Paul Gauguin Yellow haystacks (Golden harvest) 1889

Trump ad

https://twitter.com/i/status/1762535418661154964

Dr. Phil leaves hosts on The View in STUNNED SILENCE after utterly SCHOOLING them on lockdowns— Hosts PANIC: 'CUT TO COMMERCIAL BREAK!'pic.twitter.com/kqOxjo0eUP

— Benny Johnson (@bennyjohnson) February 27, 2024

Poso

https://twitter.com/i/status/1762677522922086625

Biden

NEW: Joe Biden loses his train of thought after trying to claim Trump is really the one suffering from mental decline and not him.

You can’t make this up.

“Take a look at the other guy. He is about as old as I am, but he can't remember his wife's name.”

“They told us we… pic.twitter.com/OSKrK1R3iJ

— Collin Rugg (@CollinRugg) February 27, 2024

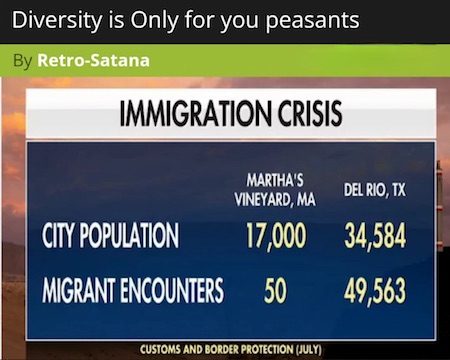

Venezuela has its lowest homicide rate in 22 years because their gangs are coming here.

Read that again and let it sink in. pic.twitter.com/cTBJjVhSTN

— End Wokeness (@EndWokeness) February 27, 2024

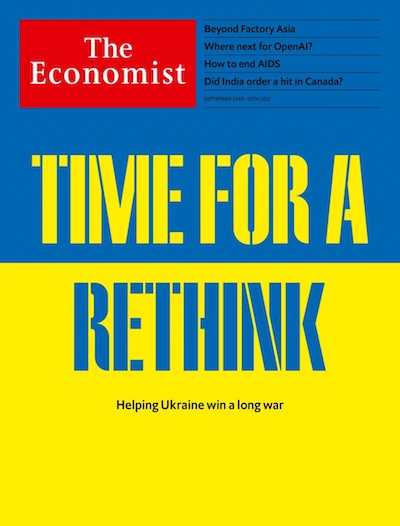

“..the world is “resetting to the great disadvantage of the US..”

• Ukraine Conflict Weakening US – Tucker Carlson (RT)

Most Americans naively believe that Ukraine could defeat Russia because the media has told them so, independent journalist Tucker Carlson said on Tuesday. What the US has done has harmed both Ukrainians and Americans, he added. Carlson spent eight days in Moscow earlier this month and interviewed Russian President Vladimir Putin on February 8. He looked back at that conversation during a three-hour podcast hosted by Lex Fridman. “I reject the whole premise of the war in Ukraine from the American perspective,” Carlson added. “There’s a war going on that is wrecking the US economy in a way and at a scale that people do not understand.” The current policy of the American government is only accelerating the demise of the dollar and the world is “resetting to the great disadvantage of the US,” Carlson said.

According to him, for the past two years the US media have insisted that Kiev can win – and it took an encounter with Hungarian Prime Minister Viktor Orban, last August, to jolt him into reality. “It doesn’t even matter what I want to happen… that’s a distortion of what is happening,” Carlson told Fridman. Russia has 100 million more people and more industry “than all of NATO combined,” he added. Carlson revealed that he feels “sorry” for Ukrainian President Vladimir Zelensky, because “ he’s caught between these forces that are bigger than he is.” A “victory” for Kiev would be to not get obliterated, he added, and that almost happened in March 2022 when Zelensky almost made peace with Russia. Then the US dispatched British PM Boris Johnson to stop it, Carlson noted.

The US journalist again confirmed that Johnson demanded $1 million to do an interview, calling the former PM a “sad, rapacious fraud.” The point of interviewing Putin wasn’t to show the world how smart or good Tucker Carlson was, but “to have more information brought to the West so people could make their own decisions about whether this is a good idea,” he told Fridman, referring to the Ukraine conflict. Every Western journalist so far has tried to make an encounter with Putin about themselves, which Carlson described as “the most tiresome, fruitless kind of interview.”

https://twitter.com/i/status/1762599403548803265

“If you have a media establishment that acts as employees of the national security state, you don’t have a free country. And that’s where we are..”

• Tucker Carlson Makes Shocking Revelation About Moscow Trip (RT)

Tucker Carlson said on Tuesday that US spies had monitored him while he was in Russia earlier this month, and leaked to a ‘friendly’ outlet that he had met with Edward Snowden. This is despite the American journalist’s claim that he had tried to keep his meeting with the NSA whistleblower a secret. Carlson went to Russia to interview President Vladimir Putin. During his eight days in Moscow, he also met with Snowden – and US spies found out about it, he told podcaser Lex Fridman in the course of a three-hour conversation. “I was being intensely surveilled by the US government,” Carlson told Fridman, noting that US spies had thwarted his plans to interview Putin in 2021 and that he received confirmation that he was being intensely monitored ahead of his Moscow trip. “Then, I’m over there, and of course I want to see Snowden, whom I admire.”

