P�a�b�l�o� �P�i�c�a�s�s�o� P�o�r�t�r�a�i�t� �o�f� �Ambroise Vollard� �1910

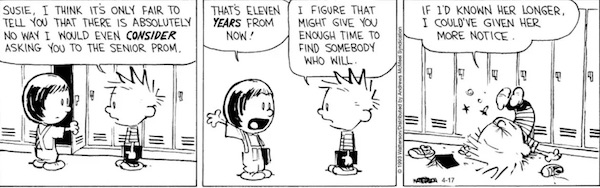

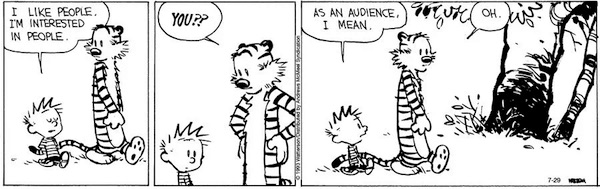

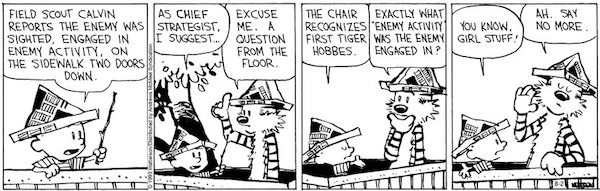

Snipers

I don't know what shocked me more, finding out that the Secret Service had never provided Trump counter sniper protection until the Butler rally or that they didn't provide the Secret Service snipers radios but told them to use their personal cell phones to text each other. pic.twitter.com/7Y16GNiFaE

— @amuse (@amuse) August 4, 2024

Kama cloud

https://twitter.com/i/status/1819807929442193629

Debate

https://twitter.com/i/status/1819896389897224365

Michaela

https://twitter.com/i/status/1819831108558864468

Rogan

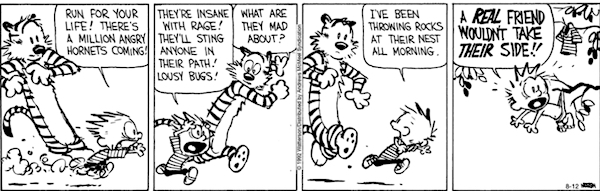

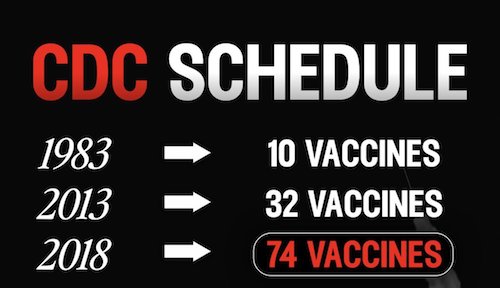

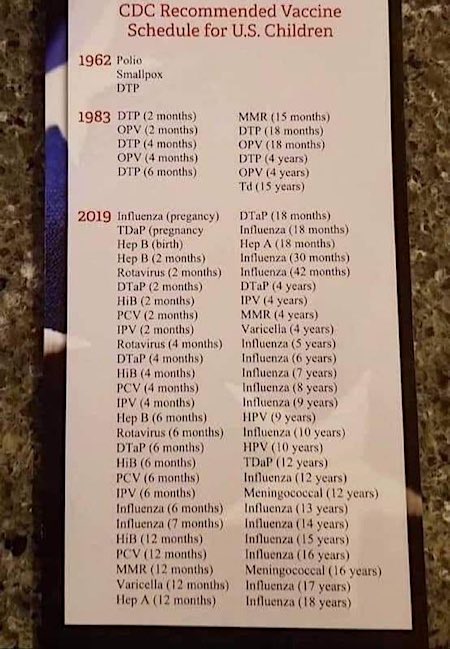

"Before COVID, I thought vaccines were the most important invention in human history.

After COVID, I don't think we went to the moon

I think Michelle Obama’s got a d___

I think Pızzagatə is real"

Joe Rogan is awake, are you?

Share this everywhere!!

pic.twitter.com/DLgM9TBPtz— TaraBull (@TaraBull808) August 4, 2024

ICYMI – Joe Rogan jokes about dying of Covid; “The funniest way for me to die is if I die from Covid. Don’t think I didn’t think it. When I got Covid the first thought I had was ‘Oh my god you better not die.‘ I talked SO MUCH shit. I talked so much shit!”pic.twitter.com/7PeZxtp8xc

— Overton (@OvertonLive) August 4, 2024

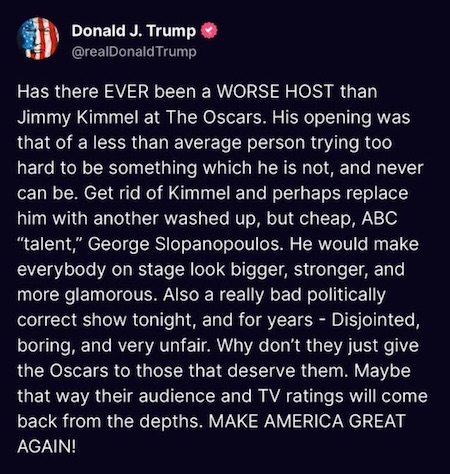

“This was a man who pledged to unite the country and did just the opposite..”

• If You Thought Things Were Bad Under Biden, Just Wait (Moore)

President Joe Biden’s time in the White House is mercifully coming to an end. He is now officially a lame duck with six months to go. How could they be so unpatriotic? From his first days in the Oval Office, Biden governed from the far left on everything from climate change, to radical income redistribution, to massive government expansionism, to racial politics, to a “blame America first” foreign policy, to his dangerous weaponization of every agency of government from the Internal Revenue Service to the FBI to the Justice Department and, perhaps, even to the Secret Service. He made President Richard Nixon look like an amateur. It is hard to point to a single policy that he got right. On the economy, he was catastrophically bad. The trillions of dollars of debt he rung up bought nothing. He sent inflation to the highest levels in almost forty years.

