Christopher Helin Star auto on steep grade, San Francisco 1922

The quote of the day today must be this one from Belgian EU Trade Commissioner Karel De Gucht in the aftermath of the Scottish rejection of independence: “A Europe driven by self-determination of peoples … is ungovernable … ”

I don’t think he understands the implications of what he says, and I’m quite sure he completely misses out on the mastodont sized problem he – quite accurately despite himself- describes.

Which is something along the lines of ‘Europeans should stop wanting to make their own decisions, because that makes it hard for us in Brussels to make those decisions for them’.

There are precious few voices in Brussels who view the EU project with a critical eye. Except for Nigel Farage and perhaps one or two others, they’re all convinced that the EU is an entity that does good, in the same way that people who work for the IMF, the World Bank and NATO – just to name a few – do.

And democratic values and proceedings can be pesky little nuisances in these ‘greater power for the greater good’ visions of society. After all, it was newly elected EU head Jean-Claude Juncker himself who stated a few years back that “When it becomes serious, you have to lie.” That, too, like De Gucht’s comment above, is a way to pervert democracy.

The people working at the EU, and most politicians in European capitals and elsewhere in the world, don’t understand the spirit of their time. Moreover, they don’t think they need to, because they’re convinced they can mold that spirit as they see fit.

The overriding idea is that there can be no question that centralized power is beneficial, and the more of it there is, the better it gets. And it’s admittedly true that more power will flow to Brussels as time goes by, i’s a process built into the entire very structure. But that doesn’t make it a good thing.

To date, there are no major parties in Europe where eurosceptics are elected to major positions; the system is quite foolproof when it comes to that. The rise of Beppe Grillo’s M5S, France’s Front National, and UKIP in Britain, are still no more than nuisances to the EU elite. As long as they can be kept out of their respective countries’ governments, all will be well, is the feeling.

And Brussels by now has plenty experience in influencing how governments are formed. It has inserted plenty technocrats in southern Europe, and played a questionable role in Kiev. From where they’re sitting, time is on their side, and they’re working hard to establish, for instance, a full banking union. Once that is done, the way back gets much harder, or so is their line of thinking.

But as I said, they don’t understand their time. They’ve fallen way behind the curve, and no, they can’t mold how people feel about the world they live in. They’re behind the curve because they refuse to accept the new economic reality that Europe not only faces, but is deeply mired in.

If they would accept that reality, their project would start to look very different, and certainly not grand, or modern, beneficial or benign. But why should they have such worries if absolutely everyone around them is absolutely convinced that the recovery is just around the corner?

Not even the Scots doubt that. That’s not why they wanted independence. For Yes! campaign leader Alex Salmond, it was about increasing wealth, not about making your own decisions in times of less wealth. Nigel Farage wants Britain out of the EU because he thinks that would make it richer.

The only one in politics – in his own way – that I know who doubts this mirage is Italy’s Grillo. And while the Italian economy is sinking further beyond salvation, ECB head Mario Draghi is jockeying for position to become Italy’s next leader, once PM Renzi has been tarred and feathered. No matter how deep their country sinks, they’ll do anything to keep any fundamental change from taking place. Never doubt the model.

A nice twist on all this is provided by Giovanni Dalla-Valle, an activist for Venetian independence, in an interview with RT:

In your opinion, how will the EU react to Veneto independency? Will they be interested in a new state in the union?

GDV: I suspect that Italy is bankrupt. So there will be an interest at some point for Europe to have a very productive and rich region like Veneto becoming a state, becoming a nation; it is a bit similar to what is happening to Bayern [Bavaria] or other areas with an independent spirit like Flanders or Catalonia… Basically, a nation that can actually help Europe, because it has got a GDP which is higher than in Romania, Hungary, for example, rather than have Italy, which is going bankrupt.

I must admit, I’m greatly amused by the notion that at some point Brussels may start encouraging separatists to move for independence, provided they live in rich regions. But it would be a political maze set in a quagmire, and it at least seems much easier for the EU to try make it impossible for anyone to secede.

Which would not work, since it’s against the spirit of our time, but Brussels doesn’t know that. Or recognize it. Still, that attitude is bound to run into huge legal complications, and that makes it look like a mere play for time.

Spain’s Mariano Rajoy this morning once again reiterated his point that a Catalunya referendum violates the Spanish constitution. But it’s exactly that constitution which the Catalans want to get rid of. So they prepare a law in their own parliament that says it’s legal. An exercise in circle jerk absurdity. If Brussels sides with Rajoy, it itself violates the UN charter that all people have the right to self-determination. And so does Rajoy himself, of course, constitution or not.

The Wall Street Journal suggests that the prospect and promise of a smooth Velvet Divorce transition into independence, while maintaining EU membership and other perks, may tempt European regions to go for it. But the EU can’t stand up to its biggest members, Spain, Italy, France, Germany, no matter how desolate some of their economies may be or become.

I had hoped that Scotland would have pulled the trigger on this, not even specifically because of the Scottish situation, but because the timing is (was) exactly right (though few will see that), and because it would have been a lightning rod example across Europe of how these things can move in a peaceful, civilized, and dignified. Not a minor point in any sense.

I fear things may proceed in different, – much – less friendly, ways now, but that won’t stop the call and desire for freedom. Neither freedom from the countries some regions are now part of, nor from the EU itself. The deteriorating economic situation makes that inevitable.

