Theodor Horydczak Sheaffer fountain pen factory, Fort Madison, Iowa 1935

The euro has been a devastating failure, costing nations both their independence and their economies.

• The Euro: Portrait Of A Devastating Failure (MarketWatch

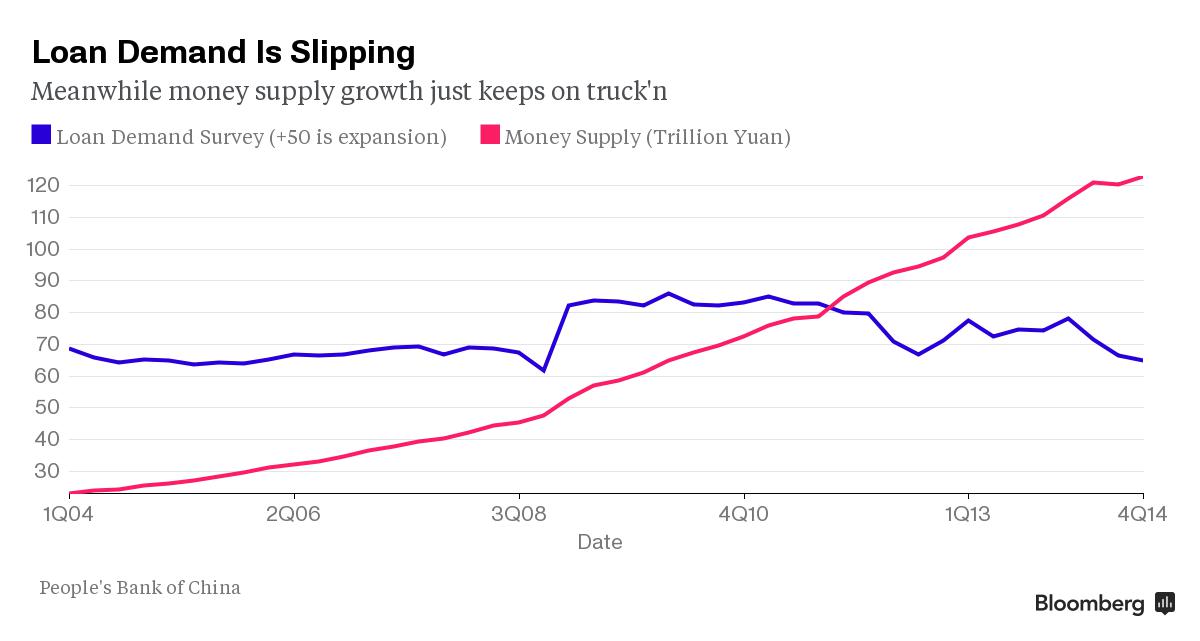

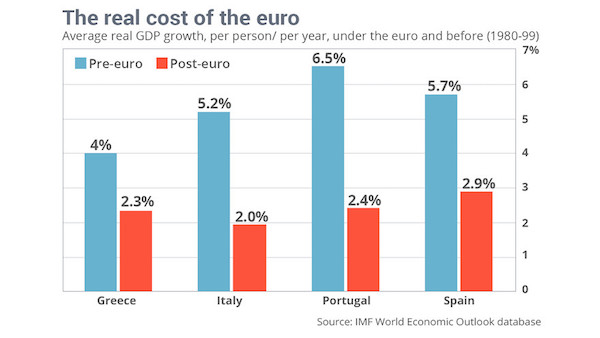

There’s a secret fear gripping the powerful across Europe nowadays. It has policy honchos lying awake at nights in Brussels. It has bankers in Berlin tossing feverishly on their silken sheets. It has eurocrats muttering into their claret. The fear? It isn’t that if Greece leaves the euro, the Greeks will then suffer a terrible economic meltdown. The fear is that if Greece leaves the euro, the country will return to prosperity — and then other countries might follow suit. Take a look at the chart. As you can see, Greece with the bad old drachma had double the economic growth of Greece under the euro. Double. And it wasn’t alone. Italy, Spain and Portugal tell similar stories.

Their economic growth back in the 1980s and 1990s, when they were “struggling” with the lira, the peseta, and the escudo, makes a mockery of their performance under the German-dominated euro. Apparently having control of your own national currency and your own monetary policy works well with having your own government and your own national sovereignty. Who knew? The data for this chart come from the IMF’s own database. They show real economic growth in four southern European currencies in the period before they embraced the euro, from 1980 to 1998, and the period since the single currency was launched at the start of 1999. (The numbers show the average annual growth in GDP, measured per capita, and in real, “purchasing power” terms to strip out inflation).

Of course many factors are involved. This isn’t just about the euro. On the other hand, the European single currency was sold to the people of these countries – when they were given a vote at all — as a magical project that would transform their economic fortunes. They were told to give up their sovereignty and independence in return for huge economic benefits. Instead, the euro “financialized” their economies – flooding them with tons of cheap, easy money, and creating gigantic paper Ponzi schemes that have now collapsed. The people of Europe were told the euro would bring stability. It hasn’t. They were told it would bring prosperity. It hasn’t. They were told it would bring growth. It hasn’t.

Are the Greeks really just a bunch of ouzo-sipping layabouts, as the Champagne-sipping layabouts in Brussels like to claim? Prior to embracing the euro, the Greeks managed real growth of 4% a year and an average unemployment rate of 7.7%. Since accepting the warm financial embrace of Brussels, Frankfurt and Berlin, Greece has managed growth of 2% a year and average unemployment rate of 14%. In other words, Greece under the euro has averaged half the growth, and double the unemployment, of Greece under the drachma. Some benefit.

