Harris&Ewing Childs Restaurant, Washington, DC 1918

Williams points out what I have many times: the EU’s problem -and the one that will undo it- is that Germany gets to call the shots every time and all of the time, and “the rest of the countries are little more than policy eunuchs..”

• The Eurozone Is Ersatz Deutschland (David McWilliams)

Of course, the main player in all this will be Germany. Germany calls the shots. Over the past five years, the pretence of a European Germany has given way to the reality of a German Europe. This is the new deal. As a result of this, the Eurozone is Ersatz Deutschland, where the rest of the countries are little more than policy eunuchs, emasculated by German fiscal straightjackets and German creditor obsessions. Again, if you doubt this, watch the ongoing implosion of the Italian banking system, which will dwarf even the great Irish banking crisis. Italy wants to recapitalise its banks using government money because it fears a complete collapse of its crippled economy. Germany is saying no. As always, German decisions reflect the interest of German industry.

This is entirely understandable. It means that the interests of German carmakers that sell tens of thousands of cars to the UK every year will influence the attitude of German politicians towards the deal that Britain gets. Already Angela Merkel is urging the Commission to back off and give the British time to sort themselves out. So because of German industrial interests, Italy, the friend with the broken banking system, will be treated harshly by Germany, while the UK, now the putative political enemy, will be treated more favourably. In short, the anti-EU Brits will get a better hearing from the Germans than the pro-EU Italians. It is this apparent mistreatment of so-called allies that initially drove Brexit and is driving Marine Le Pen’s support in France and will determine the background noise to the Italian general election later this year.

All this also puts Germany on a collision course with the EU institutions that are seeking to punish the UK for the temerity of Brexit. Germany will look to get the Brits the most access to EU market in the same way as Germany shouted loudly about Vladimir Putin’s annexation of bits of Ukraine but still took Russia’s oil and gas. This is Realpolitik – and the Commission had better get used to it.

Will Germany prop up Deutsche even when it won’t allow Italy to prop up its banks?

• I’m in Awe at How Fast Deutsche Bank is Coming Unglued (WS)

Deutsche Bank – “the most important net contributor to systemic risks,” as the IMF put it last week after a lag of several years – is having a rough time. Shares dropped 4.2% today to close at a new three-decade low of €11.63, down 48% since July 31 last year, lower even than the low during the doom-and-gloom days of the euro debt crisis and the Global Financial Crisis. It’s not the only European bank in trouble. Credit Suisse dropped 1.7% today to CHF 9.92, another multi-decade low, down 63% since July 31. Other European banks are getting mauled too. The European Stoxx 600 banking index dropped 3% today to 117.69, approaching the Financial Crisis low of March 2009.

If July 31, 2015, keeps showing up, it’s because this was the propitious day when Draghi’s harebrained experiment with negative interest rates and massive QE came unglued, when European stocks, and particularly European bank stocks began to crash. Deutsche Bank is so shaky that German Finance Minister Wolfgang Schäuble found it necessary to stick his neck out and explain to Bloomberg in February that he has “no concerns about Deutsche Bank.” Finance ministers don’t say this sort of thing about healthy banks. At the time, CEO John Cryan – whose main job these days is propping up Deutsche Bank with his rhetoric – explained ostensibly to frazzled employees that the bank’s position was “absolutely rock-solid, given our strong capital and risk position.”