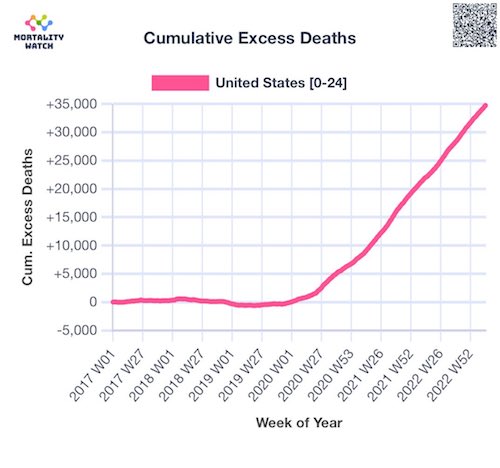

The average family lost $2,000 of income after inflation during his reign. More people died of COVID during his presidency than Trump’s — despite the availability of the vaccine. Interest rates rose. Biden declared war on American energy. He put America back into the Paris Climate Accord—and the rest of the world went on using more fossil fuels than ever. By impeding U.S. oil and gas production and pipelines he played into the hands of our enemies — China and Iran. Gas prices rose. Small business confidence sagged. Poverty rates rose. Then there was the sheer incompetence. The bungled Afghanistan withdrawal was a national security disaster. The border became a broken dam with millions seeking to illegally enter the country. The government spent $7.5 billion on electric vehicle chargers and only a handful got built. Biden gave away hundreds of billions of dollars for an illegal and immoral student loan forgiveness program. He put regulators in charge of key agencies even though — or because — they hate business.

A majority of his appointees had no business experience. It showed. When he departs the White House in the months ahead he will leave the nation poorer, weaker, more divided, more in debt, more vulnerable, and less respected than when he entered office. This was a man who pledged to unite the country and did just the opposite. He deserves to go down in history as one of the five worst presidents of the 20th and 21st century. Here is my list starting with the worst: 1) Woodrow Wilson; 2) Herbert Hoover: 3) Jimmy Carter; 4) Joe Biden; 5) Barack Obama. Now the Democrats want to run Vice President Kamala Harris, who was on board with every Biden policy and helped oversee the worst border catastrophe in modern history. Just when you thought things could not get any worse.

“.. the fourth estate that was to shed light on them has embraced the darkness.”

• We Reap the Harvest of Lies (Bell)

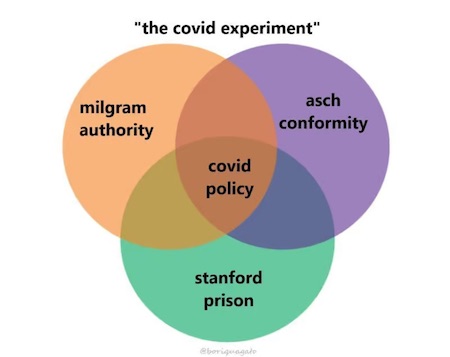

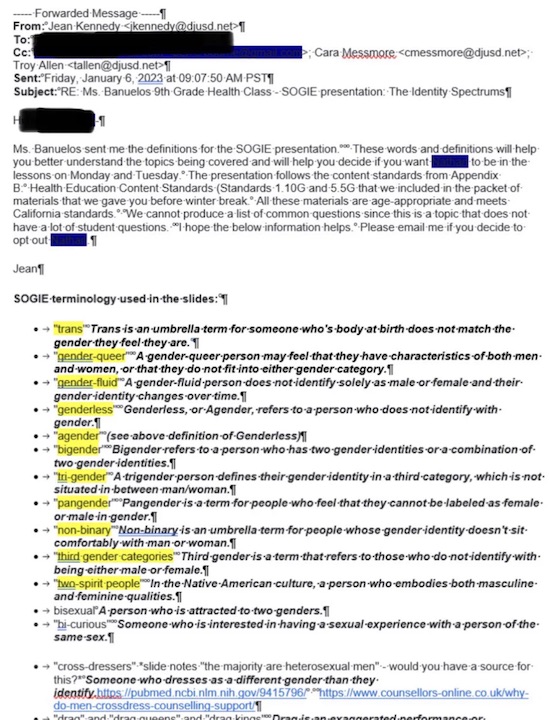

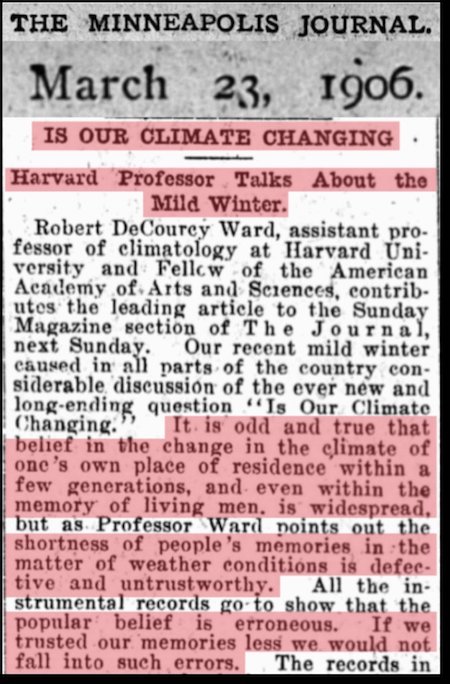

Public life has become disorienting. Most people, by and large, previously expected to hear the truth, or some semblance of it, in daily life. We would generally expect this from each other, but also from public media and authorities such as governments or international agencies set up ostensibly for our benefit. Society cannot function in a coherent and stable way without it, as so much in our lives requires us to place trust in others. To navigate the complexity of existence, we generally look for guidance to certain trusted sources, freeing up time to sift through the more questionable ones. Some claim they always knew everything was fake, but they are wrong, as it wasn’t (and still isn’t). There were always liars, campaigns to mislead, and propaganda to drive us to love or to hate, but there was a core within society that had certain accepted norms and standards that should theoretically be followed. A sort of anchor.

Truth is indestructible but the anchor cable connecting us to it, ensuring its influence, has been cut. Society is being set adrift. This really broke in the past four or five years. We were already in trouble, but now public discourse is broken. Perhaps it broke when governments elected to represent the people openly employed behavioral psychology to lie to their constituencies on a scale we had not previously seen. They combined to make their peoples do things they rationally would not; accept bans of family funerals, cover faces in public, or accept police brutality and the isolation and abandonment of the elderly. The media, health professionals, politicians, and celebrities all participated in this lie and its intent. Virtually all our major institutions. And these lies are continuing, and expanding, and have become the norm.

