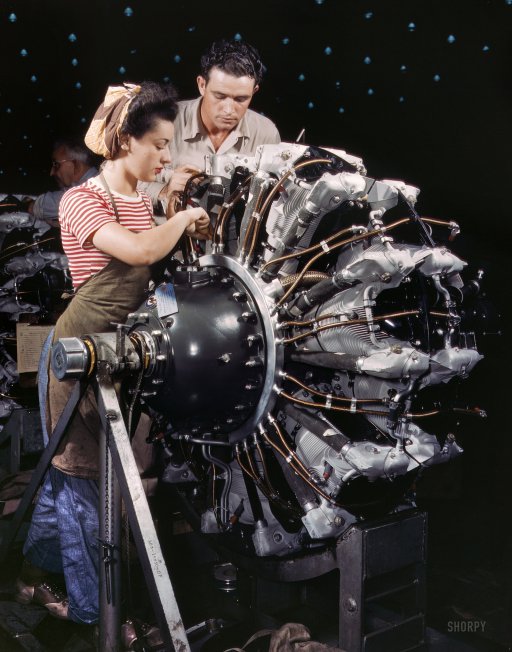

Alfred Palmer Women as engine mechanics, Douglas Aircraft, Long Beach, CA 1942

The comparison to the Tulip Craze sounds apt.

• The World’s Most Extreme Speculative Mania Unravels in China (BBG)

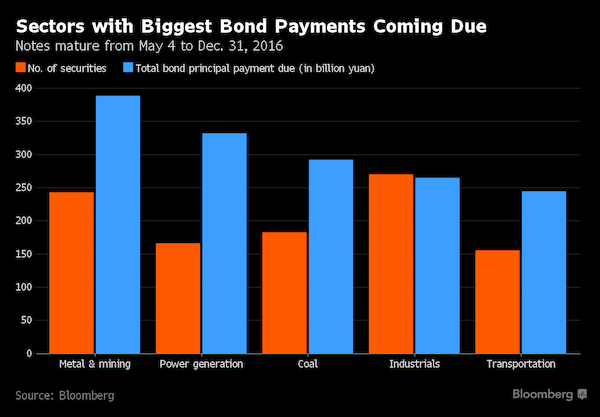

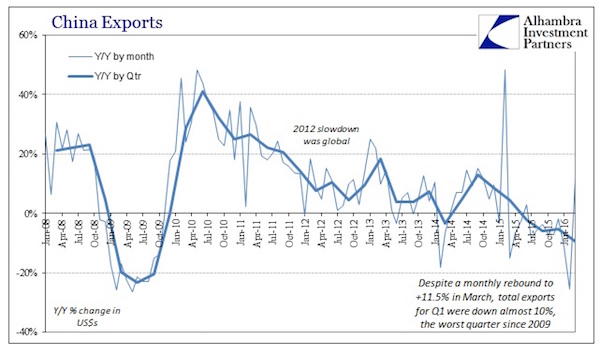

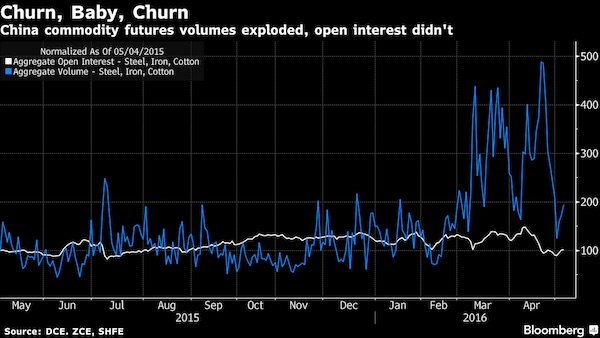

From the Dutch tulip craze of 1637 to America’s dot-com bubble at the turn of the century, history is littered with speculative frenzies that ended badly for investors. But rarely has a mania escalated so rapidly, and spurred such fevered trading, as the great China commodities boom of 2016. Over the span of just two wild months, daily turnover on the nation’s futures markets has jumped by the equivalent of $183 billion, outpacing the headiest days of last year’s Chinese stock bubble and making volumes on the Nasdaq exchange in 2000 look tame. What started as a logical bet – that China’s economic stimulus and industrial reforms would lead to shortages of construction materials – quickly morphed into a full-blown commodities frenzy with little bearing on reality.

As the nation’s army of individual investors piled in, they traded enough cotton in a single day last month to make one pair of jeans for everyone on Earth and shuffled around enough soybeans for 56 billion servings of tofu. Now, as Chinese authorities introduce trading curbs to prevent surging commodities from fueling inflation and undermining plans to shut down inefficient producers, speculators are retreating as fast as they poured in. It’s the latest in a series of boom-bust market cycles that critics say are becoming more extreme as China’s policy makers flood the financial system with cash to stave off an economic hard landing. “You have far too much credit, money sloshing about, money looking for higher returns,” said Fraser Howie, the co-author of “Red Capitalism: The Fragile Financial Foundation of China’s Extraordinary Rise.”

