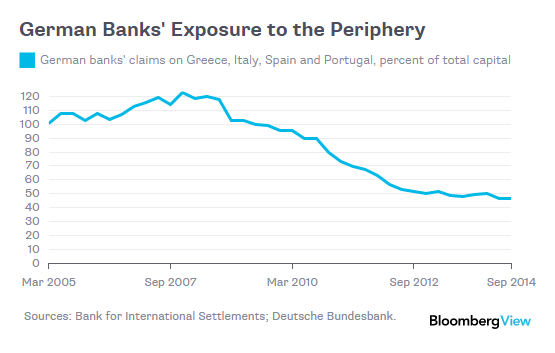

Andy Warhol Mick Jagger 1975

RFK Hannity

https://twitter.com/i/status/1684030867264643072

https://twitter.com/i/status/1684017271012995075

Azov

An American mercenary in the Azov Battalion, Justin Bans, gave an interview. He joined the Azov intelligence unit, made up entirely of Americans.

When he arrived there, he learned that his commander and associates adhered mainly to Nazi ideology:

– There are still many… pic.twitter.com/BAwpIFIhvE

— Lord Bebo (@MyLordBebo) July 25, 2023

Tucker Ice Cube

Ep. 10 Stay in your lane: our drive through South Central LA with Ice Cube.

(next episode: Ice Cube sits down with us at his studio) pic.twitter.com/cUgCh2xccH

— Tucker Carlson (@TuckerCarlson) July 25, 2023

https://twitter.com/i/status/1684017033174827008

“..Polish leadership’s concern, paradoxically, will be that Donald Trump may not return as president in 2024..”

• Glimpses Of An Endgame In Ukraine (Bhadrakumar)

It is one thing that the Russian people are well aware that their country is de facto fighting the NATO in Ukraine. But it is an entirely different matter that the war may dramatically escalate to a war with Poland, a NATO army that the US regards as its most important partner in continental Europe. By dwelling at some length on Polish revanchism, which has a controversial record in modern European history, Putin probably calculated that in Europe, including in Poland, there could be resistance to the machinations that might drag NATO into a continental war with Russia. Equally, Poland must be dithering too. According to Politico, Poland’s military is about 150,000 strong, out of which 30,000 belong to a new territorial defence force who are “weekend soldiers who undergo 16 days of training followed up by refresher courses.”

Again, Poland’s military might doesn’t translate into political influence in Europe because the centrist forces that dominate the EU distrust Warsaw, which is controlled by the nationalist Law and Justice Party whose disregard for democratic norms and the rule of law has damaged Poland’s reputation across the bloc. Above all, Poland has reason to be worried about the reliability of Washington. Going forward, Polish leadership’s concern, paradoxically, will be that Donald Trump may not return as president in 2024. Despite the cooperation with the Pentagon over the Ukraine war, Poland’s current leadership remains distrustful of President Joe Biden — much like Hungary’s Prime Minister Viktor Orban.

On balance, therefore, it stands to reason that the sabre-rattling by Lukashenko and Putin’s lesson on European history can be taken as more of a forewarning to the West with a view to modulate an endgame in Ukraine that is optimal for Russian interests. A dismemberment of Ukraine or an uncontrollable expansion of the war beyond its borders will not be in the Russian interests. But the Kremlin leadership will factor in the contingency that Washington’s follies stemming out of its desperate need to save face from a humiliating defeat in the proxy war, may leave no choice to the Russian forces but to cross the Dnieper and advance all the way to Poland’s border to prevent an occupation of Western Ukraine by the so-called Lublin Triangle, a regional alliance with virulent anti-Russian orientation comprising Poland, Lithuania and Ukraine, formed in July 2020 and promoted by Washington.

Article is bits and pieces thrown together, but still interesting.

• Major Advancements For Russia, Ukraine On Its Last Legs – Macgregor (WF)

The same people driving this war in Eastern Europe and Ukraine are the people dominating the financial markets, dominating media and ultimately shaping policy for our government.. Government by donors. This is entirely a function of people with a lot of money. – Douglas MacGregor Ret. Col. Douglas Macgregor: “[Putin] represents, in the minds of many people around the world, someone who has decided to challenge not just American military and political hegemony, but American and Western financial hegemony.

Macgregor

Retired #USArmy Colonel Douglas MacGregor:

1) #Russian troops are advancing

2) #Ukraine has no chance to win

3) what we see now is the disintegration of the #Ukrainian army.#UkraineRussiaWar #WarNews #RussianOffensive pic.twitter.com/DA4wZbfaWm— Bad God (@ocohan) July 25, 2023

DOUGLAS MACGREGOR: 'We are failing to invest where we need to at home.'

