Vincent van Gogh Landscape with snow 1888

They won’t be able to keep doing this without facing pitchforks.

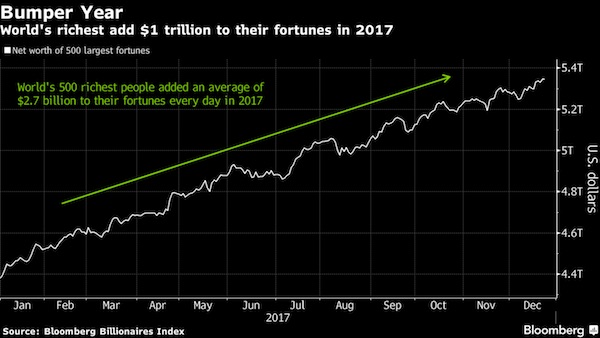

• World’s Wealthiest Became $1 Trillion Richer in 2017 (BBG)

The richest people on earth became $1 trillion richer in 2017, more than four times last year’s gain, as stock markets shrugged off economic, social and political divisions to reach record highs. The 23% increase on the Bloomberg Billionaires Index, a daily ranking of the world’s 500 richest people, compares with an almost 20% increase for both the MSCI World Index and Standard & Poor’s 500 Index. Amazon.com founder Jeff Bezos added the most in 2017, a $34,2 billion gain that knocked Microsoft co-founder Bill Gates out of his spot as the world’s richest person in October. Gates, 62, had held the spot since May 2013, and has been donating much of his fortune to charity, including a $4.6 billion pledge he made to the Bill & Melinda Gates Foundation in August.

Bezos, whose net worth topped $100 billion at the end of November, currently has a net worth of $99.6 billion compared with $91.3 billion for Gates. George Soros also gave away a substantial part of his fortune, revealing in October that his family office had given $18 billion to his Open Society Foundations over the past several years, dropping the billionaire investor to No. 195 on the Bloomberg ranking, with a net worth of $8 billion. By the end of trading Tuesday, Dec. 26, the 500 billionaires controlled $5.3 trillion, up from $4.4 trillion on Dec. 27, 2016. “It’s part of the second-most robust and second-longest bull market in history,” said Mike Ryan, chief investment officer for the Americas at UBS Wealth Management, on Dec. 18. “Of all the guidance we gave people over the course of this year, the most important advice was staying invested.”

It’s curious to see that so many people are so blind to the notion of economies and societies needing a minimum level of balance. When that balance is destroyed, a reaction must automatically and inevitably follow. The rich could have gone on enjoying their privileges for a long time, but greed got in the way.

• The Rich Are Getting So Much Richer So Fast Their Spending Can’t Keep Up (CNN)

It’s never a bad year to be rich, exactly. But 2017 turned out to be a particularly good one. Rich people are doing so well these days that their spending on luxury goods isn’t even keeping up. Luxury spending rose 5% globally in 2017, the management consulting firm Bain & Company found. But that is a fraction of the 40% rise in net worth that people in America’s top-tenth of income earners saw between 2013 and 2016, according to the Federal Reserve. “We used to see that the growth of luxury was closely correlated with the stock market,” said Milton Pedraza, chief executive officer of the Luxury Institute, a consulting firm for high-end brands. “The stock market and real estate have gone up so much that nobody wants to spend all that money. It’s impossible.”

The big increase in wealth has exacerbated a long-evolving financial split between those at the very top and those at the bottom, even as the robust economy has lifted many working people with jobs and higher wages. Here are some examples. The S&P 500 Index has risen 20% since the beginning of the year and the Dow Jones Industrial Average is up 25%, fattening portfolios and boosting dividends. To a certain extent, the benefits are shared through ownership of 401(k) accounts. But only about half of Americans participate in an employer-sponsored retirement fund, according to the Pew Research Center, and a much smaller 18.7% of Americans own stock directly. In both cases, market participation is skewed toward those with higher incomes, which means that the wealthy disproportionately benefit from Wall Street’s boom.

