El Greco Dormition of the Mother of God 1565-1566

Ramaswamy

WATCH: Never-Trump Neil Cavuto tries to bait Vivek Ramaswamy into flipping on Trump

Instead, Vivek delivers a masterclass on how to quickly TURN the tables & DUNK on a dishonest interview

When Vivek says he'll "pardon & unite with Trump to destroy the deep state"

Neil loses it: pic.twitter.com/mpivHI4l45— Benny Johnson (@bennyjohnson) August 16, 2023

RFK Fauci

Robert F. Kennedy Jr… 300 scientists wrote to President Obama warning that he must shut down Anthony Fauci because he’s going to create a microbe that will cause a global pandemic..

Obama shut down 18 of the most dangerous BSL4 labs in America and allowed Fauci to shift his… pic.twitter.com/eZZbZKUk7z

— Pelham (@Resist_05) August 15, 2023

Greenwald

"You would think the fact that Joe Biden just made as his Deputy Secretary of State… the person who was Dick Cheney's top advisor for the Iraq War, that would be something strange…

But it's not strange… Washington is a place that depends on endless war." pic.twitter.com/2dHpjSJNnw

— System Update (@SystemUpdate_) August 15, 2023

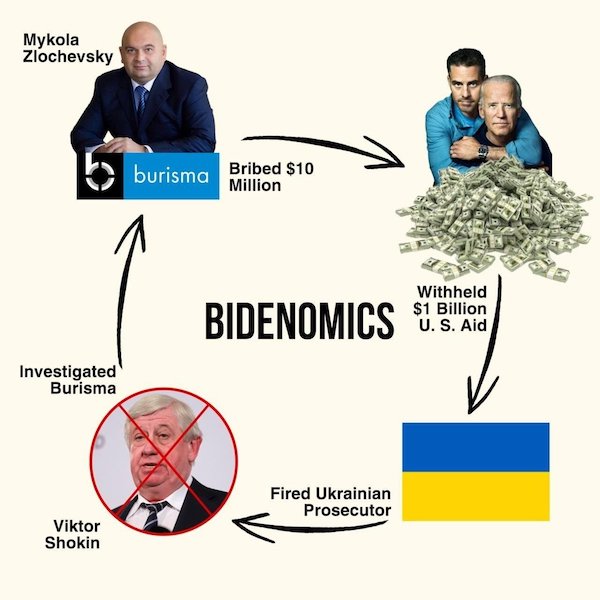

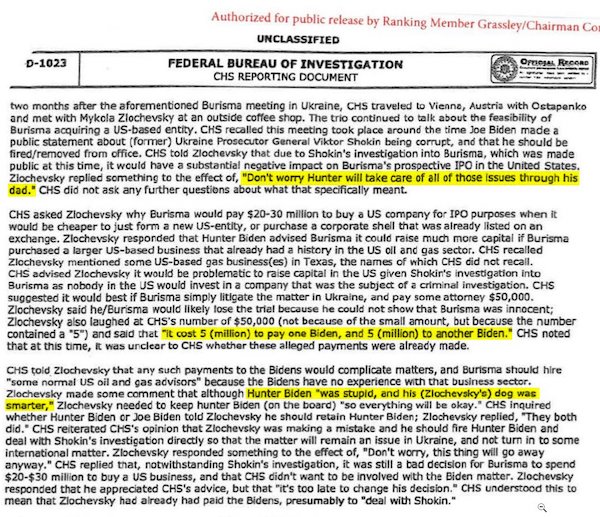

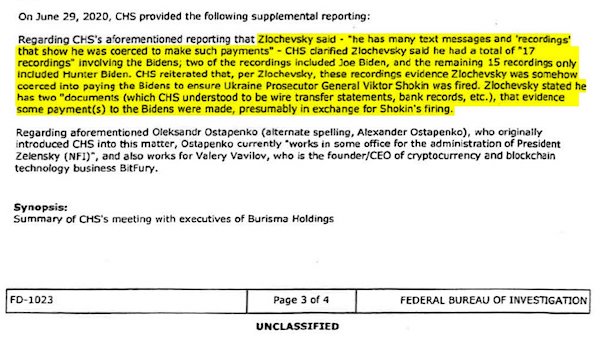

Longtime Hunter attorney (let’s see who paid his bills!) Christopher Clark for 5+ years got used to anything he wrote being accepted. But when he went for the ultimate sweetheart deal, where Hunter could have shot someone on 5th avenue (the Trump thing) without facing punishment, Judge Maryellen Noreika said: “I don’t like these terms”. Which were in the small print of the deal, of course. And neither Hunter nor Clark ever expected her to read them. She put their world upside down. Now Christopher Clark is trying to sneak out of the building, hoping no-one will notice he wrote the whole thing. Oh, and he may be called as a witness now….

Here’s Clark’s way out ?! “Biden attorney Abbe Lowell blamed prosecutors for drafting the agreements the judge wouldn’t approve..”

