Ben Shahn “Scene in Jackson Square, New Orleans” 1935

Reality.

• World Trade Falls 13.8% In Dollar Terms (FT)

Weaker demand from emerging markets made 2015 the worst year for world trade since the aftermath of the global financial crisis, highlighting rising fears about the health of the global economy. The value of goods that crossed international borders last year fell 13.8% in dollar terms — the first contraction since 2009 — according to the Netherlands Bureau of Economic Policy Analysis’s World Trade Monitor. Much of the slump was due to a slowdown in China and other emerging economies. The new data released on Thursday represent the first snapshot of global trade for 2015. But the figures also come amid growing concerns that 2016 is already shaping up to be more fraught with dangers for the global economy than previously expected.

Those concerns are casting a shadow over a two-day meeting of G20 central bank governors and finance ministers due to start on Friday. Mark Carney, the Bank of England governor, was set to warn the gathering that the global economy risked “becoming trapped in a low growth, low inflation, low interest rate equilibrium”. His comments will echo the IMF, which this week warned it was poised to downgrade its forecast for global growth this year, saying the world’s leading economies needed to do more to boost growth. The Baltic Dry index, a measure of global trade in bulk commodities, has been touching historic lows. China, which in 2014 overtook the US as the world’s biggest trading nation, this month reported double-digit falls in both exports and imports in January.

In Brazil, which is now experiencing its worst recession in more than a century, imports from China have collapsed. Exports from China to Brazil of everything from cars to textiles shipped in containers fell 60% in January from a year earlier while the total volume of imports via containers into Latin America’s biggest economy halved, according to Maersk Line, the world’s largest shipping company. “What we are seeing right now from China is not only a phenomenon for Brazil; we are seeing the same all over Latin America, declining [Chinese export] volumes into all the markets,” said Antonio Dominguez, managing director for Maersk Line in Brazil, Paraguay, Uruguay and Argentina. “It has been going on for several quarters but is getting more evident as we move into the year [2016].”

Currency war Mexican standoff.

• Scepticism Rife Over G20 Move To Calm FX (FT)

Scepticism is rife that the G20 gathering of finance ministers will agree to co-ordinate currency policy but there is some belief it could provide a short-term boost to risk appetite. Japan has led calls for the two-day meeting in Shanghai to bring calmness to an unstable market with a broad-based FX strategy, seen by some market commentators as a reprise of the 1985 Plaza Accord that succeeded in weakening a rampant dollar. But those hopes have been knocked back by China and the US, and market expectations have been subdued in the run-up to the G20 meeting that ends with a communique on Saturday. “A grand solution like the Plaza Accord feels far-fetched”, said Peter Rosenstrich at the online bank Swissquote.

“G20 members were ‘too unique’ to agree which currencies were mispriced, while to decide who wins and who loses would be ‘far too complex'” , he said. Some FX strategists are braced for a negative market reaction to the G20 meeting, basing their fears on the experience of previous gatherings. “Our fear is that…there may yet be a sense of despondency, an ‘is that it’ moment, should the G20 be seen to be papering over some rather large cracks in an all too familiar fashion“, said Neil Mellor at BNY Mellon. Market turmoil has driven a sharp rise in the value of the yen against the dollar, causing alarm at the Bank of Japan and jeopardising the government’s Abenomics growth strategy.

Japan’s negative interest rates policy, which came under attack as the G20 meeting began, has failed to reverse the yen’s rise, leading to heightened expectation of unilateral FX intervention by the BoJ. David Bloom, head of FX research at HSBC, said that possibility had been put on hold in the build-up to the G20 meeting, given the potential backlash from other G20 members. “But once that peer pressure passes after the meeting, FX intervention could be back on the table, he warned”. “Any push in USD-JPY towards 110 could be enough to trigger the green light on direct intervention”, said Mr Bloom. The best that can be hoped for from the meeting, said Steven Englander at Citigroup, was a communique that convinced investors that global policymakers are ‘sufficiently on the same page to add to global confidence’.

A whole lot of nothing. They -make that we- are going to regret this. But the political climate is not there to act.

• G20 To Say World Needs To Look Beyond Ultra-Easy Policy For Growth (Reuters)

The world’s top economies are set to declare on Saturday that they need to look beyond ultra-low interest rates and printing money if the global economy is to shake off its torpor, while promising a new focus on structural reform to spark activity. A draft of the communique to be issued by the Group of 20 (G20) finance ministers and central bankers at the end of a two-day meeting in Shanghai reflected myriad concerns and policy frictions that have been exacerbated by economic uncertainty and market turbulence in recent months. “The global recovery continues, but it remains uneven and falls short of our ambition for strong, sustainable and balanced growth,” the leaders said in a draft seen by Reuters. “Monetary policies will continue to support economic activity and ensure price stability … but monetary policy alone cannot lead to balanced growth.”

