DPC Conover Building, Third and Main, Dayton, Ohio 1904

And there’s another nice comparison.

• Oil Has Become The New Housing Bubble (CNBC)

The same thing that happened to the housing market in 2000 to 2006 has happened to the oil market from 2009 to 2014, contends well-known trader Rob Raymond of RCH Energy. And he believes that just as we witnessed the popping of the housing bubble, we are in the midst of the popping of the energy bubble. “It’s the outcome of a zero interest rate policy from the Federal Reserve. What’s happened from 2009 to 2014 is, the energy industry has outspent its cash flow by $350 billion to go drill all these wells, and create this supply ‘miracle,’ if you will, in the United States,” Raymond said Thursday on CNBC’s “Futures Now.” “The issue with this has become, what were houses in Florida and Arizona in 2000 to 2006 became oil wells in North Dakota and Texas in 2009 to 2014, and most of that was funded in the high-yield market and by private equity.”

And now that a barrel of West Texas Intermediate crude oil has fallen from $100 to $60 in five months, those energy producers are in trouble. “The popping of the credit bubble in the energy industry as a result of the downside volatility in oil is likely to result in a collapse of the U.S. rig count,” Raymond said. “From a longer-term standpoint, what it does is it really impairs the industry’s ability to invest capital.” That said, when it comes to the price of a barrel of oil itself, Raymond expects to see a rebound once U.S. production dries up. “We live in a $90 to $100 world,” he said. “We just don’t live in it today.”

Phoenix confirms what I’ve been saying all along; the problem is not oil.

• Oil’s Crash Is the Canary In the Coal Mine for a $9 Trillion Crisis (Phoenix)

The Oil story is being misinterpreted by many investors. When it comes to Oil, OPEC matters, as does Oil Shale, production cuts, geopolitical risk, etc. However, the reality is that all of these are minor issues against the MAIN STORY: the $9 TRILLION US Dollar carry trade. Drilling for Oil, producing Oil, transporting Oil… all of these are extremely expensive processes. Which means… unless you have hundreds of millions (if not billions) of Dollars in cash lying around… you’re going to have to borrow money. Borrowing US Dollars is the equivalent of shorting the US DOLLAR. If the US Dollar rallies, then your debt becomes more and more expensive to finance on a relative basis. There is a lot of talk of the “Death of the Petrodollar,” but for now, Oil is priced in US Dollars. In this scheme, a US Dollar rally is Oil negative. Oil’s collapse is predicated by one major event: the explosion of the US Dollar carry trade. Worldwide, there is over $9 TRILLION in borrowed US Dollars that has been ploughed into risk assets.

Energy projects, particularly Oil Shale in the US, are one of the prime spots for this. But it is not the only one. Emerging markets are another. Just about everything will be hit as well. Most of the “recovery” of the last five years been fueled by cheap borrowed Dollars. Now that the US Dollar has broken out of a multi-year range, you’re going to see more and more “risk assets” (read: projects or investments fueled by borrowed Dollars) blow up. Oil is just the beginning, not a standalone story. If things really pick up steam, there’s over $9 TRILLION worth of potential explosions waiting in the wings. Imagine if the entire economies of both Germany and Japan exploded and you’ve got a decent idea of the size of the potential impact on the financial system And that’s assuming NO increased leverage from derivative usage. The story here is not Oil; it’s about a massive bubble in risk assets fueled by borrowed Dollars blowing up. The last time around it was a housing bubble. This time it’s an EVERYTHING bubble. And Oil is just the canary in the coalmine.

No bottom in sight.

• Oil Slides Below $55 as U.S. Output Seen Steady Amid OPEC Fight (Bloomberg)

Oil in New York fell below $55 a barrel for the first time in more than five years amid speculation that U.S. producers may further increase output as they battle OPEC for market share. Crude in London traded below $60. West Texas Intermediate futures dropped as much as 2.1%, after closing yesterday at the lowest level since May 2009. U.S. crude drillers are benefiting as costs fall almost as quickly as prices, according to Goldman Sachs Group Inc. Brent, the benchmark for more than half the world’s oil, may decline to $50 a barrel in 2015, a Bloomberg survey of analysts showed. Oil has slumped almost 45% this year as OPEC sought to defend market share amid a U.S. shale boom that’s exacerbating a global glut.

The group, responsible for about 40% of the world’s supply, will refrain from curbing output even if crude drops to $40 a barrel, according to the United Arab Emirates. “It seems like the market is no longer able to respond to the issue of oversupply,” Hong Sung Ki, a commodities analyst at Samsung Futures Inc. in Seoul, said by phone. “On the demand side, the global economy continues to slow while it takes time for U.S. shale production to pull back on the supply side.” West Texas Intermediate for January delivery fell as much as 66 cents to $55.25 a barrel in electronic trading on the New York Mercantile Exchange and was at $55.62 at 1:18 p.m. Singapore time. It decreased $1.90 to $55.91 yesterday. The volume of all futures traded was about 3% above the 100-day average. Prices are set for the biggest annual loss since a 54% collapse in 2008.