“Even in commodities where you could have argued there is some reason for prices to rise, that gets quickly swamped by a nascent bull market and becomes an uncontrollable bubble.” In many ways, China’s financial landscape was ripe for another round of mania. New credit soared to a record in the first quarter, giving individuals and businesses plenty of cash to invest at a time when several of the country’s traditional sources of return looked unattractive. Government debt yields were hovering near record lows, while wealth-management products and company bonds had been rattled by a growing number of corporate defaults. Stocks were still too risky for many investors burned by last year’s crash, and moving money offshore had become harder as the government clamped down on capital outflows.

Crazy stuff. And not done yet.

• Iron Ore, Rebar Crash Into Bear Market (ZH)

Real demand for steel in China dropped at least 7% in April from the year before, according to Citigroup’s Tracy Liao estimates, so it should not be a total surprise that the frenzied speculative buying in Iron Ore, Rebar, and various other industrial metals in China has crashed back to reality as volumes plunge, dragging The Baltic Dry Freight Index with it as yet another government-manipulated 'signal' collapses into a miasma of malinvestment and unintended consequences. As The Wall Street Journal reports, to the extent that China’s industrial recovery explains why iron ore and steel prices have jumped this year, China’s latest trade data served as a reminder of how brittle this reason is.

China’s steel net exports rose 8.8% in April from a year before and 9.4% between January and April from a year ago. That raises the question: Why are mills exporting more steel when Shanghai front-month futures prices for rebar steel rocketed 48% between January and April, and signaled a potential rise in demand? [..]Real demand for steel in China dropped at least 7% in April from the year before, Citigroup’s Tracy Liao estimates, based on changes in exports and inventories. The drop was at least 5% between January and April from the year before.

That reinforces fears that easy money-fueled speculation is the prime mover of steel and iron ore prices today. That "Churn" is over…

Chinese futures prices in both commodities fell sharply again Monday.

With Iron Ore now down 22% from the meltup highs, entering a bear market…

And Steel Rebar down 25%, extending losses in the US session…

And The Baltic Dry Index now down 7 days in a row, down 14% from its "everything is fine in China" highs from 715 to 616 today…

Even the Economist is waking up to what we’ve been saying for ages…

• A Debt Bust Looms For China (Economist)

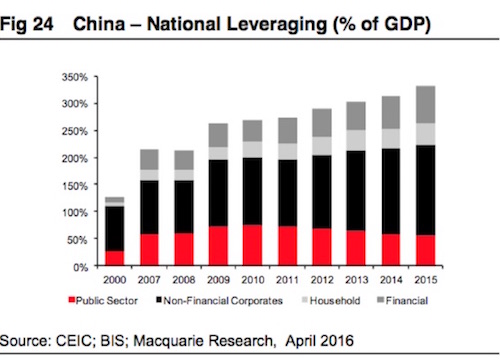

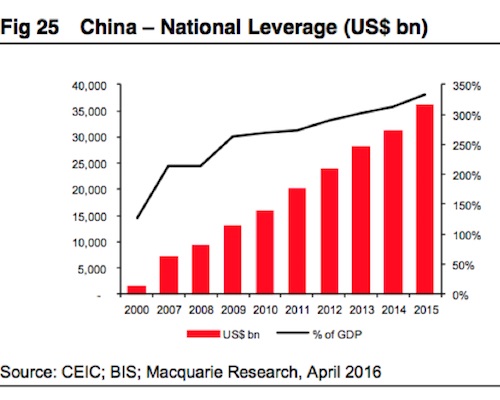

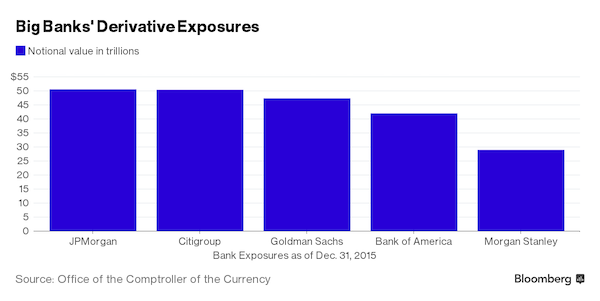

China was right to turn on the credit taps to prop up growth after the global financial crisis. It was wrong not to turn them off again. The country’s debt has increased just as quickly over the past two years as in the two years after the 2008 crunch. Its debt-to-GDP ratio has soared from 150% to nearly 260% over a decade, the kind of surge that is usually followed by a financial bust or an abrupt slowdown. China will not be an exception to that rule. Problem loans have doubled in two years and, officially, are already 5.5% of banks’ total lending. The reality is grimmer. Roughly two-fifths of new debt is swallowed by interest on existing loans; in 2014, 16% of the 1,000 biggest Chinese firms owed more in interest than they earned before tax. China requires more and more credit to generate less and less growth: it now takes nearly four yuan of new borrowing to generate one yuan of additional GDP, up from just over one yuan of credit before the financial crisis.

