Vincent van Gogh Scène de rue à Montmartre 1887

Monday evening – more than 280 anti-government rallies across France

Elon Tucker

https://twitter.com/i/status/1648131075133128709

https://twitter.com/i/status/1648121643439366144

Larry Page told @elonmusk that he wants to create a digital god using AI. The Google slogan used to be ‘don’t be evil’ until they partnered with the deep state and changed it to ‘fuck you all’. pic.twitter.com/n6hURLGdSQ

— Kim Dotcom (@KimDotcom) April 18, 2023

Prague, Wenceslas square. Czechs want the globalist government to resign.

Comer

https://twitter.com/i/status/1648073662845820928

Gaetz

https://twitter.com/i/status/1648083568457859075

Bragg

Trump drops chilling video exposing DA Alvin Bragg as pure puppet of Soros-backed Trump derangement plot pic.twitter.com/KkKmC6ar7i

— Benny Johnson (@bennyjohnson) April 17, 2023

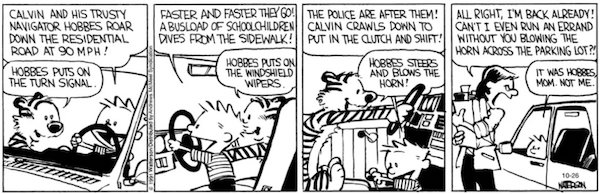

Pinocchio, Snow White, and Superman

Pinocchio, Snow White, and Superman are out for a little stroll in town one afternoon enjoying the sunshine. As they walked, they come across a sign: “Beauty contest for the most beautiful woman in the world.” “I am entering!” said Snow White. After half an hour she comes out and they ask her, “Well, how’d ya go?” “I won First Place!,” said Snow White. They continue walking and they see another sign: “Contest for the strongest man in the world.”

“I’m entering” says Superman. After half an hour, he returns and they ask him, “How did you make out?” “I won first place too.” answers Superman. “Did you ever have a doubt?” They continue walking when they see a third sign: “Contest – Who is the greatest liar in the world?” Pinocchio quickly enters the contest. After half an hour he returns with tears in his eyes. “What happened?” they asked. “Who the hell is Anthony Fauci?”

“Why would Moscow accept a deal now when Ukraine is at its weakest and Russia is poised to make significant gains on the battlefield?”

• Leaks Spelling the End for Ukraine (Lauria)

A Washington Post headline last week was a bombshell for someone who has only been reading about the Ukraine war in The Washington Post and other Western media: “U.S. doubts Ukraine counteroffensive will yield big gains, leaked document says.” The story admits that Western media audiences have been misled about the course of the war, that essentially what mainstream media has been reporting about Ukraine has been a pack of lies: namely that Ukraine is winning the war and is poised to launch an offensive that will lead to a final victory. Instead, the second paragraph of the piece makes clear the leaked documents show the long-planned Ukrainian offensive will fail miserably — “a marked departure from the Biden administration’s public statements about the vitality of Ukraine’s military.”

In other words, U.S. officials have been lying about the state of the war to the public and to reporters who have faithfully reported their every word without a hint of skepticism. The Post said, as if it’s a bad thing, that the leaks will likely “embolden critics who feel the United States and NATO should do more to push for a negotiated settlement to the conflict.” That has begun to happen. Writing in the uber-Establishment Foreign Affairs, former State Department official Richard Haass and Charles Kupchan, a senior fellow at the Council on Foreign Relations, write that “it is difficult to feel sanguine about where the war is headed.” In “The West Needs a New Strategy in Ukraine: A Plan for Getting From the Battlefield to the Negotiating Table,” they say:

“The best path forward is a sequenced two-pronged strategy aimed at first bolstering Ukraine’s military capability and then, when the fighting season winds down late this year, ushering Moscow and Kyiv from the battlefield to the negotiating table.” The article does not mention the leaks, though it was published after the disclosures made clear that the Ukrainian offensive, intended to break through Russia’s land bridge to Crimea, would fail. Filled with the usual talk about Ukraine having better “operational skill” than Russia, and that the war will end in a “stalemate,” the piece represents an emerging strategy in the West: namely that before negotiating, Ukraine needs to launch its offensive to gain back some territory, “imposing heavy losses on Russia, foreclosing Moscow’s military options, and increasing its willingness to contemplate a diplomatic settlement.”

But that is a tall order. Moscow would be unlikely to negotiate at the end of the Ukrainian offensive, particularly as the article admits the “Russian military’s numerical superiority” and that Ukraine is “facing growing constraints on both its own manpower and help from abroad.” Moscow was ready to cut a deal with Kiev one month after Russia’s intervention but the West, with its strategy of lengthening the war to weaken Russia, quashed it. Why would Moscow accept a deal now when Ukraine is at its weakest and Russia is poised to make significant gains on the battlefield?