Almost there. What happens after is a more interesting question.

• Brent Seen Falling to $50 in 2015 as OPEC Fails to Act (Bloomberg)

Crude oil prices are poised to fall below half where they were six months ago, before producers begin dealing with a global glut. Brent, the global benchmark, will slide to as low as $50 a barrel in 2015, according to the median in a Bloomberg survey of 17 analysts, down from the $115.71 a barrel high for the year on June 19. The grade has already collapsed 47% since then and needs to fall further before producers clear the current glut, said five out of six respondents who gave a reason. Brent futures sank in the weeks after the Organization of Petroleum Exporting Countries decided to maintain output even as the highest U.S. production in three decades swells a global surplus. The organization will stand by its decision even if prices fall to $40, United Arab Emirates Energy Minister Suhail Al-Mazrouei said.

“This won’t stop until oil producers are on their backs,” Bjarne Schieldrop, chief commodities analyst at SEB AB, Sweden’s fourth-biggest bank, said by phone from Oslo. “There will be better demand in the second half, hopefully some demand effects from lower prices, and definitely softer growth in U.S. shale.” The group decided at the Nov. 27 meeting to keep output unchanged to protect OPEC’s market share, even if it has a negative effect on crude prices, the official Kuwait News Agency reported, citing Oil Minister Ali al-Omair. The U.S. pumped 9.12 million barrels a day in the period ended Dec. 5, the most in weekly Energy Information Administration started in 1983. The gain came as horizontal drilling and hydraulic fracturing unlocked supplies from shale formations including the Eagle Ford in Texas and the Bakken in North Dakota.

“In the good old days of the late 20th century, before Federal Reserve omnipotence, they could depend on a regular annual interest rate churn of between 5 and 10% and do what they had do – write pension checks, pay insurance claims, and pay clients, with a little left over for company salaries.”

• Crash-O-Matic Finance (James Howard Kunstler)

“Oil prices have dropped $50 a barrel. That may not sound like much. But when you take $107 and you take $57, that’s almost a 47% decline…!”

–James Puplava, The Financial Sense News NetworkMay not sound like much? I guess when you hunker down in the lab with the old slide rule and do the math, wow! Those numbers really pop! This, of course, is the representative thinking out there. But then, these are the very same people who have carried pompoms and megaphones for “the shale revolution” the past couple of years. Being finance professionals they apparently failed to notice the financial side of the business, for instance the fact that so much of the day-to-day shale operation was being run on junk bond financing. It all seemed to work so well in the eerie matrix of zero interest rate policy (ZIRP) where investors desperate for “yield” — i.e. some return more-than-zilch on their money — ended up in the bond market’s junkyard. These investors, by the way, were the big institutional ones, the pension funds, the insurance companies, the mixed bond smorgasbord funds.

They were getting killed on ZIRP. In the good old days of the late 20th century, before Federal Reserve omnipotence, they could depend on a regular annual interest rate churn of between 5 and 10% and do what they had do – write pension checks, pay insurance claims, and pay clients, with a little left over for company salaries. ZIRP ruined all that. In fact, ZIRP destroyed the most fundamental index in the financial universe: the true cost of borrowing money. In doing so, it twerked and torqued the concept of “risk” so badly that risk no longer had any meaning. In “risk-on” financial weather, there was no longer any risk. Imagine that? It also destroyed the entire relationship between borrowed money and the cost-structure of the endeavors it was borrowed for. Take shale oil, for instance.

The fundamental limiting factor for shale oil was that the wells were only good for about two years, and then they were pretty much shot. So, if you were in that business, and held a bunch of leases, you had to constantly drill and re-drill and then drill some more just to keep production up. The drilling cost between $6 and $12-million per well. What happened the past seven years is that the drillers and their playmates on Wall Street hyped the hoo-hah out of the business — it was a shale revolution! In a few short years they drilled to beat the band and the results seemed so impressive that investment money poured into the sector like honey, so they drilled some more. It was going to save the American way of life. We were going to be “energy independent,” the “new Saudi America.” We would be able to drive to Wal-Mart forever!

Let’s all open a bank account in Russia.

• Russia Central Bank Raises Interest Rate To 17% On Ruble Collapse (Guardian)

Russia’s central bank has taken drastic action to halt the rouble’s freefall on the foreign exchanges by raising interest rates by 6.5 percentage points to 17%. After a day of turmoil dominated by fears that a crashing global oil price would devastate Russia’s energy-dominated economy, an after-hours meeting of the central bank in Moscow decided emergency action was needed to prevent the rouble’s collapse. The bank said the increase in borrowing costs – which will deepen Russia’s recession if sustained for a prolonged period – was needed to end currency depreciation and to combat inflation. Higher interest rates tend to make currencies more attractive to foreign investors and the rouble rose against the dollar in the wake of the surprise announcement. Earlier, a 10% fall in the value of the rouble against the dollar had badly rattled global markets, with the FTSE 100 index in London closing at its lowest level of 2014.