With the government’s connivance, debt levels can probably keep climbing for a while, perhaps even for a few more years. But not for ever. When the debt cycle turns, both asset prices and the real economy will be in for a shock. That won’t be fun for anyone. It is true that China has been fastidious in capping its external liabilities (it is a net creditor). Its dangers are home-made. But the damage from a big Chinese credit blow-up would still be immense. China is the world’s second-biggest economy; its banking sector is the biggest, with assets equivalent to 40% of global GDP. Its stockmarkets, even after last year’s crash, are together worth $6 trillion, second only to America’s. And its bond market, at $7.5 trillion, is the world’s third-biggest and growing fast. A mere 2% devaluation of the yuan last summer sent global stockmarkets crashing; a bigger bust would do far worse.

A mild economic slowdown caused trouble for commodity exporters around the world; a hard landing would be painful for all those who benefit from Chinese demand. Optimists have drawn comfort from two ideas. First, over three-plus decades of reform, China’s officials have consistently shown that once they identified problems, they had the will and skill to fix them. Second, control of the financial system—the state owns the major banks and most of their biggest debtors—gave them time to clean things up. Both these sources of comfort are fading away. This is a government not so much guiding events as struggling to keep up with them. In the past year alone, China has spent nearly $200 billion to prop up the stockmarket; $65 billion of bank loans have gone bad; financial frauds have cost investors at least $20 billion; and $600 billion of capital has left the country.

To help pump up growth, officials have inflated a property bubble. Debt is still expanding twice as fast as the economy. At the same time, the government’s grip on finance is slipping. Despite repeated efforts to restrain them, loosely regulated forms of lending are growing quickly: such “shadow assets” have increased by more than 30% annually over the past three years. In theory, shadow banks diversify sources of credit and spread risk away from the regular banks. In practice, the lines between the shadow and formal banking systems are badly blurred.

Encourage speculation, then crack down on it. Credibility?!

• The Cold, Hard Facts Raining on China’s Commodity Parade (BBG)

There’s nothing like facts to get in the way of a good yarn. Prices of everything from steel rebar to cotton are extending losses in China as a slew of bearish data hastens the reversal of a rally last month triggered by speculation that economic stimulus and industrial reforms would drive up demand and curb supplies. Steel futures in Shanghai fell the most since trading began in 2009 after inventories rose while iron ore in Dalian sank as much as 7.1%, extending its retreat from a 13-month high, after data showed Chinese port stockpiles expanded to the highest level in more than a year. Cotton on the Zhengzhou Commodity Exchange, which had surged to an 11-month high, slid 1.5% after China unloaded supply from its reserves. Copper lost 2.1% after the nation’s imports shrank from a record.

“Investors are looking at fundamentals more closely now,” Zhang Yu, a senior analyst with Yongan Futures, said by phone from Hangzhou. “While inventories were built up with the price surges, recent data couldn’t convince people that China’s real economy is bottoming and going to bring demand back.” The rally last month was accompanied by a surge in trading volumes, with as much as 1.7 trillion yuan ($261 billion) in commodity futures changing hands in a single day. That drew comparisons with 2015’s credit-driven stock market rally that preceded a $5 trillion rout, and prompted exchanges to raised transaction fees and margins amid orders from regulators to limit speculation.

As the exchanges stepped in, trading volumes shrank. About 20 million contracts of everything from eggs to steel changed hands on the Dalian Commodity Exchange, Zhengzhou Commodity Exchange and Shanghai Futures Exchange on Friday, down from a peak of 80.6 million contracts on April 22. “Bullish enthusiasm in Chinese commodities futures has been rapidly declining, especially after the exchanges pushed out massive measures to curb speculative trading,” Yu said.

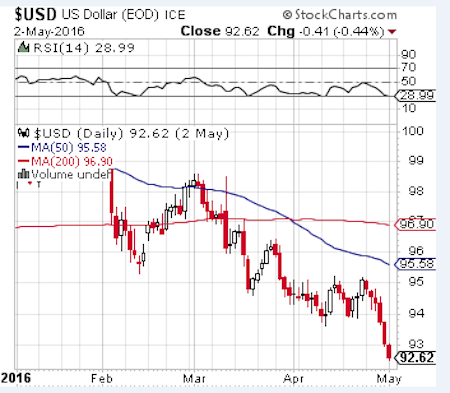

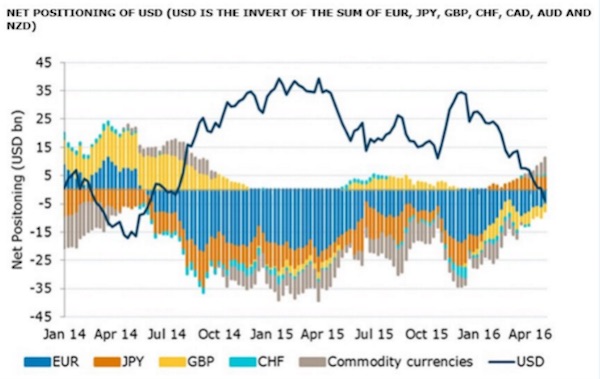

Where the smart money sits…

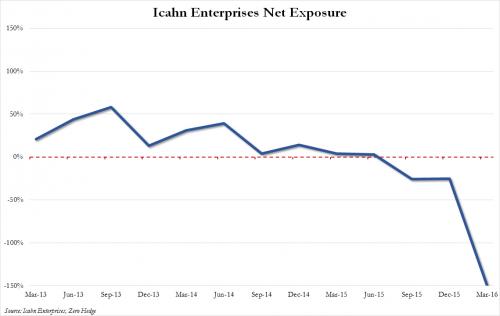

• In Historic -150% Net Short, Carl Icahn Bets on Imminent Market Collapse (ZH)

