Wyland Stanley Chalmers touring car 1922

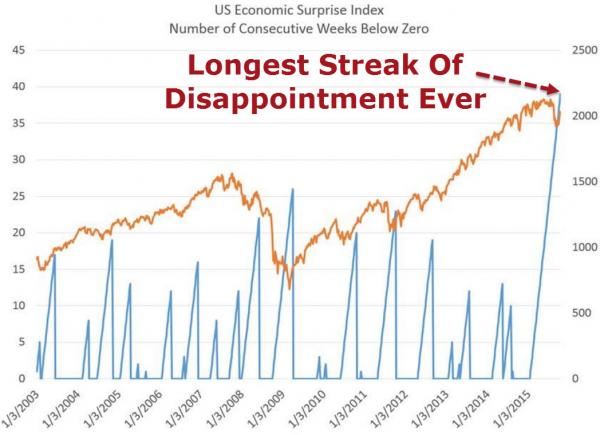

“..this period of economic weakness and disappointment is not just the longest on record, but it is entirely unprecedented…”

• US Economic Data Has Never Been This Weak For This Long (Zero Hedge)

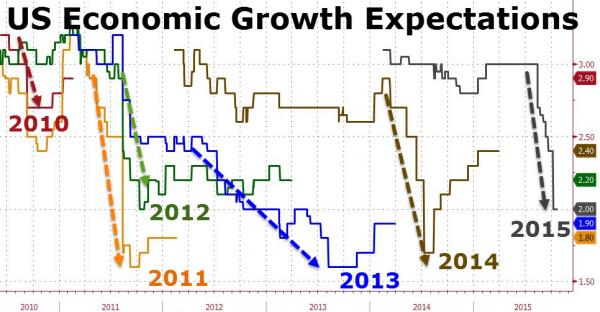

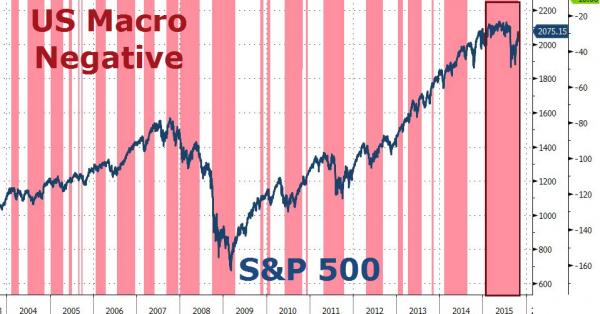

Despite the ongoing propaganda reinforcing America’s “cleanest sheets in a brothel” economic growth, the fact is, there is a reason why The Fed folded, why Draghi doubled-down, why China cut, and why Kuroda will likely unleash moar QQE this week. It appears the ‘trap’ that central planners have set for themselves – by enabling massive financial asset inflation in the face of what is now the longest streak of economic weakness and data disappointment on record – now looks set to prove their impotence and/or Enisteinian insanity. As Ice Farm Capital notes: “.. a year ago were looking at 5yr inflation breakevens around 1.5%. They have since deteriorated to 1.15% (by way of 1%) and this week we are expecting a Q3 GDP print more like 1.5% – a deceleration of a full 240bps.”

“Corporate profit margins have taken a sharp hit and corporate profits for the S&P are now down 3% yoy despite continued share buybacks. Through this entire period, markets have continually expected happy days to be just around the corner.”

As a result, we have seen economic surprises for the US negative for the longest stretch in the history of the data series:

To make it a little clearer, this period of economic weakness and disappointment is not just the longest on record, but it is entirely unprecedented…

“The industrial environment’s in a recession. I don’t care what anybody says..”

• US Companies Warn of Pending Recession (WSJ)

Quarterly profits and revenue at big American companies are poised to decline for the first time since the recession, as some industrial firms warn of a pullback in spending. From railroads to manufacturers to energy producers, businesses say they are facing a protracted slowdown in production, sales and employment that will spill into next year. Some of them say they are already experiencing a downturn. “The industrial environment’s in a recession. I don’t care what anybody says,” Daniel Florness, chief financial officer of Fastenal Co., told investors and analysts earlier this month. A third of the top 100 customers for Fastenal’s nuts, bolts and other factory and construction supplies have cut their spending by more than 10% and nearly a fifth by more than 25%, Mr. Florness said.

Caterpillar last week reduced its profit forecast, citing weak demand for its heavy equipment, and 3M, whose products range from kitchen sponges to adhesives used in automobiles, said it would lay off 1,500 employees, or 1.7% of its total, as sales growth sagged for a wide range of wares. The weakness is overshadowing pockets of growth in sectors such as aerospace and technology. Industrial companies are being buffeted on multiple fronts. The slump in energy prices has gutted demand for drilling equipment and supplies. Economic expansion is slowing in China and major emerging markets such as Brazil, which U.S. companies have relied on for sales growth. And the dollar’s strength also has eroded overseas profits.