Good definition of what happened so far: “bleed the patient” to “heal” it”.

• IMF “Defense” Of Its Actions vs Greeks Is An Unintended Confession (Bill Black)

The IMF, the heedless horseman of the troika that announced it would stop negotiating with the Greeks and go home, has attempted to justify its position through Olivier Blanchard, its “Economic Counsellor and Director of the Research Department.” Blanchard entitled his defense “Greece: A Credible Deal Will Require Difficult Decisions By All Sides.” That is a “serious person” title, but it is also economically illiterate – and no one knows that better than Blanchard. After all, it is the IMF’s deeply neo-liberal economists whose research has confirmed that the IMF’s austerity policies are self-destructive responses to the Great Recession and that fiscal stimulus programs are even more effective than economists had predicted.

That means that Blanchard and the IMF know that an economically-literate deal does not “require difficult decisions by all sides.” It requires, instead, the troika to cease its destructive demands that Greece “bleed the patient” to “heal” it. The troika’s austerity demands forced Greece into a Great Depression that is worse than the Great Depression of the 1930s in terms of sustained, obscene unemployment rates. And treating Greece in an economically rational manner would set a wonderful precedent that could be extended to Spain and Italy, which also have unemployment rates today that are near or even worse than they suffered in the Great Depression of the 1930s – seven years after the acute phase of the global financial crisis.

As we (UMKC economists and NEP bloggers) and Paul Krugman have explained repeatedly, the fiscal response to a Great Recession does not require “difficult decisions” and “sacrifices.” It requires funding worthwhile projects that provide an enormous “win-win” for the nations suffering from the Great Recession – and it helps their neighbors’ economies. Germany’s economy would be much stronger today if it had not insisted on forcing Greece, Spain, and Italy into Great Depressions. Because of the inherently flawed structure of the euro, this requires the ECB to be used far more aggressively than was contemplated by its inept architects, but it can be done. It would be an awkward, inelegant, bastardized system, but the problem in getting it done isn’t the economics, it’s the toxic interconnection of politics, economic dogmas spread by the troika and the credulous media, and disdain of the EU core for the peoples of the EU periphery that pose the insuperable problems.

Not going to happen. If an attempt is made, it’ll be watered down so much nothing much changes. Plundering entire nations is just too profitable.

• Sovereign Debt Restructuring Needs International Supervision (Joseph Stiglitz)

Governments sometimes need to restructure their debts. Otherwise, a country’s economic and political stability may be threatened. But, in the absence of an international rule of law for resolving sovereign defaults, the world pays a higher price than it should for such restructurings. The result is a poorly functioning sovereign-debt market, marked by unnecessary strife and costly delays in addressing problems when they arise. We are reminded of this time and again. In Argentina, the authorities’ battles with a small number of “investors” (so-called vulture funds) jeopardised an entire debt restructuring agreed to – voluntarily – by an overwhelming majority of the country’s creditors.

In Greece, most of the “rescue” funds in the temporary “assistance” programs are allocated for payments to existing creditors, while the country is forced into austerity policies that have contributed mightily to a 25% decline in GDP and have left its population worse off. In Ukraine, the potential political ramifications of sovereign-debt distress are enormous. So the question of how to manage sovereign-debt restructuring – to reduce debt to levels that are sustainable – is more pressing than ever. The current system puts excessive faith in the “virtues” of markets. Disputes are generally resolved not on the basis of rules that ensure fair resolution, but by bargaining among unequals, with the rich and powerful usually imposing their will on others. The resulting outcomes are generally not only inequitable, but also inefficient.

Those who claim that the system works well frame cases like Argentina as exceptions. Most of the time, they claim, the system does a good job. What they mean, of course, is that weak countries usually knuckle under. But at what cost to their citizens? How well do the restructurings work? Has the country been put on a sustainable debt path? Too often, because the defenders of the status quo do not ask these questions, one debt crisis is followed by another. Greece’s debt restructuring in 2012 is a case in point. The country played according to the “rules” of financial markets and managed to finalise the restructuring rapidly; but the agreement was a bad one and did not help the economy recover. Three years later, Greece is in desperate need of a new restructuring.

Distressed debtors need a fresh start. Excessive penalties lead to negative-sum games, in which the debtor cannot recover and creditors do not benefit from the larger repayment capacity that recovery would entail. The absence of a rule of law for debt restructuring delays fresh starts and can lead to chaos. That is why no government leaves it to market forces to restructure domestic debts. All have concluded that “contractual remedies” simply do not suffice. Instead, they enact bankruptcy laws to provide the ground rules for creditor-debtor bargaining, thereby promoting efficiency and fairness.

You can say there are not enough low-income homes. Or you can say the housing bubble has made too many homes unaffordable.

• Many Low-Income Americans Can’t Even Afford To Rent (MarketWatch)

The poorest Americans, who can’t afford to buy property, are increasingly priced out of rentals. There were only 28 adequate and available to rent homes for every 100 extremely low-income renters in 2013, down from 37 in 2000, according to the Urban Institute, a nonprofit and nonpartisan organization that focuses on social and economic policy. “This gap between supply and demand leaves 72% of the country’s poorest families burdened by the high cost of housing,” it found. Extremely low-income renters are households with incomes at or below 30% of the median income in that region. Not one county in the U.S. has enough affordable housing for all these renters.