The spirit of our time is determined by decreasing wealth (not just decreasing growth, growth is long gone), and in that mindset de-centralization is as unavoidable as any force of nature. We would all do well to accept and recognize that.

But who am I kidding? Most of us won’t do nothing of the kind until those biblical (or is that another book?) 100,000 frogs start falling from the sky. We ourselves don’t grasp the spirit of our time.

• EU Relief At Scotland’s “No” Tinged With Fear Of Nationalism (Reuters)

European Union and NATO officials expressed undisguised relief on Friday at Scotland’s clear vote against independence from Britain, but some fretted that the genie of separatism may be out of the bottle in Europe. EU partners had mostly kept quiet in the run-up to Thursday’s referendum, lest their fears of a break-up of the United Kingdom leading to contagion elsewhere in Europe be seized upon as interference. But as soon as the Scottish “No” was secure, they voiced satisfaction and drew consequences for their own countries, for the 28-nation EU and for the Western alliance. NATO Secretary-General Anders Fogh Rasmussen congratulated British Prime Minister David Cameron and said he was sure the United Kingdom would continue to play a leading role in keeping the U.S.-led defence alliance strong.

Spain’s two mainstream national parties welcomed the outcome as showing that the northwestern region of Catalonia, expected to announce bitterly opposed plans on Friday for its own independence referendum, would be better off staying in Spain. In Brussels, the European Commission said the Scottish vote was good for a “united, open and stronger Europe” – a veiled message that EU officials hope the outcome will strengthen chances of Britain voting to stay in the bloc in a promised referendum in 2017. “The European Commission welcomes the fact that during the debate over the past years, the Scottish government and the Scottish people have repeatedly reaffirmed their European commitment,” Commission President Jose Manuel Barroso said.

Belgian EU Trade Commissioner Karel De Gucht, whose native Flanders region is in thrall to a growing nationalist movement, said a Scottish split would have been “cataclysmic” for Europe, triggering a domino effect across the continent. “If it had happened in Scotland, I think it would have been a political landslide on the scale of the break-up of the Soviet Union,” said De Gucht, a liberal who does not support demands from some of his fellow Flemings for their own state. “A Europe driven by self-determination of peoples … is ungovernable because you’d have dozens of entities but areas of policy for which you need unanimity or a very large majority,” he said, adding that “parts of former countries” might behave in very nationalistic ways.

Read more …

• European Integration Emboldens Europe’s Separatists (WSJ)

Scotland’s referendum has galvanized national movements across Europe. The irony is that this has been made possible in part by the European Union, for decades the driver of economic and political integration across a once war-torn continent. In the past week, Edinburgh has been like a magnet for politicians across Europe who regard their regions as nations. Representatives from Wales, the Basque Country, Flanders, Catalonia, Galicia, Corsica, Sardinia and Friesland visited the Scottish capital. They have been emboldened in part by the safety net that the EU is perceived to offer to small countries. The institution that was created to make national borders irrelevant may perversely play a role in creating new ones.

Even as voters in many European countries register growing dissatisfaction with the EU, membership offers smaller nationalities the hope of separation with a minimum of disruption. Today, “separatism has a spring in its step,” says Charles Grant, director of the London-based Centre for European Reform. Europe’s borders have already fractured in the last 20 years. With the exception of Czechoslovakia, which split in 1993, these changes have been born out of the violent breakup of the former Yugoslavia. What is seducing nationalists these days is what Michael Desch, professor of political science at the University of Notre Dame, calls the prospect of Velvet Divorce: a gentle segue into an independent state while preserving membership of institutions like the EU and the North Atlantic Treaty Organization and retaining the same currency.

Read more …

• Madrid Ready To Fight As Catalonia ‘Legalizes’ Vote (Local.es)

Spain’s central government will hold an extraordinary cabinet meeting on Saturday or Sunday if Catalonia’s regional parliament approves the “consultation” law on the referendum on Friday, a move it hopes will make a possible independence vote more legal. Although Catalan daily La Vanguardia has reported that Catalan president Artur Mas will not call the November 9th referendum on self-rule immediately after the “consultation” bill is passed, Madrid wants to have its appeal for the State Council and Constitutional Court ready as soon as possible. With this document, Spain’s ruling right-wing Popular Party hopes to strengthen its position vis-à-vis what it considers an attack on the country’s constitution. On the other hand, Artur Mas hopes the “consultation” bill expected to be passed by landslide in the Catalan parliament on Friday will make the November vote legal in the face of very strong opposition by the PP.

“Everyone in Europe thinks that these processes are hugely negative, financially and economically,” Spanish PM Mariano Rajoy told the Spanish parliament on Wednesday with regard to Scotland and Catalonia’s independence bids. Now that Scottish voters decisively voted to stay in the United Kingdom, the uncertainty over when Artus Mas will take his next step to Catalonia’s independence referendum has been magnified. “Today we approve the law, then we go over it and correct it, once it’s published the law comes into force and the President (Artur Mas) can sign the decree for the referendum,” Catalan parliamentary secretary Josep Rull told Spanish radio station RNE. Even though Mas has assured pro-separatist Catalans that the vote will be held, he has also hinted that the referendum may be cancelled if it doesn’t have the “full democratic guarantees” of Spain’s Constitutional Court.

Read more …

• ‘Independent Veneto Can Help EU’ (RT)

The EU would be interested in having independent Veneto because its GDP is higher than Romania’s or Hungary’s, while Italy is going bankrupt, Giovanni Dalla-Valle, an activist for Venetian independence, told RT.

