National Photo Co. The House Without Children, Poli’s theater, Washington DC 1920

Update:

Michael Ruppert Has Committed Suicide

RIP

Let’s start the day with the best – or should I say the funniest – graph I’ve seen in a while, picked up from Tyler Durden. It speaks for itself.

If this means things are going according to plan, we might want to wonder what the plan is.

American markets went up yesterday, and it was suggested that this had something to do with March retail numbers, which were up 1.1%. But then in ‘the back pages’ today, Bloomberg added this:

When the year started, analysts estimated retailers’ first-quarter earnings would grow more than 13% [..] That average had dropped to 7.5% on March 1 and now stands at 3.2%

Again, if this is according to plan, what plan? And who are those “analysts”? Do they still have a job? Also, don’t let’s forget Monday’s news that US mortgage lending fell to a 17-year low, i.e. is now lower than immediately after the financial crisis.

Next, two reports that are perhaps even more devastating for America than that graph above already is.

First, a joint report, due out this fall, by Martin Gilens at Princeton and Benjamin I. Page at Northwestern, leaves little standing of the notion that America is a democracy, or at least not what they label a Majoritarian Electoral Democracy. Instead, the US political system is, in their view, an Economic Elite Domination.

Testing Theories of American Politics: Elites, Interest Groups, and Average Citizens

Multivariate analysis indicates that economic elites and organized groups representing business interests have substantial independent impacts on U.S. government policy, while average citizens and mass-based interest groups have little or no independent influence. The results provide substantial support for theories of Economic Elite Domination and for theories of Biased Pluralism, but not for theories of Majoritarian Electoral Democracy or Majoritarian Pluralism.

Despite the seemingly strong empirical support in previous studies for theories of majoritarian democracy, our analyses suggest that majorities of the American public actually have little influence over the policies our government adopts. [..] Americans do enjoy many features central to democratic governance, such as regular elections, freedom of speech and association, [but when] the preferences of economic elites and the stands of organized interest groups are controlled for, the preferences of the average American appear to have only a minuscule, near-zero, statistically non-significant impact upon public policy.

RT adds:

The authors say that even as their model tilts heavily toward indications that the US is, in fact, run by the most wealthy and powerful, it actually doesn’t go far enough in describing the stranglehold connected elites have on the policymaking process. “Our measure of the preferences of wealthy or elite Americans – though useful, and the best we could generate for a large set of policy cases – is probably less consistent with the relevant preferences than are our measures of the views of ordinary citizens or the alignments of engaged interest groups,” the researchers said. “Yet we found substantial estimated effects even when using this imperfect measure. The real-world impact of elites upon public policy may be still greater.”

Lovely. And that’s before we turn to Seymour Hersh’s The Red Line and the Rat Line: Obama, Erdogan and the Syrian rebels, in which one of America’s few remaining real journalists explains how President Obama leads the Warfare State according to, once more, a plan that few Americans would recognize or approve of, being on the cusp of all-out war in Syria one day and calling it off the next, and in which US ally Turkey supplied the sarin gas that US-supported rebels, not President Assad, used in an attack. A great read of a very unappetizing chapter in recent US history.

And that must make us, again, wonder about the role the US plays in Ukraine. A role that is certainly plenty shady, from the botched kingmaking of Under Secretary of State Victoria Nuland, handing out pastries on Maidan Square with John McCain, to the presence of Blackwater mercenaries in the very eastern cities that are now under siege (doing what exactly?). And now the visit of CIA director John Brennan to Kiev over the weekend, which led ousted President Yanukovich to state Brennan had “de facto sanctioned” the use of weapons and thus provoked the bloodshed now taking place as Ukraine has declared war on the ethnic Russian rebels it calls “terrorists”, who occupy buildings in several cities. Certainly in light of the US role in Syria as described by Hersh, it’s time someone, anyone stateside start asking what the White House and Pentagon are up to.

More bad data out of China. After the 18% February plunge in exports was followed by a 6.6% fall in March, confirming that Lunar New Year went only so far to explain events, now a 19% y-o-y drop in new credit surfaces. And while you may at first think the shadow banking system might be good for the difference, the crackdown on that system is serious enough that that’s not likely. Which means we could be looking at a substantial downsizing of the Chinese economy.

The soy importers who defaulted on orders from Brazil and the US, did so because they could not get Letters of Credit, probably because they didn’t have good collateral. But who ever did in the Middle Kingdom? I’m not saying no-one did, but that the question was never asked. One iron ore load bought on credit would be used as collateral for the next load, before the first one was paid for. Works like a charm, and whoever’s on the right side of it gets to buy a home in London or Hongcouver or a patch of US farmland, but stick a spoke in the wheel and you risk creating a game of multi million falling dominoes. A new way to measure China GDP hints at a much lower growth rate than Beijing’s opaque official 7+% number. I said it before, there’s a power game going on there between the Communist party and the market place it seeks to create. And rigid central control doesn’t rhyme with a free market.