Among the 100 largest counties, the number of affordable rental homes ranges from eight per 100 in Denton County, Texas, to 51 in Suffolk County, Mass. This regional disparity is partly due to federal assistance not keeping pace with population growth, says Erika Poethig, a director at the Urban Institute. Only nine of the 100 largest counties increased the number of affordable units for extremely low-income renters from 2000 to 2013. Between 2000 and 2013, the number of extreme low-income renter households soared 38% from 8.2 million to 11.3 million as the Great Recession pushed more families toward the lower end of the income bracket, the report found. Among the 100 largest counties, five of the 10 counties with the smallest affordability gap are in Massachusetts. Only one—San Francisco—is outside the Northeast.

“The geography of poverty is changing and federal housing policy has not kept up,” Poethig says, because the cost of living is so high in these areas. As a result, renters at this income level depend increasingly on programs run by the U.S. Department of Housing and Urban Development. Depending on the area of the country, extremely low-income translates to incomes of between approximately $12,600 and $32,800 for a family of four. Without federal housing assistance, the report found, the share of extremely low-income American households who could afford adequate housing in 2013 would have fallen to 5%.

25% make too little from work to live on.

• What Is the Real US Unemployment Rate? (CH Smith)

The BLS attempts to define a broader definition of under-employment and unemployment in its category U-6 Total unemployed, plus all persons marginally attached to the labor force, plus total employed part time for economic reasons, as a percent of the civilian labor force plus all persons marginally attached to the labor force: this is 10.8% of the work force. Depending on how we calculate the work force, and if we count everyone with any earnings as employed, we get an unemployment rate of somewhere between 5.6% and 12.5%. If we use the BLS’s metric for including under-employment, this is in the range of 10% to 15%. Common sense suggests that we calculate employment/unemployment based on earnings, not just any income in any amount.

If we reckon that only those with earnings of $15,000 or more annually (roughly speaking, full-time work at minimum wage) are fully employed, then the numbers change dramatically. The $15,000 annual earnings are also a rough benchmark of self-supporting households: two wage-earners making $15,000 each would have a household income of $30,000–enough to get by in much of the country. About 50 million people earn less than $15,000 annually. This includes roughly 10 million self-employed and 40 million with part-time jobs or other sources of earned income. This suggests that only 100 million of the 160 million work force are fully employed in the sense of not just having a job but making enough to be self-supporting.

There are many caveats resulting from the way that government social welfare is not included in earnings: thus a household might have two part-time wage-earners making very modest sums monthly who are getting by because they qualify for Section 8 housing, SNAP food stamps, Medicaid healthcare, school lunch programs, and so on. These programs enable the working poor to support a household despite low earnings. Should we include those depending on social welfare programs as fully employed? By my reckoning, roughly 60% of the civilian work force is fully employed and 40% are marginally employed (i.e. earning less than $15,000 annually) or unemployed. Since full-time workers even at minimum wage earn close to $15,000 annually, I think it is fair to use that as the cut-off for fully employed.

The BLS counts 121 million people as usually work full-time, but given only 100 million workers earn $15,000 or more, this doesn’t add up unless we include self-employed people earning very little who are counted as full-time workers. Based on income, I set the fully employed rate at 60%, and the marginally employed/unemployed rate at 40%. If we accept the BLS’s 121 million full-time jobs (which once again, this doesn’t make sense given even minimum wage full-time jobs earn $14,500, and 50 million people report earnings of less than $15,000), we still get a marginally employed/unemployed rate of 25%: work force of 160 million, 121 million fully employed.

Better start spending, guys!

• US 2040 Deficit To Nearly Double As Percent Of Economy-CBO (Reuters)

The U.S. budget deficit will more than double as a share of economic output by 2040 if current tax and spending laws remain unchanged, the Congressional Budget Office said on Tuesday. The CBO, releasing its annual long-term budget outlook, said however, that overall U.S. debt levels in 2040 will be slightly lower than estimates made a year ago for 2039 because of expectations of lower long-term interest rates. CBO said the 2040 deficit will reach 5.9% of gross domestic product, compared to 2.7% this year and 3.8% in 2025 based on its normal scoring methods. By contrast, the deficit reached nearly 10% of GDP in 2009 during the depths of the recent financial crisis.

“..their aim was to “humiliate not only the Greek government – this would be the least important – but humiliate an entire people”.

• Greek PM Tears Into Lenders As Eurozone Prepares For ‘Grexit’ (Reuters)

Prime Minister Alexis Tsipras lashed out at Greece’s creditors on Tuesday, accusing them of trying to “humiliate” Greeks, as he defied a drumbeat of warnings that Europe is preparing for his country to leave the euro. The unrepentant address to lawmakers after the collapse of talks with European and IMF lenders at the weekend was the clearest sign yet that the leftist leader has no intention of making a last-minute U-turn and accepting austerity cuts needed to unlock frozen aid and avoid a debt default within two weeks. Financial markets, for months indifferent to wrangling over releasing billions of euros of aid for Greece, reacted with mounting alarm.

European stock markets hit their lowest level since February and the risk premium on bonds of other vulnerable euro zone states leapt in one of the sharpest episodes of contagion since the height of Europe’s debt crisis in 2012. As the Austrian chancellor flew to Athens to warn Tsipras of the gravity of the situation and senior German lawmakers openly discussed the once-taboo prospect of a “Grexit” from the single currency area, Tsipras lambasted European and IMF policy. “I’m certain future historians will recognise that little Greece, with its little power, is today fighting a battle beyond its capacity not just on its own behalf but on behalf of the people of Europe,” he said in a televised speech to legislators in his SYRIZA party, drawing rousing applause.

