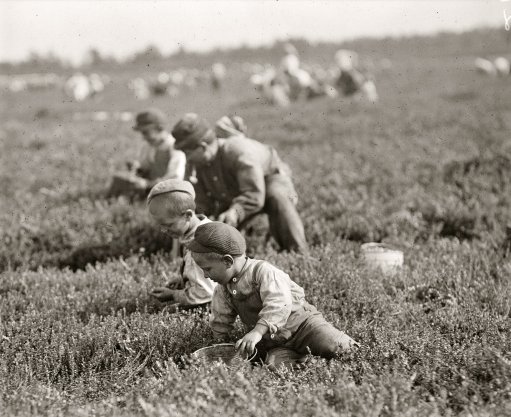

Lewis Wickes Hine Whole family works, Browns Mills, New Jersey 1910

“Nobody, so far as I’m aware, is arguing that it wouldn’t be effective. What, then, is the objection?”

• QE For The People: Monetary Policy For The Next Recession (Bloomberg)

By pre-crash standards, the big central banks have made and continue to make amazing efforts to support demand and keep their economies running. Quantitative easing would once have been seen as reckless. The official term of art – unconventional monetary policy – tacitly acknowledged that. But QE isn’t unconventional any longer. It mostly worked, the evidence suggests. The world avoided another Great Depression. Yet even in the U.S., this is a seriously sub-par recovery; growth in Europe and Japan has been worse still. Now imagine a big new financial shock. It’s quite possible that all three economies would fall back into recession. What then?

According to your economics textbook, the obvious answer is fiscal policy. But bringing fiscal expansion to bear in a sustained and effective way proved difficult after 2008. Next time round, the politics might be harder still, because public debt has grown and concerns about government solvency (warranted or otherwise) will be greater. Sooner rather than later, attention therefore needs to turn to a new kind of unconventional monetary policy: helicopter money. One thing’s for sure: The idea needs a blander name. Milton Friedman, who argued that central banks could always defeat deflation by printing dollars and dropping them from helicopters, did nothing to make the idea acceptable. Put it that way and most people think the notion is crazy.

How about “QE for the people” instead? It has a nice populist ring to it – suggesting a convergence of financial excess and the Communist Manifesto. The problem is, it isn’t bland. It sounds even bolder than helicopter money. “Overt monetary financing” is closer to what’s required, but something even duller would be better. Whatever you call it, the idea is far from crazy. Lately, more economists have been advocating it, and they’re right. The logic is simple. If central banks need to expand demand – and interest rates can’t be cut any further – let them send a check to every citizen. Much of this money would be spent, boosting demand just as Friedman said. Nobody, so far as I’m aware, is arguing that it wouldn’t be effective. What, then, is the objection?

“..the longer central banks create liquidity to suppress short-run volatility, the more they will feed price bubbles in equity, bond, and other asset markets.”

• The Liquidity Timebomb – Monetary Policies Create Dangerous Paradox (Roubini)

A paradox has emerged in the financial markets of the advanced economies since the 2008 global financial crisis. Unconventional monetary policies have created a massive overhang of liquidity. But a series of recent shocks suggests that macro liquidity has become linked with severe market illiquidity. Policy interest rates are near zero (and sometimes below it) in most advanced economies, and the monetary base (money created by central banks in the form of cash and liquid commercial-bank reserves) has soared – doubling, tripling, and, in the US, quadrupling relative to the pre-crisis period. This has kept short- and long-term interest rates low (and even negative in some cases, such as Europe and Japan), reduced the volatility of bond markets, and lifted many asset prices (including equities, real estate, and fixed-income private- and public-sector bonds).

And yet investors have reason to be concerned. [..] though central banks’ creation of macro liquidity may keep bond yields low and reduce volatility, it has also led to crowded trades (herding on market trends, exacerbated by HFTs) and more investment in illiquid bond funds, while tighter regulation means that market makers are missing in action. As a result, when surprises occur – for example, the Fed signals an earlier-than-expected exit from zero interest rates, oil prices spike, or eurozone growth starts to pick up – the re-rating of stocks and especially bonds can be abrupt and dramatic: everyone caught in the same crowded trades needs to get out fast.