• Hunter Biden’s Lead Criminal Defense Attorney Asks To Withdraw From Case (ZH)

Hunter Biden’s top criminal defense attorney has asked a federal judge for permission to withdraw from the case after a plea deal unraveled in late July. Christopher Clark, Hunter’s longtime defense attorney, filed a motion with the Delaware judge overseeing Hunter’s case on the grounds that he could now be called as a witness in future proceedings, CNN reports. “Based on recent developments, it appears that the negotiation and drafting of the plea agreement and diversion agreement will be contested, and Mr. Clark is a percipient witness to those issues,” reads the Tuesday filing. Last week federal prosecutors announced that the had reached an impasse on Hunter’s plea deal related to tax offenses and a “diversion agreement” to take care of a gun possession charges.

After the deal unraveled, the feds asked Judge Maryellen Noreika to withdraw a late August deadline to renegotiate the plea deal, after she said she was not ready to accept it & asked both sides to file additional briefs explaining the legal structure of the revised deal. Noreika also called the deal federal prosecutors reached with Hunter over his gun possession offense “unusual,” and that it contained some “non-standard terms,” such as “broad immunity” from other potential charges. Under the original plea agreement, Biden intended to plea guilty to two misdemeanor tax crimes committed in 2017 and 2018, and would avoid prison on the gun possession charge. As part of the conditions for Hunter’s release, he must not consume alcohol or prohibited drugs, or possess a firearm, must submit to random drug tests as required, must actively seek employment and not violate any laws.

On Sunday, Biden attorney Abbe Lowell blamed prosecutors for drafting the agreements the judge wouldn’t approve. Biden’s lawyers said Sunday they believed the gun diversion deal was still “valid and binding.” Abbe Lowell, one of the attorneys, placed blame on prosecutors for drafting the agreements the judge took issue with. -CNN. After the plea deal unraveled, US Attorney David Weiss requested and was granted “special counsel” status by Attorney General Merrick Garland. According to prosecutors, there is still an ongoing investigation which may carry future charges outside the scope of the plea deal. Biden pleaded guilty to two misdemeanor tax crimes, and will avoid prison charge for possessing a gun while addicted to an illegal drug. The deal sought to cap a five-year investigation into Hunter’s tax affairs and business dealings, which federal prosecutors say Hunter failed to pay over $100,000 of income tax on at least $1.5 million in income between 2017 and 2018.

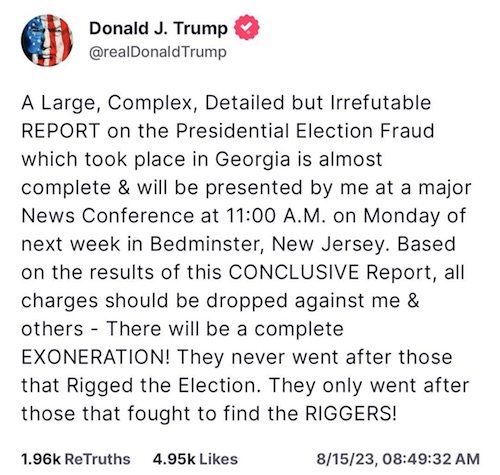

“We look forward to a detailed review of this indictment which is undoubtedly just as flawed and unconstitutional as this entire process has been..”

• Trump Attorneys Slam ‘Flawed, Unconstitutional’ Fulton County Indictment (Sp.)

A 41-count indictment, including against former US President Donald Trump, approved by a Fulton County grand jury in the state of Georgia in an election interference case, is “flawed and unconstitutional,” Trump attorneys said, adding that they look forward to a detailed review of the indictment. A Fulton County grand jury indicted Monday night Trump with 13 criminal charges related to an investigation alleging he attempted to overturn the results of the 2020 presidential election, according to a court document. Fulton County District Attorney Fani Willis later told reporters that the grand jury had issued arrest warrants for the 19 defendants named in the indictment, but they all have until August 25 to voluntarily surrender.

“This one-sided grand jury presentation relied on witnesses who harbor their own personal and political interests— some of whom ran campaigns touting their efforts against the accused and/or profited from book deals and employment opportunities as a result. We look forward to a detailed review of this indictment which is undoubtedly just as flawed and unconstitutional as this entire process has been,” the attorneys noted in a statement distributed by the ex-president in an email to his supporters.

The process leading up to the decision was “shocking and absurd, starting with the leak of a presumed and premature indictment before the witnesses had testified or the grand jurors had deliberated and ending with the District Attorney being unable to offer any explanation,” they stressed. “In light of this major fumble, the Fulton County District Attorney’s Office clearly decided to force through and rush this 98-page indictment,” the attorneys emphasized. The former US president was previously indicted on charges related to his supporters’ storming of the Capitol in January 2021, financial fraud in payments to porn actress Stormy Daniels and mishandling of classified government documents.

Responding to the Georgia Fulton County Trump Indictment as a local resident pic.twitter.com/ipaWcmDLz9

— Matt Kim (@MattAttack009_) August 15, 2023

“You either agree with the government’s interpretation of election results or else you risk going to jail.”

• Justice Shrugged: The Persecution of Donald Trump (Miele)

Trump’s refusal to accept the election results turns on his deep sense of individualistic ambition, his willingness to challenge societal norms, and his determination not to surrender his principles, even at the expense of public ridicule, political persecution, and now potentially years in prison. But you can’t view the 2020 election in a vacuum. Trump was no different than Rearden in fighting what he knows is a rigged system. For the preceding five years, Trump had been the victim of a series of vicious attacks by the Deep State and the media who never really accepted him as president. So Trump had no reason to accept the election results parroted by the same actors who had already tried to destroy him multiple times. And now, two and a half years after the 2020 election, as Trump has a fighting chance of returning to the White House in the greatest political comeback in history, his enemies have come for him again, with three separate indictments and soon to be a fourth.