'Fighting the Russians in Ukraine is Nonsensical, its irrelevant.. It's Crazy.' pic.twitter.com/AJ8fCNvfV0

— OCOC WarRoom (@OCOCWarRoom) July 23, 2023

The World Bank and associated institutions have effectively been puppets for the US… We talk all the time about the Chinese supposedly blackmailing people by lending them lots of money and then holding them accountable. Well, we do the same thing, only we do it in more subtle ways that are actually more damaging to the society, because we’re very intrusive… The bottom line is this is a new era that is coming, and they’ve already got 40 plus nations willing to join this new currency. India, China and Russia, of course, are at the center of this, at the core of it. And this is seen as a rebellion against our financial dominance. That has been so, from their standpoint, certainly destructive in so many ways for so long.”

WAKE UP: If Russia was the aggressor against Ukraine, the situation would be different now, and we would see Russians on the borders of Poland after they destroyed Ukraine, but this did not happen, because the Russians do not want this. – Col. Douglas Macgregor “It’s stupid to threaten Russia with nuclear weapons,” – said Douglas Macgregor, ex-adviser to the head of the Pentagon. “The Russians can flood the Atlantic with their submarines, as well as the Pacific Ocean, where they will be supported by the Chinese Navy..”

They’re no longer strong.

• Even Strong Western Economies Turn Into Colonies – Zakharova (TASS)

Even economically strong and developed Western countries have turned into colonies, Russian Foreign Ministry Spokeswoman Maria Zakharova said on Monday. “Western countries, even strong and developed economies, have become colonies,” the diplomat noted, addressing a Russian-African women’s forum. “The most interesting thing is that European Union nations and NATO countries have already become neo-colonies. They are economically strong; they have a long history of democratic development, and many have given birth to democratic freedoms in the past. However, today, they are not just dependent, but they are completely subordinate to the will of their metropolis – that is, the Anglo-Saxon world – in terms of the economy, politics and morality.

However, the world is unwilling to follow the old path, get back on the same old track and repeat the same mistakes,” she added. “We are not only fighting for ourselves; we are fighting for the future of the world, deciding whether it will be a free world or we will return to the colonial past,” Zakharova noted. Still, the diplomat pointed out that Russia and Africa weren’t ready to sacrifice freedom for material benefits the way some Western countries did. “Although we appreciate material welfare, there are more important things. Welfare turns against humans when there is no internal freedom, free will, and an understanding of what’s good and bad,” Zakharova emphasized.

How about Russia?

• Who Can Give Security Guarantees To Ukraine? (MoA)

In 2013 the European Union pressed the Ukraine to sign a free trade agreement with it. Russia, which was the biggest trading partner of Ukraine, made a counter offer that was financially better and had less political restrictions attached to it. Then President Victor Yanukovych of Ukraine had to reject the EU agreement. The U.S., together with the German secret service BND, had long standing ties with the right-wing groups in west-Ukraine which had previously cooperated with Nazi Germany and had been attached to the German Nazi-Wehrmacht. The CIA reactivated these groups and instigated a violent color-revolution in Kiev. That revolution led to a civil war as large parts of the ethic Russians in east Ukraine rejected the new regime that had been installed by a west Ukrainian minority.

While the ethnic Russians in Ukraine lost control over most of their original areas they also soon defeated what was left of the Ukraine army. They did so twice. Since 2015 the conflict was stalled. The Minsk agreements, under which Ukraine was supposed to became federalized, were signed, but Ukraine stalled their implementation. Meanwhile the U.S. and Britain used the time to reinstate and rearm the Ukrainian army. By 2021 the Ukraine was ready to attack the People’s Republics of Luhansk and Donetsk. Russia activated its army and warned that it would have to interfere with such plans. The imminent launch of an Ukrainian attack was called off. In early 2022 the U.S. gave the Ukrainians a green light to launch their long planned attack. Russia intervened and the current war started.

The U.S. plans behind the war expected that the pre-coordinated western sanctions that immediately followed would ruin Russia, that Russia would be shunned by the rest of the world and that a military defeat of the Russian army would lead to regime change in Moscow. The Ukraine expected that, after winning a war against its separatists, it would immediately become a member of NATO. Neither of the (totally unrealistic) expectations was met. The Ukraine is now obviously losing the war. It will soon need to sign a capitulation like ceasefire agreement with Russia. But who or what can guarantee that any such agreement will be held up? NATO membership is no longer an option.

Whose are they?

• IAEA Discovers Anti-Personnel Mines Near Zaporozhye Nuke Plant (TASS)

Experts from the International Atomic Energy Agency (IAEA) have observed directional anti-personnel mines on the periphery of the Zaporozhye Nuclear Power Plant (ZNPP), the agency’s Director General Rafael Grossi said. According to him, while inspecting the site on July 23, the IAEA experts saw some mines located in a buffer zone between the site’s internal and external perimeter barriers. The experts reported that the mines were in a restricted area that plant personnel cannot access. No mines were discovered within the site. “As I have reported earlier, the IAEA has been aware of the previous placement of mines outside the site perimeter and also at particular places inside. Our team has raised this specific finding with the plant and they have been told that it is a military decision, and in an area controlled by military,” Grossi said.