Tsipras charged that the lenders were politically motivated in demanding pension cuts and tax hikes that hurt the poor, and their aim was to “humiliate not only the Greek government – this would be the least important – but humiliate an entire people”. The 40-year-old leader’s rhetoric left unclear whether he is preparing to default and risk economic collapse as the price of standing firm, or betting – wrongly according to the creditors – on a last-minute effort by Europe to save Greece. German Chancellor Angela Merkel, who has held repeated phone calls with Tsipras in recent weeks to press him to agree on reforms with EU/IMF negotiators, struck a despondent note, saying it was unclear if a deal could be found when euro zone finance ministers meet on Thursday in Luxembourg.

“..45% of pensioners receive monthly payments below the poverty line of €665..” Yeah, cuts would be a great idea..

• A Greek Paradox: Many Elderly Are Broke Despite Costly Pensions (Reuters)

The plight of 79-year-old Athenian Zina Razi and thousands like her strikes at the heart of why talks between Greece and its creditors have collapsed. She lives off a pension system that helps to consume a huge proportion of state spending and can appear overly indulgent – but still she’s broke. Razi barely keeps up with her power and water bills, and since her middle-aged son lost his job, supports him as well. “I am always in debt,” she said. “I can’t even imagine going to the cinema or the theatre like I did in the past.” This paradox goes a long way to explain why the leftist-led government and its creditors at the European Union and IMF have failed to bridge their differences over a cash-for-reform deal, leading to Sunday’s breakdown of talks.

Five years of austerity policies imposed at the creditors’ behest have helped to turn a recession into a full-blown depression, and still they want more. Athens has flatly refused to achieve further savings by raising value-added tax on essential items or, crucially, slashing pension benefits. As it inches closer to default and a potentially calamitous exit from the euro zone, the government has dismissed such demands as “absurd” or designed to pummel Greeks’ morale. To the lenders, the pension system is still too generous compared with what the country can afford. Greece spent 17.5% of its economic output on pension payments, more than any other EU country, according to the latest available Eurostat figures from 2012. With existing cuts, this figure has since fallen to 16%. [..]

To many Greeks, not least the Syriza party that stormed to power in January promising to push the clock back on austerity, the creditors’ demands are yet another way to clobber vulnerable people needlessly. The lenders have denied asking for specific pension cuts. But the Greek side said among their suggestions was slashing a top-up payment that supports some of the poorest pensioners. For Razi, that would mean losing €180 out of her €650 monthly pension. The average Greek pension is €833 a month. That’s down from €1,350 in 2009, according INE-GSEE, the institute of the country’s largest labour union. Moreover, 45% of pensioners receive monthly payments below the poverty line of €665, the government says. With more than a quarter of Greek workers jobless, many rely on parents and grandparents for financial support.

Wolf makes sense on some things here, much less on others.

• Divorce Greece In Haste, Repent At Leisure (Martin Wolf)

Some argue that Greece at least would be far better off after a default and exit. It is indeed theoretically possible that a default to its public creditors, combined with introduction of a new currency, a big devaluation (accompanied by sound monetary and fiscal policies), maintenance of an open economy, structural reforms and institutional improvements would mark a turn for the better. Far more likely is a period of chaos and, at worst, emergence of a failed state. A Greece that could manage exit well would have also avoided today’s plight. Neither side should underestimate the risks. It is also crucial to avoid the contempt so characteristic of the frayed nerves caused by failing negotiations.

Fecklessness may be a grievous fault, but grievously have the Greeks answered it. As the Irish economist, Karl Whelan, points out in a blistering response to Mr Giavazzi, the Greek economy has suffered a staggering collapse. From peak to trough, aggregate real gross domestic product fell by 27%, while real spending in the economy fell by a third. The cyclically-adjusted fiscal balance improved by 20% of GDP between 2009 and 2014 and the current account balance improved by 16% of GDP between 2008 and 2014. The unemployment rate reached 28% in 2013, while government employment fell by 30% between 2009 and 2014. Such a brutal adjustment would have shredded the politics of any country.

Europeans are now dealing with Syriza because of this calamity. But they are also dealing with Syriza because of the refusal to write down more of the debt in 2010. This was a huge error, made far worse by the subsequent collapse of the Greek economy. Indeed, the vast bulk of the official loans to Greece were not made for its benefit at all, but for that of its feckless private creditors. Creditors, too, have a duty to take care. If they are careless, they risk big losses. If governments want to save them, their own taxpayers should be told to pay up.

A voice of reason from an unexpected corner.

• Austrian Chancellor Sides With Greece In Debt Row (Reuters)

Austrian Chancellor Werner Faymann expressed solidarity with Greek Prime Minister Alexis Tsipras before meeting the leader in Athens on Wednesday in a bid to end a standoff with international creditors over a rescue package. Faymann, a Social Democrat who has taken a relatively lenient line with Greece, told broadcaster ORF that Athens had to live up to commitments under its current bailout plan but needed support to keep it from leaving the euro zone. “I know there were a number of proposals, also from the (creditor) institutions, that I also don’t find in order,” Faymann said in the radio interview.

“High joblessness, 30-40% (with) no health insurance and then raising VAT on medicines. People in this difficult situation cannot understand that.” Faymann seemed to be wading into a row over what European Commission President Jean Claude Juncker has called misrepresentations by the Greek government over just what reforms the EU wants from Athens to unlock frozen loans. Faymann said the alternative was fighting fraud and ensuring all Greeks pay their fair share of taxes. Greece and Brussels have been locked in an increasingly bitter war of words as the clock ticks toward the end of June, when the current bailout accord runs out, exposing Greece to potential default that could usher it out of the currency bloc.

Faymann said it was never helpful when insults fly, adding: “I stand on the side of the Greek people who in this difficult position are being proposed more things detrimental to society.” He said he was confident he could support Juncker’s efforts to forge an agreement by using Austria as an example of a country where workers and pensioners get affordable health care. He acknowledged nerves were frayed but said the task was to “avoid a catastrophe.” Asked whether Greek leaders could be brought on board, he said: “I assume that someone who is elected lives up to his responsibility.”

