René Magritte Golconda 1953

Tucker Carmela excellent

https://twitter.com/i/status/1837206654711980070

RFK sued Trump

https://twitter.com/i/status/1837304665748176966

https://twitter.com/i/status/1837241352553386231

Ireland

Today, Ireland woke up to the news that the government has dropped plans to implement hate speech laws.

This is the 2nd time we have defeated the bill in 5 years.

Thank you to Elon Musk, Michael Shellenberger, Tucker Carlson, JD Vance and everyone else for your help. pic.twitter.com/HwmyxsK8mC

— MichaeloKeeffe (@Mick_O_Keeffe) September 21, 2024

Thiel

In his interview with Joe Rogan, Peter Thiel discussed why nuclear power development has stagnated in the U.S. despite its potential. Thiel argued that the main reason for halting nuclear power development stems from political and regulatory barriers, rather than technical… pic.twitter.com/B02779i7qi

— Camus (@newstart_2024) September 21, 2024

Dimon

https://twitter.com/i/status/1837245042056105994

Mars

https://twitter.com/i/status/1837626546074325240

India

https://twitter.com/i/status/1837643524600148279

Maher

Things get a little uncomfortable when Bill Maher calls out Kamala Harris on never winning a primary, a delegate, or ever actually fixing the border.

Awkward applause follows. pic.twitter.com/m77q4gFW04

— Wesley Hunt (@WesleyHuntTX) September 21, 2024

Easily the prime article/video this weekend. Because it puts everything on its head.

Larry Wilkerson, former chief of staff to Secretary of State Colin Powell “and critic of America’s wars”, states that the Pentagon has taken over US foreign policy. And that is as stark as it sounds. Wilkerson says that Biden, Harris, Blinken and Jake Sullivan have all been sidelined because the Pentagon doesn’t want to go to war, not in Ukraine and not in Gaza. “No dice”. And they can’t do a thing without the Pentagon.

Judge Nap: “COL. Lawrence Wilkerson : Can Ukraine Make It to Nov 5th?”

We have some transcript below, but do watch the whole interview.

• An American Coup? (Neuburger)

In a 30-minute interview with Judge Napolitano on September 18, Col. Lawrence Wilkerson, former chief of staff to Secretary of State Colin Powell and critic of America’s wars, described a recent event in which Pentagon chief Gen. Lloyd Austin told President Biden that, in Wilkerson’s words, “the Pentagon has taken over, essentially, diplomacy as well as any action, militarily speaking, with regard to both theaters of war,” meaning Ukraine and Israel. Wilkerson added, “And so they’re now in charge.” Austin, according to this telling, listened “to the people in the bowels of the Pentagon who know the truth” and forced the President to back down. Biden was furious, we’re told, but “took that advice.” Except, as Wilkerson tells it, it wasn’t advice, but instruction. “No dice,” as Wilkerson characterized the message, sounds pretty final. This is good news and bad news. The good, U.S. policy is now: To Netanyahu, if you invade Lebanon or attack Iran, you’re on your own. To Zelenskyy, no to long range missiles reaching deep into Russia.

So we and the world are safer, at least for a while. The bad: Is this a coup? Has the military stood up to the President, forced him to change policy? If the answers are yes, we’re on our way once more to revising the Constitution-as-practiced. Both political parties have already confirmed that the Fourth Amendment can be ignored. That’s now the “new normal.” So what’s this encroachment of the Pentagon into foreign policy, if not another “new normal”? Has MacArthur finally won?

Whatever the truth, you won’t see this reported in what people call the “news,” but I doubt Wilkerson’s sources are wrong. At any rate, we’ll know soon enough by the way Zelenskyy and Netanyahu act. Welcome to the future of U.S. foreign policy.

Wilkerson: I think what we’re seeing here is another attempt, because a 100-plane strike didn’t do it, by Netanyahu to provoke Hezbollah to some sort of action that he can then declare is warlike to the extent that he can do what he wants to do with them — even though I’m told with great confidence in the sources that the latest two visits by the Central Command Unified Commander were to tell him [Netanyahu] that we would not be with him in the event of his going to war with Hezbollah that he provoked. Nor will we be with him going to war with Iran that he provoked. And we made it quite clear that we would know if he provoked it.

Napolitano: You’re speaking of General Kurilla [CENTCOM commander since April 2022].

Wilkerson: Yes. Yes.

Napolitano: So Scott Ritter agrees with you, Doug Macgregor says he can’t imagine Austin and Blinkin letting General Kuralla do that. It’s very very interesting. … Is this speculation on your part or is it based on sources?

Wilkerson: It’s based on some pretty reliable sources. And here’s the bigger picture and I hope the others told you this too. Biden’s fury — and you could see it — he was seething when he met with the British Prime Minister.

Napolitano: Yes, yes, we have that clip. He was out of control with anger.

Wilkerson: And what he [had] just been told, apparently, was by the Pentagon, “No dice, Mr President. No dice on Ukraine and no dice on Gaza. We’re in charge now.”

Napolitano: No dice. You’re talking about no dice on the long range missiles reaching deep into Russia, even though Tony Blinkin had intimated all week in Kyiv with his British counterpart that this was happening. And Sir Keir Stormer, the British Prime Minister, had every reason to believe as he’s flying across the Atlantic that Joe Biden’s answer would be yes.

Wilkerson: He was embarrassed. He was embarrassed by the fact — he was pulling out his maps with target data and Biden told him, “Don’t even pull them out. We’re not going to talk about that.” I’ve been told, again by fairly reliable sources, that Blinkin and Sullivan — Blinkin primarily, but Sullivan too — have been sidetracked, and what’s happened is the Pentagon has taken over, essentially, diplomacy as well as any action, militarily speaking, with regard to both theaters of war. And so they’re now in charge. I have to change my evaluation of Secretary Austin if that’s the case, because it means he listened finally to the people in the bowels of the Pentagon who know the truth, and he’s reacting to that, and he’s told the President Biden that, and to Biden’s credit, even though he was furious, he finally took that advice.

Napolitano: Colonel, you once ran the State Department [as Secretary Colin Powell’s chief of staff under George Bush]. How does the Defense Department engage in diplomacy?