We are now reaping the harvest of untruth. The media can openly deny what they said or printed just months earlier about a new candidate for presidency or the efficacy of a mandated vaccine. A whole political party can change its narrative almost overnight about the fundamental characteristics of its leader. People paid as “fact-checkers” twist reality to invent new facts and hide the truth, unflustered by the transparency of their deceit. Giant software companies curate information, filtering out truths that run contrary to the pronouncements of conflicted international organizations. Power has displaced integrity. Internationally, we are pummeled by agencies such as the UN, World Bank, G20, and World Health Organization to give up our basic rights and hand their new masters our wealth on claims of threats that can unequivocally be shown to be false.

Paid-off former leaders, grasping legitimacy through the legacy of greater minds, reinforce mass falsehoods for the benefit of their friends. Once aberrations that a free media might highlight, fallacies have become norms in which the same media is openly complicit. The frightening part is not the lies, which are a normal aspect of humanity, but the broad disinterest in truth. Lies can stand for a time in the presence of a people and institutions that value truth, but they will eventually fail as they are exposed. When truth loses its value, when it is no longer even a vague guide for politics or journalism, then recovery may not occur. We are in an incredibly dangerous time, because lies are not just tolerated but are now the default approach, at the national and international level, and the fourth estate that was to shed light on them has embraced the darkness.

“..what was the true shock in Friday’s “data” is the long overdue admission that the US is effectively in a recession..”

• Guess Who Kamala Harris Blames For Disastrous Jobs Report? (ZH)

Following last week’s horrendous jobs report, the Kamala Harris campaign issued a statement blaming – you guessed it – Donald Trump! “Donald Trump failed Americans as president, costing our economy millions of jobs, and bringing us to the brink of recession,” said Harris for President spokesperson James Singer in a statement. “Now, he’s promising even more damage with a Project 2025 agenda that will decimate the middle class and increase taxes on working families, while ripping away health care, raising prescription drug costs, and cutting Social Security and Medicare — all while making his billionaire donors richer.”

According to Singer, “We’ve made significant progress, but Vice President Harris knows there’s more work to do to lower costs for families,” and “will make building up the middle class the defining goal of her presidency, taking on greedy corporations that are price gouging consumers, banning hidden fees, and capping unfair rent increases and drug costs.” So – robotic talking points centered around blaming the guy who’s been out of office for 3.5 years. On Friday the Labor Department revealed that US job growth cooled sharply in July, while the unemployment rate unexpectedly rose to the highest level in nearly three years. According to the report, the US added just 114K payrolls, a huge miss to expectations of 175K and also a huge drop from the downward revised June print of 206K, now (as always ) revised to just 179K. This was the lowest print since December 2020 (at least prior to even more revisions)…

As we wrote in response, these being numbers published by the corrupt Biden, pardon Kamala Department of Goalseeked bullshit, the previous months were revised lower as usual, with May revised down by 2,000, from +218,000 to +216,000, and the change for June was revised down by 27,000, from +206,000 to +179,000. With these revisions, employment in May and June combined is 29,000 lower than previously reported. It gets better because as shown in the next chart shows, 5 of the past 6 months have now been revised lower.

But while we have long known that the real payrolls number is far worse than reported, what was the true shock in Friday’s “data” is the long overdue admission that the US is effectively in a recession because as the rule named for pro-Biden/Kamala socialist Cluadia Sahm indicates, a recession has now been triggered. The rule, for those who don’t remember is that a recession is effectively already underway if the unemployment rate (based on a three-month moving average) rises by half a percentage point from its low of the past year. And that’s what just happened, with the unemployment rate surging 0.6% from the year’s low.

“Once her views are made known to the public,” Piereson notes, “Harris’s support will begin to melt away. . . . [B]y mid-September, Trump will have opened up a six-point lead in the polls that will remain intact for the balance of the campaign.”

• Kamala Harris and the Masque of Magical Thinking (Kimball)

Although the last few weeks have had their alarming aspects – chief among which was the attempted assassination of Donald Trump on July 13, the odds-on favorite candidate for president – they have also had their amusing moments. In the latter category, I place the sudden queen-for-a-day-like coronation of Kamala Harris. True, that coronation was in the nature of an anti-democratic semi-soft-coup (or anti-democratic “inversion of a coup”). Biden and his handlers, right up until the morning of July 21, were insisting that he was not dropping out, that he was “in it to win,” etc. But someone made him an offer he couldn’t refuse and out he went. Here’s the amusing bit. Until the moment Biden was chased out of the race, Kamala Harris functioned primarily as political life insurance. “You might not like me,” Biden communicated, “but if I go, you’re stuck with her.” Biden’s polls were in the toilet and, following his catastrophic debate with Donald Trump, were circling the drain, poised for oblivion.

But Kamala’s polls were even worse. She was cordially disliked by—well, by everyone. Her staff, her colleagues, but above all, by voters. In the 2020 race, she got no delegates: none, zero, zip. She dropped out of the race for president but was then tapped to be VP only because this half Indian, half Jamaican woman was swarthy enough to pass as black and Biden had promised to select a black female as a running mate. Kamala truly is, as Biden himself acknowledged recently, a DEI vice president. And sure enough, Kamala was every bit the disaster people predicted she would be. As a matter of clinical interest, she proved that senility is not the only cause of supreme rhetorical incoherence. Some people, and she is one, come by it naturally. Her tenure as vice president is littered with examples, and she provided another doozy just a couple of days ago when she attempted to comment on the prisoner exchange with Russia.

It’s painful, as are all the many video clips of Harris angrily denouncing people who say “Merry Christmas,” of her presiding as “border czar” over the disaster of our non-existent southern border, of her outlining how she wants to give Medicare, as well as the franchise, to all illegal immigrants, and how she wants to develop a national data base of gun owners so that she can confiscate firearms by force. Can such a person win the presidency? No. Then, how can we explain the sudden efflorescence of Harrismania? Democrats are wetting themselves with glee over their sudden fundraising windfalls ($200 million in a week, it is said) and sudden surge in the polls. New York magazine just beclowned itself with a cover showing Kamala sitting on top of the world with Barack Obama, Chuck Schumer, Nancy Pelosi, and even Joe Biden dancing and whooping it up below. “Welcome to Kamalot,” we read: “In a matter of days, the Democratic Party discovered its future was actually in the White House all along.”