According to him, “having such explosives on the site is inconsistent with the IAEA safety standards and nuclear security guidance.” That said, the IAEA experts concluded that “any detonation of these mines should not affect the site’s nuclear safety and security systems.” On June 22, ahead of Grossi’s visit to Russia, Ukrainian President Vladimir Zelensky accused Russia of plotting a terror attack on the Zaporozhye NPP. He said as much to the United States, Brazil, India, China, European, Middle East and African countries but provided no evidence to back up his allegation.

Kremlin Spokesman Dmitry Peskov refuted these allegations as yet another lie. According to Renat Karchaa, adviser to the CEO of Russian state nuclear power corporation Rosenergoatom, Zelensky’s statements may indicate that Kiev is plotting a terror attack or a strike on the ZNPP in a bid to drag NATO into the conflict. Russia’s Permanent Representative to the United Nations Vasily Nebenzya said on June 23 that Russia was alarmed over Kiev’s repeated allegations that Russian forces were mining the nuclear facility.

And they don’t produce enough to replace them.

• NATO Countries Using Ukraine to Get Rid of Outdated Weapons (Sp.)

NATO countries have been pumping weapons into Ukraine since the beginning of the conflict with Russia, but most of them are outdated and have been mothballed for decades, military expert and former high-ranking NATO artillery officer Pierre Henrot told Sputnik. “NATO countries in fact only send their oldest equipment to Ukraine and take the opportunity to replenish their armament for their armies with new generations of equipment. Examples abound: the Poles, who are the most committed alongside Ukraine, to the point that they are talking about entering western Ukraine themselves, provided very early [on] all their Soviet-era tanks to the Ukrainians and have just received for the Polish army a first contingent of American Abrams tanks, brand new and manufactured for them,” Henrot said.

Other countries have also provided decommissioned equipment, including 88 German Leopard 1 tanks that were withdrawn from arsenals in 2003, and French AMX 10-RC light tanks that were developed in the 1970s and have been decommissioned by the French army as well, the former officer added. “The worst is probably the delivery by France of VAB armoured infantry vehicles (Vehicules de l’Avant Blindes), in a four-wheeled version, which invariably gets bogged down in the autumn mud. Entering service in 1979, it has proven to be a rolling coffin for Ukrainian infantry over the past year,” the expert further explained. Some countries, including the Czech Republic, Slovakia and Romania, also sent Ukraine all their Soviet MiG or Sukhoi fighters, he said.

Another problem with such ragtag deliveries is that the spare parts and ammunition for such weapons are often different and incompatible with one another, Henrot pointed out. “It is as if the NATO partners were getting rid of their outdated weapons, already mothballed,” the former officer said. However, some of Western military aid is useful for the Ukrainian military, and of good quality, the expert noted, adding that it is usually equipment for small arms, bulletproof vests and night sight systems, as well as US-made Stingers and Javelins. “Where the Americans provided suitable and effective weapons, it was with the 2,000 portable anti-aircraft Stingers delivered or with the 10,000 Javelin anti-armor weapons provided; formidable weapons in the hands of infantrymen. It is the same for the NLAW [Next Generation Light AntiTank Weapons], a useful weapon on the battlefield,” he stated.

At the same time, the Western countries often lack sufficient capacities to produce weapons required by the Ukrainian military, Henrot mentioned. “NATO countries fail to keep up with the production of ammunition for artillery and even for small arms. Again, the variety of calibres is very large; it’s a headache, but above all, there are not enough production chains, and industrialists are reluctant to launch production units for an effort that could stop quite quickly, and they have not received a firm long-term contract from Western governments,” the expert explained. Henrot believes that the recent widely criticized decision of the United States to send cluster bombs to Ukraine is the demonstration of the same problem. “The Americans for their part have almost openly admitted that it was their last ammo in stock and that they have nothing left to deliver,” Henrot concluded.

“The Polish authorities, who are nurturing their revanchist ambitions, hide the truth from their people. The truth is that the Ukrainian cannon fodder is no longer enough for the West.”

• The Polish Response To Putin’s Challenge (Helmer)

[Putin] warned that President Vladimir Zelensky’s regime in Kiev may be contemplating a trade with Poland of the territory around Lvov in exchange for Polish military intervention to support Kiev against Russia: “Today we see that the regime in Kiev is ready to go to any length to save its treacherous hide and to prolong its existence. They do not care for the people of Ukraine or Ukrainian sovereignty or national interests. They are ready to sell anything, including people and land, just like their ideological forefathers led by Petlyura, who signed the so-called secret conventions with Poland in 1920 under which they ceded Galicia and Western Volhynia to Poland in return for military support. Traitors like them are ready now to open the gate to their foreign handlers and to sell Ukraine again.”

