Unknown Magazine and cannonballs at Battery Rodgers, Alexandria 1863

Spot on from Adriana Cohen. CNN fires Brazile after she provided Clinton with debate questions. But she’s still head of the DNC, and Obama praises her: “..she is a person of high character..” What??

• Donna Brazile’s Sins A Microcosm Of Biased Media (BH)

CNN was asking for it when it let Donna Brazile take a seat on the pundit desk. A plugged-in Brazile, now the interim chairwoman of the Democratic National Committee, seized on the opportunity and leaked questions to Hillary Clinton’s camp — one on Flint’s toxic water disaster before a CNN Michigan town hall in March and another a few days later on the death penalty before an Ohio showdown. CNN revealed yesterday – after WikiLeaks kept pointing out the embarrassing journalistic sins – that Brazile was no longer employed by the station. Unfortunately, it’s too late for Bernie Sanders. It’s also too late for voters hoping for an even playing field. There’s nothing wrong with having strong political opinions — I certainly have mine — but at least don’t cheat.

To put how serious this is into context, if Brazile traded stocks off inside information, the SEC would toss her in jail faster than you can say Martha Stewart. Yet, despite all of the above, the White House yesterday praised her integrity. You read that right. When asked about the hacked emails White House spokesman Josh Earnest said, “No, the president believes she has done a fine job stepping in during a very difficult situation to lead the Democratic Party … she is a person of high character. She is a true professional who is a tenacious and effective advocate for Democrats.” Guess rigging a debate is just being a good advocate. Talk about a lack of ethics. But after the targeting of conservatives via the IRS — and recent undercover videos showing how Democratic operatives deployed paid agitators to disrupt Donald Trump rallies — who’s surprised?

But that’s not all Donald Trump and other candidates are up against when challenging the almighty Democratic machine. In a study conducted by Media Research Center of TV coverage during this election, a whopping 91% of Trump coverage was hostile toward the businessman compared to a small fraction of negative stories on Clinton. If that’s not a stacked deck, what is? Can you imagine in the World Series if the umpires made 91% of bad calls against one team and not the other? A biased media is risking its lifeblood — followers — by giving an unfair advantage to the candidate of their choice. A week from today voters will decide if they’ve had enough.

It’s full tard insane and disgusting that this is still a story. This shallow-to-flat Clinton camp narrative would have been discarded many months ago if media like the NY Times had been just a little bit more impartial. And even this is not a real mea culpa; the article is still full of insinuations and innuendo that leaves plenty traces of the empty narrative alive.

• FBI Finds No Clear Link Between Trump and Russia (NY Times)

For much of the summer, the F.B.I. pursued a widening investigation into a Russian role in the American presidential campaign. Agents scrutinized advisers close to Donald J. Trump, looked for financial connections with Russian financial figures, searched for those involved in hacking the computers of Democrats, and even chased a lead – which they ultimately came to doubt – about a possible secret channel of email communication from the Trump Organization to a Russian bank. Law enforcement officials say that none of the investigations so far have found any conclusive or direct link between Mr. Trump and the Russian government. And even the hacking into Democratic emails, F.B.I. and intelligence officials now believe, was aimed at disrupting the presidential election rather than electing Mr. Trump.

Hillary Clinton’s supporters, angry over what they regard as a lack of scrutiny of Mr. Trump by law enforcement officials, pushed for these investigations. In recent days they have also demanded that James B. Comey, the director of the F.B.I., discuss them publicly, as he did last week when he announced that a new batch of emails possibly connected to Mrs. Clinton had been discovered.

They can’t really not say anything by next weekend.

• FBI Speeds Up Clinton Email Investigation After Criticism (LATimes)

The FBI accelerated its timeline for reviewing emails potentially linked to Hillary Clinton on Monday amid growing public pressure over the agency’s surprise announcement that it had found them in an unrelated case. Investigators had planned to conduct the review over several weeks but, after a torrent of criticism over the weekend, began scrambling to examine the trove of emails, according to law enforcement officials. The FBI hoped to complete a preliminary assessment in the coming days, but agency officials have not decided how, or whether, they will disclose the results of it publicly, and officials also could not say whether the entire review would be completed by election day.

