Henri Cartier Bresson Nehru Announces Gandhi’s Death, Birla House, Delhi, India Jan 30, 1948

Long term is always better.

• 700 Years of Data Forewarn of Rapid Reversal From Low Interest Rates (BBG)

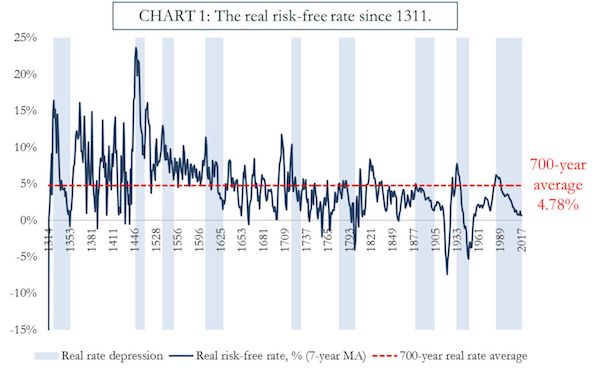

Forget secular stagnation. One historian says the world is actually in its ninth “real rate depression” and 700 years of data show that – when it comes – the turnaround could be sudden. In research published on the Bank of England’s staff blog, Harvard University’s Paul Schmelzing says most work pointing to a period of permanently lower equilibrium real interest rates is too short term. Instead, he tracked the risk-free rate since 1311 by identifying the dominant asset of each period – starting with sovereign rates in the Italian city states in the 14th and 15th centuries and moving to long-term rates in Spain, then the Province of Holland, the U.K., Germany, and finally the U.S. Real rates, or the benchmark interest rates minus inflation, have averaged 4.78% while the 200-year real-rate average is 2.6%.

That makes the current market environment “severely depressed,” Schmelzing wrote. However, it’s simply following a five-century downward trend, in which there have been nine periods of secular decline followed by reversals. The current period – since the 1980s – is the second-longest recorded and its closest historical analogy is the global “Long Depression” of the 1880s and 1890s which saw low productivity growth, deflationary price dynamics, and the rise of global populism and protectionism. This spell seems to have ended without a push from policy makers. That could be good news for those struggling to find a fix for the current low-rate environment. “There is strong evidence suggesting that the last ‘secular stagnation cycle’ started fading relatively autonomously after just over two decades following the key financial shock, not requiring the aid of decisive fiscal or monetary stimulus.”

There’ll be more.

• Saudi Banks Freeze More Than 1,200 Bank Accounts in Anti-Corruption Purge (R.)

Saudi Arabian banks have frozen more than 1,200 accounts belonging to individuals and companies in the kingdom as part of the government’s anti-corruption purge, bankers and lawyers said on Tuesday. They added that the number is continuing to rise. Dozens of royal family members, officials and business executives have been detained in the crackdown and are facing allegations of money laundering, bribery, extorting officials and taking advantage of public office for personal gain. Since Sunday, the central bank has been expanding the list of accounts it is requiring lenders to freeze on an almost hourly basis, one regional banker said, declining to be named because he was not authorised to speak to media.

The banker did not name the companies affected but said they included listed and unlisted firms across many sectors. He added that if the freezes stayed in place for long, they could start to hurt day-to-day business activities such as paying staff and creditors or making other transactions. A second banker said, however, that most of the frozen accounts belonged to individuals rather than companies, and that banks were being allowed by the regulator to continue to fund existing commitments. Among top business executives detained in the probe are billionaire Prince Alwaleed bin Talal, chairman of investment firm Kingdom Holding; Nasser bin Aqeel al-Tayyar, founder of Al Tayyar Travel; and Amr al-Dabbagh, chairman of builder Red Sea International.

The stocks of all three companies, which have issued statements saying they continue to operate as normal, plunged between 9 and 10% on Tuesday. One of the bankers speaking to Reuters said the central bank had met with some foreign banks this week to reassure them that the freezing of accounts targeted individuals, and that firms linked to those people would not be damaged.

WSJ has gone full paywall.

• Saudi Crackdown to Confiscate Up to $800 Billion in Assets (WSJ)

The Saudi government is aiming to confiscate cash and other assets worth as much as $800 billion in its broadening crackdown on alleged corruption among the kingdom’s elite, according to people familiar with the matter. Several prominent businessmen are among those who have been arrested in the days since Saudi authorities launched the crackdown on Saturday, by detaining more than 60 princes, officials and other prominent Saudis, according to those people and others. The country’s central bank, the Saudi Arabian Monetary Authority, said late Tuesday that it has frozen the bank accounts of “persons of interest” and said the move is “in response to the Attorney General’s request pending the legal cases against them.”