Investors dumped shares as they weighed up the risk that a deepening economic crisis would destabilise Russia and make it more difficult for the west to deal with its president, Vladimir Putin, adding to geopolitical tensions in eastern Europe and the Middle East. The huge jump in interest rates was seen by analysts as an attempt by the central bank to show that it was determined to protect the rouble. A smaller one-point rise to 10.5% last week had failed to impress financial markets at a time when the price of oil was plunging to a five and a half year low. Earlier, Russia bought roubles for dollars on the foreign exchanges but failed to prevent the biggest one-day decline in the currency since Russia’s debt default in 1998. The fall meant it took 63 roubles to buy a dollar, a decline of 45% since the start of a year that has seen the price of oil drop from $115 a barrel (£73) to barely $60 a barrel.

“We don’t think the call for aggressive interest rate or reserve-requirement ratio cuts are well-grounded under current circumstances, as it could fuel bubbles in stocks.”

• How China’s Interest-Rate Cut Raised Borrowing Costs (Bloomberg)

What if a central bank cut interest rates and borrowing costs rose? Since the People’s Bank of China surprised markets with the first benchmark rate reduction in two years on Nov. 21, the five-year sovereign bond yield climbed 15 basis points, that for similar AAA corporate notes surged 37 and AA debt yields jumped 76. While finance companies did start charging less for mortgages, their funding costs rose as the one-week Shanghai interbank lending rate added 37 basis points. The PBOC move misfired as it triggered an 18% surge in the Shanghai Composite Index of shares, prompting investors to raise cash by selling bonds and seeking loans, driving interest rates higher. Costs for riskier issuers of notes rose as regulators banned the use of riskier debt as collateral for financing. Investors dialed back expectations for further monetary easing as policy makers seek to cool the stock rally. “Financing costs moved in the opposite way than the central bank wished,” said Deng Haiqing at Citic Securities, China’s biggest brokerage.

“We don’t think the call for aggressive interest rate or reserve-requirement ratio cuts are well-grounded under current circumstances, as it could fuel bubbles in stocks.” The central bank reduced the one-year benchmark lending rate by 40 basis points to 5.6% and the deposit rate by 25 basis points to 2.75% starting from Nov. 22. The one-week Shanghai Interbank Offered Rate climbed to 3.59% on Dec. 12, the highest since Aug. 29, while the yield on top-rated five-year company bonds rose to 5.17% on Dec. 10, the highest since Sept. 18. The outstanding value of shares bought with borrowed money climbed to a record 122 billion yuan ($19.7 billion yuan) on Dec. 9, helping lift the benchmark stock index 39% this year. “The fund flows into the stock market could nurture prosperity in the capital market, but the real economy may not necessarily benefit in the short term,” Haitong Securities analysts wrote in a note on Dec. 7. “On the contrary, it could lead to further scarcity of funds, leading to an increase in interest rates.”

More confirmation of what I’ve been saying for a long time.

• China Manufacturing In Contraction (BBC)

China’s factory activity is in contraction, based on a private survey, reinforcing calls for more stimulus. The HSBC/Markit manufacturing purchasing manager’s index’s initial reading fell to 49.5 in December from November’s final reading of 50. A reading above 50 indicates expansion, while one below 50 points to contraction on a monthly basis. China will release its official PMI reading for December in the new year. The state’s official PMI came in at 50.3 for November. This morning’s latest reading from HSBC marks a seven-month low. Qu Hongbin, Chief Economist for China at HSBC said “Domestic demand slowed considerably and fell below 50 for the first time since April 2014. Price indices also fell sharply. The manufacturing slowdown continues in December and points to a weak ending for 2014.”

Earlier this week, China’s central bank said growth could slow to 7.1% next year from about 7.4% this year, because of a property market slump. Growth in the world’s second largest economy fell to 7.3% in the third quarter, which was the slowest pace since the global financial crisis. The risk that China might miss its official growth target of 7.5% this year for the first time in 15 years is growing because economic data is weaker than expected, economists said. A struggling property market, uneven export growth and cooling domestic demand and investment are some of the major factors weighing on overall growth. Last month the People’s Bank of China cut its one year deposit rate to 2.75% from 3.0% to try to revive its economy.

I thought they were twins?! But Ambrose here just about does a Steve Keen as far as banks’ role in money supply is concerned.