Still, I doubt that there’s an economist alive today who has the knowledge to gauge the risks and dangers that are playing out in China. Or Japan, EU and US, for that matter. So this Guardian headline was a welcome stress relief:

Financial Crisis Won’t Have Long-Term Impact On UK Growth: Economists

On the second question, over the extent of long-term damage from the crisis, the economists were not as divided. Almost two-thirds (61%) thought that the financial crisis will either have no effect on long-term UK growth rates or a small negative effect that pushes GDP down by less than 2.5% in total over a 10-year horizon.

The headline should have been: “Economists Are Useless Twits”. These people have no idea whether UK growth will be long term impacted by the crisis, they merely have models, taken straight from their school books, that suggest all is well. There’s a model for everything. But I don’t want to bash economists all the time, there are more useful things to do in life and it’s too easy. But let me close with the announcement I received recently from our close buddy Steve Keen, that rare economist with a functioning brain, that he is now chief economist at IDEA Economics.

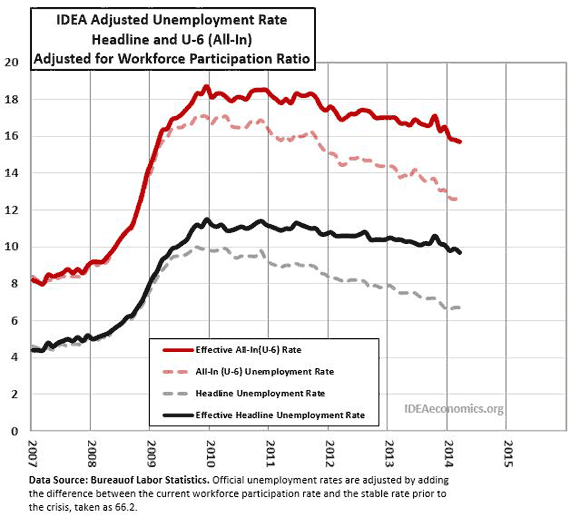

One of the first things to come out of IDEA after Steve joined is a revised US unemployment chart, depicting the IDEA Effective Unemployment Rate, which takes note of the Labor Participation Rate.

March 2014: Headline: 9.7%. All-In (U6): 15.7%.

This is where we say good night and good luck?!

• March Retail Gain Brings Little Relief to US Stores (Bloomberg)

For companies such as Bed Bath & Beyond and Family Dollar Stores, a rebound in March retail sales may prove too little late. While the Commerce Department yesterday said retail sales gained 1.1% last month, Moody’s cut its forecast for 2014 sales, saying that March’s results will give little comfort to companies whose sales were crimped by frigid temperatures in January and February. And even as spending thawed last month, analysts continued to slash estimates for retailers’ first-quarter profits.

The government report suggested warmer temperatures brought shoppers back into stores and enticed them to make purchases the blizzards had forced them to delay. Yet with incomes still stagnant and the job market still sluggish, it remains to be seen whether the momentum will carry into April, said Rick Snyder, an analyst at Maxim Group LLC in New York. “You can’t take this short-term data and jump to the conclusion” that spending is primed for big gains, Snyder said yesterday in an interview. “Things got better, but it’s relative. How bad did they start off?”

Sales dropped 0.7% in January, the biggest decline since March 2013, and rose 0.7% in February. Retail sales this year will rise 3% to 4%, Moody’s said in a statement yesterday. That’s down from its original range of 4.5% to 5.5%. When the year started, analysts estimated retailers’ first-quarter earnings would grow more than 13%, Retail Metrics Inc. said. That average had dropped to 7.5% on March 1 and now stands at 3.2%, the researcher said.

• US Is An Oligarchy, Not A Democracy, Americans Have ‘Near-Zero’ Input On Policy (RT)

The first-ever scientific study that analyzes whether the US is a democracy, rather than an oligarchy, found the majority of the American public has a “minuscule, near-zero, statistically non-significant impact upon public policy” compared to the wealthy. The study, due out in the Fall 2014 issue of the academic journal Perspectives on Politics, sets out to answer elusive questions about who really rules in the United States. The researchers measured key variables for 1,779 policy issues within a single statistical model in an unprecedented attempt “to test these contrasting theoretical predictions” – i.e. whether the US sets policy democratically or the process is dominated by economic elites, or some combination of both.

