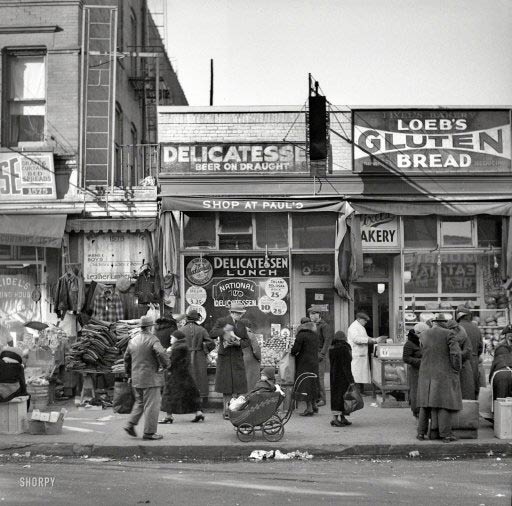

Arthur Rothstein Bathgate Avenue in the Bronx Dec 1936

These are dangerous times. The dangers come from places hardly anybody ever thought to look for them. And that is a danger in itself.

The world has become an amalgamation of centralized blocks of power on the one hand, and a move away from these blocks on the other. The latter happens for good reason. Not that any such reason should be required. The plain and basic human right to, and desire for, freedom and self-governance should be enough. It isn’t, though, as we shall find out soon enough.

The centralized blocks have been able to gather far too much power, politically, socially and militarily, all concentrated in the hands of far too few people. And because we are who we are as a species, once you arrive at that sort of power concentration, it is inevitable that the people who go look for it, and obtain it, are the last ones who should have it. That is, from the point of view of all the rest of us.

It takes a certain mindset to want so much power over others, and if you don’t end up with outright psychopaths holding the reins, you’ll get something very close to it. Nevertheless, on the other hand, the process of increasingly concentrated powers is a natural one.

But then so is the move away from that concentration, the urge to break away from the huge entities and into smaller ones. It’s as yin and yang as it gets. Still, we all understand where the problem lies: those who have accumulated all that power in their few handfuls of hands, will be extremely reluctant to give up even a few crumbs of it.

They will instead look for more and more. Which will clash with the, again, entirely natural movement elsewhere in society towards the dilution of this massive power centralization. And guess who holds the arms, which in today’s setting are the most devastating ones in human history by a factor of a thousand, or a million, or more.

The drive away from condensed power is fed by deteriorating economic circumstances, even if those are not immediately clear to all (just about everyone’s still talking about, and believing in, a ‘recovery’).

The power blocks have served their purpose, which was the concentration of wealth, and have now overstayed their welcome. This is most evident in blocks such as NATO and the EU, but it applies just as much to the US, China and the Russian empire.

Our choices then are clear. We can at this moment choose to prepare a smooth path towards de-centralization, or we can prepare to fight a thousand bloody battles over it. There are no other flavors available.

What is more evident than anything else is that we live in a failed economic model. And recovery from that failure is a mere pipedream. We will need to come up with different answers than that. Before people in America and Europe start dying by the side of the road again. If we wait until they actually do, we’ll be too late.

You will hear from many sides that independence movements such as Scotland’s and Catalunya’s are founded on populist sentiments. But that’s nowhere near the whole story. People have the right to govern themselves, if they so choose. And if you try to stop that, if you let these sentiments fester, without giving them room to breathe, they may indeed well manifest in nasty ways.

If it takes a populist leader to channel the desire for independence, chances are such a leader will emerge. To prevent such things from happening, the ‘free’ world needs to assemble something akin to a blueprint for situations in which peoples express their desire for self-determination.

The absence of such a blueprint equals a surefire way towards trouble, unrest, and worse. It can’t be that 2 million Catalans take to the streets of Barcelona, and old school soldiers issue threats to kill them, or the Madrid government declares the entire movement illegal. ‘It’s against the Spanish constitution’, they proclaim. Well, then it’s high time to change that constitution, because it violates UN charters Spain has signed up to.

Self-determination is not illegal. And that should be expressed very clearly by all nations and all leaders, through the UN, but also in EU and US law, so nobody is in doubt any longer, and the path towards independence is clear for everyone to see.

The main problem of course is: how do you make a change such as this happen when all incumbents, all those who hold power, are on one side of the divide?

We could start off by realizing that presenting de-centralization as some sort of ideological drive misses the point entirely. What we’re looking at is a wholly natural sequence of events. But nature has no edicts or laws that decide against violence and bloodshed.

That’s where we come in. We can pass international agreements that ban violence against peoples who seek to become independent. Not one inch of it will come easy, but we don’t have much of a choice if we don’t want to live in some kind of ongoing war situation for years to come.

The demise of the communist block has presented a number of examples of de-centralization, some peaceful, some incredibly bloody. There are lessons in there for us to learn.