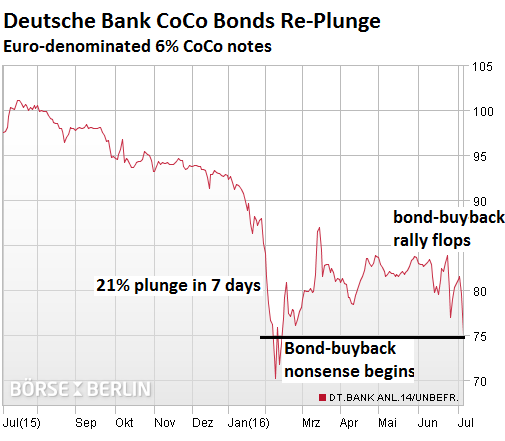

Days later, he followed up his rhetoric with a stunning ruse: On February 12, the bank announced that it would buy back $5.4 billion of its own bonds, including some issued only a month earlier. “The bank is using market conditions to buy back these bonds at attractive prices and to cut debt,” CFO Marcus Schenck said at the time. “By buying them back below their issuance value, the bank is making a profit. The bank is also using its financial strength to provide liquidity to bond investors in a difficult market environment.” Shares soared 12% on the spot! Its bonds rocketed higher. Even its contingent convertible bonds, the infamous CoCo bonds, though they weren’t part of the buyback plan, bounced.

For example, its €1.75 billion of 6% CoCo notes soared from a record low of 70 cents on the euro on February 9 to 87 cents by March – a 24% move! The ruse had worked! During the miracle rally, short sellers got their heads handed to them. But it was one of the silliest, most desperate ways to prop up shares and bonds. And now the bond-buyback miracle-nonsense rally has collapsed, with shares at a new multi-decade low, and with bonds swooning. This is what these 6% CoCo notes did: they plunged 5.7% today to 75 cents on the euro. Nearly the entire bond-buy-back miracle-nonsense rally has re-collapsed…

“..you’ll see someone say, ‘Someone is going to have to do something’.”

• “When Deutsche Bank Goes To Single Digits People Will Start To Panic” (ZH)

Following today’s Fed minutes release, Jeff Gundlach had a far less “uncertain” message: “Things are shaky and feeling dangerous,” Gundlach told Reuters in a telephone interview. It’s not just stocks that Gundlach was not too excited about, he also had some choice words about buying Treasuries here. “You’re seeing people who hated the ‘2%’ 10-year suddenly loving it at a 1.38-1.39% revisit of the all-time low closing yield,” Gundlach said. “If you buy 10-year Treasuries now, I would say, it is a terrible trade location. In fact, it is the worst trade location in the history of the 10-year Treasury.”

True, just like buying stocks less than 2% from all time highs, however what Gundlach failed to mention is that those who are buying Treasurys here are not doing it for the yield (or lack thereof on more than $11 trillion in notional), they are simply doing so to frontrun even more central bank purchases now that the monetary spigots have once again been activated as “confused” central banks around the world have just one trick left up their sleeve – to monetize even more debt in hopes of pushing every last investor into risk assets. The DoubleLine bond king also had some choice words about Europe’s banking crisis: “Banks are dying and policymakers don’t know what to do,” Gundlach said. “Watch Deutsche Bank shares go to single digits and people will start to panic… you’ll see someone say, ‘Someone is going to have to do something’.”

But it can’t bend rules only for Italy, that’s another Pandora’s box.

• To Save Italian Banks, The EU Will Have To Bend Some Rules (BBG Ed.)

Italy’s slow-motion banking crisis is getting worse, and if it isn’t stopped, it could cause system-wide damage across the euro area and beyond. To contain this danger, the European Union must be willing to bend some rules. Shares in Italy’s third-largest lender, Banca Monte dei Paschi di Siena, are down about 75% this year and trading at one-tenth of book value. A ban on short-selling the bank’s stock was imposed on Wednesday. Monte dei Paschi is only one of a group of Italian banks beset with 360 billion euros ($398 billion) of nonperforming loans; that’s some 20% of Italy’s GDP. Banking crises in Spain and Ireland were rooted in real-estate bubbles, but Italy’s stems from a culture of cronyism, poor governance and shoddy lending.