“Despite the seemingly strong empirical support in previous studies for theories of majoritarian democracy, our analyses suggest that majorities of the American public actually have little influence over the policies our government adopts,” the researchers from Princeton University and Northwestern University wrote. While “Americans do enjoy many features central to democratic governance, such as regular elections, freedom of speech and association,” the authors say the data implicate “the nearly total failure of ‘median voter’ and other Majoritarian Electoral Democracy theories [of America]. When the preferences of economic elites and the stands of organized interest groups are controlled for, the preferences of the average American appear to have only a minuscule, near-zero, statistically non-significant impact upon public policy.”

The authors of “Testing Theories of American Politics: Elites, Interest Groups, and Average Citizens” say that even as their model tilts heavily toward indications that the US is, in fact, run by the most wealthy and powerful, it actually doesn’t go far enough in describing the stranglehold connected elites have on the policymaking process. “Our measure of the preferences of wealthy or elite Americans – though useful, and the best we could generate for a large set of policy cases – is probably less consistent with the relevant preferences than are our measures of the views of ordinary citizens or the alignments of engaged interest groups,” the researchers said. “Yet we found substantial estimated effects even when using this imperfect measure. The real-world impact of elites upon public policy may be still greater.”

Look, if I can make a profit by making people’s lives miserable, I have a Constitutional right to do so, right?

• TurboTax Maker Spends Millions To Kill Simplified IRS Tax Filing (RT)

A software company that promises to help Americans avoid the annual misery of filing their IRS returns has, in fact, spent years trying to convince lawmakers to make sure filing taxes remains difficult, thus protecting its business, a new report found. Every year Americans spend an estimated $2 billion and 225 million hours preparing their tax returns by April 15. The process can include obtaining information from a bank or employer, intensive financial disclosures, and, for many Americans, an appointment with a professional accountant who is qualified to evaluate how much money the state and federal government is due.

The annual drudgery could be avoided with “return free-filing.” The process would involve an Americans’ employer and bank sending information to the US Internal Revenue Service (IRS), the government sending a bill to an individual, and that person essentially returning their payment in mere minutes, free of charge. Denmark, Sweden, and Spain already rely on pre-filed returns, and the US could as well if it were not for Intuit Inc. The owner of Turbo Tax, Intuit has spent at least $11.5 million on a federal lobbying effort over five years (spending more than Amazon or Apple) in an attempt to make sure the way Americans pay their taxes doesn’t change.

The ploy was first unveiled by a ProPublica investigation last year, although reporters found that Intuit used the same tricks through spring of this year. Lobbyists have portrayed return free-filing as a big-government intrusion, although the idea has previously been endorsed by Republican President Ronald Reagan and Democratic President Barack Obama when he was campaigning in 2008. William Gale, co-director of the Urban-Brookings Tax Policy Center, told ProPublica return free-filing is the next logical step for frustrated taxpayers.

• Seymour Hersh’s Blockbuster: Obama On The Red Line And On The Rat Line (Stockman)

Read Seymour Hersh’s devastating account of Obama’s Red Lines and Rat Lines and weep for the Republic. It is no more. For the first time in a half-century American voters actually elected the “peace candidate” in 2008 and sent Obama to the White House to end the interventionist foreign policy that had lead to disaster in Iraq, and, implicitly, to wind down the vast war machine that had been left over from the Cold War.

The latter had been converted by the Bush’s and Clintons into an armada of invasion and occupation that had rained death and destruction from Bosnia to Baghdad to Kandahar for no reasonable or justifiable purpose of national security. These aggressions were simply what a war machine does, making up rationalizations as it goes along. But the Warfare State was not about to let peace happen.

Soon Obama learned the Washington pivot, rehired the core of Bush’s War Cabinet and became enmeshed in the “national security” plots and schemes which were in the pipeline when he arrived at 1600 Pennsylvanian Avenue— much like JFK inherited the disastrous Bay Of Pigs invasion. Like the despicable Alan Dulles, he inherited ambitious scoundrels like so-called General David Petraeus, who soon had him convinced that the non-sensical and bloody “surge” in Anbar Province had been a roaring success, and that it should be exported to the quagmire in Afghanistan.

It looks to be a slow one.

• Kiev Launches Military Operation In Eastern Ukraine (RT)

Ukraine’s coup-appointed acting President Aleksandr Turchinov has announced a crackdown on anti-government protesters in the north of the Donetsk Region, eastern Ukraine. “The anti-terrorist operation started overnight Monday,” said Turchinov. “The aim of these actions is to protect the citizens of Ukraine.” According to Turchinov, this ‘anti-terrorist operation’ also aims to prevent “attempts to break Ukraine apart.” The anti-government protesters in south-eastern Ukraine have recently been protesting against coup-appointed Kiev authorities. They demand constitutional reform that would take into consideration the interests of all Ukrainian regions.