Scotland is a timely reminder of things to come. It won’t be the last, it’s in fact only the vanguard. The more it become obvious and inescapable that our economies will not recover, because they are too deep in debt and they don’t have sufficient access to cheap fossil fuels anymore, the more the call for independence will gather momentum and volume. And it will be contagious.

We have a narrow window left to regulate the process. Before countries start pulling out of international bodies because these no longer serve a purpose for them. Before the power brokers and holders sense too much threat to their acquired positions, and decide it’s time to call in the cavalry.

There’s no way we can prevent mayhem in every single case, there’ll simply be too many of them, and they will all have their very different and unique characteristics. But we still can do a lot.

Or we can close our eyes and wait for the recovery our masters will keep on promising until they pull the plug on the whole mirage.

• OECD Trims Developed World Growth Forecast as Risks Build (BW)

The Organization for Economic Cooperation and Development trimmed its growth forecasts for the biggest developed economies in the face of increasing geopolitical risks and subdued European inflation. Euro-area gross domestic product is now expected to expand 0.8% this year, down from 1.2% in May, while the U.S. will expand 2.1% instead of 2.6%, the Paris-based OECD said today in a report. “The bullishness of financial markets appears at odds with the intensification of several significant risks,” the organization said. “Continued slow growth in the euro area is the most worrying feature of the projections.” The MSCI All Country World Index has gained 6% this year even as conflicts in the Ukraine and the Middle East have intensified and inflation in the euro-area has dipped to a fraction of the European Central Bank’s target rate. The OECD, which advises its 34 member governments on economic policy, urged European officials to learn lessons from Japan where inflation expectations didn’t flag a later descent into deflation.

“The experience of Japan in the 1990s is a reminder that such expectations measures can be poor predictors of the actual future rate of inflation,” the OECD said. “The 6-to-10 year consensus expectations in Japan were similarly near 2% in the early 1990s, failing to foresee the descent into deflation.” The OECD cut its GDP forecasts for Germany, France and Italy to 1.5%, 0.4% and a contraction of 0.4%, respectively. In 2015, those economies will grow 1.5%, 1% and 0.1%, generating growth of 1.1% for the euro area as a whole. Similarly, in Brazil the OECD foresees a weak investment and uncertainty related to looming elections as keeping growth below potential at 0.3% this year and 1.4% in 2015. The outlook for other economies is brighter. The OECD sees Japan expanding 0.9% this year and 1.1% in 2015, while China is on track to grow 7.4% and 7.3%. India, the only major economy to have its growth forecast raised this year, will expand 5.7% in 2014 and 5.9% next year, the OECD said.

“Nobel prize-winner Lars Peter Hansen described U.S. economic growth as “stunningly sluggish.”

• OECD Cuts US Growth Forecast, Warns On Risk Assets (CNBC)

A stuttering recovery in the U.S. and the continued fragility of the euro zone means that risk assets are “mispriced,” the Organization for Economic Cooperation and Development warned on Monday. In its Interim Economic Assessment, the Paris-based research organization became the latest to suggest markets are at risk of a sudden correction, stressing that the current bullishness appeared “at odds” with the “intensification of several significant risks.” The OECD forecast the U.S. would grow by 2.1% this year, down from its May projection of 2.6% growth. For 2015, the group expects the U.S. economy to grow 3.1%, down from earlier estimates of 3.5%. The euro area has also been downgraded from 1.2% growth in May to 0.8% and 1.1% for next year, and the stubbornly slow growth in the region is the most “worrying feature” of the OECD’s projections.

The anticipated tapering of U.S. monetary policy could lead to shifts in international financial flows and sharp exchange rate movements, which could be particularly disruptive for emerging market economies, the OECD noted. “A number of equity markets are reaching record highs, sovereign bond yields in several countries are near all-time lows and implied share price volatility in the United States and Europe is around pre-crisis levels,” it said. “This highlights the possibility that risk is being mispriced and the attendant dangers of a sudden correction.” Speaking to CNBC, economist Robert Shiller warned of pricey valuations in stocks last month and fellow Nobel prize-winner Lars Peter Hansen described U.S. economic growth as “stunningly sluggish.”

That’s why it’ll come.

• BIS Warns Rate Shock Could Spark ‘Damaging Feedback Loops’ (CNBC)

The emerging markets are at risk of “damaging feedback loops” once the world’s central banks start reining in their monetary policy and raise rates, the Bank for International Settlements (BIS) warns. BIS, known as the central bank of central banks and one of the few organizations to foresee the global financial crisis of 2008, believes that non-financial companies from emerging economies have been encouraged to increase leverage and overseas borrowing but might have been left inadequately hedged and susceptible to currency risks. “These factors have increased the risks facing these companies, implying the existence of ‘pockets of risk’ in particular sectors and jurisdictions”, Michael Chui, Ingo Fender and Vladyslav Sushko said in the organization’s new quarterly report released on Sunday. “If these risks were to materialize, adding to broader (emerging market) vulnerabilities, stress on corporate balance sheets could rapidly spill over into other sectors, inflicting losses on the corporate debt holdings of global asset managers, banks and other financial institutions.”