Herding in the opposite direction occurs, but, because many investments are in illiquid funds and the traditional market makers who smoothed volatility are nowhere to be found, the sellers are forced into fire sales. This combination of macro liquidity and market illiquidity is a timebomb. So far, it has led only to volatile flash crashes and sudden changes in bond yields and stock prices. But, over time, the longer central banks create liquidity to suppress short-run volatility, the more they will feed price bubbles in equity, bond, and other asset markets. As more investors pile into overvalued, increasingly illiquid assets – such as bonds – the risk of a long-term crash increases. This is the paradoxical result of the policy response to the financial crisis. Macro liquidity is feeding booms and bubbles; but market illiquidity will eventually trigger a bust and collapse.

Risk where it doesn’t belong.

• Bond Dealers Enfeebled as Liquidity Breakdown Boosts Derivatives (Bloomberg)

As Wall Street retreats from its traditional role as the bond market’s middle man, investors frustrated by sudden gyrations and a lack of liquidity are turning to derivatives – in a big way. In the world’s biggest debt markets, including the U.S., Europe and Japan, the number of futures contracts on government debt reached a post-crisis high in May after doubling since 2009. Trading of German bund options and Italian futures also hit records. While some are using derivatives to hedge against higher U.S. interest rates, Pioneer Investment Management and BlackRock Inc. are also shifting into more obscure corners of the fixed-income world as rules to limit bank risk-taking have made it harder to trade at a moment’s notice. Since October 2013, dealers that trade with the Fed have slashed U.S. debt inventories by 84%.

“Liquidity risk is a big challenge,” said Cosimo Marasciulo, the Dublin-based head of fixed income at Pioneer, which oversees $242 billion. “And it’s now affecting an asset that was once considered most liquid – government bonds.” Derivatives, contracts based on underlying assets that can provide the same exposure without tying up as much capital, have become a popular option after central banks started to purchase bonds as a way to boost growth following the financial crisis, which has sapped supply and increased volatility. Over that time, bond buying by major central banks has inundated economies with at least $10 trillion of cheap cash, according to Deutsche Bank. [..]

The shift into derivatives has accelerated as the world’s biggest banks scale back their bond-trading businesses to comply with higher capital requirements imposed by Basel III, which went into effect this year. For Treasuries, the share of transactions by primary dealers has dwindled by more than half to 4% since the end of 2008, according to the Institute of International Finance, a lobbying group for banks. And in the past year, JPMorgan, Morgan Stanley, Credit Suisse and RBS have have either cut back their fixed-income trading desks or are weighing reductions in those businesses. That’s made getting the bonds you want at the price you need more difficult, especially when markets are moving.

Are the biggest funds TBTF?

• Top US Fund Managers Attack Regulators (FT)

US fund managers have launched a new attack on global regulators as they fight a rearguard action against possible rules that would treat groups such as Fidelity and BlackRock as threats to the financial system. The Financial Stability Board, a global watchdog chaired by Mark Carney, governor of the Bank of England, is exploring whether to designate the biggest asset managers as “systemically important” and hit them with tougher rules and heightened scrutiny. But Fidelity said the FSB’s approach was “irredeemably flawed” and told regulators in a letter that regulating a fund manager as systemically important “would be counterproductive and destructive”.

Fund managers argue that they do not pose systemic dangers to financial stability because they do not take deposits, guarantee returns or face the risk of sudden failure like a bank. But regulators have other concerns. Last month Mr Carney highlighted the risk on investor runs on “funds that offer on-demand redemptions but invest in less liquid assets”. The watchdogs are also looking at the stability impact of securities lending by asset managers, and the complexity of fund businesses structured as holding companies, which bear a growing resemblance to banks. Empowered by the leaders of the G20 top economies, the FSB has already designated 30 banks and 9 insurers as global institutions that require tighter regulation because of their potential to cause systemic contagion.

Next in its sights are asset managers, although the FSB, which is based in Basel, Switzerland, is debating whether it makes more sense to regulate entire institutions or particular products and activities. Fidelity and the Securities Industry and Financial Markets Association (Sifma), a US trade group, accused the FSB of ploughing ahead while ignoring an avalanche of empirical studies and previous industry comments.

Not the first time BoE people address this, but still somewhat surprising from a central bank. Central to the Steve Keen vs Krugman debate.

