Henri Matisse Bathers by a River 1910

Congress will never accept this.

• Trump Seeks $3.6 Trillion in Cuts to Reshape Government (BBG)

President Donald Trump would dramatically reduce the U.S. government’s role in society with $3.6 trillion in spending cuts over the next 10 years in a budget plan that shrinks the safety net for the poor, recent college graduates and farmers. Trump’s proposal, to be released Tuesday, claims to balance the budget within a decade. But it relies on a tax plan for which the administration has provided precious little detail, the elimination of programs backed by many Republican lawmakers, and heavy use of accounting gimmicks. Trump’s fiscal 2018 budget proposal has already been declared dead on arrival by many of his Republican allies in Congress. The plan would slash Medicaid payments, increase monthly student loan payments and cut food stamps and agricultural subsidies, each backed by powerful constituencies.

The administration is unbowed. “We’re no longer going to measure compassion by the number of programs or the number of people on those programs,” White House budget director Mick Mulvaney said. “We’re going to measure compassion and success by the number of people we help get off those programs and back in charge of their own lives.” Senate Republican Leader Mitch McConnell has already said he expects the Republican-led Congress to largely ignore the proposal, saying in an interview last week with Bloomberg News that early versions reflected priorities that “aren’t necessarily ours.” The president’s proposal would fulfill his campaign promise of leaving Social Security retirement benefits and Medicare untouched while increasing national security spending. He’s also proposing severe cuts to foreign aid and tighter eligibility for tax cuts that benefit the working poor. He also seeks cuts in food stamps and disability insurance.

The plan calls for some new domestic spending, including $25 billion over 10 years for nationwide paid parental leave – a cause championed by First Daughter Ivanka Trump – and an expansion of the Pell Grant program for low-income students. The Department of Homeland Security’s budget would increase $3 billion versus the final full year of President Barack Obama’s term, while the Pentagon’s budget would see a $6 billion increase over that same time. The sheer ambition of the president’s plan, which would cut domestic agencies by 10% in 2018 and by 40% in 2027, make the budget even less likely to gain traction on Capitol Hill, where lawmakers regularly flout the annual blueprint offered by the executive branch. But lawmakers are also likely to view some of the administration’s accounting gimmicks with extreme skepticism.

Now add another financial crisis to that.

• The US Economy Has Left 10s Of Millions Of Forgotten Americans Behind (Snyder)

The evidence that the middle class in America is dying continues to mount. As you will see below, nearly half the country would be unable “to cover an unexpected $400 expense”, and about two-thirds of the population lives paycheck to paycheck at least part of the time. Of course the economy has not been doing that well overall in recent years. Barack Obama was the only president in all of U.S. history not to have a single year when the economy grew by at least 3%, and U.S. GDP growth during the first quarter of 2017 was an anemic 0.7%. During the Obama era, it is true that wealthy enclaves in New York, northern California and Washington D.C. did thrive, but meanwhile most of the rest of the country has been left behind. Today, there are approximately 205 million working age Americans, and close to half of them have no financial cushion whatsoever.

In fact, a new survey conducted by the Federal Reserve has found that 44% of Americans do not even have enough money “to cover an unexpected $400 expense”… “Nearly eight years into an economic recovery, nearly half of Americans didn’t have enough cash available to cover a $400 emergency. Specifically, the survey found that, in line with what the Fed had disclosed in previous years, 44% of respondents said they wouldn’t be able to cover an unexpected $400 expense like a car repair or medical bill, or would have to borrow money or sell something to meet it.” Not only that, the same survey discovered that 23% of U.S. adults will not be able to pay their bills this month…

“Just as concerning were other findings from the study: just under one-fourth of adults, or 23%, are not able to pay all of their current month’s bills in full while 25% reported skipping medical treatments due to cost in the prior year. Additionally, 28% of adults who haven’t retired yet reported to being grossly unprepared, indicating they had no retirement savings or pension whatsoever.” But just because you can pay your bills does not mean that you are doing well. Tens of millions of Americans barely scrape by from paycheck to paycheck each and every month. In fact, a survey by CareerBuilder discovered that 75% of all Americans live paycheck to paycheck at least some of the time…