This could be a source of “powerful feedback loops” in the event of an exchange rate or an interest rate shock, the three economists warn. The concerns come after a so-called “taper tantrum” in May 2013, when the minutes of a Federal Reserve policy meeting sparked fears the central bank could start tapering off its $85 billion-a-month bond purchasing program. Emerging market currencies tumbled on the news as investors started to bring their dollars back to the U.S. in anticipation of higher interest rates. This gave a short and sharp insight into what could happen overseas if the yields on U.S. Treasurys suddenly spiked higher, although most expect the normalizing of interest rates to be facilitated at a smooth pace with the Federal Reserve managing market expectations and being alert to financial risks.

Tech has a booboo.

• Record S&P 500 Masks 47% of Nasdaq Mired in Bear Market (Bloomberg)

Beneath the U.S. stock market’s record-setting gains, trouble is stirring. About 47% of stocks in the Nasdaq Composite Index are down at least 20% from their peak in the last 12 months while more than 40% have fallen that much in the Russell 2000 Index and the Bloomberg IPO Index. That contrasts with the Standard & Poor’s 500 Index, which has closed at new highs 33 times in 2014 and where less than 6% of companies are in bear markets, data compiled by Bloomberg show. The divergence shows the appetite for risk is narrowing as the Federal Reserve reins in economic stimulus after a five-year rally that added almost $16 trillion to equity values.

It’s been three years since investors saw a 10% decline in the S&P 500 and they’re starting to avoid companies that will suffer the most when the market stumbles, said Skip Aylesworth, a portfolio manager for Hennessy Funds in Boston. “The small caps have had big runs and tend to get ahead of themselves,” Aylesworth said in a Sept. 10 phone interview. Hennessy Funds oversees about $5 billion. “It’s kind of like the tortoise and the hare, and they’re the hare. But then they get expensive, and when the market corrects, they get whacked.” The proportion of technology companies, small-caps and newly listed stocks stuck in their own personal bear markets has risen from 30% in March 2013, when the overall equity market surpassed its 2007 record. S&P 500 stocks with at least 20% losses have fallen since then, the data show.

Fool me once …

• Draghi’s $3.9 Trillion Ambition May Be a Stretch to Achieve (Bloomberg)

Mario Draghi’s €3 trillion ($3.9 trillion) ambition could be a stretch to achieve. New stimulus measures ranging from long-term loans to asset purchases probably aren’t enough to expand the European Central Bank’s balance sheet back to the size its president would like, Bloomberg’s monthly survey of economists shows. The first gauge of the ECB’s success will come this week when it issues the initial funds under a four-year lending program to banks. Draghi said this month he wants to boost the ECB’s assets to the level seen at the start of 2012, an increase of as much as €1 trillion from current levels. Investors are watching to see whether he’ll take the controversial step of large-scale quantitative easing to get there. “Draghi has put himself into a corner by announcing a quantitative target,” said Elwin de Groot, senior market economist at Rabobank. “As such, we envisage the possibility that if things don’t work out the way it’s hoped they will, the Governing Council may feel compelled to do proper QE after all.”

The ECB will allot the first funds under its so-called targeted longer-term refinancing operations on Sept. 18. The median estimate in the survey is that banks will receive €150 billion. Predictions ranged from €100 billion to €300 billion. The operation comes shortly before the end of the ECB’s Comprehensive Assessment of lenders’ balance sheets, aimed at ensuring the soundness of banks’ health. The results of the review, including a stress test, will be published next month and the ECB will start as euro-area bank supervisor in November. The ultimate value of the TLTROs, which run through 2016, and programs to buy asset-backed securities and covered bonds will be €985 billion, the Bloomberg survey shows. Against that, almost €350 billion of outstanding three-year loans made by the ECB to banks at the height of the euro-area debt crisis will mature and must be repaid by early next year. That would leave the three stimulus measures adding about a net €635 billion, well below the amount Draghi’s balance-sheet target implies.

Get ready to get rich, Europe!

• Draghi Prods Euro Area to Ready Ground for Economic Boost (Bloomberg)

Mario Draghi is about to give the euro-area economy a jump-start. He’s asking the currency bloc’s leaders to make sure they’re in gear. Over the next six weeks, the ECB will be rolling out measures that could begin to restore the central bank’s balance sheet to the levels it had at the height of the sovereign debt crisis. At a Sept. 12-13 meeting of finance ministers in Milan, he told them his efforts would have limited impact if they didn’t make their economies ready to absorb it. With the TLTRO liquidity scheme that starts on Sept. 18, an asset-purchase plan targeted at easing access to credit next month, and the potentially cathartic end to a year-long bank health review coming before November, Draghi’s ECB is increasing the intensity of its economic support. Political leaders are beginning to follow suit.