Was it? Again, the answer is no. It is a temporary sugar high caused partly by the feeling of liberation following the sudden release from Joe Biden, partly by the slobbering media jumping all over the reinvention of Kamala like dogs vibrating over a bitch in estrus. The feeling of intoxication may linger through the Democratic convention, but there are already signs that it is fading. I think James Piereson is correct. Kamala’s position now is akin to that of Michael Dukakis (remember him?) in 1988. Dukakis was way ahead of George Bush in the summer of 1988. Then it all unraveled. His helmet-moment in the tank sealed the deal. But it was his whole left-wing outlook that really did him in. And Dukakis was Ronald Reagan compared to Kamala Harris. “Once her views are made known to the public,” Piereson notes, “Harris’s support will begin to melt away. . . . [B]y mid-September, Trump will have opened up a six-point lead in the polls that will remain intact for the balance of the campaign.”

Although I would hesitate to be quite so arithmetically precise, I think that Piereson is also by and large correct in his electoral prediction. “Notwithstanding the euphoria today,” he writes, Trump will win the election by six points—forty-nine to forty-three percent—winning 339 electoral votes, including all of the so-called swing states, plus the Democratic-leaning states of Virginia, Minnesota, and New Hampshire. Republicans will pick up three or four seats in the Senate and perhaps twenty seats in the House, giving them safe majorities in both chambers. This will give Trump the margins he needs to implement a good piece of his agenda in 2025 and 2026. I think this is right—though, again, I hesitate to be quite so exact in attaching numbers to Trump’s victory.

He’ll be labeled racist, sexist, misogynist: “..she attempts to portray herself as the deserving underdog in a white man’s game..”

• What Donald Trump Should Beware of In The Debate With Kamala Harris (Bridge)

Mark your calendar, ladies and gentlemen, Kamala Harris has done something extraordinary. She has become the only candidate in half a century to become the presidential nominee without winning a single primary vote. Biden’s vice got enough delegate votes in the virtual roll call process to become the official Democratic nominee. Interesting how not winning votes has had an uncanny way of getting this severely unqualified woman one cackle closer to the Oval Office. But the shock and awe does not stop there, so be advised to have a seat. The absolutely, positively 100% legitimate corporate media monstrosity with blood-soaked hand to its heart reports: Harris is now more popular than Joe Biden or Donald Trump have been at any point in the 2024 election cycle.

Yes, a Morning Consult poll of 11,538 registered voters between July 26 and 28 found 50 percent have a favorable opinion of the sitting vice president, while 46 percent have an unfavorable opinion. According to the pollster, “Harris’s 4-point net favorability is a higher rating than Biden or Trump have posted all cycle.” Is anyone really buying any of this, aside from those people who would rather see Donald Duck, for example, as commander-in-chief than Donald J. Trump? Incidentally, let’s not forget that this is the same unbelievable, super-sensational candidate who had her presidential dreams (temporarily) demolished in less than five minutes by a tenacious Tulsi Gabbard during the 2020 Democratic primary debates. The problem, however, had nothing to do with the deeply unlikeable Deep State darling, of course, but rather with a little problem known in the world of politics as cash flow, the primary grease responsible for slipping the most despicable people into positions of power over the years.

As CNBC reported shortly after the debate debacle, “[w]ith Harris falling behind former Vice President Joe Biden and Sen. Elizabeth Warren, among others, some of Harris’ lead bundlers have struggled to convince members of their networks to write checks to her campaign. In some cases, many of her supporters have told the campaign that they will not host events for her.” Now, just four lackluster years later, without a serious signature project to call her own, cash is no longer a problem for female, Black and Asian-American Kamala Harris, the Democratic Party’s ultimate DEI hire. The Harris campaign announced over the weekend it had raised $310 million in July, more than double Trump’s take last month, thereby strongly pointing to the obvious: for whatever reason, the money and media machine is churning in high gear for the political left, as it has since time immemorial, and woe to the mortal who thinks this has anything to do with power-hungry vultures perched on Capitol Hill, waiting for their next feeding time.

And this is where Trump has all the reason in the world to distrust the merchants of media – even if they happen to be the notorious backstabbers at Fox News – as it plays ‘neutral’ arbitrator in the upcoming debates. As proof, as if proof were needed, here is something that Harris and not some AI-generated body double uttered just a few days ago during a rally: “Donald Trump does not care about border security; he only cares about himself,” the invisible border czar told a crowd of worshipful supporters. “And when I am president, I will actually work to solve the problem.” The fact that Kamala Harris is able to utter such inanities without any pushback or laugh track shows that the media is seriously gas-lighting the American people, and not playing fair with Trump. But in the perennial fight against left-wing media forces, Trump has a knack for being his personal Darth Vader, namely due to his willingness to speak his mind, and occasionally the truth, no matter who it hurts. In a less moronic age that was known and welcomed as candidness.

[..] On top of the race card, Trump will also be entering the lion’s den as a climate-change-denying “convicted felon,” misogynist, and an anti-abortion supporter – quaint little sound bites that Harris is certainly remembering by heart. However this tragicomedy plays out, expect lots of handwringing and lecturing from the female (check), Black (check), Indian (check) candidate as she attempts to portray herself as the deserving underdog in a white man’s game.

“We got our people back, but boy we make some horrible, horrible deals..”

• Trump Congratulates Putin On ‘Great Deal’ (RT)

Former US President Donald Trump has blasted President Joe Biden’s prisoner exchange deal with Moscow, suggesting that Russian President Vladimir Putin got the better end of the bargain. The US and Russia exchanged a total of 26 prisoners held in several countries earlier this week, in the largest such deal since the end of the Cold War. Wall Street Journal correspondent Evan Gershkovich and former US Marine Paul Whelan – both of whom were convicted of espionage in Russia – were sent to the West, as were 14 other foreign agents, opposition activists, and criminals. In return, ten Russian nationals were sent to Moscow, among them alleged intelligence agents and cybercriminals. The most prominent name on the list was Vadim Krasikov, an FSB agent who was convicted of the murder of a former Chechen militant commander in Germany in 2021.

“I’d like to congratulate Vladimir Putin for having made yet another great deal,” Trump declared at a campaign rally in Georgia on Saturday. “Did you see the deal we made? They released some of the greatest killers anywhere in the world, some of the most evil killers they got.” “We got our people back, but boy we make some horrible, horrible deals,” he continued, adding that “it’s nice to say we got them back, but does that set a bad precedent?” Prior to the swap, Trump claimed that only he could secure the release of Gershkovich. In a post to his Truth Social platform in May, he wrote that the Wall Street Journal reporter “will be released almost immediately after the election, but definitely before I assume office,” and that the US would be “paying nothing” for his return.