The banks’ sickness has hurt the broader economy, too: As borrowers defaulted, banks withheld credit, dragging down growth. Reforming Italy’s banking culture is the job of years, but short-term action is needed right now to halt the panic. The simplest approach would be to sequester impaired loans in a state-supported “bad bank” – along the lines of the ones used by Spain and Ireland. A stabilized banking industry could then resume its vital economic function of supporting investment. After Greece’s financial debacle, though, the EU adopted rules requiring a failing bank’s shareholders and creditors to shoulder much of the cost of any rescue – to be “bailed in,” as it’s called. That’s a good idea in principle. In Italy, it’s close to impossible politically, because a third of bank bonds are held by households.

The result has been a characteristic EU muddle of half-baked answers and hoping for the best. A scheme to attract private capital and securitize bad loans has been tried but hasn’t worked. Confidence kept on deteriorating. Italian Prime Minister Matteo Renzi is doubtless looking to save his political skin, but he’s right that Italy needs more freedom of action than EU rules allow. Renzi has staked his job on an October referendum on constitutional reform, one that polls show he could lose. If that happens, the euroskeptic, populist Five Star Movement might take the country in a new direction not to Europe’s liking – least of all now, coming on the heels of Brexit.

The use of the word ‘populist‘ is up there with ‘migrant’ in trying to paint a picture that is not real. Beppe Grillo has nothing to do with Farage or Le Pen or any of these people, other than he wants Italy out of the eurozone (and EU). Populist could simply mean: for normal people, but that’s not the connotation it gets, it’s utilized in a much more sinister way. On purpose.

• Populist Politicians Take On Italy’s Massive Debt Pile (BBG)

The Rome Olympics of 1960 marked the rebound of the Italian capital after years of war and reconstruction, an affirmation of the country’s renaissance and the city’s emergence as a symbol of dolce vita insouciance. Rome is still paying the bill, and the new mayor, Virginia Raggi, is sick of it. The city has roughly €13.6 billion ($15.2 billion) in debt and more than 12,000 creditors—though the pile is so complex no one really knows how much is owed to whom. Rome faces outstanding bills for operating its 61-year-old metro system, hauling trash, and running a network of unprofitable pharmacies that compete with private shops. The courts are grappling with hundreds of lawsuits over unpaid debts going back 50 years for land expropriated to build hospitals, streets, and other city projects—including some debts connected to the 1960 games, former Mayor Ignazio Marino has said.

The average interest rate: 5%, at a time when the Italian government is issuing 10-year bonds at 1.5% annually. “We can’t keep paying such high interest just because nobody bothered to renegotiate the debt,” Raggi, who was elected on June 19, told the RAI television network. Raggi, a 37-year-old lawyer and Rome’s first female mayor, has ridden a wave of frustration with Italy’s old guard—especially its handling of the economy—to one of the country’s most powerful political jobs. Her rise mirrors the growing strength of her party, the Five Star Movement, founded in 2009 by Beppe Grillo. Five Star (the stars are meant to represent water, environment, transport, development, and energy, though the party mostly focuses on fighting corruption and cutting regulations) has grown into a formidable rival to the Democratic Party of Prime Minister Matteo Renzi.

[..] Few would argue that Italy doesn’t desperately need a solution to its debt woes. The country owes creditors €2.2 trillion, or more than 130% of GDP—a ratio higher than any EU country’s other than Greece. High taxes aimed at paying down the debt stifle growth, which reduces the government’s ability to fund new programs. At the same time, Italy’s banks hold more of their country’s sovereign debt than lenders in any other euro area nation, and they’re burdened with €360 billion in bad loans, more than a quarter of the total held by euro area financial institutions. Government attempts to load these assets into a “bad bank” have foundered because of European rules against state aid to banks. As a result some institutions could face insolvency.

No, no no, I kid you not: in this Bloomberg video, the reporter asks SocGen Chairman Bini Smaghi: “Do you get a sense that markets are orderly, that markets are rational at the moment?” And he responds: “I mean, you have uncertainty, you don’t know what’s going to happen…”

Orderly and rational? You f**king kidding me? There are no markets, you bleeding doodles. And you’re not supposed to know beforehand what’s going to happen either. But you f**king do anyway, because central banks keep on feeding losers like you and there is no price discovery anywhere to be found. It’s insane to see how fast the new normal becomes normal. But these wankers make their present profits at the cost of you and me. Let’s put a halt to that. These people have no connection to us. But they should.

