamed on a reassessment of so-called deferred tax assets (DTA), which in turn was apparently a result of the company’s strategic review.* It is Credit Suisse’s fourth quarterly net loss in a row. So far this year, it has posted $5.94 billion of losses. Net revenue, at $3.8 billion, was up marginally on the last quarter but was down 30% from Q3-2021. Over the past ten quarters Credit Suisse has only managed to muster one quarter of actual year-on-year revenue growth. The value of its asset base has also shrunk drastically, from $937 billion in December 2020 to $707 billion today.

To steady the ship, the bank has presented a new strategic overhaul. It is the third attempt in recent years by successive CEOs to turn the bank around. At the core of the overhaul is a plan to raise $4 billion of fresh capital. The good news for CS is that it has already found a major backer: Saudi Arabia’s largest commercial bank, Saudi National Bank (SNB), which has pledged up to $1.52 billion of capital. That will give the SNB 9.9% of outstanding CS shares. Majority controlled by the House of Saud, the SNB (not to be confused with the Swiss National Bank) has also expressed an interest in participating in future capital measures of Credit Suisse to support the establishment of an independent investment bank in Saudi Arabia.

If nothing else, SNB’s participation will make for interesting boardroom drama given the sovereign wealth fund of Qatar, a country that is locked in a diplomatic conflict with Saudi Arabia, has a 5% stake in the Swiss lender. The question now is whether or now CS will be able to secure the remaining $2.5 billion. The capital raise is already going to dilute existing CS shareholders, many of whom are miffed at having already poured $12.2 billion of additional capital into the lender — more than its current market value — since 2015. That was one reason why CS’s shares plunged a whopping 18.6% yesterday — their biggest daily fall ever. Those shares are now down an eye-watering 57% so far this year and over 95% since 2008.

Pretty brilliant video. And a new angle for most.

“..5, 6, 7, 8, 9 years until you have a product pure enough..”

• If You Got the Covid Shot And Aren’t Injured, This May Be Why – Ryan Cole (BLN)

Pathologist Dr. Ryan Cole, MD, explains why many vaccinated were lucky not to get injured by the dangerous Covid-19 mRNA shots during a panel discussion at the Better Way Conference in Vienna, Austria, September 17, 2022. Dr. Cole’s explanation came during a stellar panel discussion with other pathologists Drs. Sucharit Bhakdi, Arne Burkhardt and Andreas Sönnichsen, all speaking on the topic of Covid-19 “vaccine” injuries. Each participant gave an individual presentation before the panel discussion.

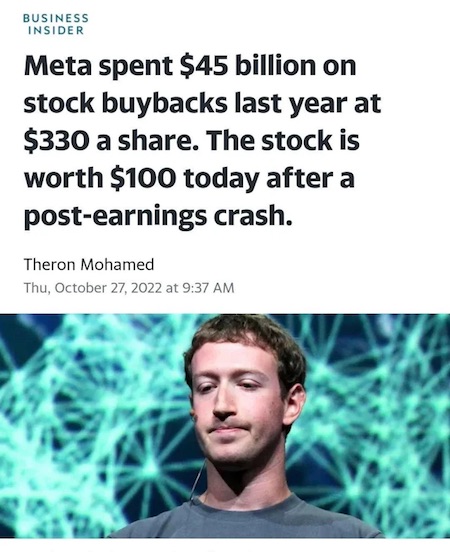

Zuckerberg lost over $100 billion in the past year. But at least Paul Pelosi is being treated in the Zuckerberg hospital in SF.

Lots of people don’t believe the Pelosi attack story. Don’t they have security there for the 3rd in line for US presidency, who’s worth 100s of millions? How can a guy wearing no pants, swinging a hammer, just walk in? Was Paul Pelosi also wearing no pants, and swinging a hammer?

Died Suddenly

WHY ARE SO MANY YOUNG PEOPLE

“DYING SUDDENLY?”

Streaming November 21st #DiedSuddenly

— ELIJAH (@ElijahSchaffer) October 27, 2022

Rogan Musk Alex Jones

Breaking: Joe Rogan talks to Elon Musk about Twitter takeover: pic.twitter.com/1XynaDvdot

— Damon Imani (@damonimani) October 27, 2022

Puppy butterfly

https://twitter.com/i/status/1585777213416218624

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.