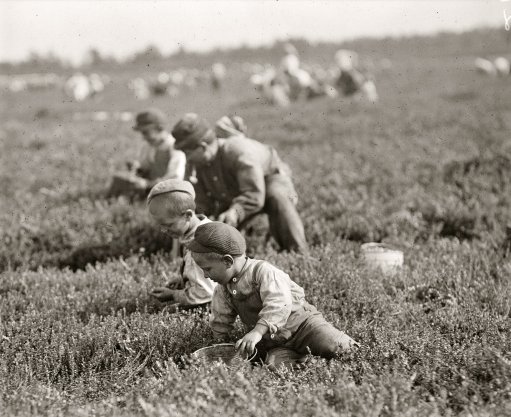

Pablo Picasso Don Quixote 1955

Robert Kennedy jr. on Gates and Fauci

"Conspiracy theorist" Robert Kennedy Jr. explains relationship between world’s most powerful doctor Bill Gates and Dr. Fauci pic.twitter.com/LmHzFL32lA

— conspiracyguy (@conspiracyguy78) April 19, 2021

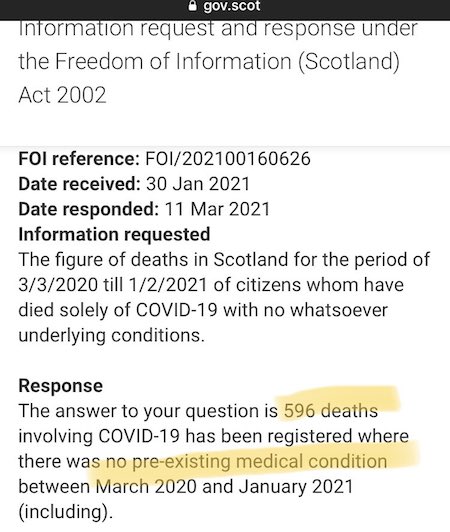

Population Scotland 5.5 million. Covid Deaths over 10 months: 596.

“..vaccinating children is not appropriate at this time because putting even a few children at risk of unknown side effects is not worth the protection it will afford them against a disease they say is not dangerous to children.”

• 100 Doctors Express Opposition To Vaccinating Children (JPost)

Some 100 medical professionals have expressed opposition to vaccinating children with the coronavirus vaccine and separating between vaccinated and unvaccinated people. “We believe there is no room for vaccinating children at this time [due to] caution, modesty, the understanding that ‘haste is from the devil’; the recognition that we do not understand everything about the virus and the vaccine against it; and the first commandment of medicine: ‘First, do not harm,’” they said in a letter to the Health Ministry on Sunday. They acknowledged that the Pfizer vaccine has prevented serious coronavirus infection and mortality in children. But they said children do not usually experience severe symptoms from the coronavirus, and the long-term possible side effects of the vaccine, even if rare, would only be known after years of study.

It is also unclear how long immunity from the vaccine lasts, which variants it works against, how often booster shots will be needed and what the far-reaching implications of the periodic immunization on the immune system and the evolution of the virus could be, they wrote. The prevailing view among the scientific community is that the vaccine cannot lead to herd immunity, meaning there is no justification for vaccinating children, they added. Some Israeli health officials have said the vaccination campaign has provided Israel with herd immunity in recent weeks. The authors of the letter said vaccinating children is not appropriate at this time because putting even a few children at risk of unknown side effects is not worth the protection it will afford them against a disease they say is not dangerous to children.

Get informed!

Fax pic.twitter.com/RFVlrqgbFw

— Dr Kevin Corbett MSc PhD (@KPCResearch) April 17, 2021

“..concerns that vaccinations alone won’t prevent the transmission of the virus.”

• WHO Rejects Covid Passports; Vaccines Don’t Stop Virus Transmission (RT)

The World Health Organization (WHO) has staunchly rejected the use of Covid passports to reopen travel in a meeting of its emergency committee, over concerns that vaccinations alone won’t prevent the transmission of the virus. Reiterating their previously stated position on Monday, the WHO’s Emergency Committee said it opposed the use of proof of vaccination documents as a condition of international travel due to the lack of evidence over the impact of vaccination on the transmission of coronavirus. The WHO’s declaration comes amid alarm from the group over “the persistent inequity in global vaccine distribution”, with the international health body stating that Covid passports would only further promote unequal freedom of movement.