The uncertainty did not stop Donald Trump from charging into the vacuum with ominous speculation that a Clinton victory would spark national upheaval. Clinton repeated that she was confident the FBI had no case against her and that voters had already made up their mind on her use of a private server while she was secretary of State. [..] FBI Director James B. Comey, a former Bush administration official appointed to run the bureau three years ago by President Obama, has come under heavy criticism from Democrats and Republicans alike for disclosing the investigation to Congress so close to the election.

Iowa Sen. Charles E. Grassley, a Republican who heads the Judiciary Committee, demanded that Comey release more information about the review by Friday. “While I disagree with those who suggest you should have kept the FBI’s discovery secret until after the election, I agree that your disclosure did not go far enough,” Grassley wrote to Comey. “Unfortunately, your letter failed to give Congress and the American people enough context to evaluate the significance or full meaning of this development.” “Without additional context, your disclosure is not fair to Congress, the American people, or Secretary Clinton,” Grassley added. He also renewed concerns that the FBI’s initial email investigation may have been hampered “by political appointees at the Justice Department.”

Jim wrote to compliment me on my Throw Huma Under the Bus? article on Saturday. Compliments right back at you.

• Halloween Nation (Jim Kunstler)

What was with James Comey’s Friday letter to congress? It looks to me like the FBI Director had to go nuclear against his parent agency, the Department of Justice, and Attorney General Loretta Lynch, his boss, in particular. Why? Because the Attorney General refused to pursue the Clinton email case when more evidence turned up in the underage sexting case against Anthony Weiner, husband of Hillary’s chief of staff, Huma Abedin. Over the weekend, the astounding news story broke that the FBI had not obtained a warrant to examine the emails on Weiner’s computer and other devices after three weeks of getting stonewalled by DOJ attorneys. What does it mean when the Director of the FBI can’t get a warrant in a New York minute? It must mean that the DOJ is at war with the FBI.

Watergate is looking like thin gruel compared to this fantastic Bouillabaisse of a presidential campaign fiasco. One way you can tell is that The New York Times is playing down the story Monday morning. Columnist Paul Krugman calls the Comey letter “cryptic.” Krugman’s personal cryptograph insinuates that Comey is trying to squash an investigation of “Russian meddling in American elections.” Senate Minority Leader Harry Reid chimed in with a statement that “it has become clear that you [Comey] possess explosive information about close ties and coordination between Donald Trump, his top advisers and the Russian government.” How’s that for stupid and ugly? It’s the Russian’s fault that Hillary finds herself in trouble again?

Earlier this week, lawyers at the DOJ attempted to quash a parallel investigation of the Clinton Foundation. They must be out of their minds to think that story will go away. Isn’t it about time that a House or Senate committee subpoenaed Bill Clinton to testify under oath about his June airport meeting with Loretta Lynch. He doesn’t enjoy any special immunity in this case. Speaking of immunity, when will we learn what kind of immunity Huma Abedin may have been granted in previous cycles of the email investigation? Plenty of other Clinton campaign associates got immunity from prosecution earlier this year, rendering bales of evidence on their own laptops inadmissible in the email server case.

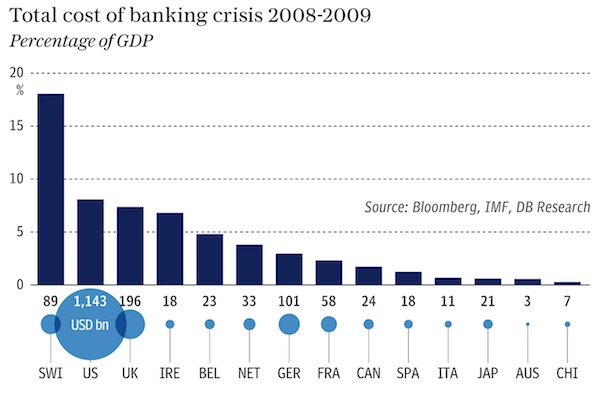

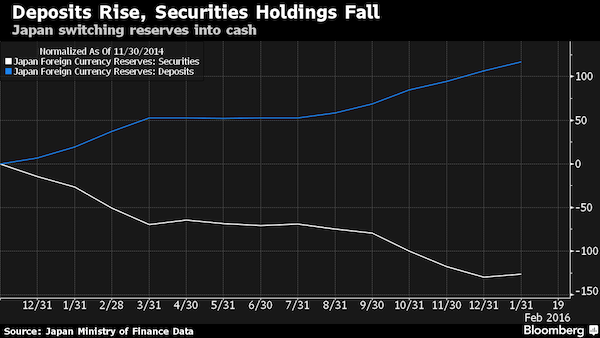

Central banks losing grip.