RT: Recently we’re hearing about the willingness of different European regions to become independent. Why does the Veneto region, which is currently part of Italy, want to become independent from Italy?

Giovanni Dalla-Valle: They have got 4,000 years of history, they have never really accepted going under the rule of Italy. The original plebiscite in 1866 was a kind of cheat widely recognized. Then they suffered a lot because they are one of the areas that are most productive in Italy. They produce 140 billion euros of GDP per year and they have got provinces like Piacenza, Treviso that export as much as Portugal and Greece together. However, they are not treated fairly by Rome. They have got taxation that now has reached levels of nearly 70 percent of income for a corporation, for a company…They can`t cope anymore with this extreme level of exploitation that they get from the central government.

RT: What is Veneto uniqueness all about?

GDV: I guess all Italian peninsulas have got plenty of different people with different histories, very fascinating glorious histories. Italy has always been a group of different peoples; it has never been really a united nation. I think Veneto has got this pride about the Serenissima, the Republic of St. Marc that with more than 1,000 years of history were known internationally for being of a high level of civilization mainly in cultural, commercial, artistic aspects and exporting culture all over the world.

Read more …

Why keep up the pretense?

• Fresh Week Of Woes For France, Downgrade Looms (CNBC)

It’s been a difficult week for French president, Francois Hollande, and it might get worse as rumors and analysts suggest the country’s debt rating is about to be cut. Earlier this week, France’s reshuffled government got off to a shaky start after narrowly winning a confidence vote on key economic reforms, marked by growing discontent from Socialist ranks. And on Thursday, the president faced hundreds of journalists during his bi-annual press conference, once again overshadowed by his private life following the release of his former partner’s tell-all book “Thank You For This Moment”. To add a final nail in this week’s coffin, the French Opinion newspaper reported on Thursday that the government had been notified that credit rating agency Moody’s would downgrade the country’s rating; a report the government swiftly denied.

If Moody’s does downgrade its rating of France – to AA2 from AA1 – it will catch up with the other major credit ratings agencies S&P and Fitch who both downgraded their ratings in November and July 2013 respectively. A downgrade “would be warranted”, Jennifer McKeown, senior European economist at Capital Economics told CNBC. For Francois Cabau, European economist at Barclays, a Moody’s rating cut wouldn’t come as a surprise, “particularly in light of recent events”. France’s attempts to contain and bring its public deficit down to levels agreed by Brussels have repeatedly failed. The French finance minister, Michel Spain, announced on September 10 that the country would break its fiscal promise to bring deficit at or below 3% of gross domestic product by 2015. “With growth and inflation weak, the deficit reduction we are planning for 2015 will be limited with a deficit around 4.3% of gross domestic product in 2015 and coming under the three% threshold in 2017,” Sapin said at the time.

Read more …

Ouch!

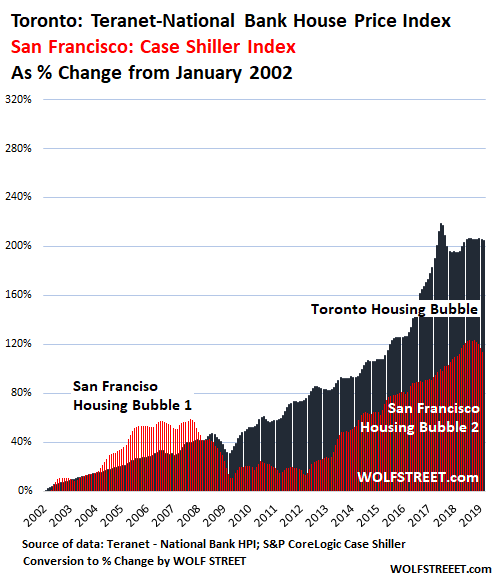

• US Housing Starts Drop 14.4%, Multi-Family Units Plunge 31.5% (Zero Hedge)

One look at the August housing starts and permits data, and one will wonder just how is it possible that yesterday NAHB homebuilder confidence rose to a 9 year high, when according to the US Department of Commerce both Housing Start and Permits tumbled in the past month, with the housing “leading indicator” that is Permits sliding 5.6% from 1040K to 998K, and declining sequentially in every region of the US, with double digit drops in the Northeast and the Midwest, while Housing Starts tumbled by 14.4% from 1117K, to only 956K, wildly missing Wall Street expectations of “only” a 5.2% drop to 1037K.

But while single-family units remained roughly flat in their depressed state, which hasn’t moved much if at all since the start of 2013, it was multi-family units that were the most volatile on the margin once again, dropping from 396K to 343K, or 13.4% for permits, and a whopping 31.5% for starts. While one can doubt the veracity of such volatile data, one thing is clear: Wall Street is having trouble with clearing multi-family housing, which also means that builders are confused whether to start new multi-family units or just dump the whole theme, now that the PE firms are leaving the own-to-rent business entirely.

Read more …

Endless nothing: banks don’t want to borrow at 0.15%, not if they have to lend out the money.