They also propose the federalization of the country and to make Russian the second official language in the regions. Earlier, a clip posted to YouTube showed local people in the town of Rodinskoye, Donetsk Region, have stopped a tank allegedly on its way from Kiev to take part in the crackdown against south-eastern Ukrainian cities. Meanwhile, the first battalion of Ukraine’s National Guard have left Kiev for the south-east, said the head National Security and Defense Council of Ukraine, Andrey Parubiy. According to Parubiy, the “battalion is comprised of volunteers from the Maidan self-defense troops”.

Big Oil, the military-industrial complex, what could be more dangerous than that?

• Ukraine’s Great Unraveling, Brought To You By Corporate America (RT)

… one nation’s crisis is another corporation’s windfall. Indeed, developments in Ukraine certainly spell big bucks for America’s bloated defense industry, which has used the Ukraine crisis in general, and the Crimean “annexation” in particular, to warn Capitol Hill of Russia’s “return to imperialism.” Never mind that Russia has not violated the territorial integrity of a single foreign country – without being attacked first, as was the case with Georgia – since the collapse of the Soviet Union. “Everybody in the Pentagon and in the defense industry is using the Ukraine crisis as a warning for why the department needs to spend more on military technology,” Loren Thompson, chief operating officer for the Lexington Institute, told AP.

Military advantage, however, is not the only reason for Washington imposing itself on Kiev. To understand the full picture, it is only necessary to consider the corporate circus that US Congress has become, in which the “people’s representatives” now take their marching orders from boardrooms across corporate America. Consider, for example, efforts by the American Petroleum Institute to take advantage of Kiev’s chaos. “We’ve just had a consistent drumbeat going since the beginning of last year,” Erik Milito, API’s director of industry operations, told Bloomberg. “We just kept doing it, and this became a more heightened debate during the whole Ukraine situation.”

• China New Credit Falls 19%, Money-Supply Growth Slows (Bloomberg)

China’s broadest measure of new credit fell 19% from a year earlier and money supply grew at the slowest pace since 2001, underscoring risks of a deeper slowdown as the government tries to curb financial dangers. Aggregate financing was 2.07 trillion yuan ($333 billion) in March, the People’s Bank of China said in Beijing today, down from 2.55 trillion yuan a year ago. M2, China’s broadest gauge of money supply, rose 12.1% from a year earlier. Policy makers are trying to rein in a credit binge and prevent defaults from spurring broader financial turmoil, while meeting a target for economic expansion of about 7.5% this year.

The State Council earlier this month outlined what some analysts have dubbed a “mini-stimulus” package of railway spending and tax relief, with first-quarter growth projected to be the slowest since 2009 in a report due tomorrow. “Deleveraging will for sure help China’s long-term growth, but the pressing issue for now is to handle the deceleration in economic growth,” said Li Wei, a Shanghai-based economist at Standard Chartered Plc. “That’s why monetary policy has to be more flexible.” Authorities may lower banks’ reserve requirements in May to send a clearer signal that they will ensure expansion, he said.

• Chinese Stocks Decline Most in 3 Weeks as Money Growth Slows (Bloomberg)

China’s stocks declined the most in three weeks, led by financial companies and commodity producers, as the slowest increase in the nation’s money supply since 2001 underscored risks of a deeper economic slowdown. Poly Real Estate Group Co. and Industrial Bank Co. fell more than 2.5% as a gauge of financial shares headed for its biggest loss in a month, while the one-year interest-rate swap dropped as much as eight basis points to a one-month low. China Shenhua Energy Co., a unit of the nation’s largest coal producer, slid 1.7%, while Sinopec Shanghai Petrochemical Co. lost 1.5%. China Mobile Ltd. slumped in Hong Kong.

The Shanghai Composite Index fell 1.1% to 2,107.98 at 1:20 p.m., heading for its biggest retreat since March 20. Stocks extended losses after data showed M2, China’s broadest measure of money supply, rose 12.1% in March from a year earlier, compared with 13.3% in February. New yuan loans were 1.05 trillion yuan ($169 billion), topping economist estimates of 1 trillion yuan. “Investors are a bit worried because M2 is quite low,” Zhang Haidong, an analyst at Tebon Securities Co., said by phone in Shanghai. “New loans may be better than expected by a little, but it’s still not considered good data; we still think liquidity is very tight.”

• Hong Kong Stocks Decline Most in a Month on China Data (Bloomberg)

Hong Kong stocks slid, with the benchmark index heading for the biggest drop in almost a month, after data showed China’s new credit fell in March from a year earlier and money supply grew at the slowest pace since 2001. Agricultural Bank of China Ltd. lost 1.8%. Guotai Junan International Holdings Ltd. tumbled 8.4% after the brokerage said it plans to sell shares. Great Wall Motor Co. sank 5.7% after JPMorgan Chase & Co. cut its rating. Hong Kong Exchanges & Clearing Ltd., the world’s second-biggest bourse operator by market value, slipped 3.6% after jumping 14% in the past two sessions on plans for cross-border equity trading with Shanghai’s exchange.