• Global Bond Markets See Worst Rout in 3 Years (BBG)

When German bond markets sneeze, U.S. Treasuries catch a cold. That’s the conclusion drawn by analysts at TD Securities as global bonds march towards their worst streak of monthly losses since 2010. There’s a distinct rhythm to the selloff, according to the Canadian investment bank. Rising yields on benchmark bunds, and to a lesser-extent gilts, have driven the jump in long-dated Treasuries this month, strategists at TD Securities argue. They cite rising rate-market correlations, elevated selling of Treasuries during European trading hours, and market fears the ECB might moderate its monetary accommodation as factors that suggest international forces largely account for the rise in benchmark 10-year yields, which flirted with a five-month high of 1.88% on Friday.

“We believe that much of the recent rise in U.S. rates has been driven by bunds and gilts,” analysts at TD Securities, led by Priya Misra, wrote in a report on Friday. Rising U.S. Treasuries have been accompanied by an uptick in market-implied inflation expectations, combined with fears that investors are saddled with outsize duration risks. But tightening Treasury-bund spreads since September 30, in fact, throw into sharp relief the external drivers for the rout in the U.S. rate market, the strategists note. “Our analysis shows that since 2010, greater than a one-standard deviation increases in 10-year Treasury yields tend to result in a widening in Treasury-bund and Treasury-gilt spreads. However, this latest move has actually resulted in a tightening of US-Germany and U.K. spreads,” which suggests global rate-markets are dancing to a similar beat, the analysts write.

Little-noticed? I have been writing about it for ages.

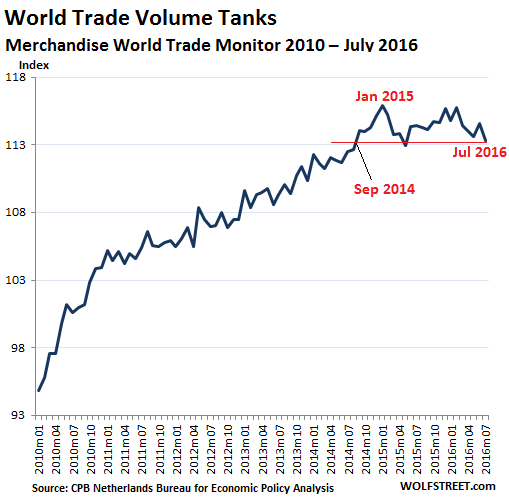

• A Little-Noticed Fact About Trade: It’s No Longer Rising (NY Times)

During the 1990s, global trade grew more than twice as fast as the global economy. Europe united. China became a factory town. Tariffs came down. Transportation costs plummeted. It was the Walmart Era. But those changes have played out. Europe is fraying around the edges; low tariffs and transportation costs cannot get much lower. And China’s role in the global economy is changing. The country is making more of what it consumes, and consuming more of what it makes. In addition, China’s maturing industrial sector increasingly makes its own parts. The IMF reported last year that the share of imported components in products “Made in China” has fallen to 35% from 60% in the 1990s.

The result: The I.M.F. study calculated that a 1% increase in global growth increased trade volumes by 2.5% in the 1990s, while in recent years, the same growth has increased trade by just 0.7%. Hanjin, like other big shipping companies, bet that global trade would continue to expand rapidly. In 2009, the world’s cargo lines had enough room to carry 12.1 million of the standardized shipping containers that have played a crucial, if quiet, role in the rise of global trade. By last year, they had room for 19.9 million – much of it unneeded. India is not China redux. Most trade flows among developed nations. The McKinsey Global Institute calculates that 15 countries account for roughly 63% of the global traffic in goods and services, and for an even larger share of financial investment.