The purge is the most extensive of the kingdom’s elite in recent history. Crown Prince Mohammed bin Salman, the son of King Salman, was named heir to the throne in June and has moved to consolidate power. He has said that tackling corruption at the highest level is necessary to overhaul what has long been an oil-dependent economy. The crackdown could also help replenish state coffers. The government has said that assets accumulated through corruption will become state property, and people familiar with the matter say the government estimates the value of assets it can reclaim at up to 3 trillion Saudi riyal, or $800 billion.

Strange bedfellows.

• Leaked Secret Israeli Cable Confirms Israeli-Saudi Coordination In Lebanon (ZH)

Early this morning, Israeli Channel 10 news published a leaked diplomatic cable which had been sent to all Israeli ambassadors throughout the world concerning the chaotic events that unfolded over the weekend in Lebanon and Saudi Arabia, which began with Lebanese Prime Minister Saad Hariri’s unexpected resignation after he was summoned to Riyadh by his Saudi-backers, and led to the Saudis announcing that Lebanon had “declared war” against the kingdom. The classified embassy cable, written in Hebrew, constitutes the first formal evidence proving that the Saudis and Israelis are deliberately coordinating to escalate the situation in the Middle East. The explosive classified Israeli cable reveals the following:

• On Sunday, just after Lebanese PM Hariri’s shocking resignation, Israel sent a cable to all of its embassies with the request that its diplomats do everything possible to ramp up diplomatic pressure against Hezbollah and Iran.

• The cable urged support for Saudi Arabia’s war against Iran-backed Houthis in Yemen.

• The cable stressed that Iran was engaged in “regional subversion”.

• Israeli diplomats were urged to appeal to the “highest officials” within their host countries to attempt to expel Hezbollah from Lebanese government and politics.As is already well-known, the Saudi and Israeli common cause against perceived Iranian influence and expansion in places like Syria, Lebanon and Iraq of late has led the historic bitter enemies down a pragmatic path of unspoken cooperation as both seem to have placed the break up of the so-called “Shia crescent” as their primary policy goal in the region. For Israel, Hezbollah has long been its greatest foe, which Israeli leaders see as an extension of Iran’s territorial presence right up against the Jewish state’s northern border.

“Having failed to liberate the Syrians, Saudi, the West, its Sunni Gulf allies and Israel will now see if they can succeed in blocking any Iranian gas ambitions by liberating the Lebanese from their own government.”

• Lebanon – The Next Front In The Great Gas War (Golem XIV)

The Great Gas War has already two distinct fronts: The now relatively quiet Northern Front in Ukraine and the Southern Front in Syria in which the Western empire has been losing. It looks to me that Lebanon is being targeted as the next front, where the West hopes its loses might be recouped. Yesterday, November 6th, Reuters reported, “Saudi Arabia said on Monday that Lebanon had declared war against it because of attacks against the Kingdom by the Lebanese Shi‘ite group Hezbollah.” This comes after Israel, Saudi’s long time though largely un-offical best friend in the region, has been very publicly preparing to renew its own war with Lebanon – or more accurately with Hezbollah. As the American news journal Newsweek put it recently, “ISRAEL PREPARES FOR ANOTHER WAR WITH HEZBOLLAH AS IDF PRACTICES LEBANON INVASION.”

Why now and why Lebanon? Well the rulers of Saudi, a Sunni dominated country, will tell us that it is because Hezbollah is a Shia terrorist organisation. “Hezbollah” literally means the “Party of Allah” or “Party of God”. Saudi Gulf affairs minister Thamer al-Sabhan yesterday pointedly referred to Hezbollah as, “the Lebanese Party of the Devil”. Saudi is not alone of course, Hezbollah has also been listed as a terrorist organisation by America, Israel, the Arab League, the UK and the EU. It is also, however, part of the popular government of Lebanon having seats in its parliament. I suggest, however, a powerful reason that a new war with Hezbollah may be in the offing is because Lebanon is the next link in any gas pipeline that could potentially bring Iranian Gas to Europe.