The four-count indictment most recently brought against Trump by Special Counsel Jack Smith is intended to make a victory in 2024 nearly impossible. The Deep State in this case represents the entrenched bureaucracy of the federal government as well as the individual states’ election officials. This is the same Deep State that gathered up 51 national security officials to sign a statement prior to the 2020 election that falsely claimed that Hunter Biden’s laptop “has all the classic earmarks of Russian disinformation.” It had none of them. No wonder Trump was disinclined to accept their conclusions that the election was secure and fair. Trump sought to prove his concerns about the legitimacy of the 2020 election by pursuing a vigorous legal strategy as was guaranteed to him under the First Amendment’s right “to petition the government for a redress of grievances.”

Biden’s weaponized Department of Justice is determined to deny that right to Donald Trump, and by extension to the rest of us. You either agree with the government’s interpretation of election results or else you risk going to jail. The indictment brought against Trump acknowledges that everyone has a First Amendment right to speak their minds and even to “formally challenge the results of the election through lawful and appropriate means,” but it then avers that Trump’s right to believe he won the election is abrogated by a string of court losses and equally pessimistic assessments from so-called experts.

Here’s where it gets interesting, and where the Department of Justice has overstepped. The four counts in the indictment are based on what prosecutor Jack Smith calls three conspiracies: “A conspiracy to defraud the United States” by seeking to stop the counting of electoral votes on Jan. 6, 2021; “a conspiracy to corruptly obstruct and impede the Jan. 6 congressional proceeding at which the collected results of the presidential election are counted and certified; and “a conspiracy against the right to vote and to have one’s vote counted.”

All of these alleged conspiracies and the resulting four charges are directly related to the joint congressional session on Jan. 6, when the Electoral College votes were opened and debated to determine whether they should be counted. Moreover, when Jack Smith announced the indictment, he suggested that Trump was responsible for the riot that occurred at the U.S. Capitol on that day, yet none of the charges hold Trump responsible for the violence. Every charge in this dubious indictment could have been brought even if the protesters had marched “peacefully and patriotically” to the Capitol as Trump had requested. The charges in the indictment have nothing to do with the violence; they only relate to Trump’s insistence that he won the election, and that he would do whatever it takes to prove it.

In other words, these are not real crimes like insurrection or sedition; they are thought crimes. Smith’s “conspiracy” charges simply reflect that Trump consulted his lawyers to develop a legal strategy on how to right the wrong that he perceived. In its substance, from paragraphs 8 to 123, the indictment merely alleges over and over again that Trump refused to accept the conclusions of others that the election of Biden was legitimate, and that he had help from like-minded attorneys. How infuriating that must be to prosecutor Smith, who believes with all his heart that no one could doubt the veracity of what government officials (like him!) tell us.

Tucker 2020

"It now appears there actually was meaningful voter fraud in Fulton County, Georgia last November."

"That is not a conspiracy theory. It's true."

Tucker Carlson lays out the FACTS backing up the claims of election fraud in Georgia in the 2020 election. pic.twitter.com/mJVT2FPJTt

— Kyle Becker (@kylenabecker) August 15, 2023

Every single word, even every thought, becomes a crime..

• The Criminalization of Election Controversies (Turley)

The long-anticipated indictment by Fulton County District Attorney Fani Willis is expected in the coming days and will focus on alleged election tampering and related offenses in the 2020 presidential election. If indictments were treated like frequent flyer miles, Donald Trump would get the Georgia indictment for free. However, it will be anything but costless. Regardless of the merits, it will magnify both the cost and complications for Trump. Like the New York indictment, a Georgia indictment would not be subject to a presidential pardon. Not only have GOP candidates indicated that they would pardon Trump on any federal charges if elected to the presidency, Trump could pardon himself (including a preemptive pardon before trial) if elected — but that power does not reach state convictions.

As with Manhattan District Attorney Alvin Bragg, many view Willis as a Democratic prosecutor pursuing the highly unpopular former president. However, given the three grand juries and the three years that have passed, Willis may have found new evidence or witnesses that could tie Trump to criminal conduct in seeking to challenge the results in the election. Thus far, the focus has been on the controversial call that Trump had with Georgia officials — a call widely cited as indisputable evidence of an effort at voting fraud. Yet, the call was similar to a settlement discussion, as state officials and the Trump team hashed out their differences and a Trump demand for a statewide recount. Trump had lost the state by less than 12,000 votes. That might be what he meant when he stated, “I just want to find 11,780 votes, which is one more than we have because we won the state.”