Snowden allegedly accepted Carlson’s invitation to have dinner at the Four Seasons Hotel, but declined the interview as well as a photo request, saying that it would be better to tell no one. “I didn’t tell anybody,” Carlson told Fridman, however the meeting was leaked. “Semafor runs this piece – reporting information they got from the US intel agencies, leaking against me, using my money, in my name, in a supposedly free country – they run this piece saying I met with Snowden, like it was a crime or something.” “If you have a media establishment that acts as employees of the national security state, you don’t have a free country. And that’s where we are,” Carlson added. Carlson revealed that he did not fear getting arrested in Russia at any point, but was warned by his lawyers that the US might arrest him depending on the content of the Putin interview.

Tucker Carlson attempted to have a private dinner with Edward Snowden.

"I was being intensely surveilled by the US government"

"If you have a media establishment that acts as employees of the national security state, you don't have a free country…and that's where we are" pic.twitter.com/gFjGZkhta1

— Clint Russell (@LibertyLockPod) February 27, 2024

“I felt not one twinge of concern for the 8 days that I was there,” he told Fridman about being in Moscow. Before he left for Russia, his team of attorneys counseled him to “not do this… A lot will depend on the questions you ask of Putin. If you’re seen as too nice to him you could be arrested when you come back,” Carlson quoted the lead lawyer as saying, to which he said he replied, “You’re describing a fascist country, OK?”

Tucker Carlson with Lex Fridman this morning, his attorney's advice in regards to interviewing Putin:

"Their sincere conclusion was, do not do this…a lot will depend on the questions you ask of Putin. If you're seen as too nice to him you could be arrested when you come back" pic.twitter.com/XkqbqhvaDk

— Clint Russell (@LibertyLockPod) February 27, 2024

In 2013, Snowden revealed that the NSA was systematically engaged in mass illegal spying on American citizens. Fearing for his safety, he fled to Hong Kong with the intent to reach Ecuador, which did not have an extradition treaty with the US, but was stopped during a layover in Moscow after Washington canceled his passport. Russia ended up granting him asylum and reportedly, eventual citizenship. One of the founders of Semafor, the outlet to which Carlson claims US spies leaked his dinner with Snowden, is Ben Smith, a former editor-in-chief of the now defunct BuzzFeed newsroom. In 2017, Smith notoriously published the ‘Steele Dossier,’ a sham document leaked by US spies to discredit incoming President Donald Trump.

https://twitter.com/i/status/1762572926295929019

“The Reds are holding the evidence that Navalny was not murdered and that everything the Whites are saying is false.”

• Navalny Organization Splits Into Whites And Reds (Helmer)

Alexei Navalny’s organization outside Russia is now repudiating Lyudmila Navalnaya, Navalny’s mother, for having accepted the medical evidence and official certification that the cause of his death was an embolism, or blood clot, which stopped his heart. On Monday, several days after the release of the post-mortem documents and of Navalny’s body to his mother’s custody, Maria Pevchikh, Navalny’s script writer, and Kira Yarmysh, Navalny’s press secretary, have repeated their allegations that Navalny had been murdered. In their revised version of the story on Monday, Pevchikh claimed in a self-produced video that “on February 16, 2024, Vladimir Putin killed Alexei Navalny”. Reuters, the New York-based news agency, reported Pevchikh’s claim, adding that “Maria Pevchikh, who is based outside Russia, did not present documentary evidence for her assertion.” The New York Times amplified Pevchikh’s allegations, but omitted the Reuters qualifier.

The newspaper did not report attempting to make contact with Lyudmila Navalnaya but added this innuendo: “it remained unclear whether his family would seek to conduct an independent autopsy before his burial.” “Alexei Navalny could be sitting in this seat right now, right today,” Pevchikh broadcast. “That’s not a figure of speech, it could and should have happened…Navalny was supposed to be free in the coming days.” Pevchikh then recited details of a purported exchange of Russian spies in prison outside Russia in exchange for Navalny and Americans in Russian prisons. The NATO-funded Bellingcat organization was involved, Pevchikh said. “Investigator Hristo Grozev helped us devise and implement this plan.” Negotiations took place with American and German officials, she said, but “they did nothing.”

She then said: “Roman Abramovich was the one who delivered the proposal to swap Navalny to Putin. As an informal negotiator communicating with American and European officials, and at the same time representing Putin; an unofficial channel of communication with the Kremlin.” Pevchikh claims she asked Abramovich for details of what had been told to Putin and what the president replied. “Unfortunately”, Pevchikh said, “Abramovich did not answer these questions but he did not deny anything either.” Yarmysh followed Pevchikh with a 3-line tweet: “We know why Alexei was killed right now. He should have been exchanged literally these days. An offer was made to Putin.”

The evidence of prisoner swaps between the US, Germany, and Russia is no news and corroborated officially, although the identities of the swap candidates keep changing, as do the names of the reported go-betweens. Abramovich’s role as the intermediary in the abortive Istanbul negotiations between Russian and Ukrainian officials of March 2022 has not been followed with any report of subsequent intermediation by Abramovich, except to save himself from sanctions. All that is missing from the new Pevchikh-Yarmysh announcements is the medical evidence of the cause of Navalny’s death. That is being closely held by Navalny’s mother, and she is in charge of the arrangements for his funeral.