That was the reason the West decided to “liberate” the Syrian people and it will be why they decide to enforce the same salvation upon the people of Lebanon. Having failed to liberate the Syrians, Saudi, the West, its Sunni Gulf allies and Israel will now see if they can succeed in blocking any Iranian gas ambitions by liberating the Lebanese from their own government. I would not be surprised to hear quite soon from opposition groups vocally denouncing the government or at least Hezbollah. I expect spokes people from those groups to suddenly get a global platform along-side American and regional supporters such as Saudi.

How to spell insanity.

• UK Sales Of Bombs And Missiles To Saudi Arabia Increase By Almost 500% (Ind.)

The number of British-made bombs and missiles sold to Saudi Arabia since the start of its bloody campaign in Yemen has risen by almost 500%, The Independent can reveal. More than £4.6bn of arms were sold in the first two years of bombings, with the Government grant increasing numbers of export licences despite mounting evidence of war crimes and massacres at hospitals, schools and weddings. The United Nations says air strikes by the Saudi-led coalition are the main cause of almost 5,295 civilian deaths and 8,873 casualties confirmed so far, warning that the real figure is “likely to be far higher”. It has condemned the “entirely man-made catastrophe” leaving millions more on the brink of famine and sparking the world’s worst cholera epidemic, while blacklisting Saudi Arabia for killing and maiming children.

There is also fresh concern over the Kingdom’s attempt to shut all air, land and sea ports into Yemen, which it said was to stop the flow of weapons but will also halt aid imports. British-made bombs have been found at the scene of bombings deemed to violate international law but the UK has continued its political and material support for Riyadh’s campaign. Figures from the Department for International Trade (DIT) show that in the two years leading up to the Yemen war, £33m of ML4 licences covering bombs, missiles and countermeasures were approved. But in the two years since the start of Saudi bombing in March 2015, the figure increased by 457% to £1.9bn, according to calculations by Campaign Against the Arms Trade (CAAT). Licences covering aircraft including Eurofighter jets have also risen by 70% to £2.6bn in the same period.

Secret meetings as the Middle East is imploding. And arms sales are exploding.

• May to Lose Second Top Minister in One Week Over Secret Israel Meetings (BBG)

Prime Minister Theresa May is weighing whether to fire a member of her cabinet only seven days after her defense secretary quit in a sexual harassment scandal, as the U.K. government faces fresh turmoil in the midst of Brexit talks. May is likely to dismiss her International Development Secretary Priti Patel in a row over a succession of unauthorized meetings she held with Israeli officials behind the prime minister’s back, according to reports from the BBC and The Sun Tuesday, which the U.K. government declined to deny. The premier has not yet had the chance to speak to Patel – who is on an official trip to Africa – about the latest revelations. A conversation would be expected before a decision is made about the minister’s future. If she is forced out, Patel will be the second minister to depart May’s cabinet in one week, after Michael Fallon resigned from the defense ministry amid allegations over his past behavior toward women.

For some, May’s latest headache is yet another demonstration of her weakness, which draws repeated questions over how her government can last long enough to see Brexit to the finish line. If more dominoes drop – in the shape of senior ministers – the last one to fall could ultimately be the prime minister herself. “The destabilizing effect on an already weak administration has prompted another burst of speculation that May could soon be forced to resign,” Mujtaba Rahman of Eurasia Group said in a note to clients. He thought one likely scenario is for May to be toppled if she fails to get a grip on the latest crisis and is ousted because her MPs judge that the government cannot go on like this – and is incapable of recovering the authority a prime minister needs.

The British economy is being bled dry….

• Those Who Broke The Economy Cannot Fix It (Ann Pettifor)

Make no mistake, last week’s increase in interest rates was a big deal. Painful as it might be for a good share of the population, the real point is that the Bank is signalling the end of a particular phase of monetary policy. Since 2010 the counterpart to self-defeating austerity policies has been expansionary monetary policies. These have inflated assets – enriching the already-rich, while failing to stimulate wider economic recovery. Yesterday the Bank of England’s Monetary Policy Committee signalled an end of this dangerous game. But this technocratic realignment makes no difference to the fact that ‘the Guardians of the nation’s finances’ – Bank and Treasury economists – have failed absolutely to revive the economy.