• Italy May Spur Systemic Bank Crisis: SocGen (BBG)

Italy’s banking crisis could spread to the rest of Europe, and rules limiting state aid to lenders should be reconsidered to prevent greater upheaval, Societe Generale SA Chairman Lorenzo Bini Smaghi said. “The whole banking market is under pressure,” the former ECB executive board member said. “We adopted rules on public money; these rules must be assessed in a market that has a potential crisis to decide whether some suspension needs to be applied.” With Italian banks weighed down by about €360 billion in soured loans, the government has been sounding out regulators on ways to shore up lenders amid a renewed selloff in the wake of the British vote to leave the EU.

The government would invoke an EU rule allowing temporary state aid if regulatory stress tests uncover a shortfall at Banca Monte dei Paschi di Siena, a person with knowledge of the discussions said Tuesday. European banking stocks resumed their descent as policy makers disagreed and sometimes issued contradictory statements about what may come next. Deutsche Bank, Germany’s largest lender, slid 6.1% to its lowest level since at least 1989. Societe Generale, France’s second-biggest bank, which Bini Smaghi has chaired for just over a year, fell 1.8% as of 2 p.m. in Paris. Italian Finance Undersecretary Pier Paolo Baretta said in an interview on RAI radio Wednesday morning that a “technical solution” on Monte Paschi could be hours away, before issuing a statement an hour later that said “no intervention is expected in the next few hours.”

German Finance Minister Wolfgang Schaeuble, speaking at a news conference in Berlin hours later, said his Italian counterpart Pier Carlo Padoan told him that Italy intends to stick to the banking-union rules.

He’s talking about Deutsche. Renzi’s desperate to save his skin. And he WILL challenge Berlin to do it. They will respond by making Italy Greece Redux.

• Italy’s Bad Loan Woes Tiny Compared To Europe’s Derivative Problem – Renzi (R.)

The difficulties facing Italian banks over their bad loans are miniscule by comparison with the problems some European banks face over their derivatives, Italian Prime Minister Matteo Renzi said on Wednesday. Italian bank shares have tumbled in recent days and are the worst performers among European lenders this year on investor concerns over how they will handle some €360 billion of bad and non-performing loans. Speaking at a joint news conference with Swedish Prime Minister Stefan Lofven, Renzi said other European banks had much bigger problems than their Italian counterparts. “If this non-performing loan problem is worth one, the question of derivatives at other banks, at big banks, is worth one hundred. This is the ratio: one to one hundred,” Renzi said.

Stiglitz doesn’t have much. Disappointing?!

• From Brexit to the Future (Stiglitz)

Digesting the full implications of the United Kingdom’s “Brexit” referendum will take Britain, Europe, and the world a long time. The most profound consequences will, of course, depend on the European Union’s response to the UK’s withdrawal. Most people initially assumed that the EU would not “cut off its nose to spite its face”: after all, an amicable divorce seems to be in everyone’s interest. But the divorce – as many do – could become messy. The benefits of trade and economic integration between the UK and EU are mutual, and if the EU took seriously its belief that closer economic integration is better, its leaders would seek to ensure the closest ties possible under the circumstances.

But Jean-Claude Juncker, the architect of Luxembourg’s massive corporate tax avoidance schemes and now President of the European Commission, is taking a hard line: “Out means out,” he says. That kneejerk reaction is perhaps understandable, given that Juncker may be remembered as the person who presided over the EU’s initial stage of dissolution. He argues that, to deter other countries from leaving, the EU must be uncompromising, offering the UK little more than what it is guaranteed under World Trade Organization agreements. In other words, Europe is not to be held together by its benefits, which far exceed the costs. Economic prosperity, the sense of solidarity, and the pride of being a European are not enough, according to Juncker.