China joined this club the old-fashioned way: It used factories to build a middle class. But the automation of factory work is making it harder for other nations to follow. Dani Rodrik, a Harvard economist, calculates that manufacturing employment in India and other developing nations has already peaked, a phenomenon he calls premature deindustrialization. The weakness of the global economy is exacerbating the trend. Infrastructure investment by multinational corporations declined for the third straight year in 2015, according to the United Nations. It predicts a further decline this year. But even if growth rebounds, automation reduces the incentives to invest in the low-labor-cost developing world, and it reduces the benefits of such investments for the residents of developing countries.

Overcapacity.

• US Trucking Companies Pare Down Fleets Amid Tepid Shipping Demand (WSJ)

Big trucking companies have spent the second half of the year shrinking their fleets in hopes of changing an imbalance between the supply of rigs on the road and tepid shipping demand that has flattened industry earnings. They will learn in the coming weeks, as retailers stock up at stores and distribution centers for the holidays, whether efforts to slim down capacity have produced the rate increases that trucking companies say they need to increase profitability and to expand fleets next year. Trucking-industry reports in the coming week will take the pulse of a market at a critical point in the fourth quarter, when companies look to build off momentum in the consumer and manufacturing arenas to set business plans for 2017.

Industry data groups ACT Research and FTR are due to report this week on new heavy-duty truck orders for companies in October, a critical month for setting fleet plans for the coming year after several months in which orders have plummeted to historically low levels. DAT Solutions, which measures freight rates in the industrial-trucking market, will report the next week on whether carrier efforts to rein in capacity amid tepid demand are pushing up prices as hoped. DAT says prices for spot-market freight hauls and shipments moving under long-term contracts have been slipping for most of the year, and that rates in September were down 6.4% from the same month a year earlier. “We haven’t seen any difficulty in finding trucks,” said Ken Forster, CEO of logistics company Sunteck, that finds and books trucks for freight shippers. “It’s clear that overcapacity has driven down pricing.”

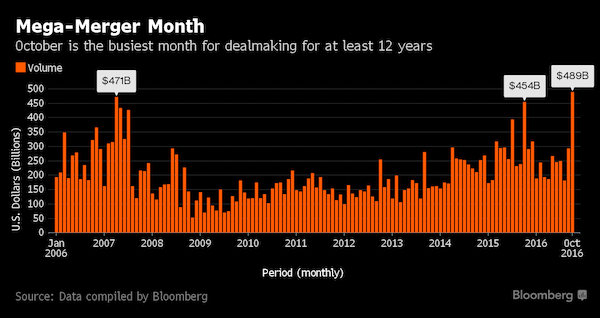

Desperate insanity: “Low growth – which is bad for most things, but it’s good for M&A because that’s how you get growth..” No, it’s how you fake growth.

• October Mergers Smash All Records With $500.1 Billion In Deals (ZH)

Last week David Rosenberg pointed out that mega Merger Manias like the one we are experiencing “invariably takes place at or near cycle peaks, as companies realize that they can no longer grow their earnings organically. We have just witnessed five multi-billion dollar deals this past week alone — $207 billion globally (AT&T/Time Warner; TD Ameritrade/Scottrade) in what has been the most active announcement list since 1999 … what do you know, near the tail end of that tech bull market too.” And now that October is officially over, we can close the books on what has been an unprecedented month for M&A.

According to Bloomberg, in the month when a chill was sent through the spines of corporate CFOs and their investment bankers over fears that rates are about to rise and thus make debt-funded deals more expensive, the scramble to acquire competitors went off the charts, leading to an all time high in global M&A with almost half a trillion dollars of mergers and acquisitions announced globally. CenturyLink’s $34 billion acquisition of Level 3 Communications, as well as General Electric’s deal to combine its oil and gas division with Baker Hughes, pushed October’s deal volumes to about $489 billion. That’s the highest amount for at least 12 years, topping the previous record of $471 billion in April 2007, the data show.