“As for the Polish leaders, they probably hope to form a coalition under the NATO umbrella in order to directly intervene in the conflict in Ukraine and to bite off as much as possible, to ‘regain’, as they see it, their historical territories, that is, modern-day Western Ukraine. It is also common knowledge that they dream about Belarusian land.” If that were to happen, Putin said Russia would support a Ukrainian regime replacing Zelensky and opposing the Poles. “The Polish authorities, who are nurturing their revanchist ambitions, hide the truth from their people. The truth is that the Ukrainian cannon fodder is no longer enough for the West. That is why it is planning to use other expendables – Poles, Lithuanians and everyone else they do not care about. I can tell you that this is an extremely dangerous game, and the authors of such plans should think about the consequences.”

The Polish state media have ignored Putin’s historical precedents and the deal-making underway between the Ukrainian military command and its Polish counterpart. The Polish commercial network TVN24, which is owned by the US media corporation Warner Bros. Discovery, broadcast a discussion with a think-tank academic and a retired military intelligence colonel. “‘The Russians are trying to drive a wedge between Poland and Ukraine,’ Agnieszka Legucka, an analyst for Russia at the Polish Institute of International Affairs, said in the Fakty po Faktach [Facts after Facts] programme. ‘Putin has recently been portraying himself as such an expert in history. Anyway, in 2019 he launched attacks on Poland, in particular when it comes to this historical dimension. He accused us of starting World War II,’ she said.

‘And Poland now, especially when it supports Ukraine so much both militarily and humanely, has become one of the countries that is attacked by the Russian authorities directly, including Vladimir Putin and Dmitri Medvedev.’ According to the expert, the Russians ‘are trying to drive a wedge between Poland and Ukraine. And the issue of the alleged separation of Ukraine and even Belarus is very eagerly raised by both Russian and Belarusian propaganda,’ she added.”

“..if that document is true, who wants to believe that President Zelensky and his administration have not used that as leverage over Joe Biden..”

• Zelensky Associate Was Present at Biden Bribery Meetings (GP)

Author Peter Schweizer went on with Jesse Watters on Monday night where he proceeded to drop another bomb on the Biden Crime Family. According to Schweizer, who wrote a best-seller “Secret Empires” on the Biden Family crimes, told Jesse that one of Vlodomyr Zelensky’s top officials was sitting in the room when they were discussing bribing the Bidens, Joe and Hunter. Ukrainian President Zelensky has a top official who was sitting in on meetings where they talked about bribing the Bidens. Schweizer suggests Zelensky is using this as leverage over the Biden regime for weapons and billions in US dollars. Peter Schweizer: We’ve been at this since 2018. ** They initially said there were no foreign deals. ** Then they shifted and said there were. There might have been foreign deals, but the Bidens made no money. ** Then it became Joe Biden didn’t know about any of the deals. ** Then it became Joe Biden didn’t participate in any of the deals. ** And now it’s that he was not in business with his son.

Look, the implications for this are huge, Jesse. If you look at that 1023 form that the FBI released, if that document is true, that document reveals that one of the people that was at those meetings that heard the conversations about bribing the Bidens worked for – President Zelensky. Who really wants to believe, if that meeting took place and that document is accurate, that that individual did not go and report to President Zelensky what he heard? And again, if that document is true, who wants to believe that President Zelensky and his administration have not used that as leverage over Joe Biden when it comes to negotiations on Ukraine policy? We may all have to start learning the Ukrainian word for compromise because this is a very clear indication of how this has shaped this administration’s policy towards Ukraine and also towards China. It is also convenient for Zelensky that there is not a team of US auditors in his country tracking where all of this money went.

NEW: Zelensky may be at the center of the Biden bribery scandal as author Peter Schweizer reveals one of the people at the alleged meeting with Hunter Biden outlined in the 1023 form just so happened to be an associate to the Ukrainian president.

So someone at the center of the… pic.twitter.com/Qb59SFzsom

— Collin Rugg (@CollinRugg) July 25, 2023

“Biden cured cancer in the same way that he marched for civil rights, was arrested trying to see Nelson Mandela, grew up in the black church, was raised in the Puerto Rican community, was a professor at UPenn, built the greatest economy in the world, and never spoke to his son about business..”