Troika-induced fear and panic.

• ‘It’s Going To Be Bad, Whatever Happens’: Greeks Stash Cash At Home (Guardian)

“Everybody’s doing it,” said Joanna Christofosaki, in front of a Eurobank cash dispenser in the leafy Athens neighbourhood of Kolonaki. “Our friends have all done it. Nobody wants their money to be worthless tomorrow. Nobody wants to be unable to get at it.” A researcher in the archaeology department at the Academy of Athens, Christofosaki said she knew plenty of people who had “€10,000 somewhere at home” and plenty of others who chose to keep their stash at the office. Was she among them? “If I was, I certainly wouldn’t tell you.” It was not too hard, in central Athens’ plushest district on Tuesday, to find people worried that the latest breakdown of talks between Greece and its creditors over a new aid-for-reforms deal may have implications for the security – and accessibility – of their savings.

With time fast running out to secure a desperately needed €7.2bn in new rescue funds before the end of the month, when Athens is due to repay €1.5bn in loans to the IMF, anxious Greeks have begun withdrawing money from their country’s banks at an unprecedented rate. Bank deposits have been falling steadily since October and now stand at their lowest level since 2004. Withdrawals in recent weeks have averaged €200-250m a day, but on Monday – after the shock collapse of last-ditch talks between the Greek government and its eurozone and international lenders – withdrawals surged to €400m. “People are very concerned,” said the owner of a small company who asked not to be named. “I think those who could, have already transferred some money abroad. And lots of others have taken out a few thousand, enough to see them through any immediate crisis. I have.”

Broad strokes?!

• Greek Central Bank Issues ‘Grexit’ Warning If Aid Talks Fail (Reuters)

The Greek central bank warned on Wednesday that the country would be put on a “painful course” towards default and exiting the euro zone if the government and its international creditors failed to reach an agreement on an aid-for-reforms deal. It also said Greece risked a renewed bout of recession and predicted that the current economic slowdown would accelerate in the second quarter of this year. The Greek economy had started growing again last year after being pounded by years of austerity, but fell back into negative growth in the first quarter of 2015, contracting by 0.2% y-o-y. The ongoing crisis has prompted an outflow of deposits of about €30 billion from Greek lenders between October and April, the central bank said.

Time is fast running out for Athens and its creditors to reach a deal before a €1.6 billion repayment by Greece to the IMF falls due at the end of the month. But neither side appears willing to give ground, with Greek Prime Minister Alexis Tsipras accusing the creditors of trying to “humiliate” his country by demanding more cuts. Despite the heated rhetoric, the central bank said that the two sides appeared to have reached a compromise on the main conditions attached to an aid agreement, and that little ground remained to be covered for a deal to stick. “Failure to reach an agreement would … mark the beginning of a painful course that would lead initially to a Greek default and ultimately to the country’s exit from the euro area and, most likely, from the EU,” the Bank of Greece said in a monetary policy report. “Striking an agreement with our partners is a historical imperative that we cannot afford to ignore.”

“Yet with Tsipras gone, would the next Greek government be any more pliable – any more inclined to maintain the new rate of VAT or persist with the new round of pension cuts? I see no reason to think so.”

• Europe Asks the Impossible of Greece (Crook)

Suppose for a moment that the European Union gets what it’s demanding from Greek Prime Minister Alexis Tsipras. It doesn’t look as though that will happen, but let’s imagine that Tsipras surrenders. How long, I’m wondering, would this smell like victory? Tsipras has agreed to the EU’s new, less demanding targets for Greece’s primary budget surplus over the next few years. The sticking point is that the measures he would use to hit those targets aren’t enough. Instead of raising the rate of value-added tax (a kind of sales tax) and/or collecting it on a wider range of goods, Tsipras says he’ll attack tax evasion and fraud. That’s won’t raise enough money, says Europe. The EU wants more cuts to public spending on pensions as well, which Tsipras refuses to consider.

For some reason, Europe has also been insisting on further labor-market reforms. These would doubtless be desirable, but they’re unlikely to yield extra growth in the short term and therefore have no fiscal implications in the relevant timescale. Tsipras’s numbers don’t add up, says Europe: They aren’t credible. Suppose, as I say, he did agree to raise VAT and cut pension spending. How credible would that be? Chances are good that it would be his last act as prime minister. He’d be breaking election promises and, aside from that, would enrage the faction of his own party that thinks he’s already conceded too much. Good riddance, you might say.

Yet with Tsipras gone, would the next Greek government be any more pliable – any more inclined to maintain the new rate of VAT or persist with the new round of pension cuts? I see no reason to think so. In short, if Tsipras capitulated and gave the EU what it wants, that wouldn’t be credible either. Let’s pursue this “Europe wins” thought experiment one step further. Suppose that Tsipras capitulated, and that he was able somehow to stay in power long enough to keep his promises – or that the successor government was reliably conservative on fiscal policy. Would this be sufficient to put Greek public finances on the path to sustainability? The sustainability of Greek debt, you may recall, is Europe’s main purpose in all this.

Germans think it’s about money. Well, maybe it’s time for Deutsche to crash. And/or the Landesbanken.