Wilkerson: They engage in diplomacy every day. Every day. There are four-stars in the various syncdoms, the regions that they control, the AORs [Areas of Responsibility] [who] are the true U.S. diplomats. And some of them are very good at it. I saw some of them. I worked with some of them who are very good at it, better than any Secretary of State. But it shouldn’t be that way. That’s a parenthetical remark. We shouldn’t have the military leading diplomacy. But we often do. And the Japanese prime minister once told me why to my face. He said, “Larry, when your East Asia and Pacific Assistant Secretary comes out here, he’s not got anything but his briefcase. When the man from Honolulu comes out here, from Camp Smith in Hawaii, he’s towing air wings, submarines, battle groups, Marine amphibious groups, Army divisions. I listened to him. This is the Prime Minister of Japan.

Napolitano: Who told General Kurilla to tell Prime Minister Netanyahu, “If you invade Lebanon, you’re on your own?”

Wilkerson: It was, I think, Austin. But that’s the chain of command. Austin conveyed that message to him [Kurilla]. But I think it was Austin that convinced Biden to give him that command so he could transmit it to Kurilla.

“..everything you thought you lived your life for would be dead. And if you survived? To quote Nikita Khrushchev, “The survivors would envy the dead.”

Most Americans approached last weekend thinking about how they would spend the much-anticipated end of the work week with their friends and family. Few realize how close they came to actualizing the scenario so horrifyingly spelled out in Annie Jacobsen’s alarming must-read book, Nuclear War: A Scenario. 72 minutes. That is all it takes to end the world as we know it. That is less time than most movies playing at the local cinema. Most people could not drive to the local home improvement store to buy the materials needed to do the little repairs around the home that usually wait for the weekend. Walk the dogs? Play with the kids? Forget about it. 72 minutes. And everything you thought you lived your life for would be dead. And if you survived? To quote Nikita Khrushchev, “The survivors would envy the dead.”

MUST WATCH AND SHARE ‼️ ‼️ ‼️

72 MINUTES BEFORE THE COMPLETE EXTINCTION OF THE PLANET

Scott Ritter Interview for Gegenpol

Germany must take the initiative and propose a new arms control program to Europe.

Germany must remove Zelensky from power to prevent a nuclear war.… pic.twitter.com/KEafjxEAab

— Ignorance, the root and stem of all evil (@ivan_8848) September 21, 2024

Ukraine, together with many of its NATO allies, has been asking for permission from the United States, the United Kingdom, and France to be able to employ precision-guided long-range weapons systems provided by these countries against targets deep inside Russia. On Sept. 6, at a meeting of the Ramstein Contact Group, a forum where U.S.-NATO military support to Ukraine is coordinated, Ukrainian President Volodymyr Zelensky personally appealed to the group for more weapons support from its Western allies and called on allies to allow Ukraine to use the weapons they provided to strike deeper inside Russia. “We need to have this long-range capability,” Zelensky said, addressing the attendees, who included U.S. Secretary of Defense Lloyd Austin, “not only on the divided territory of Ukraine but also on Russian territory so that Russia is motivated to seek peace. We need to make Russian cities, and even Russian soldiers think about what they need: peace or Putin.”

Secretary Austin, in comments made afterwards, said he didn’t think the use of long-range missiles to strike inside Russia would help end the war, adding that he expected the conflict would be resolved through negotiations. Moreover, Austin noted, Ukraine had its own weapons capable of attacking targets well beyond the range of the British Storm Shadow cruise missile. Despite Austin’s pushback, President Joe Biden appeared to be on track to give Zelensky the green light he was looking for regarding the use of British-provided Storm Shadow cruise missiles and U.S.-provided long-range ATACMS (Army Tactical Missile System) missiles for strikes on Russian soil. On Sept. 11, U.S. Secretary of State Antony Blinken, accompanied by British Foreign Secretary David Lammy, visited Ukraine, where they held meetings with Zelensky and his newly appointed foreign minister, Andrii Sybiha.

Blinken and Lammy, however, failed to make the announcement the Ukrainians were waiting with bated breath to hear. Instead, Blinken and Lammy reiterated the full support of their respective nations to Ukraine’s victory, adding that they would adapt their support to meet Ukrainian needs. “The bottom line is this: We want Ukraine to win,” Blinken said after his meeting with Zelensky. The stage was now set for Keir Starmer, the prime minister of the United Kingdom, to fly to Washington, D.C., last Friday, where he would meet with Biden and jointly agree to give Ukraine permission to use Storm Shadow and ATACMS against targets inside Russia. Russia has long made it clear that it would view any nation which authorized the use of its weapons to strike Russia as a direct party to the conflict. In comments to the media in Russia last Thursday — one day before the Biden-Starmer meeting at the White House — Russian President Vladimir Putin made it clear that any lifting of the restrictions on Ukrainian use of U.S.- and U.K.-provided long-range weapons would change “the very essence of the conflict.” He said:

“This will mean that NATO countries, the United States, European countries are fighting Russia. And if this is the case, then…we will make appropriate decisions in response to the threats that will be posed to us.” Kremlin spokesperson Dmitry Peskov, speaking after Putin’s announcement, noted that the Russian president’s words were “extremely clear” and that they had reached their intended audience — U.S. President Biden. Biden didn’t seem happy about the message. In responding to a question from reporters prior to his meeting with Prime Minister Starmer at the White House about what he thought about Putin’s warning, Biden snapped angrily, “I don’t think much about Vladimir Putin.” The evidence suggests otherwise.

Update from another planet.

• ‘It’s Over For Russia’ – Boris Johnson (RT)

Russia must understand that “it’s over,” and that Ukraine will not concede any territory for peace, former British Prime Minister Boris Johnson has argued. For this goal to be achieved, however, Kiev will need long-range weapons, NATO membership, and half a trillion dollars, Johnson added. In an op-ed published in The Spectator on Saturday, Johnson argued that Ukrainian forces still have the “ability to win,” if only the West would cave to every single one of Kiev’s demands. These include, he wrote, permission to strike deep inside Russian territory with Storm Shadow and ATACMS missiles, and immediate invitation to NATO with Article 5 security guarantees, and “half a trillion dollars… or even a trillion.” Disregarding Russian President Vladimir Putin’s recent warning that enabling long-range strikes would place NATO in a state of war with Russia as “bluster and saber-rattling,” Johnson argued that these steps are necessary to “send the crucial message to the Kremlin.”