• Why Paul Krugman Is Wrong (AEP)

Professor Paul Krugman is the world’s most influential commentator on economic issues by a wide margin. It is a well-deserved ascendancy. He is brilliant, wide-ranging, readable, and the point of his rapier is very sharp. He correctly predicted and described the Long Slump; though whether he did so entirely for the right reasons is an interesting question. He demolished claims by hard-money totemists that zero rates and quantitative easing would lead to spiralling inflation in a global liquidity trap, as he calls it – or in a China-led world of excess supply and deficient demand, as others would put it. He correctly scolded those who claimed that rich developed countries with their own sovereign currencies are at risk of a bond market crisis unless they retrench into the downturn, or might go the way of Greece. So it is disconcerting to find myself on the wrong side of his biting critique. On other occasions I might submit to his Nobel authority, bruised, but wiser. This time I stand my ground.

The dispute is over whether central banks can generate inflation even when interest rates are zero. He says they cannot do so, and that it is jejune to float such an outlandish idea. Monetary policies are to all intents and purposes impotent at that point. He goes on to suggest that the historical and global evidence has demonstrated this beyond any possible doubt, and here he ventures into flinty terrain. Let me counter – and I will return to this – that his own theoretical model of how the economy works has broken down in one key respect over the last six years. Things are happening that he strongly implied would not and could not happen. He has so far been frugal in acknowledging the limitations of his theory, let alone in exploring why it has gone wrong. He has fallen back to a default setting: the IS-LM model. Developed in 1936, it defines the relationship between interest rates and real output. He returns to the IS-LM invariably and reflexively, almost as if were a religious incantation.

He rebukes me for quoting Tim Congdon from International Monetary Research, specifically for invoking traditional monetary theory to suggest that QE can work even when bond yields are hyper-compressed. The precise quote: “The interest rate is totally irrelevant. What matters is the quantity of money. Large scale money creation is a very powerful weapon and can always create inflation.” Mr Congdon’s claim is a self-evident truism. Central banks can always create inflation if they try hard enough. As Milton Friedman said, they can print bundles of notes and drop from them helicopters. The modern variant might be a $100,000 electronic transfer into the bank account of every citizen. That would most assuredly create inflation. I don’t see how Prof Krugman can refute this, though I suspect that he will deftly change the goal posts by stating that this is not monetary policy. To anticipate this counter-attack, let me state in advance that the English language does not belong to him. It is monetary policy. It is certainly not interest rate policy.

Fun with US stats.

• You Are Hereby Baffled With Bullshit (Zero Hedge)

Just in case you were confidently reflecting on America’s decoupling recovery… we present – today’s baffle ’em with bullshit meme:

“Gross said it would be “very difficult” for oil prices to stabilize.”

• Bill Gross: US Structural Growth Rate To Be About 2% Or Less (CNBC)

Bill Gross said in an exclusive interview with CNBC on Monday that economic growth will likely fall to 2%. “Yes, we’re starting from a 3% growth economy that will probably persist for another quarter or so,” he said. “We get back to a relatively new structural growth rate, which is not 3 but probably 2 or even less. “He attributed the decline to falling oil prices, which in turn affects industries such as fracking. Oil’s slide also “determines currency movements,” setting off a chain reaction. “Then financial markets try and readjust,” he said. “Hedge funds reduce leverage and sell other positions.”

Gross said it would be “very difficult” for oil prices to stabilize. Financial conditions are also a problem, Gross said. “Why would the Federal Reserve raise interest rates in order to slow economic growth if in fact inflation was moving lower? They have a dual mandate from that standpoint,” he said. “I think the market basically doesn’t respect the second part of that mandate.” He also sees the 10-year yield holding near 2%.”I think high quality bonds are a safe bet, just not a high returning bet,” he said.

Interesting point from Yves Smith.

• Did Wall Street Need the Swaps Budget to Hedge Against Oil Plunge? (Yves)

Conventional wisdom among banking experts is that Wall Street’s successful fight last week to get a pet provision into the must-pass budget bill (or in political junkies’ shorthand, Cromnibus) as more a demonstration of power and a test for gutting Dodd Frank than a fight that mattered to them. But the provision they got in, which was to undo a portion of Dodd Frank that barred them from having taxpayer-backstopped deposits fund derivative positions, may prove to be more important than it seemed as the collateral damage from the 40% fall in oil prices hits investors and intermediaries. Mind you, all the howling by Big Finance over this measure can’t be seen as an indicator of its importance. Yes, they have been trying to get this passed for two years. In fact, as Akshat Tewary of Occupy the SEC points out:

The provision that just got passed by the House (Section 630 of the Cromnibus) is identical to another bill already passed by the House last year – HR 992 (Swaps Regulatory Improvement Act). So the House has basically passed the same bill twice. Last year the Senate wouldn’t approve it and the banks were not happy…so the Republicans thought they would hide it in the budget bill so the Senate was forced to approve it this time.