Over the past year, based on his increasingly more dour media appearances, billionaire Carl Icahn had been getting progressively more bearish. At first, he was mostly pessimistic about junk bonds, saying last May that “what’s even more dangerous than the actual stock market is the high yield market.” As the year progressed his pessimism become more acute and in December he said that the “meltdown in high yield is just beginning.” It culminated in February when he said on CNBC that a “day of reckoning is coming.” Some skeptics thought that Icahn was simply trying to scare investors into selling so he could load up on risk assets at cheaper prices, however that line of thought was quickly squashed two weeks ago when Icahn announced to the shock of ever Apple fanboy that several years after his “no brainer” investment in AAPL, Icahn had officially liquidated his entire stake.

As it turns out, Icahn’s AAPL liquidation was just the appetizer of how truly bearish the legendary investor has become. [..] In the just disclosed 10-Q of Icahn’s investment vehicle, Icahn Enterprises LP in which the 80 year old holds a 90% stake, we find that as of March 31, Carl Icahn – who subsequently divested his entire long AAPL exposure – has been truly putting money, on the short side, where his mouth was in the past quarter. So much so that what on December 31, 2015 was a modest 25% net short, has since exploded into a gargantuan, and unprecedented for Icahn, 149% net short position.

[..] starting in Q3 and Q4, Icahn proceeded to wage into net short territory, with roughly -25% exposure, a number that has increased a record six-fold in just the last quarter! What is just as notable is the dramatic leverage involved on both sides of the flatline, but nothing compares to the near 3x equity leverage on the short side (this is not CDS). As a reminder, Icahn Enterprises used to be run as a hedge fund with outside investors, but Icahn returned outside money in 2011, leaving IEP and Icahn as the two dominant investors. According to Barron’s, the entire fund appears to be about $5.8 billion, with $4 billion coming from Icahn personally. Which means that this is a very substantial bet in dollar terms.

There’s no bigger pleasure -and confirmation- than have Krugman criticize you.

• Trump Says US Will Never Default Because It Prints the Money (WSJ)

Donald Trump fired back at critics Monday over what he claimed was a misrepresentation of his comments on debt of the U.S. government, saying he never advocated the U.S. default on its debt. “First of all, you never have to default because you print the money,” Mr. Trump said in a telephone interview with CNN that was reported on by Politico. In an interview with Fox Business’s Maria Bartiromo, Mr. Trump said that he had proposed that the U.S. government could buy back its own debt at a discount if interest rates rise. The price of earlier issued bonds often fall when interest rates rise. “Certainly I’m not talking about renegotiating with creditors,” Mr. Trump said. Mr. Trump was responding to a New York Times article that ran on Friday that examined a CNBC interview on the prior day.

The article stated that Mr. Trump said he “might reduce the national debt by persuading creditors to accept something less than full payment.” “I would borrow, knowing that if the economy crashed, you could make a deal,” Mr. Trump said in the CNBC interview. “And if the economy was good, it was good. So therefore, you can’t lose.” This provoked alarm from commentators who interpreted it as Mr. Trump saying he would attempt to force Treasury holders to accept less than payment in full. “The reaction from everyone who knows anything about finance or economics was a mix of amazed horror and horrified amazement,” New York Times columnist Paul Krugman wrote.

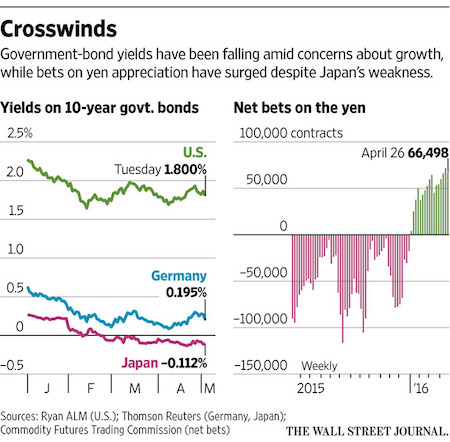

The market in U.S. Treasuries, which are considered to be among the safest assets in the world, appeared to brush off the report of Mr. Trump’s remarks. Yields on 10-year Treasuries were slightly lower Monday than they were a week earlier. “All I said was that if interest rates goes up, we’ll have a chance to buy back bonds, which is standard,” Mr. Trump said. Mr. Trump’s remarks Monday echo a point made by former Federal Reserve chairman Alan Greenspan a few years ago. “The United States can pay any debt it has because we can always print money to do that. So there is zero probability of default,” Mr. Greenspan said.

Anything Steve is a must.