“The message is: that’s it. It’s over. You don’t have an empire any more. You don’t have a ‘near abroad’ or a ‘sphere of influence’. You don’t have the right to tell the Ukrainians what to do, any more than we British have the right to tell our former colonies what to do,” he asserted. “It is time for Putin to understand that Russia can have a happy and glorious future, but that like Rome and like Britain, the Russians have decisively joined the ranks of the post-imperial powers, and a good thing, too,” he continued. The West, Johnson argued, “must abandon any idea that the Ukrainians will do a deal” or “trade land for peace.” “We in the West would be mad to try to impose that outcome,” he added. Ironically, Russia and Ukraine reportedly agreed to a peace deal during talks in Istanbul in 2022. The agreement would have involved Ukraine declaring military neutrality, limiting its armed forces, and vowing not to discriminate against ethnic Russians. In return, Moscow would have joined other leading powers in offering Ukraine security guarantees.

Ukrainian leader Vladimir Zelensky withdrew from the talks at the last moment. According to Ukrainian negotiator David Arakhamia, former US Under Secretary of State Victoria Nuland, and several Ukrainian media reports, Johnson was instrumental in convincing Zelensky to abandon negotiations. Former Israeli Prime Minister Naftali Bennett and the deputy leader of Türkiye’s ruling party, Numan Kurtulmus, have also claimed that several Western states conspired to scupper the deal. Five months after the Istanbul talks, Russia assumed control of four former regions of Ukraine. According to the most recent figures from the Russian Defense Ministry, the Ukrainian military has lost nearly half a million men since February 2022, and the Pentagon concluded last year that Ukraine stands little chance of regaining its former territories.

“..unscrewing everything they screwed up over the past two and a half years through self-inflicted idiocy in the interests of impressing their girlfriend Vladimir Zelensky (aka president of Ukraine).”

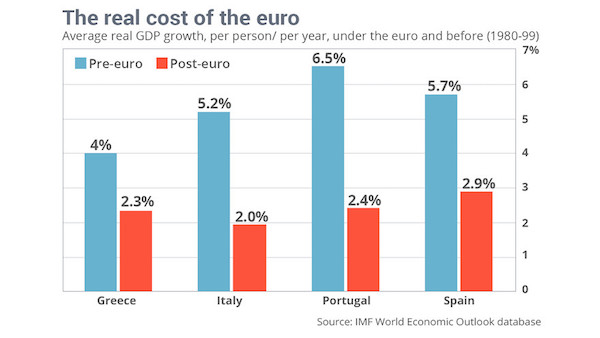

• Has The EU Suddenly Realized How Much It Has Screwed Itself Over? (Marsden)

The EU is having a full-blown existential crisis. Someone has really screwed up its economy, and the culprit is conspicuously absent from a new report outlining the carnage. Are there no mirrors in Brussels? Former European Central Bank president and Italian prime minister, Mario Draghi, has published a new “economic competitiveness” report after a year of work at the request of unelected ‘Queen’ Ursula von der Leyen’s ‘Royal’ European Commission. And it’s a real page-turner, one of the great mysteries of our times. One is left to breathlessly leaf through the 400-page document looking for a culprit responsible for the massive amount of economic carnage detailed by Draghi. “For the first time since the Cold War we must genuinely fear for our self-preservation,” he told reporters in Brussels. How about starting off by not actively self-sabotaging?

Draghi said that the bloc desperately needs to keep up with China and the US, but has been failing. Perhaps it has something to do with the fact that the EU readily jumped in to ride shotgun alongside Uncle Sam along regime change highway, but now finds itself kicking dirt on the roadside and wanting to make its own way. “Now conditions have changed,” Draghi said. “World trade is slowing. China is actually slowing very much, but it’s become much less open to us, and actually it’s competing with us in global markets on all accounts. We’ve lost our main supplier of cheap energy, Russia. And now we have to start for our defense again for the first time since the Second World War.” Apparently, the jokers ruling Europe from the big top tent in Brussels are shocked to discover that they’ve been victimized. Who could possibly have done such a thing?

Gotta love the use of the passive there. “Lost” their cheap energy from Russia. Like it just fell out of their pocket like a set of house keys on the way back from the store. Listening to Draghi, you’d also think that the EU hasn’t actually adopted “de-coupling” from China as a strategy, egged on by Washington, which wanted Europe all to itself, before EU officials rebranded it a “de-risking” when they realized how stupid a move it would be to fully alienate China as the bloc’s top trading partner and customer. And now, oh gee, the EU has to start thinking about its own defense again, Draghi said, rather than just using it to shake free some natural resources from all the places with fortuitously-located terrorist problems. The Ukraine conflict has been an equally convenient excuse to make more weapons at taxpayer expense for the EU’s own defense after emptying out the old junk from its closets.

Good thing, too, because making more weapons is about the only real easy answer for improving the economy right now, judging by the dire state of things outlined in this new report. Still, the EU can’t even do the military-industrial racket right. Draghi has pointed out that EU members are basically idiots for buying most of their weapons abroad, with nearly two-thirds coming from the US. Big mystery as to why Washington wants to keep the party going in Ukraine when it’s making bank by drumming up the need to ramp up weapons purchases for EU members under the guise that their former top economic lifeline and energy supplier (Russia) was suddenly a big threat to them. The bonus: making Europe more dependent on the US for pricier gas, too.