Geopolitics figured prominently, with the draft noting risks and vulnerabilities had risen against a backdrop that includes the shock of a potential British exit from the European Union, which will be decided in a June 23 referendum, rising numbers of refugees and migrants, and downgraded global growth prospects. But there was no sign of coordinated stimulus spending to spark activity, as some investors had been hoping after the market turmoil that began 2016. Divisions have emerged among major economies over the reliance on debt to drive growth and the use of negative interest rates by some central banks, such as in Japan. Germany had made it clear it was not keen on new stimulus, with Finance Minister Wolfgang Schaeuble saying on Friday the debt-financed growth model had reached its limits.

“It is even causing new problems, raising debt, causing bubbles and excessive risk taking, zombifying the economy,” he said. The G20, which spans major industrialized economies such as the United States and Japan to the emerging giants of China and Brazil and smaller economies such as Indonesia and Turkey, reiterated in the communique a commitment to refrain from targeting exchange rates for competitive purposes, including through devaluations. While G20 host China has ruled out another devaluation of the yuan after surprising markets by lowering its exchange rate last August, there still appeared to be concerns that some members may seek a quick fix to domestic woes through a weaker currency.

Japanese finance minister Taro Aso said late on Friday he had urged China to carry out currency reform and map out a mid-term structural reform plan with a timeframe. U.S. Treasury Secretary Jack Lew also encouraged China on Friday to shift to a more market-oriented exchange rate in “an orderly way” and “refrain from policies that would be destabilizing and create an unfair advantage”.

“Data disappears when it becomes negative..”

• As China’s Economic Picture Turns Uglier, Beijing Applies Airbrush (NY Times)

This month, Chinese banking officials omitted currency data from closely watched economic reports. Weeks earlier, Chinese regulators fined a journalist $23,000 for reposting a message that said a big securities firm had told elite clients to sell stock. Before that, officials pressed two companies to stop releasing early results from a survey of Chinese factories that often moved markets. Chinese leaders are taking increasingly bold steps to stop rising pessimism about turbulent markets and the slowing of the country’s growth. As financial and economic troubles threaten to undermine confidence in the Communist Party, Beijing is tightening the flow of economic information and even criminalizing commentary that officials believe could hurt stocks or the currency.

The effort to control the economic narrative plays into a wide-reaching strategy by President Xi Jinping to solidify support at a time when doubts are swirling about his ability to manage the tumult. The persistence of that tumult was underscored on Thursday by a 6.4% drop in Chinese stocks, which are now down more than a fifth since the beginning of this year alone. The government moved to bolster confidence on Saturday by ousting its top securities regulator, who had been widely accused of contributing to the stock market turmoil. Mr. Xi is also putting pressure on the Chinese media to focus on positive news that reflects well on the party. But the tightly scripted story makes it ever more difficult to get information needed to gauge the extent of the country’s slowdown, analysts say. “Data disappears when it becomes negative,” said Anne Stevenson-Yang, co-founder of J Capital Research, which analyzes the Chinese economy.

The party’s attitude has raised further questions among executives and economists over whether Chinese policy makers know how to manage a quasi-market economy, the second-largest economy in the world, after that of the United States. Economists have long cast some doubt on Chinese official figures, which show a huge economy that somehow manages to avoid the peaks and valleys that other countries regularly report. In recent years, China made efforts to improve that data by releasing more information more frequently, among other measures. It also gave its financial media greater freedom, even as censors kept a tight leash on political discourse. But the party now sees reports of economic turbulence as a potential threat. The same goes for data. “Many economic indicators are on a downward trend in China, and economic data has become quite sensitive nowadays,” said Yuan Gangming, a researcher at the Center for China in the World Economy at Tsinghua University.

Analysts are not ging to leave this alone anymore.

• Chinese Accounting Is ‘Highly Questionable’ (CNBC)

Financial reporting in China was back in the spotlight again Friday, with one strategist claiming Chinese businesses were using “accounting trickery” to mask underlying credit problems. China looks like it’s heading towards a credit bust, Chris Watling, CEO and chief market strategist at Longview Economics told CNBC on Friday, explaining that cash borrowed by mainland firms is primarily being used to service debts. “We’ve been looking a lot at Chinese accounting recently and it is highly questionable,” he said. The corporate sector is increasing borrowing to pay interest, while instances of fraud and default are on the rise, he added in a note published Thursday. He said there were many examples where operating profit has been high, while cash flow has been negative — a “classic sign” that firms aren’t generating a profit, he added.

Watling highlighted that the balance sheets of commercial banks were particularly worrying. “In an economy which has undergone a credit boom, all of the lending is not necessarily readily apparent from the top level data,” he said. “Accounting trickery is often at work,” Watling claimed. Chinese corporates would reject the accusations, but this isn’t the first time there has been speculation over the accuracy of Chinese figures. Back in September, the state’s statistics bureau announced it would officially change the way it calculated gross domestic product amid skepticism over the credibility of the numbers as the government sought to sooth reaction to China’s economic slowdown. Watling now claims lenders are using tricks like labelling loan collateral as revenue in their balance sheets, rather than as a creditor.