• Merkel’s Bavarian Allies Say Greeks Act Like ‘Clowns’ In Debt Talks (Reuters)

German Chancellor Angela Merkel’s Bavarian allies have accused the Greek government of not having grasped the seriousness of the situation in the debt talks yet, with CSU Secretary-General Andreas Scheuer calling ruling politicians in Athens “clowns”. The remarks were the latest sign of hardening positions towards Greece among European politicians, on the eve of a meeting of euro zone ministers that could be the last chance to rescue Greece from default at the end of the month. Scheuer said in an interview with Rheinische Post newspaper published on Wednesday that Greece had done too little so far to stay in the euro and there would be no “careless compromises” just for the sake of keeping Greece in the single currency bloc.

“The Greek government apparently hasn’t realized the seriousness of the situation yet,” Scheuer said. “They are behaving like clowns sitting in the back of the class room, although they have received explicit warnings from all sides that they might fail to pass to the next grade.” German Chancellor Angela Merkel said on Tuesday she was willing to do all she could to keep Greece in the euro zone but insisted the onus remained on Athens and its creditors to break a deadlock and reach a deal. Merkel is facing growing opposition among her ruling conservatives to granting Greece any further bailout funds. Germany is Greece’s biggest creditor and the biggest contributor to the EU budget and the euro zone bailout fund.

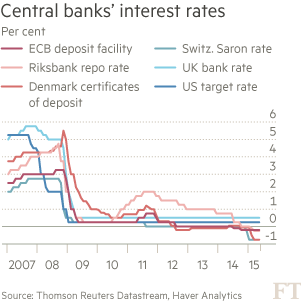

All the central bankers have left is uncharted territory. And that’s a scarier thought than anyone cares to admit.

• Central Banks Enter The Unknown With Sub-Zero Rates (FT)

For years, central bankers have treated the fabled interest rate known as the “zero lower bound” as if it were a physical barrier. Like the notion that temperatures cannot fall below absolute zero, policy makers thought they could not impose negative borrowing costs, as depositors would simply withdraw their money and hoard the cash. However, as the risk of deflation has pushed central banks in the eurozone, Denmark, Sweden and Switzerland to venture below zero, the question has shifted from whether negative rates are possible to how low they can go. Critics fear the unprecedented experiment of negative rates could have unwarranted side effects, including the formation of asset bubbles and deep disruption to the operation of the banking system.

“Negative rates are the policy for which we know least,” said Lucrezia Reichlin, an economist at London Business School. “They may create distortions and have undesirable distributional effects, so they should be considered an emergency, temporary measure.” Denmark’s Nationalbanken was the first central bank in Europe to experiment properly with negative rates after the global financial crisis. In July 2012, the DNB began charging lenders 0.2% for some of the cash parked in its deposit facility – a measure needed to defend the longstanding peg between the krone and euro. But this experiment acquired a whole different scale at the start of the year, when the ECB launched a programme of quantitative easing, having already cut its deposit rate to -0.2%.

This forced neighbouring central banks to slash their own rates deep into negative territory to stem the risk of large-scale capital inflows. In January, Switzerland dropped its deposit rate to as low as -0.75%, while Sweden’s Riksbank moved its main repo rate to -0.25% in March. The DNB, which had briefly raised the deposit rate back into positive territory, is now charging banks 0.75% for their excess reserves. Economists say that the possibility of negative rates arises because there are costs to storing and insuring cash. Savers will continue to keep their money in a deposit so long as this costs less than moving it into a safe. In fact, depositors may be willing to pay even more than that, as it is far easier to handle money from a bank account than it is from a vault.

“Yuan-ruble trade in Russia has grown 800% between January and September 2014..”

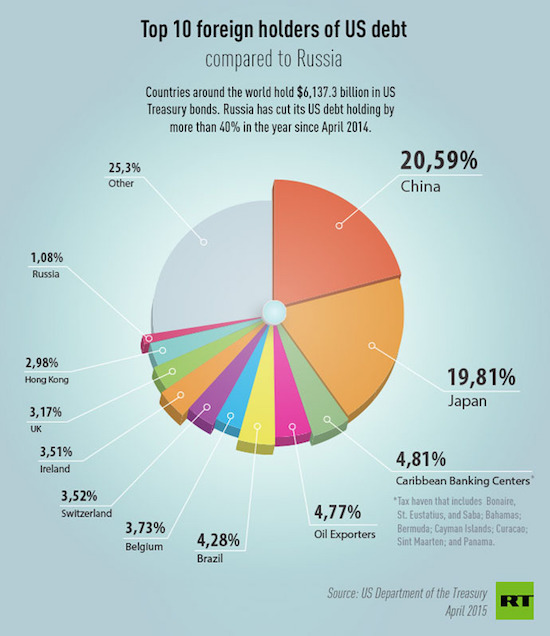

• Russia Cuts US Debt Holding By More Than 40% Over Year (RT)

Russia held US Treasury bills worth $66.5 billion as of April this year, according to the latest monthly report from the US Treasury. That compares with the $116.4 billion held a year ago. From March to April 2015, Russia sold $3.4 billion in US Treasury bonds,reported US Department of the Treasury Monday. Since August 2014, the value of US bonds in the Russian government portfolio has been steadily declining and the volume of Russian investments in US bonds dropped dramatically. Russia is now only 22nd on the list of the major US debt holders, compared to twelfth place in April 2014.

The Western sanctions imposed against Russia last year over re-unification with Crimea and its position in Ukrainian crisis have pushed Moscow to cut its dependence on the US dollar and build a more self-sufficient financial system. Western sanctions have encouraged Russia to work more actively with Asia, as the Asia-Pacific region and BRICS, as they make up 60% of the world GDP, said Russian Prime Minister Dmitry Medvedev last week. The BRICS summit in Russia this July will see the opening of the $100 billion New Development Bank, intended to compliment the World Bank and sponsor infrastructure projects within the group. Another project to be launched is currency pool worth another $100 billion, expected to guard the group from exchange rate volatility, said Russian President Vladimir Putin in May.