In her latest tweet, Yarmysh implies this too is no longer under the outside organization’s control, as it proposes an alternative, parallel ceremony. “We are looking for a hall for a public farewell to Alexei,” Yarmysh said yesterday. “Time: end of this work week. If you have suitable premises, please contact us.” Pevchikh is based in London; Yarmysh left Russia in 2021 and is also abroad. They are the Whites now. The Reds, Navalny’s mother and Anatoly Navalny, his father, remain in Moscow. The Reds are holding the evidence that Navalny was not murdered and that everything the Whites are saying is false.

Kamala is part of the “Big Four”? Get serious.

• Big Four Leave Oval Office Without Plan to Avert Shutdown (Sp.)

US President Joe Biden summoned four congressional leaders on Tuesday in an effort to avoid a government shutdown that is predicted to occur on March 8, including: Vice President Kamala Harris, House Minority Leader Hakeem Jeffries, Senate Minority Leader Mitch McConnell, Senate Majority Leader Chuck Schumer, and House Speaker Mike Johnson. US legislators must come up with a spending plan that both sides of the aisle can agree on, in order to avoid the shutdown. At the beginning of the year, the short-term continuing resolution (CR) established a phased, two-step deadline to fund the government, which extended funding through March 1 for about 20% of the federal government that is responsible for military construction, as well as the departments of veterans affairs, agriculture, housing and urban development, transportation and energy. The remaining 80% of the government is funded until March 8.

Aquiles Larrea, the CEO of Larrea Wealth Management, spoke to Sputnik’s The Final Countdown on Tuesday, and sounded hopeful congressional leaders still have enough time to avoid a shutdown, but stressed that time is slipping away. “I think that the appearance of having to try to do something, getting something done with the congressional leadership is very important at this point, especially since we’ve gone past a few stopgap measures at this point. But I think, we’re not going to have any choice but to put another one in there unless we can get people to agree overnight,” said Larrea. “Let’s just say, in a perfect world, that the Congress agrees overnight, the Senate has to look over the bill over the weekend and hopefully before the March 8th deadline comes to some accord. That way they can get it to the president, but that time is quickly slipping away. So, something the president has probably taken it upon himself, whether it’s appearance, whether it be true, whether it be magic to come out and say, ‘guys, let’s do something, let’s figure this out, we have to agree on something,’” he continued. “The only wild card in the bunch right now is the caucus within the House Republican Party.”

Sputnik’s Angie Wong commented on what she views as political posturing by the four congressional leaders and Biden, noting that the US president plans to go to the southern border ahead of the potential shutdown. Former President Donald Trump will also visit the border on Thursday. US Democrats have been fighting for more money to fund Ukraine and Israel, while Republicans have been working to send money to the US-Mexico border, because they believe that will help secure it. Wong then asked Larrea why Biden had not issued an executive order to close the US-Mexico border. “I think he’s trying to give Congress a fair chance to come up with some solutions because just the president invoking an executive order seems more tyrannical than anything. You know, ‘oh, this guy, he just came in, he did this,’. I think it gives plenty to chew on opponents to say, ‘well, he had to do this because it was out of control,’ and it won’t be a positive thing,” Larrea explained.

Biden — confused — ignores questions as his handlers herd the press out of the room pic.twitter.com/VPmr3q0Jwh

— RNC Research (@RNCResearch) February 27, 2024

“..get it done” and “do the right thing,” adding that “history is looking over your shoulder.”

• US Border A Bigger Priority Than Ukraine – Speaker Johnson (RT)

Congress will not pass a new aid package for Ukraine without reforms to US immigration policy, House Speaker Mike Johnson has said, arguing that America’s own security takes priority over Kiev’s conflict with Russia. Speaking after a contentious meeting with President Joe Biden and congressional leaders earlier on Tuesday, Johnson insisted that House Republicans would not budge on the foreign aid if Democrats did not compromise on the border. GOP lawmakers are “actively pursuing and investigating all the various options” for the Ukraine legislation, but “The first priority of the country is our border and making sure it’s secure,” Johnson told reporters.

The Republican speaker has faced increased pressure from congressional Democrats, the White House and even fellow GOP members in the Senate over the aid bill, with President Biden warning that the “consequences of inaction every day in Ukraine are dire” ahead of his meeting with Johnson. Democratic Senate Majority Leader Chuck Schumer, who attended the sit-down with Biden, also said he urged Johnson to “get it done” and “do the right thing,” adding that “history is looking over your shoulder.” He described the discussion around the Ukraine bill as “intense,” stating “Everyone in that room was telling Speaker Johnson how vital” the military assistance was.

While the Senate previously passed a $95 billion aid package – including $60 billion for Kiev in addition to funding for Israel and Taiwan – House Republicans have refused to back companion legislation unless it includes significant reforms at the US-Mexico border. Citing a surge in illegal immigration since Biden took office in 2021, Johnson called the situation a “catastrophe” and stressed that the White House could “take executive authority right now, today, to change that.” Ukrainian officials have repeatedly urged for additional aid, as US assistance has waned following a lackluster summer counteroffensive. President Vladimir Zelensky made his latest appeal last week during a meeting with Schumer and other Democrats, where he reportedly warned that Kiev would “surely lose the war” without further cash injections from Washington.