And it may be helping inflate banks’ balance sheets, which in aggregate have increased tenfold in 10 years to over three times gross domestic product at $30 trillion, he said. However, whether this will help lead to a devastating credit bust isn’t clear, Watling explained, saying that while the cracks are starting to show, the economy is managed so differently that normal market rules don’t necessarily apply. A current slowdown in Chinese growth comes at a time when the country’s leadership is stepping up regulation, curbing an overheated credit market and switching an export-focused economy into a consumer-driven one. After double-digit growth for the last decade, investors and officials in China are coming to terms with growth that has fallen below 7%, hitting a 25- year low.

“China produces more than double the steel of Japan, India, the U.S., and Russia—the four next-largest producers—combined..”

• China Commodities Industry Resists Cuts Despite Production Glut (BBG)

China has had an overcapacity problem in its aluminum, chemical, cement, and steel industries for years. Now it’s reaching crisis levels. “The situation has gone so dramatically bad that action has to happen very soon,” said Jörg Wuttke, president of the European Union Chamber of Commerce in China, at a press conference in Beijing on Feb. 22, where a chamber report on excess capacity was released. That report’s conclusion: “The Chinese government’s current role in the economy is part of the problem,” while overcapacity has become “an impediment to the party’s reform agenda.” Many of the unneeded mills, smelters, and plants were built or expanded after China’s policymakers unleashed cheap credit during the global financial crisis in 2009. The situation in steel is especially dire.

China produces more than double the steel of Japan, India, the U.S., and Russia—the four next-largest producers—combined, according to the EU Chamber of Commerce. That’s causing trade frictions as China cuts prices. On Feb. 12 the EU announced it would charge antidumping duties of as much as 26.2% on imports of Chinese non-stainless steel. Steel mills are running at about 70% capacity, well below the 80% needed to make the operations profitable. Roughly half of China’s 500 or so steel producers lost money last year as prices fell about 30%, according to Fitch Ratings. Even so, capacity reached 1.17 billion tons, up from 1.15 billion tons the year before. With about one-quarter of China’s steel production coming from Beijing’s neighboring province of Hebei, excess production is a major contributor to the capital’s smoggy skies.

And with average steel prices likely to fall an additional 10% in 2016, fears of spiraling bad debts are growing. A survey released in January by the China Banking Association and consulting firm PwC China found that more than four-fifths of Chinese banks see a heightened risk that loans to industries with overcapacity may sour. [..] China will “actively and steadily push forward industry and resolve excess capacity and inventory,” the People’s Bank of China said on Feb. 16 after a meeting with the National Development and Reform Commission, the banking regulatory commission, and other agencies.

The government may find it hard to achieve that goal. The steel industry will lose as many as 400,000 jobs as excess production is shuttered, Li Xinchuang, head of the China Metallurgical Industry Planning and Research Institute, predicted in January. Hebei and the industrial northeastern provinces of Heilongjiang, Jilin, and Liaoning, home to much of China’s steel production, don’t have lots of job-creating companies to absorb unemployed steelworkers. “They are concerned about the possibility of social unrest with workers’ layoffs,” says Peter Markey at consultants Ernst & Young. “As you can see around the world, steelworkers are pretty feisty people when it comes to protests.”

The big kahuna that should dominate the G20.

• Yuan Uncertainty Scares Funds Away From China Bond Market (BBG)

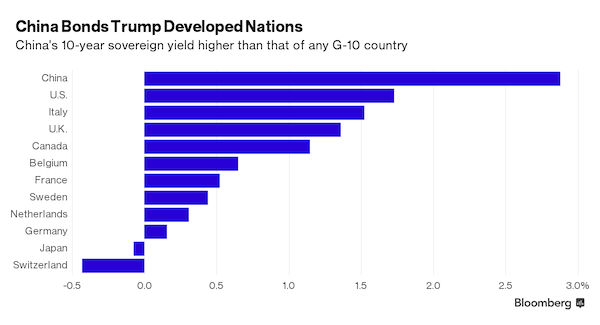

Yield versus yuan. That’s the crux of the investment decision now facing the global funds given more access to China’s bond market. While it offers the highest yields among the world’s major economies, PIMCO and Schroder Investment say exchange-rate risk is damping global demand for Chinese assets. Barclays said this week there’s a growing chance China will announce a sharp, one-time devaluation to change sentiment toward the currency and suggested such a move would need to be in the region of 25% to be effective. “Uncertainty around currency policy remains one of the larger hurdles for foreign investors,” said Rajeev De Mello at Schroder Investment in Singapore. “This should be resolved as the year progresses and would then be a signal to increase investments in Chinese government bonds.”