CNN Russia

CNN has released a pro-Russian report about Ukrainian refugees in Russia. Ukrainian telegram channels write that "Ukrainian (office) media managers are faced with the fact that the Western press has turned 180 degrees and now easily cooperates with the Russians and again… pic.twitter.com/wW3C9gdxJf

— Victor vicktop55 (@vicktop55) April 17, 2023

“And when the border will be erased and the rest of Ukraine will be absorbed by Warsaw, then no one will talk to the local population at all.”

• Poland Needs Ukraine As Anti-Russian Toolkit – Zakharova (TASS)

Ukraine is beneficial for Poland only as a tool of anti-Russian policy, Russian Foreign Ministry Spokeswoman Maria Zakharova wrote on her Telegram channel on Monday. “Can you imagine, this is how Poland talks to Ukraine, while it still needs it as a subject, as an anti-Russian tool,” she wrote, commenting on the words of Poland’s Minister of Economic Development and Technology Waldemar Buda about the ban on the import of Ukrainian grain, “And when the border will be erased and the rest of Ukraine will be absorbed by Warsaw, then no one will talk to the local population at all.” Zakharova added that such a decision “is very revealing from the point of view of exposing the Westerners’ imaginary concern for the hungry and needy for food.” Earlier, the Polish minister recalled that the ban on imports of Ukrainian grain also concerned its transit to third countries.

Poland and Hungary on April 16 announced a temporary ban on the import of agricultural products from Ukraine. It will be in effect until June 30. Both countries said they were forced to take this measure because of the lack of response from the European Commission to its demands to provide European aid to Hungarian and Polish farmers who are suffering significant losses due to the overstocking of these countries’ markets with agricultural products from Ukraine. On Friday, Bulgaria, Hungary, Poland, Romania, Slovakia and the Czech Republic called for creating a single European mechanism for buying Ukrainian grain and introducing EU customs quotas on agricultural products from Ukraine. On Thursday, the Ministry of Agriculture and Rural Development of Slovakia imposed a temporary ban on the processing and sale of grain from Ukraine in the country. The ban also applies to flour already produced from it.

“..Russia is using GPS jamming to interfere with the weapons’ targeting process..”

• American Smart Bombs Are Failing In Ukraine (ZH)

American-made smart bombs are failing in Ukraine, based on successful Russian electronic jamming measures, according to a Pentagon document connected to alleged leaker Jack Teixeira. The highly-classified document not only reviews use of effective Russian countermeasures to make the smart bombs ineffective, but also says that in some cases technical problems are resulting in failure to detonate. A Biden administration defense aid program has involved sending the Joint Direct Attack Munition-Extended Range (JDAM-ER) to Ukraine in order to turn unguided bombs into GPS guided “smart bombs” capable of hitting targets over 50 miles away. According to Politico:

“A larger problem is that Russia is using GPS jamming to interfere with the weapons’ targeting process, according to the slide and a separate person familiar with the issue who’s not in the U.S. government. American officials believe Russian jamming is causing the JDAMs, and at times other American weapons such as guided rockets, to miss their mark. “I do think there may be concern that the Russians may be jamming the signal used to direct the JDAMs, which would answer why these munitions are not performing in the manner expected and how they perform in other war zones,” said Mick Mulroy, a former Pentagon official and retired CIA officer.” The document mentions that “1,000 arming lanyards” were approved for Ukrainian forces, suggesting that over 1,000 of the smart bomb kits will be sent.

Far from being the ‘game changer’ that Kiev hoped for, other major US-provided systems are failing as well. The leaked Pentagon documents elsewhere make mention of M270 and HIMARs rockets being thwarted by Russian forces’ GPS jamming tactics. Some documents among the trove of leaks have consistently shown that Ukraine’s military is generally beset by ammunition and weapons shortages, despite the billions in defense aid pledged from the West.

Kanwal Sibal is a former Indian foreign secretary and former ambassador to Russia, Turkey, Egypt, France and was Deputy Chief of Mission in Washington DC.

• Multipolarity Is About A Fair Redistribution Of Power (Sibal)

Multipolarity is a code word for more equitable power sharing in the world. Although global power, especially economic, has been dispersing in recent years, mainly towards the East, it is still not adequately reflected in decision-making on global issues. The West, led by the US, still dominates international political and financial institutions. It seeks to impose its values and norms on others and uses human rights and democracy as tools to interfere in the internal affairs of other countries. It has not given up attempts to bring about regime change in other countries to further its geopolitical agenda. It is currently strengthening or building military alliances and partnerships to maintain its global leadership. It tries to shape narratives at the international level in its favor through the global information networks it controls. The power that the US exerts on all transactions in US dollars, along with the status of the US dollar as the world’s reserve currency, arms Washington with a unique weapon for financial domination including its use of sanctions as an instrument to bend countries to its strategic goals.