• Zombies-To-Be and the Walking Dead of Debt (Steve Keen)

Using the dynamics of credit –which most other economists ignore– I explain why Japan, the USA and UK are among the “Walking Dead of Debt” and why China, Canada, Australia and South Korea are on their way to joining the Debt Zombies. This presentation is based on work I’m doing for a new 25000 word book for Polity Press entitled “Can we avoid another financial crisis?”, which should be published later this year.

What official numbers seek to hide away. But we all know anyway.

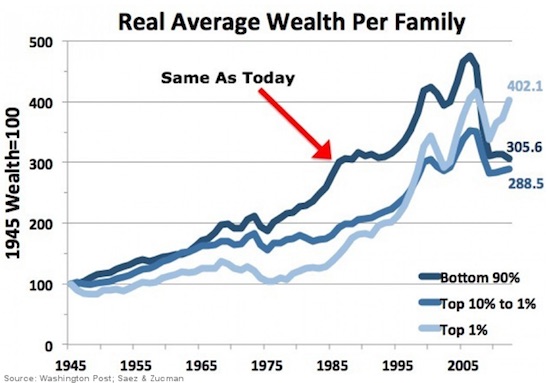

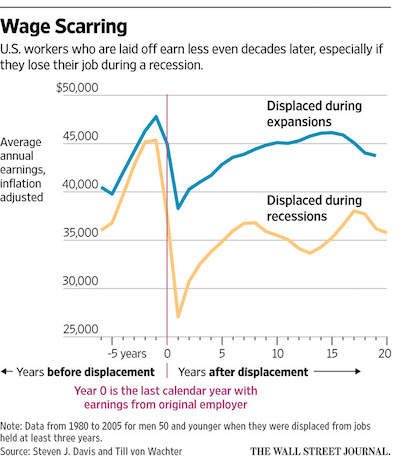

• The Recession’s Economic Trauma Has Left Enduring Scars (WSJ)

About one in six U.S. workers became unemployed during the recession years of 2007, 2008 and 2009. Today, nearly 14 million people are still searching for a job or stuck in part-time jobs because they can’t find full-time work. Even for the millions of Americans back at work, the effects of losing a job will linger, the research suggests. They will earn less for years to come. They will be less likely to own a home. Many will struggle with psychological problems. Their children will perform worse in school and may earn less in their own jobs. “The average effects are severe and very long lasting,” said Jennie Brand, a sociologist at University of California, Los Angeles. “There’s no quick recovery.”

U.S. economic output remains stubbornly below its potential level, as estimated by the Congressional Budget Office. And many people probably won’t be back on their feet by the time the next recession arrives. J.P. Morgan Chase & Co. economists recently predicted a new recession was more likely than not within three years. Anger about stagnant wages, among other things, has helped fuel the presidential runs of Donald Trump and Bernie Sanders. When the John J. Heldrich Center for Workforce Development at Rutgers University surveyed Americans after the recession about the causes of high unemployment, their top responses were cheap foreign labor, illegal immigrants and Wall Street bankers.

Labor Department data show 40 million layoffs and other involuntary discharges during the recession that began in December 2007 and ended in June 2009. The official unemployment rate peaked at 10%. Princeton University economist Henry Farber calculated that the rate of job loss from 2007 through 2009 was 16%. As in previous recessions, millions of Americans faced a phenomenon economists sometimes call wage scarring. People who lose a job, even during economic expansions, usually earn less money when they re-enter the workplace. They are out of work for a time and often take a pay cut as the price of returning to work at a new employer or even in a new career.

This time, the damage was exacerbated by the job market’s painfully slow recovery. Extended or repeated spells of unemployment mean more severe earnings losses, and recent years have seen an unusually large number of job seekers out of work for more than six months or stuck in part-time positions. “They had a much harder time finding a job, and in particular a full-time job, which immediately turns into an earnings decline,” Mr. Farber said.

Better at making things up than the government.

• Japan Will Leave Banks to Carry Out Their Own Stress Tests (BBG)

Japan’s financial regulator is stepping up oversight of its biggest banks while stopping well short of imposing the type of intrusive stress tests that have been adopted in the U.S. and Europe. Unlike the Federal Reserve and the Bank of England, which conduct annual examinations of the large banks they supervise, Japan’s Financial Services Agency has no plans to impose its own stress tests on the country’s lenders. Instead, it is looking for ways to verify the banks’ own reviews. “We’re considering if we can come up with a stress test-like setup,” Toshihide Endo, the director-general of the FSA’s supervisory bureau, said in an interview last month. “We don’t plan to impose external tests.”

Japan’s regulator has already signaled a different approach than overseas peers in the way it oversees the country’s banks, with FSA Commissioner Nobuchika Mori condemning a supervisory approach to bankers where the “sentiment of trust seems to have become a thing of the past.” Mitsubishi UFJ Financial Group Inc.’s President Nobuyuki Hirano cautioned global regulators against restricting the use of banks’ own methods for gauging operational risk, questioning the need for authorities to impose a standardized regime when they’re able to review internal models. Japanese taxpayers didn’t have to bail out lenders during the global financial crisis as the nation’s banks escaped the scale of losses incurred by overseas financial institutions.