“..provide all documents on Special Counsel Robert Hur’s investigation of President Joe Biden’s “willful” mishandling of classified information..”

• US House Panels Subpoena AG on Biden’s Mishandling of Classified Docs (Sp.)

The chairmen of the House Judiciary Committee and Oversight Committee on Tuesday issued a subpoena demanding that US Attorney General Merrick Garland provide all documents on Special Counsel Robert Hur’s investigation of President Joe Biden’s “willful” mishandling of classified information. According to the cover letter accompanying the subpoena and signed by Congressmen James Comer and Jim Jordan respectively, the US Justice Department to date has not provided either records related to Hur’s investigation or a deadline when it expects to produce all of the requested material. The initial request to provide the documents was made on February 12, according to the letter. The Judiciary and Oversight Committees are leading an investigation into business dealings and other activities of the Biden family to determine whether there are sufficient grounds to draft articles of impeachment against Biden.

“We have more than 50 decently-sized American firms alone working here, and plenty of European companies..”

• How Russia Could Hit Back If West Seizes Assets (Sp.)

Treasury Secretary Janet Yellen has called on nations of the Western “coalition” against Moscow to “find a way to unlock the value of [Russia’s] immobilized assets to support Ukraine’s continued resistance and long-term reconstruction.” “I believe there is a strong international law, economic and moral case for moving forward. This would be a decisive response to Russia’s unprecedented threat to global stability,” Yellen said at a meeting of G20 finance ministers and central bank governors in Sao Paulo, Brazil on Tuesday. Tackling the question of the potential threats to the dollar’s status as the de facto world reserve currency that such an unprecedented move would entail, Yellen said that it it’s “extremely unlikely” that the greenback would be negatively affected. “Realistically there are not alternatives to the dollar, euro and yen,” she assured.

Yellen is the latest senior Western official to propose moving forward with the seizure of Russian assets as Western countries’ own desire to continue fueling the Ukrainian proxy war against Russia falters. Earlier this month, the European Union adopted a law allowing Brussels to bank windfall profits from Russian assets trapped in European banks and use them in Ukraine, a move characterized by Moscow as blatant “theft” which will be met with legal action. Russian officials and independent economic observers alike have warned of the possible consequences stemming from what Yellen is proposing, with Russian finance minister Anton Siluanov saying Moscow has the means to issue a “symmetrical” response to this form of Western financial aggression. “We have no fewer frozen [assets than Western countries],” Siluanov said in an interview with Sputnik on Monday. “Any actions taken against our assets would receive a symmetrical response.”

“Russia has already taken conservatorship of assets of a number of foreign companies which refused to operate in Russia,” Dr. Andrei Kolganov, a professor of economics at Moscow State University and chief researcher at the Russian Academy of Sciences’ Institute of Economics, told Sputnik, commenting on the folly of the West’s asset seizure plans. This instrument was already used against foreign investors with an ownership stake in the Baltika Beer Company, as well as the assets of Finnish energy concern Fortum, the professor noted. “So in principle, the mechanism for the confiscation of foreign assets has already been worked out. Moving from conservatorship to confiscation is, in principle, a fairly simple technical procedure. The amount of assets that are ‘frozen’ on the territory of the Russian Federation, or which may be frozen, is now estimated at approximately $288 billion,” Kolganov explained.

In other words, the professor said, Russia has control over a big chunk of Western assets which, if the US and its allies proceed with confiscation, “will not escape to the West, but will work here in Russia, because we are talking about investment, first and foremost, in the manufacturing sector.” From there, these assets could become the property of the Russian state, or be transferred to Russian private owners and continue to work as before. Confiscation of assets of Western companies in Russia would seriously impact their respective bottom lines, meaning they could try to put pressure on governments, both in their home countries and in Russia, to try to avoid having their capital seized. “We have a lot of foreign companies working in Russia, including those from so-called unfriendly countries. We have more than 50 decently-sized American firms alone working here, and plenty of European companies,” Dr. Georgy Ostapkovich, director of the Center for Market Research at the Institute of Statistical Research and Economics of Knowledge at Russia’s Higher School of Economics, told Sputnik.

Kolganov says that as unpleasant as a seizure of Russia’s assets abroad might be it would not serve to tank the country’s economy, with Moscow able to continue its international payments using its sizable and healthy foreign exchange earnings after reorienting its trade toward developing countries. The money frozen in Western banks constitutes reserves, which “were not actively used for international trade and international payments” anyway, the professor explained. “For private businesses, the confiscation of assets would create a pretty big hole in their earnings and budgets. Therefore, it would be a rather sensitive measure if Russia had to resort to it in response to the confiscation of its assets,” the economist added. Dr. Ostapkovich emphasizes that Moscow will have to be strategic and precise in the foreign assets it may choose to seize, to avoid the risk of friendly countries and companies doing business in Russia feeling threatened.

Kiev.

• Ukraine Set to Lose More Territory in 1-2 Months Without US Support – WH (Sp.)