China is due to release first-quarter gross domestic product data tomorrow. “Investors are using the money supply data as an excuse to take profit and lock in gains ahead of China’s GDP data,” said Louis Tse, a Hong Kong-based director at VC Brokerage Ltd. The money supply data shows not enough liquidity, and “the lower the GDP, the higher the expectation the government will pour money into the market, but that’s already discounted.”

• Deeper China Slowdown Seen In Quarterly Than In Yearly GDP (Bloomberg)

China’s loss of economic momentum in the first quarter was deeper than the most widely-cited data will show, according to analyst forecasts for a gauge that’s gaining increasing recognition. Gross domestic product grew 1.5% from the previous three months, according to the median estimate in a Bloomberg News survey ahead of data released tomorrow, down from 1.8% in the fourth quarter. That indicates a sharper deceleration than the median projection for 7.3% growth from a year earlier, down from 7.7%.

Investors are focused on the scale of a slowdown that prompted Premier Li Keqiang to provide what some analysts dubbed a “mini-stimulus” of spending and tax relief. While the indicator suffers from flaws including the government’s failure to give details of methodology, it provides an extra tool to analyze an economy that bond-fund manager Bill Gross calls the “mystery meat” of emerging markets.

Strong euro killing PIIGS.

• Spain Anxiety on Euro Leaves Rajoy With Two-Front Battle (Bloomberg)

Spanish Prime Minister Mariano Rajoy is counting on Mario Draghi’s help in a battle on two fronts against the strength of the euro. With the currency reaching a level high enough to provoke the European Central Bank president to threaten action, data today and tomorrow will show the latest damage it has caused to inflation and trade. For Spain, the effect has already been double-edged, depressing consumer prices enough to cause annual declines in an economy still overburdened with unemployment, while also threatening its export-based recovery. Rajoy said on April 7 that he would like “a different exchange rate,” and Draghi said as much in Washington five days later when he told reporters that the euro’s strengthening “requires further monetary stimulus.”

Such assistance can’t come soon enough for Spanish companies including Cosentino SA, a manufacturer of bathroom and kitchen quartz surfaces. “The economic rationale of maintaining all our factories in Almeria is becoming weaker and weaker,” Chief Financial Officer Luis de la Haza said in a telephone interview from the southern region of Spain, where the company has 10 facilities and two fifths of its workforce. “We’ve been suffering for months without any respite from the euro’s exchange rate. The single currency has appreciated more than 5% against the dollar in the past 12 months, undermining euro-area exporters’ cost-cutting efforts to win business outside the 18-nation bloc. At the same time, slowing inflation makes competition within the region tougher.

• Spanish Bank BBVA Warns Of 10-Year Jobs Blight (Guardian)

Spanish unemployment could take 10 more years to return to the levels seen before the financial crisis, according to a report that paints a picture of an economy hampered by low wages, low skills and lack of investment in research. Spanish workers earn 20%-40% less than those in other leading European countries, according to the study by Spain’s second-biggest bank, BBVA. The earnings gap is partly explained by very high unemployment, which BBVA said “derives from a labour market that functions substantially worse than in other countries”. The bank found Spanish spending on research and development is 70% below the US or EU average, and said the economy suffered from low skills and a lack of technology in the workplace.

“All of these differences derive from an inadequate legal and institutional system of incentives,” the report said. The researchers forecast that even if employment increased at a rate of 2% it would take 10 years to reach 2007 levels. Calling for long-term “balanced, solid and inclusive” growth to bring per capita income in line with the US and eurozone competitors, the report urged Spain’s traditionally small- and medium-sized firms to enlarge and seek international markets. “Large companies are more productive, have more human capital, survive longer, invest more in R&D and export more,” it said, adding that this enlargement would only occur if legal, financial and fiscal obstacles were removed.

It noted that for each percentage point fall in unemployment there was a 0.6% rise in GDP, so reducing unemployment also cuts public debt, which is now at record levels. Figures released on Monday by the Bank of Spain show public debt rose by €8.1bn (£6.7bn) in February, taking the total owed by central and regional government to a record €988bn, equivalent to 95% of the nation’s annual GDP.

Why do I find this headline appealing?