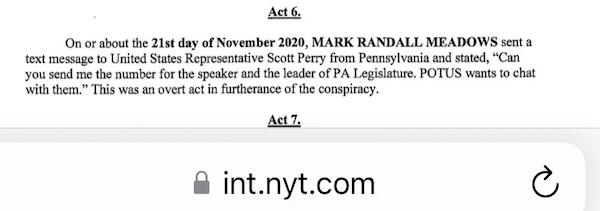

Mark Meadows was charged for asking for a politician’s phone number…

While others have portrayed the statement as a raw call for fabricating the votes, it seems more likely that Trump was swatting back claims that there was no value to a statewide recount by pointing out that he wouldn’t have to find a statistically high number of votes to change the outcome of the election. It is telling that many politicians and pundits refuse to even acknowledge that obvious alternate meaning. For Trump’s part, he is not helping with his signature, all-caps social media attacks. In addition to attacking Willis for a supposedly “racist” and “unethical” past, Trump recently declared that Willis “wants to indict me for a perfect phone call; this was even better than my perfect call on Ukraine.” I have previously disagreed with the claimed perfection of that Ukraine call, the subject of Trump’s first impeachment. However, neither call needs to be “perfect” to be protected.

The importance made of the call in the likely Georgia indictment will be one of the greatest “tells” as to what Willis has in terms of evidence. If the call is a critical linchpin to the prosecution, it will look like a political stunt out of the Bragg-school of prosecution. There have also been stories indicating that Willis is focusing on connections of Trump team members like Rudy Giuliani to a “breach” of the voting system on Jan. 7, 2021. The team was seeking access to the voting machines to show that they could be compromised or manipulated. Text messages state that the team secured an “invitation” to examine the machines in Coffee County.

Pipe burst

The moment CBS broke the news on Election Night that a “pipe burst” at State Farm Arena, “pausing” the vote count in Fulton County, GA. Video would later show multiple people inside the arena continuing to count votes unsupervised.

As seen in this clip, Trump was winning by more… pic.twitter.com/LJ2qFfys7b

— Merissa Hansen (@merissahansen17) August 16, 2023

The biggest show on earth. Brought to you by Disney…

• Trump Must Turn Himself In At Georgia Jail – Sheriff (RT)

Former US President Donald Trump and 18 co-defendants on his racketeering case are set to be booked on their charges at a county jail in Georgia, a departure from the courthouse processing seen in his three other criminal cases. The Fulton County Sheriff’s Office announced the decision on Tuesday, saying that Trump and the other defendants could appear at the local jail to turn themselves in “at any time,” though noted the plan is still subject to change due to the “unprecedented nature” of the case. “At this point, based on guidance received from the district attorney’s office and presiding judge, it is expected that all 19 defendants named in the indictment will be booked at the Rice Street Jail,” the sheriff’s office said in a statement, pointing out that the facility is “open 24/7.”

That procedure would differ from Trump’s other ongoing criminal litigation, in which he has been processed inside courthouses. During booking, defendants are typically photographed and fingerprinted, and while Trump was not required to provide mugshots for his other lawsuits, Fulton County Sheriff Pat Labat said he planned to snap a photo of the ex-president for the racketeering case. “It doesn’t matter your status. We have a mugshot ready for you,” Labat told reporters ahead of the latest indictment. “Unless someone tells me differently, we are following our normal practices.” Trump and a long list of his current and former allies were hit with a sweeping 41-count indictment earlier this week, with prosecutors alleging they worked to invalidate Joe Biden’s victory in the 2020 presidential race.

Among the charges is a felony racketeering count, as well as several counts for conspiracy to interfere in an election, perjury, and soliciting a public official to violate their oath. The latest round of charges mark Trump’s fourth criminal indictment this year alone, with federal prosecutors previously slapping him with dozens of felony counts for the alleged mishandling of classified material after leaving the White House in 2021. He has also been charged in New York for an alleged hush-money scheme with porn actress Stormy Daniels during his 2016 campaign, and faces a separate election-interference case led by special counsel Jack Smith, who is also spearheading the classified documents trial. Trump, who has announced his candidacy in the 2024 presidential contest, has denied all wrongdoing in each case, insisting he has been unfairly targeted in a politically motivated “witch hunt” which began during his own presidency.

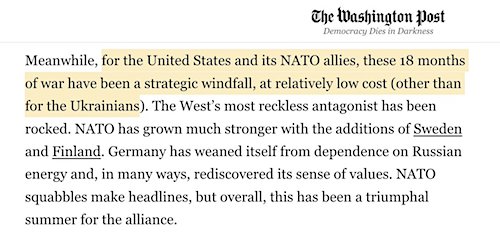

“..$900 from each and every US household, at a time when most Americans say they can’t afford a $1,000 emergency.”

• Ukraine Matters To Biden More Than Hawaii – Ron Paul (RT)

President Joe Biden is demanding another $24 billion for Ukraine while the US “disintegrates,”former Texas congressman Ron Paul wrote on Monday, pointing out the unprecedented devastation from the Hawaii fires. It’s “hard to look at recent footage of the devastation in Maui and then hear President Biden tell Congress that he needs another $24 billion for Ukraine,” Paul said. “How can this Administration continue to justify tens of billions of dollars for this losing war that is not in our interest while the rest of the United States disintegrates?” The US has poured “well over $120 billion” into the “proxy war on Russia,” Paul added. He cited a Heritage Foundation analysis that calculated this comes out to $900 from each and every US household, at a time when most Americans say they can’t afford a $1,000 emergency.