Ukraine is on track to lose additional territories in the coming months due to a lack of military support from the US, White House National Security Communications adviser John Kirby said on Tuesday. “If they continue to get no support from the US, in a month or two, it is very likely that the Russians will achieve more territorial gains and have more success against Ukrainian frontlines in terms of just territory gain,” Kirby told reporters He pointed out that such a situation could happen in eastern Ukraine, but also potentially in the south of the country. Kirby stressed that the situation on the ground is dire. US President Joe Biden said on Tuesday that the need to provide additional support to Ukraine is urgent. Russia has repeatedly warned NATO countries that arms supplies to Ukraine would be considered legitimate targets. Moscow has accused NATO countries of “playing with fire” by arming Ukraine, emphasizing that such actions hinder the possibility of Russia-Ukraine negotiations.

“This is the line beyond which it’s no longer just NATO’s involvement in the war..”

• Catastrophic Scenario If NATO Troops Deploy To Ukraine – Russian Senator (RT)

The potential deployment of NATO troops to Ukraine will lead to a “catastrophic scenario,” and could be interpreted as a “declaration of war” on Moscow, top Russian senator Konstantin Kosachev has said.The Vice Speaker of Russia’s upper chamber, the Federation Council, offered his take on remarks by French President Emmanuel Macron on the possibility of sending troops in a Telegram post on Tuesday. The approach exhibited by the French leader carries a risk of the situation devolving into a “catastrophic scenario,” Kosachev warned, stating that the move would not be tolerated by the Kremlin. “This is the line beyond which it’s no longer just NATO’s involvement in the war – this has been happening for a long time, but can be interpreted as the alliance entering direct hostilities, or even as a declaration of war,” Kosachev wrote.

The senator’s comments echoed a statement made by Kremlin spokesman Dmitry Peskov, who said the move would make a direct collision between the US-led bloc and Moscow not only “possible,” but actually “inevitable.” The idea of sending ground forces to Ukraine was raised by Macron on Monday while he was speaking to reporters after a meeting of European leaders in Paris. The president suggested that any scenario, including sending in troops, could not be ruled out, arguing that the West should stop at nothing to prevent Russia from prevailing over Ukraine. “In terms of dynamics, we cannot exclude anything. We will do everything necessary to prevent Russia from winning this war,” he stated, while admitting that there was no consensus among NATO members on the troop issue.

The remarks prompted NATO allies to publicly reject the suggestion, with the bloc’s leadership insisting no preparations to send forces to Ukraine actually exist. Secretary-General Jens Stoltenberg stated there were “no plans for NATO combat troops on the ground in Ukraine,” and several members of the alliance, including the US, offered separate statements denying any such intent.

Putin NATO

https://twitter.com/i/status/1762445822137127039

“There are thousands of people busting their ass, often in dangerous places, sacrificing a lot for the country. And to have their work just dismissed by a commander in chief, is really just discouraging..”

• Trump Plans To ‘Reform’ CIA and FBI – Politico (RT)

Former US President Donald Trump is “likely” to launch sweeping reforms of the US intelligence community if he is re-elected in November, prompting concerns from the agencies that once baselessly accused him of ties to Russia. Politico interviewed 18 intelligence officials – including several former Trump appointees who later came out as his outspoken critics – in an article published on Monday, warning that the possible purge could “undermine the credibility of American intelligence.” “Trump intends to go after the intelligence community,” said one former senior intelligence official. “He started that process before and he’s going to do it again. Part of that process is to root out people and to punish people.” The new president would replace “people perceived as hostile to his political agenda with inexperienced loyalists,” Politico summarized the claim by Trump critics.

The two people specifically named were former acting Director of National Intelligence (DNI) Richard Grenell and aide Kash Patel, who played a key role in declassifying materials about the origins of ‘Russiagate’. Politico acknowledged that Trump’s hostility to the intelligence community was related to the infamous document claiming that Russia “interfered” in the 2016 election against Hillary Clinton. It quoted former FBI official Andrew McCabe defending the inclusion of the so-called Steele Dossier – produced by a former British spy paid by the Clinton campaign via cut-outs – in the appendix as merely due diligence. Though the FBI quickly found out that the dossier was false and who funded it, they continued to use it to spy on Trump’s campaign and presidency.

When Trump challenged the intelligence assessment – authored not by all 17 agencies, but a hand-picked group of Obama administration loyalists – at the July 2018 summit with Russian President Vladimir Putin, the spies felt that “never before had a commander in chief so publicly delegitimized their work.” Trump’s DNI Dan Coats told Politico that this prompted him to offer his resignation in February 2019 – which was eventually accepted that August. Other Trump appointees turned critics interviewed in the article were former National Security Advisor John Bolton and Fiona Hill, a top Russia adviser on the National Security Council – and witness against Trump at his Ukraine impeachment trial. “He wants to weaponize the intelligence community,” lamented Hill. “If he guts the intel on one thing, he’ll be partially blinding us.”

Several unnamed officials said Trump’s possible purges could jeopardize “sources and methods” used by US spies and undermine the trust American allies have in Washington, which the Biden administration has tried so hard to rebuild. Back in December, a diplomat from an unnamed NATO member country described Trump getting re-elected and actually purging the US administrative apparatus as a “doomsday option.” Others worried that appointments of “controversial” figures could lead competent junior officials and staff to resign. “There are thousands of people busting their ass, often in dangerous places, sacrificing a lot for the country. And to have their work just dismissed by a commander in chief, is really just discouraging,” Jon Darby, former director of operations at the National Security Agency (NSA), told Politico.

“The state of Israel makes me very uncomfortable,” a colleague once told me. This was something I was used to hearing from young progressives on college campuses, but not at work.”