Deallogic had a slightly different higher October deal total, calculating that the value for mergers and acquisitions for October actually surpassed the half a trillion mark, hitting $500.1B, but the idea is the same and adds that global deal volume has only been higher during five other months in records going back to 1995. More than half of the deals have been based in the US, where M&A volume has already hit a monthly record of $321.2 billion. That’s about a third higher than the next biggest month on record, according to Dealogic. Cited by Bloomberg TV, Bob Profusek, partner and chair of the global M&A practice at law firm Jones Day said that “every weekend recently has been busy.”

According to the Jones Day lawyer “the fundamental drivers are still there,” Profusek said. “Low growth – which is bad for most things, but it’s good for M&A because that’s how you get growth – and very accommodating capital markets.” More important, however, are concerns that the period of low interest rates is coming to an end, prompting corporations to scramble and issue debt now while it is still cheap.

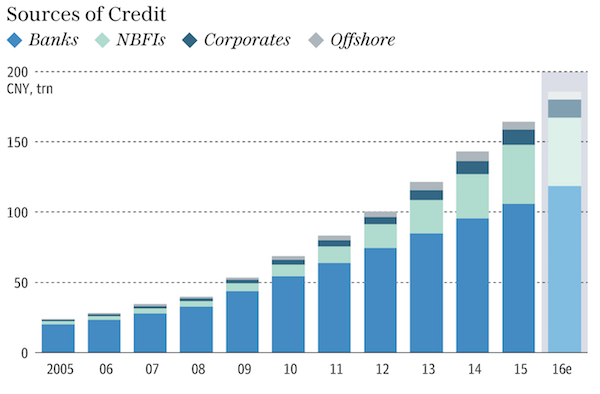

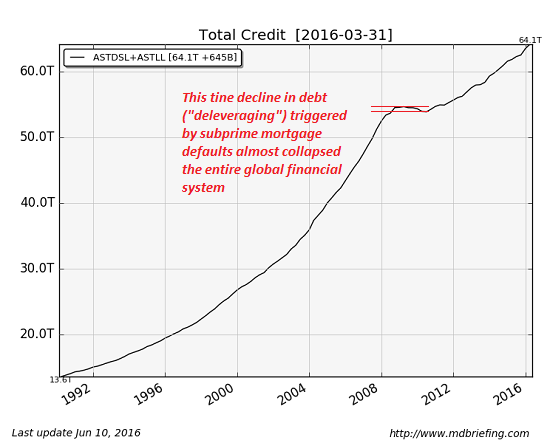

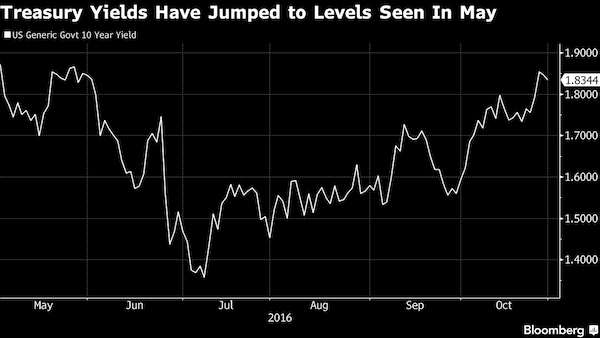

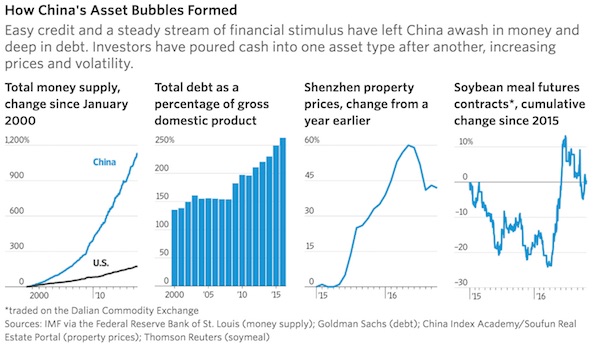

“China’s money supply has quadrupled since 2007, and the new cash is largely trapped inside the country by government capital controls.”