• Banks Are Not Intermediaries Of Loanable Funds – And Why This Matters (BoE)

In the intermediation of loanable funds model of banking, banks accept deposits of pre-existing real resources from savers and then lend them to borrowers. In the real world, banks provide financing through money creation. That is they create deposits of new money through lending, and in doing so are mainly constrained by profitability and solvency considerations. This paper contrasts simple intermediation and financing models of banking. Compared to otherwise identical intermediation models, and following identical shocks, financing models predict changes in bank lending that are far larger, happen much faster, and have much greater effects on the real economy

Since the Great Recession, banks have increasingly been incorporated into macroeconomic models. However, this literature confronts many unresolved issues. This paper shows that many of them are attributable to the use of the intermediation of loanable funds (ILF) model of banking. In the ILF model, bank loans represent the intermediation of real savings, or loanable funds, between non-bank savers and non-bank borrowers. But in the real world, the key function of banks is the provision of financing, or the creation of new monetary purchasing power through loans, for a single agent that is both borrower and depositor. The bank therefore creates its own funding, deposits, in the act of lending, in a transaction that involves no intermediation whatsoever.

Third parties are only involved in that the borrower/depositor needs to be sure that others will accept his new deposit in payment for goods, services or assets. This is never in question, because bank deposits are any modern economy’s dominant medium of exchange. Furthermore, if the loan is for physical investment purposes, this new lending and money is what triggers investment and therefore, by the national accounts identity of saving and investment (for closed economies), saving. Saving is therefore a consequence, not a cause, of such lending. Saving does not finance investment, financing does. To argue otherwise confuses the respective macroeconomic roles of resources (saving) and debt-based money (financing).

The paper shows that this financing through money creation (FMC) description of the role of banks can be found in many publications of the world’s leading central banks. What has been much more challenging is the incorporation of the FMC view’s insights into dynamic stochastic general equilibrium (DSGE) models that can be used to study the role of banks in macroeconomic cycles. DSGE models are the workhorse of modern macroeconomics, and are a key tool in macro-prudential policy analysis. They study the interactions of multiple economic agents that optimise their utility or profit objectives over time, subject to budget constraints and random shocks. The key contribution of this paper is therefore the development

My post yesterday of Tsipras’ integral text for Le Monde.

• Alexis Tsipras: The Bell Tolls for Europe (The Automatic Earth)

Judging from the present circumstances, it appears that this new European power is being constructed, with Greece being the first victim. To some, this represents a golden opportunity to make an example out of Greece for other countries that might be thinking of not following this new line of discipline. What is not being taken into account is the high amount of risk and the enormous dangers involved in this second strategy. This strategy not only risks the beginning of the end for the European unification project by shifting the Eurozone from a monetary union to an exchange rate zone, but it also triggers economic and political uncertainty, which is likely to entirely transform the economic and political balances throughout the West.

Europe, therefore, is at a crossroads. Following the serious concessions made by the Greek government, the decision is now not in the hands of the institutions, which in any case – with the exception of the European Commission- are not elected and are not accountable to the people, but rather in the hands of Europe’s leaders. Which strategy will prevail? The one that calls for a Europe of solidarity, equality and democracy, or the one that calls for rupture and division? If some, however, think or want to believe that this decision concerns only Greece, they are making a grave mistake. I would suggest that they re-read Hemingway’s masterpiece, “For Whom the Bell Tolls”.

Ambrose acknowledges what I wrote quite some time ago: “The matter has moved to a higher level and is at this point entirely political.”

• Defiant Tsipras Threatens To Detonate Crisis Rather Than Yield To Creditors (AEP)

The Greek prime minister has accused Europe’s leaders of ‘issuing absurd demands’. Greek premier Alexis Tsipras has accused Europe’s creditor powers of issuing “absurd demands” and come close to warning that his far-Left government will detonate a pan-European political and strategic crisis if pushed any further. Writing for Le Monde in a tone of furious defiance after the latest set of talks reached an impasse, Mr Tsipras said the eurozone’s dominant players were by degrees bringing about the “complete abolition of democracy in Europe” and were ushering in a technocratic monstrosity with powers to subjugate states that refuse to accept the “doctrines of extreme neoliberalism”.

“For those countries that refuse to bow to the new authority, the solution will be simple: Harsh punishment. Judging from the present circumstances, it appears that this new European power is being constructed, with Greece being the first victim,” he said. The Greek leader, head of the radical-Left Syriza government, issued a stark warning that his country will not submit to these demands and will instead take action “to entirely transform the economic and political balances throughout the West.” Alexis Tsipras made his thoughts known in a piece for Le Monde, the French newspaper “If some, however, think or want to believe that this decision concerns only Greece, they are making a grave mistake. I would suggest that they re-read Hemingway’s masterpiece, “For Whom the Bell Tolls”,” he said.

