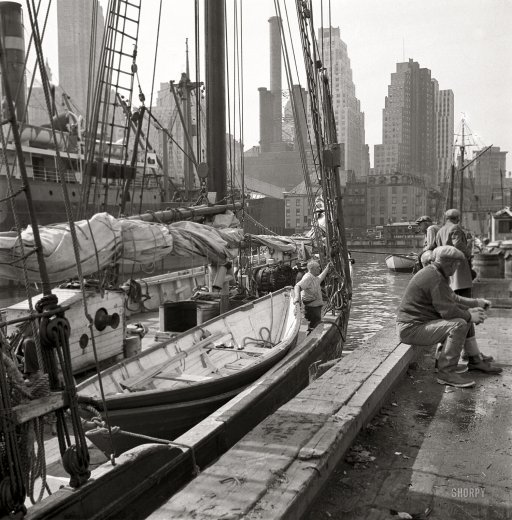

Gottscho-Schleisner Fulton Market pier, view to Manhattan over East River, NY 1934

Increasingly over the past year or so, when people ask me what I do, and that happens a lot on a trip like the one I’m currently on in the world of down under, I find myself not just stating the usual ‘I write about finance and energy’, but adding: ‘it seems to become more and more about geopolitics too’. And it’s by no means just me: a large part of the ‘alternative finance blogosphere’, or whatever you wish to call it, is shifting towards that same orientation.

Not that no-one ever wrote about geopolitics before, but it used to be far less prevalent. Much of that, I think, has to do with a growing feeling of discontent with the manner in which a number of topics are handled by the major media and the political world. Moreover, as would seem obvious, certain topics lay bare in very transparent ways how finance and geopolitics are intertwined.

In the past year, we’ve seen the crash of the oil price, which will have – financial and political – effects in the future that dwarf what we’ve seen thus far. We’ve seen Europe and its banks stepping up their efforts to wrestle Greece into – financial and political – submission. And then there’s the nigh unparalleled propaganda machine that envelops the Ukraine-Crimea-Russia issue, which has bankrupted the economy of the first and imposed heavy economic sanctions on the latter, for political reasons.

And while there are plenty people out there all across the west who may feel convinced that Greece had it coming, that waging wars in far away lands is the only way to keep the west safe, and that Putin is the biggest and meanest bogeyman this side of Stalin, if not worse, many also have come to question the official version(s) of events. Something that, if you ask me, is always good, even if it doesn’t mean the conclusions arrived at are always top notch.

For that matter, even Société Générale does geopolitical commentary, as evidenced in a note published by Tyler Durden:

Western sanctions have exerted a broad-based negative impact on Russian businesses. The cost of borrowing has climbed considerably not just for sanctioned institutions, but also for other Russian entities. Risk management departments across global enterprises are likely to continue erring on the side of caution, continually assessing the risk of sanctions materializing for counterparties in Russia. Normalization of business practices may only reemerge long after the removal of sanctions. Although this does not mean completely avoiding interactions with Russian entities, businesses and investors are increasingly cautious and selective in their participation…

Western sanctions against Russia may persist indefinitely. Some locals believe in the likelihood of de-escalation later this year, pointing to the lack of political cohesion and unanimity among Europe’s political leaders, and increasing calls for easing of sanctions. Russian businesses believe that escalation of sanctions may be hard to implement, given that they will also hurt European counterparties.

Some local asset managers are optimistic on the performance of Russian assets later this year, based on a perceived high likelihood of improvement in geopolitics. Although locals differ in their assessment of the timeline when sanctions may be lifted, they appear united in their support and admiration of President Putin. Few care to speculate on President Putin’s ultimate game plan, or whether one exists, citing the opacity of the situation. With that said, locals broadly concur that Russia would never (again) relinquish Crimea. In this light, Western sanctions against Russia based on its annexation of Crimea may persist indefinitely…

While in my opinion the conclusions in the note leave to be desired, which may be an indication that the boys are somewhat new to the topic, the very fact that SocGen issues notes about geopolitics, and uses the term itself, is interesting and – to an extent – solidifies the link about finance and geopolitics I noted before.

Still, I’, inclined to think that when it comes to Greece, the bank’s analysts are capable of leaving their narrow finance perch behind for a broader vista that allows for a view that makes Greece a political instead of a financial issue. Because that’s what is has become, whether the parties involved wish to acknowledge it or not.

Greece, like Ukraine, is about power politics, executed at about the same level of intelligence and sophistication that you and I had when we are still playing in a sandbox. And finance, economics, is one of the very favorite weapons to try and get the side perceived as weaker to say Uncle.

And that in and of itself is still far from the worst thing. The worst is that what reaches the general public about these power games – which are far from innocent, they kill, maim, hurt real people – is a distorted and simplified precooked storyline, so hardly anyone can make up their own mind about what happens. That is why the ‘alternative finance blogosphere’ feels increasingly compelled to cover that part of the story as well.