“How many Americans would rather have those $900 dollars back in their pocket rather than in the pockets of Lockheed-Martin, Raytheon, and Ukraine’s oligarchs?” Paul asked, noting that even the establishment media is now admitting that “Ukraine is not winning and cannot win.” “Continuing to pour money into a losing cause will just result in bankruptcy at home and more dead Ukrainians overseas,” Paul concluded. The Texas physician served in Congress for a total of 23 years and ran for president three times – as a Libertarian in 1988, and in Republican primaries in 2008 and 2012 – before retiring in 2013 to found the Ron Paul Institute for Peace and Prosperity. Multiple fires broke out in Hawaii last week, devastating the island of Maui and practically destroying the historic town of Lahaina.

As of Sunday, the death toll was reported at 96, with at least 1,000 more people still missing. “This is the largest natural disaster we’ve ever experienced,” Hawaii Governor Josh Green said at a news conference on Sunday. Damages to homes alone were estimated at $6 billion. Biden spent the weekend on the beach in Rehoboth, Delaware. He said “no comment” when asked about Maui. White House press secretary Karine Jean-Pierre on Monday confirmed there were no plans for the president to visit Hawaii. Last week, Biden sent Congress a request for $13 billion in “security assistance” and $7.3 billion for “economic and humanitarian assistance” for Ukraine, which has included paying the salaries of government employees in Kiev.

“hyperbolic rhetoric”

• Team Biden Hurts US Prestige and Credibility By Walking Into Ukraine Trap (Sp.)

US observers have raised the question whether President Joe Biden could shift from his maximalist aims in Ukraine which threaten to turn into a trap for Washington. Prior to the much-anticipated 2023 Ukrainian counteroffensive, American politicians and mainstream press had drawn a picture of what the endgame in Ukraine should look like, with Kiev forces seizing as much territory as it could to gain the upper hand in negotiations. Citing White House officials, the US media suggested that by the end of summer, Ukraine would tip the balance in its favor. However, the reality on the ground does not match expectations. The Quincy Institute for Responsible Statecraft, a DC-based think tank, has raised the question as to whether Team Biden has a Plan B for a face-saving exit after it persuaded everyone in the West that anything short of Kiev’s victory would be a global catastrophe.

In fact, the Biden administration set a trap for itself by employing a “hyperbolic rhetoric” in order to sell the idea of Washington’s Ukraine war to the American public and the world’s community. President Biden raised the stakes as high as possible while claiming in February 2023 during his speech in Poland that “what literally is at stake is not just Ukraine, it’s freedom.” Another talking point of the US foreign policy establishment, lawmakers and academia was that Russia’s victory would not only “embolden” Moscow for new “invasions” but also encourage Beijing to “take military action” against Taiwan – something that has been repeatedly denied as nonsense by China which has always seen the island as its inalienable territory.

Republican presidential contender Chris Christie has even gone so far as to claim that China’s potential “invasion” of Taiwan would inevitably necessitate putting American boots on the ground. As a result, the hyped-up narrative deprived Team Biden of room for maneuver: should the US president decide to pull out, he would have to explain to the international community why he is “giving up” on democracy and human values, bowing down to “dictators”, and leaving the world in “danger.”

Anathema.

• Ukraine Could Give Up Territory To Russia – NATO Official (RT)

Kiev could end up relinquishing some of its former territory in exchange for NATO membership, Secretary General Jens Stoltenberg’s chief of staff, Stian Jenssen said at a debate on Tuesday. In his own statements on the issue, Stoltenberg has insisted that Kiev will set its own terms for “victory.” “I think that a solution could be for Ukraine to give up territory, and get NATO membership in return,” Jenssen said at the debate, according to Norway’s VG newspaper. This discussion is already underway within NATO, he said, suggesting that it could be a “possible solution” to the conflict. No NATO leaders have publicly endorsed the idea of Kiev giving up its claims to the territories of Donetsk, Lugansk, Kherson, or Zaporozhye, which were incorporated into the Russian Federation following referendums last September.

Likewise, while Western officials have cast doubt on Ukraine’s ability to seize Crimea – an historical Russian territory which rejoined the Russian Federation in 2014, none have urged Kiev to abandon its claim to the peninsula. Such an idea has apparently been floated behind the scenes, however. Swiss outlet Neue Zürcher Zeitung claimed in February, citing sources, that CIA Director William Burns had offered Russia a “land for peace” deal in which Moscow would keep “20% of Ukrainian territory.” The White House, the CIA, and the Kremlin all denied that such a proposal had been made. Whether such a deal would be accepted by Kiev or Moscow remains doubtful. Russian President Vladimir Putin stated last year that securing the military neutrality of Ukraine was a key factor behind his decision to send troops into the country, and that having a NATO-aligned Ukraine on Russia’s borders would present an unacceptable security risk.

Ukrainian National Security and Defense Council chief Aleksey Danilov stated on Tuesday that Kiev will never negotiate with Putin’s government, that none of Ukraine’s Western backers are pushing for peace, and that “Russia must be destroyed like a modern-day Carthage.” Achieving this goal is proving extremely difficult for Kiev. Two months into its long-anticipated counteroffensive against Russian forces, the Ukrainian military has lost more than 43,000 men and nearly 5,000 pieces of heavy equipment, according to the latest figures from the Russian Defense Ministry.

Stoltenberg insists that NATO will “ensure that Ukraine gets the weapons it needs to be able to retake territory, liberate the lands and win this war and prevail as a sovereign, independent nation.” While he has delivered variations on this statement throughout the conflict, NATO has been more evasive on when Ukraine can join the military bloc. After a summit in Lithuania last month at which Kiev was denied an offer of membership, NATO’s 31 members put out a joint statement explaining that Ukraine can join only “when allies agree and conditions are met.”