The regulator may analyze big banks with international operations to see if they’re adequately reflecting risks such as oil price movements and the economic performance of emerging nations in their own stress tests, according to Endo. The FSA may start scrutinizing the stress tests of banks from as early as the second half of this year, he said. MUFG, Japan’s largest lender by market value, runs a number of stress tests on its balance sheet using different scenarios that include measures of interest and exchange rates, stock-market movements and economic growth, according to an e-mailed reply from spokesman Kazunobu Takahara. The impact from the different tests on the bank’s assets and profitability are then estimated, he said.

Where does the economy meet politics? Does anybody know?

For years, it was easy to see the political storm clouds gather over Europe with its fractious coalitions and its ancient babble of conflicts. Marine Le Pen’s Daddy, severe old Jean-Marie, was on the scene in France decades before Donald Trump ascended to glory on the noxious clouds of America’s crapified culture, attended by heavenly hosts of Kardashian angels and the cherub Honey BooBoo. For all the strains in recent American life, the two-party system had seemed as solid as the granite towers of the Brooklyn Bridge. Not even the estimable Teddy Roosevelt could blow up the system when he tried in 1912 — though his Progressive (“Bull Moose”) Party carried California, Pennsylvania, and Minnesota, and he far out-polled the incumbent Republican President Taft, who garnered a measly 8 electoral votes (Democrat Woodrow Wilson won).

Ross Perot made an impact in 1992 — he certainly had a good point about NAFTA and “the giant sucking sound” of jobs draining out of the USA. But his popinjay manner didn’t go over so well, and at the critical moment in the general election he lost his nerve and withdrew, only to foolishly re-enter weeks later. Then there was the Ralph Nader in 2000, whose egoistic crusade arguably put George W. Bush in the White House. Since then, the country see-sawed between the long tenures of two Deep State errand boys from each major party, putting both parties in such a bad odor that Trump now rises on their mephitic fumes. Which raises the question, of course: what exactly is this Deep State? Answer: A leviathan of symbiotic rackets producing maximum incompetence affecting adversely the majority of citizens.

It’s a blood-sucking beast of a hundred-thousand heads draining the USA of its dwindling vitality, lying about its intentions while it advertises the pietistic certainties of the Left and superstitious shibboleths of the Right, leaving a smoking hole in the middle where the practical problems of everyday life used to be worked out by practical means. The Deep State is also the sum of unintended consequences and diminishing returns of a late-stage, bureaucratic, techno-industrial economy cannibalizing itself to stay alive. One obvious conclusion is that this economy has got to change before there is nothing left to eat, and no political figure on the scene, including Trump and Bernie Sanders, has a plausible vision of where this takes us.

Both really just assume that the engine keeps chugging down the track of ever more material wealth that can be distributed differently. The truth is, there will be a lot less material wealth of the kind we’re used to, and a lot less capital representation in the things we call “money.” In fact, the scene at hand today is just a spectacle of the shrewdest and biggest rodents scarfing up the table-scraps of a 200-year-long banquet.

“..a twist that would stretch the credibility of a House of Cards plot..”

• Rousseff Impeachment Vote Annulled, Throwing Brazil Legislature Into Chaos (G.)

Brazil’s new lower house speaker has annulled last month’s impeachment vote against Dilma Rousseff in a twist that would stretch the credibility of a House of Cards plot. The surprise move, which comes just days before the upper house was due to consider the motion, throws the legislature into chaos and could provide a lifeline to the embattled president. Waldir Maranhao, who took over as acting speaker last week, said a new congressional vote would be needed as a result of procedural flaws in the previous session. Maranhao is no friend of the government, prompting speculation that he may be acting on behalf of his predecessor, Eduardo Cunha, who was removed from his post by the supreme court on the grounds that he was interfering in a corruption investigation into his alleged kickbacks from the state-run oil company, Petrobras.

For the moment, however, uncertainty reigns. After last month’s lower house vote, the impeachment process was passed to the senate, where a committee recommended on Friday that the leftist president be put on trial by the full chamber for breaking budget laws. In a news release, Maranhao said the impeachment process should be returned by the senate so that the lower house can vote again. It remained unclear whether his decision could be overruled by the supreme court, the senate or a majority in the house. Brazilian markets fell sharply after the surprising decision was announced. Rousseff, who denies wrongdoing, has been fighting for her political survival for several months as opposition congressmen have pushed aggressively for her ouster.

The full senate had been expected to vote to put Rousseff on trial Wednesday, which would immediately suspend her for the duration of a trial that could last six months. During that period the vice-president, Michel Temer, would replace her as acting president. With appeals and counter-appeals still possible, Rousseff gave a cautious response to the news. “It’s not official. I don’t know the consequences. We should be cautious,” she said, but repeated her determination to keep fighting.

Had the impression it was worse.

• 85% Of Fort McMurray Has Been Saved, Says Alberta Premier (G.)