“The new measures together with the TLTROs will have a sizable impact on our balance sheet, which is expected to move toward the size it used to have at the beginning of 2012,” Draghi told reporters on Sept. 12. “No matter what the monetary and even fiscal stimulus has been decided, we won’t see much growth coming from these measures only if there are no serious structural reforms.” Draghi arrived in Milan with political will for those reforms at risk. While there are some stirrings of fiscal stimulus that could boost growth, such as a 300 billion-euro ($389 billion) plan floated by incoming EU Commission President Jean-Claude Juncker, governments are dragging their feet on measures to make the economy more efficient. Last week France and Italy were both scolded by the EU for their lack of progress.

“We need to accelerate the implementation of our ambitious structural reform agenda,” said Jeroen Dijsselbloem, the Dutch finance minister who leads meetings of euro-area finance chiefs. “We cannot solely rely on monetary policy, but need the appropriate policy mix.” In response, finance ministers said they will “take stock” of the need to reduce the tax burden on labor when discussing member states’ draft budgets in November.

• Scots Aren’t the Only Angry Bunch (Bloomberg)

This week’s referendum in Scotland could result in the U.K. losing almost one-third of its landmass, and 8% of its population, and, very likely, its present prime minister. In a summer rich with shocks, the breakup of a United Nations Security Council member suddenly seems more likely than the long-predicted fracturing of Iraq. Most people I spoke with when traveling through Scotland last month expected the battle for independence waged by the Scottish Nationalist Party to have been lost. Recent opinion polls, however, show that almost half of Scottish voters hope to break free of their London masters on Thursday. Their disaffection was not the work of a day. It has been in the making for at least three decades. Jason Cowley, editor of Britain’s leading political weekly, the New Statesman, correctly points out that Britain’s Conservative prime minister in the 1980s, Margaret Thatcher, did more for Scottish independence with her regime of privatization, deregulation and unfair taxation than any Scottish nationalist.

By some estimates, the deindustrialization that Thatcher presided over had more devastating effects in Scotland than in England. That’s why Thatcher’s Conservative Party is almost extinct in Scotland, and its current leaders, David Cameron, George Osborne and Boris Johnson, evoke a visceral hostility and scorn. This isn’t just class hatred for privately educated and plummy-accented Tories, or for the axis of Eton College, Rupert Murdoch’s News International and the City of London that they embody. Many Scots are unhappy, too, with the City-obsessed Labour Party, which under Tony Blair, Thatcher’s self-proclaimed heir, placed itself in the avant garde of marketization, initiating among other things the privatization of the National Health Service. Recriminations have now erupted in England as financial markets finally register the prospect of Scotland’s secession. But blaming Cameron, who fecklessly called the referendum and limited it to a binary choice, obscures the fact that the Scottish mutiny is part of a larger worldwide trend.

Yes, but …

• Alex Salmond: No Neverendum For Scotland (NS)

One question that has risen with increasing frequency, as the Scottish independence polls have narrowed, is whether a narrow No on Thursday would result in a second referendum in the near future. With the SNP expected to remain the dominant force at Holyrood, the potential exists for a “neverendum” (the term coined by Canadian writer Josh Freed to describe the repeated votes on Quebec’s status). But asked this morning on The Andrew Marr Show, whether “if it’s a No vote by a whisker”, he could come back for another “in a few years’ time”, Alex Salmond said that it was still his view that the result would stand for “a generation.” He said: “By that what I mean is that, if you remember the previous constitutional referendum in Scotland [on devolution], there was one in 1979 and then the next one was in 1997. That’s what I mean by a generation. In my opinion, and it is just my opinion, this is a once in a generation opportunity. ”

Asked whether he could pledge that “Alex Salmond will not bring back another referendum if you don’t win this one”, he added: “Well, that’s my view. In my view this is a once in a generation, perhaps even once in a lifetime opportunity for Scotland.” But as Salmond, who will turn 60 this year, was careful to state, this is just his view. Nicola Sturgeon, the 44-year-old deputy first minister, who has emerged more clearly than ever as his heir-in-waiting during the campaign, has suggested that another referendum could be held within 15 years (a generation is usually defined as 25 years). As Harry recently noted on our new May 2015 site, the nationalists’ demographic advantage means that they would be in a strong position to win a second vote. The possibility of a neverendum is one that Alistair Darling is understandably keen to forestall. He told Marr: “The one point that I do actually agree with Alex Salmond is that I think with Thursday we’ve got to decide this for a generation. I don’t know anybody who actually wants to go through another two-and-a-half year referendum.”

Blah.