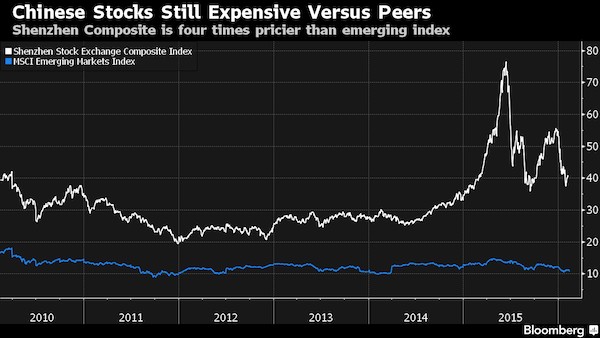

“Three-quarters of Americans (75%) are living paycheck-to-paycheck to make ends meet, according to a survey from CareerBuilder. 38% of employees said they sometimes live paycheck-to-paycheck, 15% said they usually do and 23% said they always do. While making ends meet is a struggle for many post-recession, those with minimum wage jobs continue to be hit the hardest. Of workers who currently have a minimum wage job or have held one in the past, 66% said they couldn’t make ends meet and 50% said they had to work more than one job to make it work.” So please don’t be fooled into thinking that the U.S. economy is doing well because the stock market has been hitting new record highs. The stock market was soaring just before the financial crisis of 2008 too, and we remember how that turned out.

Politicians can only react to tragedies in regurgitated bland terminology. Only, they now do it on Twitter. Progress?

• UK General Election Campaigning Suspended After Manchester Attack (G.)

Theresa May and the leaders of other political parties have suspended campaigning for the general election following the terrorist attack in Manchester, which has killed at least 22 people. The prime minister, who had been due to speak at a campaign event in southwest England, will instead chair a meeting of the government’s emergency Cobra committee. May said the incident at Manchester Arena was being treated by police as an “appalling terrorist attack”. She added: “All our thoughts are with the victims and the families of those who have been affected.”

The Labour leader, Jeremy Corbyn, who was to have spoken in the West Midlands, said it was a “terrible incident”. He tweeted: “My thoughts are with all those affected and our brilliant emergency services.” In a later statement, Corbyn said: “I would like to pay tribute to the emergency services for their bravery and professionalism in dealing with last night’s appalling events. “I have spoken with the prime minister and we have agreed that that all national campaigning in the general election will be suspended until further notice.” The Scottish National party was due to unveil its election manifesto on Tuesday, but it has now postponed the event.

Saved by the terror attack?

• Theresa May Ditches Manifesto Plan With ‘Dementia Tax’ U-Turn (G.)

Theresa May has announced a U-turn on her party’s social care policy by promising an “absolute limit” on the amount people will have to pay for their care but is not planning to say what level the cap will be set at before the election. The prime minister’s decision came after Conservative party proposals to make people pay more of the costs of social care were branded a “dementia tax” – but she insisted it was simply a clarification. “Since my manifesto was published, the proposals have been subject to fake claims made by Jeremy Corbyn. The only things he has left to offer in this campaign are fake claims, fear and scaremongering,” she said, during a speech in Wrexham to launch the Welsh Tory manifesto. “So I want to make a further point clear. This manifesto says that we will come forward with a consultation paper, a government green paper. And that consultation will include an absolute limit on the amount people have to pay for their care costs.”

The prime minister said key elements of her party’s social care policy – to limit winter fuel allowance to the poorest and take people’s properties into account in the means test for social care at home – would remain in place. It is understood that the party will not pre-empt the consultation with a figure, not least because the level will depend on where the means test is set for winter fuel allowance. But the Conservative manifesto and a briefing for journalists on the policy had made no mention of a cap, with the policy only announced after days of backlash and amid a slight tightening in the opinion polls. May immediately faced a string of difficult questions from reporters, with one saying the announcement amounted to a “manifesto of chaos”. A testy prime minister responded by insisting that there was always going to be a consultation and the “basic principles” of the policy were unchanged.