Overwhelming and heart-breaking was how Rachel Notley, the Alberta premier, described the destruction left behind in the wake of a wildfire that continues to rage out of control in northern Alberta. “I was very much struck by the power of the devastation of the fire,” Notley said after touring the city of Fort McMurray on Monday. “It was really quite overwhelming in some spots.” Last week more than 88,000 residents frantically evacuated the oilsands city after shifting winds brought a nearby forest fire to the city’s doorstep. The fire swept through the city in a seemingly random path, leaving behind piles of rubble and twisted metal, burned-out pick-up trucks and charred swing sets in some neighbourhoods. In others, homes sat untouched, their green lawns sharply contrasting with the grey of the city’s worst-hit areas.

Some 2,400 homes and buildings were destroyed or damaged by the fire, said Notley. For the tens of thousands of residents now scattered across the province, many of them wondering whether they have a home to return to, Notley had good news. Some 85% of the city – around 25,000 structures – had been saved. “The city was surrounded by an ocean of fire only a few days ago,” said Notley. “But Fort McMurray and the surrounding community have been saved and it will be rebuilt.” But she cautioned: “That of course doesn’t mean that there aren’t going to be some really heartbreaking images for some people to see when they come back.” The fire has not completely released its grip on the city, said Notley. “There are smouldering hotspots everywhere. Active fire suppression is continuing.”

The wildfire continues to grow in the region, albeit at a much slower pace. By Monday it had swelled to 204,000 hectares – an area more than 22 times the size of Manhattan – but winds were pushing it east, away from communities. It now sits some 25km from the neighbouring province of Saskatchewan. Cooler weather helped crews continue to keep the fire at bay, away from Fort McMurray, Anzac and the Suncor Energy oilsands facility. Currently more than 700 firefighters are battling against the blaze, with another 300 expected to arrive in the area shortly. “This fire is burning out of control out there, it still is, but we are holding the line where we need to, at least for today,” said Notley.

People like this are so utterly clueless it’s frightening.

• Growth Crisis Threatens European Social Fabric, Warns ECB VP (Tel.)

The fragile global recovery could be derailed unless governments step up efforts to support growth and strengthen the European banking system, two central bankers have warned. Vítor Constâncio, vice president of the ECB, said policy inaction combined with declining productivity and weak demographics could lead to a dangerous spiral of lower growth, higher debt and reduced job prospects. This could create unrest in countries already blighted by sky-high unemployment, he warned. The world also faced the prospect of permanently lower growth, Mr Constâncio told an audience at a City Week conference in London. If this materialised, this could result in weaker spending by households and businesses. “There would also very likely be societal implications, as lower economic growth would not be able to create enough jobs for citizens and may exacerbate income inequality,” he said.

Mr Constâncio described the eurozone recovery as “continued” and “moderate”, but said it remained “subject to fragilities”. “While I expect the recovery in the global economy to gather momentum as the headwinds eventually dissipate, there are many factors which could potentially derail it,” he said. Mr Constâncio stressed that the ECB’s massive stimulus package was working, adding that policymakers would “allow some time for the package of measures adopted in March” – including interest rate cuts and an increase in its monthly asset purchases to €80bn, from €60bn – to take effect. But the central banker said government fiscal stimulus and action to boost productivity and “complete Europe’s banking and markets union” would also be needed to boost growth.

All good and well, but there are strong forces in Brussels and beyond that deliberately seek to create a failed state. And they’re at least half way there.

• The Choice For Europe: Rescue Greece Or Create A Failed State (Paul Mason)

Between now and mid-June the European political elite must give its answer to an existential question. Will it honour the deal it made to rescue Greece last July; or will it push the radical left government into default – effectively creating a failed state in Europe? That this is primarily Europe’s dilemma, not Greece’s or the IMF’s, is clear after Monday’s Eurogroup. The IMF boss, Christine Lagarde, warned the Europeans that the fund will not participate in further bailouts without a substantial debt write-off. In turn, the Greek prime minister, Alexis Tsipras, forced through the last of the main austerity measures demanded by creditors: reforms to the pension system that will leave worse off everyone who is receiving more than €1,000 a month, and demand much higher contributions from workers in future.

However, by delaying their approval until now, the lenders have managed, once again, to push Greece towards bankruptcy. Although growth is better than predicted, tax receipts are still dire and bailout disbursements suspended. Worse, and more insidious, the months of callous inaction have pushed the mood in Greek society into a dangerous place. A population that, two years ago, started demanding and giving printed receipts as an act of collective moral renewal, has given up on them once again. The most popular graffiti tag has become “all this political shit”. The only thing that can end the crisis is debt restructuring. One way or another, Europe’s creditors – the taxpayers of Germany, France, the Netherlands etc – have to lose money.

It may be dressed up by extending repayment dates; or it may take the form of the “haircut”, whereby the treasuries of northern Europe – and the ECB – write down the value of the €350bn they have lent Greece. But it has to happen. And that means Germany’s politicians must change their minds. The old problem in Europe was a transnational freemarket economy with no democratic government; a central bank obliged by treaty to impose deflation; and a Germany willing to take the upside of the project – 4% unemployment versus 25% in Greece – but never to lead it. The new problem is different: when the EU overturned the will of the Greek people last year July, it became, effectively, a political entity based on force, not law.