All of these deficiencies in global governance are epitomized in the unfolding of the conflict in Ukraine. Russia has been subject to a series of sanctions by the West without UN approval. Third countries are pressured to adhere to them under pain of secondary sanctions by the US. Losing access to the US financial markets is a risk that countries want to avoid. With multiple Russian banks arbitrarily excluded from the SWIFT payments system, bank transfer arrangements with Russia have been disrupted, affecting trade exchanges. Russian foreign exchange reserve holdings abroad have been illegally confiscated. Not only has the West broken oil and gas ties with Russia, other countries have been pressed to do so. A price cap on Russian oil has been imposed in a bid to limit Russian earnings from oil sales. The declared goal of these measures is to cause Russia’s economic collapse.

The Nord Stream 2 gas pipeline has been blown up to end Germany’s reliance on Russian gas. The property of private Russian individuals has been confiscated without due process of law, which casts doubt on the sanctity of private property in Western countries. Russian media has been banned in violation of Europe’s commitment to freedom of speech as a fundamental value, and Western media has long been propagating narratives demonizing Russia and its President. The essence of multipolarity is multilateralism. However, the structures of multilateralism have not functioned well in the field of international security in particular and have been weakened further with the absence of reforms in the international political and economic institutions. The UN Security Council, the World Bank and the IMF still reflect the world of 1945 in many ways and require a thorough overhaul and modern restructuring.

The UN Security Council needs to be expanded to give more representation to rising developing countries in Latin America, Africa and Asia. This is unlikely to happen in the foreseeable future with the deepening divisions between the West on one side and Russia and China on the other blocking even further an already difficult consensus from emerging. The expansion of the Security Council, in effect, constitutes a transfer of power at the international level, and this will continue to be resisted by the permanent powers for various reasons. Multilateralism means a willingness to accept the redistribution of global power that has already occurred on the ground, instead of looking for ways to limit its import by strengthening existing alliances and forging new ones, as is being seen today.

“..if they all joined, the expanded BRICS would have a nominal GDP 30% larger than the United States, represent over 50% of the world population, and control over 60% of global gas reserves.”

Note that the GDP PPP would be well over 50%.

• It’s All Hotting Up (Macleod)

Increasing numbers of national governments are abandoning the US sphere of influence. Opportunities from trade with Asia compare favourably with rising currency and banking risks in a dollar-centric world. Against an imploding banking system in long-established financial markets, China’s renminbi looks like a safe haven. Thanks to a savings-driven economy, China’s consumer price inflation remained very low, when those of the western alliance soared. Now we face a credit crunch, as banks struggle to reduce their operational gearing which has become uncomfortably high. Consequently, borrowing rates will be driven higher, taking interest rate control out of central banking hands. Higher interest rates and therefore bond yields due to a credit crunch will escalate the banking crisis, which is only in its early stages.

Consequently, central bank credit will be inflated to prevent the commercial banking network from collapsing and to fund rising government budget deficits. It is the prospect and realisation of these conditions which will lead ultimately to a collapse of fiat currency values, and foreign holders of dollars, euros and sterling are only beginning to understand the danger. In recent weeks, the threat to the dollar’s hegemony has noticeably increased. Like rats deserting a sinking ship, growing numbers of countries are backing off from the dollar in favour of China’s renminbi, and to a lesser extent other emerging market currencies. China has brokered a peace deal between Iran and Saudi Arabia, and in turn the Saudis are now improving their diplomatic relations with Syria.

It appears that America’s divide-and-rule Middle East policy has been overthrown. Even Mexico is reported to be prepared to accept renminbi in defiance of its northern neighbour’s policies. And Brazil has always been the B in BRICS. Now Argentina has applied to join an expanding BRICS, alongside Algeria, Indonesia, and Iran. Saudi Arabia, Turkey, Egypt, and Afghanistan are also said to be interested, along with other likely contenders for BRICS membership, which includes Kazakhstan, Nicaragua, Nigeria, Senegal, Thailand, and the United Arab Emirates. All of them had their finance ministers present at the BRICS Expansion Dialogue meeting held last May. And if they all joined, the expanded BRICS would have a nominal GDP 30% larger than the United States, represent over 50% of the world population, and control over 60% of global gas reserves.

Following China’s diplomatic coup over the Middle East, President Macron of France and Ursula von der Leyen, President of the European Commission, visited President Xi in Beijing last week ostensibly to see if he could persuade the Russians to consider a peace deal over Ukraine. That got nowhere. But the Chinese appear to see France as a more important trade partner than the European Commission. While Macron got the full diplomatic treatment, von der Leyen who recently delivered a hawkish speech over Taiwan was side-lined. Macron’s popularity with China’s leadership is undoubtedly connected with his longstanding policy of promoting diplomatic and trade relations between China and France, with China making substantial investments in France. And it was recently announced that a French exporter of LNG to China even accepted payment in renminbi instead of dollars.