Instead, the WHO has recommended that countries impose quarantine measures for international travellers and introduce “coordinated, time-limited, risk-based and evidence-based approaches for health measures.” Concerns about the inequality that would be caused by the use of Covid passports has been sparked by wealthier nations snapping up vaccines, while poorer countries have been left without enough doses to effectively vaccinate their population. The WHO has described this growing divide between national vaccine rollouts as a “moral outrage” and “catastrophic moral failure”, demanding world leaders support a more equitable distribution of vaccines.

DeSantis

Florida Gov. Ron DeSantis: "It took me a few weeks, March and into April, to get enough data to say okay, you know, we're not doing Fauciism. We're gonna make sure our state's open. We're gonna get the kids back into school, and we'll just focus our protection on elderly people." pic.twitter.com/zFL7KQq4WN

— Scott Morefield (@SKMorefield) April 20, 2021

But how? He doesn’t say.

• World Can Bring Covid-19 Pandemic Under Control In Months – WHO Chief (RT)

A consistent global approach to the Covid-19 pandemic could bring it under control before the end of the year, the director-general of the World Health Organization (WHO) has said, despite a record week for Covid-19 infections. “We have the tools to bring this pandemic under control in a matter of months, if we apply them consistently and equitably,” Tedros Adhanom Ghebreyesus told a news briefing on Monday. The WHO chief also said the total number of new Covid-19 cases in the past seven days had increased for the eighth consecutive week, with a record 5.2 million infections reported.

“Big numbers can make us numb,” Ghebreyesus said, as he urged people not to forget that each death from the virus is a “tragedy” for families and communities. He also highlighted the “alarming” increase in infections and hospitalizations among those aged 25 to 59, “possibly” due to highly transmissible newer variants and the increased social mixing of younger generations. On Monday, the WHO’s emergency committee gave Ghebreyesus its advice on vaccines, variants, and international travel, among other coronavirus issues. The panel pushed back against Covid vaccine passport schemes, citing a lack of evidence that the jabs prevent transmission as well as ongoing global inequalities when it comes to getting hold of vaccine doses.

“Americans who have completed immunization with FDA-approved vaccines are still considered “at increased risk for getting and possibly spreading new [Covid-19] variants,”

• ‘Do Not Travel’: State Department Updates Advisory For 80% Of The World (RT)

Citing “unprecedented risk” from the Covid-19 pandemic, the State Department is urging Americans to reconsider going abroad and is updating its travel advisory to the highest, Level 4 warning for most of the planet. On Monday, Foggy Bottom announced that it will be updating the travel advisory during the week, to “better reflect the Centers for Disease Control and Prevention’s (CDC) science-based Travel Health Notices,” which will result in the number of places at Level 4: Do Not Travel advisory to increase to “approximately 80% of countries worldwide.” The change does not imply a judgment on the current health situation in any given country, the State Department explained, but an “adjustment” in the travel advisory system to “rely more on CDC’s existing epidemiological assessments” and reflect “logistical factors” such as the availability of testing.

There are currently only 34 countries with a Level 4 travel warning, including war zones such as Syria, Libya, Afghanistan, Iraq and Yemen; US-sanctioned countries like Venezuela, North Korea, Myanmar, Cuba and Russia; coronavirus-stricken Brazil and Argentina, and a number of African countries. The updated guidelines seem to be based on the CDC’s advisory published on Monday. Unvaccinated people are advised to delay or cancel any international travel. Americans who have completed immunization with FDA-approved vaccines are still considered “at increased risk for getting and possibly spreading new [Covid-19] variants,” the CDC says.

“The UK’s pandemic response relies too heavily on scientists and other government appointees with worrying competing interests, including shareholdings in companies that manufacture covid-19 diagnostic tests, treatments, and vaccines.”

• To Conquer Nature And Death, We Have Made A New Religion Of Science (Cook)

The British scientist James Lovelock who helped model conditions on Mars for NASA so it would have a better idea how to build the first probes to land there, is still ridiculed for the Gaia hypothesis he developed in the 1970s. He understood that our planet was best not viewed as a very large lump of rock with life-forms living on it, though distinct from it. Rather Earth was as a complete, endlessly complex, delicately balanced living entity. Over billions of years, life had grown more sophisticated, but each species, from the most primitive to the most advanced, was vital to the whole, maintaining a harmony that sustained the diversity. Few listened to Lovelock. Our god-complex got the better of us. And now, as the bees and other insects disappear, everything he warned of decades ago seems far more urgent.