Home prices reached all-time highs, according to the Case-Shiller home price index. That’s especially the case in hot markets like Seattle and San Francisco, where many working people are already unable to afford ownership. Although homeownership is a source of middle class wealth, homeowners generally tend to be higher-income. According to the Census Bureau, 78.4% of families making more than the median income own homes, compared to 49.5% of those making less.

Just another chapter in the ‘Rich Getting Richer’ files. This too will evoke a response.

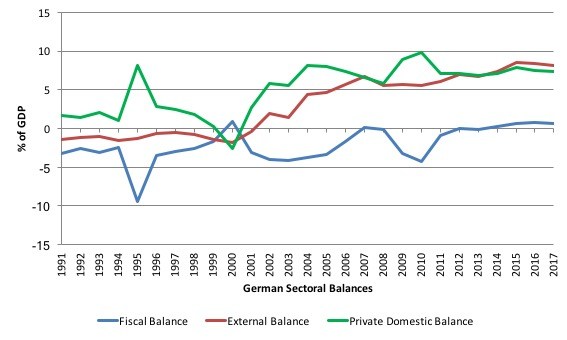

• Germany – A Most Dangerous And Ridiculous Nation (Bilbo)

Germany’s domination of the EMU is clear both in political and economic terms. The current political impasse within Germany will not change that. Once resolved the on-going government will continue in the same vein – running excessive fiscal surpluses and huge external surpluses. It can sustain those positions because it dominates European policy and can force the adjustment to these overall ‘unsustainable’ positions onto both its own citizens (lowering their material living standards), and, more obviously, onto citizens of other EMU nations, most noticeably Spain and Greece. If it couldn’t bully nations like Greece, Italy, Spain and even France, Germany’s dangerous domestic strategy would be less effective. If all EMU nations followed Germany’s lead – then there would be mass Depression throughout Europe. This dangerous and ridiculous nation is a blight.

Only by exiting the Eurozone and floating their currencies against the currency that Germany uses can these beleaguered EMU nations gain some respite. When the Europhile Left come to terms with that obvious conclusion things might change within Europe. The following graph (using IMF WEO data) shows the sectoral balances for Germany from 1991 to 2017 (the last year is estimated). It is an extraordinary graph really in the context of Germany’s integral role in the Economic and Monetary Union (EMU). Germany is part of a currency union and its outcomes are much more closely tied to the fortunes of its EMU partners than say a nation, such as Australia, which has its own currency and floats it on international markets. What you see are two distinct EMU periods, when Germany was in gross violation in one way or another of the Treaty rules (laws).

It is not overstating the case to say that the increased poverty and hardship for citizens within Europe is directly related to the German government’s obsession with fiscal and external surpluses and its intransigence when confronted about this. Germany has become a dangerous yet ridiculous nation. While the Financial Times article (Dec 22, 2017) – The fiscal surplus that Germany should spend – referred to “Germany’s fiscal surplus” as an: ..a chronic embarrassment of riches.. I would prefer to refer to it as an embarrassing example of policy vandalism and an illegal assault on the rules that Germany has signed up to follow. Why illegal? Because it is directly related to Germany’s violation of the Macroeconomic Imbalance Procedure, which specifies under its so-called Scoreboard Indicators that the “major source of macroeconomic imblances” includes a: “3-year backward moving average of the current account balance as% of GDP, with thresholds of +6% and -4%”.. So the upper warning threshold (for an external surplus) is 6% of GDP.

Nicely put: “January should be a time for looking ahead but up and down the country millions of Brits will be looking over their shoulder at the cost of their festive spending..”

• Britons Borrow An Average £452 Each On Credit Cards At Christmas (G.)