• Asset Bubbles From Stocks to Bonds to Iron Ore Threaten China (WSJ)

A succession of asset bubbles has formed in China, caused by a torrent of speculative money sloshing from stocks to bonds to commodities. The biggest apparent bubble is in housing, but prices have surged for niche assets, too, such as calligraphy, antiques and art. In May, futures prices for soybean meal, used as pig feed, jumped 40%. The trading volume of 600 million tons was nine times higher than China’s annual consumption. The pipe-making material PVC is up 40% so far this year on the Dalian Commodity Exchange. The world’s second-largest economy is slowing. Easy credit and successive fiscal stimuli, designed to keep China aloft, mean it is awash in money that is chasing an increasingly small number of investment opportunities.

China’s money supply has quadrupled since 2007, and the new cash is largely trapped inside the country by government capital controls. [..] The debt binge began with a crisis-related stimulus package. China’s public and corporate debt then grew threefold to about $22 trillion as Communist Party leaders used freer credit to support struggling state-owned firms and meet annual economic-growth targets. The downside of so much cash washing from one asset type to the next burst into view with a stock-market crash in the summer of 2015 that wiped out $5 trillion, or 43%, of value in Chinese stocks at one point. The Shanghai market had doubled from June 2014 to June 2015 as investors borrowed 2 trillion yuan ($300 billion) to buy stocks. To steady the stock market, authorities restricted short selling, and a “national team” of investors relied on by the Chinese government to support its stock market stepped in to purchase beaten-up shares.

Money then flowed into bonds. Many investors bought them by borrowing money against bonds they already owned, repeating the process over and over again. Such borrowing grew to 2.5 times the size of the $7 trillion bond market, according to bond-market analysts. The surge slowed only when yields tightened enough that bonds looked less attractive than other asset types. In this year’s first quarter, China’s total credit surged by another $690 billion, equivalent to about three times the economy of Ireland. Then came a bout of commodity speculation, which pushed prices for some products out of sync with economic fundamentals. Iron-ore futures surged 50% from January to April even though Chinese ports were piled with iron ore. Prices slumped in May.

Again: world trade is shrinking.

• China Shows a Cheap Currency Doesn’t Pack the Same Punch Anymore (BBG)

Chalk up China as another example where a cheapening exchange rate is failing to lift exports. As already seen in Japan in recent years, what textbooks say should happen when a country’s currency falls – its exports gain – isn’t. Bathroom accessories maker Dongguan City XinChen, in the southern Chinese province of Guangdong, is among those seeing one step forward, two steps back when it comes to the exchange rate. “The support from a weaker yuan is negligible compared to the pressure we face from rising labor and materials costs,” said owner Sandy Chang. “Foreign demand is already down. When growth is slow in our major markets, people just don’t buy.”

That tepid demand – on display in September data that showed China’s exports fell 10% from a year earlier – means factories are yet to get a sustained shot in the arm from a currency that’s weakened 9% against the dollar since August 2015. On a trade-weighted basis, the declines this year have been even more marked, with the yuan down 6.7% versus its 4.1% drop against the dollar in 2016. “China’s not going to get much out of anything from further currency depreciation in a weak global economy,” Stephen Roach, a senior fellow at Yale University and former Morgan Stanley non-executive chairman in Asia, said. “You can cut your relative prices through depreciation, but if you don’t have the external demand the impact is going to be limited.”

Mad Max is here: “Along with chemicals from wood burning, scientists found lead, arsenic and cadmium particles, showing that people are burning painted and treated wood, and also their rubbish, to keep warm.”

• Air Quality Worsens In Greece As People Burn Anything To Stay Warm (G.)

Greece’s financial recession is leaving its footprint on the environment. This follows twenty years of huge improvements in Greece’s air pollution. While most European countries struggle with the consequences of failure to control exhaust pollution from diesel vehicles, Greece benefitted from long-standing bans on diesel cars in the two biggest cities, Athens and Thessaloniki. This allowed the country to reap the full benefits of technologies to control petrol exhaust, without these being offset by the poor performance of diesel cars. As a consequence nitrogen dioxide from traffic approximately halved alongside Greek roads between 1996 and 2006, in contrast to the lack of improvement elsewhere in Europe. Lifting the diesel car ban in 2012 and lower taxes on diesel fuel acted as a huge incentive for those struggling with travel costs.