The words originally come from John Donne’s Meditation XVII, with its poignant reminder that the arrogant can be blind to their own demise. “Perchance he for whom this bell tolls may be so ill, as that he knows not it tolls for him,” it reads. Mr Tsipras’s article is a thinly-disguised warning that Greece may choose to default on roughly €330bn of debt in the biggest sovereign default ever, and pull out of the euro, rather than breech its key red lines. The debts are mostly to European official creditors and the European Central Bank. The situation has become critical after depositors withdrew €800m from Greek banks in two days at the end of last week, heightening fears that capital controls may be imminent.

Mr Tsipras’s choice of words also implies that Greece may turn its back on the Western security system, presumably by shifting into the orbit of Russia and China. The article comes as Panagiotis Lafanzanis, the energy minister and head of Syriza’s powerful Left Platform, returns from Moscow after securing a provisional deal with Gazprom to build part of the “Turkish Stream” gas pipeline through Greece. The Russian energy minister, Alexander Novak, said over the weekend that the project has been agreed in principle. ” We are now discussing technical details,” he said. Greek officials have told The Telegraph that Russia is offering up to €2bn in up-front credit to sweeten the arrangement, though it will not be a state-to-state transaction.

Greek banks’ holdings of Greek bonds got a 53.5% haircut in a Private Sector Involvement scheme in 2012.

• Greece’s Creditors’ Crazy Commands (KTG)

Creditors command and demand, Greece is willing but … some red lines cannot be set aside. Apart from that, creditors’ commands are anything but logical as their demands could be only described as crazy. Furthermore the creditors seem divided as to what they demand from Greece with the logical consequence that the negotiations talks have ended into a deadlock. According to Greek media reports, “While the European Commissions wants austerity measures worth €4-5 billion for the second half of 2015 and the 2016, the IMF raises the lot to €7 billion for 2016. The all-inclusive austerity package should include among others €2.7 billion cuts in pensions.

The Pensions Chapter is one of the thorns among the negotiation partners, and Greece would love to postpone it for after the provisional agreement with the creditors. While it is not clear whether it is the IMF or the EC or both, it comes down to the command that “Pensions should not be higher of 53% of the salary due to the financial situation of the social security funds.” Pension for a civil servant (director, 37 years of work) should come down to €900 from €1,386 today after the pension cuts during the austerity years. Pension for private sector – IKA insurer (37 years of work, 11,000 IKA stamps) and salary €2,300 should come down to €1,250 from €1,452 today after the austerity cuts. (examples* via here)

Of course, with the PSI in March 2012, Greece’s social security funds suffered a huge slap in their deposits in Greek bonds. According to the Bank of Greece report of 2012, social security funds were holding Greek bonds with nominal value €18.7 billion euro. The PSI gave them a new look with a nice hair cut of 53.5%. Guess, how many billions euros were left behind. If one adds the loss of contributions due to high unemployment, part-time jobs, uninsured jobs and the disappearance of full time jobs in the last 3-4 years, the estimations concerning the money available at the Greek social insurance funds are … priceless!

Everyone hesitates when push comes to shove.

• The Key Reason Why Euro’s Future Is Uncertain (Ivanovitch)

The need to consider technical aspects of investment options in a currency of an allegedly very uncertain future is a permanent challenge for the euro area portfolio analysis. In spite of that, the region’s political leaders seem oblivious to the widely held view that the common currency is just a flimsy and provisional political structure. If they understood that reality, their loose talk about the “euro crisis” and the euro’s “doubtful long-term viability” would never be uttered, because without their currency the Europeans would not even have a customs union that was laboriously built and implemented ever since the Treaty of Rome came into effect on January 1, 1958. Indeed, like Caesar’s wife, the permanence of the euro should be above any suspicion.

Sadly, the unbearable lightness of the euro area politicians gives no confidence in their resolve to rally around their single currency – an epochal achievement and a unique symbol of European unity. The serious and continuing degradation of the political situation in France is the main reason for my euro pessimism. France has been the country that originated and carried most of the policies and institutions designed to bring a hostile and divided continent back together. France, unfortunately, seems in no position to play that noble role anymore. France is mired in a deep economic and fiscal crisis, and its leader is one of the country’s most unpopular acting presidents ever. An opinion poll, published May 30, shows that 77% of the French people don’t want President François Hollande to run for re-election in 2017.