“Nothing has changed, nothing has changed,” she added tersely, raising her voice when asked towards the end of the session if anything else in the Tory manifesto was likely to be altered. The prime minister accused a Guardian journalist of borrowing a term from the Labour party after it was suggested that the “dementia tax” would still mean a wide disparity between the children of Alzheimer’s and cancer sufferers. “This is a system that will ensure that people who are faced by the prospect of either requiring care in their own home or go into a home are able to see that support provided for them and don’t have to worry on that month by month basis about where that funding is coming from. They won’t have to sell their family home when they are alive, and they will be able to pass savings on to their children,” she said.

Yeah, curious.

• US Healthcare Industry Blames Trump And GOP For Obamacare Rate Hikes (F.)

The healthcare industry is beginning to shift blame for Obamacare’s 2018 rate hikes and an unstable individual insurance market to Donald Trump and the Republican-led Congress. An alliance of health insurers, doctors and employers are urging the Trump administration and Congress to fund cost-sharing subsidies for millions of Americans under the Affordable Care Act. Politico reported Friday that Trump is telling “advisers he wants to end key Obamacare subsidies.” If cost-sharing reductions (CSRs) aren’t funded through 2018, Trump and Republicans will be responsible for more insurers leaving public exchanges and a rate hike of nearly 20% on average, reports indicate.

The cost-sharing reductions (CSRs) are used to help 7 million Americans pay less out of pocket for healthcare services. “There now is clear evidence that this uncertainty is undermining the individual insurance market for 2018 and stands to negatively impact millions of people,” several powerful groups representing hospitals, doctors, patients, insurance companies and U.S. employers wrote in a letter to Republican Senate Majority Leader Mitch McConnell and GOP Majority Whip John Cornyn of Texas.

The worst idea in a long time. But since they bought Syngenta, probably inevitable.

• China Pushes Public to Accept GMO as Syngenta Takeover Nears (BBG)

China will carry out a nationwide poll next month to test the public’s acceptance of genetically-modified food, a technology the government says would boost yields and sustainable agriculture in a country that’s seen consumption soar. [..] China is the world’s fourth-largest grower of GMO cotton and the top importer of soybeans, most of which are genetically modified and used for cooking oil and animal feed for pigs and chickens. But public concern over food safety issues and skepticism about the effects of consuming GMO foods have made the government reluctant to introduce the technology for staple crops. A 2012 trial of so-called Golden Rice – a yellow GMO variant of the grain that produces beta-carotene – caused a public storm after reports that the rice was fed to children without the parents being aware that it was genetically modified.

“Many Chinese turn pale when you mention the GMO word,” said Jin in his small office. Some still believe GMO food can cause cancer and impair childbirth, due to misleading reports in newspapers and social media, he said. A recent decision by a local legislative body against growing GMO crops has added to public confusion, Jin said. The national survey aims to discover what the public’s concerns are so that the government can resolve the confusion, Jin said. “If the government pushes ahead before the public is ready to accept the technology, it would be embarrassing – like offering a pot of half-cooked rice to eat.” Jin said he expected the poll result to show that the general public’s perception of GMO is still negative, but “as more people get to know the technology, more would be willing to accept it.”

The lack of an authoritative scientific institution to answer questions, the widespread illegal cultivation of GMO crops, and public mistrust of government authorities after a series of food scandals have all contributed to skepticism about GMO, Jin said. [..] Syngenta, which produces genetically modified seeds for corn, is gearing up for rapid expansion in the country after shareholders accepted a $43 billion offer for the Swiss agribusiness by China National Chemical. The Chinese state-owned company is expected to complete the deal this month. The American Chamber of Commerce in China had complained that U.S. strains of GMO suffered from slower and less predictable approval for import into China. Chinese and U.S. officials have agreed to evaluate pending U.S. biotechnology product applications by the end of the month, including corn and cotton.

The GMOs will be used globally.