• Two Chinese Executives Awarded $600 Million For US Pork Deal (Guardian)

Two executives at the Chinese company that bought the US firm Smithfield Foods, the world’s biggest pork producer, last September have been awarded more than $600m (£360m) of shares for their part in the $4.9bn deal. WH Group and some of its shareholders launched an initial public offering for up to $5.3bn in Hong Kong last week, the second biggest ever listing by a food and beverage company. Wan Long, the company’s 73-year-old chief executive and chairman, sometimes known as China’s “chief butcher”, and Yang Zhijun, an executive director in charge of investment, merger and acquisitions and financing, were granted shares with an estimated value of $597m, the filing showed.

David Webb, a Hong Kong-based corporate governance advocate, said: “This is very unusual. Normally you would incentivise management for overall long-term performance and not simply for executing a transaction, which is part of their job. Especially given there’s no evidence yet that the transaction is value-accreting. Let’s hope they don’t continue that kind of remuneration policy after they go public.”

• Financial Crisis Won’t Have Long-Term Impact On UK Growth: Economists (Guardian)

Fears that the financial crisis will have a significant negative impact on long-term UK economic growth are unfounded, according to the results of a new survey that brings together views from a broad range of economists. The first poll by the Centre for Macroeconomics asked just two questions, albeit meaty ones: on the size of the output gap and on the long-term effect on growth rates from the financial crisis. The responses, from economists in the City, at thinktanks and universities, provide more food for thought over the permanence of the drop in GDP over the downturn.

Economists were divided down the middle when asked whether they agreed the output gap – a measure of how far the level of output is below the potential level of output of the economy – was 3% or larger (in other words more than the Office for Budget Responsibility estimates). According to the OBR, the output gap in the last quarter of 2013 was 1.7%. That estimate implies that the drop in GDP relative to its pre-crisis trend, which may be as much as 10% on some estimates, is for the most part permanent.

In this survey, 46% of the respondents either agreed or strongly agreed the output gap was noticeably larger than the OBR estimate, among them Jonathan Portes of the NIESR thinktank and Morten Ravn from University College London. An equal number disagreed or strongly disagreed, and many of those commented that they supported the OBR estimate. On the second question, over the extent of long-term damage from the crisis, the economists were not as divided. Almost two-thirds (61%) thought that the financial crisis will either have no effect on long-term UK growth rates or a small negative effect that pushes GDP down by less than 2.5% in total over a 10-year horizon.

But among those who disagreed with that view, several highlighted losses in the financial sector that may be felt for many years in the wider economy. George Buckley at Deutsche Bank and John Driffill at Birkbeck College, London, both commented that growth before the financial crisis was unsustainable and that the financial crisis therefore could have an impact on growth rates by bursting that bubble.

We’re reaching the life cycle of the average upswing. Who knew?

• ‘Time for a new recession’ (RT)

The US economy bottomed out in June 2009. May 1 will mark the 59th month of expansion. The average upswing since 1945 has been 58.4 months. True, averages are, by their very definition somewhat middling, as their precision is perpetually open to negotiation. However the upswing’s days are clearly numbered we re just haggling over how many months it will be. Given the severity of the last recession, the rebound recovery will probably be slightly longer than average, but can it last for another 60 months to equal the longest post-war expansion? After all, that was during the 1960s, with heady optimism surrounding the white heat of technology. Likewise, the 1980s saw a lengthy expansion. However, President Reagan was pro-business, as opposed to the big government anti-enterprise Obama administration.

Let s consider those two words between which we often experience a chasm in the real world: hope and reality. The hopey-changey one of 1600 Pennsylvania Avenue clearly clings to a certain blind faith in his divine right ability to enjoy economic growth as he dithers stylishly over most every decision. Likewise, many investors cling to the last swinging reed of optimism in any bull market as they are all long, hoping for a greater fool to drive the market further up. Ultimately, the music stops and the invisible hand of the market removes a few chairs before the cycle starts again. The reality is the band has played a full set and could become bored playing encores anytime soon, leaving the fat lady to belt out her final number.

• Edward Snowden: A Whistle-Blowing Outlaw With A Pulitzer Prize To His Name (LA Times)

A few months ago, I wrote that it was wrong to try to classify Edward Snowden as either a whistle-blower or a traitor, because he’s a bit of each. Only now he’s a whistle-blowing outlaw with a Pulitzer Prize to his name. Formally, of course, the prize went to the newspapers that published articles based on Snowden’s massive data leak, the Washington Post and the Guardian. They don’t give the Pulitzer Prize to sources. But the Pulitzer board members, a gilt-edged group drawn from such institutions as the New York Times, the Wall Street Journal and Columbia University, knew they were giving Snowden a signal honor too. Were they right?

If it’s a question of impact, that’s easy: Snowden’s revelations forced the Obama administration and Congress to launch significant reforms of NSA’s practices, reforms that weren’t happening before. These were the most important newspaper investigations of the year. If it’s a question of journalistic quality, that’s pretty easy too. The two newspapers didn’t just summarize the digital mountain of documents Snowden gave them; they assembled teams of reporters — the Post listed 33 contributors — to turn data into intelligible reports.