• World Waits For White Smoke From The Fed (Reuters)

The U.S. Federal Reserve may give clearer hints on when it will hike the cost of borrowing in the United States in the coming week, as struggling Europe braces for a tight vote in Scotland on whether to leave the United Kingdom. As the U.S. economy picks up pace, its central bank is inching closer to raising interest rates, a move that will send ripples across the globe. In the euro zone, however, the European Central Bank is moving in the opposite direction in a desperate bid to rekindle growth and inflation. The United States is shaking off the hangover from a financial crisis that hammered Europe and even knocked mighty China off its stride. But the U.S. rebound, thanks in large part to cheap Fed money, now means Federal Reserve Chair Janet Yellen will have to decide when to pare back this support.

Further hints as to when the first U.S. rate hike in more than eight years will happen could come on Wednesday in a statement after the bank’s governors meet. “It does seem like a done deal that it is going to increase interest rates,” said Paul Dales of economics consultancy Capital Economics. “We are going into a new phase where the Fed is trying to bring things back to normal. It can send reverberations around the world economy.” Choosing when to increase the cost of borrowing in the world’s biggest economy – a move expected next year – is a delicate balancing act. Yellen and others will be trying to work out how to keep the economic recovery on a steady keel without stopping it before the effects of the upswing lead to higher wages.

“92% of millennials who don’t already own a home do not plan on buying one in the future. Ever.”

• California Home Sales Collapse, Prices Hit Wall (WolfStreet)

This must be part of the explanation why home sales in the expensive parts of California, which is where most people live, are collapsing: according to a Harris Poll on behalf of electronic broker Redfin, 92% of millennials who don’t already own a home do not plan on buying one in the future. Ever. These people, now between 25 and 34, are in their peak home-buying age. They’re the much sought-after first-time buyers. They’re the foundation of the market. But not this generation. Homeownership rate among them, according to the Commerce Department, already plunged from 41% in 2008 to 36% currently; as opposed to 65% for all Americans. These folks are not “pent-up demand” accumulating on the sidelines, as the wishful thinkers have proclaimed. “Millennials who flock straight from college to San Francisco and other expensive cities are making a choice to spend their income on quadruple-digit rents and eight-dollar gourmet hot dogs from trendy food trucks,” explained Redfin San Francisco agent Mark Colwell.

“This means they’re not saving for a down payment, further removing them from the housing market.” So Redfin checked Census data to find the 20 Zip codes in the country with the highest population of educated millennials. Median household income in these neighborhoods is 50% higher than in all ZIP codes. Median home prices are on average $255,000 higher as well. And the average down payment for homes in these neighborhoods is $80,000. A down payment that is out of reach for most millennials. A new report about consumer finances by the Federal Reserve shows that the median family headed by a millennial earned $35,509 in 2013 dollars, 6% less than their counterparts in the Fed’s first survey of this type in 1989. Actually, median households headed by someone under 55 also made less than their predecessors in 1989 (this is what inflation does to real wages; FOMC members who’re clamoring for more, or any, inflation should read these reports from other corners of the Fed).

Yup.

• ECB’s Securities Purchases A Risk For Taxpayers: German Central Banker (CNBC)

European taxpayers should not be left accountable for the securities that form part of the European Central Bank’s (ECB) new asset-purchase program, Jens Weidmann, the president of the Deutsche Bundesbank has told CNBC. The central bank is about to embark on the purchase of asset-backed securities (ABS) in an attempt to boost the region’s economy and boost inflation. This means euro zone banks would sell the ECB their loans and other types of credit that have been packaged together. The ECB has said that it would only purchase less risky “senior” tranches of securitized debts and loans, but also wants to purchase riskier “mezzanine” tranches which are deemed to be more effective. These riskier tranches would require public guarantees, according to ECB President Mario Draghi, which is the stumbling block for Weidmann, who is also a member of the ECB’s Governing Council.

“I am more skeptical about these initiatives which rely on purchasing ABSs and transferring risk from banks’ balance sheets to the taxpayer,” he told CNBC in Milan on Saturday. ABS became infamous in the latter part of the last decade when the complex bundles of securities were believed to have played a key role in the global financial crash of 2008. In a speech last week Draghi said the “senior” tranches of ABS can be considered high-quality assets. He cited data from the Association of Financial Markets in Europe which estimated that only 0.12% of European residential mortgage-backed securities left outstanding in mid-2007 had defaulted since that date. Weidmann told CNBC that the revival of the ABS market can be beneficial to the economy, adding that it “liberates liquidity and liberates capital in the banks’ balance sheet.”

With the kind of personal debt the Swedes have, such turmoil may not end well.

• Election Throws Sweden Into Turmoil as Nationalists Advance (Bloomberg)

Sweden’s election threw the nation’s political establishment into turmoil as backing for the anti-immigration Sweden Democrats more than doubled, leaving the largest Nordic economy facing a hung parliament. The three-party Social Democratic opposition led by Stefan Loefven won 43.7%, versus 39.3% for the four-party government of Prime Minister Fredrik Reinfeldt, with all the votes counted. The Sweden Democrats garnered 12.9% to become the third largest party. The result, which sent the krona lower, marks an end to eight years of rule by Reinfeldt’s conservative-led coalition, which delivered successive rounds of tax cuts without adding to Sweden’s debt.