• Biden Claims To Have ‘Ended Cancer’ (RT)

During a speech on Tuesday, US President Joe Biden seemed to claim that his administration had cured cancer. “I said I’d cure cancer. They looked at me like, ‘Why cancer’? Because no one thinks we can. That’s why. And we can. We ended cancer as we know it,” Biden said during a speech in the East Room of the White House. Biden was scheduled to speak about expanding Americans’ access to mental health care. After the cancer remark, he continued to talk about healthcare for military veterans, which is run by the federal government. The strange claim was quickly noticed by Republicans, who have often accused the 80-year-old Democrat of behaving as if afflicted by dementia. “Biden just told everyone that he cured cancer. I feel like that would have at least gotten a press release,” quipped Congresswoman Lauren Boebert of Colorado.

Biden: "I said I’d cure cancer … We ended cancer as we know it." pic.twitter.com/assi1qavbB

— The Post Millennial (@TPostMillennial) July 25, 2023

“Biden cured cancer in the same way that he marched for civil rights, was arrested trying to see Nelson Mandela, grew up in the black church, was raised in the Puerto Rican community, was a professor at UPenn, built the greatest economy in the world, and never spoke to his son about business,” tweeted Texas activist Christian Collins. Those were just some of the claims Biden had made over his 50-year political career that turned out to be tall tales. The longtime Democrat also has a history of misspeaking in public. Just last week, he introduced himself as an artificial intelligence. The week before, in Europe, he urged Russia to “stop attacking Russia.” Earlier this month, he also claimed that Moscow was “losing the war in Iraq.”

Biden’s elder son Beau passed away in 2015 from an aggressive brain cancer, which his father has publicly attributed to “burn pits,” a method used by the US military to dispose of garbage. Beau Biden was reportedly exposed to the toxic pits during his 2008 deployment in Iraq as a military lawyer, and earlier as a contractor in Kosovo. In February 2022, Biden announced a government program to find a cure for cancer, dubbing it a re-launch of the Obama administration’s 2016 ‘Cancer Moonshot’. The new program’s goal was to “reduce the cancer death rate by half within 25 years and improve the lives of people with cancer and cancer survivors,” according to the National Cancer Institute. In March this year, Biden had surgery to remove from his chest a “small skin lesion” that had “basal cell carcinoma,” according to the White House physician.

I think I count 8 reported cases. In 4 months. Madness.

• Biden’s Dog Attacks 8 White House Staffers in Cover-Up (Sp.)

Commander, President Joe Biden’s soon-to-be two-year canine, has been implicated in seven biting assaults within four months, attacking Secret Service and White House personnel, reports have claimed. A series of alarming occurrences featuring Commander have emerged, all of which were kept undisclosed until now. These incidents are reminiscent of attacks associated with Major, whom the White House claimed was handed over to the president’s close acquaintances in 2021 due to his biting spree. On November 3, Commander was at the center of a serious biting incident when he attacked a Secret Service uniformed officer, inflicting injuries on the arm and thigh before the victim was hospitalized.

The details of this incident were brought to public attention when relevant emails were disclosed to the conservative legal organization Judicial Watch under the Freedom of Information Act. In another occurrence, Commander, broke the skin of another Secret Service member’s hand and arm. Additionally, Commander bit a security technician at President Biden’s home in Wilmington, Delaware, the following month. “This is a special sort of craziness and corruption where a president would allow his dog to repeatedly attack and bite Secret Service and White House personnel. And rather than protect its agents, the Secret Service tried to illegally hide documents about the abuse of its agents and officers by the Biden family,” Judicial Watch President Tom Fitton noted. Reports suggest that Biden doubted the claims about Major attacking a Secret Service agent. Moreover, the White House has not revealed any biting events implicating Commander.

According to the reported emails, agents disclosed a series of incidents that occurred discreetly. On October 3, 2022, near the East Wing garden, Commander “inflicted a ‘friendly soft bite’ on [a Secret Service agent’s] forearm as [he] held the door open,” regardless “no skin was broken from the bite.” On the morning of October 5, 2022, the first recorded incident involved Commander hopping on an emergency response technician on the grounds of the presidential villa and biting their “arm/wrist area.” On November 10, a Secret Service Uniformed Division officer was bitten on the left thigh as First Lady Jill Biden walked Commander in the Kennedy Garden near the East Wing. Media sources reveal that the officer reported experiencing “bruising, tenderness, and pain” in the bite area. On November 14, one other Secret Service officer recounted an incident via email where they had to defend themselves as Commander charged toward them.

The officer described grabbing a black chair they were sitting on, making eye contact with the dog, and backing away to avoid being attacked. On December 11, Commander bit a Secret Service special agent in the Presidential Protective Division. This event transpired after the president yanked Commander’s leash following a movie. The agent reported being double-bitten, first on the arm with a 1.5cm cut and lesions, and a 1cm cut on their hand and thumb sustained from a second bite. On December 16, another Secret Service member was attacked and inflicted with canine bites, as indicated in a workplace injury form available to media sources. “I was walking across the complex, and a dog bit my left arm,” the officer wrote, expressing the wound as “Dog bite, superficial laceration, contusion, soreness, and bruising.”