No, Europe is to be held together by threats, intimidation, and fear. That position ignores a lesson seen in both the Brexit vote and America’s Republican Party primary: large portions of the population have not been doing well. The neoliberal agenda of the last four decades may have been good for the top 1%, but not for the rest. I had long predicted that this stagnation would eventually have political consequences. That day is now upon us.

Hey, their jobs depend on it…

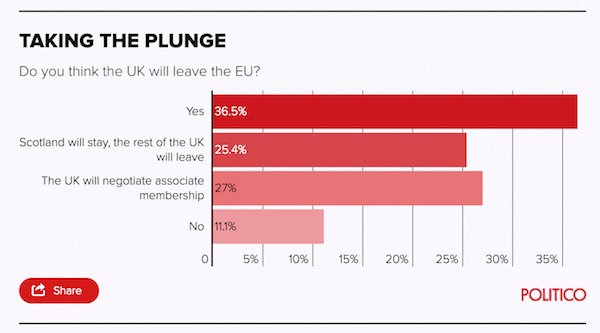

• Finance Insiders: The UK Won’t Really Go (Pol.)

Finance industry insiders still don’t think a full Brexit will actually happen. Only 37% of participants in POLITICO’s Economic Caucus, which surveyed an elite group of 63 business and economic leaders, said that Britain will exit the European Union following the June 23 referendum. An overwhelming majority said the U.K. won’t cut its ties altogether — a finding that reflects the finance community’s optimism, delusion or a little of both. Britain will suffer much more than the rest of the Continent and will fall into recession following the referendum, said the caucus, which includes EU ambassadors, European Commission Vice President Kristalina Georgieva, former Italian Prime Minister Mario Monti, and OECD and European Central Bank economists.

More than three-quarters of those surveyed said the U.K. should brace itself for a major economic slowdown as uncertainty hits “confidence, consumer spending and investment,” whereas they predicted the wider European economy will fare much better. Britain scored “an astonishingly avoidable own goal,” said one member of the caucus, all of whom spoke on condition their remarks not be individually attributed. “The uncertainty [while exit negotiations take place] will particularly hit the British services market, which is the strong point of the U.K. economy at the moment,” said one caucus member, adding that “anti-foreigner sentiment, if not kept in check, might persuade many skilled workers to leave the U.K.” Reports of hate crime in London are up by more than 50% since Britons voted by a margin of 52-48% to leave the EU, police figures show.

Bubbles are all China has left. Nothing new there.

• China’s Innovation Economy A Real Estate Bubble In Disguise? (R.)

The Chinese government’s call to the nation to build an innovation-driven economy from the top down has sparked a rush by local governments to construct new buildings in the name of supporting creativity. Innovation centers have been popping up around the country and are set to more than double to nearly 5,000 in the next five years, according to internet research firm iiMedia. The only problem for local governments; entrepreneurs are not moving in. Many centers are in small Chinese cities or towns, not ideal locations for attracting startups. There is no local market for their product, no local ecosystem of suppliers and fellow entrepreneurs and centers generally provide only basic amenities, such as a desk and a telephone. They lack the financial, technical or marketing expertise that many startups need.

Most incubators have occupancy rates of no more than 40%, iiMedia says. The result: like steel mills, theme parks and housing before them, the country now faces a glut of innovation centers as another top-down policy backfires to leave white-elephant projects and a further buildup of debt. “The risk of a bubble is extremely large,” said Shi Jiqiang, a partner at Leilai Management, which runs day-to-day operations at a startup base in the city of Tianjin, near Beijing. “This is both a test for government and for the managers of startup spaces … there aren’t enough entrepreneurs.” [..] Beijing argues its development model that worked so well for infrastructure and real estate, powering the country through the global financial crisis, can build successful, high-tech startups.