More than 40 countries and associations have said they would like to boost trade with the Russia-led economic block known as the Eurasian Economic Union (EEU). Vietnam became the first country out of the EEU to sign a free trade zone deal with the block in May and is considering switching to local currencies in bilateral trade. Russian Prime Minister Dmitry Medvedev said Moscow was ready to consider a currency union across the EEU. Russia s largest bank, Sberbank, issued its first credit guarantees in yuan this June, which marked another step in its de-dollarizing policy. Yuan-ruble trade in Russia has grown 800% between January and September 2014, and accounts for 7% of bilateral trade, with a huge potential to grow, according to May data.

World power.

• Five Million Reasons Why China Could Go to War (Bloomberg)

With five million citizens to protect and billions of investment dollars at stake, China is rethinking its policy of keeping out of other countries’ affairs. China has long made loans conditional on contracts for its companies. In recent years it has sent an army of its nationals to work on pipelines, roads and dams in such hot spots as South Sudan, Yemen and Pakistan. Increasingly, it has to go across borders to protect or rescue them. That makes it harder to stick to the policy espoused by then-premier Zhou Enlai in 1955 of not interfering in “internal” matters, something that has seen China decline to back international sanctions against Russia over Ukraine or the regime of Syrian President Bashar al-Assad.

As President Xi Jinping’s “Silk Road” program of trade routes gets under way, with infrastructure projects planned across Central Asia, the Indian Ocean and the Middle East to Europe, China’s footprint abroad will expand from the $108 billion that firms invested abroad in 2013, up from less than $3 billion a decade earlier. That is forcing China to take a more proactive approach to securing its interests and the safety of its people. With more engagement abroad there’s a risk that China, an emerging power with a military to match, is sucked into conflicts and runs up against the U.S. when tensions are already flaring over China’s disputed claims in the South China Sea.

“It is going to be a long, hard haul,” said Kerry Brown, director of the University of Sydney’s China Studies Centre. “You either have disruption as a new power rips up the rule book and causes bedlam or you’ve got a gradual transition where China is ceded more space but also expected to have more responsibility.” For more than a half century China stuck to Zhou’s policy predicated on non-interference and respect for the sovereignty of others. The policy partly reflected a focus on domestic stability and economic development by governments that lacked the means or interest to play a more active role offshore. It also led President Barack Obama to last year describe China’s leaders as “free riders” while others carried the global security burden. [..]

Parello-Plesner and Mathieu Duchatel, who co-wrote “China’s Strong Arm: Protecting Citizens and Assets Abroad” estimate there are five million workers offshore, based on research and interviews with officials, a figure that’s about five times larger than that given by the Ministry of Commerce. The official data reflect a lack of systemic consular registration and the absence of formal reporting by subcontractors sending workers abroad, according to the writers, who estimate about 80 Chinese nationals were killed overseas between 2004 and 2014. “There are now several countries that – in terms of the number of Chinese citizens there – are ‘too big to fail’,” said Parello-Plesner. “The business-oriented ‘going-out’ strategy now has to be squared with broader strategic calculations.”

Great angle, great insight.

• The Magical Content Tree (Dmitry Orlov)

A long, long time ago books were very expensive. They were produced by copying them by hand, page by page, onto parchment, by very poor monks toiling in their monastic scriptoria, but the books they produced turned out to be expensive anyway. The aristocracy could afford them, and, of course, the clergy, but the laymen had little access to the written word. Things were somewhat better in other, more technologically advanced parts of the world. The Chinese invented paper shortly before 200 BC, and by 200 AD lots of Buddhist texts were being mass produced using wood block printing. This know-how slowly diffused west, reaching Moslem Spain a few centuries later. By 1400 AD the art of paper-making made it all they way to the most backward of European provinces—Germany.

But then came a surprise: a German craftsman by the name of Johannes Gutenberg introduced moveable type: the ability to compose printed pages using reusable letters cast from lead. His legacy is still with us: the people who compose text for printing are still called “typesetters,” because once upon a time they physically set type, and the gaps between lines of text are still referred to as “leading,” because they used to be produced by inserting thin strips of lead. This innovation reduced the cost of producing books by orders of magnitude, making it possible for people of modest means to acquire a library. Gutenberg’s breakthrough is one of the most important bits of disruptive technology to come around, along with the steam engine and the nuclear bomb.

But an even bigger disruptive transformation occurred with the advent of the internet, which entirely decoupled the act of reproducing a work from the act of producing it in the first place. In effect, by investing in computing hardware and by paying for an internet connection, everybody gets access to a printing press. Once the equipment has been paid for, the incremental cost of producing another copy of something is zero. The overall cost is, of course, higher than ever; there is a good reason why Microsoft made fantastic fortunes with their mediocre, buggy products, or why Apple Computer is the public company with the highest market capitalization.

If you look at cost versus utility, many families now spend hundreds of dollars a month on smartphones, tablet computers, laptops, e-book readers, internet services, cellular phone services and so on. Were they to spend an equivalent amount on paper books and periodicals, they would amass a fantastically huge library in no time. Some people also pay for content—they purchase e-books, subscribe to premium services and so on—but most of the “content” they “consume” is free, paid for by advertising, or by promises of future revenue or increased market share, or by some other intangible, or—the most important category of all—by nothing at all.

Jim in fine form.

• Enter Jeb and Hil (Jim Kunstler)

The Floridian clod seeking to don the mantle of Millard Fillmore made an amazing foreign policy speech at an economic conference in Berlin last week. Inveighing against Russian President Vladimir Putin, he gave a very vivid impression of a man who has no idea what he is talking about.