The whole report is just loaded with gems, like this one: “If Europe cannot become more productive, we will be forced to choose. We will not be able to become, at once, a leader in new technologies, a beacon of climate responsibility and an independent player on the world stage. We will not be able to finance our social model. We will have to scale back some, if not all, of our ambitions. This is an existential challenge…” Draghi’s going on about all these grand ambitions like leading new tech and being a climate and social icon, while European elites have been yelling at the plebs to turn down the heating and air conditioning to stick it to Putin and cheering mild winters like we’re living in the dark ages. Draghi also said that the EU needs another €800 billion ($890 billion), which is about 4.5% of the entire bloc’s GDP, just to be able to stay globally competitive. And that competitiveness can only be achieved by thoroughly unscrewing everything they screwed up over the past two and a half years through self-inflicted idiocy in the interests of impressing their girlfriend Vladimir Zelensky (aka president of Ukraine).

They made some Baltic Lunatic the EU’s new defense commissioner.

• EU Leadership Urges Europe To Be Ready To Fight Russia In 6-8 Years (ZH)

NATO’s tiny Baltic states have continued to be among the most hawkish within the alliance when it comes to ‘confronting Russia’ and making war plans. One Lithuanian official is making headlines for saying that eventual NATO war with Russia is inevitable, and that Europe must begin preparing now. Andrius Kubilius, a former Lithuanian prime minister and the EU’s new defense commissioner, has told Reuters that Europe must prepare to go to war with Russia withing the next six to eight years. “Defense ministers and NATO generals agree that Vladimir Putin could be ready for confrontation with NATO and the EU in 6-8 years,” Kubilius said in his capacity as the European Union’s first-ever Defense Commissioner. “If we take these assessments seriously, then that is the time for us to properly prepare, and it is a short one. This means we have to take quick decisions, and ambitious decisions,” he added.

Kubilius’ appointment is seen as an indicator that the EU is getting more serious about war-spending as a bloc, though EU leadership has no decision-making capacity when it comes to NATO. Apparently he’s unconcerned with the dangers of nuclear-armed confrontation. Russia has said it would deploy nuclear weapons if its territory and population faces existential threat of annihilation. Kubilius described further in his statement, “The European Union won’t have defense plans or military leadership, like NATO does — but the European Union has instruments to get larger financing, which NATO doesn’t.” He has called for a total investment of a gargantuan sum: 500 billion euros in the coming years in order to ramp-up the readiness of European militaries.

European Parliament has recently passed a largely symbolic resolution approving the Zelensky government’s use of long-range weapons to attack inside Russia. The head of Russia’s State Duma, Vyacheslav Volodin, has responded by saying “What the European Parliament is calling for leads to a world war using nuclear weapons.” Thinks looking bleak: A newly-created EU leadership position and the very first directive issued relates to future war with Russia… Clearly peace is on the minds of few. The only way to avoid escalation leading to nuclear-armed showdown in the heart of Europe is the negotiating table, but both Moscow and Kiev have of late issued statements denying that they are even close to sitting down together to seek settlement or ceasefire.

Better not get into a fight. Unwinnable.

• The DEI Trojan Horse Has Undermined US Military (Sp.)

The US military is facing what has been characterized as its worst recruitment, morale, and public trust crisis in modern history. Here’s what the Biden administration’s Diversity, Equity, and Inclusion has to do with it. An analysis of a trove of internal documents by The Daily Caller has revealed that the US Air Force has been excluding white male applicants from its popular Reserve Officers’ Training Corps program in favor of minorities. Highlighting the Biden administration’s obsession with Diversity, Equity, and Inclusion (DEI), the prejudice reflects a broader push by Washington’s liberal establishment to turn Martin Luther King Jr.’s quote about not judging people “by the color of their skin, but by the content of their character” on its head. Team Biden went to work on DEI and “equity” (not to be confused with “equality”) guidelines for the military immediately after stepping into office, firing off three key executive orders in January 2021, including:

EO 13985: “Advancing Racial Equality and Support for Undeserving Communities Through the Federal Government” (including the military). EO 13988: “Preventing and Combating Discrimination on the Basis of Gender-Identity or Sexual Orientation.” EO 14004: “Enabling All Qualified Americans to Serve Their Country in Uniform” – aimed at easing transgender individuals’ ability to serve. Together with the June 2021 EO 14035 on “Diversity, Equity, Inclusion, and Accessibility in the Federal Workforce,” the trio of directives kicked off a fundamental transformation of the military, sparking a series of bizarre scandals and leading to an unprecedented drop in readiness and morale:

In 2021, the Air Force and Navy faced widespread derision after rolling out maternity flight suits, with Tucker Carlson calling the move a “mockery of the US military,” and highlighting the absurdity of having “pregnant women…fight[ing] our wars.” In June 2023, facing an outcry from conservative lawmakers, the military banned drag shows on base, deeming them “inconsistent with regulations regarding the use of resources,” with DoD spokespeople scrambling to assure that “the Department does not fund drag shows or drag activities.” In October 2023, the advocacy group which won a historic Supreme Court case against race-conscious admissions to US universities brought cases against West Point and the US Naval Academy on grounds of DEI-based bias. The Supreme Court binned the West Point case in February 2024, with the Naval Academy’s affirmative action trial kicking off this past week.

The staggering costs of Pentagon DEI initiatives has also garnered considerable attention and criticism, with spending jumping from $68 million in 2022, to $86.5 million in 2023, and $114.7 million in 2024. The funds provide for things like mandatory diversity training and the hiring of onsite “diversity officers” to ensure compliance with DEI regulations. The Biden Pentagon has been hailed as the most diverse in history, with racial and sexual minorities receiving a host of top jobs, from a proud lesbian tapped to serve as Air Force under secretary, to a transgender assistant secretary of defense, to Lloyd Austin – the Pentagon’s first black chief. But these DEI “milestones” have not exactly helped the military achieve its goals over the past four tumultuous years, with the humiliating withdrawal from Afghanistan in 2021 and the Navy’s impotence against the Houthis from January 2024 on showing that more diversity does not mean more won battles.

In fact, the DEI seems to have made things worse, with the military facing an unprecedented “crisis of recruitment, trust, and spending,” as a Newsweek piece recently put it, forcing some observers and lawmakers on Capitol Hill to consider returning the draft, or offering immigrants citizenship in exchange for service amid recruitment numbers dropping between 20-40%, public trust in the military plummeting from 73% in 2019 to 60% today, and morale and readiness described as being among the lowest since World War II. DEI, combined with other Biden policies aimed at the military, including mandatory COVID shots, have been blamed for the crisis.