• ECB Throws a Party, Nobody Shows Up (Bloomberg)

European Central Bank President Mario Draghi is a smart guy, with a career including stints at Goldman Sachs, the World Bank and the Bank for International Settlements. So there must be a reason he has created a bank-lending program that not many banks want to borrow from, and an asset-backed bond purchase program that I can’t find a single market participant to applaud. Here’s my take on Draghi’s tactics. He would like to unleash a full quantitative-easing program echoing the Federal Reserve and the Bank of England, but he can’t get it past the Bundesbank. By inching that way, however, with increasingly QE-style programs that are doomed to fail, he’s engaged in a slow Machiavellian seduction that will lead the German central bank into acquiescence. The ECB held the first of its so-called targeted longer-term refinancing operations today. Banks in the euro region borrowed just 82.6 billion euros ($106.5 billion) from the newfangled facility, falling short of the 100 billion euros to 300 billion euros predicted by economists in a Bloomberg survey.

The program is designed to funnel cash into the banking system, which in turn should make its way into the economy and boost investment, jobs and growth. European banks, however, are about to undergo scrutiny of the health of their balance sheets, with reviews of their asset quality and their liquidity coverage ratios. In the absence of companies beating down your door for loans, you would have to be a brave (or foolish) bank treasurer to play fast and loose with your balance sheet, no matter how generous the ECB’s lending terms. Draghi said in August that he was hoping commercial banks might line up for as much as 850 billion euros from the TLTRO cash trough. Earlier this month, he said the ECB wanted to “steer the size of our balance sheet toward the dimensions it used to have at the beginning of 2012,” meaning as much as 1 trillion euros in new assets. Today’s results suggest that might be a hard slog.

Read more …

• European Central Bank Gets Another Shove Toward QE (MarketWatch)

Try again, Mario. Eurozone banks turned up their nose Thursday at a new round of cheap, four-year loans provided by the European Central Bank. Known as targeted long-term refinancing operations, or TLTROs, banks borrowed just 82.6 billion euros ($16.9 billion) from the new facility. Anything below 100 billion euros was going to be viewed as a disappointment. The loans were announced in June alongside rate cuts and were touted by European Central Bank President Mario Draghi as a tool aimed at encouraging banks to use the cheap liquidity to provide loans to companies, alleviating a long-running credit crunch that has remained a drag on the region’s economic recovery. So why didn’t the banks take it up? There are some good reasons, and analysts stress that the outcome wasn’t completely surprising. The ECB’s tough bank stress tests – the Asset Quality Review – are due next month, which may have discouraged banks from adding to their balance sheets.

“No wonder banks are keeping their balance sheets as clean as possible and not engaging as anything that either makes them look like they are lending to risky borrowers, or that they are desperate and need cheap funds from the ECB to keep afloat,” said Kathleen Brooks, research director at Forex.com in London. “Thus, the ECB could have shot itself in the foot with the timing of this auction.” Thursday’s auction isn’t the last word. There are several more operations, and banks may be more eager to take advantage of the funds once the tests are complete. The ECB is also preparing to purchase asset-backed securities in coming weeks, as well, a form of lightweight quantitative easing that Draghi and company also hope will boost activity and help stave off the threat of deflation. But the bottom line may be that the ECB, which has continued to see its balance sheet shrink, will continue to feel pressure to eventually pull out all the stops.

Read more …

• Are Stock And Bond Traders Really Reading Fed Differently? (MarketWatch)

Bond traders look at Janet Yellen and see a central bank chief ready to raise rates next year at a slightly faster pace than previously imagined, while stock investors supposedly see a dove, more worried about a weak job recovery. In reality, the diverging market reactions are partly due to a question of timing. “From an equity perspective, the Fed is reacting to better economic data, which in theory should be better for stocks,” said Anthony Valeri, senior vice president of fixed-income research at LPL Financial. “Yes, the stock market gets nervous when the Fed hikes rates or gets close to hiking rates, but it’s still a long ways away,” and the language in the statement was balanced enough to reassure equity investors.

It’s a different story for bonds, which are directly affected by Fed rate hikes, particularly at the short end of the curve, he noted. Moreover, bond traders came into the Fed meeting already pricing in far less aggressive rate hikes than the Federal Open Market Committee had projected in its forecasts, known as the dot plot. In fact, even after the bond selloff, Treasurys are still well behind the Fed, which expects a Fed funds rate around 60 basis points higher than the 0.75% level predicted by Fed funds futures, he said. Bond market participants appeared to take the Federal Reserve’s Wednesday statement, and Fed Chairwoman Janet Yellen’s subsequent news conference, as a warning that rates may rise a little faster than had been anticipated when they come. Bonds extended their drop Thursday, pushing the yield on the 10-year Treasury note to its highest level since early July.

Stocks, meanwhile, rallied, with strategists offering the explanation that investors were comforted by the Federal Open Market Committee’s decision to maintain its pledge to keep rates low for a “considerable time,” while also emphasizing a “significant underutilization of labor resources.” Stocks resumed their march to the upside in Thursday’s session, propelling the Dow and the S&P 500 into record territory. Bank of America Merrill Lynch credit strategist Hans Mikkelsen said the divergence between bonds and “risk assets,” including equities, reflects the ability of the Fed, and Yellen in particular, to “masterfully” guide interest rates higher while simultaneously lowering rate-related uncertainty.

Read more …

Ans they knew it too.

• China Fines GlaxoSmithKline $489 Million, Jails Executives (Reuters)

A court in Changsha has also sentenced Mark Reilly, the former head of GSK in China, and other GSK executives to between two and four years in jail, Xinhua added. The verdict, handed out behind closed doors in a single-day trial according to Xinhua, is the culmination of a Chinese probe into the British drug maker which Chinese authorities made public in July last year. Chinese police said then that the firm had funnelled up to 3 billion yuan to travel agencies to facilitate bribes to doctors and officials.