• Former NY Times Editor Blasts the “Gray Lady” for Bias and Activism (Turley)

Former New York Times editor Adam Rubenstein has a lengthy essay at The Atlantic that pulls back the curtain on the newspaper and its alleged bias in its coverage. The essay follows similar pieces from former editors and writers that range from Bari Weiss to Rubenstein’s former colleague James Bennet. The essay describes a similar work environment where even his passing reference to liking Chik-Fil-A sandwiches led to a condemnation of shocked colleagues. An opinion-section editor, Rubenstein was involved in the controversy over publishing Sen. Tom Cotton’s (R., Ark.) op-ed where he argued for the possible use of national guard to quell violent riots around the White House. It was one of the lowest points in the history of modern American journalism. Cotton was calling for the use of the troops to restore order in Washington after days of rioting around the White House.

While Congress would “call in the troops” six months later to quell the rioting at the Capitol on January 6th, New York Times reporters and columnists called the column historically inaccurate and politically inciteful. Reporters insisted that Cotton was even endangering them by suggesting the use of troops and insisted that the newspaper cannot feature people who advocate political violence. One year later, the New York Times published a column by an academic who had previously declared that there is nothing wrong with murdering conservatives and Republicans. Rubenstein noted: “On January 6, 2021, few people at The New York Times remarked on the fact that liberals were cheering on the deployment of National Guardsmen to stop rioting at the Capitol Building in Washington, D.C., the very thing Tom Cotton had advocated.” Instead, he describes an environment in which the staff routinely rejected conservative viewpoints, subjected conservatives to added demands and editing, and faced staff opposition to working on such pieces. He noted:

“Being a conservative—or at least being considered one—at the Times was a strange experience. I often found myself asking questions like “Doesn’t all of this talk of ‘voter suppression’ on the left sound similar to charges of ‘voter fraud’ on the right?” only to realize how unwelcome such questions were. By asking, I’d revealed that I wasn’t on the same team as my colleagues, that I didn’t accept as an article of faith the liberal premise that voter suppression was a grave threat to liberal democracy while voter fraud was entirely fake news. Or take the Hunter Biden laptop story: Was it truly “unsubstantiated,” as the paper kept saying? At the time, it had been substantiated, however unusually, by Rudy Giuliani. Many of my colleagues were clearly worried that lending credence to the laptop story could hurt the electoral prospects of Joe Biden and the Democrats. But starting from a place of party politics and assessing how a particular story could affect an election isn’t journalism. Nor is a vague unease with difficult subjects. “The state of Israel makes me very uncomfortable,” a colleague once told me. This was something I was used to hearing from young progressives on college campuses, but not at work.”

“Let us analyze the history of relations between the so-called “West” and Russia over the last 30 years and we will see that, in fact, Russia was forced to defend itself against a war that was already underway against it..”

This February 24th marked two years since the beginning of Russia’s intervention in the war in Ukraine. All major Western media — monopolized by billionaires who use the press to maintain their domination — call the Special Military Operation, the official name of the Russian campaign, “war”. With this, they propagate the idea that it was Russia that started the war. A lie that (purposefully) covers up the guilt, not only of the government that is today headed by Vladimir Zelensky, but, mainly, of the great Western powers. The propaganda disseminated by this gigantic press monopoly attempts to brainwash ordinary citizens, accusing evil Russia of invading defenseless Ukraine in a criminal war of conquest. The truth is that the war started not two years ago, but ten years ago! And the one who started it was not Russia, but Ukraine itself. Russia was not even directly involved in the conflict. Those who played a fundamental role in the outbreak of this war were precisely those who accuse Russia today.

Vladimir Putin, the Russian president, in his interview with American reporter Tucker Carlson, recapped the dramatic events that led to the war. Let us analyze the history of relations between the so-called “West” and Russia over the last 30 years and we will see that, in fact, Russia was forced to defend itself against a war that was already underway against it. The dismantling of the Soviet Union weakened Russia as never before in history. Practically overnight, the peripheral territories that had belonged to it for centuries became independent. The great objective of the imperialist powers since the beginning of the 20th century had been achieved. The wave of separations also encouraged two wars in Chechnya in the 90s and 2000s, at the same time that the neoliberal shock policy was devastating its economy. In addition to having lost much of the territory of the former Soviet Union, Russia saw these new countries being completely dominated by imperialism.

In 2004, a “color revolution”, known as the Orange Revolution, prevented the election of a neutral president in Ukraine to ensure a U.S. puppet — Viktor Yushchenko — in power. In 2008, it was Georgia’s turn to be captured by Western nations, which made Russia outline its first response to this suffocation that they sought to impose on it, in what became known as the Ossetian War. All of Russia’s former allies were being wiped off the map. The NATO bombings in Libya, with the execution of Muammar Gaddafi, in 2011, once and for all raised the alarm for Moscow. When the United States, England and France tried to do the same in Syria, soon after, Putin learned the Libyan lesson and vetoed in the UN Security Council an identical operation to overthrow the regime of Bashar al-Assad, in addition to supporting it militarily.