Only one opinion allowed.

• TikTok Wipes Out Sputnik Accounts (Sp.)

The US Department of the Treasury issued a statement on September 4 announcing sanctions against Sputnik’s parent media group Rossiya Segodnya, RIA Novosti, RT, Sputnik, and Ruptly. The sanctions also targeted Margarita Simonyan, editor-in-chief of Rossiya Segodnya, and a number of other senior executives. On the morning of September 21, the video-sharing platform TikTok removed the Sputnik International account of the Sputnik news network, just days after the US announced new sanctions targeting Russian media. TikTok has not yet commented on the development.

TikTok, which is part of the Chinese company ByteDance, has been under intense pressure from US authorities in recent months. In April, US President Joe Biden signed into law a bill passed by Congress that would ban TikTok in the United States if it refuses to divest from its Chinese-owned parent company ByteDance. TikTok and ByteDance have since challenged the measure in court. Earlier this month, the US State Department tightened the operating conditions of Rossiya Segodnya and its subsidiaries, designating them as “foreign missions.”

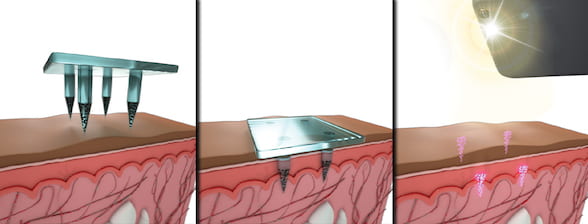

“Israel’s actions signal a new level of risk to global trade, where civilian products may be tampered with for political or military advantage. What was once a matter of state-to-state conflict is now a threat to individual households.”

• No One Is Safe: The Global Threat of Israel’s Weaponized Pagers (Sweidan)

Israel’s coordinated attacks on Lebanon, marked by the near-simultaneous explosion of thousands of pager and walkie-talkie devices over two days, resulted in the deaths of at least 37 people, including children, and left thousands severely wounded. This brutal terrorist attack should serve as a dire warning to the world: a stark reminder that the occupation state’s criminal actions know no limits, indiscriminately targeting those who challenge its interests, or those of its western allies. In the wake of this aggression, who can guarantee that Israeli exports to other countries won’t be weaponized in future conflicts? The “pager attack” serves as yet more evidence that Israel poses a global threat, ushering in a dangerous, dystopian new era in which civilians are no longer safe, even in their own homes. When analyzing the pager detonations from a legal standpoint, it becomes clear that Israel’s killing spree in Lebanon this week lies somewhere between a war crime and an act of terrorism.

The legal classification depends on the current state of affairs between Lebanon and Israel. If Lebanon is considered to be at war with Israel, the targeting of civilians — non-combatants — through the bombing of pagers blatantly violates international laws of warfare, including the Geneva Conventions. Article 51 of Additional Protocol I to the Geneva Conventions (1949) strictly prohibits indiscriminate attacks on civilians, and Article 85 lists attacks on civilians as grave breaches that amount to war crimes. In this case, we must identify who qualifies as a “combatant” under international humanitarian law. A combatant is defined as someone under military command, wearing a distinguishable uniform and openly carrying weapons. Without these markers, those targeted in the pager attack are considered civilians under international law. Additionally, the attack violates the principles of distinction and proportionality, fundamental tenets of international humanitarian law.

The principle of distinction mandates that combatants must be differentiated from civilians — a rule clearly ignored in Israel’s attacks, evidenced by the deaths of children. The principle of proportionality prohibits attacks where the harm to civilians is excessive compared to the military advantage gained. In this instance, the minimal military impact pales in comparison to the devastating toll on civilians, including the psychological and moral damage inflicted. Therefore, Israel’s adoption of a strategy of indiscriminate violence during its recent aggression against Lebanon is a war crime. The Guardian notes that half a century after the Second World War, a global treaty — to which Israel is a signatory — came into force, which “prohibited in all circumstances to use booby-traps or other devices in the form of apparently harmless portable objects that are specifically designed and constructed to contain explosive material.”

However, if we consider that Lebanon is not in a formal state of war with Israel, the aggression falls under a different legal classification: terrorism. According to the International Convention for the Suppression of Terrorist Bombings (1997), Israel’s actions can be categorized as a “terrorist bombing.” The use of civilian devices, like pagers, in non-military zones with the intent to spread fear aligns with the convention’s definition of terrorism, which criminalizes the unlawful use of explosives to target civilians or infrastructure with the intent to intimidate populations or coerce governments.

The UN General Assembly Declaration on Measures to Eliminate International Terrorism (1994) defines terrorism as any act aimed at causing death or serious bodily harm to civilians for the purpose of intimidating a population or compelling a government or international organization to act. Accordingly, the pager bombings were intended to intimidate the Lebanese and the resistance or force them to make concessions, which is consistent with the definition of terrorism under customary international law. Yesterday, Belgian Deputy Prime Minister Petra De Sutter condemned the “massive terrorist attack” in Lebanon and Syria, while Volker Türk, the UN High Commissioner for Human Rights, wrote in a statement that the attack “violates international human rights law, and, to the extent applicable, international humanitarian law.”

Israel’s pager bombing has also sparked global concerns about the security of international supply chains. If Israel has indeed begun weaponizing civilian devices through third parties in other countries, this raises the terrifying prospect that supply chains once thought to be safe could be compromised at any time. In an interview with India Today TV, a technologist expressed concern that Israel’s actions could lead to similar risks in other countries, creating the possibility of booby-trapped electronics infiltrating homes worldwide. The implications are profound: Israel’s actions signal a new level of risk to global trade, where civilian products may be tampered with for political or military advantage. What was once a matter of state-to-state conflict is now a threat to individual households.

In 1990, the CIA were sure Putin was -literally- their man.