On 2022’s Christmas Eve, a Secret Service inspector notified colleagues that another officer had been wounded at [undisclosed location] the day before. The inspector’s email cited that nearly every official in the room discussed specific incidents involving the First Family’s dog. On January 2 this year, an agency technical security investigator was the victim of an attack while responding to an alarm at the president’s Wilmington residence, frequently visited during weekends. “Commander squeezed his way through the door and immediately bit/latched onto the lower right side of my back,” the attack victim emailed. “These shocking records raise fundamental questions about President Biden and the Secret Service,” Fitton remarked.

“The answer remains the same. The president was never in business with his son.”

That’s not “the same”. It is a big change from “I never talked to him about his business”.

• Biden Changes Long-Standing Position on Hunter’s Foreign Deals (Turley)

Starting with his campaign for the presidency and continuing until this week, President Joe Biden has maintained one clear and consistent position on his son’s influence peddling schemes. As a virtual mantra, Biden — and the White House staff — have categorically maintained that he had no knowledge of any foreign dealings of his son. That has been proven to be a lie, but Biden continued to maintain the position. Yet, on the eve of the testimony of a key Biden associate, the White House has changed its position. Now the President is only claiming that he was “not in business” with his son.Some of us have written multiple columns over the last four years arguing that the President was clearly and knowingly lying in his denials of knowledge and discussions of these deals. Even when he made the statement, it was clearly untrue but most of the media shrugged and happily walked away.

Then the evidence began to mount. The laptop includes pictures and appointments of Hunter’s foreign business associates with Joe Biden. There is also a recording of Joe Biden discussing a Times report on Dec. 12, 2018, detailing Hunter’s dealings with Ye Jianming, the head of CEFC China Energy Company. He assures his son that “I think you’re clear” after lawyers worked on the New York Times before the story ran. There is also a recording of his uncle James assuring Hunter that he and his father were going to arrange for “safe harbor” for him as his world began to collapse. Then there is the July 30, 2017 Whatsapp message from Hunter Biden to one of his Chinese associates, Henry Zhao, the director of Harvest Fund Management and Communist Party official. Zhao was funneling money to Hunter’s firm BHR Partners. Hunter is quoted as writing:

“I am sitting here with my father and we would like to understand why the commitment made has not been fulfilled. Tell the director that I would like to resolve this now before it gets out of hand, and now means tonight. And, Z, if I get a call or text from anyone involved in this other than you, Zhang, or the chairman, I will make certain that between the man sitting next to me and every person he knows and my ability to forever hold a grudge that you will regret not following my direction. I am sitting here waiting for the call with my father.” Nevertheless, the White House has maintained the total denial . . . until this week before the testimony of Devon Archer. White House press secretary Karine Jean-Pierre was asked by Fox News journalist Gillian Turner:

“Chairman James Comer today says that the Oversight Committee has evidence that the president in the past communicated directly with foreign business associates of his son Hunter Biden many times. Curious if the White House and the president still stand behind his comment that he’s never been involved and has never even spoken to his son about his business?” The response from Jean-Pierre was surprising: “So, I’ve been I’ve been asked this question a million times. The answer is not going to change. The answer remains the same. The president was never in business with his son. I just don’t have anything else to add.” It takes an utter contempt for the intelligence of the public to insist that “the answer remains the same” and then give an entirely new answer. However, that is only if most of the public is informed of the contradiction. None of the media in the White House press corp followed up on Turner’s questions when Jean-Pierre immediately moved on.

“[Hunter Biden] was money laundering. He was racketeering. He committed wire fraud. He violated the Mann Act. The list goes on and on and on..”

Hunter’s plea deal covers two years of tax evasion. But “IRS agents saw evidence that the first son was engaged in tax evasion that “stretched back two decades.”

• Hunter Biden’s Memoir Became Source of Tax Evasion Evidence (Sp.)

US Internal Revenue Service (IRS) agent Joseph Ziegler, who was known only as “Whistleblower X” in the Hunter Biden tax case prior to his testimony at the House Oversight Committee last Wednesday, said that some of the alleged tax evasion schemes in which Hunter Biden reportedly engaged in were detailed in his 2021 work, “Beautiful Things: A Memoir.” As per Ziegler, the opus showed that some of the expenses described by Hunter were for personal choices and not corporate benefit. “That’s almost the biggest component of this that I don’t think that the general public understands: You have statements being made in a book that are talking about going out to California, leaving your life and then going to start this new life. Yet, on your tax return you’re essentially stating things that are completely different,” Ziegler told the John Solomon Reports podcast.