The drag on earnings and sluggish growth projections for next year come as the Federal Reserve considers raising interest rates for the first time in nine years, and could add momentum to those in favor of postponing any rate increase until next year. Profit and revenue are falling in tandem for the first time in six years, with a third of S&P 500 companies reporting so far. Analysts expect the index’s companies to book a 2.8% decline in per-share earnings from last year’s third quarter, according to Thomson Reuters. Sales are on pace to fall 4%—the third straight quarterly decline. The last time sales and profits fell in the same quarter was in the third period of 2009.

Priorities couldn’t be more skewed.

• EU Agrees To Tighten Border Controls And Slow Migrant Arrival (AP)

European and Balkan leaders agreed on measures early Monday to slow the movement of tens of thousands whose flight from war and poverty has overwhelmed border guards and reception centers and heightened tension among nations along the route to the European Union’s heartland. In a statement to paper over deep divisions about how to handle the crisis, the leaders committed to bolster the borders of Greece as it struggles to cope with the wave of refugees from Syria and beyond that cross over through Turkey. The leaders decided that reception capacities should be boosted in Greece and along the Balkans migration route to shelter 100,000 more people as winter looms. They also agreed to expand border operations and make full use of biometric data like fingerprints as they register and screen migrants, before deciding whether to grant them asylum or send them home.

“The immediate imperative is to provide shelter,” European Commission President Jean-Claude Juncker said after chairing the mini-summit of 11 regional leaders in Brussels. “It cannot be that in the Europe of 2015 people are left to fend for themselves, sleeping in fields.” Nearly 250,000 people have passed through the Balkans since mid-September. Croatia said 11,500 people entered its territory on Saturday, the highest tally in a single day since Hungary put up a fence and refugees started moving sideways into Croatia a month ago. Many are headed northwest to Austria, Germany and Scandinavia where they hope to find a home. “This is one of the greatest litmus tests that Europe has ever faced,” German Chancellor Angela Merkel told reporters after the summit. “Europe has to demonstrate that it is a continent of values and of solidarity.”

“We will need to take further steps in order to get through this,” she said. Slovenian Prime Minister Miro Cerar said his small Alpine nation was being overwhelmed by the refugees – with 60,000 arriving in the last 10 days – and was not receiving enough help from its EU partners. He put the challenge in simple terms: if no fresh approach is forthcoming “in the next few days and weeks, I do believe that the European Union and Europe as a whole will start to fall apart.” The leaders agreed to rapidly dispatch 400 border guards to Slovenia as a short-term measure. As they arrived at the hastily organized meeting, some leaders traded blame for the influx with their neighbors, with Greece targeted for the mismanagement of its porous island border.

“We should go down south and defend the borders of Greece if they are not able to do that,” said Hungarian Prime Minister Viktor Orban, who claimed he was only attending the meeting as an “observer” because Hungary is no longer on the migrant route since it tightened borders. But the country that many say is another key source of the flow – Turkey – was not invited, and some leaders said that little could be done without its involvement. “It has to be tackled in Turkey and Greece, and this is just a nice Sunday afternoon talk,” Croatian Prime Minister Zoran Milanovic said, after complaining about having to leave an election campaign to take part in the mini-summit of nations in Europe’s eastern “migrant corridor.”

“If we do not deliver some immediate and concrete actions on the ground in the next few days and weeks, I do believe that the European Union and Europe as a whole will start falling apart..”

• Tensions Rise Between European Nations Over Refugee Crisis (Bloomberg)

European leaders clashed over how to manage the influx of hundreds of thousands of refugees forging through the region’s eastern flank as they warned that Europe is buckling under the strain of the crisis. While 11 leaders including German Chancellor Angela Merkel managed to come up with short-term fixes at a summit on Sunday, including the provision of emergency shelter for 100,000 refugees and a stepped-up system for their registration, the meeting laid bare tensions between nations that risk fraying the fragile fabric of cooperation in addressing the growing problem. “This is one of the greatest litmus tests that Europe has ever faced.” Merkel said after the gathering in Brussels. “We will need to take further steps to get through this litmus test.”

With winter approaching and more than a million migrants set to reach the European Union this year, national authorities have shut their borders and waved asylum seekers through to neighboring countries as they struggle to get a grip on Europe’s largest influx of refugees in seven decades. “We have made clear to everyone this evening that waving them through has to stop,” European Commission President Jean-Claude Juncker said. While it’s important to implement measures agreed on Sunday, “there will be no miracle cure.” The situation in the Western Balkans – the focus of the summit in Brussels – has worsened over the past few months, aggravating deep-seated distrust between nations that emerged from the violent breakup of the former Yugoslavia.