• When Vladimir Putin Was Pootie-Poot (Adam Dick)

United Sates President Joe Biden has spent most of his presidency refusing to talk with Russia President Vladimir Putin. This is despite — or maybe because of — the fact that such discourse could have led to an agreement ending the US government’s proxy war against Russia. Instead of talking out a resolution to the fighting, Biden has kept pumping dollars, weapons, and intelligence to the Ukraine government, resulting in a rising death toll and expanding war. Also advanced has been the risk of drawing the US and Russia directly into a war against each other that could go nuclear. Still, Biden will not pick up the phone or fly on a plane to talk things over with the president of Russia. “I have no good reason to talk to Putin right now,” said Biden on July 11, 2024 in response to a reporter’s question at one of Biden’s rare press conferences.

We know Biden loves his vacation time, but, really, isn’t ending the Ukraine War and preventing its further escalation a good enough reason to start chatting with Putin? How about putting in a little effort to give peace a chance? Long, long ago, during the presidency of George W. Bush, a US president not only regularly talked with Putin, including in in-person meetings, he even had an affectionate nickname for the Russia president. For Bush, Putin was Pootie-Poot. How things have changed. Not every American president before Biden had a cute nickname for counterparts among the long line of Russia leaders, and Soviet leaders during the decades when Russia was subsumed in the Soviet Union.

Yet, they all were willing to talk. This includes Ronald Reagan who called the Soviet Union an “evil empire” and pushed for increased US military spending to counter what he presented as a Soviet threat. Reagan met with and kept in regular contact with Soviet leader Michail Gorbachev, succeeding in putting in place arms control deals between the nations. Other US presidents, while directly and by proxy militarily countering the “red spread” and “Soviet expansion,” kept in communication with Soviet leaders. They wanted to be dedicated cold warriors while minimizing the risk of outright war between the US and Soviet Union. Biden should give Putin a call. And when Biden makes that call, why not give Putin a nice nickname too? Doing this may run counter to Biden’s nature, but it could be the first step down the path to peace. Unfortunately, there is little indication that seeking peace is even a small component of the Biden administration’s agenda.

“The difference between us and the others in general is that we speak honestly and openly about this issue..”

• All of Europe Does Business With Russia – Hungary (RT)

A significant number of companies in the EU continue to discreetly do business with Russia despite the bloc’s sanctions, Hungarian Foreign Minister Peter Szijjarto has said. “Here I would like to disappoint the idealists, as the situation is that everyone in Europe is doing this,” Szijjarto said in Budapest on Friday.“ The difference between us and the others in general is that we speak honestly and openly about this issue. All of Europe does business with the Russians, but some deny this; we don’t need that.” Szijjarto added that Hungary does not agree with the sanctions, but since this is EU policy, Budapest respects them. Hungary typically vetoes specific EU proposals if they seriously harm national interests, he said, adding that developing economic cooperation with Russia is one of those interests.

The EU imposed sanctions on Moscow in 2014, and expanded them after the Ukraine conflict escalated in 2022. The main targets are high-value sectors of the Russian economy, including energy, finance, and trade. Hungary has long been at odds with the EU over its approach to the Ukraine conflict and its sanctions policy towards Moscow. This makes it difficult for the EU to agree on new restrictions, Euractiv reported in August, citing diplomatic sources. Many experts in both Russia and the West have warned that unilateral sanctions bring more harm to the countries that impose them than to Russia itself. EU officials have also acknowledged that Moscow has been successful in sidestepping the restrictions. In June, Finance Ministry data showed that Russian budget revenues from oil and gas soared by 73.5% in January-May this year, compared to the first five months of 2023.

“Long-term deals are expected to help avoid price swings and provide India with steady access to Russian oil at a lower price..”

• Indian State Oil Refiners Seeking Long-term Deals With Russia – Media (RT)

India’s state-owned oil refiners are in talks with Russia about clinching long-term supply deals, the news outlet Business Standard reported this week, citing sources at the country’s Ministry of Petroleum and Natural Gas. Agreements could reportedly be sealed as soon as next April when the new fiscal year starts. India, the world’s third-largest consumer of crude oil, depends on imports for up to 85% of its needs. Russia is India’s top oil supplier, and New Delhi has often noted that Moscow has been instrumental in ensuring the nation’s energy security. Nevertheless, while India’s private refiners already have annual deals for Russian oil supplies, the state companies have tended to buy it in the spot markets, reserving long-term contracts for sources from the Middle East. According to the ministry’s sources, however, the high volatility in spot prices has rendered this arrangement no longer attractive for the state refiners.

Long-term deals are expected to help avoid price swings and provide India with steady access to Russian oil at a lower price. India stepped up purchases of Russian crude in 2022 shortly after the outbreak of the Ukraine conflict and the first rounds of Western sanctions on Moscow. New Delhi has taken advantage of the discounts Moscow offered on its oil after the latter effectively lost its traditional buyers in the West. Last month, India even overtook China as the largest buyer of Russian crude. Ramping-up purchases of Russian oil not only helped India bolster its domestic energy security, but made it one of the leading exporters of petrochemicals to Europe. India’s exports of refined oil products to European countries jumped by 2,539 times since 2018, The Print reported earlier this month, citing data from the Ministry of Commerce and Industry.

Western states have been pressuring India to stop buying Russian oil, but New Delhi has remained adamant that it would continue to do so. Indian officials have also argued on more than one occasion that the decision to buy Russian oil has helped prevent a global energy crisis. In an interview with RT in July, India’s minister of petroleum and natural gas, Hardeep Singh Puri, stated that without Russian oil on the market, global prices would have hit $250-300 per barrel.

Nobody seems to know what she is busy with.

• Harris ‘Too Busy’ To Talk To Media – Adviser (RT)

US Vice President Kamala Harris hasn’t given many media interviews because “she’s a very busy person,” one of her campaign advisers, Keisha Lance-Bottoms, has told CNN. Even liberal pundits have criticized Harris for dodging the spotlight. In the two months since she announced her presidential campaign, Harris and running mate Tim Walz have given a total of seven sit-down interviews, while former President Donald Trump and running mate J.D. Vance have given 70 interviews and press conferences, according to a tally compiled by Axios this week. When conversations with partisan allies – for instance Trump’s live chat with X owner Elon Musk – are counted, the former president pulls even further ahead of Harris, who has largely stuck to scripted rallies to reach voters. Asked why Harris is not doing more interviews, Lance-Bottoms told CNN on Friday that “we would love to see her sit down every single day with CNN and do interviews, but it’s that she’s a very busy person.”