With Gershkovich back in the US, Trump has switched tone, arguing that Biden and Vice President Kamala Harris – who is running for the presidency against Trump – are inept negotiators who paid too high a price for his freedom. “We got 59 hostages, I never paid anything,” he told his supporters on Saturday. However, while Trump did secure the release of dozens of American prisoners during his presidency without making any concessions, he did trade captives on multiple occasions. Among these deals were two one-for-one swaps with Iran, and the 2019 exchange of an American and an Australian for three senior Taliban leaders held in an Afghan jail.

“The facts are that the US will lose. It cannot fight a multi-pronged war against superpowers but it seems dead set on continuing to do that..”

• Israel and US Stoke the Fire as China Pursues Peace (Manley)

Hamas political leader Ismail Haniyeh was killed Wednesday in an attack on his residence in Tehran. Hamas has blamed Israel and the US for Haniyeh’s death and vowed retaliation. On Friday, Intelligence Minister Ismail Khatib said Israel ordered the strike after receiving a green light from the US. The Global Times reported Thursday that China firmly opposed and condemned the assassination of Hamas political leader Ismail Haniyeh that took place on Wednesday in Tehran. Fu Cong, China’s permanent representative to the United Nations, said the act was a blatant attempt to “sabotage peace efforts and wantonly trampled on the fundamental UN Charter principle of respect for sovereignty and territorial integrity of all states.” Fu added that China is “deeply worried” the incident could trigger further upheaval in the Middle East.

KJ Noh sat down with Sputnik’s The Critical Hour program this week to discuss China’s response to the assassination of Haniyeh. Noh, who is a political activist, writer and teacher, suggested China is open to peaceful negotiations while Israel and the US appear to be escalating tensions. “China’s approach is to settle differences through dialogue and negotiation and reconciliation and to develop, to look for win-win solutions, to have mutual respect, to build and not to bomb,” Noh explained. “And what Israel has done [is] they’ve essentially toppled any chance of a political settlement by assassinating their interlocutor. [It] can’t get any more naked than that.” “If you kill the person across the table who you’re talking to, that means you’re not interested in any peaceful negotiation,” the writer added. “What’s clear, both in the case of Ukraine and in the case of Israel, is I think the US does not want negotiation. It wants what Israel wants, which is ethnic cleansing and genocide.”

On Tuesday, US Deputy Secretary of State Kurt Campbell said the US is “far behind” China in Africa and other regions in the Global South and has “much more work to do” in competing with China. In an opinion piece, the Global Times suggested the US’ call for “more work to do” in the Global South is a “strategy to manipulate and weaponize these nations, using them as tools against China.” “Kurt Campbell wants war, and he has said that he would unleash a magnificent symphony of death. That’s the way he thinks, but he also knows that the US cannot fight China by itself,” Noh said. “And so, everything that the US is pivoting to do right now is to weaponize as many proxies as possible, and therefore this is their strategy towards the Global South – force them into blocs and turn them into weapons against China.”

“The US wants more and it wants to block confrontation and it wants win-lose relations or lose-lose relations. China wants win-win relations and it wants to develop the world on the basis of mutual benefit and equality,” he added. “That’s the foundational difference. And we can see that the US, by appointing Campbell and everything else they’re saying and doing is doubling down on this pathway to planetary destruction.” The US is at risk of losing in the event of multiple conflicts with adversaries due to a lack of capabilities and capacity reported Sputnik Monday, citing a report from the US Congress affiliated Commission on the National Defense Strategy.

“They want to come to a different conclusion, despite being confronted by the same facts. The facts are that the US will lose. It cannot fight a multi-pronged war against superpowers but it seems dead set on continuing to do that,” said Noh. The report also found that the US military lacks both the capabilities and capacity required to be confident in its ability to deter and prevail in combat. It added that China remains the “preeminent challenge” to US interests and the country’s most formidable military threat. “So, once again, having come to the same conclusions, they do not suggest a way out or a reasonable accommodation with the rest of the world. They still want to double down on US supremacy. They want more war, preferably spending more money, using more proxies and more instruments of death,” the activist added.

“On Saturday, Tehran told Arab diplomats that they did not care if their response leads to war.”

• US Sends Forces to Middle East, Fear Catastrophic War Is Imminent (Sp.)

Nearly 40,000 people in Gaza have been killed since Israel’s operation in Gaza began in October, according to the territory’s health ministry. Fears of an imminent regional or world war are rising as the United States sends military forces to the Middle East to safeguard Israel after its latest escalation in the region. On Friday US Defense Secretary Lloyd Austin said he had ordered more ballistic missile defense-capable cruisers and destroyers to the Middle East and Europe. An additional fighter jet squadron will be sent to the Middle East as the US increases their “readiness to deploy additional land-based ballistic missile defense,” it was reported. The USS Abraham Lincoln aircraft carrier strike group will also be moved to the Middle East as a way to “maintain a carrier strike group presence”, the report added. Fears of a regional war in the Middle East have been growing since the assassination of Hamas political leader Ismail Haniyeh, who was killed in an attack on his residence in Tehran.

Just hours prior, Israel also struck south Beirut and killed Hezbollah commander Fuad Shukr. Hamas has blamed Israel and the US for Haniyeh’s death and vowed retaliation. On Friday, Intelligence Minister Ismail Khatib said Israel ordered the strike after receiving a green light from the US. Israel’s provocation has resulted in Iran-backed groups in the Middle East swearing vows of vengeance. Groups from Lebanon, Yemen, Kiraq and Syria have already addressed the war in Gaza between the Palestinian group Hamas, and Israel whose military efforts have been supported by the US. The US has given Israel more aid than any other nation since World War II. On Sunday, the Wall Street Journal reported that Iran had refused to moderate its response to the assassination of Haniyeh and was planning to launch a massive retaliatory strike against Israel, with analysts claiming Tehran’s barrage could last multiple days.

On Saturday, Tehran told Arab diplomats that they did not care if their response leads to war. Iran said on Saturday that it expects Hezbollah to strike deep within Israel and to no longer confine their attacks solely to military targets. A Lebanese security source, who spoke on the condition of anonymity, said a Hezbollah member was killed in an “Israeli drone” strike on a vehicle in south Lebanon Saturday, according to an AFP report. Late on Friday Israel carried out strikes on truck convoys entering Lebanon from Syria, the report added.