The main flow of migrants fleeing conflict-stricken nations changed from a route through southern Europe to one leading from Turkey to Greece and through countries including Croatia, Serbia and Slovenia. “If we do not deliver some immediate and concrete actions on the ground in the next few days and weeks, I do believe that the European Union and Europe as a whole will start falling apart,” Slovenian Prime Minister Miro Cerar told reporters before the meeting. Greece, which is at the front line for refugees arriving in Europe, agreed to provide temporary shelter for 30,000 refugees by the end of the year, with the UN High Commissioner for Refugees supporting a further 20,000 places in the country.

An additional 50,000 places will be established by the countries along the Western Balkan route, according to a statement issued after the gathering. Countries also agreed to work together and with Frontex, the EU border-management agency, to bolster frontier controls and cooperation, including between Turkey and Bulgaria and between Greece and Macedonia. Greece fended off “absurd proposals” at the meeting, including allowing countries to block migrants entering from neighboring countries and giving Frontex a new undertaking on the Greek frontier with Macedonia, Prime Minister Alexis Tsipras said. Tsipras signaled disappointment that Turkey wasn’t invited to the summit because it plays “the basic role, the key role” in the crisis.

Sanity. It still does exist.

• Greece Says Refugees Are Not Enemies, Refuses to Protect Borders From Them (WSJ)

Greece’s migration minister has rejected accusations by Germany and other European countries that Greece is failing to defend its borders against mass migration, insisting that the refugees and other migrants trekking to Europe constitute a humanitarian crisis, not a defense threat. “Greece can guard its borders perfectly and has been doing so for thousands of years, but against its enemies. The refugees are not our enemies,” Yiannis Mouzalas said in an interview. Greece is under pressure from other European governments to use its coast guard and navy to control the huge influx of migrants who are making their way, via the Aegean Sea and Greece’s territory, from the Middle East to Northern Europe, especially Germany.

At a European summit in Brussels on Sunday, leaders from Greece and other countries on the latest migration route through the Balkans are facing allegations from Germany, Hungary and others that they are passively allowing migrants to pass through. “In practice what lies behind the accusation is the desire to repel the migrants,” said Mr. Mouzalas. “Our job when they are in our territorial sea is to rescue them, not [let them] drown or repel them.” Countries in Southern and Central Europe have been struggling to cope with the arrival of more than half a million people this year, with the largest number reaching Europe via Turkey and Greece. Many are from war-torn Syria and are treated as refugees from mortal danger, while others come from as far as Pakistan and are seen as having weaker claims to asylum in Europe.

Last week alone, Greece received about 48,000 migrants and refugees on its shores, the highest number of weekly arrivals this year, the International Organization for Migration said Friday. European Union authorities want countries along the transit route to agree on a plan to stop allowing people through, to fingerprint everyone who enters their territory, to beef up border surveillance in Greece, and to deploy 400 border guards to Slovenia, the latest hot spot. Athens opposes an idea floated by European Commission President Jean-Claude Juncker to set up joint Turkish-Greek border patrols. Greece and Turkey have long-standing disputes over their territorial waters, which have led to military tension over the years.

“This was an unfortunate statement by Mr. Juncker,” Mr. Mouzalas said. “The joint patrols have never been on the table. They have no point anyway, as they wouldn’t help ease the situation.” He said an alternative could be to set up a European body to patrol Turkish waters, closer to where many migrants begin their trip, to stem the flow of people attempting the perilous journey to the Greek islands. Mr. Mouzalas said Turkey should have been invited to Sunday’s summit. “Turkey is the door and Greece is the corridor; Europe should not treat Greece as the door,” Mr. Mouzalas said.

Nobody trusts anybody anymore.

• European Trust: The Perfect Storm (Mungiu-Pippidi)

The EU is not a popular democracy – such was not, after all, the intention of its founding fathers. Jean Monnet recounts in his memoirs that the founding idea originated in the First World War and that the goal was to pool resources to enable the repulse of an enemy under a unified command – because coordination was failing to deliver under such conditions. It still fails. Ghita Ionescu, the founder of the London School of Economics journal Government and opposition wrote more than twenty years ago that the democratic deficit predated the EU, caused by the specialization of knowledge and increase in the power of experts on one hand, and on the other by the transnationalization of what had previously been national matters. Consequently, it became impossible for governments to act alone even after the “fullest consultation of their peoples”.

In 2004, the number of Europeans who believed that their voice counted in the EU was 39%. Ten years later, after the powers of the European Parliament have greatly increased, that figure has dropped to 29% (those who feel disempowered have increased from 52 to 66, an even greater difference). In other words, a majority always knew that the EU was not a popular democracy from the outset. Even in 2004, for every European who believed he had a voice in the EU two believed that they had none (Eurobarometer 2013a). Apart from Denmark, where an absolute majority believe that their voice counts in the EU (57% vs. 41%), in 26 countries people believe they have no influence in the EU in proportions that vary from 50% in Sweden and 51% in Belgium, up to 86% in both Cyprus and Greece – for obvious reasons.