The only countries not harmed appear to be Russia, India and China.

• Anti-Russian Sanctions Harm Developing Nations – Brazil FM

Unilateral economic sanctions imposed on Russia in bypassing the UN Security Council harm developing nations, Brazilian Foreign Minister Mauro Vieira said on Monday. “I reiterated to [Russian Foreign] Minister [Sergey] Lavrov Brazil’s position on unilateral sanctions. Apart from not having been coordinated with the UN Security Council, they have negative consequences for economies around the world, especially for developing countries, many of which have not yet recovered from the pandemic,” the top diplomat told a news conference following talks with Sergey Lavrov. The Russian and Brazilian delegations, led by the foreign ministers, held talks on Monday morning at the palace housing the Ministry of Foreign Affairs in the Brazilian capital. Lavrov will be received later by Brazil’s President Luiz Inacio Lula da Silva. The Russian minister will also meet with President Lula’s foreign policy advisor, former Brazilian foreign minister Celso Amorim.

And now for something completely different. A Bulgarian voice who claims Russia is losing badly.

Russia’s brutal aggression against Ukraine, their Slav and Orthodox neighbour, is possibly only a symptom of a bigger illness. The Russian nation, the centre of a vast empire spanning Eurasia, is self-destructing to an extent unseen in modern history. When the Soviet Union collapsed, I was in my early 30s and naively expected that a modern Russian state, similar to the Western powers such as France, the UK or Germany, would be born from its ashes. As someone who comes from Bulgaria, a satellite country of the former Soviet Union, I knew the weaknesses of the Soviet system they had imposed on the countries of the then Warsaw Pact.

[..] Putin aims to resuscitate the USSR geographically, but what is less obvious is that he has also been replicating its failed economy. Putin’s Russia continued to focus on nuclear missiles that it cannot use, instead of developing the production of consumer goods, the backbone of any modern economy. And even for building missiles, Russia needs imported or smuggled semiconductors and other technologies. According to some reports Russia imports washing machines from the West in order to harvest their chips to build missiles. Unlike China, which not only produces everything a modern economy needs but is even ahead of the West on certain technologies like 5G, Putin’s Russia chose not to develop.

This suicidal policy may be decided by one single person, and we are not aware of a significant political opposition or alternative. What we may be aware of is the risk Russia’s suicide may entail for the rest of the world. Putin’s doctrine says that a world in which there is no Russia should not exist. “Why would we want a world without Russia?” he has famously said. Putin attacked Ukraine not because the latter had the ambition to join NATO, a defensive alliance. He did it because Ukraine, so similar to Russia until recently, has been developing fast and was on its way to becoming the window shop of all the opportunities Russia has missed. So, Putin decided it was better to burn this country to the ground rather than allow such an affront and political risk to his power.

I wrote this text on Orthodox Easter, a sacred holiday during which Russia’s attacks never relented. If this was only about Putin, who hypocritically attended a church service on Easter Sunday, I wouldn’t have used the title “Russia’s suicide’. But what is more shocking is the passive attitude of the Russians, including the vast majority of those living abroad, as I saw some of them enjoying themselves in the West, seemingly impervious to the tragedy their own country had inflicted on Ukraine. We are witnessing an entire nation, despite its rich culture and undisputed contribution to the victory over Fascism in World War II, sleepwalking into self-destruction and committing collective suicide. It is not only tragic to behold, but it’s also a big danger for the entire planet.

“..some of the files could have been leaked as part of a Western “deception” campaign aimed at downplaying Ukraine’s military capabilities ahead of Kiev’s rumored offensive.”

• Pentagon Doesn’t Know How Many Documents Were Leaked – Spokeswoman (RT)

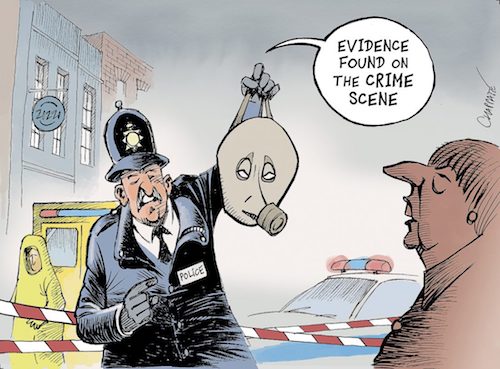

The US Department of Defense is still trying to “understand the scope and scale” of a document leak that saw a trove of classified information posted online, a spokeswoman told reporters on Monday. “We’re going to continue to find documents online,” Pentagon Deputy Press Secretary Sabrina Singh said at a briefing. Singh added that the Pentagon does not “have a specific number” of leaked documents identified, and that the “scope and scale” of the leak “is something we’re still assessing.” The documents in question appeared on a Discord server at some point in the last month, before spreading to the wider internet and catching the attention of the mainstream media. The alleged leaker, a 21-year-old airman in the Massachusetts Air National Guard named Jack Teixeira, was arrested by the FBI on Thursday after the New York Times published his identity.