Supernova revisited.

• Bill Gross Calls Sovereign Bonds Too Risky (BBG)

Bill Gross said sovereign bond yields at record lows aren’t worth the risk. “The sovereign bonds are not up my alley,” Gross, who built the world’s biggest bond fund at PIMCO and is now at Denver-based Janus Capital, said on Bloomberg Television Wednesday. “It’s too risky.” Low yields mean bonds are especially vulnerable because a small increase can bring a large decline in price, he said. Yields in the U.S., the U.K. and Australia pushed to all-time lows Wednesday, while those in Germany and Japan dropped to unprecedented levels below zero. The average yield on the bonds in Bank of America’s World Sovereign Bond Index this week dropped below 1% for the first time, based on data going back to 2006.

Bonds are rallying on speculation the British vote to leave the European Union will damp global economic growth, driving demand for the safest assets. The Federal Reserve is losing confidence in its need to raise interest rates as officials face rising uncertainty about the outlook for growth at home and abroad, the minutes of its most recent meeting issued Wednesday indicate. [..] Gross warned almost a month ago central bank policies that pushed trillions of dollars into bonds with negative interest rates will eventually backfire violently. “This is a supernova that will explode one day,” he wrote on Twitter.

But it’s all they have left.

• Voodoo Central Banking Is A Bad Idea (BBG)

Desperate times, we’re told, demand desperate measures, and there may be no more desperate country anywhere in the world than Japan. Even as policymakers struggle to boost growth and inflation, post-Brexit turmoil has caused the yen to strengthen, slamming Japanese exporters. BOJ Governor Haruhiko Kuroda is coming under more and more pressure to expand his already crazy-loose monetary policy. With few options available, he might be forced to push key interest rates even deeper into negative territory when the BOJ meets later this month. Proponents of Kuroda’s negative-rate policy, introduced in January, contend that the strategy is transferring profits from big banks to needy households, lowering borrowing costs for companies, encouraging more risk-taking in investment and propping up real estate values.

Kuroda in June proclaimed that negative rates were “having a positive impact on the real economy.” Yet there are already ample indications that negative rates are failing to achieve their main goals of spurring growth and inflation. And more broadly, the fact that central bankers have resorted to negative rates at all is a signal of just how narrow-minded and counterproductive the approach to restoring global growth has become. Contrary to Kuroda’s optimistic words, Japan sunk even deeper into deflation in May. The IMF has slashed its 2016 forecast for Japan’s GDP growth to 0.5%. Perhaps Japan’s negative-rate policy needs more time to work its magic. Maybe Japanese companies and consumers, knowing how desperate Kuroda is, are holding out for even lower borrowing costs in coming months.

Yet Europe’s experience suggests otherwise. Even though the ECB introduced negative rates two years ago, growth in the euro zone looked to be slowing even before Brexit. Inflation is barely expected to inch back into positive territory in June, at 0.1%. It’s at least as likely that the entire strategy is flawed. The purpose of loose monetary policy is to stimulate economies by encouraging greater borrowing. That, however, assumes that investors see sound economic opportunities that make taking on debt worthwhile. Apparently, not many Japanese feel that way. [..] In the first quarter, according to a recent report by Capital Economics, bank lending to Japan’s private sector grew at the slowest pace since 2014, while the amount of corporate bonds outstanding actually shrank.

But we’ll bury that under blubber like: “”The Class 8 market is stuck in a holding pattern, at the bottom end of this cycle…”

• US June Truck Orders Down 34% vs Year Ago (R.)

U.S. orders for heavy duty trucks in June were down 34% from the same month last year to a four-year low as trucking firms were holding off on buying new 18-wheelers amid a weak freight environment, according to preliminary data released by a freight transportation forecaster on Wednesday. “The Class 8 market is stuck in a holding pattern, at the bottom end of this cycle,” Don Ake, vice president for commercial vehicles at FTR said in a statement. “Fleets are cautious as freight demand has cooled off this year,” he said. Preliminary data showed 13,000 units ordered in June, the lowest monthly total since July 2012 and the worst June since 2009. FTR said that all truck manufacturers were equally affected by the month’s weak order numbers.