GSK said in a statement on their website on Friday that the activities by the firm’s China unit were a “clear breach” of GSK’s governance and compliance procedures. “Reaching a conclusion in the investigation of our Chinese business is important, but this has been a deeply disappointing matter for GSK. We have and will continue to learn from this,” GSK CEO, Andrew Witty, said in the statement.

Read more …

Anything for a bank.

• US Regulators Weigh Delay for Separating Banks’ Swaps Units (Bloomberg)

U.S. banks may get another year to shift some swaps trading from their government-insured units as regulators respond to demands to give them more time, according to two people familiar with the talks. A delay until July 2016 in applying the Dodd-Frank Act separation requirement is being weighed in discussions between bank lobbyists and officials from the Federal Reserve and Office of the Comptroller of the Currency, according to the people, who requested anonymity to talk about the matter. The provision was included in the 2010 law as a way to shield taxpayers from the kind of risky trading that helped fuel the 2008 credit crisis. Groups representing JPMorgan, Citigroup and Bank of America say the deadline should be delayed while rules are being completed.

Separating swaps units from banking operations is “one of the most important provisions of Dodd-Frank, and one of the ones the big banks fear the most,” Art Wilmarth, a George Washington University law professor, said in an interview. “They get huge cost advantages — including margin advantages — if they keep them inside the bank,” he said. Six years after the worst financial crisis since the Great Depression, the lobbying underscores the banking industry’s persistence in fighting rules crafted to prevent a repeat of 2008, when taxpayers rescued AIG after billions of dollars in losses at a swaps-trading unit. The industry groups have won concessions on Volcker Rule limits on banks’ proprietary trading and filed lawsuits that have delayed rules at the Securities and Exchange Commission and Commodity Futures Trading Commission.

Dodd-Frank requires banks to move certain equity, commodity and non-cleared credit swaps outside of bank units with deposit insurance and access to the Fed’s discount window. Blanche Lincoln, a former U.S. senator who led the Agriculture Committee in the run-up to the regulatory overhaul, sponsored the swaps provision. It originally applied to more types of derivatives before being scaled back amid objections from bank lobbyists, then-Fed Chairman Ben S. Bernanke and former Federal Deposit Insurance Corp. Chairman Sheila Bair. As a result, the banks don’t have to remove interest-rate swaps, the largest part of the market.

Read more …

Word! I’ve said this a 1000 times: “if you want to pursue idiots like the Fed doing crazy policies, and if you think you can get out in time, go for it.”

• “Stocks Are More Crash-Prone Than Ever”: Fleckenstein (Zero Hedge)

Infamous short-seller Bill Fleckenstein left a CNBC anchor questioning her faith in the status quo in this brief interview. As she pestered him with questions about ‘missing out on the rally’, Fleckenstein snapped back “so what? I don’t care, it doesn’t matter” asking rhetorically “when the market declines, how fast will it all be taken away from you?” Fleckenstein warned “I don’t think we will get through October without some accident,” adding that “the stock market is more crash-prone than ever.” When pressed again about sitting on the sidelines, Fleckenstein rebukes, “if you want to pursue idiots like the Fed doing crazy policies, and if you think you can get out in time, go for it. I don’t want to try to do that.” As CNBC notes, some traders might regret missing out on what may go down in history books as the bull market of a lifetime, but “I’m not kicking myself,” he said. “I don’t care, it doesn’t matter.” “I don’t have to play every day,” he added.

Read more …

There ain’t none.

• Why Global Growth Is So Disappointing (Epsilon)

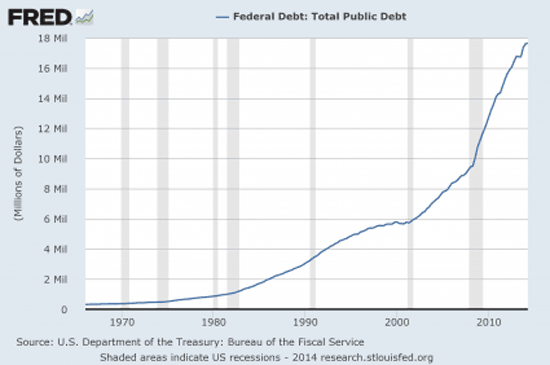

There is one great mystery in the high falutin’ circles of the Fed, ECB, and IMF today. Why is global growth so disappointing? There are different variations on this theme – why aren’t businesses investing more? why aren’t banks lending more? – but it’s all one basic question. First the Fed, then the BOJ, and now the ECB have taken superheroic efforts to inflate financial asset prices in order to bridge the gap between the output shock of 2008 and a resumption of normal economic growth. They’ve done their part. Why hasn’t the rest of the world joined the party? The thinking was that leaving capital markets to their own devices in the aftermath of the Great Recession could result in a deflationary equilibrium, which is macroeconomic-speak for falling into a well, breaking your leg, at night, alone. It’s the worst possible outcome.