The Christmas spending hangover means that Britons who splurged on plastic will start 2018 owing an average of more than £450 on their credit cards – with many fearful the debt will still be haunting them by next Christmas. Nearly £8.5bn has been loaded on to cards to cover the cost of gifts and entertaining, according to research by the price comparison service uSwitch, which found nearly a fifth of consumers had exceeded their Christmas budget as they grappled with rising living costs. “January should be a time for looking ahead but up and down the country millions of Brits will be looking over their shoulder at the cost of their festive spending,” said Tashema Jackson, money expert at uSwitch.com which polled 4,000 consumers.

The survey found Britons had borrowed an average of £452 to cover the cost of the festivities. One annual survey found that the UK’s cheapest supermarket Christmas dinner cost 18% more than last year, as the impact of inflation and Brexit-related commodity costs made its way to the festive family table. Half of the respondents told uSwitch they were worried they would still be trying to clear the debt in December 2018. Nearly one in 10 were still paying off debts dating back to last Christmas.

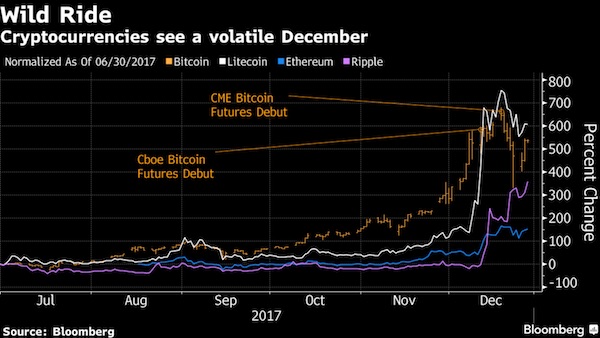

If you bought at $19,000 and used leverage, does this still feel like a pause?

• Bitcoin’s Rally Has Taken A Pause (BBG)

Bitcoin’s rally took a pause Wednesday, suggesting it isn’t about to make another run at its record reached last week. The fervor that propelled the digital currency past $19,000, prompted in part by regulated U.S. derivatives exchanges starting to trade contracts based on the unit this month, has yet to return. Bitcoin traded around $15,947 as of 10:31 a.m. Tokyo time Wednesday, according to composite prices on Bloomberg, up 0.1% from late Tuesday though below that day’s high. “Nobody knows the ultimate value of this underlying asset,” Edward Stringham, president of the American Institute for Economic Research, said on Bloomberg Television. “We cannot predict whether it’s going to be zero or one million dollars or anything in between.”

For skeptics doubting whether individuals and businesses will truly start using bitcoin as a medium of exchange – as opposed to some officially backed digital currency – the short-lived rebound from the past week’s selloff portends further declines. “It’s much more likely once you’ve made a big downward movement like the one we made last week that you have a bigger and more complex correction,” Ric Spooner, a Sydney-based analyst at CMC Markets, told Bloomberg Television. “Once a market like this one locks into those patterns it becomes pretty good” to follow via chart-based analysis, he said. Spooner said it’s possible bitcoin could drop to $5,700 or $8,700 in coming months.

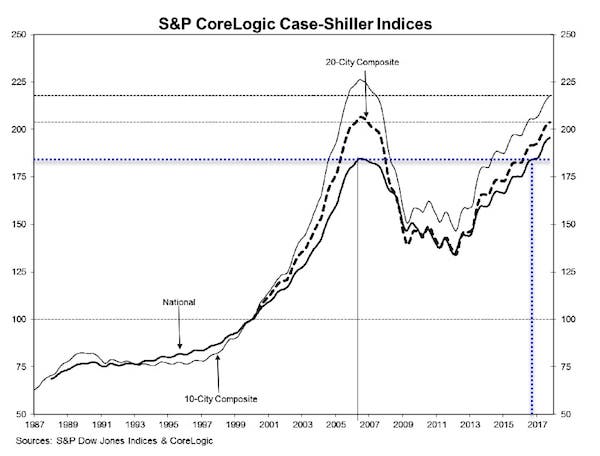

“Congratulations. The Fed re-blew the housing bubble. In the misguided way in which the Fed calculates inflation, none of this is considered inflationary. Few new buyers can afford to buy.”