“..To enter the bloc [NATO], the Kiev authorities would have to give up even Kiev itself, the capital of Ancient Rus..”

• If Ukraine Agrees To Give Up Territories, It Will Lose Kiev – Medvedev (TASS)

Should Ukraine agree to relinquish disputed territories for the sake of joining NATO, it will have to give up even Kiev, the deputy chairman of Russia’s Security Council, Dmitry Medvedev, said on his Telegram channel. While commenting on a remark by the director of NATO’s Secretary-General’s Private Office, Stian Jenssen, to the effect that Ukraine might become a member of the alliance in case of territorial concessions to Russia, Medvedev wrote: “Why? The idea is curious. The only question is that all of allegedly ‘their’ territories are highly disputable. To enter the bloc [NATO], the Kiev authorities would have to give up even Kiev itself, the capital of Ancient Rus,” he added.

“Well, they (the Ukrainian authorities – TASS) would have to move the capital to Lvov then. If, of course, the Poles agree,” Medvedev remarked. The director of NATO Secretary General’s Private Office, Stian Jenssen, said earlier on Tuesday that Ukraine could become a NATO member if it agreed to cede territories that it currently refused to recognize as part of Russia.

“..Kiev’s foreign advisers are essentially using the Ukraine conflict as a testing ground for various military strategies involving Western weapons, while President Vladimir Zelensky supplies the manpower for these experiments…”

• Western Military Dominance ‘Has Ended’ – Moscow (RT)

Asian, African and Latin American states have seen their role in the global arena increase as Western military dominance has started to wane, Russian Defense Minister Sergey Shoigu has said. Speaking at the 21st International Security Conference in Moscow on Tuesday, the minister argued that Russia’s military operation in Ukraine has “put an end to the dominance of the collective West in the military sphere.” “Just as the defeat of fascism by the Red Army in Europe in the last century gave a powerful impetus to anti-colonial movements throughout the world, so will the defeat of the Ukrainian neo-fascists supported by the West serve as a factor in counteracting modern neo-colonialism,” Shoigu said.

The minister noted that Russia is currently fighting “not just the armed forces of Ukraine, but the entire collective West,” which, he added, has recently been joined by several states from the Asia-Pacific region. In its confrontations with Kiev’s forces, which have been provided with foreign weaponry worth billions of dollars, Russia has dispelled many myths about the superiority of Western military standards, Shoigu said. It has become clear that the use of Western weapons and supposedly advanced NATO tactics and training “cannot ensure superiority on the battlefield,” he added. The minister also claimed that Kiev’s foreign advisers are essentially using the Ukraine conflict as a testing ground for various military strategies involving Western weapons, while President Vladimir Zelensky supplies the manpower for these experiments.

Shoigu said the losses among Ukrainian military personnel are being disregarded by Ukraine’s Western backers. The Russian minister also claimed that Ukraine’s military resources are almost completely exhausted, according to preliminary estimates. Russia’s Defense Ministry had previously reported that since launching their counteroffensive operation in early June, Ukraine’s forces had lost some 43,000 soldiers as well as nearly 5,000 pieces of heavy equipment, including dozens of Western tanks and combat vehicles. Shoigu suggested that the US is using the Ukraine conflict to line the pockets of its defense industry by forcing its partners in Europe to procure new products to replace those they have sent to Kiev.

“Under these conditions, bilateral relations between Russia and China have surpassed the level of strategic ties in all respects, becoming more than just allied.”

• Ukraine’s Military Resources Are “Almost Exhausted” – Shoigu (ZH)

Russia’s defense minister Sergei Shoigu in fresh remarks before a security conference in Moscow acknowledged that while the special military operation in Ukraine has been a real test for Russia, the reality is that Ukraine’s ability to fight and its resources have been “almost exhausted”. He further said the Russian military has learned much about the West’s advanced weapons systems in the process. “In the special military operation, the Russian army has debunked many myths about the superiority of Western military standards,” he said in the rare public speech, as cited in Reuters. “The preliminary results of combat operations show that Ukraine’s military resources are almost exhausted,” he emphasized at one point, but without providing further specifics.

Importantly, China’s own defense chief, Li Shangfu, was in the audience for the event. The Kremlin has recently said that a Putin trip to Beijing to meet with President Xi Jinping is “on the agenda”, to happen by year’s end. Shoigu during the speech touted the large numbers of Western-supplied tanks and armored vehicles that have been taken out on the Ukrainian battlefield. “We have data on … the destruction of German tanks, American armored vehicles, British missiles and other weapons systems,” he said. “We are ready to share our assessments … with our partners.” Likely he had China in particular in mind, also as he followed by comparing the West’s deep involvement in Ukraine to the Taiwan situation. He then said: “Under these conditions, bilateral relations between Russia and China have surpassed the level of strategic ties in all respects, becoming more than just allied.”