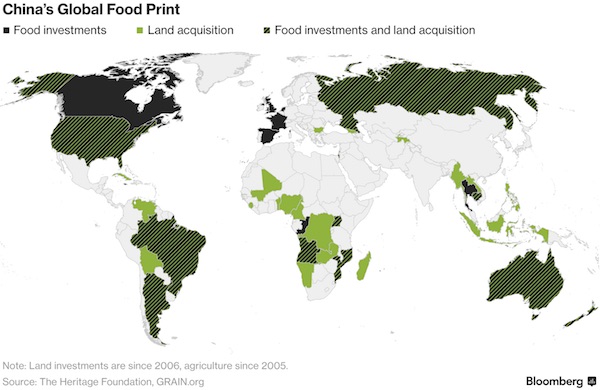

• China Spins a Global Food Web From Mozambique to Missouri (BBG)

Faced with a shrinking area of good arable land and a population of 1.4 billion people who are eating more, Chinese agriculture companies have been buying or leasing farms abroad for decades. After the world food crisis, when grain prices soared from 2006 to 2008, that investment went into overdrive. But many projects were plagued by corruption, mistrust, local resistance and trade restrictions. “By and large, they have not achieved the goals they have set,” said Shenggen Fan, an agricultural economist who grew up on a farm near Shanghai and now heads the Washington-based International Food Policy Research Institute. “The general conclusion was that it was not a good investment—it was too quick.”

[..] China will still need to source an increasing amount of food from overseas as its growing middle class eats more and demands better quality and variety. The nation already consumes about half of the world’s pork and whole milk powder, and about a third of its soybeans and rice. So, as the global food crisis abated, Chinese companies turned their attention elsewhere—to finding farms with quality producers in more developed countries whose products would sell for a premium in Shanghai and Beijing. “China is just getting started,” said Kartini Samon, who runs the Asia program for Grain, a non-profit focused on farmers’ rights that tracks Chinese farm deals. “They’re slowly building their power and their supply chains.”

Chinese firms have spent almost $52 billion on overseas agriculture deals since 2005 and food industry-related transactions have quadrupled over the past six years, according to data compiled by the American Enterprise Institute and the Heritage Foundation. “More and more of what we’re seeing is Chinese companies wanting to buy really good food businesses, as opposed to buying any food businesses,” said Ian Proudfoot, the Auckland-based global head of agribusiness for KPMG. They include WH Group’s 2013 purchase of Virginia-based Smithfield Foods Inc., the world’s biggest pork producer, and China National Chemical’s $43 billion agreement to take over Swiss pesticide maker Syngenta.

In a key rural policy statement issued by the Communist Party in February, the government said it supports Chinese companies investing in agriculture overseas, from production and processing to storage and logistics. “They won’t just want the production facilities, they’ll be looking for the story and the brand,” said Proudfoot. Of the 17 agricultural deals made by Chinese companies over the past two years, only two were in developing countries—Cambodia and Brazil—and six were in Australia, according to the AEI/Heritage Foundation data. Shanghai Pengxin, which has dairy-farming interests in New Zealand and a Brazilian grain-trading business, is looking for well-known brands in developed countries that can generate fast returns in markets like Shanghai, said a spokesman..

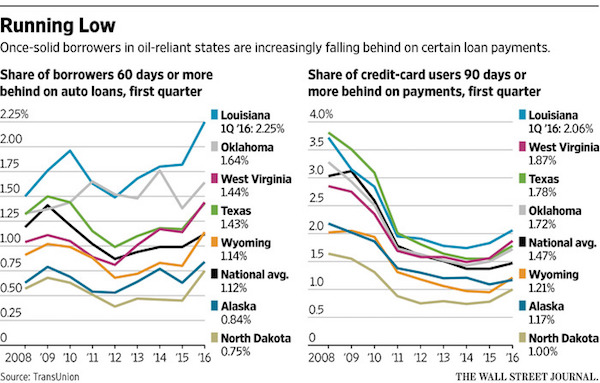

This is based on ‘findings’ by Moody‘s, but it rated Santander ABS as high as AAA as late as February. We’ve definitely seen this before.