But there is nothing new here, except, of course, the terrible constraints that the euro crisis has imposed on Greece, Cyprus and other countries, a tragedy caused by the complexity of an interdependent world which makes people less and less able to decide their own fate. In such complex situations, it is only the populists who offer simple solutions for how to empower voters. We do know what has caused the loss of trust: over two generations a significant question mark has arisen over whether the EU is the best vehicle to maximize social welfare for its various peoples. On one hand, there is the EU’s economic performance since the advent of the economic and growth crisis. On the other, there is loss of trust in European elites, perceived as demanding austerity from the people only to live a life of privilege themselves where taxes are concerned.

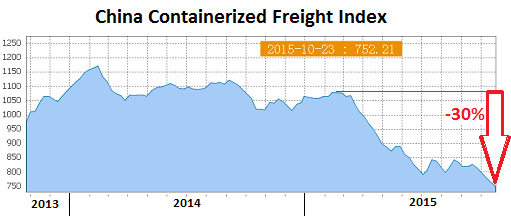

“These rates are a function of oversupply of shipping capacity and of lackluster demand for shipping containers to distant corners of the world. They’ve been in trouble since February. “Trouble” is a euphemism. They relentlessly plunged.”

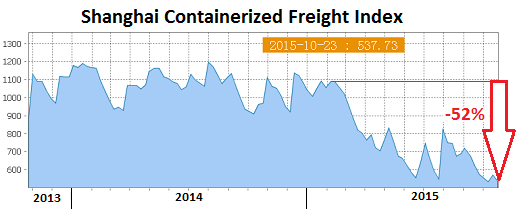

• China Containerized Freight Index Collapses to Worst Level Ever (WolfStreet)

A week ago, we pointed out how China’s dropping exports and plunging imports – the “inevitable fallout from China’s unsustainable and poorly executed credit splurge,” according to Thomson Reuters – had collided with long-term bets by the shipping industry that has been counting on majestic endless growth. The industry has been adding capacity in quantum leaps, where “the scramble to order so-called ultra-large container vessels had turned into a stampede,” as the Journal of Commerce put it. So we said, “Pummeled by Lousy Global Demand and Rampant Overcapacity, China Containerized Freight Index Collapses to Worst Level Ever”. And now, the China Containerized Freight Index (CCFI) has dropped to an even worse level.

Unlike a lot of official data emerging from China, the index, which is operated by the Shanghai Shipping Exchange and sponsored by the Chinese Ministry of Communications, is raw, unvarnished, not seasonally adjusted, or otherwise beautified. It’s volatile and a reflection of reality, as measured by how much it costs, based on contractual and spot market rates, to ship containers from China to 14 major destinations around the world. These rates are a function of oversupply of shipping capacity and of lackluster demand for shipping containers to distant corners of the world. They’ve been in trouble since February. “Trouble” is a euphemism. They relentlessly plunged.

By early July, the index dropped below 800 for the first time in its history, which started in 1998 when the index was set at 1,000. It soon recovered to about 850. And just when bouts of hope were rising that the worst was over, it plunged again and hit even lower levels. The latest weekly reading dropped another 1.7% from the prior week to 752.21, the worst level ever. The CCFI is now 30% below where it had been in February this year and 25% below where it had been 17 years ago at its inception.

The Shanghai Containerized Freight Index (SCFI), also operated by the Shanghai Shipping Exchange, tracks spot rates (not contractual rates) of shipping containers from Shanghai to 15 major destinations around the world. It’s even more volatile than the CCFI. But being based on spot rates, it’s a good indicator where the CCFI is headed. For last week, the SCFI plunged 5.4% to a new record low of 537.73, down 46% from where it had been at its inception in 2009 when it was set at 1,000 – and down 52% from February:

Spending is cratering in China too.

• A China Twist: Why Are Malls Closing If Consumption Is Rising? (Reuters)

Major listed mall operators are also feeling the pain. Dalian Wanda, a big property developer, said in January it would close or restructure 30 of its retail venues and in August said more adjustments were underway. Malaysia-based Parkson, which operates more than 70 department stores in China, closed several of its stores in northern China last year following a 58% drop in China net profit in 2013. “As growth in retail sales slows because of the country’s lower GDP growth, and in cities where mall space is abundant, vacancy rates have risen substantially,” said Moody’s analyst Marie Lam in a research note. In its latest efforts to re-energize the economy, China’s central bank on Friday cut interest rates for the sixth time in less than a year.

Tim Condon, an economist at ING in Singapore warned that investors should not read China’s official retail figures as exclusively reflective of rising household consumption, noting that the data also capture some government purchases. [..] … the risk is that the frenetic pace of mall construction cascades into a bad-debt problem for banks if shoppers fail to match the zeal of property developers. China is currently the site of more than half the world’s shopping mall construction, according to CBRE, a real estate firm, even though it appears that many of these malls will not produce good returns for their investors.