The People’s Bank of China said Wednesday that most types of overseas financial institutions will no longer require approvals or quotas to invest in the 35 trillion yuan ($5.4 trillion) interbank bond market, which had foreign ownership of less than 2% at the end of January. The nation’s 10-year sovereign yield of 2.87% compares with 1.74% in the U.S., which offers the highest rate among Group of 10 countries, and sub-zero in Japan and Switzerland. The yuan has weakened 5% versus the dollar since a surprise devaluation in August, even as the central bank burnt through more than $400 billion of the nation’s foreign-exchange reserves over the last six months trying to support the exchange rate amid record capital outflows.

China is opening its capital markets to foreign investors to try and draw money as the slowest economic growth in a quarter century drives funds abroad, pressuring the yuan. Freer access will help the nation’s bonds gain entry to global benchmarks, bolstering appetite for the securities as a restructuring of local-government debt spurs record issuance. Uncertainty on the currency is preventing investors from buying onshore assets now, according to Luke Spajic, an emerging markets money manager at Pimco, whose developing-nation currency fund has outperformed 82% of peers during the past five years. “If you buy these bonds, collect coupons, make some profits, how can you take the money out, are there any issues.” Spajic said in an interview in Shanghai on Thursday. “What we want to clarify is how this process works now, given the capital control environment.”

“.. in the case of a country like Italy, where the banks own around €400 billion of government debt and are already severely undercapitalised, the effects on the banking system would be catastrophic.”

• Germany Lays the Foundations for a New Eurozone Debt/Banking Crisis (Fazi)

In recent weeks, Germany has put forward two proposals for the future viability of the EMU that, if approved, would radically alter the nature of the currency union. For the worse. The first proposal, already at the centre of high-level intergovernmental discussions, comes from the German Council of Economic Experts, the country s most influential economic advisory group (sometimes referred to as the ‘five wise men’). It has the backing of the Bundesbank, of the German finance minister Wolfgang Sch‰uble and, it would appear, even of Mario Draghi.

Ostensibly aimed at severing the link between banks and government (just like the banking union) and ensuring long-term debt sustainability , it calls for: (i) removing the exemption from risk-weighting for sovereign exposures, which( essentially means that government bonds would longer be considered a risk-free asset for banks (as they are now under Basel rules), but would be ‘weighted’ according to the ‘sovereign default risk’ of the country in question (as determined by the fraud-prone rating agencies depicted in The Big Short); (ii) putting a cap on the overall risk-weighted sovereign exposure of banks; and (iii) introducing an automatic sovereign insolvency mechanism that would essentially extend to sovereigns the bail-in rule introduced for banks by the banking union, meaning that if a country requires financial assistance from the European Stability Mechanism (ESM), for whichever reason, it will have to lengthen sovereign bond maturities (reducing the market value of those bonds and causing severe losses for all bondholders) and, if necessary, impose a nominal ‘haircut’ on private creditors.

The second proposal, initially put forward by Schaeuble and fellow high-ranking member of the CDU party Karl Lamers and revived in recent weeks by the governors of the German and French central banks, Jens Weidmann (Bundesbank) and François Villeroy de Galhau (Banque de France), calls for the creation of a eurozone finance ministry , in connection with an independent fiscal council . At first, both proposals might appear reasonable – even progressive! Isn’t an EU- or EMU-level sovereign debt restructuring mechanism and fiscal authority precisely what many progressives have been advocating for years? As always, the devil is in the detail.

As for the proposed ‘sovereign bail-in’ scheme, it s not hard to see why it would result in the exact opposite of its stated aims. The first effect of it coming into force would be to open up huge holes in the balance sheets of the banks of the riskier countries (at the time of writing, all periphery countries except Ireland have an S&P rating of BBB+ or less), since banks tend to hold a large percentage of their country’s public debt; in the case of a country like Italy, where the banks own around €400 billion of government debt and are already severely undercapitalised, the effects on the banking system would be catastrophic.

“..in light of the downgraded U.S. economic outlook,..”

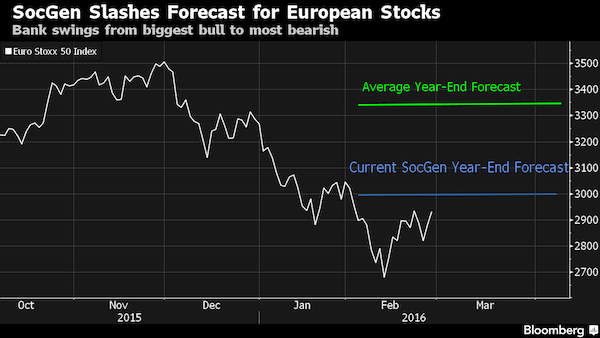

• Societe Generale Slashes Forecast For European Stocks (BBG)

The biggest bull on European stocks just buckled. Societe Generale, among the few firms that hadn’t cut 2016 estimates in response to global-growth concerns, now has the most bearish forecast. The bank sees the Euro Stoxx 50 Index ending 2016 at 3,000, up just 4.3% from Thursday’s close. It’s a far cry from only two weeks ago. Europe’s equities were at a 2 1/2-year low, yet the bank’s call for an year-end level of 4,000 translated to an almost 50% advance. Societe Generale also cut its estimate for the Stoxx Europe 600 Index to 340, indicating a 4.1% rise from the last close. “We trim our equity market forecasts in light of the downgraded U.S. economic outlook,” strategists led by Roland Kaloyan wrote in a report.