So the decision was made to buy trillions of dollars in assets, forcing all of us to take on more risk with our money than we would otherwise prefer, and to jawbone the markets (excuse me … “employ communication policy”) to leverage those trillions still further. All this in order to buy time for the global economic engine to rev back up and allow private investment activity to take over for temporary government investment activity. It was a brilliant plan, and as emergency intervention it worked like a charm. QE1 (and even more importantly TLGP) saved the world. The intended behavioral effect on markets and market participants succeeded beyond Bernanke et al’s wildest dreams, such that now the Fed finds itself in the odd position of trying to talk down the dominant Narrative of Central Bank Omnipotence. But for some reason the global economic engine never kicked back in.

The answer? We must do more. We must try harder. And so we got QE2. And QE3. And Abenomics. And now Draghinomics. We got what we always get in the aftermath of a global economic crisis – a temporary government policy intervention transformed into a permanent government social insurance program. But the engine still hasn’t kicked in. So now villains must be found. Now we must root out the counter-revolutionaries and Trotskyites and Lin Biao-ists and assorted enemies of progress. Because if the plan is brilliant but it’s not working, then obviously someone is blocking the plan. The structural villains per Stanley Fischer (who is rapidly becoming a more powerful Narrative voice and Missionary than Janet Yellen): housing, fiscal policy, and the European economic slow-down. Or if you’ll allow me to translate the Fed-speak: consumers, Republicans, and Germany. These are the counter-revolutionaries per the central bank apparatchiks. If only everyone would just spend more, why then our theories would succeed grandly.

Read more …

Grandma‘s dementia setting in?

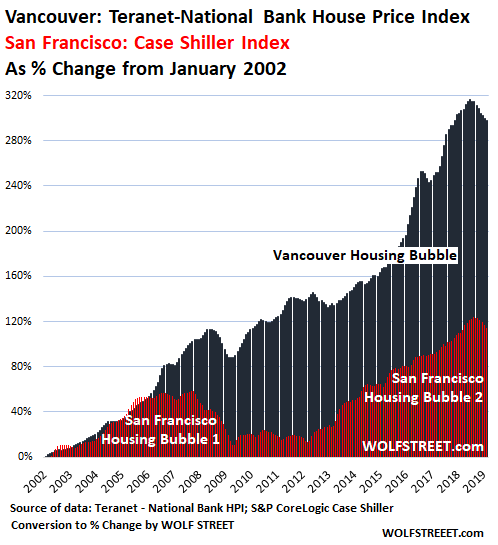

• Janet Yellen Believes You Can Get Rich By Going Into Debt (Phoenix)

Janet Yellen’s latest talk was very telling. The title of her talk was: “The Importance of Asset Building for Low and Middle Income Households”. The title alone is very telling. Fed policies under Bernanke and Yellen have proven absymal at creating jobs or boosting incomes. The only thing the Fed has done is push housing and stock (asset) prices higher. Thus, for Yellen, the means of improving one’s lot in life has nothing to do with obtaining a higher paying job. The best way to move up in life is to own stocks… or a house… or preferably both. This is how the Fed thinks: in terms of asset prices and leverage. These are items that only the top 0.1% of Americans really benefit from. Indeed, the Fed’s very policies (low interest rates, plenty of liquidity) benefit the wealthiest the most because these individuals can use their wealth as collateral in order to leverage up and benefit from rising asset prices.

This is the very strategy Larry Ellison has been using for years to live beyond his even ample means: The multi-millionaire or billionaire can leverage up to invest in real estate or stocks… the average american cannot. Indeed, over 95% of Americans cannot buy a home in cash. So buying a home means going deeply in to debt, not generating wealth. Indeed, the only way of building wealth through real estate for most Americans would be if you bought a home and the home’s price increased substantially to the point that selling would actually turn a profit beyond closing costs, taxes (both capital gains and property taxes for the duration of your inhabiting the home), and moving. This means: 1) home prices have to increase dramatically, 2) you have to have a LOT of variables work out in your favor. The fact Yellen believes in this stuff is telling. You won’t hear the Fed talk about incomes or jobs because the Fed has no clue how to create either. But asset prices are easy to boost… just spent $3 trillion and you’ll get a roaring stock market.

Read more …

It’s all junk.

• Highly Indebted Chinese Firms Face Off With Ratings Agencies (Reuters)

Chinese companies hounded by debt obligations accrued over the past few years are grappling with a new adversary at what is a very inconvenient time: global ratings agencies. Standard & Poor’s and Fitch Ratings have slashed more ratings of Chinese companies in 2014 than a year earlier as towering debts weigh on corporate bottom-lines. The thumbs-down from the agencies will make it harder – and more costly – for companies to borrow at a time when their cash flows are taking a hit from a weakened economy. Analysts say big companies backed by the Chinese government are less likely to be at risk than smaller, independent firms that had binged on the easy credit springing from a round of government stimulus in 2008-2009.

On Monday, S&P cut the ratings of China Shanshui Cement and Guangzhou R&F Properties by a notch, plunging them deeper into junk status. Last week, fellow rating agency Moody’s downgraded steelmaker China Oriental, already wallowing in non-investment territory, also by a notch. “When the economy is deleveraging and credit is not growing as fast as before, they need extra cash to repay debt instead of refinancing it in the market, thereby creating pressure on balance sheets and in some cases on the ratings,” said Moody’s analyst Ivan Chung. Data released over the weekend showed factory output grew at its slackest pace in six years in August, stoking fears that China’s economy was sliding deeper into a downturn. Analysts say the steel, metals, chemicals sectors and real estate developers in some cities will find it difficult to raise cash as excess capacity heaps pressure on their credit profiles.