• Auto Lender Santander Checked Income on Just 8% in Subprime ABS (BBG)

Santander Consumer USA, one of the biggest subprime auto finance companies, verified income on just 8% of borrowers whose loans it recently bundled into $1 billion of bonds, according to Moody’s. The low level of due diligence on applicants compares with 64% for loans in a recent securitization sold by General Motors Financial’s AmeriCredit unit. The lack of checks may be one factor in explaining higher loan losses experienced by Santander Consumer in bond deals that it has sold in recent years, Moody’s analysts Jody Shenn and Nick Monzillo wrote in a May 17 report, which reviewed data required of asset-backed bond issuers that’s recently been made available. Limited verification of loan applicants’ stated incomes and employment “creates more uncertainty around whether borrowers will be able to afford their monthly payments, which becomes particularly important if they have poor credit records and risky loan terms,” the analysts wrote.

Andrew Kang, Dallas-based Santander Consumer’s treasurer, acknowledged Moody’s findings and said the company’s practice on income verification has been consistent over time even if it’s lower than levels reported among competitors. The higher losses in the loans backing the bonds have been visible to investors, Kang said. Investors have been protected because Santander Consumer included extra loans in the securities in case some went bad, for example, creating a buffer against losses, he said. The Moody’s analysts didn’t make any claim that noteholders were at risk as the bond-grader simply looked at the new data available in the deals to provide analysis on how lenders underwrite. Moody’s rated the Santander deal as high as Aaa in February. Investors who bought into the securities included Massachusetts Mutual Life, according to data.

Martin Luther rubber duckies. Nothing is holy. Our crisis is spiritual too.

• Germany Commemorates The 500th Anniversary Of Luther’s Reformation (AFP)

From burgers to rubber duckies to liquor, Wittenberg is cashing in on its 16th century resident, who changed Christendom forever. It is on a door of a church here that Luther is said to have nailed his 95 theses in 1517, leading to a split with the Roman Catholic Church and giving birth to Protestantism. As Germany commemorates the 500th anniversary of the Reformation, the seismic theological shift started by Luther, Wittenberg is decked out in full Luther regalia. On arrival at the town’s main train station, visitors are greeted with a giant rectangular block labelled “The Bible – Luther’s translation”. Walk a few metres and a billboard seeks to tempt the weary with a “Luther Burger”. In the display windows of shops running one kilometre through the centre of the old town, there is something for everyone – a toddler-sized Luther teddy bear, bags of Luther pasta and Luther tea.

Born in Eisleben on November 10, 1483, Luther moved to Wittenberg in 1511. It was in the eastern town where he married Katharina von Bora, became a father of six children, and published his ideas attacking papal abuses and questioning the place of saints. The theologian, who died in 1546, argued that Christians could not buy or earn their way into heaven but only entered by the grace of God, marking a turning point in Christian thinking. But Luther also came to be linked to Germany’s darkest history, as his later sermons and writings were marked by anti-Semitism – something that the Nazis used to justify their horrific persecution of the Jews. Yet the theologian’s part in reshaping the religious order has unequivocally secured his place as one of the most important figures in European history.

For the 500th Reformation anniversary, Germany has declared an exceptional public holiday on October 31. And tens of thousands of Christians from across the world are descending on the town of 47,000 inhabitants where history was made. [..] going by the number of tourists carrying jute bags featuring Luther’s image, or the steady stream of people picking up Luther cookies, it is clear that the crowd just can’t get enough of the theologian. The boom in Luther souvenirs has been driven by this year’s celebrations, Ruske noted. “There are Luther noodles, Luther tomatoes, Luther chocolate and also Luther coffee. There are many great products that we sell… but there are also bizarre souvenirs. But as long as the demand is there, there’ll always be offers,” said Ruske. The tourism office itself has been stocking 500 Playmobil figurines of Luther every month over the past year. “But they keep selling out,” she said.

“The nation suffers desperately from an absence of leadership and perhaps even more from the loss of faith that leadership is even possible..”