“We nevertheless maintain a positive stance on equities, as the recent correction already prices in this scenario to a certain extent. Equity indices should recover in the second quarter from oversold levels, followed by low single-digit quarterly declines in the second half of the year.” Societe Generale favors French and Italian stocks, citing “improving economic momentum,” while saying weakness in China will likely pressure the DAX Index. Along with the Swiss Market Index, the German benchmark is among the bank’s least-preferred markets in Europe. European equity funds had a third straight week of outflows, according to a Bank of America note on Friday citing EPFR Global data. Societe Generale analysts also expect the U.K. equity market to benefit from “rising Brexit fever.” It now expects the FTSE 100 Index to end the year at 6,400, up 6.4% from yesterday’s closing level.

The power of the dollar.

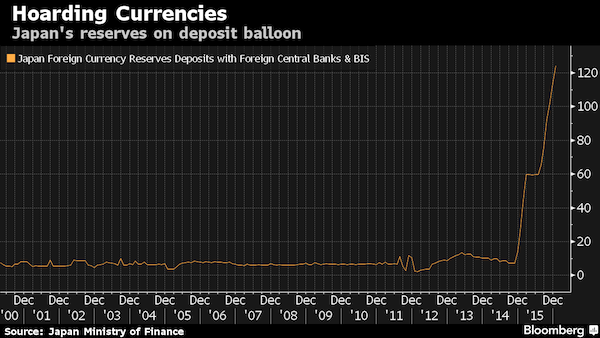

• Japan Builds $124 Billion Cash Hoard Even as It Cuts Treasuries (BBG)

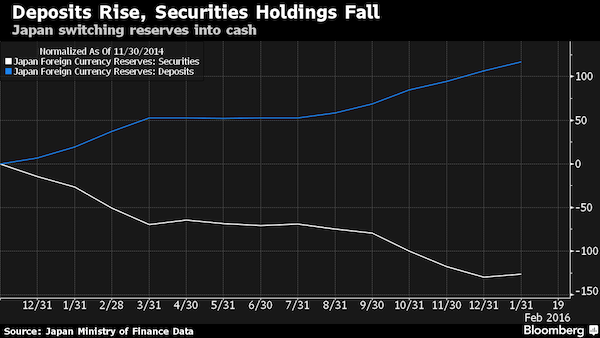

Japan has stockpiled a record amount of cash at central banks as part of its currency reserves, after selling Treasuries, as policy makers around the world adjust to rising U.S. interest rates and falling bond-market liquidity. Foreign-exchange deposits in the vaults of overseas institutions ballooned to $124.1 billion as of Jan. 31, from $14 billion at the end of 2014, according to data from Japan’s Ministry of Finance. That’s the most based on figures going back to 2000, and accounts for about 10% of the nation’s total reserves. While the figure isn’t broken down, it coincides with a surge in greenbacks held by global central banks at the Fed. Any shift away from Treasuries would protect Japan’s reserves from potential losses as the Fed extends monetary policy tightening and concerns rise over bond-market liquidity.

Dollar holdings kept in cash stand to benefit from higher U.S. interest rates and a stronger currency, even as monetary authorities in Japan and across Europe start charging banks for some deposits. “Everybody’s devaluing their currencies, everywhere across the planet, except the U.S. dollar,” said John Gorman at Nomura, the nation’s biggest brokerage. “People are more comfortable putting their reserves in a currency that’s appreciating rather than a currency that’s depreciating. An official in the office of foreign exchange reserve management in the Ministry of Finance declined to comment on the matter, saying it can affect markets. The increase in Japan’s cash at foreign institutions is a change in the composition of the country’s foreign-exchange reserves. The overall stockpile, the world’s largest after China’s, has fallen almost 3% to $1.19 trillion since it reached a record at the start of 2012.

Japan, America’s largest overseas creditor after China, is cutting its Treasuries position. The stake among both government and private investors dropped 8.8% in 2015, the first sales since 2007, based on the most recent Treasury Department data. The reduction dovetails with a decline in foreign securities in Japan’s foreign exchange reserves. Since November 2014, bond holdings fell $126.4 billion, while deposits rose $116.9 billion. The strategy of selling Treasuries and holding dollars would allow investors to get out of older U.S. government securities that can be difficult to trade and may get even tougher to transact if the Fed raises rates further. Declining liquidity in the Treasury market is driving demand for the newest, easiest-to-sell securities. When policy makers increased benchmark borrowing costs in December, they indicated they will act four more times in 2016. Even so, the Bloomberg U.S. Treasury Bond Index has advanced 3.4% so far in 2016 in a flight from riskier assets.