Industry participants view any incursion on their right to make profit (as in pay themselves big bonuses) as a casus belli. That leads to regular histrionics about minor restrictions, like the TARP’s pathetically weak limits on executive bonuses. Exerts on regulation said that the Dodd Frank provision at issue, known as derivatives push-out, was simply about the big US financial firms keeping their profit margins via continued access to cheap funding. Banks weren’t barred from engaging in this type of business but they’d have to do it in different legal entities.

Election propaganda wars.

• Greek Central Bank Boss Warns Of ‘Irreparable’ Economic Damage (BBC)

Greece’s economy faces “irreparable” damage from the ongoing political crisis, the boss of its central bank has warned. “The crisis in recent days is now taking serious dimensions…and the risk of irreparable damage for the Greek economy is now great,” said Yannis Stournaras. Greek politicians will start voting on Wednesday for a new Greek president. There will be a snap general election if the government nominee loses. The political uncertainty has rattled Greek markets over the past week. Greece’s economy emerged from a six-year long recession in the first quarter of the year.

However, the size of Greece’s economy is still about a quarter below the peak it reached before the severe recession and debt crisis triggered by the global financial crash. And conservative Prime Minister Antonis Samaras’s decision to call an early vote in parliament to elect a new president has caused fresh concerns. His conservative-led coalition needs the support of other parties if its candidate is to obtain the backing of MPs. On Thursday an official in the governing coalition said it was still short of the support needed to stop the government collapsing in the parliamentary vote. Greece’s government has warned of a catastrophe if snap elections are called and left-wing anti-bailout party Syriza wins, but Syriza has accused the government of fear mongering.

“The German “data are consistent with only marginal gross-domestic-product growth in the fourth quarter at best ..”

• German Economy at Risk of Downturn as Growth Seen Weak at Best

German private-sector growth slowed to the weakest in 18 months in December, increasing the risk that a soft phase will turn into a more pronounced economic downturn. Markit Economics said a Purchasing Managers Index for manufacturing and services fell to 51.4 this month from 51.7 in November. Economists forecast an increase to 52.3. A factory gauge rose to 51.2 from 49.5, crossing the 50 mark that divides expansion from contraction, while a measure for services fell to 51.4 from 52.1. While German data showed this month that the economy, Europe’s largest, had a modest start into the last quarter of the year, the Bundesbank has pointed to signs that growth could strengthen. As the rest of the euro area struggles to expand and inflation hovers close to zero, the European Central Bank has held out the prospect of expanding its range of asset-purchases next year.

The German “data are consistent with only marginal gross-domestic-product growth in the fourth quarter at best,” said Oliver Kolodseike, an economist at London-based Markit. “The possibility of a renewed downturn at the start of next year is clearly becoming more and more likely, especially if the survey data continue to disappoint.” The German economy narrowly escaped recession in the third quarter, recording growth of 0.1% after shrinking by the same extent in the April-June period. Economists predict growth of 0.2% in the final three months of the year. Companies signaled a second consecutive monthly decline in new business in December, citing a lack of investment and increased competition, according to today’s report.

“NATO jets escorted Russian planes 140 times in 2014, a 70% increase on the previous year, while they flew missions that were “in strict compliance with international rules ..”

• Russia Says US, NATO Increased Spy Flights Seven-Fold (Bloomberg)

Russia has reported a seven-fold increase in reconnaisance missions by U.S. and NATO aircraft near its border on the Baltic Sea since April as tensions flared over the crisis in Ukraine. Russian fighter jets also flew more than 300 missions in response to NATO and other foreign military aircraft approaching the country’s borders this year, compared with more than 200 in 2013, Lieutenant-General Mikhail Mizintsev, head of the Russian Defense Ministry’s joint military command center, said. The sharp increase in air activity by NATO and countries including Sweden and Finland is taking place without “any mutual exchange of information,” Mizintsev said today in his first interview with foreign media. “All achievements in the field of trust-building and voluntary transparency that NATO and Russia have formed over the years have ceased.” Russia’s disclosures about NATO activities around its borders come as it’s embroiled in the worst standoff since the Cold War with the U.S. and its allies over the conflict in Ukraine.

It mirrors NATO reports of a jump in Russian military flights close to the borders of member states. The number of flights by NATO’s tactical aircraft close to the borders of Russia and Belarus doubled to about 3,000 this year, Mizintsev said. He rejected NATO’s claim that it had intercepted Russian aircraft some 400 times this year, a 50% increase on 2013. NATO jets escorted Russian planes 140 times in 2014, a 70% increase on the previous year, while they flew missions that were “in strict compliance with international rules,” Mizintsev said. NATO will remain vigilant in tracking Russian flights, Secretary General Jens Stoltenberg told reporters today after a meeting at the military alliance’s Brussels headquarters with Ukrainian Prime Minister Arseniy Yatsenyuk. Mizintsev said Russia registered 55 cases of foreign jets flying in “dangerous proximity” to its long-range military aircraft, at a distance of less than 100 meters, in 2013-14. Russia’s missions were “as risky as NATO aircraft flights near the Russian border can be considered risky,” he said.