Read more …

Nomura doesn’t look terribly smart in this.

• Unsecured Loan, Missing CEO Add Red Flags To China Lending (Reuters)

Nomura Holdings and co-lenders spent nine months poring over the books, sizing up management and even checking out the factory floor at China’s Ultrasonic AG before deciding in August to give the Frankfurt-listed shoemaker a $60 million unsecured credit facility. The loan was unsecured in keeping with regulations in China at the time it was structured. Nomura, a Japanese bank, and its partner banks, however, felt they had done their homework. But within weeks, the 3-year loan had been drawn down in full and two of Ultrasonic’s top executives had disappeared – leaving the lenders in a situation that should ring alarm bells for foreign bankers exposed to China. “You couldn’t get onshore security for offshore loans,” said a person involved in the loan negotiations. “It was a common risk in offshore borrowing for Chinese companies.” The affair is a reminder for offshore banks of the risk of lending to small and mid-sized Chinese firms which have long struggled to access credit.

Local banks are more inclined to lend to larger, more established companies as economic growth slows, forcing smaller firms to seek expensive loans in the less-regulated shadow banking industry or from offshore lenders. Asia-Pacific banks had about $1.2 trillion worth of China-related exposure at the end of last year, including bank and non-bank lending, latest Fitch Ratings data show. “These mid-sized companies are getting hit the hardest by the slight slowdown in the economy, and that’s having an impact on how they view the future …,” said Kent Kedl, Shanghai-based managing director for Greater China and North Asia at consultancy Control Risks. “This isn’t to say that mid-sized companies have any more innately corrupt people in them than do large companies, but large companies can weather storms a little easier.”

Read more …

Big shift.

• Steel Industry On Life-Support As China Economy Slows (Reuters)

Subsidies accounted for four-fifths of the profits reported by Chinese steel companies in the first half of this year, a dramatic increase in reliance on state support that illustrates starkly the industrial weakness that is an increasing drag on the economy. The headwinds faced by China’s massive steel sector – falling profit margins and growing dependence on handouts – are shared by other key industrial and infrastructure-related sectors, including aluminium, cement and coal. A Reuters analysis of first-half financial statements from 77 listed Chinese steel, aluminium and cement companies revealed a sharp deterioration in profitability. For the first half of 2013, subsidies accounted for 22% of total profits posted by China’s listed steel mills, and reached 47% in the full year. In the first six months of 2014, the figure jumped to 80%, and, even then, the sector’s profit margin halved to just 0.3%.

The performance of the steel sector, which has been a major driver of China’s growth, underlines the massive challenge facing President Xi Jinping as Beijing tries to wean the economy off its dependence on external demand and investment spending. Data out at the start of the week showed China factory output grew at the weakest pace in nearly six years in August, raising fears that the economy may be at risk of a sharp slowdown unless Beijing implements fresh stimulus measures. The company statements also show rising accounts receivable – the accounting term for money owed by customers – in a sign that more Chinese manufacturers are falling behind on their payments as growth falters, posing an additional problem for firms with high credit costs and financing difficulties. Chinese leaders have repeatedly said they would use a period of anticipated slower growth to implement structural reform.

Growth was at its weakest in 18 months in the first quarter, but the level of support still being poured into companies suggests the re-tooling of the economy has a long way to go. A total of 2,235 firms, or 88% of Chinese listed companies, received government subsidies totaling 32.2 billion yuan ($5.24 billion) in the first half of 2014, according to data from information provider ChinaScope. Most of the subsidies – largely from local governments – were channeled to the steel, cement and property sector in the form of cash, tax rebates or support for loan repayments. The reasons given ranged from research and development to support for government environmental priorities. “There isn’t a lot of innovation happening in sectors such as steel or aluminium,” said Professor Wen Laicheng at Central University of Finance and Economics in Beijing. “The subsidies are clearly a lifeline to help the companies get through these tough times.”

Read more …

Vacuum cleaners, gay porn, bacon-flvored ice cream, we need to latch onto anything we can find.

• UK Retail Sales Boosted By Vacuum Cleaners (CNBC)

U.K. retail sales were up in 0.4% in August compared to the previous month and gained almost 4% year-on-year, with consumers flocking to buy high-powered vacuum cleaners ahead of an EU ban. The annual increase is now the 17th month of consecutive year-on-year growth according to data from the Office of National Statistics (ONS), which described the current retail climate as “one of growth.” Sales of household goods surged in August, jumping 12.7% when compared with the previous year. The ONS said it was the largest year-on-year increase since October 2001.

Furniture stores were the main contributor, seeing growth of over 23% when compared to the same period last year, making it the largest jump in sales in 26 years when records began in 1988. Electrical appliance stores also added to the increase in sales, with retailers suggesting consumers were rushing to buy high-powered vacuum cleaners before EU energy saving regulations came into force at the end of August. From 1 September, companies in the EU were banned from making or importing vacuum cleaners above 1600 watts. The recently introduced rules are part of the EU’s energy efficiency directive, designed to help tackle climate change.

Read more …

• Assange Says ‘Google A Privatized Version Of The NSA’ (RT)

WikiLeaks founder Julian Assange equated Google with the National Security Agency and GCHQ, saying the tech giant has become “a privatized version of the NSA,” as it collects, stores, and indexes people’s data. He made his remarks to BBC and Sky News. “Google’s business model is the spy. It makes more than 80 percent of its money by collecting information about people, pooling it together, storing it, indexing it, building profiles of people to predict their interests and behavior, and then selling those profiles principally to advertisers, but also others,” Assange told BBC. “So the result is that Google, in terms of how it works, its actual practice, is almost identical to the National Security Agency or GCHQ,” the whistleblower argued.