The premier said he will hand in his resignation today as the responsibility of forming a new government falls to the Social Democrats, which won the most votes. “We have a new unique parliamentary situation in Sweden,” Loefven said at an election-night party. He vowed to keep the Sweden Democrats from influence, opening the doors to government parties to “put the interest of Sweden first.” Traders and investors have been bracing themselves for market turbulence amid signs the election would fail to produce a clear winner.

Boom boom.

• Australians Face Repayment Shock on High-Risk Mortgages (Bloomberg)

Sydney mortgage broker Luke Gardiner, who started his business just last year, is already overwhelmed with customers. “There has not been a slow period in the last 12 months,” said the broker, whose Gardiner Financial Services Pty arranged more than A$5 million ($4.5 million) in mortgages in both June and July, about A$1 million more than in May. “I’ve been waiting for a break, but it hasn’t come.” Driving the growth is demand for high-risk mortgages such as interest-only loans and financing to buy rental properties. That’s setting the stage for a jump in mortgage delinquencies when interest rates increase from record lows, Moody’s Investors Service said this month. The easier terms are fueling housing demand, boosting prices 11% in major cities in August from a year earlier. “There has been an advent of higher-risk lending,” said Nader Naeimi, head of dynamic asset allocation at Sydney-based AMP Capital Investors Ltd., which manages about A$144 billion. The regulator “hasn’t been able to curb it.”

The Australian Prudential Regulation Authority in May warned of growing evidence of “lending with higher risk characteristics.” It issued draft guidelines urging lenders to assess whether borrowers were capable of repaying mortgages at higher interest rates. It also asked banks to conduct regular stress tests on its loan books to determine the impact of rising unemployment, interest rates and falling property prices. Interest-only mortgages jumped to 43% of all new home lending in the three months through June 30, and credit to buy rental properties climbed to 38%, both record highs, according to APRA data starting in the first quarter of 2008. “The higher proportion of investment and interest-only lending suggests that APRA’s efforts have not slowed a broad increase in higher-risk exposures,” Ilya Serov, senior credit officer at Moody’s, wrote in a Sept. 1 report.

Time to go, François.

• France Braces For A ‘Tough Autumn’ (CNBC)

With all the sound and fury coming from the debate over the future of Scotland, the tough choices facing France appears to have slipped off the radar. A confidence vote on Prime Minister Manuel Valls’ new cabinet, scheduled for Tuesday, equally has the potential to shake up markets, analysts warn. President Francois Hollande announced the shake-up of his cabinet at the end of August – a upheaval that saw left-leaning Economy Minister Arnaud Montebourg depart. This attempt to regain a handle on power by the embattled President, who is currently under fire following the publication of a headline-grabbing memoir by his former partner which claimed he didn’t like poor people, may yet backfire. While the government is expected to pass through, there are likely to be a few key abstentions from members of Hollande’s Socialist Party (PS), which will emphasize the fragility of the government as it tries to push through economic reforms. “The vote is likely to display the growing rift inside the PS,” Antonio Barroso, senior vice president at Teneo Intelligence, wrote in a research note Monday.

It could even lead to the dissolution of the government, he warned, as he forecast a “tough autumn” for the country’s government. “It is likely that rogue deputies will continue to defy Valls in the coming months, with the 2015 budget being the first major test that the PM will face in the coming weeks,” Barroso wrote. Hollande’s budget is increasingly worrying to investors. The French economy, as measured in gross domestic product, is forecast to grow 0.4% on average this year and 1% in 2015 by the government. At the same time, inflation is expected to remain low and the government is planning to cut expenditure, but not increase taxes. This will mean that the public deficit to GDP ratio will rise to 4.4% this year, according to Barclays economists’ calculations, and that France will not hit the 3% public deficit to GDP target until 2017 – which could get it in trouble with its European Union partners.

China can lie with the best.

• Li’s Options Narrow as China Growth Slowdown Deepens (Bloomberg)

Chinese Premier Li Keqiang’s options have narrowed: stimulate or miss his 2014 growth target. The weakest industrial-output expansion since the global financial crisis, and moderating investment and retail sales growth shown in data released Sept. 13, underscore the risks of a deepening economic slowdown led by a slumping property market. Stocks, metals and currencies including the Australian dollar fell as analysts cut their forecasts for 2014 growth. “This is a pretty important wakeup call that they need to do more,” said Helen Qiao, chief Greater China economist at Morgan Stanley in Hong Kong. “The government is trying very hard to reach this particular target rate, which will not necessarily be mission impossible if they roll out more easing measures starting from now. The risk is they could underestimate how much more easing tools they need.”