Amen.

• All I Want for Christmas is a (Real) Government Shutdown (Ron Paul)

The political class breathed a sigh of relief Saturday when the US Senate averted a government shutdown by passing the $1.1 trillion omnibus spending bill. This year’s omnibus resembles omnibuses of Christmas past in that it was drafted in secret, was full of special interest deals and disguised spending increases, and was voted on before most members could read it. The debate over the omnibus may have made for entertaining political theater, but the outcome was never in doubt. Most House and Senate members are so terrified of another government shutdown that they would rather vote for a 1,774-page bill they have not read than risk even a one or two-day government shutdown. Those who voted for the omnibus to avoid a shutdown fail to grasp that the consequences of blindly expanding government are far worse than the consequences of a temporary government shutdown.

A short or even long-term government shutdown is a small price to pay to avoid an economic calamity caused by Congress’ failure to reduce spending and debt. The political class’ shutdown phobia is particularly puzzling because a shutdown only closes 20% of the federal government. As the American people learned during the government shutdown of 2013, the country can survive with 20% less government. Instead of panicking over a limited shutdown, a true pro-liberty Congress would be eagerly drawing up plans to permanently close most of the federal government, staring with the Federal Reserve. The Federal Reserve’s inflationary policies not only degrade the average American’s standard of living, they also allow Congress to run up huge deficits.

Congress should take the first step toward restoring a sound monetary policy by passing the Audit the Fed bill, so the American people can finally learn the truth about the Fed’s operations. Second on the chopping block should be the Internal Revenue Service. The federal government is perfectly capable of performing its constitutional functions without imposing a tyrannical income tax system on the American people. America’s militaristic foreign policy should certainly be high on the shutdown list. The troops should be brought home, all foreign aid should be ended, and America should pursue a policy of peace and free trade with all nations. Ending the foreign policy of hyper-interventionism that causes so many to resent and even hate America will increase our national security.

And what do you think happens when the water evaporates as temperatures rise?

• Peat Is Amazon’s Carbon Superstore (BBC)

The most dense store of carbon in Amazonia is not above ground in trees but below ground in peatlands, a study has calculated. An international team of researchers said their work, which uses satellite data and field measurements, provides the “most accurate estimates to date”. Protecting these landscapes is vital if efforts to curb climate change are to be successful, they added. The findings appear in the journal Environmental Research Letters. Writing in the paper, the scientists observed: “This investigation provides the most accurate estimates to date of the carbon stock of an area that is the largest peatland complex in the Neotropics.” They said it also confirmed “the status of the [Pastaza-Marañón foreland basin in north-west Peru] as the most carbon-dense landscape in Amanozia”.

“We expected to find these peatlands but what was more of surprise was how extensive they were, and how much this relatively small area contributed to Peru’s carbon stock,” explained co-author Freddie Draper from the University of Leeds. The 120,000 sq km basin accounts for just about 3% of the Peruvian Amazon, yet it stores almost 50% of its carbon stock, which equates to about three billion tonnes. Mr Draper told BBC News that the team used a new approach to produce their figures: “We used quite a novel method, combining a lot of field data – for about 24 months, we measured how deep the peat was, how dense it was and how much of it was carbon. “That measured how much carbon was in the ground, and then we estimated how much carbon was in the trees.

“Probably the most novel part, because the study covered such a large area, we used different satellite products (radar and images) to identify where these peatlands were.” The team said that the basin remains “almost entirely intact”, but threats are increasing. “Maintaining intact peatlands is crucial for them to continue to act as a carbon sink by continuing to form peat and contribute fully to regional habitat and species diversity,” explained co-author Katy Roucoux from the University of St Andrews. Dr Roucoux told BBC News that scientists are still learning about the contribution these landscapes make to the global carbon cycle. “An important issue is the extent to which the peatland ecosystems are continuing to lock up and store carbon as peat today. It certainly looks as though they are as the environmental conditions are right, ie water-logged.”

It will take forever to solve this issue.

• Denmark Claims North Pole Via Greenland Ridge Link (AP)

Scientific data shows Greenland’s continental shelf is connected to a ridge beneath the Arctic Ocean, giving Danes a claim to the North Pole and any potential energy resources beneath it, Denmark’s foreign minister said. Foreign Minister Martin Lidegaard said Denmark will deliver a claim on Monday to a United Nations panel in New York that will eventually decide control of the area, which Russia and Canada are also coveting. The five Arctic countries – the United States, Russia, Norway, Canada and Denmark – all have areas surrounding the North Pole, but only Canada and Russia had indicated an interest in it before Denmark’s claim. Lidegaard told the AP that the Arctic nations so far “have stuck to the rules of the game” and he hoped they would continue to do so.