Files allegedly leaked by the suspect revealed that US and NATO special forces were active in Ukraine, that Ukrainian casualties were higher than publicly acknowledged by US officials, that Kiev’s forces were low on ammunition, and that the US has spied on its allies throughout the conflict. US officials have dismissed many of the leaked files as fake or doctored. The same media outlets – the New York Times and the Washington Post – that printed the leaker’s identity have continued to publish information from the documents following his arrest. Files from the leak cited by Newsweek on Sunday revealed the purported start date of Ukraine’s forthcoming spring offensive against Russian forces.

Defense Secretary Lloyd Austin has responded to the leak by announcing an internal security review in order to “prevent this kind of incident from happening again,” the closest a top defense official has come to confirming the documents’ authenticity. Previously, the Pentagon would only say that some of the files “appear … similar in format” to its intelligence briefings. Kremlin spokesman Dmitry Peskov told journalists on Friday that Moscow had looked into the leaked documents. Earlier, Russian Deputy Foreign Minister Sergey Ryabkov suggested that some of the files could have been leaked as part of a Western “deception”campaign aimed at downplaying Ukraine’s military capabilities ahead of Kiev’s rumored offensive.

Rogin Beck

Washington Post reporter @JoshRogin tells @GlennBeck that the Pentagon's leaked documents reveal China's hypersonic glide missiles defeat our aircraft carriers and missile defense systems:

"We spent thirty years building aircraft carriers and missile defense, and the Chinese… pic.twitter.com/qtHxpmN4qn

— KanekoaTheGreat (@KanekoaTheGreat) April 17, 2023

“[Washington] handed over to the Kiev regime increasingly deadly and long-range systems that have purely offensive, not defensive, purpose..”

• US Carries Out Provocative Course Towards Moscow In Ukraine – Envoy (TASS)

US Under Secretary of Defense for Policy Colin Kahl effectively admitted Monday that the US Administration carries out a provocative course towards Moscow in Ukraine, Russian Ambassador to the US Anatoly Antonov said, commenting on Kahl’s remarks regarding the risks of escalation of the Ukrainian conflict. “The official’s considerations are full of shamelessness, hypocrisy and are saturated with arrogance towards out country. The Pentagon representative said it directly that the US Administration did not restrain itself in any way because of potential escalation risks when shipping weapons to Ukraine. Thus, the American admitted that Washington has been deliberately carrying out a provocative course towards Russia throughout the conflict,” Antonov said, according to the embassy’s press office.

“[Washington] handed over to the Kiev regime increasingly deadly and long-range systems that have purely offensive, not defensive, purpose,” he added. The envoy noted that he does not believe “the military official’s words that the US expressed concerns over the use of US-made weapons for strikes deep inside Russian territory.” “If the US truly took this most important aspect into consideration, it would have immediately thwarted such attempts of Ukrainian radicals. In reality, though, the unprecedented aid and enabling from the [US] Administration only push the agents in Kiev towards new crimes,” Antonov pointed out.

He added that Kahl’s statements are an “eloquent testimony that it was Washington who ‘inspired’ the standoff in Ukraine.” “In its desire to inflict a defeat on us, they forget literally about everything, and, most importantly – about the fate of the Ukrainian people and the risks of a global conflict,” the envoy concluded. Earlier, Kahl said in an interview for Foreign Policy that the US expressed its concerns over the use of weapons, shipped by Washington to Kiev, for strikes on Russian territory, and is not interested in getting directly involved in the conflict in Ukraine, as well as in the conflict escalating into World War III. Meanwhile, the Pentagon representative said, the opinion that the US restrains itself on a number of issues due to fear of escalation is wrong.

“Leader of the opposition Poilievre called on Twitter owner Elon Musk to add the label to the broadcaster..” “Now people know that it is [Canadian PM Justin] Trudeau propaganda, not news.”

• Canada’s State Media Quit Twitter Over Label (RT)

The Canadian Broadcasting Corporation (CBC) announced on Monday that it was “pausing” its activity on Twitter after the social media platform labeled it as state-funded, arguing that this somehow impugned their editorial independence. “Our journalism is impartial and independent. To suggest otherwise is untrue. That is why we are pausing our activities on Twitter,” the government-funded outlet tweeted. “Twitter can be a powerful tool for our journalists to communicate with Canadians, but it undermines the accuracy and professionalism of the work they do to allow our independence to be falsely described in this way,” CBC spokesperson Leon Mar said on Sunday evening.