Something tells me we can always get stupider.

• “Peak Stupidity” – Where We Go From Here (Beversdorf)

A reminder of what the market actually represents is a good place to start. The stock market is simply an asset with some intrinsic value based on an expectation of future free cash flows to equity holders. Those cash flows are generated from revenues less costs of the underlying companies that make up the market. Let’s use the Wilshire 5000 Full Price Cap Index as the proxy market for this discussion as it is the broadest measure of total market cap for US corporations. It’s level actually represents market capital in billions.

So the market has put a valuation on those expected future cash flows to equity holders (as of today) at around $19.7T (a 55% increase from Jan of 2012) down from around $22.5T (a 77% increase from Jan of 2012) at the market peak last summer. So let’s take a look at the growth in cash flows of US corporations over that same period. We should expect to find a growth pattern in free cash flows similar to the above growth pattern in the overall market valuation (the Wilshire is a statistically large enough sample to be representative of total US corporations). Let’s have a look…

The above chart depicts corporate free cash flows (blue line) indexed to 100 in Jan 2012. It is obtained by taking the BEA’s Net Cash Flow with IVA and CCAdj adding back depreciation and net dividends and subtracting net capex. (The actual definitions of these can be found here.) What we find is that while the current valuation of expected future free cash flows to equity holders (i.e. market cap of Wilshire) has increased by some 55% since the end of 2011, the actual free cash flows of US corporations have only increased by 4%.

This becomes a very difficult fact to reconcile inside the classroom. Why would market participants be baking in so much growth when the actual data simply doesn’t support it?

Well there are plenty of potential explanations. For instance, rarely are investors rational. While buy low and sell high is rational investing behaviour, often market euphoria comes at the market top right before a major sell off, leading to a buy high and sell low strategy. Another reason is that the Fed has been providing a free put to all investors for the past 7 years essentially significantly reducing naturally occurring risk factors. But whatever the reason this dislocation between expected and realized growth begs the question, how long can it last? So let’s explore this issue.

Below is a longer term growth chart of the Wilshire vs US corporate free cash flows to equity holders both indexed to 1995 (i.e. 1995 = 100).

And so over the past 20 years we’ve seen this same type of dislocation three times. That is, we see expectations of growth far exceeding actual growth of free cash flows to equity holders. In the previous two dislocations we reached a peak dislocation (peak stupidity) followed by a reversion to reality (epiphany) where expected growth moves back in line with actual growth.

“Whereas US banking sector assets were worth only 80% of its GDP, Britain’s were worth 500%..”

• Bankers Have Not Learnt The Lessons Of The Great Crash (Tel.)

Barack Obama used to talk about the audacity of hope. Mervyn King was Governor of the Bank of England during ‘the biggest financial crisis this country has faced since 1914’. Its lesson, he says, is that we now need ‘the audacity of pessimism’. Only when we fully understand how badly things went wrong – and why they are still wrong today – can we start to put them right. His new book suggests how. I meet Lord King in his modest office at the London School of Economics. Typically, he is just off to the West Midlands for a dinner for famous sons of Wolverhampton. He is a proud provincial boy, not a City slicker. I ask him to recall the moment he first understood the depth of the problem facing the world. Back in September 2007, when he ‘it was already clear that Northern Rock would need support’, King recalls, he was in Basel for a conference.

There was alarm in the United States because ‘sub-prime’ mortgages were collapsing. The central bank supervisors at the conference insisted that sub-prime failure could not bring down the system. But King talked to his friend Stan Fischer, then Governor of the Bank of Israel. They shared their fears: ‘If the only thing that goes wrong is sub-prime, ok. But what else could go wrong? What if the unimaginable happens?’ It did. Over the next two months, says King, he became obsessed with the need for more equity capital in the banking system. The banks resisted at first and ‘The politicians [Gordon Brown’s government] were susceptible to pressure from the banks’. But ‘we limped along till the bankruptcy of Lehman Brothers’ in September 2008. Then ‘the banking of the entire industrial world was at risk of collapse’.

Britain – without a proper ‘bank resolution regime’ which, says King, ‘could have solved the problem of Northern Rock in a weekend, without fuss’ – was enormously vulnerable. Whereas US banking sector assets were worth only 80% of its GDP, Britain’s were worth 500%, a terrifying ratio. New Labour, having turned its back on nationalisation, had to revert to it: ‘It must have been galling for them.’ In Mervyn King’s mind, the credit crunch was brought about by something profoundly wrong. Bankers had been encouraged to take enormous risks with the customers’ money, enrich themselves and then dump the losses on the taxpayer. Huge pay increases for senior executives had produced a ‘very unattractive culture when clever people started to say to themselves: “I’m smart, I can make money out of people who don’t understand this”.’