In 2008, the five pledged that control of the North Pole region would be decided in an orderly settlement in the framework of the United Nations, and possible overlapping claims would be dealt with bilaterally. Interest in the Arctic is intensifying as global warming shrinks the polar ice, opening up possible resource development and new shipping lanes. The area is believed to hold an estimated 13% of the world’s undiscovered oil and 30% of its untapped gas. Lidegaard said he expects no quick decisions, with other countries also sending in claims. “This is a historical milestone for Denmark and many others as the area has an impact on the lives of lot of people. After the U.N. panel had taken a decision based on scientific data, comes a political process,” Lidegaard told The Associated Press in an interview on Friday. “I expect this to take some time. An answer will come in a few decades.”

Oh boy …

• Welcome To Manus, Australia’s Asylum Seeker Dumping Ground Gulag (Guardian)

The 60,000 people of Manus province, a remote island outpost of Papua New Guinea, had no say in the decision by Australian and local leaders to detain, process and at least temporarily resettle foreign asylum seekers on their shores. “We heard about it on the radio,” says Nahau Rooney, a pioneering political leader, former PNG justice minister and Manus’ most famous daughter. In the 14 months since Australia’s “PNG solution” was brokered, sending asylum seekers trying to reach Australia by boat to Manus for processing and eventual resettlement in PNG, the operation has also sent a tsunami of change crashing through every dimension of island life. It has delivered a booming economy, jobs and desperately needed services.

It has also brought social and environmental damage, deaths, dislocation, disputes and deep anxiety about what will come next. What is certain is that life in Manus will never be the same. […] Two years ago there were only a couple of flights a week to faraway Manus province. Today aircraft sweep in every day over the Bismarck Sea, crossing 370km of open water from the Papua New Guinea mainland to bump down on a strip carved into the jungle by Japanese soldiers 72 years ago. It’s here, since November 2012, that more than 1,650 asylum seekers who once tried to sail to a new life in Australia have instead found themselves unloaded on to PNG soil. Most of the first wave, about 300, did fly back to Australia for processing when the regional resettlement arrangement with PNG was signed in August 2013.

But under its terms all who have arrived since have been assured that even if they are ultimately recognised as refugees, they will never live in Australia. PNG will be their home. None of these asylum seekers have yet been released, though this is said to be close. Two have died. More than 240 have flown away again, “voluntary returns” to their homelands. At last count 1,056 remain in detention, 20 minutes from where they landed. They are held in a compound at a place called Lombrum. Though it long predates them, the name in local language refers to the bottom of a canoe where captives are kept. Momote airport has also seen the coming and going of the legions of guards, tradespeople, medics, interpreters and officials required to wrangle, secure, house, assess and care for the asylum seekers.

Well, done, y’all!

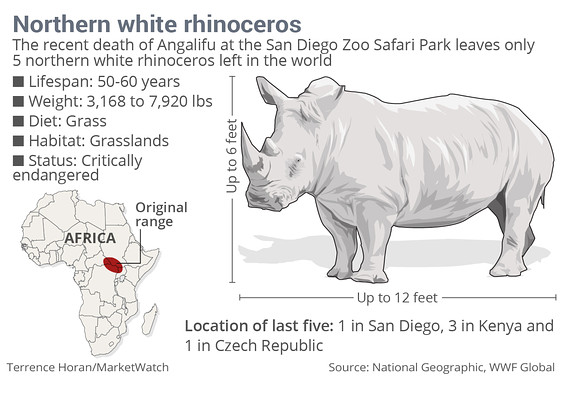

• Only Five Northern White Rhinos Now Exist On The Entire Planet (MarketWatch)

One of six known remaining northern white rhinoceroses died at the San Diego Zoo Safari Park on Sunday. The rhino, Angalifu, was around 44 and died of old age, the Associated Press reported. “Angalifu’s death is a tremendous loss to all of us,” said the park’s curator, Randy Rieches, in a statement, according to the AP. “Not only because he was well-beloved here at the park but also because his death brings this wonderful species one step closer to extinction.” The zoo took to Twitter to memorialize Angalifu and draw attention to the plight of the northern white rhino via the #EndExtinction hashtag:

The white rhino is the second largest land mammal and has two subspecies: the northern and southern white rhino. The southern white is currently classified as “near threatened,” with a population of about 20,000, according to the World Wildlife Fund. With the death of Angalifu, only five northern white rhinos exist — all of them in captivity. There are no northern white rhinos known to be in the wild. Of the remaining rhinos, one is at the same San Diego zoo, another is at a zoo in the Czech Republic, and three are at a wildlife conservancy in Kenya.

Of course it is, there’s no other way. These kinds of conferences never solve a thing.