“Some Poles also consider the lands of western Belarus as the Polish ‘borderlands’..”

• Why is Poland Massing Troops on Frontier With Belarus?

Poland kicked off a large-scale military operation along the border with Belarus on August 1, ostensibly to secure the frontier in the face of what Defense Minister Wladyslaw Kosiniak-Kamysz characterized as a migrant-fueled “hybrid war” against Warsaw. Why does Minsk have reason to be wary of Warsaw’s official justifications? The Polish border defense operation, dubbed ‘Safe Podlasie’ (referring to the northeastern Polish province of Podlaskie) involves about 17,000 troops led by the 18th Mechanized Division of the Polish Armed Forces, with the officially-stated aim of the deployment being to fight illegal migrant flows in a dispute with Belarus that goes back to 2021. “Our soldiers will counter illegal crossings in places that are not intended for this. This operation is a response to illegal immigration from the east, which poses a challenge to Poland’s internal security,” Kosiniak-Kamysz said ahead of the deployment.

Poland has already built a 186 km long, five-meter high, $400 million anti-immigration border fence along part of the border, and plans to construct a massive, 200-meter to 2 km-wide “buffer zone” at some point in the future. But Operation ‘Safe Podlasie’ was kicked off simultaneously with Operation Eastern Aurora, a NATO mission ostensibly meant to secure Polish airspace “in the face of unpredictable Russian actions,” thus potentially betraying Warsaw’s true intentions and rationale for the troop buildup. Belarus has long been skeptical of Warsaw’s military deployments on its western frontier. With over 216,000 personnel under arms (the Belarusian military has about 65,000 troops total, for comparison), Poland has the third-largest military in NATO after the US and Turkiye, and has dramatically ramped up the deployment of alliance assets and troops (including a new American missile defense facility in Redzikowo, northern Poland with offensive capabilities) in recent years.

In March, Poland hosted the Dragon 24 wargames, involving some 20,000 NATO troops and 3,500 pieces of military equipment. Successive Polish governments have had long-standing ambitions to topple Belarusian President Alexander Lukashenko to install a more European Union and NATO-friendly government, sponsoring and lending other forms of aid to radical opposition forces in the country, most recently in 2020. Some Polish geostrategists see Belarus as a key piece of the ‘Intermarium’, a geopolitical concept first conceived by Polish statesman Jozef Pilsudski in the first part of the 20th century to ‘reunite’ the territories of the old Polish-Lithuanian Commonwealth to contain Russia from the Baltic to the Black Seas. Some Poles also consider the lands of western Belarus as the Polish ‘borderlands’. In 2020, Lukashenko accused Warsaw of harboring plans to annex Grodno region amid the foreign-backed post-election unrest facing Belarus at the time. The Polish government vocally denied the claims.

“These planes will appear, their number will gradually decrease, they will be shot down and destroyed..”

• American Jets Spotted Over Ukraine (RT)

US-made F-16 fighter jets have been spotted in Ukrainian airspace, according to videos shared online by local residents. They appear to show at least one jet conducting a surveillance flight over the city of Odessa. Kiev was promised the planes in 2023 by a number of NATO states, including the US, France, Bulgaria, Denmark, the Netherlands, Belgium, Canada, Luxembourg, Norway, Poland, Portugal, Romania, and Sweden. They formed the so-called ‘F-16 coalition’, pledging to provide Kiev with the fighter jets and train Ukrainian pilots to operate them. No delivery date was set, however, and Kiev has recently expressed its impatience. A report by Bloomberg, citing sources in Kiev, indicated that the first batch of jets arrived earlier this week, and that the number delivered so far was “small.” Ukrainian leader Vladimir Zelensky confirmed the delivery in a statement on his official Telegram channel on Sunday.

He did not disclose the number of planes supplied but singled out Denmark and the Netherlands to express his gratitude for the delivery. The two countries were to provide Kiev with 24 and 19 F-16s respectively from their own stocks. Zelensky hailed the long-awaited arrival of the jets, claiming they will help Kiev deliver “exactly such combat results that will bring our victory closer – our just peace for Ukraine.” Moscow has warned that F-16s, just like any other Western weapons provided to Kiev, will not change the outcome of the conflict and will only prolong it. Kremlin spokesman Dmitry Peskov said earlier this week that there is no “magic pill” for Kiev and that it will not have this “panacea” for long. “These planes will appear, their number will gradually decrease, they will be shot down and destroyed. They will not be able to significantly influence the dynamics of events at the front,” Peskov stated.

“Russia’s air defense systems would make it too risky for Ukraine to try to use the jets to support its troop movements on the front line..”

• Destruction of NATO F-16s Sent to Ukraine Will Boost Russia’s Image (Sp.)

The first F-16s have been delivered to Ukraine, media reported earlier in the week. Promised to the Kiev regime a year ago, it took far longer than predicted to train Ukrainian pilots on the jets, with media speculating about what the F-16s will be used for, citing air defense as an option. Deliveries of aging F-16 fighter jets to Ukraine will play into Russia’s hands and improve its image, The Independent has speculated. Russian President Vladimir Putin “would savor the image that destroying F-16s from NATO countries would bring,” the UK media outlet noted. Russia’s Armed Forces will likely “destroy the F-16s on the ground with long-range missiles,” the publication further predicted. It went on to underscore that Russia’s Su-35 fighter jet would be “one of the biggest threats” to the F-16s, and noted that sophisticated air surveillance radars would be used against them. Russia’s air defense systems would make it too risky for Ukraine to try to use the jets to support its troop movements on the front line, analysts cited by the outlet acknowledged.

The fact that Kiev’s pilots only got a nine-month training “crash course” on using the F-16s as compared to the typical three-year course Western pilots receive was also noted. Ukraine recently received a handful of F-16s from the Netherlands. Denmark, Belgium, and Norway have promised to provide the Kiev regime with more over the next few months. Russian Foreign Minister Sergey Lavrov warned the United States and its NATO allies that Moscow sees the presence of nuclear-capable F-16s in Ukraine as a nuclear threat. President Vladimir Putin emphasized that Western-supplied F-16 jets to Ukraine would not have the power to alter the situation on the battlefield. He warned that if these fighter jets are deployed from the territory of third countries, they will be considered legitimate targets for Russian forces. Every previous alleged game-changing weapon has failed to turn the tide of the West’s proxy conflict in Ukraine, as Russia has had effective countermeasures ready and waiting for each of them.