Through our arrogance, we are destroying the conditions for advanced life. If we don’t stop soon, the planet will dispose of us and return to an earlier stage of its evolution. It will begin again, without us, as simple flora and microbes once again begin recreating gradually – measured in aeons – the conditions favourable to higher life forms. But the abusive, mechanistic relationship we have with our planet is mirrored by the one we have with our bodies and our health. Dualism has encouraged us to think of our bodies as fleshy vehicles, which like the metal ones need regular outside intervention, from a service to a respray or an upgrade. The pandemic has only served to underscore these unwholesome tendencies. In part, the medical establishment, like all establishments, has been corrupted by the desire for power and enrichment.

Science is not some pristine discipline, free from real-world pressures. Scientists need funding for research, they have mortgages to pay, and they crave status and career advancement like everyone else. Kamran Abbasi, executive editor of the British Medical Journal, wrote an editorial last November warning of British state corruption that had been unleashed on a grand scale by covid-19. But it was not just politicians responsible. Scientists and health experts had been implicated too: “The pandemic has revealed how the medical-political complex can be manipulated in an emergency.” He added: “The UK’s pandemic response relies too heavily on scientists and other government appointees with worrying competing interests, including shareholdings in companies that manufacture covid-19 diagnostic tests, treatments, and vaccines.”

“..asked if he would run in 2024, Biden himself said he isn’t really thinking about it and adding, “I have no idea if there will be a Republican Party. Do you?”

• So Wait, Russia Got Biden Elected? (Malic)

Announcing a series of anti-Russian measures – incorrectly called “sanctions” – last week, President Joe Biden claimed Moscow is engaging in “efforts to undermine the conduct of free and fair democratic elections and democratic institutions in the United States and its allies and partners.” Look, here’s the deal – to borrow a phrase from Biden himself – the only one doing the delegitimizing here are Americans themselves. It wasn’t ‘Russia’ that declared the 2020 election was the “most secure… in American history.” It wasn’t the Kremlin that claimed absolutely nothing had gone wrong with any votes anywhere, and anyone so much as wondering about it was evil and ought to be silenced – it was the corporate media and Biden’s Democrats. And it wasn’t VK or Telegram that rushed to do the silencing, but the very American-owned Facebook, Twitter and Google.

It’s not Russia, either, that’s currently engaged in a push to “reimagine” US politics, elections and the very system of government. That would actually be… Biden and his own party, the Democrats. The 800-page HR1, or “For The People” Act, would fundamentally transform US elections, expanding universal mail-in ballots, mandating automatic voter registration and California-style ballot harvesting, banning voter ID or updating voter rolls, taking from states the authority to draw congressional districts – and if you try challenging it in court, narrowly defines how it can be done to the point where it’s practically impossible. Just to be sure, the Democrats are now proposing to pack – “expand,” in their parlance – the US Supreme Court.

They want to appoint another four justices, and bring the ratio from the current 6:3 in favor of (nominal) ‘conservatives’ to a 7:6 ‘liberal’ majority. Never mind the SCOTUS has been the Nine since 1869, and when FDR – the closest thing to the American Caesar so far – had tried to expand the court in 1937, his own party repudiated him and refused to do so. Don’t forget the initiative to give statehood to Washington, DC – explicitly prohibited by the US Constitution – that would guarantee Democrats two more seats in the Senate. Or the fact that, asked if he would run in 2024, Biden himself said he isn’t really thinking about it and adding, “I have no idea if there will be a Republican Party. Do you?”

Happens all the time.

• Russian Jet Intercepts US, Norwegian Patrol Aircraft (ZH)

A major intercept incident between Russia and US-NATO allied aircraft has occurred over the far northern Barents Sea on Monday. “A Russian fighter jet on Monday reportedly intercepted and escorted US and Norwegian patrol aircraft,” The Hill reports. “The Russian Defense Ministry said the incident over the body of water near Sweden, Norway, Finland and Russia involved a MiG-31 fighter jet,” it continued, based on initial reporting by Russia’s state-run RIA news agency. NATO member Norway shares a far northern small section of Arctic border with Russia, thus the region of the Barents Sea has always been a highly sensitive defense sector for the Kremlin, for which it keeps fighter jets at Arctic bases at ‘the ready’.