“She’s the vice president as well as a candidate,” Lance-Bottoms continued, reiterating that Harris is simply “too busy” to match Trump’s media schedule. Harris has come under fire from the New York Times for avoiding unscripted appearances, while CNN commentator Scott Jennings hammered the vice president on Friday for deliberately avoiding “hostile media.” The night before, Harris spoke at length to TV host Oprah Winfrey, although the interview was friendly and featured a host of Harrris’ celebrity supporters, including Meryl Streep, Jennifer Lopez, Julia Roberts, Chris Rock, and Ben Stiller. Harris’ campaign believes that “limiting interactions with the press is the right strategy – even if it frustrates reporters,” Axios reported, citing sources close to the campaign. According to a recent New York Times/Siena poll, 31% of voters feel that they don’t know enough about Harris, while only 12% are unsure who Trump is or where he stands on key issues.

You can't make this up.

Jake Tapper asked Kamala Senior Adviser and former Atlanta Mayor Keisha Lance Bottoms why Kamala isn't doing more interviews.

Her response: "She's a very busy person."pic.twitter.com/Cn1bAjw1FZ

— Greg Price (@greg_price11) September 20, 2024

Too many failures to be failures.

• Secret Service Allowed ‘Multiple Failures’ Before Trump Shooting – Report (RT)

Multiple “operational and communications failures” by the US Secret Service allowed a gunman to open fire on former President Donald Trump during a campaign rally in July, an internal review has found. Trump narrowly avoided death while speaking to a crowd in Butler, Pennsylvania, in July, when a bullet fired from around 150m away grazed his ear. The gunman, a 21-year-old named Thomas Matthew Crooks, fired from a rooftop that had apparently been left unprotected by the Secret Service, killing one rally goer and injuring two others before he was shot dead by a sniper. In the aftermath of the incident, it emerged that local police had spotted Crooks using a range-finder an hour before he opened fire and passed a photo on to Secret Service agents. The agents noticed the gunman on the roof 20 minutes before the incident, but took no action until the first shots rang out.

In a preliminary report released on Friday, the Secret Service stressed that local police were responsible for securing the roof in question. However, the report stated, the officers covering this building had no contact with the Secret Service. Some information about the shooter relayed by local law enforcement never made it to the Secret Service, the report stated, blaming a lack of radio communication between the various agencies working at the rally site. As a result, information about Crooks’ appearance and movements had to be relayed by chains of phone calls and text messages, it claimed. Shortly before the rally began, Crooks was able to fly a camera-equipped drone over the site without being stopped or questioned. The Secret Service report stated that while the agency deployed a counter-drone team to the site, “there were some technical difficulties” with their equipment.

Regarding the choice of venue, the report stated that a Secret Service team had visited the site beforehand and noted that the line of sight between the rooftop and the stage where Trump spoke could pose a “challenge.” However, “the security measures to alleviate these concerns were not carried out.” The internal investigation is still ongoing, and a final report is expected in the coming weeks. While much of Friday’s summary appeared to pass blame on to local law enforcement, Acting Secret Service Director Ronald Rowe told reporters that the agency nevertheless needs “a shift in paradigm in how we conduct our protective operations.” Rowe’s predecessor, Kimberly Cheatle, resigned ten days after the shooting. Several other high-ranking agents were placed on leave during the investigation.

Trump survived another attempt on his life earlier this month, when a pro-Ukraine activist aimed a rifle at the former president at one of his golf courses in Florida. Secret Service agents fired several shots at the man and arrested him after he fled the scene. Republican Representative Matt Gaetz claimed earlier this week that some GOP lawmakers believe there is a “mole inside the Secret Service providing information about points of vulnerability” to would-be assassins.

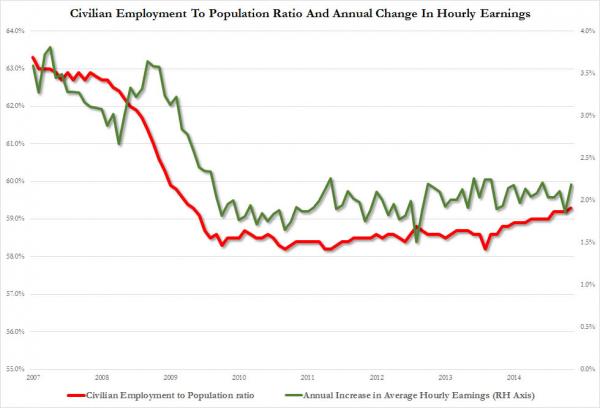

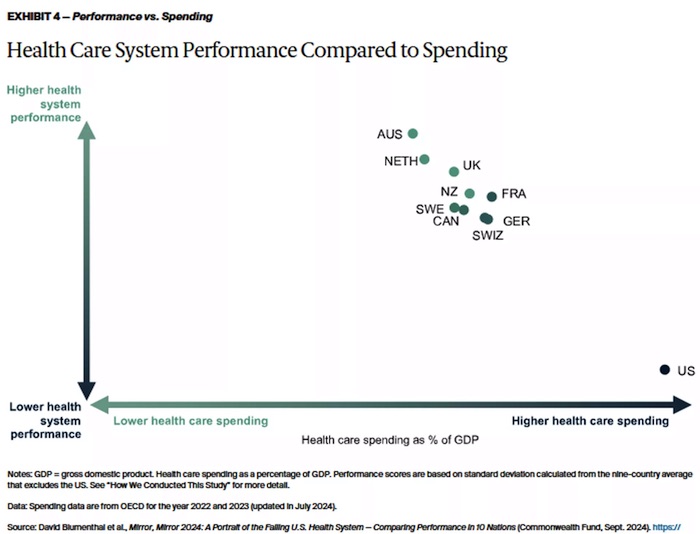

“Recent surveys indicate that healthcare is among the top priorities for voters in the November presidential election..”