Amongst new car sales diesels leapt from less than 20% (around zero in Thessaloniki) to over 60%, but, so far, economic pressures have reduced traffic volumes averting a possible deterioration in air pollution. However, a tripling in the cost of heating oil brought about larger changes as hard-pressed Greeks have switched to burning wood. Wintertime particle pollution increased by around 30% in Thessaloniki in 2013 and air toxicity worsened on evenings when fires were lit. Analysis of wintertime air in Athens shows that it is not just logs that are being burnt. Along with chemicals from wood burning, scientists found lead, arsenic and cadmium particles, showing that people are burning painted and treated wood, and also their rubbish, to keep warm.

Greece will get nothing from Obama.

• A Parting Gift To Athens From Obama (Kath.)

[..] the key players in the euro area consistently kept the US at arm’s length when it came to dealing with the crisis, particularly in Greece. We should not forget that in February 2010, about three months before Greece’s first bailout was signed, the US Treasury secretary at the time, Timothy Geithner, had warned eurozone state leaders and ministers during a G7 meeting in Canada that they could not make moral hazard the driving force of their crisis strategy. “You can put your foot on the neck of those guys [the Greeks] if that’s what you want to do… but you have to make sure you counteract that with a bit more credible reassurance that you’re going to not allow the crisis to spread beyond Greece,” he said, according to the raw transcripts of his memoirs, which were published under the title “Stress Test.”

“They just wanted to take a bat to them,” added Geithner. “But in taking a bat to them, they were feeding a fare that was in its early stages.” The eurozone was not particularly interested in Washington’s message at the time, and has been similarly unimpressed by the US government’s interventions since. Washington’s position is weakened in European eyes because it does not have “skin in the game,” in other words it does not stand to lose financially or politically from any Greek debt relief, especially as the money owed to the International Monetary Fund, of which the US is the largest member with a 17.5% quota, has “super-senior status” and cannot be restructured.

To see a more recent example of US proposals for a change in approach on Greece not having an impact in the eurozone, we only need to wind back to the end of January 2015 and Obama’s comment in the wake of the SYRIZA-led government’s first election win. “You cannot keep on squeezing countries that are in the midst of a depression,” he told CNN. “At some point, there has to be a growth strategy in order to pay off their debts and eliminate some of their deficits,” he added, pointing out that it is difficult to carry out structural reforms when people are seeing their living standards plummet. “Over time, the political system and society cannot sustain it,” he concluded.

Britain does to its own children, too, what it does to refugee kids. What’s the last you heard Corbyn say about this? Where the f*ck is he?

• Creating Child Poverty For A Whole New Generation (G.)

In a little council house in Birkenhead, Steve is panicking over how he’ll find an extra £304 rent money a month. He has just days to magic up an answer. If he can’t, he can guess what will happen. “Eviction. Come the end of November, I won’t have a roof.” As a single parent, Steve won’t be the only one slung out. His four boys, aged from three to eight, would also lose their home and probably be taken from their dad. “I’d be fed to the dogs.” Everything I’ve tried so hard for …” – a snap of his fingers – “Nothing.” It’s not a landlord doing this to Steve; it’s our government. It’s not his rent that’s going up; it’s his housing benefit that’s getting cut. And he’s not the only one; on official figures, almost 500 households in the borough of Wirral face a shortfall of up to £500 a month.

From next Monday 88,000 families across Britain will have their housing benefit slashed. They will no longer have the cash to pay their rent. Among all those whose lives will be turned upside down will be a quarter of a million children. That’s enough kids to fill 350 primary schools, all facing homelessness. Those figures come directly from the Department for Work and Pensions. Plenty dispute them, which is unsurprising since DWP officials keep changing their minds. Some experts believe the number of children at risk could total 500,000. This is the biggest benefit cut that you’ve never heard of. The newspapers will waste gallons of ink on Candice Bake-Off’s lipstick and Cheryl’s apparent baby bump. But about a government policy that could disrupt hundreds of thousands of lives, there is near silence.