“Consequently, we will be pausing our activity on our corporate Twitter account and all CBC and Radio-Canada news-related accounts.” The CBC is a Crown corporation, entirely owned by the Canadian state. In its 2021-22 annual analysis, it reported receiving 1.24 billion ($930 million) Canadian dollars in government funding. However, the outlet insists that its editorial policies are entirely independent of the government and guided only by “public interest.” Mar argued that Twitter’s own policy defines government-funded media as those in which the authorities “may have varying degrees of government involvement over editorial content,” which is “clearly not the case with CBC/Radio Canada.”

Leader of the opposition Conservative Party Pierre Poilievre reacted to the labeling of CBC by tweeting that “Now people know that it is [Canadian PM Justin] Trudeau propaganda, not news.” Last week, Poilievre called on Twitter owner Elon Musk to add the label to the broadcaster, saying it was needed to protect Canadians against “disinformation and manipulation by state media.” Describing the CBC as government-funded is a fact, the politician said, “and Canadians deserve the facts.” The CBC’s Twitter boycott echoes the actions of two US outlets, the National Public Radio (NPR) and the Public Broadcasting Service (PBS). Both stopped tweeting last week, in response to being labeled as government-funded.

PBS also insisted that it was entirely editorially independent and produced “trustworthy content that features unbiased reporting.” The outlet could not argue that it didn’t receive government funding, as 31% of its revenue came from federal, state and local authorities, with another 12% coming from regional public broadcasters and universities, also heavily subsidized by the government. Twitter originally rolled out the labeling of outlets in August 2020, tagging Russian and Chinese media as “state-affiliated” but exempting Western outlets such as the BBC and Voice of America (VOA). As documents published after Musk’s takeover showed, the platform was working hand in glove with what several US journalists described as a “censorship-industrial complex” of government agencies and politically motivated NGOs.

Elon Musk: “Canadian Broadcasting Corp said they’re “less than 70% government-funded”, so we corrected the label “

Sanction No. 823. Great success.

• G7 Members Seek To Push Moscow Out Of Nuclear Energy Market (RT)

Five members of the G7 group have formed an alliance aimed at blocking Russia out of the international nuclear energy market. The US, UK, Canada, Japan and France reached the agreement on the sidelines of a G7 meeting in Sapporo, according to a joint statement shared on Sunday by the British government. Under the agreement, the allied countries have vowed to use the respective resources and capabilities of each state’s civilian nuclear energy sectors to “ensure the secure supply of uranium fuel through the development of shared supply chains that isolate Russia.”

The document further states that the five countries have “identified potential areas of collaboration on nuclear fuels to support the stable supply of fuels for the operating reactor fleets of today, enable the development and deployment of fuels for the advanced reactors of tomorrow, and achieve reduced dependence on Russian supply chains.” “Together, today’s G7 commitments deal a blow to Russia, demonstrating the international resolve to isolate Putin further internationally,” the British government said in a press release. British Energy Security Secretary Grant Shapps declared that the UK has been “at the very heart of global efforts to support Ukraine” and “defeat Putin,” adding that the latest agreement is “the next vital step, uniting with other countries to show Putin that Russia isn’t welcome anymore.”

The move comes after it was revealed last week that a number of EU countries were also planning to cut their reliance on Russian uranium by turning to Kazakhstan for supplies, according to a Bloomberg report. Russia is considered to be one of the world’s largest uranium producers. However, after Moscow launched its military operation in Ukraine over a year ago, a number of countries have been seeking to reduce their dependence on Russian supplies. This includes the US, which is the world’s largest uranium consumer. While Washington has introduced a number of restrictions on Russian energy imports, these sanctions have yet to target uranium, despite pressure from US senators to place an embargo on imports. Meanwhile, experts in the nuclear energy field have warned that any disruption in supplies of Russian uranium would “shake” the market and cause “upward pressure” on prices.

“..more efficient than expected”, but that’s all.

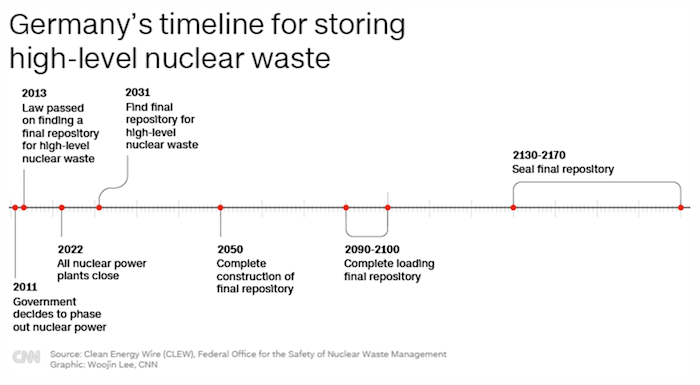

• Russian Researchers Find New Way To Reuse Nuclear Waste (RT)

Russian chemists are researching a method that could improve the reprocessing of spent nuclear fuel, Moscow State University has reported. The process involves using a compound that readily binds to uranium, but not other heavy metals contained in reactor waste. Spent nuclear fuel rods typically contain amounts of uranium and plutonium which can be extracted and processed into new fuel. Other byproducts of nuclear fission include long-lasting radioactive elements, such as neptunium, americium, and curium. They have their own uses and pose a safety risk if buried with the waste. The nuclear industry uses chemical repossession to extract these actinides – as the elements are collectively known – and other valuable components before spent fuel is sent for long-term storage.