While time may soon tell whether or not Ukraine’s defenses are “almost exhausted” – it has become very clear that the counteroffensive is not going well, and Biden’s ‘all in’ support to Kiev is becoming politically unpopular and an additional liability for Democrats going into the 2024 presidential election. Another key part of the Russian defense chief’s speech touched on nuclear weapons. He blasted allegations by the West that Putin is ready to use them: “From a military point of view, there is no need to use nuclear weapons in Ukraine to achieve the set goals,” Shoigu said at an international security conference in Moscow. He slammed media speculation that Russia could potentially use nuclear or chemical weapons to compensate for slow progress in its nearly six-month military campaign in Ukraine as “absolute lies.”

As NATO eyes the Pacific.

• Shoigu Hails High Level Of Contacts Between Russia, Chinese Military (TASS)

Russia and China maintain communication between the two countries’ military at a high level and conduct joint land, naval and air drills, Russian Defense Minister Sergey Shoigu said on Tuesday. “We are maintaining contacts at a high level, exchanging delegations, conducting joint exercises and drill – this is shown on all global channels – about our joint patrols on land, at sea, and in the air,” he said during a working meeting Chinese Defense Minister Li Shangfu on the sidelines of the 11th Moscow Conference on International Security. The Russian defense minister noted that cooperation with China is developed both bilaterally and within multilateral formats, such as the Shanghai Cooperation Organization (SCO) and the ADMM-Plus (ASEAN Defense Ministers’ Meeting Plus).

“Russia and China are strategic partners, good neighbors and close friends,” he stressed. “During Chinese President Xi Jinping’s visit to Russia this March, the leaders of our countries reiterated that Russian-Chinese comprehensive partnership and strategic cooperation have reached the highest point ever in the entire history of bilateral relations. We are implementing our leaders’ agreements in practice.” Shoigu thanked his Chinese counterpart for taking part in the Moscow security conference, noting that Li’s speech at the conference opening and the analysis of international situation “deserve closer attention.”

The Russian defense minister noted that China traditionally takes an active part in the Army international forum and China’s products traditionally attract specialists’ interest. “Yesterday, I visited your exposition, which broadly represents China’s defense sector. I saw many new and promising things,” Shoigu said, adding that since the previous exhibition, where China also took part, “a serious step forward had been taken.” “Today, all companies, all countries taking part in the exhibition take into account the experience of the latest development, including in the zone of the special military operation,” he said. The Russian minister said he is confident that today’s meeting will help strengthen the traditionally friendly ties between the two countries’ defense ministries and enhancing regional and global security.

He noted that this is his third meeting with his Chinese counterpart this year and congratulated him on the 96th anniversary of the establishment of the Chinese People’s Liberation Army, which was marked on August 1. The Army 2023 international military-technical forum is running at the Patriot Congress and Exhibition Center, the Alabino training ground and the Kubinka airfield outside Moscow on August 14-20. About 1,500 leading Russian defense enterprises and 85 foreign companies and businesses from seven countries are participating in the forum’s expositions and business program. The forum has been organized by the Russian Defense Ministry. TASS is the forum’s strategic media partner.

“..despite “outstanding performance characteristics” their highly-sophisticated equipment couldn’t perform appropriately in Ukraine’s tough battlefield conditions.”

• Why US Drones Prove Useless in Ukraine (Sp.)

After China banned exports of long-range remotely-piloted aircraft to Ukraine, US military experts found that American arm-makers have nothing to offer the Ukrainian military to fill the gap. On one hand, US defense-tech firms produce drones with a price tag starting from $16,000, well above China’s DJI Mavic UAVs that cost around $2,000 or even less. What’s more, according to the US mainstream press, some US defense contractors who have spent months testing their drones in Ukraine have now decided to leave their drones in storage. The crux of the matter is that despite “outstanding performance characteristics” their highly-sophisticated equipment couldn’t perform appropriately in Ukraine’s tough battlefield conditions.

American arms manufacturers have long been focused on qualitative superiority of their systems while their Russian and Chinese peers concentrated on functionality and quantity, as per David T. Pyne, an EMP Task Force scholar and former US Department of Defense officer. “During the latter stages of the Cold War between the US and the Soviet Union, the US focused on producing more expensive high-tech weapon systems that were qualitatively superior to Soviet systems in most areas while the Soviets more than compensated for US technological superiority by outproducing the US and its NATO allies by a wide margin. While Russia has caught up with the US technologically, I think the same Cold War-era mentality that quality is more important than quantity continues to hold true here in the US as we continue to prioritize more high-tech equipment even though it costs a lot more money to produce,” Pyne told Sputnik.

According to Pyne, Russia appears to have a much more cost-effective military budget than the US has “because its procurement, manufacturing and personnel costs are lower.” Russia’s electronic warfare (EW) systems, air defenses and aircraft reportedly pose yet another challenge to NATO-grade unmanned vehicles. “Russian electronic warfare capabilities remain the best in the world across the electromagnetic spectrum,” the EMP Task Force scholar stressed. “I think that Russian EW systems remain highly effective against US-built drones although media reports indicate that the US is helping Ukraine learn how to more effectively counter Russian GPS jamming equipment, likely reducing the percentage of Ukrainian drones it can successfully jam down to perhaps eighty percent.”

“..a “sabotage hit squad” consisting of some 100 Ukrainian “nationalist and neo-Nazi militants..”