A joint report by the China Chain Store Association and Deloitte showed that by the end of this year, the total number of China’s new malls is projected to reach 4,000, a jump of over 40% from 2011. Real estate analysts note that much of the surge in retail space construction came at the behest of local governments, who were rushing to push real estate development as part of attempts to stimulate the economy. The result has been malls built in haste and managed poorly. Not surprisingly, shoppers are voting with their feet. “If you build it and they’re not coming, that’s a non-performing loan,” said Condon of ING. “That’s the banks’ problem.”

A process familiar to the west: “The evidence of recent years shows that China is getting less and less real GDP growth for every yuan of credit create..”

• China’s Leaders Shift From Short-Term Stimulus to Five-Year Plan (Bloomberg)

China’s leaders gathering in Beijing this week to formulate the 13th five-year plan confront an era of sub-7% economic growth for the first time since Deng Xiaoping opened the nation to the outside world in the late 1970s. Old drivers such as manufacturing and residential construction are spluttering, and new areas like consumption, services and innovation aren’t picking up the slack quickly enough. While President Xi Jinping’s blueprint for 2016-2020 will seek to map out the structural change needed to propel the next leg in China’s march toward high-income status, a more immediate fix has been delivered with the sixth interest-rate cut in a year. “Defensive economic stimulus is needed to ensure that structural reforms maintain their momentum,” said Stephen Jen at hedge fund SLJ Macro Partners.

“If growth slows too much, the pace of structural reforms in China will also need to be curtailed. The government wants to conduct reforms before the macro conditions get worse.” Late Friday, China announced it would cut benchmark interest rates, stepping up the battle against deflationary pressures and easing the financing burden on indebted local governments and companies. It also lowered the amount of deposits banks must hold as reserves, adding liquidity that has been drained by intensifying capital outflows since August’s yuan devaluation. Underscoring the juggling act between reform and stimulus, Friday’s rate-cut announcement was accompanied by the scrapping of a ceiling on deposit rates.

[..] some critics argue administering more stimulus now is the wrong medicine and what’s needed are faster and deeper market-driven reforms. China’s sliding growth is mainly caused by too much easy credit channeled into over-investment, says Patrick Chovanec at Silvercrest Asset Management n New York. “The evidence of recent years shows that China is getting less and less real GDP growth for every yuan of credit created,” said Chovanec. “In other words, more easing won’t help, and could even hurt.” The cut to interest rates may only serve to give yet another lifeline to inefficient state companies, the entities most likely to borrow at the benchmark rate, said Andrew Polk at the Conference Board in Beijing. The risk is that these state companies add more industrial capacity with the funds, worsening deflation and tightening real monetary conditions for the rest of corporate China, he said.

The relentless and unstoppable rise of bad loans.

• China Banks Turn To Investors For More Capital As Bad Loans Pile Up (Reuters)

Mounting bad loans are running down Chinese banks’ capital buffers, forcing them to turn to investors for fresh funds despite raising a record amount last year. Commercial banks are issuing expensive preference shares as well as convertible and perpetual bonds to shore up their capital bases, even after 2014’s bumper issuance when lenders raced to meet new regulatory requirements. But with bad loans up 30% in the first half of 2015 according to China’s banking regulator, doubts are growing about the ability of some banks to withstand the economic slowdown. “China is facing a systemic credit crisis,” said Jim Antos, banking analyst at Mizuho Securities in Hong Kong. “Chinese banks, until mid 2014, were able to cope with deterioration of loans. It seems that has changed.”

Banks’ operating profit margins also are expected to worsen, following the central bank’s decision on Friday to cut interest rates for the sixth time in less than a year. China’s listed commercial lenders raised $57.6 billion (£37.6 billion) last year to bolster their core capital according to Thomson Reuters data. But they may need to raise an additional 553 billion yuan (£54.7 billion) if a slowdown in the economy pushes the ratio of non-performing loans (NPLs) from 1.5 to 4%, according to calculations by Barclays’ banking analyst Victor Wang. Huaxia Bank is the latest lender to get approval from the Chinese Banking Regulatory Commission (CBRC) to issue 20 billion yuan in preference shares.The economic downturn and structural adjustment have caused “overdue loans to increase quickly, increasing pressure on credit risk management of the entire system,” the official said.

Lombard Street Research with a weird plea for a global consumer revival: “..now they can see that oil prices are staying low, consumers are starting to spend the windfall.” BS.