The whistleblower said he and IRS supervisory agent Gary Shapley, also known as the first IRS whistleblower in Hunter Biden’s case, are gathering more documents to provide to Congress. The trove reportedly includes WhatsApp messages in addition to the one made public from 2017 in which Hunter invoked his father’s name to force his Chinese associate into forking out large sums of money. The whistleblower said there is evidence of US President Joe Biden’s association in the Hunter tax case. Earlier, the president repeatedly denied being related to his son’s business dealing or knowing anything about them. Ziegler told the media outlet that a family friend named Rob Walker told the FBI that then-Vice President Joe Biden attended a meeting with the Chinese executives, and that his son deducted as a business expense a hotel room in father’s name.

Ziegler highlighted his team was prevented from finding out whether Joe Biden actually used the room or was present at the hotel. “But what I think it’s important to know is that that was a deduction that was taken on Hunter’s tax return,” he said. Moreover, per the whistleblower, IRS agents saw evidence that the first son was engaged in tax evasion that “stretched back two decades.” “In my transcript, I talked about certain issues that Hunter had, I think, going back to the early 2000s,” he said.

In June, the younger Biden struck a plea deal with federal prosecutors on two minor tax crimes and a gun case. However, Republican congressmen said they are determined to get to the bottom of Hunter’s alleged crimes. Last week, House Oversight and Accountability Committee Chairman James Comer said he expects to file “between six and 10 criminal referrals” with the Justice Department related to Hunter after the congressional probe is completed.

“[Hunter Biden] was money laundering. He was racketeering. He committed wire fraud. He violated the Mann Act. The list goes on and on and on,” Comer alleged.

Devon Archer is scheduled to testify on Friday. Will that happen? Will he be alive?

• Members and the Media Panic as the Biden Scandal Mounts (Turley)

Now, Archer is expected to testify that Joe Biden participated in actual telephone calls with them. That will allow investigators to build further on the foundation Goldman laid. Archer will join other witnesses like Hunter’s business associate Tony Bobulinski, who said that he sat down with Joe Biden to discuss the deals. Bobulinski was instructed by Biden associate James Gilliar not to speak of the former veep’s connection to any transactions. No matter the severity of the revelations, the liberal media calls the investigations a “clown show.” Others have continued to tell the public that there remain no alleged ties from Hunter to President Biden despite emails, pictures and witness testimony. Yet it is becoming harder and harder to avoid these details.

With the possible testimony of Hunter’s business associates, the only hope is that Republicans might be convinced to “move on.” What was most notable about the question to Christie was the reference to the plea bargain. A year ago, I wrote a column on how the political and media establishment would likely use a “scandal implosion” approach as the evidence mounted over the corruption allegations. After the Democrats lost the House, there was a need to cap off the scandal and I suggested that the Justice Department would secure a light plea on a couple tax counts with little or no jail time. Members and the media would then declare the scandal closed and demand that we all “move on.” It is unnerving to see how the response unfolded so precisely as predicted. Members made repeated reference to the plea bargain to avoid further discussion.

Rep. Kweisi Mfume (D.-Md.) was positively irate that “We are doing this all over again for the Hunter Biden show to someone who has pleaded guilty and has taken responsibility for not filing taxes for two years. This is ludicrous. Beam me up, Scotty. There’s no intelligent life down here. None.” He then tore up papers in disgust. Members and the media were literally citing a plea bargain as dispositive, even as two lead investigators were saying it was fixed and politically influenced. Some in the media attacked these two IRS veterans as “so-called whistleblowers” (just as members previously attacked “so called journalists” for discussing censorship records). Others insisted that the allegations were still “unproven” or “unverified” while showing the same lack of interest in establishing the truth. Notably, these same media outlets did wall-to-wall coverage of the false Russian collusion claims in the Steele dossier.

There’s a lot of X’s out there.

• Twitter Rebrand to ‘X’ Fraught With Permit, Trademark Issues (DeMartino)

Later Sunday night, the logo began appearing in place of the social media site’s iconic bird logo for some users on some platforms. While the old Twitter branding remains for some users on some platforms, Musk promised in a Tweet (or an “X”) that the old branding would soon be gone completely. “And soon we shall bid adieu to the Twitter brand and, gradually, all the birds,” Musk wrote. Musk also changed his profile picture and the profile picture of the official “Twitter” account to the site’s new logo. X.com also now redirects to Twitter.com. X users responded to the delayed signage removal and the rebrand in general with a mix of mocking and indifference, while others took the opportunity to dunk on the city of San Francisco.