The last straw for the Russians was the second coup in Ukraine, which began at the end of 2013. Viktor Yanukovych, who had been prevented from being elected in 2004, was in power. He conducted a friendly policy with Moscow, although he was hesitant and negotiated with the European Union. However, in the end, he did not adhere to the latter, preferring the greater advantages that his country would have by maintaining privileged relations with its sister nation. The EU and the U.S. did not accept this modest demonstration of sovereignty by Ukraine and used, as in 2004, NGOs paid by George Soros and the CIA to execute a new “color revolution” in Kiev. This time, however, avowedly neo-Nazi groups were the shock troops of the demonstrations on Maidan Square.

The result of the coup d’état, consolidated at the beginning of 2014, was not just the fall of a government that was in dialogue with Russia to replace it with one aligned with the West. It was more than that: a regime came to power supported by the same fascist organizations that led the Maidan. Ukrainian fascism has always been strongly anti-Russian and its influence on the new regime led to the persecution of all Ukrainians of Russian origin — who represent the majority of the population in around 40% of the country’s territory. The regions of Donetsk, Luhansk and Crimea, where 75% of voters had elected Yanukovych in 2010 and were of Russian origin, were the most persecuted and rebelled. Crimea held a referendum where the overwhelming majority of the population chose to reincorporate into Russia (to which it had always belonged), resulting in an annexation carried out shortly thereafter by the Russian Federation.

Putin, however, did not do the same in Donetsk and Lugansk. The people of these two regions declared independence from Ukraine and formed two self-styled people’s republics. Armed with arms, they resisted the military invasion ordered by the new Kiev authorities, spearheaded by fascist paramilitary militias such as the infamous Azov, Aidar and Right Sector battalions. This was the true beginning of the current war in Ukraine, which, until the beginning of the Russian intervention, had claimed the lives of more than 14,000 people — most of them killed by the invading Ukrainian forces.

Kujat

Retired German General Harld Kujat, former chairman of the NATO Military Committee, explains why the claim that Russia sought to conquer all of Ukraine in Feb. 2022 doesn't add up:

"Russia deployed about 190,000 soldiers against a Ukrainian force more than twice as large. This… pic.twitter.com/ZfpOjvhS7B

— Aaron Maté (@aaronjmate) February 27, 2024

“Was all this part of Rutte’s plan to put himself as the main candidate for Biden to support?”

• Macron’s Bid to Undermine NATO and the EU Hit the Bullseye (Jay)

A recent meeting of over 20 EU member states in Paris, organised by French President Emmanuel Macron raised eyebrows for many reasons. True, he managed to cajole these EU countries to agree to sending more money to Ukraine but many will ask whether Macron’s meddling comes with a much higher price. It is hardly a secret that he wants to create a fast track EU, which is made up of most EU countries – which excludes those who block big decisions like Hungary – who think of an EU which is stronger, which has its own army and can think independently of NATO. Last year he even went as far as organising a conference where all EU member states were invited, as well as the UK and Turkey, to test the waters as to the creation of a new, in formal EU-NATO pillar.

And now it is happening. Macron just recently held a meeting in Paris which agreed a higher level of funding to Ukraine with talks of even boots on the ground in Ukraine. The problem of course for NATO is that it has an identity crisis as more and more Americans and Europeans see it as a defence organisation which can only threaten and escalate in the Ukraine war – while being the leader of a proxy operation where not one NATO soldier can ever get killed – while not actually going the full nine yards. For over three years, with the war in Ukraine specifically going badly for the West in the last year, NATO’s role becomes compromised and more opaque. The very fact that Macron took this recent initiative is testimony to this and Biden is surely worried about NATO’s role now, as he throws his weight behind the Dutch Prime Minister’s bid to take over its helm.

The transition though from the bumbling, buffoonish Jens Stoltenberg to Mark Rutte will be seamless if it happens at all. Rutte will need to convince all 31 members of NATO and there are questions whether Hungary and Turkey will back the Dutchman’s bid to run the outfit. European nations might want a new face, a fresh voice and might push for a woman to run NATO, throwing their weight behind Estonian Prime Minister Kaja Kallas. The point about Rutte is that he is a keen advocate of much bigger military spending which will be welcomed by Trump if he were to win the U.S. elections this year, just a matter of days after the NATO boss will take office. Rutte has really stepped up to the mark when it comes to sending military hardware to the Ukrainians.

The long-serving Dutch prime minister and one of Europe’s longest-serving leaders, he has already committed to send Ukraine 24 of its F-16 fighters — the most of any country — and is helping train Ukrainian pilots. The Dutch military has also sent tanks, artillery systems, ammunition and Patriot air defence systems to Kiev over the past two years. According to Politico, the government itself has also pledged another $2.1 billion in military and humanitarian aid for Ukraine over the coming year. Was all this part of Rutte’s plan to put himself as the main candidate for Biden to support?

NATO

BIG: European leaders except for French President Emmanuel Macron, RULE OUT sending troops to Ukraine.. pic.twitter.com/VUiltOF1Pd

— Douglas Macgregor (@DougAMacgregor) February 28, 2024

“..a US and Israeli attempt to give the public an illusion that Hamas had approved of them..”