His main rival, the former President Nicholas Sarkozy, fares no better: more than 70% of the French would not support his presidential candidacy two years from now. That leaves Germany’s Chancellor Angela Merkel (representing two close center-right parties) alone in a leadership position, despite credibility problems caused by destabilizing spying scandals and a fraying governing coalition with Social Democrats. It, therefore, should not be surprising that there is no political decision on Greece’s legitimate demand to renegotiate unreasonable austerity conditions imposed upon its deeply impoverished population. The French and German leaders seem paralyzed, even though they know that forcing Greece out of the monetary union would spell the end of the euro – with incalculable damages to the European and world economies.

Deflation is here because people don’t spend. That’s a far wider issue than just Greece.

• Draghi Deflation Relief Means Little With Greek Threat Unsolved (Bloomberg)

With a solution to the Greek crisis still out of reach, Mario Draghi can count on at least one piece of good news this week: euro-area consumer prices are rising again. Economists in a Bloomberg survey forecast that the inflation rate rose to 0.2% in May from zero in April. The report, due on Tuesday, would follow improving data from Spain and Italy and mark the first price increase in six months. While the European Central Bank president can take comfort from the fading deflation risk, he and his fellow policy makers will be distracted by a looming Greek loan repayment that could make or break months of negotiations aimed at funding the country and preventing a splintering of the currency bloc.

As the economy stutters through its recovery, concerns about the debt crisis are putting the reins on consumer and business sentiment across the region. “There’s not a huge uncertainty about the economic outlook, there’s more uncertainty about Greece,” said Holger Sandte, chief European analyst at Nordea Markets in Copenhagen. The return of inflation is “good news for the ECB,” he said. “In the months ahead, while we might get a setback, the tendency is upward.” The improving inflation backdrop partly reflects a rebound in oil prices since falling to a six-year low in January. ECB policy makers may also see it as a sign their €1.1 trillion stimulus is working. Draghi said last month that the unconventional actions “have proven so far to be potent, more so than many observers anticipated.” Governing Council member Patrick Honohan said that price inflation is “getting back up.”

“..it was undeniable proof that as a nation, we had completely bolloxed this once-in-a-lifetime opportunity.”

• Shale Oil’s House of Cards (TheStreet)

I knew that the conventional wisdom on the drop in oil prices after the OPEC meeting in November, 2014 was going to be ascribed solely to the Saudis, a conclusion that was far too simple to explain the massive collapse. No, something else, something even more important was going on. The Saudi reticence to cut production was just a catalyst. The bigger theme was an already overdue bust that was happening in U.S. shale oil. This oil bonanza had been built on a house of cards, ready at any moment to topple over. The list of fragile flaws in the system was long. Each state had its own set of regulations and oversights on leases and operations, with no consistent framework for oil shale fracking.

Despite (or because of) the complete freedom in oversight, fracking for oil from shale had grown at a frightening and undisciplined pace. As prices declined, it became clear that much of this breakneck activity had been financed by very risky and highly leveraged capital investments that mirrored some of the worst pyramiding schemes I had ever seen. But because prices had been high, many of the shortcomings had been conveniently overlooked: Oil was being taken out of the ground as quickly as it could be drilled. The months following the OPEC announcement showed me just how rickety the entire structure for retrieving shale oil had become. Oil companies that had been the darlings of Wall Street not one year earlier were now losing 70 to 80% of their share value, as their corporate bonds, which were already poorly rated, risked complete default.

Virtually every company involved in shale production was forced to slash development budgets, hoping to ride out what they prayed was a temporary dip in the price of oil. Yet projected production numbers from all of these players continued to rise, almost insuring that prices would stay cheap. What had been a universally optimistic industry not 6 months prior had changed overnight into a frightened group playing a collective game of chicken, as oil producers hunkered down with reduced budgets and hoped like mad that the “other guy” would go broke first. That shale oil had folded like a cheap suitcase so quickly and completely was incredible to witness and, I thought, incredibly important: it was undeniable proof that as a nation, we had completely bolloxed this once-in-a-lifetime opportunity.

“An expansion would signal officials are confident in the template..” No, it means things are not going as planned, and that is due to debt to shadow banks.

• China Considers Doubling Its Local Bond-Swap Program (Bloomberg)

Chinese policy makers are considering plans to as much as double the size of a clean-up program for shaky local government finances, according to people familiar with the discussions. In what would be the second stage of the program, a further 500 billion yuan ($81 billion) to 1 trillion yuan of local-government loans would be authorized to be swapped into bonds issued by provinces and cities, the people said, asking not to be named because the talks are private. The first stage of the bond swap, currently under way, is 1 trillion yuan.