You need look no further than the (ongoing) decline in real wages, to continuing low levels of private investment, and to the dangers of rising household debt. A small interest rate rise is hardly likely to improve these conditions. Bank and Treasury economists (aided and abetted by the OBR) are guilty of defeatism. They argue that despite their powers, THERE IS NOTHING TO BE DONE. It is assumed that somehow ‘the invisible hand’ or ‘the markets’ will, without intervention by the authorities, correct the weakness, insecurity and failures of the British economy. The prolonged and painfully weak recovery is regularly blamed on something defined as “productivity”. By shifting responsibility for economic failure on to productivity, the Bank, Treasury and OBR economists are saying that somehow economic failure is inherent to the economy – to businesses and especially to workers.

“Nothing to do with us, guv” they mutter. They add that the situation has been exacerbated by the vote to leave the EU. This is a handy way of denying that the ongoing economic failure of the British economy (and the Brexit vote) can be explained by austerity policies, and the failures of the financial system. By taking this approach, economists at the Bank have – conveniently – set the scene for endorsing further inaction by the Chancellor later this month. Yesterday the Governor of the Bank was flanked by Ben Broadbent and Dave Ramsden. Ben Broadbent, as a Goldman Sachs economist, was among the earliest to call for austerity policies. Dave Ramsden (who did not vote for the rate rise) implemented these policies as top economist at the Treasury.

But both Broadbent and Ramsden were senior figures in economic policy-making throughout the debt inflation that preceded the crisis, and (we presume) supporters of financial globalisation. It is obvious to anyone with an ounce of common sense that austerity policies have hurt the most vulnerable, and damaged Britain’s economic potential, by forcing a brutal adjustment to lower quality and lower paid work. Labour has been forced to bear the brunt of the Global Financial Crisis. The weakness in productivity is just the outcome of these policies, not the cause.

… while Germany’s needs diverge ever more from those of southern Europe.

• German ‘Wise Men’ Sound Alarm Over ‘Overheating’ Economy (R.)

The German economy is at risk of overheating, according to a leaked advisory council report that follows pressure from the Bundesbank for a swifter end to the ECB’s expansive monetary policy. In their annual report, seen by Handelsblatt newspaper, the five “wise men” who advise the German government on economic policy said the economy, which they expected to expand strongly this year and next, was moving gradually into a “boom phase”. “There are clear signs that economic capacity is over-utilised,” read the report, which is due to be published on Wednesday. Germans have been among the foremost critics of the ECB’s bond-buying program, which was introduced three years ago to depress borrowing costs and reignite growth in the euro zone’s heavily indebted southern periphery.

The wise men expected Germany’s economy to expand by 2% this year and by 2.2% in 2018, Handelsblatt said. With unemployment at its lowest level since the early 1990s, Germany’s circumstances are very different from Italy’s or Spain‘s, straining the ECB’s ‘one-size-fits-all’ monetary policy. ECB President Mario Draghi last month announced a halving n the size of its 2 trillion euro bond-buying program, but this is far from the return to conventional monetary policy many Germans, including Bundesbank president Jens Weidmann, demand. Without an intervention to cool the economy, Germany’s hawks fear the buoyant economy could tip over into an inflationary cycle. Last week, a senior official from Chancellor Angela Merkel’s conservatives warned that German savers would not tolerate continued low interest rates for much longer.

Accountants and auditors are not doing their jobs.

• Bean Counters: Lost in Paradise (Ren.)

“The phrase ‘Set a thief to catch a thief’ is common parlance,” says Professor Atul K. Shah. “‘Set a global brand of professional accountants to rob society and pilfer its taxes, bleeding governments’, is not, but it should be.’ Professor Bill Black says internal controls are absolutely critical in reducing fraud by insiders in particular, but not just insiders, as the Paradise Papers have repeatedly demonstrated. Emile Woolf says there is no way to remove control fraud and dodgy accounting practices from the economy without first prosecuting the culprits. “The devils that committed this criminal negligence – with the exception of the Royal Bank of Scotland (RBS) – have never been fined or prosecuted” he said. “What you can then do is create a ring fenced fund inside those institutions, earmarked to save them from going under. But the company has to recognise it has to be paid back.

“RBS is incapable of paying back the billions of fines it still owes for misconduct,” he says. “Where does that money come from and where does it go? Without the fines RBS would have made £100 million profit this year, but because of the reserve for fines in the USA and UK, all those fines are far too great to allow for payment of a dividend.” Of course calculating a true profit figure is difficult when a significant portion of that profit is fraudulent, because it doesn’t take into account the result of the inequities of ten years ago. “The worrying thing for all of us is if it happens again,” he says. “My hope is that three years from now, banks will be forced to recognise their loans that will never be repaid. But my worry is that this is going to be after the next financial crisis, because it’s happening again. There is no redeeming features in the present. The only difference is the next crisis is going to be bigger.”