It comes as tensions are still soaring over Ukraine, and after last week a Russia MiG-31 had intercepted a US spy plane near Russia’s far northeast Kamchatka Peninsula over the Pacific Ocean. Moscow has also recently denounced the US Air Force’s additional longrange bomber presence in Norway, out of which recent missions have flown over the Baltic and North seas in a ‘message’ to Russia.

“The culpability of this systemic incompetence is so widespread, however, that there can be no serious accounting for what has transpired.”

• America Can Successfully Defend Taiwan Against China – In Its Dreams (Ritter)

The US military has deteriorated to the point that the only way it could win a simulated war game in which it was called on to defend Taiwan from a ‘Chinese invasion’ force was by inventing capabilities it does not yet possess. In 2018 and 2019, the US Air Force conducted detailed simulated war games that had its forces square off against those of China. On both occasions, the US was decisively defeated, the first time challenging the Chinese in the South China Sea, and the second time defending Taiwan – which China sees as an integral part of its territory – against a Chinese invasion. In 2020, the US repeated the Taiwan scenario, and won – but only barely. The difference? In both 2018 and 2019, it played with the resources it had on hand.

Last year, it gave itself a host of new technologies and capabilities that are either not in production or aren’t even planned for development. In short, the exercise was as far removed from reality as it could get. The fact is the US can only successfully defend Taiwan from a full-scale Chinese invasion in its dreams. What the current war games underscored is that, as currently configured, equipped, and deployed, the US Air Force lacks the required combination of lethality and sustainability necessary to wage full-scale conventional conflict against a peer-level foe. The mix of aircraft currently in the US Air Force inventory was unable to ‘compete’ in the war game – even the current model of F-35 was excluded as not being up to the task of fighting and surviving against the Chinese military.

[..] Today, with the political decision having been made to depart Afghanistan, and a similar decision being brooded regarding Iraq and its corollary conflict, Syria, the US military is a fundamentally broken institution. It lost its ‘forever wars’ in the Middle East and Southwest Asia by not winning. As such, the senior leadership at the helm of the US military has been conditioned to accept defeat as de rigueur; it comes with the territory, a reality explained away by lying – either to yourself, your superiors, or both. Too many successful careers were created on the backs of lies repackaged as truth, of defeats sold as victories, as deficits portrayed as assets. In many ways, the recently concluded US Air Force war game is a byproduct of this psychosis – an exercise in self-delusion, in which reality is replaced by a fictional world where everything works as planned, even if it does not exist.

The US Air Force cannot wage a successful war against China today. Nor can it do so against Russia. Its ability to sustain a successful air campaign against either Iran or North Korea is likewise questionable. This is the kind of reality that would, in a world where facts mattered, cost a lot of senior people their jobs, in uniform and out. The culpability of this systemic incompetence is so widespread, however, that there can be no serious accounting for what has transpired. Instead, the US Air Force, having been confronted by the reality of its shortcomings, ‘invents’ a victory. In and of itself, this ‘victory’ is meaningless. If China were to invade Taiwan, there is literally nothing short of employing nuclear weapons the US could do to stop it. But by ‘beating’ China using fictional resources, the US Air Force has created a blueprint of procurement that will define its budgetary requests for the next decade.

“..account managers and traders can bet billions on a daily basis with no skin in the game but massive potential upside if nothing goes wrong.”

• The $2.3 Quadrillion Global Timebomb (von Greyerz)

As I warned in last week’s article on Archegos and Credit Suisse, investment banks have created a timebomb with the $1.5 quadrillion derivatives monster. A few years ago, the BIS (Bank of International Settlement) in Basel reduced the $1.5 quadrillion to $600 trillion with a pen stroke. But the real gross figure was still $1.5q at the time. According to my sources, the real figure today is probably over $2 quadrillion. A major part of the outstanding derivatives are OTC (over the counter) and hidden in off balance sheet special purpose vehicles. The $30 billion in Archegos derivatives that went up in smoke over a weekend is just the tip of the iceberg. The hedge fund Archegos lost everything and the normal uber-leveraged players Goldman Sachs, Morgan Stanley, Credit Suisse, Nomura etc lost at least $30 billion.