An expansion would signal officials are confident in the template they’ve crafted for reducing risks from a record surge in borrowing that local authorities took on to fund a glut of investment projects. The complex process – which includes inducements for banks to buy new, longer-maturity, lower yielding bonds — is alleviating a funding crunch among provinces that had threatened to deepen the economy’s slowdown. “It’s solving the cash-flow issue at the local governments and ensuring that infrastructure projects this year aren’t delayed,” said Nicholas Zhu at Moody’s, referring to the initial 1 trillion-yuan program. He said any additional quota probably would be for debt swaps in 2016.

Much more of this to come.

• China $550 Billion Stock Wipeout Reminds Traders of 2007 Catastrophe (Bloomberg)

The rout wiped out about $350 billion of market value in a week on the Shanghai and Shenzhen exchanges. It so traumatized traders that eight years later they still refer to the decline by the date it began: the 5/30 catastrophe. The milestone for the modern Chinese stock market, which began in 1990, started on midnight, May 30, 2007, with Hu Jintao’s government unexpectedly announcing it would triple a tax on stock trading. The plunge sparked by the pronouncement had followed a breathless rally, making it eerily similar to last week’s events. On Thursday, stocks erased almost $550 billion in value after surging 143% on the Shanghai Composite Index over the past year. Traders could be forgiven for a wave of deja vu mixed with a dollop of dread: In 2007, stocks recovered from their May losses only to drop more than 70% over the next 12 months from an October peak. Here’s a look at the similarities and differences between China’s markets then and now. What’s similar:

* Timing of declines: Both selloffs followed rallies that sent the benchmark index up more than 100% in just months. Thursday’s tumble in Chinese stocks came after brokerages tightened lending restrictions and the central bank drained cash from the financial system. The Shanghai Composite shed 6.5% and fell another 0.2% in volatile trading on Friday. On May 30, 2007, the Shanghai gauge also tumbled 6.5% after the government raised the stamp tax to 0.3% from 0.1%. The measure aimed to cool the stock market after it doubled in about six months and almost quadrupled from the end of 2005. By June 4, the benchmark had lost 15%. The market then started to stabilize and rose another 66% to an all-time high in October 2007 before tanking again as the global financial crisis raged.

* Rookie traders: The two stock rallies were fueled by record amounts of new investors, increasing fluctuations. About 29 million new stock accounts have opened this year through May 22, almost as many as in the previous four years combined, according to the China Securities Depository & Clearing Corp. Margin debt on the Shanghai exchange has soared more than 10-fold in the past two years to a record 1.35 trillion yuan ($220 billion) on Thursday. In the first five months of 2007, more than 20 million stock accounts opened, four times the amount in all of 2006. Margin trading, or investing with funds borrowed from brokerages, wasn’t allowed then.

” Japan remains 30 years behind its peers in how its companies are run..”

• Hedge Fund Activists Are Japan’s Best Friend (Pesek)

Japan has New York hedge fund manager Daniel Loeb to thank for its biggest stock market surge since 1988. Investors have been taking inspiration from Loeb’s surprising success with the Japanese robot maker Fanuc. When Loeb bought a stake in the notoriously opaque company earlier this year and started demanding changes, few in corporate Japan believed he would get anywhere. It’s not just that Fanuc was known for its insularity; foreign activist investors had a long history of failure when dealing with corporate Japan. So when Fanuc President Yoshiharu Inaba started heeding Loeb’s demands – inviting journalists to the company’s campus near Mt. Fuji, opening a shareholder relations department and doubling the %age of profit the company pays out to shareholders – other foreign investors took note.

They began flocking to the Nikkei stock exchange in hopes of getting at the trillions of dollars sitting on Japan’s corporate balance sheets. (It’s estimated that executives are hoarding cash that amounts to half the country’s annual $4.9 trillion of output.) But the stock surge doesn’t represent a broader vote of confidence in Prime Minister Shinzo Abe’s economic program – nor should it. Abe has failed to carry out the bold structural reforms – lowered trade barriers, less red tape for startups and loosened labor markets – that he promised would enliven growth and boost corporate profits. Investors are aware that Japan’s latest economic data isn’t very good: Household spending is weak (down 1.3% in April), 340,000 people have given up on the labor market and inflation is back at zero.