• Case-Shiller 20-Home Price Index Just Shy Of 2006 Bubble Peak (Mish)

The Case-Shiller national home price index surged past the pre-recession high last year. The city composites lag. Steady gains continue in the Case-Shiller Home Price Indexes.

Case-Shiller Year-Over-Year Summary

• The National Home Price NSA Index reported a 6.2% annual gain in October, up from 6.1% in the previous month.

• The 10-City Composite annual increase came in at 6.0%, up from 5.7% the previous month.

• The 20-City Composite posted a 6.4% year-over-year gain, up from 6.2% the previous month.

• Seattle, Las Vegas, and San Diego reported the highest year-over-year gains among the 20 cities. In October, Seattle led the way with a 12.7% year-over-year price increase, followed by Las Vegas with a 10.2% increase, and San Diego with an 8.1% increase.

Nine cities reported greater price increases in the year ending October 2017 versus the year ending September 2017.

Case-Shiller Month-Over-Month Summary

• Before seasonal adjustment, the National Index, 10-City and 20-City Composites all posted a month-over-month gain of 0.2% in October.

• After seasonal adjustment, the National Index, 10-City and 20-City Composites all recorded a 0.7% month-over-month increase in October.

• Eleven of 20 cities reported increases in October before seasonal adjustment, while all 20 cities reported increases after seasonal adjustment.

Xi cannot afford to even allow teh suggestion that he loses control; at the same time he needs to generate growth. He may well find the two contradict each other.

• China Bets on More State Control for 2018 (Balding)

First, watch the data, not the New Year’s resolutions. While China touts deleveraging efforts, the data is mixed. The debt-to-GDP ratio in China is only up slightly from 2016 to 260%, though it is expected to top out at 327% in 2022. The moderation was due not to slowing debt growth, but a jump in commodity prices that pushed up nominal GDP. Watch debt growth in 2018: Prices are expected to fall again, raising debt-to-GDP. China still has not given up its debt habit. Second, the Federal Reserve rate hikes last year were likely to play a big role in Chinese policy. In retrospect, they did and did not. Interest rates in China are up sharply, with even interbank rates over one month up 1.5% since January 2017. Money market rates are up to 6.39% for 14-day repurchases.

Rate increases are putting pressure on Chinese corporate bonds given the overwhelmingly short-term nature of borrowing, which constantly resets rates. Oddly, even as U.S. interest rates increased, the dollar fell, with indexes down 9%. Though it is unclear why the dollar fell, if the Fed hikes four times as predicted by Goldman Sachs, this could cause the currency to reverse course. A strong dollar and rising U.S. rates will pressure China. Third, heading into the National Congress, I said watch out for Chinese politics. Though Premier Li Keqiang remains in office, Beijing clearly swept away any vestiges of market adherence. The installation of Party committees over the board of directors in foreign firms and major state-owned enterprises laid bare Beijing’s ambition. Communist Party strength would take priority over everything.

As we look into 2018, some of these themes carry forward, but with a twist. Beijing is solidifying its control over all aspects of the economy. The Party released new rules on overseas investments by firms and has enforced rules mandating that banks balance their foreign exchange transactions. After the Fed recently raised rates by 0.25%, the People’s Bank of China followed with a hike of only 0.05%, confident it can tame any potential outflows. If the Fed hikes another three times and the dollar does not drop another 10%, this would push interest rates in China for debt over six months close to an intolerable 8% and reduce foreign exchange reserves beneath the $3 trillion level.

What a curious mistake.

• Eight Lawsuits Over Apple Defrauding iPhone Users By Slowing Devices (R.)

Apple defrauded iPhone users by slowing devices without warning to compensate for poor battery performance, according to eight lawsuits filed in various federal courts in the week since the company opened up about the year-old software change. The tweak may have led iPhone owners to misguided attempts to resolve issues over the last year, the lawsuits contend. All the lawsuits – filed in U.S. District Courts in California, New York and Illinois – seek class-action to represent potentially millions of iPhone owners nationwide. A similar case was lodged in an Israeli court on Monday, the newspaper Haaretz reported. The company acknowledged last week for the first time in detail that operating system updates released since “last year” for the iPhone 6, iPhone 6s, iPhone SE and iPhone 7 included a feature “to smooth out” power supply from batteries that are cold, old or low on charge.