One by one they fall: “..the firm’s investment-banking revenues are forecast to be down 25% in the first quarter. Markets revenues are down 20% year-on-year..”

• Bank Of America Preparing Big Layoffs In Investment Banking And Trading (BI)

Bank of America is preparing for significant job cuts across its global banking and markets business, according to people with knowledge of the matter. Senior executives in the division were tasked with identifying potential job cuts a few weeks ago, and this week were asked to increase their size, according to people familiar with the situation. The cuts are likely to be over 5% of staff, the people said. Some business lines will face deeper cuts than others, and the details haven’t been finalized. Employees could be told of the cuts as soon as March 8, one of the people said, which is weeks sooner than managers were initially expecting. The people didn’t know the reasons the cuts had been pushed forward.

BofA is joining firms across Wall Street in paring back staff amid one of the worst quarters for investment-banking and trading revenues. Business Insider reported on Monday that Deutsche Bank was cutting 75 staff in fixed income, while Morgan Stanley and Barclays have also recently cut staff. Daniel Pinto, CEO of JPMorgan’s corporate and investment bank, said on Tuesday that the firm’s investment-banking revenues are forecast to be down 25% in the first quarter. Markets revenues are down 20% year-on-year, Pinto said, speaking at JPMorgan’s Investor Day conference.

Their shareholders will pay the fine.

• UBS Accused of Money Laundering in Belgian Tax Case (BBG)

Belgian authorities accused UBS of money laundering and fiscal fraud over allegations it helped clients evade taxes, citing help from France where the Swiss bank is fighting similar accusations. The investigating judge also accused UBS of illegally approaching Belgian clients directly rather than through its Belgian unit, according to an e-mailed statement Friday from the Brussels prosecutor’s office. UBS said it will continue to defend itself against any unfounded allegations. The probe is continuing and the investigating judge will present his findings to prosecutors at a later date. The accusations are based on strong evidence of guilt uncovered by the investigative magistrate, said Jennifer Vanderputten, a spokeswoman at the prosecutor’s office. UBS will be given the right to access evidence supporting the allegations, she said.

The Belgian prosecutor cited “excellent collaboration” with authorities in France, where UBS is awaiting a decision on whether it will face trial for allegedly helping clients evade taxes. UBS is also accused in France of laundering proceeds from tax evasion. Investigating judges in France wrapped up their formal investigation earlier this month, turning the case over to the national financial prosecutor who will make a recommendation on whether it goes to trial. The bank, which has called the French allegations “unfounded,” was forced to post a bail of 1.1 billion euros ($1.2 billion). Friday’s decision came after the head of UBS’s Belgium unit was similarly accused in 2014 of money laundering and fiscal fraud as part of the probe. Marcel Bruehwiler was questioned for several hours before being released in June 2014.

Yeah, like Middle Ages.

• With No Unified Refugee Strategy, Europeans Return to Old Alliances (NY Times)

Roughly five weeks ago, Donald Tusk, one of the EU’s most powerful political figures, issued a blunt warning to its 28 countries: Come up with a coherent plan to tackle the refugee crisis within two months, or risk chaos. Surprisingly, given the plodding pace of European Union policy making, three weeks before Mr. Tusk’s deadline, many of Europe’s national leaders are now moving swiftly, announcing tough new border policies and guidelines on asylum — even with three weeks remaining on the deadline set by Mr. Tusk, president of the European Council. The problem is that the leaders are not always adhering to European rules, possibly not sticking to international law and not acting with the unity envisioned by Mr. Tusk. In some cases, they instead seem to be reverting to historical alliances rather than maintaining the EU’s mantra of solidarity.

This week, Austria joined with many of the Balkan countries to approve a tough border policy in what some are wryly calling the return of the Hapsburg Empire. Four former Soviet satellites, led by Poland and Hungary, have become another opposition power bloc. All the while, a call for unity by Chancellor Angela Merkel of Germany is increasingly being ignored, even as she struggles to tamp down on a political revolt at home while searching for a formula to reduce the number of refugees still trying to reach Germany. “We are now entering a situation in which everybody is trying to stop the refugees before they reach their borders,” said Ivan Krastev, chairman of the Center for Liberal Strategies, a research institute in Sofia, Bulgaria. Mr. Krastev added, “The basic question is, which country turns into a parking lot for refugees?”

For many months, European Union officials, joined by Ms. Merkel, have tried to share the burden by distributing quotas of the refugees already in Greece and Italy to different member states. Many states have balked, and the program is largely paralyzed. European Union leaders also agreed to pay 3 billion euros, roughly $3.3 billion, to aid organizations in Turkey to help stanch the flow of migrants departing the Turkish coast for the Greek islands. But record numbers of migrants keep coming.

What will this lead to?