Google has been working with the NSA “in terms of contracts since at least 2002,” Assange told Sky News. “They are formally listed as part of the defense industrial base since 2009. They have been engaged with the Prism system, where nearly all information collected by Google is available to the NSA,” Assange said. “At the institutional level, Google is deeply involved in US foreign policy.” Google has tricked people into believing that it is “a playful, humane organization” and not a “big, bad US corporation,” Assange told BBC. “But in fact it has become just that…it is now arguably the most influential commercial organization.” “Google has now spread to every country, every single person, who has access to the internet,” he reminded.

Read more …

Chinas potential shale is in mountainous regions.

• Gas Hungry China Cuts Shale Goal By 50% (RT)

China has halved its 2020 goal for shale gas production. The country faces challenges ranging from difficult geology to shortage of technology in the area meant to quench its ever-growing energy needs. The country is only starting mass production of shale gas, which drastically changed the energy landscape in the US in recent years, with the extraction of 200 million cubic meters annually. In 2012, when Chinese shale gas production was virtually non-existent, Beijing eyed an ambitious goal of 60-80 billion cubic meters (bcm) by 2020, but the latest plans from the Ministry of Land and Resources on Wednesday lowered it to more conservative 30 bcm. A higher figure is possible, but conditional. “China aims to pump at least 30 billion cubic meters of shale gas by 2020. With proper drilling technology, output can increase to 40 to 60 billion cubic meters,” Che Changbo, deputy director of the ministry’s geological exploration department, said at a news conference in Beijing.

Short-term prospects for shale gas production are more optimistic, according to the ministry. It will surpass the old government 2015 target of 6.5 bcm next year and hit 15 bcm in 2017. China has carved out 54 shale gas blocks spanning 170,000 sq km. Producers have drilled 400 wells, including 130 horizontal. The ministry said the economies of scale and localization of drilling technology are making shale gas more commercially attractive in China. The cost of one well has fallen from 100 million yuan to 50 to 70 million yuan, while the drill time dropped from 150 days to between 46 and 70 days. But the industry is still hurdled by several problems, including complex geology, shortage of advanced technology and skilled personnel and regulation barriers. There is also the dominating position of two state-owned giants, PetroChina and Sinopec, which enjoy a privileged access to fields discouraging private investment.

Read more …

Big chnage in projections.

• World Population To Hit 11 Billion In 2100, 70% Chance Of Ever More (Guardian)

The world’s population is now odds-on to swell ever-higher for the rest of the century, posing grave challenges for food supplies, healthcare and social cohesion. A ground-breaking analysis released on Thursday shows there is a 70% chance that the number of people on the planet will rise continuously from 7bn today to 11bn in 2100. The work overturns 20 years of consensus that global population, and the stresses it brings, will peak by 2050 at about 9bn people. “The previous projections said this problem was going to go away so it took the focus off the population issue,” said Prof Adrian Raftery, at the University of Washington, who led the international research team. “There is now a strong argument that population should return to the top of the international agenda. Population is the driver of just about everything else and rapid population growth can exacerbate all kinds of challenges.”

Lack of healthcare, poverty, pollution and rising unrest and crime are all problems linked to booming populations, he said. “Population policy has been abandoned in recent decades. It is barely mentioned in discussions on sustainability or development such as the UN-led sustainable development goals,” said Simon Ross, chief executive of Population Matters, a thinktank supported by naturalist Sir David Attenborough and scientist James Lovelock. “The significance of the new work is that it provides greater certainty. Specifically, it is highly likely that, given current policies, the world population will be between 40-75% larger than today in the lifetime of many of today’s children and will still be growing at that point,” Ross said. Many widely-accepted analyses of global problems, such as the Intergovernmental Panel on Climate Change’s assessment of global warming, assume a population peak by 2050.

Read more …

“There’s a hard stop here.”

• Exxon, Rosneft Halt Arctic Oil Well Drilling on Sanctions (Bloomberg)

Exxon Mobil and Rosneft halted drilling on an offshore oil well intended as the first step in unlocking billions of barrels of crude in Russia’s remote Arctic, according to people familiar with the project. Work stopped just a few days after the U.S. and European Union barred companies from helping Russia exploit Arctic, deep-water or shale-oil fields, said three people with knowledge of the rig’s operations who asked not to be named since they weren’t authorized to speak about the project. The U.S. sanctions, meant to punish Russia for escalating tensions in Ukraine, gave American companies until Sept. 26 to stop all restricted drilling and testing services.

Exxon, Rosneft and Seadrill Ltd. North Atlantic Drilling unit are under the gun to finish or temporarily seal the $700 million well off Russia’s northern coast before the sanctions deadline, said Chris Kettenmann, chief energy strategist at Prime Executions Inc., a brokerage firm in New York. With just eight days left before sanctions require Exxon to stop all Arctic work with its Russian partner Rosneft, the project probably is on hold until next year at the earliest, he said. “This has been one of the most-watched wells in the industry, so this is a huge deal,” said Kettenmann, who has a sell rating on Exxon’s shares. “There’s a hard stop here.”

Read more …