• America’s Healthcare Dead Last in Rich Nation Rankings (Sp.)

The percentage of Americans able to access quality healthcare hit a new low of 55% in 2024, according to the West Health-Gallup Healthcare Affordability Index. Affordability of healthcare has become one of the top issues ahead of the 2024 US presidential election. The US healthcare system continues to lag far behind other high-income countries, an analysis by the Commonwealth Fund shows. It has retained its dismal ranking since 2004, when the nonprofit launched its surveys. Ten nations, including Australia, Canada, the UK, and the US, were compared on healthcare system aspects such as access, care process, administrative efficiency, equity, and health outcomes. The US showed the worst overall performance despite spending more per capita on healthcare than any other nation (16% of its GDP in 2022).

It ranked lowest in both accessibility and healthcare outcomes, with 26 million Americans having no insurance, and a quarter of the working age population underinsured. As inflation fuels costs, over 40% of Americans spent at least $1,000 on healthcare out-of-pocket last year, per the survey. At 77.5 years, US life expectancy is over four years below the 10-country average (the same as sanction-riddled Iran). The US has the highest rates of preventable and treatable deaths for all ages. Over 107,000 people died from overdoses in 2023 amid a raging substance abuse crisis, according to the Centers for Disease Control and Prevention. There were 43,000 gun-related deaths in 2023, according to a report by the National Institute of Health Care Management. Recent surveys indicate that healthcare is among the top priorities for voters in the November presidential election.

“..children are meant to play, to be loved, to be accepted and protected..”

• Words You Can’t Ignore (Max Jones)

A frightened little girl trembles and screams “in terror after mistaking thunder for an Israeli airstrike.” – Times of Gaza. Most of the people — and especially the children — who survive this genocidal slaughter will forever be traumatized. Children are meant to play, to be loved, to be accepted and protected. The children of Gaza will never get to be children. Most will never get to be adults either. Like this little girl, they will be stuck in the past, unable to experience something as simple as rainfall and thunder. When the rain falls and the thunder booms, their scars will take them back to their terror — the only thing that once separated them from the explosions destroying their homes, the blood and gore of their friends and relatives, and the reality that at any moment they might be killed. I urge you to not look away from this poor girl — look openly enough and you will see yourself. The times you were afraid and no one was there. The times you needed someone to assure you that things would be ok, and no one did. The times you needed to be accepted.

Israel killed Naya Ghazi in Beirut today.

She was just a child. pic.twitter.com/gnJFBC5hAo

— sarah (@sahouraxo) September 20, 2024

A four-year old girl, Rahaf Ziad Abu Suweirih, died the other day in Gaza when Israeli bombs shelled her home — but the bombs did not kill her. Her little heart stopped, incapable of handling the horrors imposed upon her by Israel’s genocide. As I said above, children are meant to play, to be loved, to be accepted and protected. The children of Gaza will never get to be children. Rahaf Ziad Abu Suweirih’s body knew this so well — and thus, knew that Rahaf should never have experienced the terror, violence, and abandonment that Israel’s genocide forced her to endure — that her tiny heart spared her. Her loved ones will mourn her death. They will try to make sense of the pain they feel, and how anyone could weaponize such hatred against something so innocent. The scars her death left them will remain tender for the rest of their lives. A story true for all the survivors of Gaza. But death is not merely an inducer of pain. It is also a protectorate; a unifier. It reaches up from the deepest depths of the soul to hug the broken human when no one else can.

It takes all the fragments that the tribulations of life shatter and pieces them back together. It is death that can lift a blanket over the abandoned child, or the terrorized adult, and give them permission to rest when the world cannot. This is especially evident in Gaza, where children cannot be children. They have to be survivors. Fighters. Being a child in Gaza only makes easy prey for the hunters playing blood sport. For a child, who again, is only meant to play, to be loved, accepted and protected, this creates a living hell that they have to believe is traversable, either by themselves or the adults they look to for guidance. Of course, no one can navigate the constant and unpredictable patterns of bombs, death and terror. But for the child, what choice do they have between believing the lie that they can control something, or succumbing to death itself? The reality is that Israel creates an uninhabitable space for Gazans, a “labyrinth of death,” that no one could ever survive without the chance of luck.

[..] But protecting one’s self, and one’s children, from the bombs of genocide means denying reality and believing, in one way or another, that you still possess some control of your own fate. To survive, the victims cannot accept that they are effectively “mice in a trap.” They must create different versions of reality in which they can prevail. In other words, they must become multiple people living different fantasies — all to protect their physical self. While these different realities may protect the survivors from death, they will not cease to exist once the war is over. This will send them scrambling in search of the unity that they were forced to abandon. In fleeting moments, they will find places of refuge that unite their broken spirits. These places will tend to the wounds that their traumas left them with “treatments” of comfort and solace.

Yet in time, these places will obscure the unity they at first grant. Whether the survivor finds shelter in the fuzzy feeling of a white opiate, in a bottle of liquor, in a toxic relationship, or any other pathology that detaches them from the pain of reality, the survivor will end up mistakenly believing that they are only complete with the help of the “treatment” that temporarily soothes their pain. This lie will lead them into a new trap: one much harder to see but just as real as the “mice trap” of Gaza. Without realizing it, they will never stop searching for the person that they were never allowed to be, and they will cling to the places that offer the illusion of fulfillment.

No. 1

BREAKING REPORT: Trump song reaches # 1 on the charts..

MEDIA WOULD HATE IF YOU SHARED THIS.. pic.twitter.com/BFto2eV6vo

— Chuck Callesto (@ChuckCallesto) September 20, 2024

GROK

"Grok 3.0 will be the most powerful A.I. in the world. It is training with 10x, soon 20x the compute of Grok 2."

一 Elon Musk

— DogeDesigner (@cb_doge) September 21, 2024

Cats

They should do this program in every prison. pic.twitter.com/2TG0LTTR4O

— Ian Miles Cheong (@stillgray) September 21, 2024

Blondie

https://twitter.com/i/status/1837430585117045144

Jenga

Well done.. pic.twitter.com/lzzs3maHXZ

— Buitengebieden (@buitengebieden) September 21, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.