These investment banks are making casino bets that they can’t afford to lose. What their boards and top management don’t realise or understand is that the traders, supported by easily manipulated risk managers, are betting the bank on a daily basis. Most of these ludicrously high bets are in the derivatives market. The management doesn’t understand how they work or what the risks are and the account managers and traders can bet billions on a daily basis with no skin in the game but massive potential upside if nothing goes wrong. But we are now entering an era when things will go wrong. The leverage is just too high and the bets totally out of proportion to the equity. Just take the notorious Deutsche Bank (DB) that has outstanding derivatives of €37 trillion against total equity of €62 billion.

Thus the derivatives position is 600X the equity. Or to put it in a different way, the equity is 0.17% of the outstanding derivatives. So a loss of 0.2% on the derivatives will wipe the share capital and the bank out! Now the DB risk managers will argue that the net derivatives position is just a fraction of the €37 trillion at €20 billion. That is of course nonsense as we saw with Archegos when a few banks let $30 billion over a weekend. Derivatives can only be netted down on the basis that counterparties pay up. But in a real systemic crisis, counterparties will disappear and gross exposure will remain gross. So all that netting doesn’t stand up to real scrutiny. But it is typical for today’s casino banking world when depositors, shareholders and governments take all the downside risk and the management all the upside.

“The video has the status of a religious icon, portraying, as it seems to, the vivid distillation of the black experience in America..”

• The Movie Follows the Script (Jim Kunstler)

Former police officer Chauvin is charged with Murder 2, Murder 3, and Manslaughter all predicated on varying degrees of intention and recklessness in the death of George Floyd, the internationally acclaimed saint-of-oppressed-peoples who died under Mr. Chauvin’s knee in an indelible video shared ‘round the world last May. The video has the status of a religious icon, portraying, as it seems to, the vivid distillation of the black experience in America: pure, unalloyed, hateful, murderous subjugation. The trouble is what’s not in the indelible picture: Mr. Floyd’s prodigious ingestion of the world’s hardest narcotic, fentanyl, at a level likely to cause death, plus methedrine, plus THC, on top of a 90-percent blockage of a coronary artery, and other cardiopathies, and Covid-19, all according to the official medical examiner.

Also, as it happened in the instance of his arrest, Mr. Floyd was failing to follow police instructions, and acting dangerously deranged — behavior apt to lead to police restraint, under which he died, rest his soul. So, now it will be left to the jury to sort all this out, under the threat of getting “doxed” (having their home addresses disclosed) by the Black Lives Matter org, as well as following the $27-million lawsuit settlement on the Floyd family for “wrongful death” by the Minneapolis City Council before the trial commenced — not exactly a propitious lead-in for a fair outcome. One might even view the public expressions of black opinion leaders and politicians as coercive — but then coercion is the animating spirit of liberal Wokery, the wish and the will to punish at all costs.

In any case, the fine spring weather around the country invites the young and energetic to caper angrily in the streets after a harsh winter of lockdowns. The mobs will turn out, things will burn, businesses will get looted (and destroyed), and people will get hurt. So it will be for two reasons: groups of people follow social scripts and societies give tacit permission for the acting-out of feelings — in this case, feelings of grievance that demand retribution and vengeance. What’s actually at issue here is whether black people in America really want to join with the other ethnic groups present in the land in a national common culture — that is, a consensus about behavior, ceremonies, and manners — or would rather opt out of it, oppose it, or violently destroy what’s left of it.

Chauvin judge

Watch at about the :19 mark: pic.twitter.com/bbmgQF3ePp

— Andy Grewal (@AndyGrewal) April 19, 2021

Blood glucose.

• Why People Are Persistently Hungry All The Time (RT)

A study between multiple universities has revisited the link between blood sugar and appetite, and found the relationship is far more complex than previously understood, yielding new insights on how to tame persistent hunger. The researchers examined blood sugar responses and other indicators from 1,070 participants in the UK and the US, sourcing data from the PREDICT (Personalised REsponses to DIetary Composition Trial) nutrition research project. The volunteers ate standardised breakfasts, after which they were free to choose their remaining meals throughout the remainder of the day, observing a fasting window for three hours after breakfast. They continuously wore blood glucose monitors and recorded what and when they ate each day using a phone app, along with their self-reported hunger levels, over the study period of two weeks.