This is also a major problem in the more domestic issue of economic recovery. Unless we would agree, which we really shouldn’t, that making a small group of the population richer while the much larger rest is made poorer, is how we define ‘recovery’, we have no recovery. But it is still accepted and proclaimed like a gospel: our economies are in recovery.

If you take a step back and watch things from a distance, it’s truly too silly to be true, but endless repetition of the same lines, be they true or not, has them accepted as being cast in stone. It’s like selling detergent. It’s exactly like that: say something often enough and people start to believe it, connect to it. Of course it doesn’t hurt that people very much want to believe a recovery is here. Just as they want to believe product X will turn them into shiny happy people dressed in ultra white shirts.

And of the best pieces I’ve seen in a while on the illusionary recovery topic comes from Scott Minerd at Guggenheim Partners, writing in the FT:

QE Will Lower Living Standards Long Term

New monetary orthodoxy is likely to permanently impair living standards for generations to come, while creating a false perception of reviving prosperity. As economic growth returns again to Europe and Japan, the prospect of a synchronous global expansion is taking hold. Or, then again, maybe not. In a recent research piece published by Bank of America Merrill Lynch, global economic growth, as measured in nominal US dollars, is projected to decline in 2015 for the first time since 2009, the height of the financial crisis.

In fact, the prospect of improvement in economic growth is largely a monetary illusion. No one needs to explain how policy makers have made painfully little progress on the structural reforms necessary to increase global productive capacity and stimulate employment and demand. Lacking the political will necessary to address the issues, central bankers have been left to paper over the global malaise with reams of fiat currency. [..]

What I decidedly do not like about Minerd’s piece is the suggestion that if only policy makers had made more progress on ‘structural reforms necessary to increase global productive capacity’, things would have been fine, or better at least. Like if someone came up with a better way towards growth, that would solve our problems.

In my view, this is not about failing to find the right way towards more growth, it’s that more growth itself is not the right way to solve the issues. When he says policy makers and central bankers are ‘lacking the political will necessary to address the issues’, I can only hope he means the will needed to restructure the entire financial system, force bankrupt banks into bankruptcy and break up what’s left into pieces too small to ever again threaten an economy, let alone the entire financial system. But I don’t see him say it, so I’m left doubting that’s what he means.

Essentially, monetary authorities around the globe are levying a tax on investors and providing a subsidy to borrowers. Taxation and subsidies, as well as other wealth transfer payment schemes, have historically fallen within the realm of fiscal policy under the control of the electorate. Under the new monetary orthodoxy, the responsibility for critical aspects of fiscal policy has been surrendered into the hands of appointed officials who have been left to salvage their economies, often under the guise of pursuing monetary order.

The consequences of the new monetary orthodoxy are yet to be fully understood. For the time being, the latest rounds of QE should support continued U.S. dollar strength and limit increases in interest rates. Additionally, risk assets such as high-yield debt and global equities should continue to perform strongly.

Despite ultra-loose monetary policies over the past several years, incomes adjusted for inflation have fallen for the median U.S. family. With the benefits of monetary expansion going to a small share of the population and wage growth stagnating, incomes have been essentially flat over the past 20 years.

That last bit is the same as saying there is no recovery. Which is a tad curious, because Minerd started out saying, in his first paragraph: ‘As economic growth returns again to Europe and Japan’. Pick one, I’d say.

In the long run, however, classical economics would tell us that the pricing distortions created by the current global regimes of QE will lead to a suboptimal allocation of capital and investment, which will result in lower output and lower standards of living over time.

In fact, although U.S. equity prices are setting record highs, real median household incomes are 9% lower than 1999 highs. The report from BoA Merrill Lynch plainly supports the conclusion that QE and the associated currency depreciation is not leading to higher global output. The cost of QE is greater than the income lost to savers and investors. The long-term consequence of the new monetary orthodoxy is likely to permanently impair living standards for generations to come while creating a false illusion of reviving prosperity.

It’s by no means the first time I bring this up, but I’ll do it again until there’s no more need. The stories we are bombarded with 24/7 under the quite hilarious misnomer ‘News’ have been prepared, pre-cooked and pre-chewed for our smooth and painless digestion, and as such they contain only tiny little flakes of reality. They are designed to make us feel good, not understand the world around us.

It’s up to sites like the Automatic Earth – and there’s quite a few others – to expose these storylines and narratives for what they really are: tools to sell detergents. Their purpose is not to inform people, but to manipulate them into forming opinions about their world that serve the intentions of one or more groups of people hungry enough for power to occupy themselves with this sort of scheming.

Somewhere on the not so sharp edge between money and power, there are lots of people who devote their entire lives towards devising ways to make up your mind for you. And if you’re like most people, you like that, because it absolves you from having to think for yourself. But the price to pay doesn’t come with the commercials: if you let others think for you, you or your children may be called into war at any time of somebody else’s choosing.

And, as Scott Minerd says, the economic future for your entire families will look utterly bleak. Because that recovery they talk about? It’s not for you.

Home › Forums › Recovery, Geopolitics And Detergents