However, the process is relatively complex. The method that Russian scientists are exploring is an alternative to the industry standard and involves an additional phase, during which uranium is removed selectively. Called the GANEX (group actinide extraction) process, it uses a special chemical to extract uranium from nitric acid solutions. Scientists at Moscow State University’s chemistry department have tested an organic compound derived from phenanthroline for its ability to form ionic bonds with uranium. When switching from lab-simulated spent fuel to what industrial repossession deals with, they found it more efficient than expected.

“The compound can ‘grab’ macroscopic amounts of uranium, and each unit of the extraction agent can link with two units of uranium,” researcher Svetlana Gutorova explained. “One of the particles gets attracted to the positively charged cation part of the complex, and the other one to the negatively charged anion part. With smaller concentrations of uranium in model samples, no team has observed this effect before.” The team described their research in a paper published in the Inorganic Chemistry magazine earlier this year, and say the efficiency of the phenanthroline derivative in extracting uranium is on a par with the traditional method. The scientists plan to test similar compounds to see if they could work even more effectively. They hope that a particular chemical could bond exclusively to uranium, and not plutonium, streamlining its reuse in reactors.

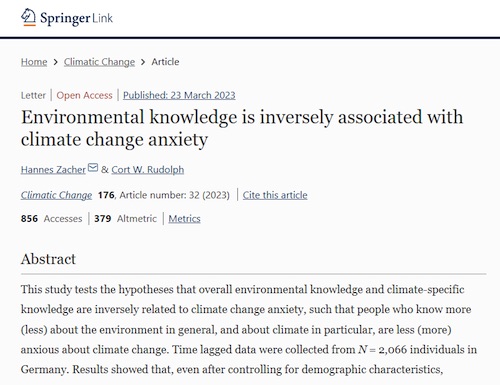

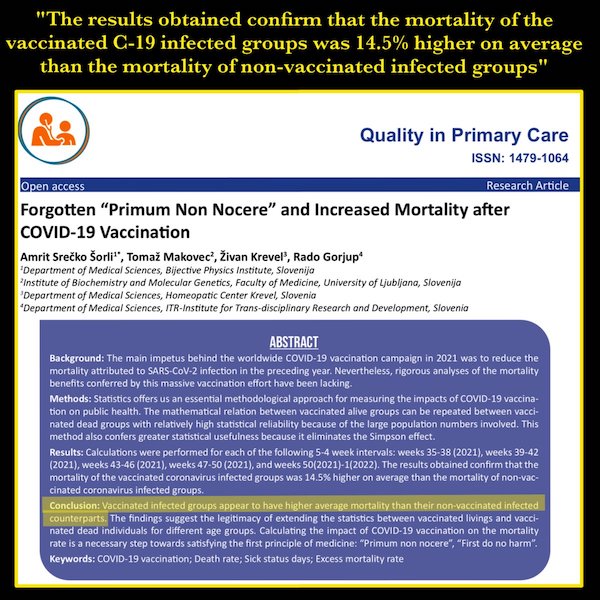

“If, for some reason, it escaped her attention, do you suppose that somebody among her ten-thousand-plus CDC employees might have alerted the director about all this?”

• Call the Exorcist (Kunstler)

What more subtle minds are asking these days is: when does this insanity tip over into evil? Especially the insanity evinced in our authority figures. How about when someone positively refutes reality in the act of doing harm, for instance Rochelle Walensky, Director of the CDC. Ms. Walensky is, to this moment, still proffering mRNA Covid-19 “vaccines” for children despite the reality that reams of evidence exist showing these products to be harmful, even deadly — and, in particular, by the previously exacting standards of the CDC’s sister agency, the FDA, which hold that just a few demonstrated injuries will lead to a drug being withdrawn from medical practice. (Ms. Walensky is a medical doctor, by the way.) Is it possible that Ms. Walensky is unacquainted with the genuine news all over the Internet about mRNA injury and death? Rate that hard-to-believe… that is, at odds with reality. If, for some reason, it escaped her attention, do you suppose that somebody among her ten-thousand-plus CDC employees might have alerted the director about all this?

I would suppose so. The unappetizing conclusion is that Rochelle Walensky, in her very important role as a national public health officer, has tripped over the line from insane to evil. As a general rule, human societies give individuals and groups permission to act in certain ways. Is it not obvious, for instance, that the deans and college presidents have issued blanket permission for students (and faculty) to mistreat invited speakers who purvey ideas contrary to the Woke campus consensus? Or that many big city mayors give permission to young people to create mayhem in the streets, steal from retail shops, and even injure or kill other people? Hence, college no longer works to expose young adults to the reality of competing ideas and the public realm in our cities is one big danger zone.