• Do You, Mr. Jones…? (Jim Kunstler)

In case you wonder how our politics fell into such a slough of despond, the answer is pretty simple. Neither main political party, or their trains of experts, specialists, and mouthpieces, can construct a coherent story about what is happening in this country — and the result is a roaring wave of recursive objurgation and wrath that loops purposelessly towards gathering darkness. What’s happening is a slow-motion collapse of the economy. Neither Democrats or Republicans know why it is so remorselessly underway. A tiny number of well-positioned scavengers thrive on the debris cast off by the process of disintegration, but they don’t really understand the process either — the lobbyists, lawyers, bankers, contractors, feeders at the troughs of government could not be more cynical or clueless.

The nation suffers desperately from an absence of leadership and perhaps even more from the loss of faith that leadership is even possible after years without it. Perhaps that’s why so much hostility is aimed at Mr. Putin of Russia, a person who appears to know where his country stands in history, and who enjoys ample support among his countrymen. How that must gall the empty vessels like Lindsey Graham, Rubio, Schumer, Feinstein, Ryan, et. al. So along came the dazzling, zany Trump, who was able to communicate a vague sense-memory of what had been lost in our time of American life, whose sheer bluster resembled something like conviction as projected via the cartoonizing medium of television, and who entered a paralysis of intention the moment he stepped into the oval office, where he proved to be even less authentic than the Wizard of Oz.

Turned out he didn’t really understand the economic collapse underway either; he just remembered an America of 1962 and though somehow the national clock might be turned back. The industrial triumph of America in the 19th and 20th century was really something to behold. But like all stories, it had a beginning, a middle, and an end, and we’re closer to the end of that story than the middle. It doesn’t mean the end of civilization but it means we have to start a new story that provides some outline of a life worth living on a planet worth caring about.

Pilger is the source to turn to.

• Getting Julian Assange: The Untold Story (John Pilger)

Julian Assange has been vindicated because the Swedish case against him was corrupt. The prosecutor, Marianne Ny, obstructed justice and should be prosecuted. Her obsession with Assange not only embarrassed her colleagues and the judiciary but exposed the Swedish state’s collusion with the United States in its crimes of war and “rendition”.

Had Assange not sought refuge in the Ecuadorean embassy in London, he would have been on his way to the kind of American torture pit Chelsea Manning had to endure. This prospect was obscured by the grim farce played out in Sweden. “It’s a laughing stock,” said James Catlin, one of Assange’s Australian lawyers. “It is as if they make it up as they go along”. It may have seemed that way, but there was always serious purpose. In 2008, a secret Pentagon document prepared by the “Cyber Counterintelligence Assessments Branch” foretold a detailed plan to discredit WikiLeaks and smear Assange personally. The “mission” was to destroy the “trust” that was WikiLeaks’ “centre of gravity”. This would be achieved with threats of “exposure [and] criminal prosecution”. Silencing and criminalising such an unpredictable source of truth-telling was the aim.

Perhaps this was understandable. WikiLeaks has exposed the way America dominates much of human affairs, including its epic crimes, especially in Afghanistan and Iraq: the wholesale, often homicidal killing of civilians and the contempt for sovereignty and international law. These disclosures are protected by the First Amendment of the US Constitution. As a presidential candidate in 2008, Barack Obama, a professor of constitutional law, lauded whistle blowers as “part of a healthy democracy [and they] must be protected from reprisal”. In 2012, the Obama campaign boasted on its website that Obama had prosecuted more whistleblowers in his first term than all other US presidents combined. Before Chelsea Manning had even received a trial, Obama had publicly pronounced her guilty.

Few serious observers doubt that should the US get their hands on Assange, a similar fate awaits him. According to documents released by Edward Snowden, he is on a “Manhunt target list”. Threats of his kidnapping and assassination became almost political and media currency in the US following then Vice-President Joe Biden’s preposterous slur that the WikiLeaks founder was a “cyber-terrorist”. Hillary Clinton, the destroyer of Libya and, as WikiLeaks revealed last year, the secret supporter and personal beneficiary of forces underwriting ISIS, proposed her own expedient solution: “Can’t we just drone this guy.” According to Australian diplomatic cables, Washington’s bid to get Assange is “unprecedented in scale and nature”. In Alexandria, Virginia, a secret grand jury has sought for almost seven years to contrive a crime for which Assange can be prosecuted. This is not easy.