But if Abe is wise, he will leverage the uptick in foreign investment to reignite his reform program. After all, Japan’s new foreign investors are a demanding and vocal crowd, and their goals are broadly in alignment with Abe’s. “They tend to speak out in ways that locals won’t, adding to the pressure on management to change,” says Jesper Koll, former JPMorgan, and adviser to Japan’s government. “That’s something to be supported in the current environment, not silenced.” Abe has already started leading a charge for more stringent corporate governance standards. Last year, Tokyo implemented a stewardship code urging investors to shame underperforming CEOs and introduced an index of 400 Japanese companies doing a good job of providing returns on investment.

Last week, Abe unveiled a code of conduct for executives along with requests that companies increase the number of outside directors. But Chicago money manager David Herro says that for all Abe’s efforts, Japan remains 30 years behind its peers in how its companies are run. Corporate Japan still indulges in cross-shareholdings and permits itself male-dominated boards, and the country’s timid media does little to hold it to account. “Japan has gone from zero to two,” Herro told Bloomberg News last week. “It’s improving. But we need to get to eight, nine or 10.”

A discussion like climate change: denied until it’s too late.

• Sydney And Melbourne Are ‘Unequivocally’ In A House Price Bubble (Guardian)

Sydney and parts of Melbourne are “unequivocally” experiencing a house price bubble, according to Treasury secretary John Fraser. Speaking at Senate estimates in Canberra on Monday, Fraser said he was concerned about the amount of money being poured into the housing market with interest rates at a record low of 2%. “It does worry me that the historically low level of interest rates are encouraging people to perhaps overinvest in housing,” Fraser said. As Sydney saw an auction clearance rate of 87.4% at the weekend, Fraser said: “When you look at the housing price bubble evidence, it’s unequivocally the case in Sydney.” It was also “certainly the case in higher priced areas in Melbourne”, he said, but elsewhere in Australia the evidence was “less compelling”.

Fraser’s comments give an insight into his role as a member of the Reserve Bank of Australia board, which has voted twice this year to cut interests rates, including at its May meeting. If his concerns reflect a wider view on the board, it suggests Tuesday’s monthly meeting of the board will not see another rate cut. However, his remarks will be tempered by figures released on Monday which showed that home prices dipped in May for the first time in six months, with Sydney’s booming property market losing a bit of steam. Home values in Australia’s capital cities fell by 0.9%, with drops recorded everywhere except Darwin and Canberra, the latest CoreLogic RP Data home value index showed.

Sydney’s home values fell 0.7%, with Melbourne down 1.7% and Hobart posting the biggest fall with a 2.7% slide. For the year to 31 May, home values were up by 9%, with the average property priced at $570,000. It came as approvals for the construction of new homes fell 4.4% in April, which was much worse than market expectations of a 1.5% fall. Over the 12 months to April, building approvals were up 16.6%, the Australian Bureau of Statistics said on Monday. Approvals for private sector houses rose 4.7% in the month, and the “other dwellings” category, which includes apartment blocks and townhouses, was down 15%.

Europe and democracy remains an uneasy relationship.

• Czech Finance Minister Proposes Referendum on the Euro (WSJ)

The Czech finance minister on Sunday proposed letting the public have a say in whether the country should adopt the euro through a nonbinding referendum. The proposal caused disagreement in the Czech Republic cabinet. Roughly two-thirds of the population in the European Union country are against giving up the national currency, the koruna. After meeting the prime minister, the central bank governor and the country’s president at a special gathering to discuss the Czech position toward Europe’s common currency, Finance Minister Andrej Babis said he proposes holding a nonbinding public referendum in 2017—in conjunction with expected general elections—on whether to adopt the euro.

The purpose of holding a referendum would be “so that citizens can express themselves, like they’ve done in Sweden,” said Mr. Babis, who himself hasn’t yet taken a position on the currency issue and is widely considered a top candidate for the premier’s post after the next elections. In a 2003 referendum, Swedish voters rejected switching to the euro. Sweden continues to use the krona despite having a treaty obligation to switch to the euro at some point. Such a referendum in the Czech Republic wouldn’t break treaties but would serve as a gauge of public opinion before politicians embark on the potentially treacherous task of surrendering the national currency.