The slowdown in August economic data that included a second straight decline in imports and a 40% drop in the broadest measure of new credit will test Li’s resolve to avoid stronger monetary stimulus to meet his 7.5% goal. An unprecedented lending spree from 2009 to 2013 led to a surge in debt on a scale that’s triggered banking crises in other economies, according to the International Monetary Fund, underscoring the premier’s reluctance to open the spigot. Growth in gross domestic product may slip to 6.5% to 7% in the third quarter if September numbers are also weak, Australia & New Zealand Banking Group analysts estimate, down from 7.5% in the April-June period. A monthly GDP tracker compiled by Bloomberg shows the economy expanding 6.3% in August from a year earlier, down from 7.4% in July. Royal Bank of Scotland cut its forecast for China’s 2014 economic growth to 7.2% from 7.6%, citing weak momentum indicated by the August data.

That should read: they will.

• Bad Loans Could Bust China (Bloomberg)

The risk of what Nobel laureate Paul Krugman calls “Japanification” – a semi-permanent economic funk – has haunted China for at least a couple years now. Last week a Bank of America Merrill Lynch report again asked, “Will China Repeat Japan’s Experience?” Let’s dispense with the suspense: Yes, China very likely will. And the outcome will have far more serious global implications than Krugman’s main worry, which focuses on the chances of stagnation in Europe. China’s “severely under-capitalized financial system,” “imbalanced growth” and chronic “overcapacity” all remind Merrill Lynch analysts Naoki Kamiyama and David Cui of Japan in 1992, when its bubble troubles first began to paralyze the economy. China is even more reliant on exports than Japan was in the 1990s, and its all-important property market now “may be tipping over.”

Most worrying is the shaky banking sector. What concerns Kamiyama and Cui is the lack of bold action in Beijing at a time when the scale of Chinese bad debt may be higher than Japan’s ever was; they believe non-performing loan ratios are “significantly into double-digit” territory. In the first half of this year, the analysts estimate, commercial banks had to book larger non-performing loan liabilities than for all of 2013. Mind you, this comes even as the government claims financial imbalances are being addressed. As recently as July, total social financing, a proxy for debt, was still growing by almost 1% y-o-y, a rate well above China’s nominal GDP growth.

In other words, China has spent much of this year adding to its debt and credit bubbles – not curbing them. If this were 1992, China could simply force state-owned banks and enterprises to rein in excesses and ride out the resulting modest hit to gross domestic product. But China passed the point of no return after the crash of Lehman Brothers in 2008, when it unleashed a $652 billion stimulus package, followed by untold smaller ones since. The moves put China, in the words of New York hedge-fund manager James Chanos, on a “treadmill to hell.” If Beijing were to attempt a broad credit shakeout now, virtually every sector of the economy would suffer. The risks of social unrest would soar.

Somone get rid of these clowns.

• Kiev Threatens To Restart Nuclear Weapons Program (RT)

Kiev’s promise to restart its nuclear weapons program if it doesn’t get enough support from the West is completely insane, be it real or just an empty threat, political commentator Daniel Patrick Welch told RT. “If we cannot protect Ukraine today, if the world doesn’t help us, we will have to go back to the development of nuclear weapons, which will protect us from Russia,” Ukrainian Defense Minister Valery Geletey said in an interview with Ukrainian TV, also claiming that NATO members have already started supplying Kiev with conventional weapons.

RT: Is the prospect of a nuclear Ukraine something to be concerned about?

Daniel Patrick Welch: You know, your guess is as good as mine. I think what it shows first and foremost is that the inmates are fully in charge of the asylum here. This is a completely insane threat. If it is real then it is suicidal. And if it is a threat then it is petulant. In the same briefing Geletey mentioned that arms were starting to come in from their new friends in the NATO alliance. So it really is just a matter of watching, and speaks of the fragility of this truce. There is nothing there. These people in Kiev are desperate to keep the war on Russia going at all possible costs.

RT: And Ukraine’s neighboring countries, what do they have to say about that?

DPW: Well, I think slowly, I mean these people, some of them – Slovakia, to some extent the Czechs, Hungary, are creeping out of under the jackboot of American control. The Americans obviously put them up to everything they say. They know in advance. They know exactly what he is going to say. Now the Eastern European bordering states have to be realizing that they have backed a really bad horse in this race. And I can’t imagine that this isn’t seen as something incredibly destabilizing and dangerous.

Then again, Kiev has lied about everything lese.

• Kiev Says NATO Members Have Started Supplying Weapons (RT)

NATO member states have started supplying weapons to Ukraine, the country’s Defense Minister said on TV. His comments came a few days after a similar statement by a Ukrainian presidential aide sparked a diplomatic scandal and a rash of denials. In an interview with Channel 5, Ukrainian Defense Minister Valery Geletey said that he had held verbal consultations with the defense ministers of the “leading countries of the world, those that can help us, and they heard us. We have the supply of arms under way.” “This process has begun, and I feel that this is exactly the way we need to go,” the minister said. Ukrainian President Petro Poroshenko, who attended the Sept. 4-5 NATO summit in Wales, announced that he had negotiated direct modern weapons supplies with a number of NATO member states.