Joel Benjamin told Renegade Inc that accounting is as much about *what* you count or don’t count as it is *how* you count it. “This is evidenced through the practice of ‘base erosion and profit shifting’ – shifting profits to offshore low or no tax jurisdictions, ” he said. In the space of 50 years, Britain’s economy has transformed from an industrial power house, to that of a finance-led extractive parasite, where the cash starved productive economy receives less than 10% of bank credit. “Until the Big Four accountancy firms are accurately viewed as enablers of corporate offshore dealing, regulatory arbitrage and ardent defenders of the neoliberal order, not the ‘reputable’ objective independent arbiters of the public interest as they claim, society will continue to be taken for a ride, and public services and social cohesion will continue their long decline,” he said.

Bill Mitchell in a long talk with his alter ego.

• British Mainstream Media Spreading Dangerous MMT Ideas (Bilbo)

Mitchell tried to tell me that governments do not spend by ‘printing money’ but rather just adjust bank accounts with numbers. But I know as anyone in the street knows that they just want to print more and more. That is at the core of MMT – they want the government to go on a spending spree and just ignore the inflationary consequences. They hide that by saying that “public spending cannot be unlimited and must be commensurate to the capacity of the economy” which is just a smokescreen that I can see through. And everybody will see through it. It is code for spend like a drunken’ sailor – throw money at lazy people who cannot be bothered finding a job. Throw money at public schools that teach socialist doctrines – you know about inequality and stuff like that.

Throw money at public hospitals so that people can receive unlimited health care without having to pay for it – that is the quickest way to encourage waste and bad behaviour. People know that they can just get sick and no matter what their income is they will get some care. Where is the incentive to stay healthy in that sort of system. The article also shows how stupid Mitchell is when it says he: “… debunks the idea that governments borrow money from international markets and with it the notion that they are hostage to the market.” Well where the hell else do they get the cash from? Does he really think we are that stupid? How come China has all those US government debt bonds or whatever they are called and the US government is spending the Chinese cash? How does he explain that obvious point?

Well he tried to claim the Chinese doesn’t issue US dollars and that only the US government issues US dollars so that it cannot possibly be funded by the Chinese. I don’t buy that, not that I understood anything he said about this – all this talk about trade surpluses accumulating financial claims in the currency that the deficit country issues, and then allowing the surplus nation to use those claims (say, US dollars in the first instance) to purchase US dollar financial assets etc ad nauseum. As if that tells us anything. How come the Chinese can loan the US government money that is what I want to know? Mitchell told the journalist that Jeremy Corbyn should not worry about international capital markets because Britain could impose capital controls if it wanted to. That gets to the nub of my worries – socialist governments stealing hard-earned cash from investors who actually have some get up and go.

Malls don’t look like good investments.

• Brick-and-Mortar Meltdown Sinks Property Prices (WS)

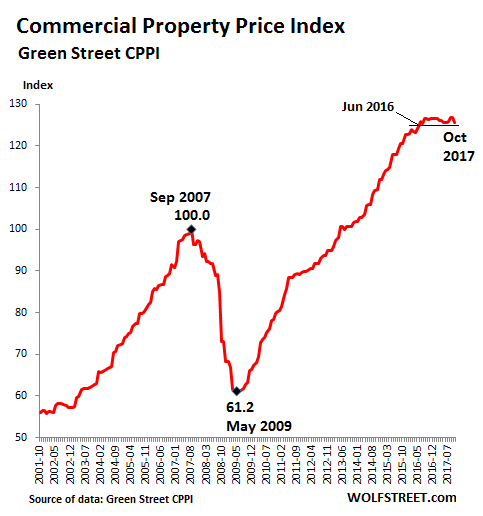

Commercial real estate prices soared relentlessly for years after the Financial Crisis, to such a degree that the Fed has been publicly fretting about them. Why? Because US financial institutions hold nearly $4 trillion of commercial real estate loans. But the boom in most CRE sectors is over. The Green Street Property Price Index – which measures values across five major property sectors – had soared 107% from May 2009 to the plateau that began late last year, and 27% from the peak of the totally crazy prior bubble that ended with such spectacular fireworks. But it has now turned around, dragged down by a plunge in prices for retail space. The CPPI by Green Street Advisors dropped 1.1% in October from September. In terms of points, the 1.4-point decline was the largest monthly decline since March 2009. The index is now below where it had been in June 2016:

This phenomenal bubble, as depicted by the chart above, has even worried the Fed because US financial institutions hold nearly $4 trillion of CRE loans, according to Boston Fed governor Eric Rosengren earlier this year. Of them, $1.2 trillion are held by smaller banks (less than $50 billion in assets). These smaller banks tends to have a loan book that is heavily concentrated on CRE loans, and these banks are less able to withstand shocks to collateral values. Rosengren found that among the root causes of the Financial Crisis “was a significant decline in collateral values of residential and commercial real estate.” But the CRE bubble isn’t unraveling as gently as the chart suggests. Some sectors are still surging, while others are plunging. According to the report, the index, which captures the prices at which CRE transactions are currently being negotiated and contracted, “was pushed down by falling mall valuations.”

Puidgemont predicted to get 14-15 out of 135 seats. He won’t be the leader.

• Catalan Secessionist Parties Fail To Agree On Unity Ticket For Vote (R.)

Catalan secessionist parties on Tuesday failed to agree on a united ticket to contest a December snap regional election, making it more difficult to rule the region after the vote and press ahead with their collective bid to split from Spain. Catalonia’s secessionist push has plunged Spain into its worst political crisis in four decades, triggered a business exodus, forced Madrid to cut its economic forecast and reopened old wounds from Spain’s civil war in the 1930s. Pro-independence groups have called for a general strike in the restive region on Wednesday. Catalan political parties had until midnight on Tuesday to register coalitions ahead of the Dec. 21 vote, but the two main forces which formed an alliance to rule the region for the last two years did not manage to agree on a new pact in time.

While they could still find an agreement after the vote, political analysts say the lack of a deal on a joint campaign may also trigger a leadership fight at the top of the movement. This is because center-right PdeCat (Catalan Democratic Party) of sacked Catalan president Carles Puigdemont is expected to be overtaken by leftist Esquerra Republicana de Catalunya (ERC) of former regional vice president Oriol Junqueras. Puigdemont and Junqueras are the two main leaders behind the current secession bid that last month led to a unilateral declaration of independence which Spain thwarted by imposing direct rule on the region. Junqueras is currently in custody pending a potential trial on charges of sedition, rebellion and misuse of public funds. Puigdemont, who faces the same charges, is currently in self-imposed exile in Belgium and has said he would oppose extradition.

An opinion poll released on Sunday by Barcelona-based newspaper La Vanguardia showed Junqueras’ ERC could garner between 45 and 46 seats in the 135-strong regional assembly while Puigdemont’s PdeCat would win between 14 and 15 seats. In order to reach the 68-seat threshold for a majority, they would then have to form a parliamentary alliance with anti-capitalist CUP, which is expected to get seven or eight seats. Such an alliance previously existed between 2015 and 2017.

Down the drain.

• 1 in 200 British, 1 in 60 Londoners Are Homeless (G.)

More than 300,000 people in Britain – equivalent to one in every 200 – are officially recorded as homeless or living in inadequate homes, according to figures released by the charity Shelter. Using official government data and freedom of information returns from local authorities, it estimates that 307,000 people are sleeping rough, or accommodated in temporary housing, bed and breakfast rooms, or hostels – an increase of 13,000 over the past year. Shelter said the figures were an underestimate as they did not include people trapped in so-called “hidden homelessness”, who have nowhere to live but are not recorded as needing housing assistance, and end up “sofa surfing”. London, where one in every 59 people are homeless, remains Britain’s homelessness centre. Of the top 50 local authority homelessness “hotspots”, 18 were in Greater London, with Newham, where one in 27 residents are homeless, worst hit.

However, while London’s homeless rates have remained largely stable over the past year, the figures show the problem is becoming worse in leafier commuter areas bordering the capital, such as Broxbourne, Luton, and Chelmsford. Big regional cities have also seen substantial year-on-year increases in the rate of homelessness. In Manchester, one in 154 people are homeless (compared with one in 266 in 2016); in Birmingham one in 88 are homeless (119); in Bristol one in 170 are affected (199). Polly Neate, chief executive of Shelter, said: “It’s shocking to think that today, more than 300,000 people in Britain are waking up homeless. Some will have spent the night shivering on a cold pavement, others crammed into a dingy hostel room with their children. And what is worse, many are simply unaccounted for.

Home › Forums › Debt Rattle November 8 2017