• ‘Deflationary Boom’ In Prospect As China Slows (FT)

The slowdown in Chinese growth, confirmed by last week’s third-quarter GDP report, is feeding fears that the world economy faces a prolonged period of stagnation, perhaps even a new crisis. In fact, China’s weakness is one of the reasons to be optimistic about global growth. Of course, there are many reasons to be pessimistic too. Many emerging markets are in deep trouble. Many asset prices are unsustainably high. Seven years after the financial crisis erupted, major central banks are still forced to keep monetary policy at emergency settings. And the world is short of genuine consumer demand. It is on this last score that China gives cautious grounds for confidence. Chinese growth of about 3-5% as the economy weans itself off wasteful investment is exactly what the world needs.

As the price of oil, copper and other commodities falls in response to China’s structural adjustment, demand deflates in countries that export energy and natural resources. Brazil and Russia, already deep in recession, will be among those watching anxiously for any economic policy announcements at this month’s plenary meeting of the ruling Chinese Communist party. At the same time, however, global rebalancing transfers income from commodity producers to western consumers. Households have largely chosen so far to set aside money saved on cheaper petrol and lower home heating bills. Economic growth in Europe and the US is below par. But now they can see that oil prices are staying low, consumers are starting to spend the windfall.

We capture these two divergent trends in our forecast of a “deflationary boom” in the world economy — with deflation referring to the step-down in demand in China, emerging markets and commodity-producing countries, and boom describing the step-up in household spending in the US, the eurozone and Britain. If China does manage to make the transition to consumer-driven growth, lower investment would mean less crowding-out of opportunities for profitable capital expenditure in advanced economies. Investment growth would follow the consumer revival. For this rosy scenario to materialise, however, either an unprecedented degree of international co-ordination is required or quite a few pieces of the global economic puzzle have to fall into place independently. The latter is what has been happening over the past year. Can it continue? Here are some signposts investors should keep an eye on.

Self-defeating policies, in China as much as in the west.

• Why China’s Interest Rate Cut May Be Bad News For The World Economy (Guardian)

So what’s the problem? China, Japan and the eurozone are all easing policy. The US is going to delay tightening policy. More stimulus equals stronger growth and fends off the threat of deflation. That’s got to be good, hasn’t it? Well, only up to a point. Problem number one is that by deliberately weakening their exchange rates, countries are stealing growth from each other. Central banks insist that this does not represent a return to the competitive devaluations and protectionism of the 1930s, but it is starting to look awfully like it. Problem number two is that the monetary stimulus is becoming less and less effective over time. There are two main channels through which QE operates. One is through the exchange rate, but the policy doesn’t work if all countries want a cheaper currency at once.

Then, as the weakness of global trade testifies, it is simply robbing Peter to pay Paul. The other channel is through long-term interest rates, which are linked to the price of bonds. When central banks buy bonds, they reduce the available supply and drive up the price. Interest rates (the yield) on bonds move in the opposite direction to the price, so a higher price means borrowing is cheaper for businesses, households and governments. But when bond yields are already at historic lows, it is hard to drive them much lower even with large dollops of QE. In Keynes’s immortal words, central banks are pushing on a piece of string. Nor is that the end of it. Charlie Bean, until recently deputy governor of the Bank of England, is the co-author of a new report that looks at the impact of persistently low interest rates.

It concludes there is a danger that periods when interest rates are stuck at zero are likely to become more frequent, resulting in a greater reliance on unconventional measures such as QE that are subject to diminishing returns. “Second, and possibly more importantly, a world of persistently low interest rates may be more prone to generating a leveraged ‘reach for yield’ by investors and speculative asset-price boom-busts.” The current vogue is for macro-prudential policies – attempts to prevent bubbles from developing in specific asset markets, such as housing. But the paper makes the reasonable point that the macro-prudential approach – yet to be tried in crisis conditions – might not work. There is, therefore, a risk that tighter monetary policy in the form of higher interest rates will have to deployed in order to deal with the problems that monetary policy has created in the first place.

Pushing on an orchestra of strings.

• Emerging Currencies’ Fate Looms Large In Rich World Rates Policy (Reuters)

The fate of emerging market currencies is looming ever larger in the outlook for interest rates in the advanced world, promising that their central banks will keep policies super loose for some time to come. Ever since China sprang a surprise depreciation of the yuan in August, the resulting decline of a whole host of emerging market (EM) currencies has produced a disinflationary pulse that the world is ill prepared to withstand. The danger was clearly much on the mind of ECB President Mario Draghi on Thursday when he all but guaranteed a further easing as soon as December.

“The risks to the euro area growth outlook remain on the downside, reflecting in particular the heightened uncertainties regarding developments in emerging market economies,” warned Draghi, as he sent the euro reeling to two-month lows. They were also cited as a reason the U.S. Federal Reserve skipped a chance to hike interest rates in September. In a recent much-discussed speech, Fed board member Lael Brainard put the deflationary pressures emanating from emerging markets at the center of a forceful case against a “premature” tightening in policy. Fuelling these worries has been a downdraft in emerging market currencies caused in part by worries that higher U.S. rates would suck much needed capital from countries already struggling with large foreign currency debts.