So allow me to explain. From next week Theresa May’s government will extend the cap on household benefits. Poor families in London will not be allowed more than £442 a week. Those outside the capital will be cut to £385 a week. In some areas the cuts will be brought in straightaway; in others with a slight delay. But in the end, families above the limit will be hit twice over. First, they will be pushed further into poverty. And, like Steve, their housing benefit will be docked, so they will be left scrabbling just to make the rent and keep a roof above their heads. How those families will manage is anyone’s guess. When Steve opened the letter at the end of July he had a “panic attack”. All that went round his mind was one question: “How the hell am I going to pay this?” Then came what he calls “a depressive state” that lasted nearly two months. Now he bottles it up, for the sake of his boys. “When they’re not around, that’s when I cry. When they’re out at school, when they’re asleep: that’s when I break down.”

Given their approach to this simple and easy-to-solve non-issue, people like Holland and May should obviously be nowhere near any decision making positions. Perhaps more than anything else, letting children perish for your own petty political reasons says you’re a sociopath.

• Calais ‘Jungle’ like ‘Lord of the Flies’, With 1500 Abandoned Children (Ind.)

The Calais ‘Jungle’ has become like ‘Lord of the Flies’, with 1,500 children left unsupervised, sleeping in bare containers and free to roam the adjacent camp site, close to heavy machinery being used to dismantle and remove the wreckage, volunteers have told The Independent. Taps supplying drinking water to the children’s compound have been turned off, and food for the young refugees, who are mostly boys aged between 10 and 17, is not being supplied by the authorities, aid organisations claim. Nobody is allegedly allowed inside the containers except for a handful of security guards, raising serious concerns about the safety of the ‘Jungle’s’ most vulnerable occupants.

A small group of volunteers from three tiny charities told The Independent they are working “round the clock” to distribute bottled water, food, and blankets to the children, in a bid to support them. The task is extremely difficult, they said, because the organisations have only been given about 20 passes between them permitting access to the razed ‘Jungle’ site. Members of the grassroots aid organisations Refugee Community Kitchen, Calais Kitchens, and Little Ashram Kitchen, said they have had to distribute supplies from the roadside by the fenced-off compound. Only French officials can access the restricted container site, volunteers said, but they have not been present on a day to day basis. Volunteer Steve Bedlam told The Independent: “They’ve left them with no support whatsoever. They’ve just left these 1,500 kids since Friday and gone.”

No official organisations are distributing water, Mr Bedlam said, leaving the three volunteer-run organisations sending in thousands of litres everyday. Food is also extremely limited. “There’s running water in the toilets, but the sinks have been turned off,” Mr Bedlam said. “This has been confirmed by several of the kids. When we bring water in a truck it goes crazy. People are grabbing at it, like they want to get six bottles.” A French organisation was supplying one hot meal a day, Mr Bedlam said, but it was not nearly enough food for a teenage boy, leaving the camp occupants reliant on volunteers. Many of the children also had no blankets or shoes, he said, and some unregistered refugees are still sleeping outside in the “freezing cold”. Another volunteer told The Independent she believes there are 12 children in each container, and she said one boy told her he had slept on a table.

Bless you.

• QPR To Bring Over 1,000 Children To UK In Kindertransport-Style Mission (G.)

Queens Park Rangers (QPR), the football club, has offered to help bring refugee children stranded in France to the UK. The Championship club is part of a new plan for more than a thousand refugee children that emerged on Monday night. QPR has put a fleet of coaches on standby to go to France to collect the children. And Hammersmith & Fulham council – QPR’s local council in west London – says it has volunteer social workers ready to travel to France in the next couple of days to assess and support the children. Lord Alf Dubs, who has led plans to bring child refugees to the UK in a Kindertransport-style mercy mission, announced the plan in a letter to the home secretary, Amber Rudd, and the French ambassador, Sylvie Bermann, on Monday.

In his letter, Dubs writes: “I formally request that the French government allows us to send in coaches and social workers to collect those refugee children that have a right to be here in the UK. We will need assistance with travel documents out of France. We have people arranging the coordination of this.” Dubs added: “I am also writing the British government and hope that this intervention can bring the assistance the refugee children so desperately need. Given the urgency of this matter I should be grateful for a quick response.” The home secretary made a statement to parliament saying that the UK government had only been granted access to the camp by the French authorities and permitted to bring over Dubs-amendment children very recently. They are children with no relatives in the UK but who are deemed eligible to travel to the UK as a result of their vulnerability.