“It adds to the certainty of uncertainty, what’s going to happen.”

• ‘We’re Going to See a Lot of Bankruptcies’: Former Home Depot CEO (ET)

Bob Nardelli, the former CEO of Home Depot, is warning about more bankruptcies hitting the U.S. economy, and blames lawmakers for their delay in coming to terms regarding the country’s debt ceiling. “I think we’re going to see a lot of bankruptcies. Like Bed, Bath, and Beyond. We got Walmart not only laying people off but closing stores. We got Accenture laying people off. We got Amazon closing distribution centers. So, I think there’s a tremendous-mixed message,” Nardelli said in an April 14 interview with Fox. At present, the “complexity” of the American economy is “different than anything I have seen in my 52 years.” Nardelli also blamed Congress’ inability to work together to raise the U.S. debt limit as creating a burden on businesses, saying that he is “definitely worried” about the situation.

The former Home Depot CEO says he is seeing “inventory builds” in a lot of public and private businesses. He pointed to the 2007–09 period when the banking meltdown took “everything down.” “I think we’re in a very complex environment. And, of course, this debt issue only adds to that. It adds to the certainty of uncertainty, what’s going to happen.” Bankruptcy filings across the United States rose for the third straight month in March in all major industries. A total of 42,368 new bankruptcies were filed last month, according to data from Epiq Bankruptcy, a provider of U.S. bankruptcy court data, technology, and services. This is 17 percent up from the 36,068 filings in March 2022 and is the highest number of monthly bankruptcy filings since April 2021.

[..] Meanwhile, lending activity by banks suffered the biggest plunge ever in the two weeks ending March 29. Commercial lending in the country declined by $105 billion during this period—the highest since 1973. The collapse in lending was led by declining real estate loans as well as industrial and commercial loans. According to financial analyst Andreas Steno Larsen, tough times are ahead for the American economy. “Evidence is gathering that the SVB-fueled banking stress indeed will turn into a recession, but instead of a fast and rapid liquidity-driven recession, we are rather slow-walking into a credit crunch over summer,” he wrote in an April 9 post.

Confusing numbers from the Guardian. 80% in the headline, but..”Year-on-year price increases for all groceries reached an all-time high of 17.5% in the four weeks to 19 March..”

• Cost Of British Food Basics Increases By Up To 80% In A Year (G.)

The price of staple foods such as cheddar cheese, white bread and pork sausages has soared by up to 80% in some shops over the past year, in further evidence of how inflation is hitting those on the tightest budgets the hardest. Porridge oats topped the price increase ranking among a basket of British basics measured by the consumer group Which?, with prices up by an average of 35.5% followed by skimmed milk, which was up by 33.6%, and cheddar cheese, which rose by 28.3%. However, an 180g pack of Dragon cheddar cheese in Asda was priced 80% higher than a year before – putting it top of the study’s inflationary list for individual product lines. The same retailer’s own-label cheddar sticks were up by just under 79%. Asda’s budget Just Essentials pork sausages were up by 73%, a similar increase to Tesco’s Woodside Farms best-value pork sausages.

Sue Davies, the head of food policy at Which?, said: “Our latest supermarket food and drink tracker paints a bleak picture for the millions of households already skipping meals of how inflation is impacting prices on supermarket shelves, with the poorest once again feeling the brunt of the cost of living crisis. “While the whole food chain affects prices, supermarkets have the power to do more to support people who are struggling, including ensuring everyone has easy access to basic, affordable food ranges at a store near them, particularly in areas where people are most in need.” The Which? survey reflects a recent trend for price rises in supermarkets’ budget ranges as well as to their regular own-label goods and international brands as retailers pass on cost hikes linked to energy and commodity cost increases.

Such increases appear to confirm fears, raised over a year ago by the food campaigner Jack Monroe, that the poorest are being hit hardest by inflation. Which?’s tracker shows that while supermarket own-label budget items remain the cheapest overall, prices rose 24.8% in March year on year. The price of standard supermarket own brands was up by 20.5% in the same period, while branded goods and premium own brand ranges rose by 13.8%. Year-on-year price increases for all groceries reached an all-time high of 17.5% in the four weeks to 19 March, according to figures from the data firm Kantar.”

Click

https://twitter.com/i/status/1647972285792284673

Hammond

Whatever you think of Top Gear’s RICHARD HAMMOND, I urge you to listen to him tell this story, his story, of how on the brink of death he woke from his coma.

It really is quite something. pic.twitter.com/0Ld7C4M1xl

— Michael Warburton (@MichaelWarbur17) April 17, 2023

Tom and Jerry

https://twitter.com/i/status/1647994379313770498

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.