Yeah, just make ’em dumber. They’ll learn from their smartphones?!

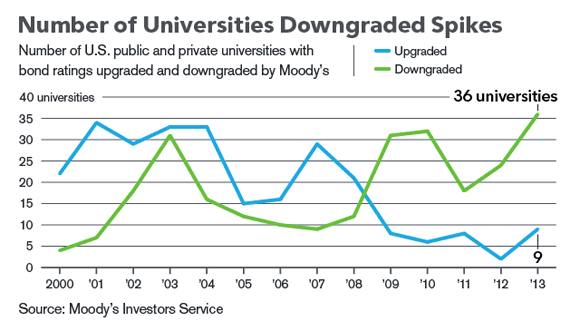

• Small US Colleges Battle Death Spiral as Enrollment Drops (Bloomberg)

The number of private four-year colleges that have closed or were acquired doubled from about five a year before 2008 to about 10 in the four years through 2011, according to a study last year by researchers at Vanderbilt University in Nashville, Tennessee, citing federal data. Plus, among all colleges, 37 merged in the three years through 2013, more than triple the number from 2006 to 2009, according to Higher Education Publications Inc., a Reston, Virginia-based directory publisher.

“There will clearly be some institutions that won’t make it and there will be some institutions that will be stronger because of going through these difficult steps,” said David Warren, president of the Washington-based National Association of Independent Colleges and Universities. Harvard Business School professor Clayton Christensen has predicted that as many as half of the more than 4,000 universities and colleges in the U.S. may fail in the next 15 years. The growing acceptance of online learning means higher education is ripe for technological upheaval, he has said.

Should we celebrate?

• Canada’s Climate Warms to Corn as Grain Belt Shifts North (Bloomberg)

The snow is piled waist-deep outside the Southern Manitoba Convention Centre as more than 400 farmers gather to consider the once-unthinkable: growing corn on the Canadian prairie. At one end of the packed auditorium last month in Morris, home of the Red River Wild hockey club, an Ohio farmer brought in by DuPont Co. is making a presentation with a slide that reads “Ear Count 101.” At the other end, Deere & Co. is showing off tractors and other equipment from a booth while Daryl Gross explains planters and corn-dryers to curious men wearing seed caps.

“This is here to stay,” said Gross, who sells CNH Global NV tractors for Southeastern Farm Equipment Ltd. in nearby Steinbach. His customers are increasingly devoting acreage to corn. “There are a lot of guys who are experimenting with it and looking at it,” he said. Corn is the most common grain in the U.S., with its production historically concentrated in a Midwestern region stretching from the Ohio River valley to Nebraska and trailing off in northern Minnesota. It had been ungrowable in the fertile farmland of Canada’s breadbasket. That is changing as a warming climate, along with the development of faster-maturing seed varieties, turns the table on food cultivation. The Corn Belt is being pushed north of what was imaginable a generation ago.

Money quote: “Shale gas drilling and fracking [in OZ] are over three times as costly as in the US”.

• Is A US-style Shale Revolution Coming For Australia? (CNBC)

Australia, home to the world’s seventh largest recoverable shale gas reserves, has several characteristics conducive for commercializing the resource including existing infrastructure, industry know-how and low population density in shale-rich regions. So, what is the potential for a U.S.-like shale revolution in the country? Australia has an estimated 437 trillion cubic feet of recoverable shale gas reserves, according to the Energy Information Administration (EIA), around two-thirds of the U.S.’s 665 trillion cubic feet – the world’s fourth largest – and two-fifths of China’s 1,115 trillion cubic feet – the world’s largest.

“Broadly most people would recognize Australia is the closest analogy [to the U.S.], with our infrastructure position and unconventional shale gas opportunities,” James Baulderstone, vice president, Eastern Australia at oil and gas firm Santos, told CNBC. The Australian shale gas industry is still in its infancy, but exploration has increased in the last few years. The sector has been drawing international interest from global players. The likes of Chevron, ConocoPhillips, Statoil, Total, BG Group, have invested over $1.55 billion in Australia’s shale gas industry as of mid-2013, according to EIA. [..]

Shale gas drilling and fracking are over three times as costly as in the US, according to industry estimates. Another key difference is the regulatory environment, in particular the mineral rights ownership, say industry participants. In the U.S., landowners possess the rights to the resources beneath their land and are entitled to royalties. This has ensured local communities are able to benefit financially, thus helping to temper local opposition to the industry. In Australia, the state owns any underground resources. Australian landholders have to provide access, in return for some compensation, to energy companies that want to explore and exploit their land.

Not exactly surprising. For money, we’ll burn anything.