• More Migrants Trapped In Greece As Balkan Countries Enforce Limits (Kath.)

The European Commission said Friday that it is putting together a humanitarian aid plan for Greece as Balkan countries placed further restrictions on the numbers of refugees and migrants that could cross their territories. As of last night, authorities in the Former Yugoslav Republic of Macedonia (FYROM) had not allowed any refugees to pass from Greece. Earlier, Slovenia, Croatia and Serbia said they would each restrict the number of migrants allowed to enter their territories to 580 per day. The clampdown comes in the wake of Austria last week introducing a daily cap of 80 asylum seekers and saying it would only let 3,200 migrants pass through each day. As border restrictions north of Greece have been stepped up, the number of migrants and refugees stuck in the country has increased.

The government is attempting to stem the flow of migrants to mainland Greece by asking ferry companies to delay crossings from the Aegean islands, but between 2,000 and 3,000 people are arriving in Greece each day. It is estimated that there are currently 20,000 to 25,000 in the country. Some of them are out in the open, having chosen not to remain in transit centers or other temporary shelters provided by Greek authorities. Several thousand have reached the village of Idomeni at the border with FYROM, where conditions were said to be deteriorating last night as a result of bad weather.

The government launched a hotline for people or companies who want to donate items that are in need at the moment, such as non-perishable food, sneakers, towels and plastic cutlery. European Commission spokeswoman Natasha Bertaud admitted Friday that due to the changing situation in Greece, Brussels is putting together an “emergency plan” to avert a humanitarian crisis in Greece. Speaking at an economic forum in Delphi yesterday, Migration Commissioner Dimitris Avramopoulos warned that the upcoming summit between EU members and Turkey on March 7 would be crucial to addressing the growing crisis. “If there is no convergence and agreement on March 7, we will be led to disaster,” the former Greek minister said.

Is this the bombshell?!: UN’s Peter Sutherland says: “Any country that unilaterally rejects an EU law duly enacted on migration or otherwise cannot remain a member of the Union”

• EU Med Countries Oppose Unilateral Actions On Refugee Crisis (AP)

The rift over how to handle Europe’s immigration crisis ripped wide open Friday. As nations along the Balkans migrant route took more unilateral actions to shut down their borders, diplomats from EU nations bordering the Mediterranean rallied around Greece, the epicenter of the crisis. Cypriot Foreign Minister Ioannis Kasoulides — speaking on behalf of colleagues from France, Spain, Italy, Portugal, Malta and Greece — said decisions on how to deal with the migrant influx that have already been made by the 28-nation bloc cannot be implemented selectively by some countries. “This issue is testing our unity and ability to handle it,” Kasoulides told a news conference after an EU Mediterranean Group meeting. “The EU Med Group are the front-line states and we all share the view that unilateral actions cannot be a solution to this crisis.”

Kasoulides urged EU countries to enact all EU decisions on immigration so there “will be no unfairness to anybody.” Greek Foreign Minister Nikos Kotzias blasted some European nations for imposing border restrictions on arriving migrants, saying that police chiefs are not allowed to decide to overturn EU decisions. He said Mediterranean colleagues were “unanimous” in their support for Greece’s position on the refugee crisis and that there was “clear criticism to all those who are seeking individual solutions at the expense of other member states.” The Greek government is blaming Austria — a fellow member of Europe’s Schengen Area — for the flare-up in the crisis. Austria imposed strict border restrictions last week, creating a domino effect as those controls were also implemented by Balkan countries further south along the Balkans migration route.

Greece recalled its ambassador to Austria on Thursday and rejected a request to visit Athens by Austrian Interior Minister Johanna Mikl-Leitner. The United Nations secretary-general expressed “great concern” Friday at the growing number of border restrictions along the migrant trail through Europe. Ban Ki-moon’s spokesman said the U.N. chief is calling on all countries to keep their borders open and says he is “fully aware of the pressures felt by many European countries.” The statement noted in particular the new restrictions in Austria, Slovenia, Croatia, Serbia and Macedonia. Thousands of migrants are pouring into Greece every day and officials fear the country could turn into “a giant refugee camp” if they are unable to move north due to borders closures.

In Munich, German Chancellor Angela Merkel echoed the Mediterranean EU ministers in calling for a unified European approach to tackle the migrant crisis. Merkel, who has said that those fleeing violence deserve protection, said she was encouraged by the recent deployment of NATO ships to the Aegean Sea alongside vessels from the European Union border agency Frontex. “NATO has started to work in collaboration with the Turkish coast guard and Frontex. It is too early to see the effects of this measure. All 28 (EU) member states want to stop illegal immigration,” she said. But NATO Secretary-General Jens Stoltenberg said the ships would only be providing a support role. “NATO ships will not do the job of national coastguards in the Aegean. Their mission is not to stop or turn back those trying to cross into Europe,” he wrote.

Home › Forums › Debt Rattle February 27 2016