Poroshenko claimed that some of the NATO member states said during bilateral consultations they are ready to supply Ukraine with lethal and non-lethal arms, including “high precision weapons,” as well as with medical equipment. NATO has had repeatedly said that the alliance is not going to supply any weapons or military equipment to Ukraine. At the same time, NATO Secretary-General Anders Fogh Rasmussen said that the alliance would not interfere if member states made decisions of their own regarding arms supply to Ukraine. When Poroshenko’s aide Yury Lutsenko wrote on his Facebook page that the US, along with France, Italy, Poland and Norway, would supply modern weapons to Ukraine, the news prompted all the countries mentioned in Lutsenko’s post to say they had no information about supplies.

What a stupid denial this is.

• Glenn Greenwald Accuses New Zealand PM Over Spying Claims (Guardian)

An already tumultuous New Zealand election campaign took another dramatic turn less than a week before polling day when the prime minister, John Key, responded angrily to claims by the American journalist Glenn Greenwald that he had been “deceiving the public” over assurances on spying. Greenwald, who is visiting New Zealand at the invitation of the German internet entrepreneur Kim Dotcom, says he will produce documents provided by the NSA whistleblower Edward Snowden that prove the New Zealand government approved mass surveillance of its residents by the Government Communications Security Bureau (GCSB), New Zealand’s equivalent of the NSA. Dotcom, who is sought for extradition from New Zealand by the US on copyright charges relating to his now defunct Megaupload file-storage site, is hosting an event in Auckland on Monday called The Moment of Truth, which doubles as a rally for the Dotcom-founded Internet party.

Greenwald has promised to produce his evidence at the event, while Dotcom is pledging to show further links between Key and Hollywood relating to his own case. Adding to the spectacle, Julian Assange is expected to beam in via video link from the Ecuadorian embassy in London, while Dotcom has hinted that Snowden may also appear on the big screen from Moscow. In media interviews, Key has repeatedly dismissed Greenwald as “Dotcom’s little henchman”. Speaking on TVNZ’s Q+A programme, he acknowledged that the government had in 2012 considered a “mass cyber-protection” proposal, which he said was “really a Norton antivirus at a very high level”, but rejected it. Greenwald, he argued, would therefore have seen incomplete material. “This is what happens when you hack in to illegal information, when you wander down to New Zealand six days before an election trying to do Dotcom’s bidding – what happens is you get half the story,” said Key.

He said he was ready to declassify secret documents to support his argument. “There is no ambiguity here. There is no and there never has been any mass surveillance.” Greenwald responded by saying: “I absolutely stand by everything I’ve said.” He told 3 News: “They did far more than look at the idea; they adopted the idea and took steps to make it a reality.” He added: “I’ve done reporting of surveillance all over the world and a lot of governments haven’t liked what I’ve said, but I’ve never seen a head of government lose their dignity and get down in the mud and start chucking names to discredit the journalist in order to discredit the journalism.”

One of the world’s oldest living species …

• Wild Chinese Sturgeon On Brink Of Extinction In Polluted Yangtze River (AFP)

The fish has survived for 140m years but failed to reproduce last year according to Chinese researchers The wild Chinese sturgeon is at risk of extinction after none of the rare fish were detected reproducing naturally in the polluted and crowded Yangtze river last year. One of the world’s oldest living species, the wild Chinese sturgeon is thought to have existed for more than 140m years but has seen its numbers crash as China’s economic boom has brought pollution, dams and boat traffic along the world’s third-longest river. For the first time since researchers began keeping records 32 years ago, there was no natural reproduction of wild Chinese sturgeon in 2013, according to a report published by the Chinese Academy of Fishery Sciences. No eggs were found to have been laid by wild sturgeons in an area in central China’s Hubei province, and no young sturgeons were found swimming along the Yangtze toward the sea in August, the month when they typically do so.

“No natural reproduction means that the sturgeons would not expand its population and without protection, they might risk extinction,” Wei Qiwei, an investigator with the academy, told China’s official Xinhua news agency on Saturday. The fish is classed as “critically endangered” on the International Union for the Conservation of Nature’s “red list” of threatened species, just one level ahead of “extinct in the wild”. Only around 100 of the sturgeon remain, Wei said, compared with several thousand in the 1980s. Chinese authorities have built dozens of dams – including the world’s largest, the Three Gorges – along the Yangtze river, which campaigners say have led to environmental degradation and disrupted the habitats of a range of endangered species. Many sturgeon have also been killed, injured by ship propellers or after becoming tangled in fishermen’s nets.

Home › Forums › Debt Rattle Sep 15 2014: The Yin and Yang of Growth and Power