• Is The Lima Deal A Travesty Of Global Climate Justice? (Guardian)

At one point on Saturday night it looked quite likely that the Lima climate talks would collapse in disarray. Instead of the harmony expected between China and the US following their pre-talks pact, the world’s two largest economies were squaring off; workmen were dismantling the venue; old faultlines between rich and poor countries were opening up again and some countries’ delegations were rushing to catch their planes. In the end, after a marathon 32-hour session where everyone stared into the abyss of total failure, a modicum of compromise prevailed. Some deft changes of emphasis in the revised text and the inclusion of key words such as “loss” and “damage” proved just enough for diplomats to bodge a last-minute compromise. There were cheers and tears as the most modest of agreements was reached. The Peruvian president of the UN climate change convention, or Cop20, could say without irony: “With this text, we all win without exception.”

Not so. Countries may technically still be on track to negotiate a final agreement in Paris next year, but the gaps between them are growing rather than closing and the stakes are getting higher every month. We have now reached the point where everyone can see clearly that whatever ambition there once was to respect science and try to hold temperatures to an overall 2C rise has been ditched. We also know that developing countries will not get anything like the money they need to adapt their economies and infrastructure to climate change and that those countries that have been historically responsible for getting the world into its current climate mess will be able to do much what they like. As it stands, 21 years of tortuous negotiations may have actually taken developing countries backwards on tackling climate change.

From an imperfect but legally binding UN treaty struck in 1992, in which industrialised countries accepted responsibility and agreed to make modest but specific cuts over a defined period, we now have the prospect of a less than legally binding global deal where everyone is obliged to do something but where the poor may have to do the most and the rich will be free to do little. In 1992, rich countries were obliged to lead and to help the poor, but we now have a situation where those who had little or no historical responsibility for climate change are likely to cut emissions the most. This travesty of global climate justice, say many developing countries, is largely the fault of the US, which, backed by Britain and others industrialised countries like Canada and Australia, has helped build up distrust in developing countries by continually trying to deregulate the international climate change regime by weakening the rules, shifting responsibility to the south and making derisory offers of financial help.

“Existing computer models may be severely underestimating the risk to Greenland’s ice sheet..”

• Bad News For Florida: Models Of Greenland Ice Melting Could Be Way Off (NBC)

Existing computer models may be severely underestimating the risk to Greenland’s ice sheet — which would add 20 feet to sea levels if it all melted — from warming temperatures, according to two studies released Monday. Satellite data were instrumental for both studies — one which concludes that Greenland is likely to see many more lakes that speed up melt, and the other which better tracks large glaciers all around Earth’s largest island. The lakes study, published in the peer-reviewed Nature Climate Change, found that what are called “supraglacial lakes” have been migrating inland since the 1970s as temperatures warm, and could double on Greenland by 2060. The study upends models used by the Intergovernmental Panel on Climate Change because they “didn’t allow for lake spreading, so the work has to be done again,” study co-author Andrew Shepherd, director of Britain’s Centre for Polar Observation and Modelling, told NBCNews.com.

Those lakes can speed up ice loss since, being darker than the white ice, they can absorb more of the sun’s heat and cause melting. The melt itself creates channels through the ice sheet to weaken it further, sending ice off the sheet and into the ocean. “When you pour pancake batter into a pan, if it rushes quickly to the edges of the pan, you end up with a thin pancake,” study lead author Amber Leeson, a researcher at Britain’s University of Leeds, explained in a statement. “It’s similar to what happens with ice sheets: The faster it flows, the thinner it will be. “When the ice sheet is thinner,” she added, “it is at a slightly lower elevation and at the mercy of warmer air temperatures than it would have been if it were thicker, increasing the size of the melt zone around the edge of the ice sheet.”

The mix of IPCC models have Greenland contributing 8.7 inches to global sea level rise by 2100 without the doubling of supraglacial lakes, but the team fears that a doubling could add almost as much as that over the next century. Such a rise in sea level would have serious repercussions for heavily populated low-lying areas, like Florida or Bangladesh, which could see beach and barrier island erosion and salt water encroachment, scientists say. The glaciers study, published in the peer-reviewed Proceedings of the National Academy of Sciences, used NASA satellite data to reconstruct how the height of the ice sheet has changed at nearly 100,000 locations from 1993 to 2012.

The team found significant variations that aren’t factored in by existing computer models for future changes on Greenland because they focus on just four glaciers. “The problem is that these models have been applied to four glaciers only, one of which has not been changing much, to predict how these glaciers may change in the future,” Kees van der Veen, a study co-author and University of Kansas geographer, told NBCNews.com. “Results for these four glaciers have been extrapolated to the entire ice sheet to estimate the contribution of the entire ice sheet to sea level rise,” he adds. “Our results show that this is not appropriate because of how differently individual glaciers have changed over the last decade.”

Home › Forums › Debt Rattle December 16 2014