The scale of the shift can be seen in the Fed’s trade weighted U.S. dollar index for other important trading partners, which includes China, Brazil, Mexico and the like. The dollar index began to take off in mid-July and by the end of September had surged over 6% to an all-time high. The impact was clear in U.S. bond markets, where yields on 10-year Treasury notes fell from 2.43% in mid-July to just 2.06% by early October. Investors expectations for U.S. inflation in five years time, a benchmark closely watched by the Fed, sank from a peak of 2.47% in early July to hit an historic trough of 1.99% three months later. That in turn saw investors drastically scale back expectations on when and how fast the Fed might hike. In mid-July, Fed fund futures for December implied a rate of 37 basis points.

By early October it implied only 18 basis points. All of which threatens to become a self-fulfilling cycle where the fear of a Fed hike spurs a steep fall in emerging currencies which in turn stirs concerns about disinflation and prevents the Fed from moving at all. “It’s a negative feedback loop,” says Robert Rennie, global head of market strategy at Westpac in Sydney. “China first flipped the switch with its depreciation of the yuan and the risk of capital flight from EM has kept the pressure on,” he added. “It’s now certain the ECB will ease in December and the Fed will find it tough to hike in December.”

Bootle’s a bit of an idiot, but Africa’s fall does deserve more attention.

• Africa Is In Grave Danger From The Global Economic Slowdown (Telegraph)

Nowhere in the world is more at risk from the combination of Chinese economic slowdown, low commodity prices and imminent rises in US interest rates, than Africa. There is now a serious question over whether many African economies can achieve rapid growth in the years ahead or whether they are due to sink back into mediocre performance, thereby condemning their people to a continued low standard of living. The fact that this question now needs to be asked may come as a shock. Not long ago Africa was growing very strongly. Indeed, many good judges saw it as due to repeat the sort of economic take-off accomplished by several countries in east Asia a few decades previously. Yet, whereas five years ago the sub-Saharan African (SSA) growth rate was almost 7pc, last year it was down to less than 5pc.

Moreover, it looks as though this year’s performance will be even weaker, with growth dropping to 3pc. Nor is there any real prospect of a return to previous rapid growth rates. There is a suspicion in the minds of many investors that Africa’s recent growth surge was really just the outcome of the commodity boom. Accordingly, if we are in for a long period of commodity prices at about this level, then African growth prospects are pretty poor. Admittedly, there is considerable variation across countries. The worst hit are Nigeria, Zambia and Angola. The major economy that is doing best is Kenya. Meanwhile, SSA’s most developed economy, and the destination for much overseas investment, namely South Africa – where I was last week – seems to be mired in a phase of decidedly slow growth. This year it might manage 1.5pc.

But its medium-term prospects are pretty poor; its potential growth rate might only be 2pc. When you adjust for population growth, its potential growth of per capita GDP may only be 1.2pc per annum, which is pretty paltry compared to China – even after the recent slowdown. China’s importance to Africa is great – especially for South Africa, Angola, Congo and Zambia. But it can be exaggerated. Exports to China represent about 10pc of South Africa’s GDP. That is substantially lower than the UK’s exposure to the EU. In fact, China is Africa’s second largest export market. The largest is the EU, and by a considerable margin. Africa exports about 50pc more to the EU than it does to China. Accordingly, perhaps the most important factor bearing upon Africa’s economic future is what is going to happen to the euro-zone.

Abenomics was always just a crazy desperate move with zero chance of succeeding. And it’s going to get a lot worse still.

• Japan’s Struggling Economy Finds ‘Abenomics’ Is Not an Easy Fix (NY Times)

Japan’s economy has contracted so many times in the last few years that the meaning of recession has started to blur. If an economy is shrinking almost as often as it is growing, what does any single downturn say about its health? Now Japan appears to be faltering again. After a decline in the second quarter, there are signs that output may have slipped again in the third, driven down in part by a slowing Chinese economy. Economists expect any recession to be short and shallow, but the deeper lesson looks more troubling: Nearly three years after Prime Minister Shinzo Abe gained office on a pledge to end economic stagnation, a decisive break with the past still appears far off. “The potential growth rate is close to zero, so any small shock can put the economy into recession,” said Masamichi Adachi at JPMorgan Chase. “Growth expectations are anemic.”

As a result, some economists are betting that the Bank of Japan, which has been pumping vast amounts of money into the economy by buying up government debt, will pull the trigger on more stimulus at its next board meeting on Friday. The central bank’s aggressive intervention has been central to Mr. Abe’s policies, widely known as Abenomics. But events have conspired to blunt its impact. Last year, it was an ill-timed sales tax increase, which rattled Japanese consumers and dissuaded them from spending. Lately it has been the deceleration in China, whose factories have been important buyers of Japanese-made machinery. But the more fundamental problem, many specialists say, is that Japan’s economy simply doesn’t grow much in the first place.