Apple does so well, he’s taking a break.

• Warren Buffet Unloads Apple Shares (RT)

Billionaire investor Warren Buffett’s Berkshire Hathaway has significantly cut its investment in Apple, offloading nearly half of its holding since the start of the year, according to a quarterly earnings report released on Saturday. The value of the holding company’s stake in Apple dropped from $174.3 billion as of the end of last year to $84.2 billion on June 30. In the final quarter of last year, Berkshire also sold around 10 million Apple shares, or roughly 1% of its holding. Despite the sell-off, Apple remains the largest investment in Berkshire’s portfolio. Nevertheless, the persistent offloading of Apple shares is notable for Buffett, who is famous for being a long-term investor and a vocal Apple fan. During the Berkshire annual meeting in May, Buffett said he believed the tech giant would remain one of the conglomerate’s core holdings.

However, during the same meeting, he hinted that his selling of Apple stock is partly motivated by tax considerations, and also by his plans to build up Berkshire’s cash position. In total, Berkshire sold off $75.5 billion in stock in the second quarter, a move that lifted its cash holdings to a record high of $277 billion, up from $88 billion in the first quarter of 2024. It was the seventh straight quarter in which the company sold more stock than it bought. Cash now represents roughly 30% of Berkshire’s market value of over $900 billion. Some analysts say the company’s cash buildup may signal Buffet’s concerns about the US economy.

“I would be getting a little worried,” Jim Shanahan, an analyst for Edward Jones told MarketWatch in a note. Buffett’s recent moves “make me concerned about his outlook for the markets and economy. It’s incredible how much the cash has grown,” he wrote. Apple stock had a rough start to this year amid concerns over weakness in iPhone sales and competition from other tech majors, but started rapidly gaining after the company unveiled Apple Intelligence, its batch of new AI features, in early June. A rally last month pushed the iPhone maker’s stock price to over $230 per share and its market cap to over $3.5 trillion, the highest any publicly traded company has ever achieved. The shares have since given back some of the gains, closing at roughly $219 per share on Friday.

First you welcome them, but then you file a lawsuit against 17 charter bus companies?! Shouldn’t you sue Texas, if anyone? Yourself, perhaps?

• New York State Supreme Court Blocks Attempt to Pause Migrant Arrivals (ET)

The New York State Supreme Court has denied New York City Mayor Eric Adams’s request for a preliminary injunction against busing illegal immigrants from Texas to the city. Adams, who faces challenges from New York City Comptroller Brad Lander and others in his reelection bid next year, filed a lawsuit against 17 charter bus companies in January. His goal was to stop the companies from busing migrants, many of them undocumented, from communities in Texas to New York. The mayor cited Social Services Law 149, which stipulates that any person “who knowingly brings, or causes to be brought, a needy person from out of state into this state for the purpose of making him a public charge” has an obligation “to convey such person out of state or support him at his own expense.” But in her nine-page July 29 ruling, Judge Mary V. Rosado found that the lawsuit was “unconstitutional.”

The judge found that the matter was similar to a 1941 Supreme Court case, Edwards v. California, in which the Supreme Court found that an “essentially identical” law in California was unconstitutional for violating the Interstate Commerce Clause. She cited the ruling, saying, “The Court finds that it cannot grant the … request for injunctive relief as the merits of [the] claim are dubious at best given myriad constitutional concerns.” The state supreme court’s ruling is a setback for the Adams administration, whose legal moves had succeeded in getting one bus company, Roadrunner Charters Inc., to enter into an agreement to pause busing migrants to the city until the court reached a decision. Now, Roadrunner Charters and other bus services are free to continue transporting migrants to New York. Texas Gov. Greg Abbott quickly responded to the ruling on X, formerly Twitter, writing, “Another WIN! … Until the Biden-Harris Administration secures the border, Texas will continue to send migrants to sanctuary cities.”

Adams’s position was that dropping thousands of people in New York strained social services and the amount of available shelter space past the limit, costing more than $700 million. In a similar spirit to the busing lawsuit, the mayor has sought to enforce a 60-day limit on shelter space for asylum seekers in the city. In the past two years alone, a reported 205,000 migrants have arrived in the city, straining existing social services and prompting the Adams administration to set up more than 200 emergency shelter sites.

The New York Civil Liberties Union (NYCLU), which filed an amicus brief in the case, argued that people have a right to come to New York regardless of their immigration status or whether they are self-sufficient and that the injunction Mayor Adams sought was unconstitutional. “The court has rightly rejected the city’s cruel attempt to limit newly arrived immigrants from traveling to and making a home here in New York City. Everyone, whether or not they are a citizen and no matter their resources, has the right to travel and reside anywhere within the United States—including Texas and New York,” Beth Haroules, a senior staff attorney at the NYCLU, said in a statement. “New Yorkers deserve better than xenophobia and discrimination masquerading as policy,” she continued, adding that the NYCLU looks forward to the court’s full dismissal of the mayor’s case.

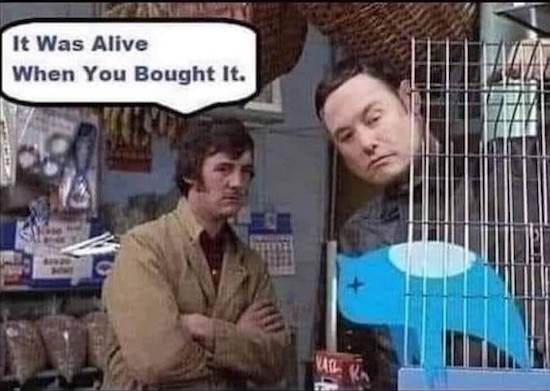

What inept looks like. It doesn’t matter what government, they’re all the same.

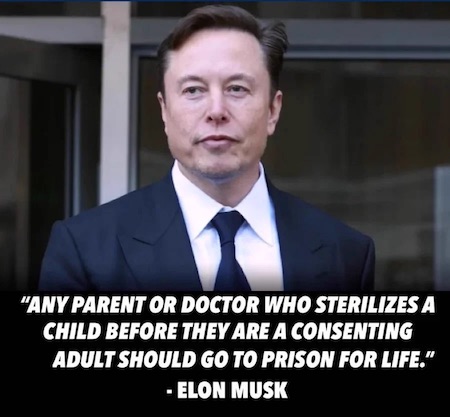

• Elon Musk Speculates Civil War ‘Inevitable’ as Violence Sweeps UK (Sp.)