• Coal Rises Vampire Like as German Utilities Seek Survival (Bloomberg)

What’s a beleaguered utility to do when forced by the government to close its profitable nuclear power plants? It turns to lignite, a cheap, soft, muddy-brown colored form of sedimentary rock that spews more greenhouse gases than any other fossil fuel. The story of German power giant RWE is a parable of the crisis facing that nation’s utility sector – in fact, many utilities across Europe — as nuclear power plants get shuttered in the wake of the Fukushima disaster, renewables steal away revenue and consumers and companies complain about rising power costs that are three times higher than in the U.S.

Chancellor Angela Merkel’s decision in 2011 to shutter all 17 of Germany’s nuclear power stations by 2022 struck a blow to RWE’s profit stream, particularly for a company that has almost no presence in renewables. RWE posted its first loss last year since World War II and may face worse losses going forward. The Essen-based company, founded in 1898 to produce power for Germany’s industrial heartland, has had no choice except to ramp up production from its profitable coal-fired plants, most of which burn lignite. The result: RWE now generates 52% of its power in Germany from lignite, up from 45% in 2011. And RWE isn’t alone. Utilities all over Germany have ramped up coal use as the nation has watched the mix of coal-generated electricity rise to 45% last year, the highest level since 2007.

Sad.

• Surge In Deaths Of Environmental Activists Over Past Decade (Guardian)

The killing of activists protecting land rights and the environment has surged over the past decade, with nearly three times as many deaths in 2012 than 10 years previously, a new report has found. Deadly Environment, an investigation by London-based Global Witness documents 147 recorded deaths in 2012, compared to 51 in 2002. Between 2002 and 2013, at least 908 activists were killed in 35 countries – with only 10 convictions. The death rate has risen in the past four years to an average of two activists a week, according to the report, which also documents 17 forced disappearances, all of whom are presumed dead.

Deaths in 2013 are likely to be higher than the 95 documented to date, the environmental rights organisation warned, with under-reporting and difficulties verifying killings in isolated areas in a number of African and Asian nations. Reports from countries including Central African Republic, Zimbabwe, and Myanmar, where civil society groups are weak and the regimes authoritarian, were not included in the Global Witness count. “Many of those facing threats are ordinary people opposing land grabs, mining operations and the industrial timber trade, often forced from their homes and severely threatened by environmental devastation,” the report said. Others have been killed for protests over hydroelectric dams, pollution and wildlife conservation.

Brazil, the report found, is the world’s most deadly country for communities defending natural resources, with 448 deaths between 2002 and 2013, followed by 109 in Honduras and Peru with 58. In Asia, the Philippines is the deadliest with 67, followed by Thailand at 16. More than 80% of the recorded deaths were in Latin and Central America. There have been only 10 successful prosecutions connected with the killings in Brazil over the past 12 years. Isolete Wichinieski, national coordinator of the Brazilian group Commisão Pastoral da Terra, said: “what feeds the violence is the impunity”.

• Dire UN Climate Reports Raise Questions About Global Willpower (NatGeo)

A trio of United Nations-sponsored climate reports released over the past seven months point to a dangerously warming planet, but big questions remain about whether the world’s nations will take action and, ultimately, about whether the reports will matter. On Sunday, the Intergovernmental Panel on Climate Change (IPCC) released its third major climate assessment, rounding out a process that began in September and plays out every seven years. The reports indicate that sharp greenhouse gas emissions cuts worldwide need to begin now, with a 40% to 70% reduction by mid-century, to avert the worst effects of climate change.

“We cannot play a waiting game where we bet on future technological miracles to emerge and save the day,” said Christiana Figueres, head of the UN Framework Convention on Climate Change (UNFCCC), in a statement on the report. The UNFCCC has hosted international summits aimed at fostering worldwide agreements on halting global warming since the 1990s, with the next big one scheduled for Paris in 2015. The UN reports have been aimed largely at world leaders attending the summit, the most anticipated since a 2009 meeting in Denmark.

“Above all, governments must strengthen and expand bold policy incentives to reduce emissions at home and together construct a new climate change agreement in Paris next year,” Figueres said. There are doubts about whether governments will go that far, but the IPCC reports indicate that such action is needed. Among the reports’ findings:

• Humanity’s influence on a warming climate is “clear” and has accelerated since the 1950s largely due to burning oil, coal, and other fossil fuels that release atmosphere-warming greenhouse gases.

• Global warming is already harming agriculture, the environment, and human health in real ways worldwide.

• Greenhouse gas emissions rates have accelerated since 1970, with the steepest increase coming in the past decade. About 80% of those emissions are tied to fossil fuel use.

Home › Forums › Debt Rattle Apr 15 2014: This Is Where We Say Good Night And Good Luck?