• MI6 Plans To Send Ukrainian Mercenaries To Africa (RT)

The UK foreign intelligence service MI6 has allegedly prepared a group of saboteurs to disrupt Russia’s growing economic cooperation with African states, a military-diplomatic source told the RIA and TASS news agencies on Wednesday. The British spy agency created a “sabotage hit squad” consisting of some 100 Ukrainian “nationalist and neo-Nazi militants,” the source claimed, citing “information confirmed by several sources.” London reportedly asked Kiev back in July to “provide maximum and prompt assistance to representatives of the British intelligence MI6 and SAS special unit” in order to select fighters with “significant combat experience on the ‘eastern front’.”

The source, cited by both RIA and TASS, claimed that the British-Ukrainian unit will be tasked with “sabotage of infrastructure in African countries, as well as the elimination of African leaders oriented towards cooperation with Russia.” The militant group, alleged to be headed by Kiev’s Main Directorate of Intelligence officer Lt. Col. Vitaliy Prashchuk, is expected to be deployed to the Sudanese city of Omdurman from the Ukrainian port of Izmail by a “chartered civilian ship” sometime during the second half of August, the source added. London has been deeply involved in the Ukraine conflict since its escalation in February 2022, supplying domestically produced and foreign military hardware to Ukraine, training Ukrainian troops in Britain and elsewhere in Europe, and sharing intelligence.

The Wall Street Journal reported in May that British special forces “are operating very close to the front lines” and that their “guiding influence on Ukrainian special-forces activity is evident in the sabotage operations Ukraine has conducted against Russian railway, airfield, fuel and other logistical nodes.” “We can’t rule out that the British participated in the planning, organization and support of terrorist attacks carried out by the Kiev regime on the territory of Russia,” the Russian Foreign Ministry said at the time, adding that Moscow reserves the right to respond to such conduct by the UK at a time and place of its choosing.

“..charities and foundations are strictly forbidden by law to operate with the effect, much less the intent, of benefiting a political party..”

• How Charities Secretly Help Win Elections (Thayer)

This investigation reveals the shocking true story of the Everybody Votes campaign—the largest and most corrupt “charitable” voter registration effort in American history—that may have decided the 2020 presidential election and could decide 2024. Commissioned by Clinton campaign chairman John Podesta, funded by the Democratic Party’s biggest donors, and coordinated with cutthroat Democratic consultants, the Everybody Votes campaign used the guise of civic-minded charity to selectively register millions of “non-white” swing-state voters in the hopes of getting out the Democratic vote for a 2020 presidential win. It worked. Our exclusive research reveals how a little-known organization called the Voter Registration Project (VRP) leveraged connections with billionaire private foundations, Sam Bankman-Fried’s mother, and foreign billionaires with a history of breaking U.S. election law to raise $190 million for the Everybody Votes campaign and register 5.1 million people.

Using data from leaked copies of the campaign’s secret plans, as well as 2020 exit polls, our researchers have discovered that the VRP’s 5.1 million new registrations provided Democratic presidential candidate Joe Biden with somewhere between 1 million to 2.7 million votes across eight specially chosen swing states during the 2020 election. If the state-by-state projections of the campaign’s Democratic consultants held true into 2020, the Everybody Votes campaign’s “massive registration surge” would have provided Democrats more votes than the total margins of victory in Arizona, Georgia, Nevada, and Pennsylvania. Biden ultimately won each of these states in 2020, netting him 53 electoral college votes.

Our investigation proves, once and for all, that Democrats used truckloads of money from private foundations and public charities to give their donors enormous tax breaks and pad their electoral margins in 2020, even though charities and foundations are strictly forbidden by law to operate with the effect, much less the intent, of benefiting a political party. The investigation also proves that the campaign’s supposed concerns for the “civic participation” of “underrepresented communities” were nothing more than a convenient lie. Unearthed drafts of the Everybody Votes campaign’s original partisan schematics prove that the campaign was designed to win elections first and worry about “civic participation” later. Changing the electorate’s racial composition was only ever a secondary concern.

If the Everybody Votes campaign was a political action committee (PAC) or a 501(c)(4) “dark money” group and if the organizers had just admitted they cared more about electoral results than inequality, then there would be no scandal. But it wasn’t, and they didn’t, and the result is an enormous scandal entangling some of the Left’s biggest political donors and many of its most powerful nonprofit activist groups. It’s not just a scandal of the past either. The operation was so successful in 2020 that the Everybody Votes campaign has announced it will continue on through 2024, registering millions more. New job listings suggest that this cycle’s operations will target Florida, Georgia, Michigan, Nevada, Arizona, Pennsylvania, Texas, and Wisconsin—each a must-win presidential swing state. Only time will tell if the campaign is a repeat success.

Greenpeace co-founder, Dr. Patrick Moore: Net Zero policies will result in the genocide of half the population.

"If we banned fossil fuels, agricultural production would collapse in a very short period of time.. People will begin to starve… and half the population will die in a… pic.twitter.com/FhTJYpQM3k

— Wide Awake Media (@wideawake_media) August 15, 2023

"If we actually achieved Net Zero, at least 50% of the population would die of hunger and disease. [Because] at least 50% of the population depends on nitrogen fertiliser for its existence.“

– Greenpeace co-founder, Dr. Patrick Moorepic.twitter.com/GJvqksZrh0

— James Melville (@JamesMelville) August 15, 2023

Dig through earth

https://twitter.com/i/status/1691436302162345984

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.