Angry anti-migrant protests have swept across the UK, with the latest unrest set off by the horrific stabbing of three children in Southport by the 17-year-old son of Rwandan immigrants. Manchester, Liverpool, and Birmingham have witnessed violent demonstrations, with mosques attacked, police premises ransacked, and cars and buildings set ablaze. US billionaire Elon Musk has speculated that the UK is heading towards civil war. Musk weighed in on the wave of violence sweeping across the country amid uncontrolled migration and soaring crime, posting on X a succinct post that read, “Civil war is inevitable.” The Tesla CEO and owner of X made the comment under one of many videos showing scenes of unrest gripping towns and cities in Britain during the past days. The latest wave of interethnic violence was triggered by a recent tragedy in the town of Southport, where a 17-year-old teen of Rwandan origin stabbed three girls to death on July 29.

Police arrested dozens of people on Saturday, as projectiles and fireworks were set off, and storefronts set on fire. Footage posted on social media shows crowds chanting anti-immigrant slogans such as “stop the boats” in Liverpool, in a reference to the dinghies used by asylum seekers to cross the English Channel to the UK. Former Home Secretary Priti Patel denounced Prime Minister Sir Keir Starmer and his Labour Party for complacency amid the riots, writing on X that Parliament ought to be recalled from summer break. The UK’s newly minted Labour Prime Minister Keir Starmer, who has inherited the migrant crisis from his predecessor, faces an uphill battle to tackle illegal migration. The number of people crossing the English Channel is currently estimated to be more than 10,000 this year alone. Previous measures resorted to by the UK government have failed to stanch the tide of illegals.

“..Starmer did not discuss any of the root causes of the unrest. Instead he pinned all blame for the violence on “far right hatred” and online “misinformation.”

• British Rioters Torch Migrant Hotel (RT)

Right-wing protesters in the English town of Rotherham have set fire to a hotel housing asylum seekers, as demonstrations against immigration and Islam continue across the country. Prime Minister Keir Starmer has vowed that the rioters will “face the full force of the law.” Hundreds of people gathered outside the Holiday Inn Express in Rotherham on Sunday afternoon, pelting police officers with wood and bottles and chanting “get them out,” referring to the 130 asylum seekers housed in the hotel since 2022. South Yorkshire police said at least ten officers were injured in clashes with the rioters, who broke windows and set dumpsters ablaze outside the building, before setting a fire inside the hotel’s ground floor. Multiple arrests were made, and the fire was extinguished shortly afterwards.

Dozens of British towns and cities have been rocked by right-wing protests and riots since Monday, when a British teenager of Rwandan descent stabbed three children to death and injured ten others in the town of Southport, near Liverpool. Although initially sparked by a false rumor that the knifeman responsible for the stabbings was Muslim, the demonstrations have since grown into a wider backlash against Islam, mass immigration, and the perception that political leaders are more concerned with suppressing right-wing dissent than tackling immigrant crime. More than 150 people were arrested after riots in Liverpool, Manchester, Stoke, Leeds and other cities on Saturday. Similar riots took place in locations including Middlesbrough, Blackburn, and Tamworth on Sunday. Mobs of Muslim protesters, some armed with knives and machetes, have been seen in some cities, including Bolton and Stoke.

In a speech on Sunday, Starmer warned that more arrests would follow. “Those who have participated in this violence will face the full force of the law,” he declared, warning that those responsible “will regret taking part in this disorder.” In Sunday’s address and in a similar speech earlier this week, Starmer did not discuss any of the root causes of the unrest. Instead he pinned all blame for the violence on “far right hatred” and online “misinformation.” Rotherham is infamous for its Muslim ‘grooming gang’, a group of predominantly British-Pakistani men who sexually abused around 1,400 young girls between the late 1980s and 2013. Three separate reports published in 2013, 2014, and 2015 found that local politicians and police covered up the gang’s crimes, partly out of fear that identifying and punishing the perpetrators would be seen as “racist.”

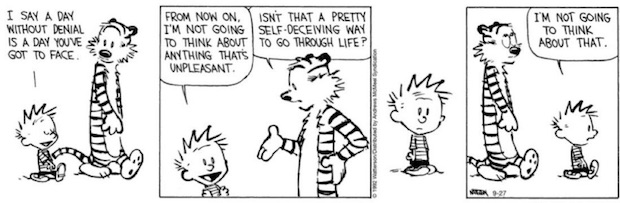

Tucker coast guy

Neil Oliver: "There was no pandemic."

"What we ended up with was a pandemic of testing, with the misapplication of PCR tests that were never designed, according to their designer, to be used as diagnostic tools."

"They simply took an opportunity to do something that they were… pic.twitter.com/q7762NG7Sv

— Wide Awake Media (@wideawake_media) August 4, 2024

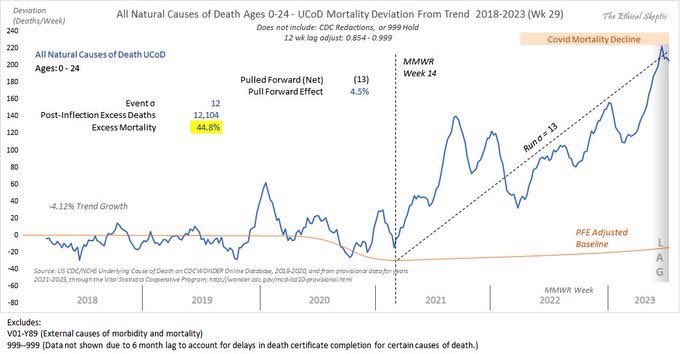

Renz

“We Incentivized MURDERING Patients in Hospitals”

• “If you go to the hospital and you get a positive COVID test, then the hospital gets more money.”

• “If you get put on remdesivir, the hospital gets more money.”

• “If you get put on a vent, the hospital gets more money.” pic.twitter.com/buDwJ75qLM

— (Honest/Ethical/Safe Dr) David Cartland (@CartlandDavid) August 4, 2024

Dog toy

https://twitter.com/i/status/1820101192543768864

Cubs

So beautiful story.

— The Best (@ThebestFigen) August 4, 2024

Moose

5. The size of a moose pic.twitter.com/GacO97pqSa

— Creepy.org (@creepydotorg) August 4, 2024

Newquay

https://twitter.com/i/status/1820091457086071157

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.