Your first reaction is ‘you can’t make this up’. But then you realize that’s exactly what somebody did. And MI6 actually discussed the movie and its plot in 2002, but Britain went on to help kill 600,000 Iraqi’s anyway.

• The Rock Movie Plot ‘May Have Inspired MI6 Source’s Iraqi Weapons Claim’ (G.)

An allegation in an MI6 report about Iraq’s supposed chemical weapons capability before the 2003 war to remove Saddam Hussein appeared to have been lifted from a Hollywood film, according to the Chilcot report. A section of the inquiry’s findings about the build-up to the conflict in the autumn of 2002 found that MI6, formally known as the Secret Intelligence Service or SIS, feared a source might have taken inspiration from The Rock, a 1996 thriller starring Sean Connery and Nicolas Cage. The report details how MI6 sent information to “a small number of very senior readers”, including Tony Blair and the then foreign secretary, Jack Straw, on 11 and 23 September 2002. Based on what MI6 called “a new source on trial with direct access”, this alleged that Saddam’s government had accelerated the production of chemical and biological agents, and in particular that chemical agents might be carried in glass containers.

After some discussion on the reliability of the new source, in early October MI6 was questioned directly about this idea. The report says: “It was pointed out that glass containers were not typically used in chemical munitions; and that a popular movie [The Rock] has inaccurately depicted nerve agents being carried in glass beads or spheres.” MI6 accepted this possible flaw to the intelligence, the report adds: “The questions about the use of glass containers for chemical agents and the similarity of the description to those portrayed in The Rock had been recognised by SIS. There were some precedents for the use of glass containers but the points would be pursued when further material became available.”

“The World Is Being Pulled In An Irreversible Direction..”

• Putin Warns of War: ‘I Don’t Know How to Get Through to You People’ (RI)

Vladimir Putin has finally taken the kid gloves off. The Russian president was meeting with foreign journalists at the conclusion of the Saint Petersburg International Economic Forum on June 17th, when he left no one in any doubt that the world is headed down a course which could lead to nuclear war. Putin railed against the journalists for their “tall tales” in blindly repeating lies and misinformation provided to them by the United States on its anti-ballistic missile systems being constructed in Eastern Europe. He pointed out that since the Iran nuclear deal, the claim the system is to protect against Iranian missiles has been exposed as a lie. The journalists were informed that within a few years, Russia predicted the US would be able to extend the range of the system to 1000 km.

At that point, Russia’s nuclear potential, and thus the nuclear balance between the US and Russia, would be placed in jeopardy. Putin completely lost patience with the journalists, berating them for lazily helping to accelerate a nuclear confrontation by repeating US propaganda. He virtually pleaded with the western media, for the sake of the world, to change their line: We know year by year what’s going to happen, and they know that we know. It’s only you that they tell tall tales to, and you buy it, and spread it to the citizens of your countries. You people in turn do not feel a sense of the impending danger – this is what worries me. How do you not understand that the world is being pulled in an irreversible direction? While they pretend that nothing is going on. I don’t know how to get through to you anymore.

Must watch.

• Crazy – A Story Of Debt (Grant WIlliams)

This is a story about debt – 2008 was the crystallization of that, the years since have been the denial of it, and the years to come will be the resolution. Grant Williams, founder & publisher of the ‘Things That Make You Go Hmmm…’ research service, and co-founder of Real Vision TV, brings us an eye-opening presentation titled Crazy, where he puts into perspective the extraordinary levels of global debt and unprecedented monetary policy, and reminds us that the many factors that led to the ‘08 crisis are still very much present.

Home › Forums › Debt Rattle July 7 2016