Baseline growth is essentially zero. GDP is the same size it was in the mid-1990s, in part because the work force is shrinking. So where a faster-moving economy might simply lose momentum in response to headwinds, Japan’s goes into reverse. So far, Mr. Abe’s policies have done little to change the dynamic. “Overseas investors appear increasingly disillusioned with Abenomics,” Naohiko Baba at Goldman Sachs said last week. [..] Mr. Abe has continued to make ambitious promises. Last month, he set a goal of increasing Japan’s nominal economic output to 600 trillion yen by 2020 or soon after – an increase of about 20% from the current level. He gave little indication of how an economy that has not grown in two decades could expand by a fifth in just a few years.

Audacious pronouncements have been a hallmark of Abenomics from the start — part of what Mr. Kuroda has described as an effort to dispel Japan’s “deflationary mind-set.” But after three mostly lackluster years, its architects’ credibility is being questioned by many, including their natural supporters in the business elite. “I believe ¥600 trillion is an outrageous figure,” Yoshimitsu Kobayashi, chairman of the Japan Association of Corporate Executives, said after Mr. Abe announced his goal. “I see it as merely a political message.”

Jaoan, US, Europe, all these forecasts are completely useless.

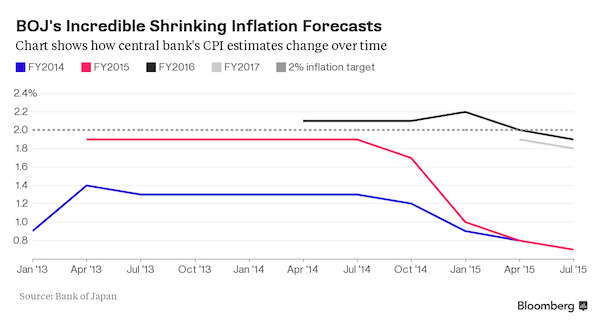

• Reality Keeps Catching Up With BOJ’s Inflation Forecasts (Bloomberg)

The Bank of Japan will release updated inflation forecasts this Friday. These are an indicator of when, or if, the bank’s board members see Japan reaching the inflation target of 2%. If history is a guide, the forecasts will probably be cut again, with some people with knowledge of the board’s discussions seeing the possibility of a reduction in the estimates for this and next fiscal years. The bank has had to lower estimates for all four years from 2014, as the chart below shows. Japan’s central bank was the second worst inflation forecaster, according to a Bloomberg survey which compared it to the Bank of Canada, the Fed, the ECB, and the Bank of England. The BOJ’s GDP estimates were the least accurate. While Governor Haruhiko Kuroda says he sees the nation hitting that target sometime around the six months from April, the bank isn’t forecasting inflation that high for any full year through the fiscal year that ends in March 2018.

Forgotten history. Europe’s full of it.

• When Greeks Fled To Syria (Kath.)

Giorgos Taktikos was just 5 years old when he and his family began their long journey to the Sinai Desert by boarding a small boat in the middle of the night and leaving behind their native Chios. Today, at the age of 78, Taktikos is following history being written the other way round. As a former refugee, he is pained to observe the boatloads of people fleeing the Middle East and reaching Greek shores, while his mind races back to his own long and difficult journey into the unknown. A native of the Chiot village of Kourounia, Taktikos was one of over 30,000 Greeks who left several eastern Aegean islands during the German wartime occupation, some seeking refuge in Syria, others reaching South Africa, in an effort to escape hunger and war.

Boats crossing over, people drowning at sea, overflowing train wagons, refugee camps and deprivation – some things haven’t changed as far as the refugee journey goes. What has changed, however, is the destination: While people were striving to reach Syria back then, today it’s the other way round. “It’s hard to beat hunger and fear; refugee pain is tremendous,” said Taktikos. In the fall of 1942, hunger spread across occupied Greece: While there were severe food shortages in urban centers, the situation was even worse on the islands, given the British Royal Navy’s blockade of the Aegean and the Mediterranean region in general. Getting away was the only way out and for residents of the eastern Aegean, including Samos, Icaria, Chios, Lesvos and Limnos, this was made slightly easier given the islands’ proximity to Turkish shores.

“I was 5. There was plenty of poverty and hunger on the island. In November 1942, a time when it seemed the situation was about to get even worse, my father decided it was time for us to flee in order to survive. Along with two young men, we stole a boat which the Germans had requisitioned, and one night my my father, mother and younger sister, together with another two families, crossed over to Cesme. We were collected by Father Xenakis, an Orthodox priest who met refugees as they arrived and took them to an area where humanitarian organizations could look after them. The first thing he did when we arrived was to make sure the wooden boat was broken into little pieces, so as not to be detected by the Turkish coast guard, who would have forced us to get back on it and return to Greece.”

Home › Forums › Debt Rattle October 26 2015