Phones without the adjustment would shut down abruptly because of a precaution designed to prevent components from getting fried, Apple said. The disclosure followed a Dec. 18 analysis by Primate Labs, which develops an iPhone performance measuring app, that identified blips in processing speed and concluded that a software change had to be behind them. One of the lawsuits, filed Thursday in San Francisco, said that “the batteries’ inability to handle the demand created by processor speeds” without the software patch was a defect. “Rather than curing the battery defect by providing a free battery replacement for all affected iPhones, Apple sought to mask the battery defect,” according to the complaint.

[..] The problem now seen is that users over the last year could have blamed an aging computer processor for app crashes and sluggish performance – and chose to buy a new phone – when the true cause may have been a weak battery that could have been replaced for a fraction of the cost, some of the lawsuits state.

“Bezos and Omidyar obviously helped the NSA to keep more than 95% of the Snowden archive away from the public…”

• From Snowden To Russia-gate – The CIA And The Media (Moon of A.)

The promotion of the alleged Russian election hacking in certain media may have grown from the successful attempts of U.S. intelligence services to limit the publication of the NSA files obtained by Edward Snowden. In May 2013 Edward Snowden fled to Hongkong and handed internal documents from the National Security Agency (NSA) to four journalists, Glenn Greenwald, Laura Poitras, and Ewen MacAskill of the Guardian and separately to Barton Gellman who worked for the Washington Post. Some of those documents were published by Glenn Greenwald in the Guardian, others by Barton Gellman in the Washington Post. Several other international news site published additional material though the mass of NSA papers that Snowden allegedly acquired never saw public daylight.

In July 2013 the Guardian was forced by the British government to destroy its copy of the Snowden archive. In August 2013 Jeff Bezos bought the Washington Post for some $250 million. In 2012 Bezos, the founder, largest share holder and CEO of Amazon, had already a cooperation with the CIA. Together they invested in a Canadian quantum computing company. In March 2013 Amazon signed a $600 million deal to provide computing services for the CIA. In October 2013 Pierre Omidyar, the owner of Ebay, founded First Look Media and hired Glenn Greenwald and Laura Poitras. The total planned investment was said to be $250 million. It took up to February 2014 until the new organization launched its first site, the Intercept. Only a few NSA stories appeared on it. The Intercept is a rather mediocre site.

Its management is said to be chaotic. It publishes few stories of interests and one might ask if it ever was meant to be a serious outlet. Omidyar has worked, together with the U.S. government, to force regime change onto Ukraine. He had strong ties with the Obama administration. Snowden had copies of some 20,000 to 58,000 NSA files. Only 1,182 have been published. Bezos and Omidyar obviously helped the NSA to keep more than 95% of the Snowden archive away from the public. The Snowden papers were practically privatized into trusted hands of Silicon Valley billionaires with ties to the various secret services and the Obama administration.

The EU is actively assisting Libya’s slave trade. That is quite something to close off the year with.

• Italy Rescues More Than 250 Migrants In Mediterranean (R.)

More than 250 migrants were rescued in the central Mediterranean during the night between Monday and Tuesday, Italy’s Coast Guard said. A statement said the migrants, in one large rubber dinghy and two small boats, were rescued in three missions by two ships, one from a non-governmental organization. Migrant arrivals to Italy have fallen by two-thirds year on year since July after officials working for the U.N.-backed government in Tripoli put pressure on people smugglers in the Libyan city of Sabratha to stop boats leaving. Italy is also bolstering the Libyan coast guard’s ability to turn back boats. Last week, the United Nations began bringing African refugees to Italy from Libya, evacuating them from detention centers whose conditions have been condemned by rights groups as inhumane.