• Leaked Gaza Ceasefire Proposal US ‘Psychological Warfare’: Hamas (Cradle)

Hamas official Ahmad Abdul Hadi stated on 27 February that a leaked proposal for a ceasefire deal in Gaza is part of a “psychological warfare” campaign being carried out by the US. Details of the alleged proposal were leaked to Reuters on Monday, the same day US President Joe Biden said he hoped a ceasefire agreement between Israel and Hamas could be reached by 4 March. “My national security adviser tells me that they’re close. They’re close. They’re not done yet. My hope is by next Monday we’ll have a ceasefire,” Biden claimed during an appearance on a late-night US talk show. But Abdul Hadi, the Hamas representative in Lebanon, stated that the resistance movement is not satisfied with the proposal and will not compromise on any of its demands, particularly “on a ceasefire and reaching an honorable, serious deal.”

Hamas is seeking a permanent end to the war and the release of thousands of Palestinian prisoners in Israeli jails. Israel is seeking the release of the 136 captives held by Hamas in Gaza and a temporary ceasefire that would allow it to resume the war after a pause. “We are open to any ideas posed by mediators but are also keen on preserving our key demands,” Abdul Hadi told Al-Mayadeen, adding that Israel is “seeking to hold Hamas accountable for any later failures in talks, planning to use this as an excuse to pave the way for the invasion of Rafah.” He said the leaks were not part of the Paris negotiations but a US and Israeli attempt to give the public an illusion that Hamas had approved of them. He reiterated that “everything being shared is not serious, but a ploy to maneuver and press on the Resistance.”

The proposal leaked to Reuters outlined plans for a 40-day truce during which Hamas would free around 40 captives – including female soldiers, those under 19 or over 50 years old, and the sick – in return for about 400 Palestinians held captive in Israel. Israel would withdraw its troops from populated areas of Gaza. Displaced Gaza residents, excluding men of fighting age, would be permitted to return to their homes. Israel would be required to allow additional humanitarian aid to enter Gaza, as hundreds of thousands of Palestinians in the strip are on the verge of starvation. Palestinian Islamic Jihad (PIJ) also responded to leaked Paris proposal. “The leaks are an attempt to pressure the Palestinians and incite them against the resistance. They are pushing for a ceasefire before Ramadan in anticipation of what might happen in Al-Quds. The enemy believes that it can deceive the resistance with different methods in order to achieve a victory it has failed to achieve on the ground,” PIJ Political Bureau member Ihsan Ataya told Al-Mayadeen.

“That is what the Assange case is about. Justice along with truth is being eliminated from the Western world.”

• The Death of Justice in the Western World (Paul Craig Roberts)

British courts have cooperated with Washington’s police state for years by keeping Julian Assange in captivity while pretending to give him every benefit of the doubt in the extradition case. Of course, the law is clear that he should not be turned over to revengeful Washington, but Britain is not independent of Washington and is merely going through motions that keep Assange in captivity. It seems clear that Washington and London are conspiring to break the spirit of those Americans and British who still hope that their governments are capable of delivering justice. A demoralized people are easier coerced into tyranny, which is where the entirety of the Western world is headed. So much is already lost. One would have thought that the US and British media would have been fierce in Assange’s defense if only in order to protect its power to hold government accountable and to protect itself.

After all, the New York Times and The Guardian and other news organizations published the documents that Wikileaks released, for which Assange is in captivity. Yet until recently when the New York Times, Guardian, and a few other news organizations made a weak request that the extradition case against Assange be dropped, the US and British media were faithful carriers of the official narrative that Assange was a rapist, a Russian spy, and a hacker of US national security secrets, such as Washington’s hidden war crimes and deceit of its allies. Washington is after Assange for more than revenge. They are teaching journalists a lesson that they are no longer allowed to hold government accountable when the government commits crimes. In other words, the criminalization of government is being institutionalized. That is what the Assange case is about. Justice along with truth is being eliminated from the Western world.

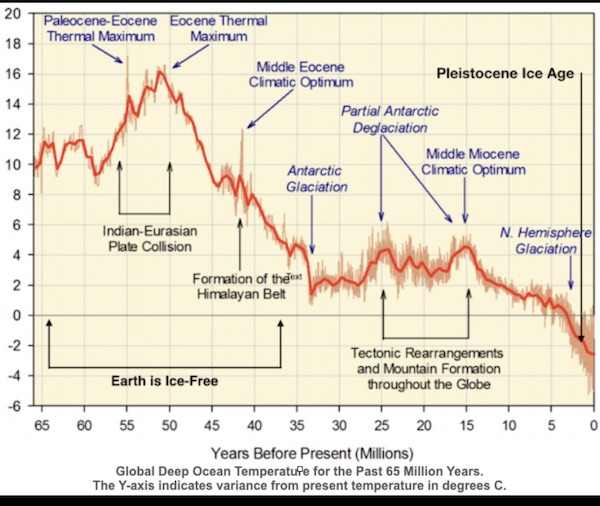

Plimer

Australian geologist, Prof. Ian Plimer: "We have been cooling down for the last 4000 years… It's all about when you start the measurements."

"If you take measurements from the Medieval Warming, we've cooled about five degrees since then. If you take measurements from the… pic.twitter.com/Y1YU8kGaIo

— Wide Awake Media (@wideawake_media) February 27, 2024

Bender

the last stun bender pic.twitter.com/cti4G9WAqj

— Enez Özen (@Enezator) February 27, 2024

Cats toasters

Cats being started by toasters

pic.twitter.com/gnmJQqADzx— Science girl (@gunsnrosesgirl3) February 28, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.