At present, there is also a question of whether the “X” branding is even available for Musk to use for social media sites. Both Microsoft and Meta* hold trademarks of “X.” The Meta patent lists the service as potentially “providing interactive websites featuring technology that enable online users to create personal profiles” that users can use “for broadcasting, transmitting, receiving, accessing, viewing, uploading, downloading, sharing, integrating, encoding, decoding, displaying, formatting, organizing, storing, caching, transferring and streaming of data, text, games, game content, digital media, images, music, audio, video and animations.” Another listed use for the Meta trademark of X includes “online social networking services.”

Microsoft’s patent, first filed in 2002, lists “on-line chatrooms” and “electronic bulletin boards” for users to share messages about video games and an online video game storefront. Both patents, particularly the Meta one, which seems related to a social media site, could cause legal problems for Musk, who has been in an online feud with Meta CEO Mark Zuckerberg. Musk has threatened to sue Meta for launching an X competitor called “Threads” and the two floated a potential cage fight being aired on Pay-Per-View.

“Musk foresees these payment capabilities potentially becoming half of the global financial system.”

• Musk: ‘X Will Become Most Valuable Brand on Earth’ (Sp.)

The rebranding of Twitter to “X” was announced over the weekend and near instantly began to face varying hurdles, from potential legal challenges to a barrage of criticism from users thrown off by the platform’s redesign. Some forecasts indicated the change could result in billions’ worth in losses for the firm’s value. Elon Musk, the billionaire entrepreneur and CEO of companies Tesla and SpaceX, announced his confidence in the success of X social media on Tuesday, vowing that the Twitter rebrand would make the platform the “most valuable brand on Earth.” Musk’s statement came in response to a US media article that estimated the rebranding could potentially decrease Twitter’s value by $4 billion to $20 billion.

Nevertheless, Musk remains undeterred, envisioning “X” as a comprehensive communication platform that also offers robust financial transactions. The potential integration of payment systems into Twitter/X has sparked speculation that users may soon be able to send and receive money directly through the platform. Musk foresees these payment capabilities potentially becoming half of the global financial system. While specific details about the payment systems have not been revealed, Musk emphasized the importance of executing them correctly for the magnum opus of Twitter/X to become a reality, noting his intentions to revolutionize the financial world. Linda Yaccarino, Twitter’s new CEO, has expressed enthusiasm about the transformation and hinted at more changes to come, signaling the company is just getting started.

Under Yaccarino’s leadership, the platform aims to fulfill its immense potential and meet the expectations of fans and critics alike. Since acquiring Twitter for $44 billion in October 2022, Musk has embarked on a series of changes to enhance the user experience and drive innovation on the platform. The rebranding to “X” was the latest in a series of moves aimed at revitalizing Twitter and positioning it as a leader in the ever-evolving social media landscape. With popular platforms such as TikTok vying for users’ attention, critics have underscored that the success of Musk’s rebranding strategy will undoubtedly face challenges as the viability of company’s future remains uncertain.

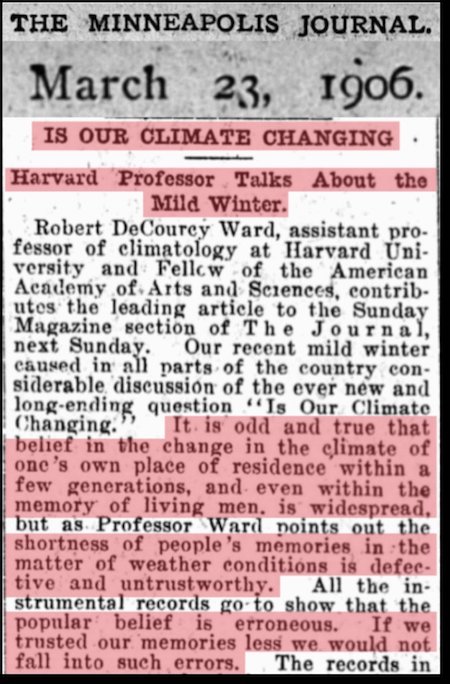

Plimer

Geologist, Professor Ian Plimer, blows the "human-induced climate change" myth completely out of the water:

"[Changes in climate] are driven by that great ball of heat in the sky, which we call 'the Sun'. A trace gas (CO2) has nothing to do with our climate."

"If we get further… pic.twitter.com/dm0PXw3yxN

— Wide Awake Media (@wideawake_media) July 25, 2023

Viper

https://twitter.com/i/status/1683884068000215044

Peacock

The sun back lit this peacocks breath creating the illusion of fire

pic.twitter.com/iojQ9fd4gz— Science girl (@gunsnrosesgirl3) July 25, 2023

Idolomantis diabolica

https://twitter.com/i/status/1683874828694982657

The exact moment the sunlight penetrates the wings of a Black and white Jacobin hummingbird revealing a secret of nature that cannot be seen with our eyes. No digital manipulation. IG: christianspencerphoto

Metallica

https://twitter.com/i/status/1683773227389140992

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.