The researchers discovered that dips in blood glucose levels, aka “sugar dips,” were significantly linked with appetite levels and energy intake/calorie consumption. Participants with big blood sugar dips experienced a nine percent increase in appetite, consumed their second meal of the day half an hour sooner, and posted an overall average consumption of 300 calories more throughout the course of the day, than those who didn’t experience these sugar dips. The research shows “great potential for helping people understand and control their weight and long-term health,” says senior author and genetic epidemiologist Ana Valdes from the University of Nottingham. “Many people struggle to lose weight and keep it off, and just a few hundred extra calories every day can add up to several pounds of weight gain over a year.”

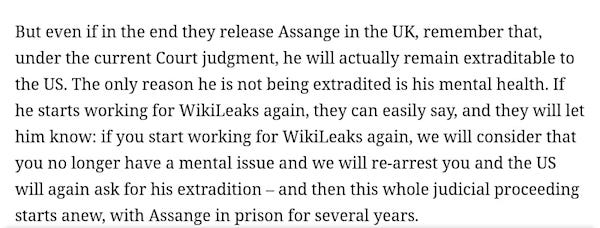

“When you visited him, he told you: Please, save my life. What does he have in common with other victims of torture?”

• Nils Melzer Says The Treatment Of Assange Leaves Him “Speechless” (Maurizi)

He deals with torture victims on a daily basis, so he is not easily shocked by abuses. And yet, he says, he is ‘speechless’ when it comes to the case of Julian Assange. The UN Special Rapporteur on Torture, Nils Melzer, has just published a book in German: “Der Fall Julian Assange”, which reconstructs his investigation based on exclusive documents. He tells Il Fatto Quotidiano what he has discovered and what he thinks is likely to happen. What made a Special Rapporteur on Torture work on the Assange case and write a book on it?

“When Julian Assange was still at the embassy in December 2018, his legal team actually reached out to my office. I remember it was just before Christmas, I saw this message pop up on my screen and I swiped it away immediately. I had this intuitive reaction: what does that guy want? He’s a rapist, a narcissist, a hacker, this isn’t serious, so I just discarded it. I have around 15 requests per day, and I can do one, it’s very routine for me to decide quickly, but I remember those negative emotions I had, that I usually don’t have. Three months later his lawyers came back to me in March 2019, and they also sent me Dr. Sondra Crosby’s medical assessment. And I knew Dr. Crosby was a big name as an independent medical expert, who was not associated with Assange activists.

I read these objective assessments by Dr. Crosby, by the UN Working Group on Arbitrary Detention, I also read an article by James Goodale the Pentagon Papers man. I realised that I had strong prejudices against Assange, even though it’s my profession as a Human Rights expert to be objective. I started investigating further, scratching the surface of this case. The deeper I got into the case, the more dirt and contradictions came to the light. I also knew that I could not rely on information in the media and in the press, because that’s precisely the source that had deceived me in the first place. To be objective, I had to go visit him in prison, and, to be sure, I took not one medical doctor, but even two medical doctors with me, who are independent from each other and are not employed by the UN; they work as external experts for the International Criminal Court, the International Committee of the Red Cross and so on.

We spent 4 hours with Julian Assange, I spoke to him for one hour, and the forensic expert had one hour for a physical examination, and the psychiatrist did a two-hour psychiatric examination. Each medical examination was done separately from the other, so they wouldn’t influence each other. All three of us at the end compared our conclusions and agreed that he showed all the signs that are typical of victims of psychological torture. I must admit that I didn’t expect such a clear result. I reported back to the involved governments by the end of May. I was convinced Julian Assange had been deliberately persecuted and kept in a legal limbo in Sweden, in the US, in the UK and everywhere to put him under pressure and to make him crack. It was done very publicly, in order to make an example of him, to scare other investigative journalists. The message was: ‘If you expose our dirty secrets, this is what is going to happen to you, and no one can protect you. We can violate your rights every day the way we want and no one can do anything about it.’

[..] When you visited him, he told you: Please, save my life. What does he have in common with other victims of torture? “Torture is used for a wide range of purposes. There is the classic context of interrogations, the other one is torture to intimidate, like when they come to a village and they rape a woman in the village square, in front of everybody, it’s not as much to punish her, as it is to intimidate the population. That’s a very common purpose of torture, even more common than interrogation, and that’s what they are doing with Assange. In a modern democratic society they are not doing it by flogging, but they are doing it using the psychological method, by excluding him from society, by defaming him, by humiliating him in the media, in the press. Think of the witch trials in the 17th century, when those women were stripped naked and paraded around the city and everyone spat at them, that’s a bit what they are doing with Assange.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.