“Russia must respect the sovereignty of all of its neighbors. And who can doubt that Russia will do what it pleases if its aggression goes unanswered?”

Jeb Bush was averring elliptically to the failed state formerly known as Ukraine, trying to put over the shopworn story that Russia was needlessly making war on its neighbor (and former province).

“Bush called for increased clarity on what type of sanctions would be imposed on the country if Prime Minister Vladimir Putin does not back down against a united international front…. ‘I don’t think we should be reacting to bad behavior [Bush said]. By being clear what the consequences of “bad behavior” is in advance, I think we will deter the kind of aggression that we fear from Russia. But always reacting, and giving the sense we’re reacting in a tepid fashion, only enables the bad behavior of Putin.’”

Note, by the way, that here is yet another scion of the Bush clan who was inexplicably brought up speaking Ebonics: “What the consequences… is?” Say what?

Ukraine became a failed state due to a coup d’état engineered by Barack Obama’s state department. US policy wonks did not like the prospect of Ukraine joining Russia’s regional trade group called the Eurasian Customs Union instead of tilting toward NATO and the European Union. So, we paid for and enabled a coalition of crypto-fascists to rout the duly elected president. One of the first acts of the US-backed new regime was to declare punishment of Russian language speakers, and so the predominately Russian-speaking people in eastern Ukraine revolted. Russia reacted to all this instability by seizing the Crimean peninsula, which had been part of Russia proper both before and through the Soviet chapter of history. The Crimea contained Russia’s only warm water seaports and naval bases. What morons in the US government ever thought Russia would surrender those assets to a newly-failed neighbor state?

A look behind the Sunday Times Snowden article.

• The American Far-Right’s Trojan Horse In Westminster (Nafeez Ahmed)

There is a violent extremist fifth column operating at the heart of power in Britain, and they stand against everything we hold dear in Western democracies: civil liberties, equality, peace, diplomacy and the rule of law. You wouldn’t think so at first glance. In fact, you might be taken in by their innocuous-looking spokespeople, railing against the threat of Muslim extremists, defending the rights of beleaguered Muslim women, championing the principle of free speech – regularly courted by national TV and the press as informed experts on global policy issues. But peer beneath the surface, and an entirely different picture emerges: a web of self-serving trans-Atlantic elites who are attempting to warp public discourse on key issues that pose a threat not to the public interest, but to their own vested interests.

One key organisation at the centre of this web is the Henry Jackson Society (HJS), an influential British think-tank founded a decade ago, ostensibly to promote noble ideals like freedom, human rights and democracy. But its staff spend most of their energies advancing the very opposite. More recently, HJS has turned to demonising Edward Snowden supporters and privacy advocates as accomplices with al-Qaeda and Islamic State (IS) – as is also being done by Rupert Murdoch s Sunday Times, with its hole-ridden story claiming Snowden’s revelations had allowed Russia and China to identify active MI6 agents. Journalists who have reviewed the Snowden files say that there was nothing in them that would permit MI6 operatives to be identified.

Former senior CIA official Robert Steele, whose books have received endorsements from the past and then serving Chairman of the Select Committee on Intelligence, said: “I can state categorically that there could not have been names of either intelligence officers or agents in the Snowden materials. The system simply does not work that way.” But the two-week time period between the publication of HJS report, and the Sunday Times hit-piece, is unlikely to be a coincidence. Like the Times piece, the latest HJS report damning Snowden draws almost entirely on anonymous intelligence sources along with unsubstantiated claims from the very officials responsible for mass surveillance, to claim that Snowden’s revelations had crippled the war on terror.

Lots of places are going to be uninhabitable for lack of water.

• More Than A Third Of The World’s Biggest Aquifers Are In Distress (FT)

More than a third of the world’s biggest aquifers, a vital source of fresh water for millions, are “in distress” because human activities are draining them, according to satellite observations. Scientists from Nasa, the US space agency, and the University of California, Irvine, analysed 10 years of data from the twin Grace satellites, which measure changes in groundwater reserves by the way they affect Earth’s gravitational pull. “Twenty-one of the world’s 37 biggest aquifers have passed sustainability tipping points … they are being depleted,” said Jay Famiglietti, the study leader. “Over a third [13] are so bad that they are experiencing exceptionally high levels of stress.” The problem is most serious in regions where rainfall and snowmelt cannot make up for water extracted for agriculture, industry, drinking and other human purposes.

The scientists determined aquifers’ overall stress rates on the basis of their depletion over 10 years of satellite measurements, together with their potential for replenishment, taking account of regional climate and human activities. The results, published in the Water Resources Research journal, show that the Arabian Aquifer System, an important water source for more than 60 million people, is the most “overstressed” in the world. It is followed by the Indus Basin aquifer of India and Pakistan and the Murzuq-Djado Basin in northern Africa. California’s Central Valley, currently at the center of a political battle over water rights, was classed as “highly stressed” and suffering rapid depletion mainly for agriculture.

Although many of the world’s great aquifers are being drained rapidly, there is “little to no accurate data about how much water remains in them,” the researchers added. Professor Famiglietti said: “Available physical and chemical measurements are simply insufficient. Given how quickly we are consuming the world’s groundwater reserves, we need a co-ordinated global effort to determine how much is left.” By comparing their satellite-derived groundwater loss rates to the limited data on groundwater availability, the researchers found huge discrepancies in projected times to total depletion of the aquifers. In the Northwest Sahara Aquifer System, for example, such times fluctuated between 10 and 21,000 years. The study noted that a dearth of groundwater was leading to severe ecological damage, including rivers running dry, water quality deteriorating and land subsiding.