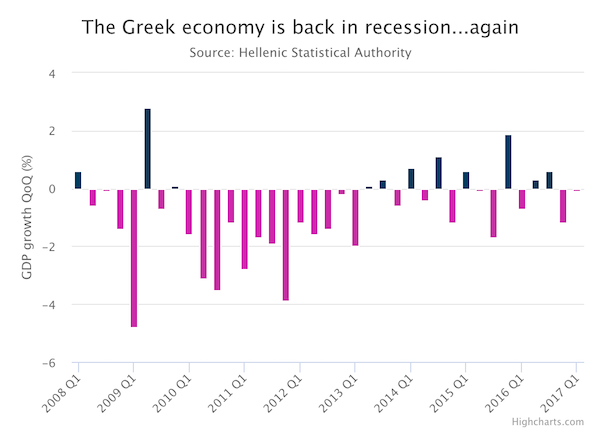

The Troika has no intention of solving the issue. They demand a 3.5% surplus for years to come, making sure Greece can’t grow.

• EU Ministers Fail To Reach Greek Debt Deal, Delay Release Of Bailout (Tel.)

Eurozone finance ministers failed to agree on a deal which would have released vital rescue funds for Athens on Monday night, after Greece’s creditors rejected calls for an upfront commitment to reduce the country’s debt burden. Jeroen Dijsselbloem, who leads the Eurogroup of finance ministers, said the ministers had held an “in-depth discussion” on debt sustainability and said they were “very close” to an agreement. However, he added that they had “not reached an overall agreement on that part of the discussion”. “Tonight we were unable to close a possible gap between what could be done and what some of us had expected should be done or could be done. We need to close that by looking at additional options or by adjusting our expectations.”

“Both are possible and both perhaps should be done, and that I think will bring us to a more positive and definite positive conclusion at the next Eurogroup in June,” Mr Dijsselbloem said. Talks are expected to continue over the coming weeks ahead of the next meeting on June 15. Prior to the meeting, Eurozone finance ministers had said they were confident that a political agreement could be reached on Monday evening. This would have paved the way for a fresh tranche of financial aid to ensure Greece avoids a summer cash crunch. However, officials were at odds with the IMF over the critical issue of debt relief, which is a condition of the Fund’s participation in Greece’s third, €86bn bail-out. The IMF had stressed that debt relief was necessary to ensure the country can return to fiscal health, and had called for details on the scope and timing of relief before it joined the programme.

Ahead of the meeting in Brussels, Mr Dijsselbloem had said he was optimistic that creditors would release new loans to Athens after the Greek parliament passed fresh austerity measures last week, including pension cuts. Greece’s debt share currently stands at around 180pc of GDP, but Mr Dijsselbloem said detailed relief measures would not be thrashed out until 2018. Insiders said talks aimed at bridging the gap between the IMF and some of Greece’s creditors would be difficult. “Discussions are going to be long, and I am not sure they will be successful,” said one. Others said everyone was working hard to secure a deal that included the Fund. “If we lose the IMF now, we lose the IMF forever,” said one source.

Macron is nothing but Merkel’s little helper.

• Macron Tells Tsipras France Hopes To Ease Greek Debt (K.)

French President Emmanuel Macron says his new administration will push for an international debt relief deal for austerity-weary Greece. Macron’s office says that he spoke Monday with Greek Prime Minister Alexis Tsipras and stressed “his determination to find an accord soon to lighten the burden of Greek debt over the long term.” The phone conversation was the first contact between the two since Macron’s election earlier this month. French Finance Minister Bruno Le Maire, named last week, is joining EU finance ministers for talks Monday and Tuesday expected to focus on Greece’s debt problems. Athens hopes that the ministers will agree this week on a deal on easing Greece’s debt repayment terms. Successive Greek governments have slashed spending in return for bailout money to avoid bankruptcy.

But no-one has the guts to stand up to Merkel and Schäuble.

• German Government At Odds With Itself Over Greek Debt Relief (R.)