Prime Minister Bohuslav Sobotka dismissed the idea, saying while there is no deadline by which the country must adopt the euro, the Czech Republic—like the 12 other countries that have joined the bloc since 2004—is bound by accession treaties to the European Union to adopt the common currency, and so there is no need for any referendums. Despite the urging of President Milos Zeman, who seeks deeper ties with Russia but is nevertheless calling for politicians to work to integrate the country monetarily with the neighboring eurozone—officials agreed that the fate of the national currency will be left for a future government.

Eroding power base.

• Prime Minister Renzi Bruised In Italy’s Regional Elections (Politico)

Prime Minister Matteo Renzi’s party suffered a blow in Sunday’s regional and local elections, casting his political strength into doubt as he takes on major electoral and economic reforms.The center-left Democratic party won in five of the seven regions up for grabs, but the opposition made noteworthy gains in key areas. The outcome was not the triumph that Renzi saw during last year’s European elections.Renzi’s candidates won in central Italy, Tuscany, Marche, and Umbria, as well as in the south, in Puglia and in Campania, a region so far governed by the center right. The euroskeptic Northern League prevailed, with a wide margin, in its stronghold in Veneto. In the key Liguria region, long governed by the left, a candidate of Silvio Berlusconi’s party has won.

The anti-establishment and anti-euro 5Star movement, bolstered by disappointment with mainstream parties and corruption scandals, also made gains. So far, the movement has performed well in general elections but not in local ballots. On Saturday, Renzi downplayed the vote, saying it would not be a a judgment on his tenure. “Regional elections have a local meaning, there will no consequence for the government,” Renzi said in a public meeting in Trento. After Renzi’s party dominated last year’s elections for the European Parliament, pundits dubbed him Italy’s strong man. The fragility of that reputation came into focus in the elections. His power in Brussels is also at stake. A poor showing could slow down the pace of the changes to Italy’s moribund economy that the European Commission is seeking.

“Renzi has enjoyed a honeymoon … that is now over,” said before the elections pollster Nando Pagnoncelli, who said that trust in him had dropped in polls to 40% from 60% in September. Only one Italian out of two has gone to vote. Turnout, at 52.2% is much lower than 58.6% at the European elections. “Those disillusioned voters, who once used to vote for the center right and then chose Renzi [at the European elections], are not returning to vote for the right, they will simply stay home,” he said. The vote followed a series of tough parliamentary battles over Renzi’s reform agenda. With a staggering debt at 132% of the GDP, the second highest ratio after Greece, Brussels and the European Central Bank have pushed for a major economic overhaul.

Note the press playing up the suggestion it’s now a pan-European effort.

• Over 5,000 Mediterranean Migrants Rescued Since Friday (Reuters)

The corpses of 17 migrants were brought ashore in Sicily aboard an Italian naval vessel on Sunday along with 454 survivors as efforts intensified to rescue people fleeing war and poverty in Africa and the Middle East. More than 5,000 migrants trying to reach Europe have been saved from boats in distress in the Mediterranean since Friday and operations are in progress to rescue 500 more, European Union authorities said on Sunday. In some of the most intense Mediterranean traffic of the year, migrants who left Libya in 25 boats were picked up by ships from Italy, Britain, Malta and Belgium, assisted by planes from Iceland and Finland, the EU’s border control agency Frontex said.

Naval and merchant vessels involved in rescue operations also came from countries including Germany, Ireland and Denmark. The 17 corpses found on one of the boats arrived in the Sicilian port of Augusta aboard the Italian navy corvette Fenice. Italian prosecutors are investigating how they died. Frontex is coordinating an EU rescue mission in the Mediterranean known as Triton, which was stepped up after around 800 migrants drowned off Libya in April in the Mediterranean’s most deadly shipwreck in living memory. “This is the biggest wave of migrants we have seen in 2015,” Frontex Executive Director Fabrice Leggeri said in a written statement. “The new vessels that joined operation Triton this week have already saved hundreds of people.”

Italy has so far borne the brunt of Mediterranean rescue operations. Most of the migrants depart from the coast of Libya, which has descended into anarchy since Western powers backed a 2011 revolt that ousted Muammar Gaddafi. Calm seas are increasingly favoring departures as warm spring weather sets in. The migrants saved over the weekend are all being disembarked at nine ports on the Italian islands of Lampedusa, Sicily and Sardinia and on its southern mainland regions of Calabria and Puglia. The latest wave of more than 5,000 arrivals will take the total of those reaching Italy by boat across the Mediterranean this year to more than 40,000, according to estimates by the United Nations refugee agency.

Home › Forums › Debt Rattle June 1 2015