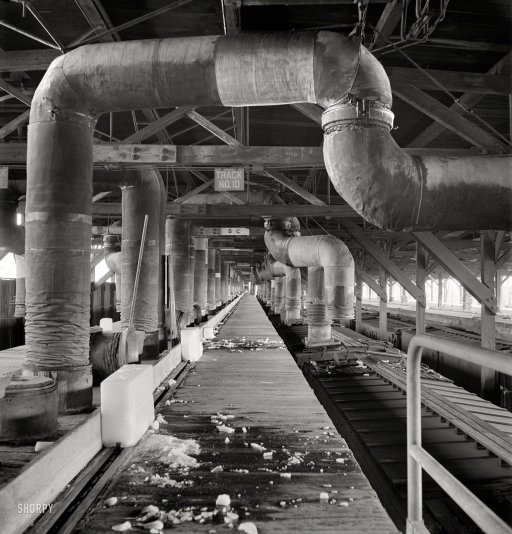

Jack Delano. Cars being precooled at the ice plant, San Bernardino, CA Mar 1943

Large and/or institutional investors, your pension funds, your market funds, you name them, have one glaringly obvious and immense Achilles heel that they very much prefer not to talk about. That is, they MUST invest their funds, in something, anything, they can’t NOT invest. They are trapped in the game. They have to roll over debt, investments, all the time.

In today’s markets, they can move into Treasuries, as we see bond funds (and undoubtedly others) do recently, and while that’s already a sign of unrest in the ranks, at the same time it exposes the funds. And not only because everyone knows it won’t allow them to meet the targets they must meet. Oil, gas and gold are unattractive alternatives.

The big funds can play the game, but they really shouldn’t, because they can’t win. Not in the end. Not when the chips are down. The reason is that they cannot fold. And the others at the table know this, and immediately recognize this for the fatal flaw it is. No matter how smart and sophisticated institutional investors and their fund managers may be, in ultimo they are, to put it in poker terms, the ‘designated’ fish.

It may take a long time before this plays out, and they realize it for what it is (fish don’t recognize themselves for what they are, other than, and even that’s a maybe, once they’ve been exposed as such by others), since in times of plenty there is no urgent need for the other players to catch and filet the fish.

As long as there’s enough to eat at the table, the ‘solid’ players can bide their time and let the fish fatten themselves (as long as it’s not from their money), only to gut them when times get leaner. In a way, the solid players use the fish as a way to stow away for a rainy day some of the ultra cheap QE money has made available, the money without which there would be no markets left, if only so their own actions don’t become too conspicuous.

Funds that invest for a living, and whose managers must meet, say, a 7-8% profit target, can appear to be well run and profitable for many years, provided they operate in a rich environment and no solid players decide to go after them (if these do, it’s game over in a heartbeat).

Seven years of QE et al have made this possible. As have many years of increasing debt and leverage and ever looser rules in global finance (re: the infamous murder of Glass-Steagall) before that. But. But that play is coming to a close. The ‘free’ money that’s been arriving at the table from outside sources for so many years is finally, thankfully, starting to dry up (and no, Mario Draghi won’t fill in the gaps).

I’ll quote out of context something then-poker playing law student and now-bankruptcy lawyer Ashvin Pandurangi wrote here at the Automatic Earth on February 9 2011. Out of context in the sense that Ashvin when he spoke of ‘fish’ meant speculators and the like, not institutional investors.

However, because of the fatal flaw for any player of having to play no matter what, the description of the psychology of fish versus solid players at the poker table is still spot on.

A Glimpse Into the Stubborn Psychology of Fish

What makes poker a profitable venture for “solid” players, unlike blackjack, craps or roulette, is their opportunity to capitalize on the mental mistakes of other players, by accurately “reading” the opponent’s potential range of hole cards in any given hand (mostly from betting tendencies and style of play), and accurately calculating the “pot odds” they are being laid (money that must be put in on the present and future betting rounds as a percentage of money that could be won from the pot). The pot odds calculation allows the solid player to determine the best course of action (bet, call, raise, fold) by comparing it to the equity his/her hand carries against the opponent’s range.[..]

Institutional investors such as your pension fund may not suffer from too many ‘mental mistakes’, they may be as smart as other players, but in their place comes the worse flaw of not being able to fold. Which means the the other players have a very easy time of calculating the “pot odds” they are being laid. They just, until today, haven’t been forced to call the hands of the fish, because of the money being injected from outside.

The best feature of a true fish is that they never learn or adapt to an opponent’s style of play. They will keep calling you with weak hands even when you only show down “monsters” at the table, because they are only concerned with their own cards and they always assume you are holding even weaker than they are.

There are not many real-life players who fit exactly into this idealized style of play, but there are many who generally harbor its underlying psychology – one of permanent and irrational belief in an ability to win a hand, despite any mounting evidence to the contrary. They cannot possibly conceive of folding, because that means giving up any chance of winning, slim as it may be, and also giving up any money already invested in the pot.[..]

Your pension fund manager may not believe in his ability to win a hand, but still be forced to play it. Because (s)he must always play something, some hand. (S)he is forced into the psychology of the fish.

The fish never stop to think what your strong bets out of position imply about your hand, especially given the fact that you most likely know that they are fish. If the fish do stop to think about these factors, then they most likely dismiss the thought before it has any chance to settle, since it would be too disruptive to their goal of never folding a potential winner. While the solid players are constantly engaged in several different layers of critical psychoanalysis, the fish are forever stuck in a one-track mindset.

It’s sort to fun to play around with, and take out of context, what Ashvin wrote, and what mindsets managers at pension- and other funds may have, not just fun for me but even far more for the solid players sitting opposite those managers. Because they know they have a rich source of profits waiting from them after QE has been cancelled, in the vaults of those whose job descriptions say they must play every day no matter what hand they’re dealt.

In essence it’s all just a pretend game, and the fish in today’s investment world are probably far more aware of their own identity than the fish at a real life poker table. But it doesn’t matter. They’re still fish, and everybody knows they’re going down. And therefore so are your pensions and your other institutional investments. What are they going to do, stop playing? They can’t.

So who are the solid players in this game, you ask? Why, Wall Street, of course. They’ve had their eye on your remaining cash all along.

Home › Forums › Institutional Fish