Germany’s coalition government split along party lines on Monday over the question of debt relief for Greece ahead of a crunch meeting in Brussels to tackle the thorny issue. Euro zone finance ministers and the International Monetary Fund are meeting to seek a deal on Greek debt relief that balances the IMF’s demand for a clear “when and how” with Berlin’s preference for “only if necessary” and “details later”. Foreign Minister Sigmar Gabriel, a Social Democrat, caused the divergence in views by demanding that the euro zone make a firm commitment on granting debt relief to Greece, effectively criticising conservative Finance Minister Wolfgang Schaeuble’s tough stance. “Greece has been promised debt relief over and over again if reforms are carried out,” Gabriel told the Sueddeutsche Zeitung paper. “Now we must stand by this promise.” “This must not fail due to German resistance,” said Gabriel.

Without the deal no new loans can be granted to Athens, even though the bailout is now handled only by euro zone governments and Greece needs new credit to repay some €7.3 billion worth of maturing loans in July. Schaeuble later described reforms agreed by Greece as “remarkable” but said the Greek economy was not yet competitive and that Athens must press ahead with implementing its existing reforms-for-aid program. “We are not talking about a new program but the implementation of the program agreed in 2015,” Schaeuble said. “At the end of the program, in 2018, we will, if necessary, put in place additional measures that we have defined.” “It is about one goal – namely to help Greece become competitive,” Schaeuble said, adding Greece was not there yet. Speaking at a regular government news conference, Foreign Ministry spokesman Martin Schaefer said institutions such as the IMF and the EC were not far apart in their assessment on Greece. “Germany should have an interest in not isolating itself too much,” Schaefer said.

So obviously, more cuts are needed to make Greece ‘competitive’ again. Contradiction in terms.

• 1.2 Million Greek Pensioners Live on Less than €500 a Month (GR)

The report of the Unified System of Control and Payment of Pensions “ILIOS” made public by the Labor Ministry shows that 1.2 million Greek pensioners live on less than €500 per month. The figures date from December 2016 and show analytical pension data after Greece’s creditors have asked that pension data calculated with the new methodology should be made public at regular intervals. According to the “ILIOS” report, the average main pension is €722 per month, the average supplementary pension is 170 euros and the average dividend to State pensioners is €97 per month. The report shows that there are 2,892,259 main pensions paid each month, 1,252,241 supplementary pensions and 409,620 dividends with a total cost of €2,342,431,276.95. The figures show that 1.2 million pensioners are paid less than €500 per month.

Elliniko is the site of the former main airport. It’s horrific. But cynically, it is being evacuated not because of the refugees’ conditions, but because there are plans to develop the site from a consortium of Greek, Chinese and Arab investors.

Amnesty should address Berlin on this, not Athens.

• Amnesty Urges Greece to Provide Safe Housing to Elliniko Refugees (GR)

Greek authorities must ensure that refugees and migrants expected to start being evacuated from three Elliniko camps on Tuesday, are provided with safe, adequate, alternative housing, Amnesty International said in a press release on Monday. “Whilst no one will mourn the closure of these uninhabitable, unsafe camps, the failure to provide people living there with information about their imminent removal has only served to increase their fears and anxieties,” said Monica Costa Riba, Amnesty International’s Regional Campaigner. “There has been no consultation with Ellinko residents who have been kept in the dark as to when and where they will be moved to. The authorities must urgently guarantee that no one will be rendered homeless or placed at risk as a result of the closure. Safe and secure adequate alternative housing which takes account of the particular needs of women and girls must be made available,” she said.

Speaking to the Athens-Macedonian News Agency, an Amnesty International member said: “All NGOs active in Elliniko were asked to leave the area, except the two that provide medical help.” Sources from the ministry of Migration Policy denied the report on an imminent evacuation, saying that authorities will instead begin an “information campaign for the people who live in Elliniko,” adding that “misinformation doesn’t help in the real handling of the issue.” Amnesty International had requested to visit the camps between May 21 and 23 but was refused, however, its researchers managed to interview residents outside the camp. One Afghan man told Amnesty International: “They don’t give us information, which creates a lot of anxiety…They want to confuse us so that we cannot decide and they’ll decide for us.” An Afghan woman said: “We talked with everyone but no one tells us anything. I am really worried about ending up on the street.”