Those applying the force were the German elite and a collection of east European countries who have in common weak democratic traditions, mafia-infested economies and rightwing electorates still traumatised by the Soviet era. Then, in a second act of force, by overturning the Dublin Treaty and letting nearly a million refugees come to Germany, Angela Merkel destroyed the coalition that had imposed the defeat on Greece. Eastern Europe has defied Merkel’s call for refugee quotas and answered her appeal for humanitarianism by putting razor wire at every border choke-point. So, now it’s no longer about austerity: there is a three-way battle for the soul of Europe; between a beleaguered centre that’s seeing its consent to govern drain away; a resurgent nationalist and racist right; and a modernised radical left. The Greek request for debt relief poses to the European centre the question: which side are you on?

No, it’s true. A team of highly overly paid EU economists has issued a report that ‘analyzes’ (note the first 4 letters) among other things what Greek debt could be 44 years from now. Your challenge: to name something even more useless than that. Hint: paint does dry at some point….

• Official Analysis Suggests Tough Talks Over Greek Debt Relief (WSJ)

Greece’s debt may rise to as much as 258.3% of GDP by 2060 or fall to as low as 62.6% of GDP, according to an official analysis of the country’s debt trajectory that heralds tough talks ahead on potential measures to ease Athens’ payment burden. The so-called debt sustainability analysis, or DSA, was drawn up by Greece’s European creditors and has been seen by The Wall Street Journal. The wide divergences in the debt predictions are due to different forecasts on how much Greece’s economy will grow in the coming decades and how much money it can put aside to pay down debt. Under all but the most optimistic scenarios, the document points to serious concerns over Greece’s ability to repay its debt, which stood at 176.9% of GDP at the end of last year.

The results of “this analysis point to serious concerns regarding the sustainability of Greece’s public debt in the long term,” the document says. The document was distributed to officials from eurozone finance ministries Monday morning and will form the basis for a first discussion on possible debt relief among the bloc’s finance ministers Monday afternoon. To reach a deal, the ministers will also have to bring on board the IMF, one of Greece’s biggest creditors. The IMF has consistently had more pessimistic forecasts for Greece’s debt ratio and demanded far-reaching measures to cut the country’s payment burden. Here it has clashed with Germany, which has opposed further debt relief.

“Today we will only have a first discussion on what, when, if and how the debt sustainability or debt relief measures could take place,” said Jeroen Dijsselbloem, the Dutch finance minister who presides over the group of ministers, on his way into Monday’s meeting. The debt sustainability analysis looks at four different scenarios for Greece’s economy and assesses how the country’s debt-to-GDP ratio will fare in each case for the decades up to 2060. The analysis shows that Greece’s debt could fall to as low 62.6% of GDP—almost in line with the currency union’s budget rules—in the most favorable scenario. But under the most pessimistic scenario, debt could rise to 258.3% of GDP by the end of 2060. Under the baseline scenario, which assumes that Greece will fully implement the terms of its bailout program, its debt will peak at 182.9% of GDP in 2016 and fall to 104.9% of GDP by 2060.

Curiously blind how NGOs blame Greece for conditions, while it’s being squeezed dry by the Troika. As if when you work for Amnesty -and get paid for it-, you can’t figure out that Greece can’t even take care of Greeks.

• Refugees Freed From Detention Centers, Trapped In Limbo On Greek Islands (R.)

Migrants and refugees are being freed from detention centres in Greece but remain trapped on its islands until their asylum requests are processed, exposing them to dire living conditions and even the risk of people smugglers, human rights groups say. At least 1,100 people have been released from centres on three islands and more will follow as their 25-day detention limit expires, police officials said. They are forbidden from travelling to the mainland, where most state-run shelters are. Some 8,000 people, many escaping the Syrian war, have arrived on boats from Turkey since March and are held under a European Union deal with Ankara designed to seal off the main route into Europe for over a million people since 2015.

Under the deal, those who do not seek asylum in Greece – and those who are rejected – will be sent back to Turkey. Asylum applications are piling up and rulings can take weeks. The United Nations refugee agency UNHCR said it was supporting government efforts to create new spaces. “All parties are working very hard to meet the needs of the human beings present on Greek islands,” said Chris Boian, a spokesman in Greece. Asked if those stranded on the islands were vulnerable to human traffickers offering to take them to the mainland, Boian said: “The risk does exist and that is the one reason UNHCR advocates full access to asylum and expansion of the asylum service and alternative legal entry channels (to Europe).”

Human rights groups said the government was not doing enough to provide asylum seekers with shelter and medical care while they wait. On Lesbos, many head to an open, municipality-run site. Those who can afford it check into hotels. Others sleep in the open. “Every country that asks people to wait in a certain place has to provide them with basic facilities. That’s not done by Greece,” said Amnesty International’s deputy Europe director, Gauri van Gulik. “It’s either – you’re in prison, or you can sleep rough on an island..”. A government spokesman, Giorgos Kyritis, said the government was doing its best to support refugees and migrants in Greece at the open reception centres, nearly all of which are on the mainland. “The government cannot afford to support these people financially on an individual basis. It’s doing whatever it can to support them in the context of its limited capabilities,” he said.